Winter nwsltr06_6 - Grand Teton National Park Foundation

Winter nwsltr06_6 - Grand Teton National Park Foundation

Winter nwsltr06_6 - Grand Teton National Park Foundation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

New Members Join <strong>Foundation</strong> Board<br />

The <strong>Grand</strong> <strong>Teton</strong> <strong>National</strong> <strong>Park</strong><br />

<strong>Foundation</strong> is pleased to welcome<br />

four new Board members.<br />

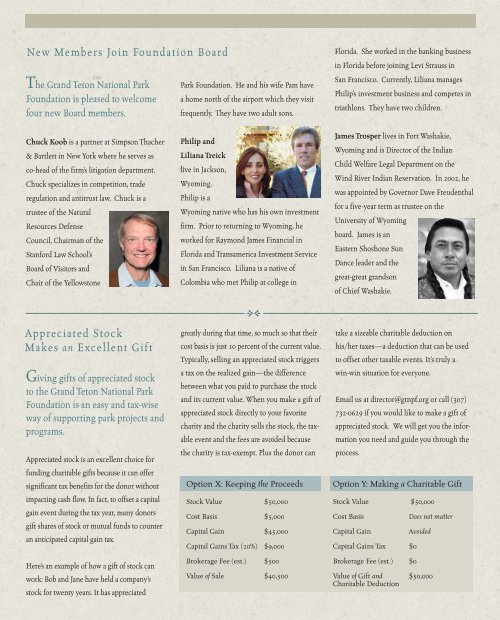

Chuck Koob is a partner at Simpson Thacher<br />

& Bartlett in New York where he serves as<br />

co-head of the firm’s litigation department.<br />

Chuck specializes in competition, trade<br />

regulation and antitrust law. Chuck is a<br />

trustee of the Natural<br />

Resources Defense<br />

Council, Chairman of the<br />

Stanford Law School’s<br />

Board of Visitors and<br />

Chair of the Yellowstone<br />

Appreciated Stock<br />

Makes an Excellent Gift<br />

Giving gifts of appreciated stock<br />

to the <strong>Grand</strong> <strong>Teton</strong> <strong>National</strong> <strong>Park</strong><br />

<strong>Foundation</strong> is an easy and tax-wise<br />

way of supporting park projects and<br />

programs.<br />

Appreciated stock is an excellent choice for<br />

funding charitable gifts because it can offer<br />

significant tax benefits for the donor without<br />

impacting cash flow. In fact, to offset a capital<br />

gain event during the tax year, many donors<br />

gift shares of stock or mutual funds to counter<br />

an anticipated capital gain tax.<br />

Here’s an example of how a gift of stock can<br />

work: Bob and Jane have held a company’s<br />

stock for twenty years. It has appreciated<br />

<strong>Park</strong> <strong>Foundation</strong>. He and his wife Pam have<br />

a home north of the airport which they visit<br />

frequently. They have two adult sons.<br />

Philip and<br />

Liliana Treick<br />

live in Jackson,<br />

Wyoming.<br />

Philip is a<br />

Wyoming native who has his own investment<br />

firm. Prior to returning to Wyoming, he<br />

worked for Raymond James Financial in<br />

Florida and Transamerica Investment Service<br />

in San Francisco. Liliana is a native of<br />

Colombia who met Philip at college in<br />

greatly during that time, so much so that their<br />

cost basis is just 10 percent of the current value.<br />

Typically, selling an appreciated stock triggers<br />

a tax on the realized gain—the difference<br />

between what you paid to purchase the stock<br />

and its current value. When you make a gift of<br />

appreciated stock directly to your favorite<br />

charity and the charity sells the stock, the taxable<br />

event and the fees are avoided because<br />

the charity is tax-exempt. Plus the donor can<br />

Florida. She worked in the banking business<br />

in Florida before joining Levi Strauss in<br />

San Francisco. Currently, Liliana manages<br />

Philip’s investment business and competes in<br />

triathlons. They have two children.<br />

James Trosper lives in Fort Washakie,<br />

Wyoming and is Director of the Indian<br />

Child Welfare Legal Department on the<br />

Wind River Indian Reservation. In 2002, he<br />

was appointed by Governor Dave Freudenthal<br />

for a five-year term as trustee on the<br />

University of Wyoming<br />

board. James is an<br />

Eastern Shoshone Sun<br />

Dance leader and the<br />

great-great grandson<br />

of Chief Washakie.<br />

take a sizeable charitable deduction on<br />

his/her taxes—a deduction that can be used<br />

to offset other taxable events. It’s truly a<br />

win-win situation for everyone.<br />

Email us at director@gtnpf.org or call (307)<br />

732-0629 if you would like to make a gift of<br />

appreciated stock. We will get you the information<br />

you need and guide you through the<br />

process.<br />

Option X: Keeping the Proceeds Option Y: Making a Charitable Gift<br />

Stock Value $50,000 Stock Value $50,000<br />

Cost Basis $5,000 Cost Basis Does not matter<br />

Capital Gain $45,000 Capital Gain Avoided<br />

Capital Gains Tax (20%) $9,000 Capital Gains Tax $0<br />

Brokerage Fee (est.) $500 Brokerage Fee (est.) $0<br />

Value of Sale $40,500 Value of Gift and $50,000<br />

Charitable Deduction