- Page 6 and 7: 7 9 6 5 13 14 12 11 8 15 4

- Page 9 and 10: NOTICE TO INVESTORS No person is au

- Page 11 and 12: FORWARD-LOOKING STATEMENTS Certain

- Page 13 and 14: MARKET AND INDUSTRY INFORMATION Thi

- Page 15 and 16: SUMMARY The following summary is qu

- Page 17 and 18: (12) MLT holds the remainder of a 3

- Page 19 and 20: The following table illustrates the

- Page 21 and 22: which, on an annualised basis, is e

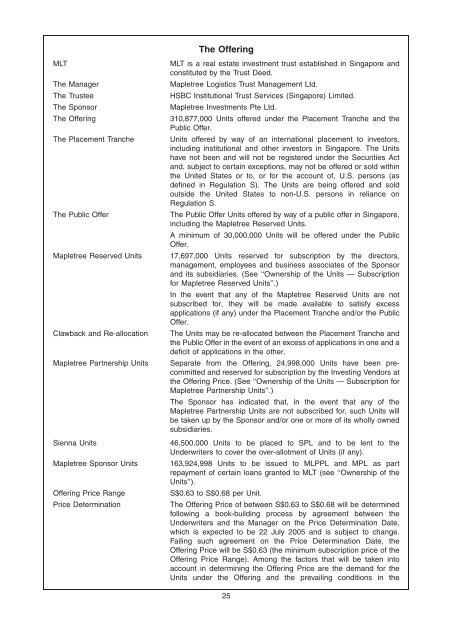

- Page 23 and 24: the Listing Date, the Sienna Units

- Page 25 and 26: 60 Alps Avenue Singapore 498815 Pro

- Page 27 and 28: Lifung Centre 5B Toh Guan Road East

- Page 29 and 30: CIAS Flight Kitchen 50 Airport Boul

- Page 31 and 32: 531 Bukit Batok Street 23 Singapore

- Page 33 and 34: STRUCTURE OF MLT The following diag

- Page 35 and 36: The Sponsor: Mapletree Investments

- Page 37: Payable by MLT Amount payable (iv)

- Page 41 and 42: and including the Listing Date in r

- Page 43 and 44: efunded (without interest or any sh

- Page 45 and 46: Forecast and Projected Statements o

- Page 47 and 48: The properties in MLT’s initial p

- Page 49 and 50: such other properties and other ter

- Page 51 and 52: would increase, which would adverse

- Page 53 and 54: ) acts of God, wars, terrorist atta

- Page 55 and 56: premium of approximately 22.4% to t

- Page 57 and 58: Although it is currently intended t

- Page 59 and 60: USE OF PROCEEDS The Manager intends

- Page 61 and 62: Units to be Issued to MLPPL, MPL an

- Page 63 and 64: DISTRIBUTIONS MLT’s distribution

- Page 65 and 66: CAPITALISATION The following table

- Page 67 and 68: Unaudited Pro Forma (1) (S$’000)

- Page 69 and 70: Forecast and Projected Statements o

- Page 71 and 72: (I) Gross Revenue Gross Revenue com

- Page 73 and 74: and (iii) where MLT is responsible

- Page 75 and 76: Any subsequent write-down of the va

- Page 77 and 78: Borrowing Costs Changes in borrowin

- Page 79 and 80: Acquisition Growth Strategy The Man

- Page 81 and 82: ) Tenant credit quality The Manager

- Page 83 and 84: The Manager will consider diversify

- Page 85 and 86: Changi Airport and the Seletar Airp

- Page 87 and 88: ) Diverse tenant trade sectors The

- Page 89 and 90:

Gross Revenue The Properties genera

- Page 91 and 92:

Occupancy The Properties have a wei

- Page 93 and 94:

(10) The tenant has an option to re

- Page 95 and 96:

The ALPS is the only logistics FTZ

- Page 97 and 98:

Tenant Information 70 Alps Avenue h

- Page 99 and 100:

61 Alps Avenue Singapore 498798 Des

- Page 101 and 102:

25 Pandan Crescent Singapore 128477

- Page 103 and 104:

5B Toh Guan Road East Singapore 608

- Page 105 and 106:

21 Serangoon North Avenue 5 Singapo

- Page 107 and 108:

50 Airport Boulevard Singapore 8196

- Page 109 and 110:

Description Pulau Sebarok Pulau Seb

- Page 111 and 112:

531 Bukit Batok Street 23 Singapore

- Page 113 and 114:

11 Tai Seng Link Singapore 534182 D

- Page 115 and 116:

Trade in Asia Asia accounted for 26

- Page 117 and 118:

Zones Within Asia-Pacific Europe-As

- Page 119 and 120:

Source: Armstrong & Associates, 200

- Page 121 and 122:

Logistics Market Overview Singapore

- Page 123 and 124:

The Free Trade Zones near Changi In

- Page 125 and 126:

Singapore Warehouse Market Review I

- Page 127 and 128:

The map below depicts the five plan

- Page 129 and 130:

