P161 - Age-related Allowance Claim form

P161 - Age-related Allowance Claim form

P161 - Age-related Allowance Claim form

- TAGS

- allowance

- www.hmrc.gov.uk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

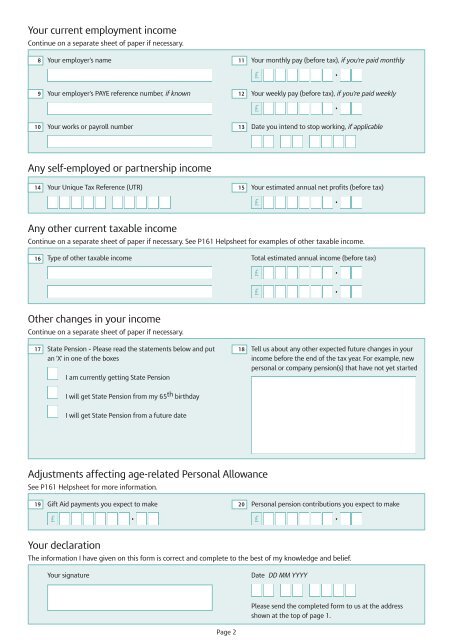

Your current employment income<br />

Continue on a separate sheet of paper if necessary.<br />

8<br />

9<br />

10<br />

Your employer’s name<br />

Your employer’s PAYE reference number, if known<br />

Your works or payroll number<br />

Any self-employed or partnership income<br />

Any other current taxable income<br />

Continue on a separate sheet of paper if necessary. See <strong>P161</strong> Helpsheet for examples of other taxable income.<br />

Type of other taxable income Total estimated annual income (before tax)<br />

Other changes in your income<br />

Continue on a separate sheet of paper if necessary.<br />

17 State Pension – Please read the statements below and put<br />

an 'X' in one of the boxes<br />

18<br />

Your declaration<br />

I am currently getting State Pension<br />

I will get State Pension from my 65 th birthday<br />

I will get State Pension from a future date<br />

Adjustments affecting age-<strong>related</strong> Personal <strong>Allowance</strong><br />

See <strong>P161</strong> Helpsheet for more in<strong>form</strong>ation.<br />

Your signature Date DD MM YYYY<br />

Page 2<br />

Your monthly pay (before tax), if you’re paid monthly<br />

Your weekly pay (before tax), if you’re paid weekly<br />

Date you intend to stop working, if applicable<br />

14 Your Unique Tax Reference (UTR) 15 Your estimated annual net profits (before tax)<br />

16<br />

Tell us about any other expected future changes in your<br />

income before the end of the tax year. For example, new<br />

personal or company pension(s) that have not yet started<br />

19 Gift Aid payments you expect to make 20 Personal pension contributions you expect to make<br />

£<br />

•<br />

The in<strong>form</strong>ation I have given on this <strong>form</strong> is correct and complete to the best of my knowledge and belief.<br />

11<br />

12<br />

13<br />

£<br />

£<br />

£<br />

£<br />

£<br />

£<br />

Please send the completed <strong>form</strong> to us at the address<br />

shown at the top of page 1.<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•