Employer Helpbook for Statutory Maternity Pay - HM Revenue ...

Employer Helpbook for Statutory Maternity Pay - HM Revenue ...

Employer Helpbook for Statutory Maternity Pay - HM Revenue ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

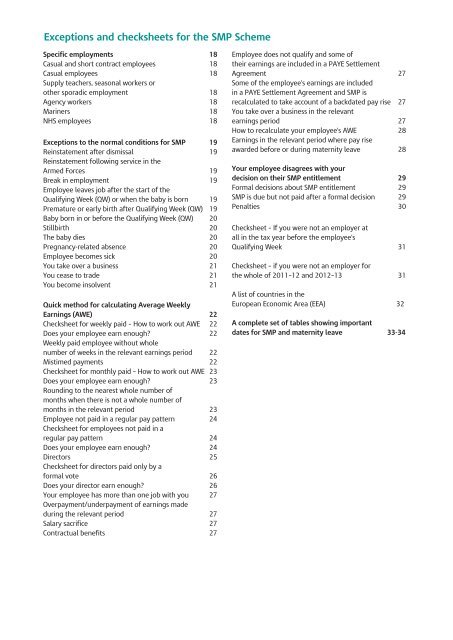

Exceptions and checksheets <strong>for</strong> the SMP Scheme<br />

Specific employments 18<br />

Casual and short contract employees 18<br />

Casual employees 18<br />

Supply teachers, seasonal workers or<br />

other sporadic employment 18<br />

Agency workers 18<br />

Mariners 18<br />

NHS employees 18<br />

Exceptions to the normal conditions <strong>for</strong> SMP 19<br />

Reinstatement after dismissal 19<br />

Reinstatement following service in the<br />

Armed Forces 19<br />

Break in employment 19<br />

Employee leaves job after the start of the<br />

Qualifying Week (QW) or when the baby is born 19<br />

Premature or early birth after Qualifying Week (QW) 19<br />

Baby born in or be<strong>for</strong>e the Qualifying Week (QW) 20<br />

Stillbirth 20<br />

The baby dies 20<br />

Pregnancy-related absence 20<br />

Employee becomes sick 20<br />

You take over a business 21<br />

You cease to trade 21<br />

You become insolvent 21<br />

Quick method <strong>for</strong> calculating Average Weekly<br />

Earnings (AWE) 22<br />

Checksheet <strong>for</strong> weekly paid – How to work out AWE 22<br />

Does your employee earn enough? 22<br />

Weekly paid employee without whole<br />

number of weeks in the relevant earnings period 22<br />

Mistimed payments 22<br />

Checksheet <strong>for</strong> monthly paid – How to work out AWE 23<br />

Does your employee earn enough? 23<br />

Rounding to the nearest whole number of<br />

months when there is not a whole number of<br />

months in the relevant period 23<br />

Employee not paid in a regular pay pattern 24<br />

Checksheet <strong>for</strong> employees not paid in a<br />

regular pay pattern 24<br />

Does your employee earn enough? 24<br />

Directors 25<br />

Checksheet <strong>for</strong> directors paid only by a<br />

<strong>for</strong>mal vote 26<br />

Does your director earn enough? 26<br />

Your employee has more than one job with you 27<br />

Overpayment/underpayment of earnings made<br />

during the relevant period 27<br />

Salary sacrifice 27<br />

Contractual benefits 27<br />

Employee does not qualify and some of<br />

their earnings are included in a PAYE Settlement<br />

Agreement 27<br />

Some of the employee’s earnings are included<br />

in a PAYE Settlement Agreement and SMP is<br />

recalculated to take account of a backdated pay rise 27<br />

You take over a business in the relevant<br />

earnings period 27<br />

How to recalculate your employee’s AWE 28<br />

Earnings in the relevant period where pay rise<br />

awarded be<strong>for</strong>e or during maternity leave 28<br />

Your employee disagrees with your<br />

decision on their SMP entitlement 29<br />

Formal decisions about SMP entitlement 29<br />

SMP is due but not paid after a <strong>for</strong>mal decision 29<br />

Penalties 30<br />

Checksheet – If you were not an employer at<br />

all in the tax year be<strong>for</strong>e the employee’s<br />

Qualifying Week 31<br />

Checksheet – if you were not an employer <strong>for</strong><br />

the whole of 2011–12 and 2012–13 31<br />

A list of countries in the<br />

European Economic Area (EEA) 32<br />

A complete set of tables showing important<br />

dates <strong>for</strong> SMP and maternity leave 33-34