Brochure: AAA2 / ARA2 / AEA2

Brochure: AAA2 / ARA2 / AEA2

Brochure: AAA2 / ARA2 / AEA2

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2<br />

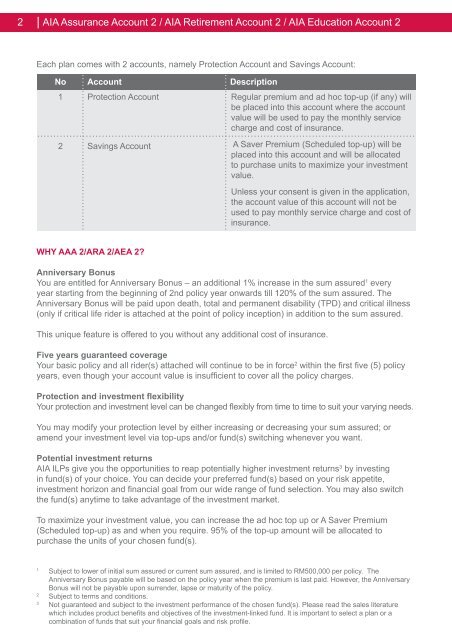

AIA Assurance Account 2 / AIA Retirement Account 2 / AIA Education Account 2<br />

Each plan comes with 2 accounts, namely Protection Account and Savings Account:<br />

No Account Description<br />

1 Protection Account<br />

2 Savings Account<br />

Regular premium and ad hoc top-up (if any) will<br />

be placed into this account where the account<br />

value will be used to pay the monthly service<br />

charge and cost of insurance.<br />

A Saver Premium (Scheduled top-up) will be<br />

placed into this account and will be allocated<br />

to purchase units to maximize your investment<br />

value.<br />

Unless your consent is given in the application,<br />

the account value of this account will not be<br />

used to pay monthly service charge and cost of<br />

insurance.<br />

WHY AAA 2/ARA 2/AEA 2?<br />

Anniversary Bonus<br />

You are entitled for Anniversary Bonus – an additional 1% increase in the sum assured 1 every<br />

year starting from the beginning of 2nd policy year onwards till 120% of the sum assured. The<br />

Anniversary Bonus will be paid upon death, total and permanent disability (TPD) and critical illness<br />

(only if critical life rider is attached at the point of policy inception) in addition to the sum assured.<br />

This unique feature is offered to you without any additional cost of insurance.<br />

Five years guaranteed coverage<br />

Your basic policy and all rider(s) attached will continue to be in force 2 within the first five (5) policy<br />

years, even though your account value is insufficient to cover all the policy charges.<br />

Protection and investment flexibility<br />

Your protection and investment level can be changed flexibly from time to time to suit your varying needs.<br />

You may modify your protection level by either increasing or decreasing your sum assured; or<br />

amend your investment level via top-ups and/or fund(s) switching whenever you want.<br />

Potential investment returns<br />

AIA ILPs give you the opportunities to reap potentially higher investment returns 3 by investing<br />

in fund(s) of your choice. You can decide your preferred fund(s) based on your risk appetite,<br />

investment horizon and financial goal from our wide range of fund selection. You may also switch<br />

the fund(s) anytime to take advantage of the investment market.<br />

To maximize your investment value, you can increase the ad hoc top up or A Saver Premium<br />

(Scheduled top-up) as and when you require. 95% of the top-up amount will be allocated to<br />

purchase the units of your chosen fund(s).<br />

1<br />

Subject to lower of initial sum assured or current sum assured, and is limited to RM500,000 per policy. The<br />

Anniversary Bonus payable will be based on the policy year when the premium is last paid. However, the Anniversary<br />

Bonus will not be payable upon surrender, lapse or maturity of the policy.<br />

2<br />

Subject to terms and conditions.<br />

3<br />

Not guaranteed and subject to the investment performance of the chosen fund(s). Please read the sales literature<br />

which includes product benefits and objectives of the investment-linked fund. It is important to select a plan or a<br />

combination of funds that suit your financial goals and risk profile.