OFFERING MEMORANDUM STRATA 2007-1, LIMITED $40000000 ...

OFFERING MEMORANDUM STRATA 2007-1, LIMITED $40000000 ...

OFFERING MEMORANDUM STRATA 2007-1, LIMITED $40000000 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

12001-01597 NY:2045248.4<br />

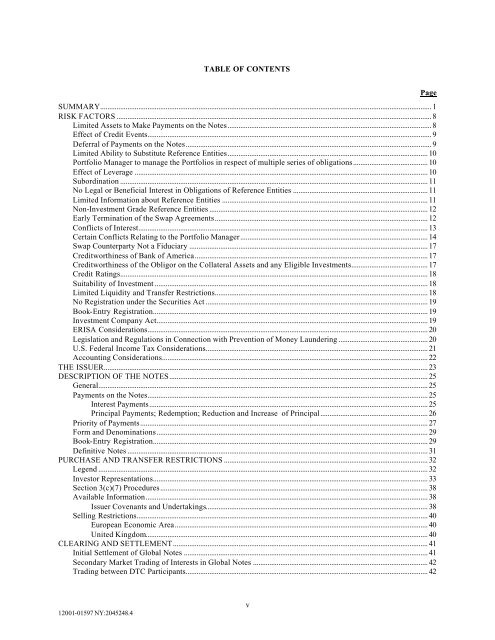

TABLE OF CONTENTS<br />

SUMMARY...................................................................................................................................................................................... 1<br />

RISK FACTORS ............................................................................................................................................................................. 8<br />

Limited Assets to Make Payments on the Notes................................................................................................................ 8<br />

Effect of Credit Events............................................................................................................................................................ 9<br />

Deferral of Payments on the Notes....................................................................................................................................... 9<br />

Limited Ability to Substitute Reference Entities.............................................................................................................. 10<br />

Portfolio Manager to manage the Portfolios in respect of multiple series of obligations......................................... 10<br />

Effect of Leverage ................................................................................................................................................................. 10<br />

Subordination ......................................................................................................................................................................... 11<br />

No Legal or Beneficial Interest in Obligations of Reference Entities .......................................................................... 11<br />

Limited Information about Reference Entities ................................................................................................................. 11<br />

Non-Investment Grade Reference Entities ........................................................................................................................ 12<br />

Early Termination of the Swap Agreements..................................................................................................................... 12<br />

Conflicts of Interest............................................................................................................................................................... 13<br />

Certain Conflicts Relating to the Portfolio Manager....................................................................................................... 14<br />

Swap Counterparty Not a Fiduciary ................................................................................................................................... 17<br />

Creditworthiness of Bank of America................................................................................................................................ 17<br />

Creditworthiness of the Obligor on the Collateral Assets and any Eligible Investments.......................................... 17<br />

Credit Ratings......................................................................................................................................................................... 18<br />

Suitability of Investment ...................................................................................................................................................... 18<br />

Limited Liquidity and Transfer Restrictions..................................................................................................................... 18<br />

No Registration under the Securities Act .......................................................................................................................... 19<br />

Book-Entry Registration....................................................................................................................................................... 19<br />

Investment Company Act..................................................................................................................................................... 19<br />

ERISA Considerations.......................................................................................................................................................... 20<br />

Legislation and Regulations in Connection with Prevention of Money Laundering ................................................. 20<br />

U.S. Federal Income Tax Considerations.......................................................................................................................... 21<br />

Accounting Considerations.................................................................................................................................................. 22<br />

THE ISSUER.................................................................................................................................................................................. 23<br />

DESCRIPTION OF THE NOTES.............................................................................................................................................. 25<br />

General..................................................................................................................................................................................... 25<br />

Payments on the Notes.......................................................................................................................................................... 25<br />

Interest Payments......................................................................................................................................................... 25<br />

Principal Payments; Redemption; Reduction and Increase of Principal........................................................... 26<br />

Priority of Payments.............................................................................................................................................................. 27<br />

Form and Denominations..................................................................................................................................................... 29<br />

Book-Entry Registration....................................................................................................................................................... 29<br />

Definitive Notes ..................................................................................................................................................................... 31<br />

PURCHASE AND TRANSFER RESTRICTIONS ................................................................................................................ 32<br />

Legend ..................................................................................................................................................................................... 32<br />

Investor Representations....................................................................................................................................................... 33<br />

Section 3(c)(7) Procedures................................................................................................................................................... 38<br />

Available Information........................................................................................................................................................... 38<br />

Issuer Covenants and Undertakings.......................................................................................................................... 38<br />

Selling Restrictions................................................................................................................................................................ 40<br />

European Economic Area........................................................................................................................................... 40<br />

United Kingdom........................................................................................................................................................... 40<br />

CLEARING AND SETTLEMENT............................................................................................................................................ 41<br />

Initial Settlement of Global Notes ...................................................................................................................................... 41<br />

Secondary Market Trading of Interests in Global Notes ................................................................................................ 42<br />

Trading between DTC Participants..................................................................................................................................... 42<br />

v<br />

Page