communications policy nabarro nathanson reception iasb Work plan ...

communications policy nabarro nathanson reception iasb Work plan ...

communications policy nabarro nathanson reception iasb Work plan ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

analyst view<br />

St. Dev.<br />

DY Relative P/E<br />

DY Relative<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

2.2<br />

2.0<br />

1.8<br />

1.6<br />

1.4<br />

1.2<br />

1.0<br />

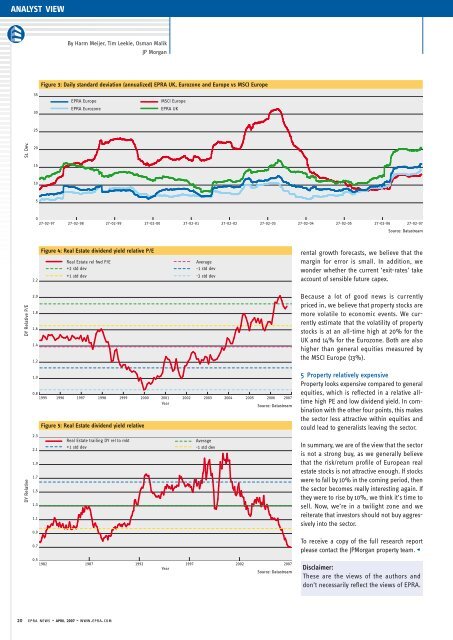

Figure 3: Daily standard deviation (annualized) EPRA UK, Eurozone and Europe vs MSCI Europe<br />

EPRA Europe<br />

EPRA Eurozone<br />

0<br />

27-02-97 27-02-98 27-02-99 27-02-00 27-02-01 27-02-02 27-02-03 27-02-04 27-02-05 27-02-06 27-02-07<br />

Figure 4: Real Estate dividend yield relative P/E<br />

Real Estate rel fwd P/E<br />

+2 std dev<br />

+1 std dev<br />

Figure 5: Real Estate dividend yield relative<br />

20 epra news - april 2007 - www.epra.com<br />

MSCI Europe<br />

EPRA UK<br />

Average<br />

-1 std dev<br />

-2 std dev<br />

0.8<br />

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Year<br />

Source: Datastream<br />

2.3<br />

2.1<br />

1.9<br />

1.7<br />

1,5<br />

1.3<br />

1.1<br />

0.9<br />

0.7<br />

By Harm Meijer, Tim Leekie, Osman Malik<br />

JP Morgan<br />

Real Estate trailing DY rel to mkt<br />

+1 std dev<br />

Average<br />

-1 std dev<br />

0.5<br />

1982 1987 1992 1997 2002 2007<br />

Year<br />

Source: Datastream<br />

Source: Datastream<br />

rental growth forecasts, we believe that the<br />

margin for error is small. In addition, we<br />

wonder whether the current ‘exit-rates’ take<br />

account of sensible future capex.<br />

Because a lot of good news is currently<br />

priced in, we believe that property stocks are<br />

more volatile to economic events. We currently<br />

estimate that the volatility of property<br />

stocks is at an all-time high at 20% for the<br />

UK and 14% for the Eurozone. Both are also<br />

higher than general equities measured by<br />

the MSCI Europe (13%).<br />

5 Property relatively expensive<br />

Property looks expensive compared to general<br />

equities, which is reflected in a relative alltime<br />

high PE and low dividend yield. In combination<br />

with the other four points, this makes<br />

the sector less attractive within equities and<br />

could lead to generalists leaving the sector.<br />

In summary, we are of the view that the sector<br />

is not a strong buy, as we generally believe<br />

that the risk/return profile of European real<br />

estate stocks is not attractive enough. If stocks<br />

were to fall by 10% in the coming period, then<br />

the sector becomes really interesting again. If<br />

they were to rise by 10%, we think it’s time to<br />

sell. Now, we’re in a twilight zone and we<br />

reiterate that investors should not buy aggressively<br />

into the sector.<br />

To receive a copy of the full research report<br />

please contact the JPMorgan property team. $<br />

Disclaimer:<br />

These are the views of the authors and<br />

don’t necessarily reflect the views of EPRA.