10-year historical average of 173,7

- Page 131 and 132:

capital values are therefore likely

- Page 133 and 134:

Food and Cold Storage Logistics Pro

- Page 135 and 136:

Regional Logistics Market Overview

- Page 137 and 138:

5.1%, which was the second fastest

- Page 139 and 140:

India Overview of the Economy The I

- Page 141 and 142:

which operate similarly to free tra

- Page 143 and 144:

With such government support reduci

- Page 145 and 146:

The Manager of MLT THE MANAGER AND

- Page 147 and 148:

Prior to joining Mapletree Investme

- Page 149 and 150:

Management Reporting Structure of t

- Page 151 and 152:

esponsible for setting up and devel

- Page 153 and 154:

Mr Chan started his career at the I

- Page 155 and 156:

Mrs Lee, a registered architect, ho

- Page 157 and 158:

the written consent of the Trustee,

- Page 159 and 160:

(xviii) total operating expenses of

- Page 161 and 162:

on which it acquires or disposes of

- Page 163 and 164:

The aggregate value of all Related

- Page 165 and 166:

THE SPONSOR The Sponsor, Mapletree

- Page 167 and 168:

THE FORMATION AND STRUCTURE OF MAPL

- Page 169 and 170:

the period of 10 Business Days imme

- Page 171 and 172:

suspension is authorised (as set ou

- Page 173 and 174:

) by Extraordinary Resolution and i

- Page 175 and 176:

The Trustee may, subject to the pro

- Page 177 and 178:

CERTAIN AGREEMENTS RELATING TO MAPL

- Page 179 and 180:

granting a licence or parting with

- Page 181 and 182:

) after the Prohibition Period, the

- Page 183 and 184:

on the same rent and other terms, c

- Page 185 and 186:

Principal terms of State Lease No.

- Page 187 and 188:

JTC has entered into a building agr

- Page 189 and 190:

The lessee may, however, sublet the

- Page 191 and 192:

) IDS’ parent company, IDS Group

- Page 193 and 194:

) in granting its consent relating

- Page 195 and 196:

apportioned between Mapletree Trust

- Page 197 and 198:

per annum on the sum of S$5.0 milli

- Page 199 and 200:

Principal terms of State Lease No.

- Page 201 and 202:

Principal terms of State Lease No.

- Page 203 and 204:

granting a licence or parting with

- Page 205 and 206:

day. It is intended that the call o

- Page 207 and 208:

exceeding 0.24. The lessee shall no

- Page 209 and 210:

the monies received by virtue of th

- Page 211 and 212:

) the lessee shall not change the u

- Page 213 and 214:

On completion of the sale and purch

- Page 215 and 216:

other causes beyond the control of

- Page 217 and 218:

e equivalent to the value of the bu

- Page 219 and 220:

(ii) obtained all the temporary occ

- Page 221 and 222:

Principal terms of the Driveway Lan

- Page 223 and 224:

Property, all fittings, fixtures an

- Page 225 and 226:

) where the proposed annual value i

- Page 227 and 228:

action, cost, claim, damage, expens

- Page 229 and 230:

TAXATION The following summary of c

- Page 231 and 232:

Non-individuals Non-individual Unit

- Page 233 and 234:

Nominee Unitholders ) Taxable incom

- Page 235 and 236:

PLAN OF DISTRIBUTION The Manager is

- Page 237 and 238:

(adjusted for any bonus issue or su

- Page 239 and 240:

Each Underwriter has represented an

- Page 241 and 242:

Units may only be offered in Austra

- Page 243 and 244:

Introduction CLEARANCE AND SETTLEME

- Page 245 and 246:

GENERAL INFORMATION (1) The profit

- Page 247 and 248:

(g) the separate agreements relatin

- Page 249 and 250:

DBS Bank DBS Bank Ltd Deposited Pro

- Page 251 and 252:

Joint Financial Advisers, Underwrit

- Page 253 and 254:

Price Determination Date 22 July 20

- Page 255 and 256:

Third Party Properties 70 Alps Aven

- Page 257 and 258:

necessarily occur) are more subject

- Page 259 and 260:

In our opinion: (A) the Unaudited P

- Page 261 and 262:

) Many of the Properties (70 Alps A

- Page 263 and 264:

Unaudited Audited Pro Forma Financi

- Page 265 and 266:

(iv) Trade and other payables Adjus

- Page 267 and 268:

(F) NOTES TO THE UNAUDITED PRO FORM

- Page 269 and 270:

(ii) Manager’s management fees Ma

- Page 271 and 272:

Term of Remaining Percentage Descri

- Page 273 and 274:

7. Interest-bearing Borrowings Pro

- Page 275 and 276:

Fair values The Manager believes th

- Page 277 and 278:

INDEPENDENT PROPERTY VALUATION SUMM

- Page 279 and 280:

VALUATION CERTIFICATE Address of Pr

- Page 281 and 282:

VALUATION CERTIFICATE Address of Pr

- Page 283 and 284:

VALUATION CERTIFICATE Date of Valua

- Page 285 and 286:

