LAPORAN TAHUNAN A N N U A L R E P O R T - Ahp.com.my

LAPORAN TAHUNAN A N N U A L R E P O R T - Ahp.com.my

LAPORAN TAHUNAN A N N U A L R E P O R T - Ahp.com.my

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Laporan Tahunan 2009<br />

Annual Report 2009 68<br />

MANAGER’S REPORT ON AMANAH HARTA TANAH PNB<br />

FOR THE YEAR ENDED 31 DECEMBER 2009 (CONTD.)<br />

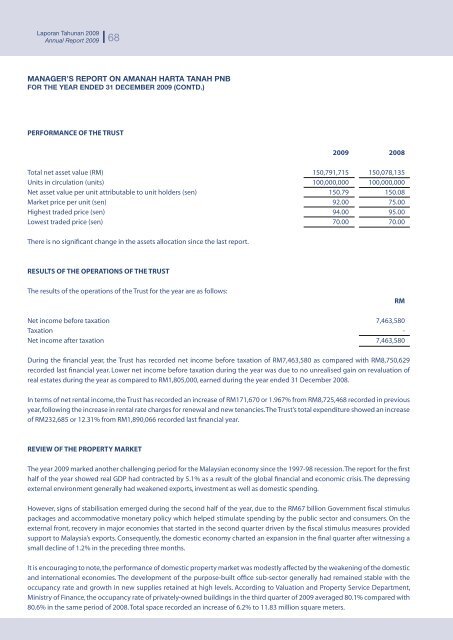

PERFORMANCE OF THE TRUST<br />

2009 2008<br />

Total net asset value (RM) 150,791,715 150,078,135<br />

Units in circulation (units) 100,000,000 100,000,000<br />

Net asset value per unit attributable to unit holders (sen) 150.79 150.08<br />

Market price per unit (sen) 92.00 75.00<br />

Highest traded price (sen) 94.00 95.00<br />

Lowest traded price (sen) 70.00 70.00<br />

There is no significant change in the assets allocation since the last report.<br />

RESULTS OF THE OPERATIONS OF THE TRUST<br />

The results of the operations of the Trust for the year are as follows:<br />

Net in<strong>com</strong>e before taxation 7,463,580<br />

Taxation -<br />

Net in<strong>com</strong>e after taxation 7,463,580<br />

During the financial year, the Trust has recorded net in<strong>com</strong>e before taxation of RM7,463,580 as <strong>com</strong>pared with RM8,750,629<br />

recorded last financial year. Lower net in<strong>com</strong>e before taxation during the year was due to no unrealised gain on revaluation of<br />

real estates during the year as <strong>com</strong>pared to RM1,805,000, earned during the year ended 31 December 2008.<br />

In terms of net rental in<strong>com</strong>e, the Trust has recorded an increase of RM171,670 or 1.967% from RM8,725,468 recorded in previous<br />

year, following the increase in rental rate charges for renewal and new tenancies. The Trust’s total expenditure showed an increase<br />

of RM232,685 or 12.31% from RM1,890,066 recorded last financial year.<br />

REVIEW OF THE PROPERTY MARKET<br />

The year 2009 marked another challenging period for the Malaysian econo<strong>my</strong> since the 1997-98 recession. The report for the first<br />

half of the year showed real GDP had contracted by 5.1% as a result of the global financial and economic crisis. The depressing<br />

external environment generally had weakened exports, investment as well as domestic spending.<br />

However, signs of stabilisation emerged during the second half of the year, due to the RM67 billion Government fiscal stimulus<br />

packages and ac<strong>com</strong>modative monetary policy which helped stimulate spending by the public sector and consumers. On the<br />

external front, recovery in major economies that started in the second quarter driven by the fiscal stimulus measures provided<br />

support to Malaysia’s exports. Consequently, the domestic econo<strong>my</strong> charted an expansion in the final quarter after witnessing a<br />

small decline of 1.2% in the preceding three months.<br />

It is encouraging to note, the performance of domestic property market was modestly affected by the weakening of the domestic<br />

and international economies. The development of the purpose-built office sub-sector generally had remained stable with the<br />

occupancy rate and growth in new supplies retained at high levels. According to Valuation and Property Service Department,<br />

Ministry of Finance, the occupancy rate of privately-owned buildings in the third quarter of 2009 averaged 80.1% <strong>com</strong>pared with<br />

80.6% in the same period of 2008. Total space recorded an increase of 6.2% to 11.83 million square meters.<br />

RM