Comm. 30 Medicaid for the Medically Needy - Iowa Department of ...

Comm. 30 Medicaid for the Medically Needy - Iowa Department of ...

Comm. 30 Medicaid for the Medically Needy - Iowa Department of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

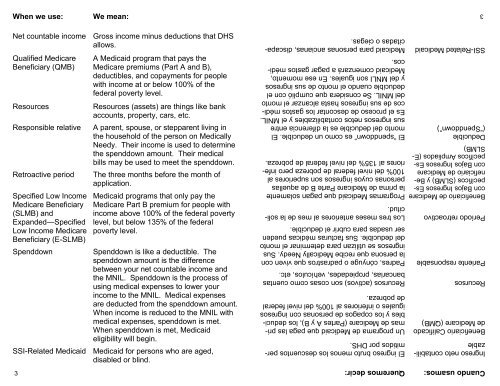

Cuando usamos: Queremos decir:Ingreso neto contabilizableBeneficiario Calificadode Medicare (QMB)3El ingreso bruto menos los descuentos permitidospor DHS.Un programa de <strong>Medicaid</strong> que paga las primasde Medicare (Partes A y B), los deduciblesy los copagos de personas con ingresosiguales o inferiores al 100% del nivel federalde pobreza.Recursos Recursos (activos) son cosas como cuentasbancarias, propiedades, vehículos, etc.Pariente responsable Padres, cónyuge o padrastros que viven conla persona que recibe <strong>Medically</strong> <strong>Needy</strong>. Susingresos se utilizan para determinar el montodel deducible. Sus facturas médicas puedenser usadas para cubrir el deducible.Período retroactivo Los tres meses anteriores al mes de la solicitud.Beneficiario de Medicare Programas <strong>Medicaid</strong> que pagan solamentecon Bajos Ingresos Específicos(SLMB) y Be-personas cuyos ingresos son superiores alla prima de Medicare Parte B de aquellasneficiario de Medicare 100% del nivel federal de pobreza pero inferioresal 135% del nivel federal de pobreza.con Bajos Ingresos EspecíficosAmpliados (E-SLMB)Deducible(“Spenddown”)El “spenddown” es como un deducible. Elmonto del deducible es la diferencia entresus ingresos netos contabilizables y el MNIL.Es el proceso de descontar los gastos médicosde sus ingresos hasta alcanzar el montodel MNIL. Se considera que cumplió con eldeducible cuando el monto de sus ingresosy del MNLI son iguales. En ese momento,<strong>Medicaid</strong> comenzará a pagar gastos médicos.SSI-Related <strong>Medicaid</strong> <strong>Medicaid</strong> para personas ancianas, discapacitadaso ciegas.When we use: We mean:Net countable income Gross income minus deductions that DHSallows.Qualified MedicareBeneficiary (QMB)A <strong>Medicaid</strong> program that pays <strong>the</strong>Medicare premiums (Part A and B),deductibles, and copayments <strong>for</strong> peoplewith income at or below 100% <strong>of</strong> <strong>the</strong>federal poverty level.Resources Resources (assets) are things like bankaccounts, property, cars, etc.Responsible relative A parent, spouse, or stepparent living in<strong>the</strong> household <strong>of</strong> <strong>the</strong> person on <strong>Medically</strong><strong>Needy</strong>. Their income is used to determine<strong>the</strong> spenddown amount. Their medicalbills may be used to meet <strong>the</strong> spenddown.Retroactive period The three months be<strong>for</strong>e <strong>the</strong> month <strong>of</strong>application.Specified Low IncomeMedicare Beneficiary(SLMB) andExpanded—SpecifiedLow Income MedicareBeneficiary (E-SLMB)<strong>Medicaid</strong> programs that only pay <strong>the</strong>Medicare Part B premium <strong>for</strong> people withincome above 100% <strong>of</strong> <strong>the</strong> federal povertylevel, but below 135% <strong>of</strong> <strong>the</strong> federalpoverty level.Spenddown Spenddown is like a deductible. Thespenddown amount is <strong>the</strong> differencebetween your net countable income and<strong>the</strong> MNIL. Spenddown is <strong>the</strong> process <strong>of</strong>using medical expenses to lower yourincome to <strong>the</strong> MNIL. Medical expensesare deducted from <strong>the</strong> spenddown amount.When income is reduced to <strong>the</strong> MNIL withmedical expenses, spenddown is met.When spenddown is met, <strong>Medicaid</strong>eligibility will begin.SSI-Related <strong>Medicaid</strong> <strong>Medicaid</strong> <strong>for</strong> persons who are aged,disabled or blind.3