TPARK LOGISTICS PROPERTY FUND (TLOGIS)

TPARK LOGISTICS PROPERTY FUND (TLOGIS)

TPARK LOGISTICS PROPERTY FUND (TLOGIS)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

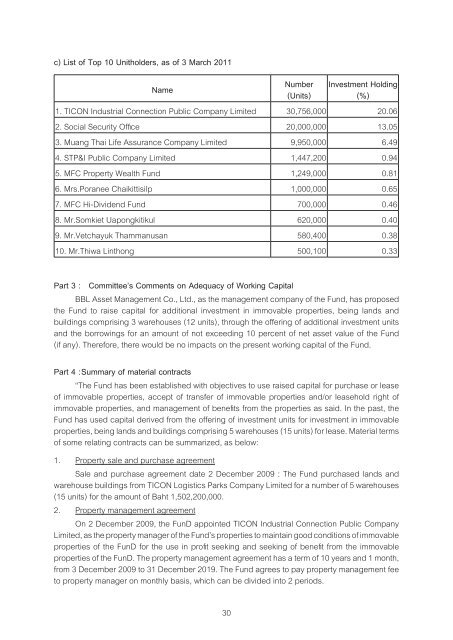

c) List of Top 10 Unitholders, as of 3 March 2011<br />

Name<br />

Number<br />

(Units)<br />

Investment Holding<br />

(%)<br />

1. TICON Industrial Connection Public Company Limited 30,756,000 20.06<br />

2. Social Security Office 20,000,000 13.05<br />

3. Muang Thai Life Assurance Company Limited 9,950,000 6.49<br />

4. STP&I Public Company Limited 1,447,200 0.94<br />

5. MFC Property Wealth Fund 1,249,000 0.81<br />

6. Mrs.Poranee Chaikittisilp 1,000,000 0.65<br />

7. MFC Hi-Dividend Fund 700,000 0.46<br />

8. Mr.Somkiet Uapongkitikul 620,000 0.40<br />

9. Mr.Vetchayuk Thammanusan 580,400 0.38<br />

10. Mr.Thiwa Linthong 500,100 0.33<br />

Part 3 : Committee’s Comments on Adequacy of Working Capital<br />

BBL Asset Management Co., Ltd., as the management company of the Fund, has proposed<br />

the Fund to raise capital for additional investment in immovable properties, being lands and<br />

buildings comprising 3 warehouses (12 units), through the offering of additional investment units<br />

and the borrowings for an amount of not exceeding 10 percent of net asset value of the Fund<br />

(if any). Therefore, there would be no impacts on the present working capital of the Fund.<br />

Part 4 : Summary of material contracts<br />

“The Fund has been established with objectives to use raised capital for purchase or lease<br />

of immovable properties, accept of transfer of immovable properties and/or leasehold right of<br />

immovable properties, and management of benefits from the properties as said. In the past, the<br />

Fund has used capital derived from the offering of investment units for investment in immovable<br />

properties, being lands and buildings comprising 5 warehouses (15 units) for lease. Material terms<br />

of some relating contracts can be summarized, as below:<br />

1. Property sale and purchase agreement<br />

Sale and purchase agreement date 2 December 2009 : The Fund purchased lands and<br />

warehouse buildings from TICON Logistics Parks Company Limited for a number of 5 warehouses<br />

(15 units) for the amount of Baht 1,502,200,000.<br />

2. Property management agreement<br />

On 2 December 2009, the FunD appointed TICON Industrial Connection Public Company<br />

Limited, as the property manager of the Fund’s properties to maintain good conditions of immovable<br />

properties of the FunD for the use in profit seeking and seeking of benefit from the immovable<br />

properties of the FunD. The property management agreement has a term of 10 years and 1 month,<br />

from 3 December 2009 to 31 December 2019. The Fund agrees to pay property management fee<br />

to property manager on monthly basis, which can be divided into 2 periods.<br />

30