2008 Annual Report - Harman

2008 Annual Report - Harman

2008 Annual Report - Harman

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

During the fourth quarter of fiscal 2007, we changed our accounting for U.S. foreign tax credits.<br />

Previously, we did not record the tax benefit of U.S. foreign tax credits resulting from German income<br />

tax. We have changed our position because recent case law has provided a probable degree of certainty<br />

regarding the treatment of these foreign tax credits. We have amended previously filed U.S. Federal<br />

income tax returns to claim foreign tax credits for German income tax for which our Company is legally<br />

liable. The tax years that were amended are 2003 through 2006. For fiscal years <strong>2008</strong> and beyond, the<br />

Internal Revenue Service has issued proposed regulations that will preclude taxpayers from claiming<br />

foreign tax credits using the same methodology. We intend to follow the proposed regulations when they<br />

become effective.<br />

We have not provided U.S. Federal or foreign withholding taxes on foreign subsidiary undistributed<br />

earnings as of June 30, <strong>2008</strong>, because these foreign earnings are intended to be permanently reinvested.<br />

The U.S. Federal income tax liability, if any, that would be payable if such earnings were not permanently<br />

reinvested would not be material.<br />

Effective July 1, 2007, we adopted FIN 48, Accounting for Uncertainty in Income Taxes – an<br />

interpretation of FASB Statement No. 109 (“FIN 48”). FIN 48 clarifies the accounting for uncertainty in<br />

income taxes by prescribing rules for recognition, measurement and classification in our consolidated<br />

financial statements of tax positions taken or expected to be taken in a tax return. For tax benefits to be<br />

recognized under FIN 48, a tax position must be more-likely-than-not to be sustained upon examination<br />

by taxing authorities. The amount recognized is measured as the largest amount of benefit that is greater<br />

than 50% likely of being realized upon settlement. The cumulative effect of applying the recognition and<br />

measurement provisions upon adoption of FIN 48 resulted in a decrease of $7.2 million of unrealized tax<br />

benefits to our balance of $31.2 million. This reduction was included as an increase to the July 1, 2007<br />

balance of retained earnings.<br />

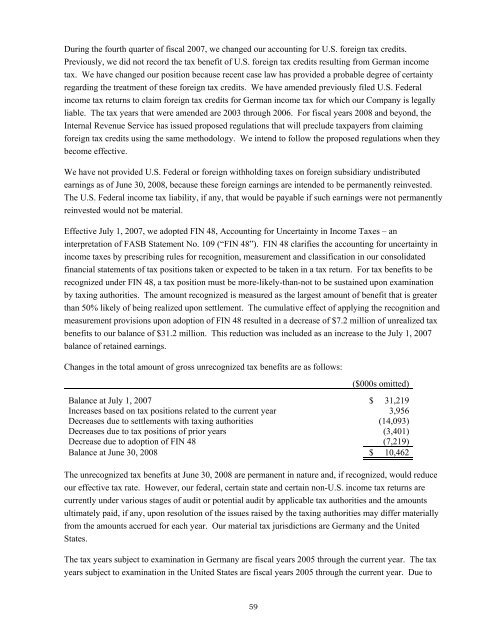

Changes in the total amount of gross unrecognized tax benefits are as follows:<br />

59<br />

($000s omitted)<br />

Balance at July 1, 2007 $ 31,219<br />

Increases based on tax positions related to the current year 3,956<br />

Decreases due to settlements with taxing authorities (14,093)<br />

Decreases due to tax positions of prior years (3,401)<br />

Decrease due to adoption of FIN 48 (7,219)<br />

Balance at June 30, <strong>2008</strong> $ 10,462<br />

The unrecognized tax benefits at June 30, <strong>2008</strong> are permanent in nature and, if recognized, would reduce<br />

our effective tax rate. However, our federal, certain state and certain non-U.S. income tax returns are<br />

currently under various stages of audit or potential audit by applicable tax authorities and the amounts<br />

ultimately paid, if any, upon resolution of the issues raised by the taxing authorities may differ materially<br />

from the amounts accrued for each year. Our material tax jurisdictions are Germany and the United<br />

States.<br />

The tax years subject to examination in Germany are fiscal years 2005 through the current year. The tax<br />

years subject to examination in the United States are fiscal years 2005 through the current year. Due to