Download - Benteler

Download - Benteler

Download - Benteler

- TAGS

- download

- benteler

- benteler.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MANAGEMENT REPORT<br />

Noncurrent capital (equity, capital represented by participation certificates and noncurrent liabilities)<br />

came to €2,160 million, or 59 % of total assets. It covered 145 % of noncurrent assets.<br />

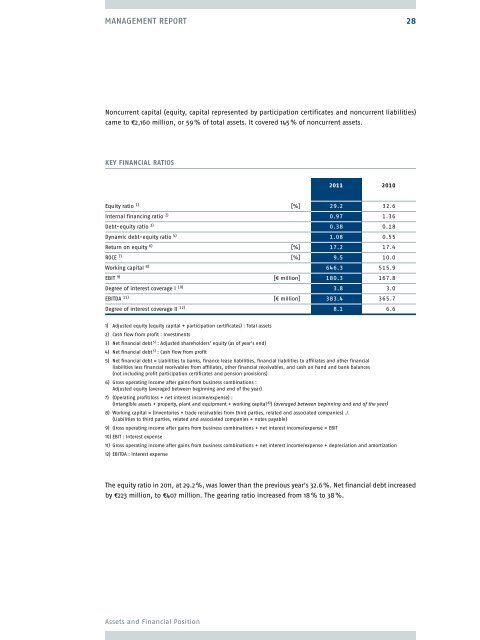

keY FInAnCIAl RAtIoS<br />

2011 2010<br />

Equity ratio 1) [%] 29.2 32.6<br />

Internal financing ratio 2) 0.97 1.36<br />

Debt-equity ratio 3) 0.38 0.18<br />

Dynamic debt-equity ratio 4) 1.08 0.55<br />

Return on equity 6) [%] 17.2 17.4<br />

ROCE 7) [%] 9.5 10.0<br />

Working capital 8) 646.3 515.9<br />

EBIT 9) [€ million] 180.3 167.8<br />

Degree of interest coverage I 10) 3.8 3.0<br />

EBITDA 11) [€ million] 383.4 365.7<br />

Degree of interest coverage II 12) 8.1 6.6<br />

1) Adjusted equity (equity capital + participation certificates) : Total assets<br />

2) Cash flow from profit : Investments<br />

3) Net financial debt 5) : Adjusted shareholders’ equity (as of year’s end)<br />

4) Net financial debt 5) : Cash flow from profit<br />

5) Net financial debt = Liabilities to banks, finance lease liabilities, financial liabilities to affiliates and other financial<br />

liabilities less financial receivables from affiliates, other financial receivables, and cash on hand and bank balances<br />

(not including profit participation certificates and pension provisions)<br />

6) Gross operating income after gains from business combinations :<br />

Adjusted equity (averaged between beginning and end of the year)<br />

7) (Operating profit/loss + net interest income/expense) :<br />

(Intangible assets + property, plant and equipment + working capital 8) ) (averaged between beginning and end of the year)<br />

8) Working capital = (Inventories + trade receivables from third parties, related and associated companies) ./.<br />

(Liabilities to third parties, related and associated companies + notes payable)<br />

9) Gross operating income after gains from business combinations + net interest income/expense = EBIT<br />

10) EBIT : Interest expense<br />

11) Gross operating income after gains from business combinations + net interest income/expense + depreciation and amortization<br />

12) EBITDA : Interest expense<br />

The equity ratio in 2011, at 29.2 %, was lower than the previous year’s 32.6 %. Net financial debt increased<br />

by €223 million, to €407 million. The gearing ratio increased from 18 % to 38 %.<br />

Assets and Financial Position<br />

28