INTERMEDIATE FINANCE II CLO Offering Memorandum - BLACK ...

INTERMEDIATE FINANCE II CLO Offering Memorandum - BLACK ...

INTERMEDIATE FINANCE II CLO Offering Memorandum - BLACK ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

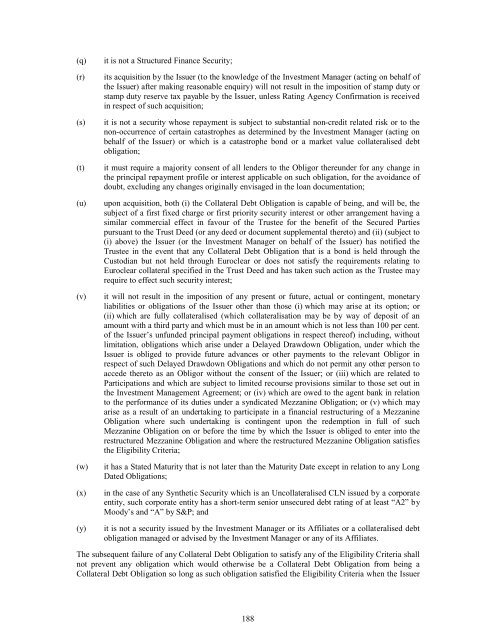

(q) it is not a Structured Finance Security;<br />

(r) its acquisition by the Issuer (to the knowledge of the Investment Manager (acting on behalf of<br />

the Issuer) after making reasonable enquiry) will not result in the imposition of stamp duty or<br />

stamp duty reserve tax payable by the Issuer, unless Rating Agency Confirmation is received<br />

in respect of such acquisition;<br />

(s) it is not a security whose repayment is subject to substantial non-credit related risk or to the<br />

non-occurrence of certain catastrophes as determined by the Investment Manager (acting on<br />

behalf of the Issuer) or which is a catastrophe bond or a market value collateralised debt<br />

obligation;<br />

(t) it must require a majority consent of all lenders to the Obligor thereunder for any change in<br />

the principal repayment profile or interest applicable on such obligation, for the avoidance of<br />

doubt, excluding any changes originally envisaged in the loan documentation;<br />

(u) upon acquisition, both (i) the Collateral Debt Obligation is capable of being, and will be, the<br />

subject of a first fixed charge or first priority security interest or other arrangement having a<br />

similar commercial effect in favour of the Trustee for the benefit of the Secured Parties<br />

pursuant to the Trust Deed (or any deed or document supplemental thereto) and (ii) (subject to<br />

(i) above) the Issuer (or the Investment Manager on behalf of the Issuer) has notified the<br />

Trustee in the event that any Collateral Debt Obligation that is a bond is held through the<br />

Custodian but not held through Euroclear or does not satisfy the requirements relating to<br />

Euroclear collateral specified in the Trust Deed and has taken such action as the Trustee may<br />

require to effect such security interest;<br />

(v) it will not result in the imposition of any present or future, actual or contingent, monetary<br />

liabilities or obligations of the Issuer other than those (i) which may arise at its option; or<br />

(ii) which are fully collateralised (which collateralisation may be by way of deposit of an<br />

amount with a third party and which must be in an amount which is not less than 100 per cent.<br />

of the Issuer’s unfunded principal payment obligations in respect thereof) including, without<br />

limitation, obligations which arise under a Delayed Drawdown Obligation, under which the<br />

Issuer is obliged to provide future advances or other payments to the relevant Obligor in<br />

respect of such Delayed Drawdown Obligations and which do not permit any other person to<br />

accede thereto as an Obligor without the consent of the Issuer; or (iii) which are related to<br />

Participations and which are subject to limited recourse provisions similar to those set out in<br />

the Investment Management Agreement; or (iv) which are owed to the agent bank in relation<br />

to the performance of its duties under a syndicated Mezzanine Obligation; or (v) which may<br />

arise as a result of an undertaking to participate in a financial restructuring of a Mezzanine<br />

Obligation where such undertaking is contingent upon the redemption in full of such<br />

Mezzanine Obligation on or before the time by which the Issuer is obliged to enter into the<br />

restructured Mezzanine Obligation and where the restructured Mezzanine Obligation satisfies<br />

the Eligibility Criteria;<br />

(w) it has a Stated Maturity that is not later than the Maturity Date except in relation to any Long<br />

Dated Obligations;<br />

(x) in the case of any Synthetic Security which is an Uncollateralised CLN issued by a corporate<br />

entity, such corporate entity has a short-term senior unsecured debt rating of at least “A2” by<br />

Moody’s and “A” by S&P; and<br />

(y) it is not a security issued by the Investment Manager or its Affiliates or a collateralised debt<br />

obligation managed or advised by the Investment Manager or any of its Affiliates.<br />

The subsequent failure of any Collateral Debt Obligation to satisfy any of the Eligibility Criteria shall<br />

not prevent any obligation which would otherwise be a Collateral Debt Obligation from being a<br />

Collateral Debt Obligation so long as such obligation satisfied the Eligibility Criteria when the Issuer<br />

188