Emporio Investment Report Test

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

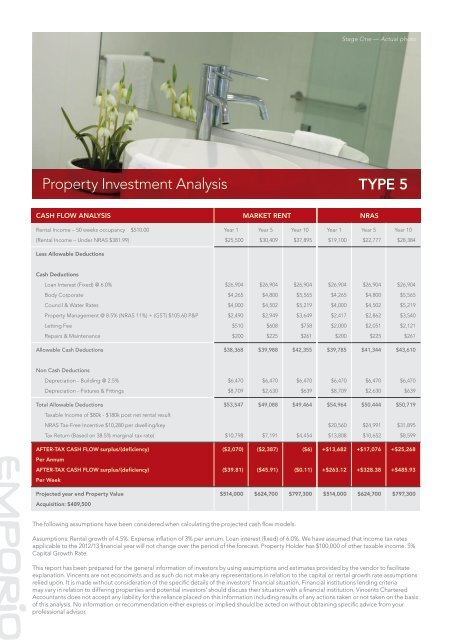

CASH FLOW ANALYSIS<br />

Rental Income – 50 weeks occupancy $510.00<br />

(Rental Income – Under NRAS $381.99)<br />

Less Allowable Deductions<br />

Cash Deductions<br />

Loan Interest (Fixed) @ 6.0%<br />

Body Corporate<br />

Council & Water Rates<br />

Property Management @ 8.5% (NRAS 11%) + (GST) $105.60 P&P<br />

Letting Fee<br />

Repairs & Maintenance<br />

Allowable Cash Deductions<br />

Non Cash Deductions<br />

Depreciation - Building @ 2.5%<br />

Depreciation - Fixtures & Fittings<br />

Total Allowable Deductions<br />

Taxable Income of $80k - $180k post net rental result<br />

NRAS Tax-Free Incentive $10,280 per dwelling/key<br />

Tax Return (Based on 38.5% marginal tax rate)<br />

AFTER-TAX CASH FLOW surplus/(deficiency)<br />

Per Annum<br />

AFTER-TAX CASH FLOW surplus/(deficiency)<br />

Per Week<br />

Projected year end Property Value<br />

Acquisition: $489,500<br />

Year 1<br />

$25,500<br />

$26,904<br />

$4,265<br />

$4,000<br />

$2,490<br />

$510<br />

$200<br />

$38,368<br />

$6,470<br />

$8,709<br />

$53,547<br />

$10,798<br />

($2,070)<br />

($39.81)<br />

Year 5<br />

$30,409<br />

$26,904<br />

$4,800<br />

$4,502<br />

$2,949<br />

$608<br />

$225<br />

$39,988<br />

$6,470<br />

$2,630<br />

$49,088<br />

$7,191<br />

($2,387)<br />

($45.91)<br />

The following assumptions have been considered when calculating the projected cash flow models.<br />

MARKET RENT NRAS<br />

Year 10<br />

$37,895<br />

$26,904<br />

$5,565<br />

$5,219<br />

$3,649<br />

$758<br />

$261<br />

$42,355<br />

$6,470<br />

$639<br />

$49,464<br />

$4,454<br />

($6)<br />

($0.11)<br />

Year 1<br />

$19,100<br />

$26,904<br />

$4,265<br />

$4,000<br />

$2,417<br />

$2,000<br />

$200<br />

$39,785<br />

$6,470<br />

$8,709<br />

$54,964<br />

$20,560<br />

$13,808<br />

+$13,682<br />

+$263.12<br />

Stage One — Actual photo<br />

Property <strong>Investment</strong> Analysis TYPE 5<br />

Year 5<br />

$22,777<br />

$26,904<br />

$4,800<br />

$4,502<br />

$2,862<br />

$2,051<br />

$225<br />

$41,344<br />

$6,470<br />

$2,630<br />

$50,444<br />

$24,991<br />

$10,652<br />

+$17,076<br />

+$328.38<br />

Year 10<br />

$28,384<br />

$26,904<br />

$5,565<br />

$5,219<br />

$3,540<br />

$2,121<br />

$261<br />

$43,610<br />

$6,470<br />

$639<br />

$50,719<br />

$31,895<br />

$8,599<br />

+$25,268<br />

+$485.93<br />

$514,000 $624,700 $797,300 $514,000 $624,700 $797,300<br />

Assumptions: Rental growth of 4.5%. Expense inflation of 3% per annum. Loan interest (fixed) of 6.0%. We have assumed that income tax rates<br />

applicable to the 2012/13 financial year will not change over the period of the forecast. Property Holder has $100,000 of other taxable income. 5%<br />

Capital Growth Rate.<br />

This report has been prepared for the general information of investors by using assumptions and estimates provided by the vendor to facilitate<br />

explanation. Vincents are not economists and as such do not make any representations in relation to the capital or rental growth rate assumptions<br />

relied upon. It is made without consideration of the specific details of the investors’ financial situation. Financial institutions lending criteria<br />

may vary in relation to differing properties and potential investors’ should discuss their situation with a financial institution. Vincents Chartered<br />

Accountants does not accept any liability for the reliance placed on this information including results of any actions taken or not taken on the basis<br />

of this analysis. No information or recommendation either express or implied should be acted on without obtaining specific advice from your<br />

professional advisor.