Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

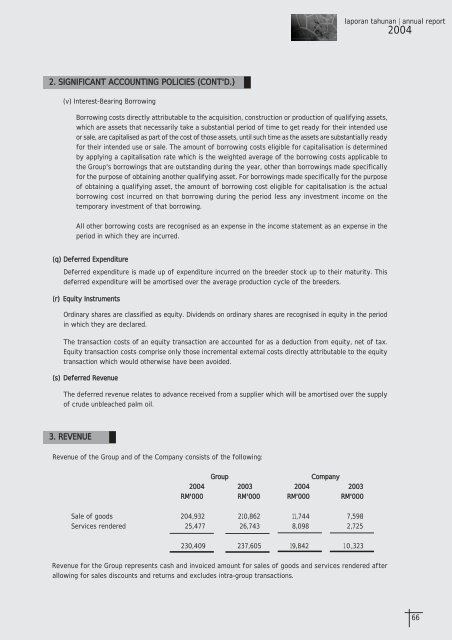

laporan tahunan | annual report20042. SIGNIFICANT ACCOUNTING POLICIES (CONT'D.)(v) Interest-Bearing BorrowingBorrowing costs directly attributable <strong>to</strong> the acquisition, construction or production of qualifying assets,which are assets that necessarily take a substantial period of time <strong>to</strong> get ready for their intended useor sale, are capitalised as part of the cost of those assets, until such time as the assets are substantially readyfor their intended use or sale. The amount of borrowing costs eligible for capitalisation is determinedby applying a capitalisation rate which is the weighted average of the borrowing costs applicable <strong>to</strong>the Group's borrowings that are outstanding during the year, other than borrowings made specificallyfor the purpose of obtaining another qualifying asset. For borrowings made specifically for the purposeof obtaining a qualifying asset, the amount of borrowing cost eligible for capitalisation is the actualborrowing cost incurred on that borrowing during the period less any investment income on thetemporary investment of that borrowing.All other borrowing costs are recognised as an expense in the income statement as an expense in theperiod in which they are incurred.(q) Deferred ExpenditureDeferred expenditure is made up of expenditure incurred on the breeder s<strong>to</strong>ck up <strong>to</strong> their maturity. Thisdeferred expenditure will be amortised over the average production cycle of the breeders.(r) Equity InstrumentsOrdinary shares are classified as equity. Dividends on ordinary shares are recognised in equity in the periodin which they are declared.The transaction costs of an equity transaction are accounted for as a deduction from equity, net of tax.Equity transaction costs comprise only those incremental external costs directly attributable <strong>to</strong> the equitytransaction which would otherwise have been avoided.(s) Deferred RevenueThe deferred revenue relates <strong>to</strong> advance received from a supplier which will be amortised over the supplyof crude unbleached palm oil.3. REVENUERevenue of the Group and of the Company consists of the following:GroupCompany2004 2003 2004 2003RM'000 RM'000 RM'000 RM'000Sale of goods 204,932 210,862 11,744 7,598Services rendered 25,477 26,743 8,098 2,725230,409 237,605 19,842 10,323Revenue for the Group represents cash and invoiced amount for sales of goods and services rendered afterallowing for sales discounts and returns and excludes intra-group transactions.66