Money Demand and Seigniorage-Maximizing ... - William Easterly

Money Demand and Seigniorage-Maximizing ... - William Easterly

Money Demand and Seigniorage-Maximizing ... - William Easterly

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

WILLIAM R. EASTERLY, PAOLO MAURO, AND KLAUS SCHMIDT-HEBBEL : 585<br />

those obtained when using conventional but incorrect measures of inflation. Section<br />

3 concludes.<br />

1. THE MODEL<br />

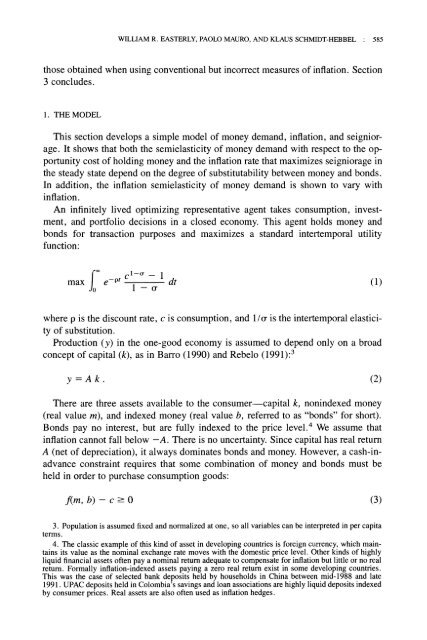

This section develops a simple model of money dem<strong>and</strong>, inflation, <strong>and</strong> seigniorage.<br />

It shows that both the semielasticity of money dem<strong>and</strong> with respect to the opportunity<br />

cost of holding money <strong>and</strong> the inflation rate that maximizes seigniorage in<br />

the steady state depend on the degree of substitutability between money <strong>and</strong> bonds.<br />

In addition, the inflation semielasticity of money dem<strong>and</strong> is shown to vary with<br />

inflation.<br />

An infinitely lived optimizing representative agent takes consumption, investment,<br />

<strong>and</strong> portfolio decisions in a closed economy. This agent holds money <strong>and</strong><br />

bonds for transaction purposes <strong>and</strong> maximizes a st<strong>and</strong>ard intertemporal utility<br />

function:<br />

rX cl-J - 1<br />

max J e-Pt dt (1)<br />

where p is the discount rate, c is consumption, <strong>and</strong> 1/cr is the intertemporal elasticity<br />

of substitution.<br />

Production (y) in the one-good economy is assumed to depend only on a broad<br />

concept of capital (k), as in Barro (1990) <strong>and</strong> Rebelo (1991):3<br />

y = A k . (2)<br />

There are three assets available to the consumer capital k, nonindexed money<br />

(real value m), <strong>and</strong> indexed money (real value b, referred to as "bonds" for short).<br />

Bonds pay no interest, but are fully indexed to the price level.4 We assume that<br />

inflation cannot fall below-A. There is no uncertainty. Since capital has real return<br />

A (net of depreciation), it always dominates bonds <strong>and</strong> money. However, a cash-in-<br />

advance constraint requires that some combination of money <strong>and</strong> bonds must be<br />

held in order to purchase consumption goods:<br />

f(m, b)-c-O (3)<br />

3. Population is assumed fixed <strong>and</strong> normalized at one, so all variables can be interpreted<br />

in per capita<br />

terms.<br />

4. The classic example of this kind of asset in developing countries is foreign currency, which main-<br />

tains its value as the nominal exchange rate moves with the domestic price level. Other kinds of highly<br />

liquid financial assets often pay a nominal return adequate to compensate for inflation but little or no real<br />

return. Formally inflation-indexed assets paying a zero real return exist in some developing countries.<br />

This was the case of selected bank deposits held by households in China between mid-1988 <strong>and</strong> late<br />

1991. UPAC deposits held in Colombia's savings <strong>and</strong> loan associations are highly liquid deposits indexed<br />

by consumer prices. Real assets are also often used as inflation hedges.