YASKAWA ELECTRIC CORPORATION Annual Report 1999

YASKAWA ELECTRIC CORPORATION Annual Report 1999

YASKAWA ELECTRIC CORPORATION Annual Report 1999

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Review<br />

Business Results<br />

In the fiscal year ended March 20, <strong>1999</strong>, Yaskawa recorded a<br />

15.3% decrease in consolidated net sales, to ¥227.4 billion. By<br />

product group, sales in Mechatronics Components fell 20.3%,<br />

to ¥99.4 billion, accounting for 43.7% of net sales. This fall<br />

reflected a decrease in sales of AC servos as well as inverters<br />

in the domestic and overseas markets. Sales in Mechatronics<br />

Systems dropped 11.5%, to ¥40.5 billion, making up 17.8% of<br />

the Group’s net sales. This was due to weaker demand for<br />

supermechatronics products for use in semiconductor production<br />

equipment. Sales in Industrial Electric Components<br />

decreased 17.7%, to ¥35.6 billion, which accounted for 15.7%<br />

of net sales. The decline in this category was due to sluggish<br />

capital investment in domestic manufacturing industries and<br />

the effects of economic turmoil in Asia. In Industrial Electrical<br />

Control Systems, sales fell 8.9%, to ¥35.5 billion, or 15.6% of<br />

net sales. This decrease was the result of slumping capital<br />

investment in domestic manufacturing industries. Sales in<br />

others amounted to ¥16.2 billion, making up 7.2% of net sales.<br />

Cost of sales amounted to ¥166.0 billion and the cost of<br />

sales ratio was 73.0%, 1.4 percentage points higher than in the<br />

previous fiscal year. Selling, general & administrative (SG&A)<br />

expenses amounted to ¥60.8 billion. SG&A expenses as a percentage<br />

of net sales increased to 26.7%, from 23.4% in the<br />

previous fiscal year. Net operating income sank 95.5%, to ¥0.5<br />

billion. Ordinary income plunged 98.6%, to ¥0.1 billion. Net<br />

loss after taxes and minority interest was ¥3.8 billion, compared<br />

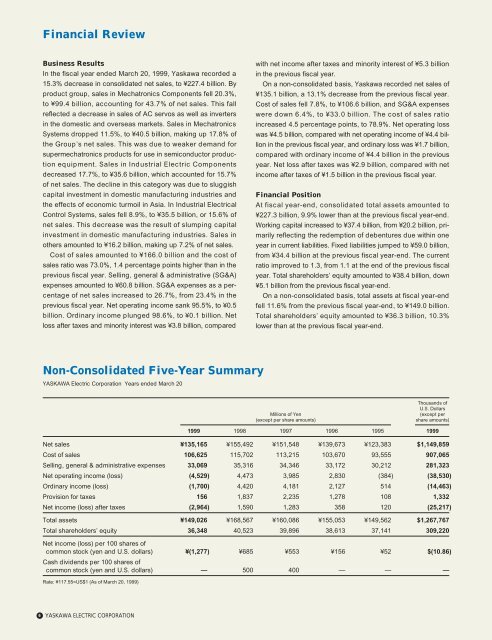

Non-Consolidated Five-Year Summary<br />

<strong>YASKAWA</strong> Electric Corporation Years ended March 20<br />

6 <strong>YASKAWA</strong> <strong>ELECTRIC</strong> <strong>CORPORATION</strong><br />

with net income after taxes and minority interest of ¥5.3 billion<br />

in the previous fiscal year.<br />

On a non-consolidated basis, Yaskawa recorded net sales of<br />

¥135.1 billion, a 13.1% decrease from the previous fiscal year.<br />

Cost of sales fell 7.8%, to ¥106.6 billion, and SG&A expenses<br />

were down 6.4%, to ¥33.0 billion. The cost of sales ratio<br />

increased 4.5 percentage points, to 78.9%. Net operating loss<br />

was ¥4.5 billion, compared with net operating income of ¥4.4 billion<br />

in the previous fiscal year, and ordinary loss was ¥1.7 billion,<br />

compared with ordinary income of ¥4.4 billion in the previous<br />

year. Net loss after taxes was ¥2.9 billion, compared with net<br />

income after taxes of ¥1.5 billion in the previous fiscal year.<br />

Financial Position<br />

At fiscal year-end, consolidated total assets amounted to<br />

¥227.3 billion, 9.9% lower than at the previous fiscal year-end.<br />

Working capital increased to ¥37.4 billion, from ¥20.2 billion, primarily<br />

reflecting the redemption of debentures due within one<br />

year in current liabilities. Fixed liabilities jumped to ¥59.0 billion,<br />

from ¥34.4 billion at the previous fiscal year-end. The current<br />

ratio improved to 1.3, from 1.1 at the end of the previous fiscal<br />

year. Total shareholders’ equity amounted to ¥38.4 billion, down<br />

¥5.1 billion from the previous fiscal year-end.<br />

On a non-consolidated basis, total assets at fiscal year-end<br />

fell 11.6% from the previous fiscal year-end, to ¥149.0 billion.<br />

Total shareholders’ equity amounted to ¥36.3 billion, 10.3%<br />

lower than at the previous fiscal year-end.<br />

Thousands of<br />

U.S. Dollars<br />

Millions of Yen (except per<br />

(except per share amounts) share amounts)<br />

<strong>1999</strong> 1998 1997 1996 1995 <strong>1999</strong><br />

Net sales ¥135,165 ¥155,492 ¥151,548 ¥139,673 ¥123,383 $1,149,859<br />

Cost of sales 106,625 115,702 113,215 103,670 93,555 907,065<br />

Selling, general & administrative expenses 33,069 35,316 34,346 33,172 30,212 281,323<br />

Net operating income (loss) (4,529) 4,473 3,985 2,830 (384) (38,530)<br />

Ordinary income (loss) (1,700) 4,420 4,181 2,127 514 (14,463)<br />

Provision for taxes 156 1,837 2,235 1,278 108 1,332<br />

Net income (loss) after taxes (2,964) 1,590 1,283 358 120 (25,217)<br />

Total assets ¥149,026 ¥168,567 ¥160,086 ¥155,053 ¥149,562 $1,267,767<br />

Total shareholders’ equity 36,348 40,523 39,896 38,613 37,141 309,220<br />

Net income (loss) per 100 shares of<br />

common stock (yen and U.S. dollars)<br />

Cash dividends per 100 shares of<br />

¥(1,277) ¥685 ¥553 ¥156 ¥52 $(10.86)<br />

common stock (yen and U.S. dollars) — 500 400 — — —<br />

Rate: ¥117.55=US$1 (As of March 20, <strong>1999</strong>)