2023 Doing Business in Cyprus (India Edition)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DOING BUSINESS C YPRUS<br />

86<br />

INDIA EDITION<br />

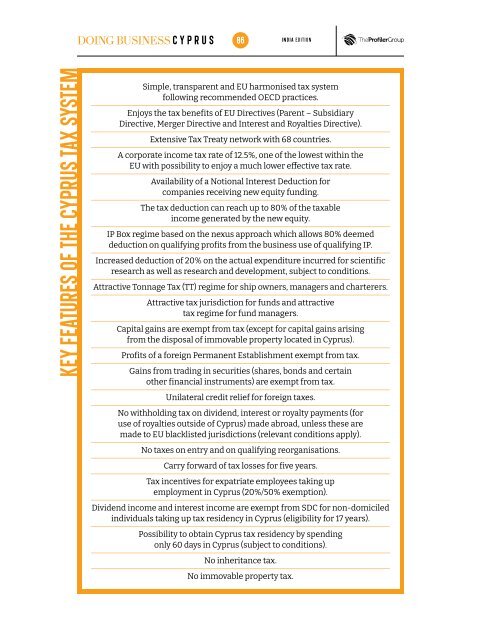

KEY FEATURES OF THE CYPRUS TAX SYSTEM<br />

Simple, transparent and EU harmonised tax system<br />

follow<strong>in</strong>g recommended OECD practices.<br />

Enjoys the tax benefits of EU Directives (Parent – Subsidiary<br />

Directive, Merger Directive and Interest and Royalties Directive).<br />

Extensive Tax Treaty network with 68 countries.<br />

A corporate <strong>in</strong>come tax rate of 12.5%, one of the lowest with<strong>in</strong> the<br />

EU with possibility to enjoy a much lower effective tax rate.<br />

Availability of a Notional Interest Deduction for<br />

companies receiv<strong>in</strong>g new equity fund<strong>in</strong>g.<br />

The tax deduction can reach up to 80% of the taxable<br />

<strong>in</strong>come generated by the new equity.<br />

IP Box regime based on the nexus approach which allows 80% deemed<br />

deduction on qualify<strong>in</strong>g profits from the bus<strong>in</strong>ess use of qualify<strong>in</strong>g IP.<br />

Increased deduction of 20% on the actual expenditure <strong>in</strong>curred for scientific<br />

research as well as research and development, subject to conditions.<br />

Attractive Tonnage Tax (TT) regime for ship owners, managers and charterers.<br />

Attractive tax jurisdiction for funds and attractive<br />

tax regime for fund managers.<br />

Capital ga<strong>in</strong>s are exempt from tax (except for capital ga<strong>in</strong>s aris<strong>in</strong>g<br />

from the disposal of immovable property located <strong>in</strong> <strong>Cyprus</strong>).<br />

Profits of a foreign Permanent Establishment exempt from tax.<br />

Ga<strong>in</strong>s from trad<strong>in</strong>g <strong>in</strong> securities (shares, bonds and certa<strong>in</strong><br />

other f<strong>in</strong>ancial <strong>in</strong>struments) are exempt from tax.<br />

Unilateral credit relief for foreign taxes.<br />

No withhold<strong>in</strong>g tax on dividend, <strong>in</strong>terest or royalty payments (for<br />

use of royalties outside of <strong>Cyprus</strong>) made abroad, unless these are<br />

made to EU blacklisted jurisdictions (relevant conditions apply).<br />

No taxes on entry and on qualify<strong>in</strong>g reorganisations.<br />

Carry forward of tax losses for five years.<br />

Tax <strong>in</strong>centives for expatriate employees tak<strong>in</strong>g up<br />

employment <strong>in</strong> <strong>Cyprus</strong> (20%/50% exemption).<br />

Dividend <strong>in</strong>come and <strong>in</strong>terest <strong>in</strong>come are exempt from SDC for non-domiciled<br />

<strong>in</strong>dividuals tak<strong>in</strong>g up tax residency <strong>in</strong> <strong>Cyprus</strong> (eligibility for 17 years).<br />

Possibility to obta<strong>in</strong> <strong>Cyprus</strong> tax residency by spend<strong>in</strong>g<br />

only 60 days <strong>in</strong> <strong>Cyprus</strong> (subject to conditions).<br />

No <strong>in</strong>heritance tax.<br />

No immovable property tax.