LAPORAN TAHUNAN A N N U A L R E P O R T - Ahp.com.my

LAPORAN TAHUNAN A N N U A L R E P O R T - Ahp.com.my

LAPORAN TAHUNAN A N N U A L R E P O R T - Ahp.com.my

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Laporan Tahunan 2009<br />

Annual Report 2009 88<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 DECEMBER 2009 (CONTD.)<br />

9. BORROWING COSTS<br />

Included in the borrowing costs are arrangement fee, stamp duty and legal fee incurred in obtaining the revolving credit-i<br />

facility of RM65 million from CIMB Islamic Bank Berhad for financing the proposed upgrading and refurbishment of Plaza<br />

VADS. As at 31 December 2009, no drawdown has been made.<br />

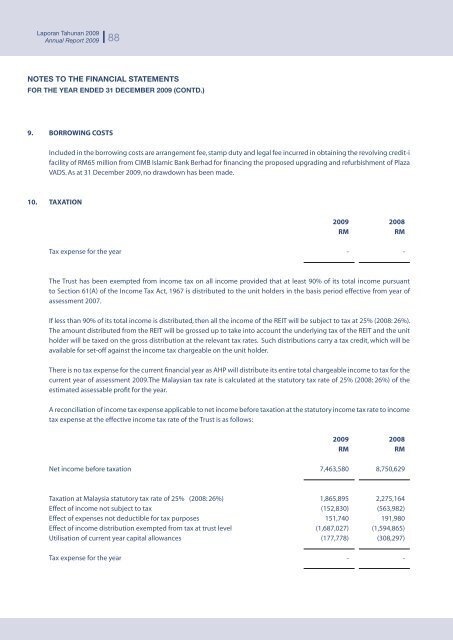

10. TAXATION<br />

2009 2008<br />

RM RM<br />

Tax expense for the year - -<br />

The Trust has been exempted from in<strong>com</strong>e tax on all in<strong>com</strong>e provided that at least 90% of its total in<strong>com</strong>e pursuant<br />

to Section 61(A) of the In<strong>com</strong>e Tax Act, 1967 is distributed to the unit holders in the basis period effective from year of<br />

assessment 2007.<br />

If less than 90% of its total in<strong>com</strong>e is distributed, then all the in<strong>com</strong>e of the REIT will be subject to tax at 25% (2008: 26%).<br />

The amount distributed from the REIT will be grossed up to take into account the underlying tax of the REIT and the unit<br />

holder will be taxed on the gross distribution at the relevant tax rates. Such distributions carry a tax credit, which will be<br />

available for set-off against the in<strong>com</strong>e tax chargeable on the unit holder.<br />

There is no tax expense for the current financial year as AHP will distribute its entire total chargeable in<strong>com</strong>e to tax for the<br />

current year of assessment 2009.The Malaysian tax rate is calculated at the statutory tax rate of 25% (2008: 26%) of the<br />

estimated assessable profit for the year.<br />

A reconciliation of in<strong>com</strong>e tax expense applicable to net in<strong>com</strong>e before taxation at the statutory in<strong>com</strong>e tax rate to in<strong>com</strong>e<br />

tax expense at the effective in<strong>com</strong>e tax rate of the Trust is as follows:<br />

2009 2008<br />

RM RM<br />

Net in<strong>com</strong>e before taxation 7,463,580 8,750,629<br />

Taxation at Malaysia statutory tax rate of 25% (2008: 26%) 1,865,895 2,275,164<br />

Effect of in<strong>com</strong>e not subject to tax (152,830) (563,982)<br />

Effect of expenses not deductible for tax purposes 151,740 191,980<br />

Effect of in<strong>com</strong>e distribution exempted from tax at trust level (1,687,027) (1,594,865)<br />

Utilisation of current year capital allowances (177,778) (308,297)<br />

Tax expense for the year - -