VALUATION CERTIFICATE Date of Valua

- Page 287 and 288:

VALUATION CERTIFICATE Date of Valua

- Page 289 and 290:

5B Toh Guan Road East Singapore 608

- Page 291 and 292:

21 & 23 Benoi Sector Singapore 6298

- Page 293 and 294:

VALUATION CERTIFICATE Date of Valua

- Page 295 and 296:

VALUATION CERTIFICATE Date of Valua

- Page 297 and 298:

37 Penjuru Lane Singapore 609215 20

- Page 299 and 300:

50 Airport Boulevard Singapore 8196

- Page 301 and 302:

201 Keppel Road Singapore 099419 Gr

- Page 303 and 304:

VALUATION CERTIFICATE Date of Valua

- Page 305 and 306:

1, 3, 5 & Vacant Land at Pulau Seba

- Page 307 and 308:

VALUATION CERTIFICATE Date of Valua

- Page 309 and 310:

VALUATION CERTIFICATE Date of Valua

- Page 311 and 312:

VALUATION CERTIFICATE Date of Valua

- Page 313 and 314:

APPENDIX IV INDEPENDENT LOGISTICS P

- Page 315 and 316:

1 Introduction Mapletree Logistics

- Page 317 and 318:

Source: WTO, CB Richard Ellis Intra

- Page 319 and 320:

The growth expectation in air freig

- Page 321 and 322:

2.6 Logistics cost breakdown Logist

- Page 323 and 324:

3.3.1 Singapore: A Logistics Hub Wi

- Page 325 and 326:

The ALPS, a 26-ha development, had

- Page 327 and 328:

products on a regional basis from S

- Page 329 and 330:

Known Future Private Warehouse Supp

- Page 331 and 332:

At the end of the first quarter of

- Page 333 and 334:

MLT’s property portfolio can be c

- Page 335 and 336:

5.2 Portfolio Analysis The table be

- Page 337 and 338:

need to rely on export industries.

- Page 339 and 340:

(12%), with support services includ

- Page 341 and 342:

site after months of delay. The sec

- Page 343 and 344:

6.2 Hong Kong 6.2.1 Overview of the

- Page 345 and 346:

6.2.4 Key infrastructure nodes Most

- Page 347 and 348:

With a view to strengthening Hong K

- Page 349 and 350:

Malaysia is located at the crossroa

- Page 351 and 352:

Port of Tanjung Pelepas The Port of

- Page 353 and 354:

Recent Sale Transactions Land Area

- Page 355 and 356:

6.4.4 Key players in the logistics

- Page 357 and 358:

Vizag Vizag is located in Andhra Pr

- Page 359 and 360:

Export turnover grew to US$26.0 bil

- Page 361 and 362:

Industrial/ Indicative Land Rental

- Page 363 and 364:

6.6.4 Key infrastructure nodes Thai

- Page 365 and 366:

Transport, the number of shipping c

- Page 367 and 368:

6.8 Philippines 6.8.1 Overview of t

- Page 369 and 370:

Prospects for the logistics sector

- Page 371 and 372:

In Vietnam, Foreign Direct Investme

- Page 373 and 374:

Also, under the current Singapore i

- Page 375 and 376:

and not for trading purposes. There

- Page 377 and 378:

partnership in Singapore or from th

- Page 379 and 380:

DECLARATION FOR SINGAPORE TAX PURPO

- Page 381 and 382:

DECLARATION FOR SINGAPORE TAX PURPO

- Page 383 and 384:

APPENDIX VI TERMS, CONDITIONS AND P

- Page 385 and 386:

(13) Subject to paragraph 17 below,

- Page 387 and 388:

(24) Acceptance of applications wil

- Page 389 and 390:

An applicant applying for 1,000 Uni

- Page 391 and 392:

Procedures Relating to Applications

- Page 393 and 394:

Additional Terms and Conditions for

- Page 395 and 396:

(c) Cash and CPF Funds — You may

- Page 397 and 398:

Offering, PROVIDED THAT the remitta

- Page 399 and 400:

Steps for ATM Electronic Applicatio

- Page 401 and 402:

Steps for Internet Electronic Appli

- Page 403 and 404:

Terms and Conditions for Use of CPF

- Page 405 and 406:

(d) Deposited property means the va

- Page 407 and 408:

(iv) the details of the valuations

- Page 409 and 410:

(d) Government securities (issued o

- Page 411 and 412:

is contracting with and other facto

- Page 413 and 414:

asis. For this purpose, no redempti

- Page 415 and 416:

(j) where the property fund is list

- Page 417 and 418:

APPENDIX VIII LIST OF PRESENT AND P

- Page 419 and 420:

(6) MR HIEW YOON KHONG Current Dire

- Page 421 and 422:

(7) MR TAN BOON LEONG Current Direc

- Page 423 and 424:

(8) MR CHUA TIOW CHYE Current Direc

- Page 425 and 426:

(B) EXECUTIVE OFFICERS OF THE MANAG

- Page 427:

INDEPENDENT REPORTING ACCOUNTANTS I