Minit Mesyuarat Panel Perundingan Kastam-Swasta Bil 1 2009

Minit Mesyuarat Panel Perundingan Kastam-Swasta Bil 1 2009

Minit Mesyuarat Panel Perundingan Kastam-Swasta Bil 1 2009

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

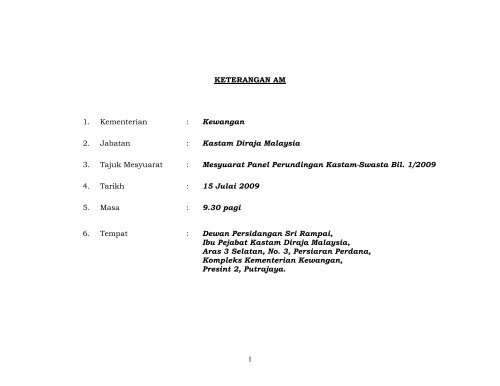

KETERANGAN AM1. Kementerian : Kewangan2. Jabatan : <strong>Kastam</strong> Diraja Malaysia3. Tajuk <strong>Mesyuarat</strong> : <strong>Mesyuarat</strong> <strong>Panel</strong> <strong>Perundingan</strong> <strong>Kastam</strong>-<strong>Swasta</strong> <strong>Bil</strong>. 1/<strong>2009</strong>4. Tarikh : 15 Julai <strong>2009</strong>5. Masa : 9.30 pagi6. Tempat : Dewan Persidangan Sri Rampai,Ibu Pejabat <strong>Kastam</strong> Diraja Malaysia,Aras 3 Selatan, No. 3, Persiaran Perdana,Kompleks Kementerian Kewangan,Presint 2, Putrajaya.1

AGENDA MESYUARATAgenda 1 : Ucapan PengerusiAgenda 2 : Ucapan Pengerusi BersamaAgenda 3 : Mengesahkan <strong>Minit</strong> <strong>Mesyuarat</strong> <strong>Bil</strong>. 2/2008Agenda 4 : Membincangkan Perkara-Perkara BerbangkitAgenda 5 : Membincangkan Usul-Usul Dalam <strong>Minit</strong> <strong>Bil</strong>. 2/2008Agenda 6 : Membincangkan Usul-Usul BaruAgenda 7 : Ucapan Penutupan Oleh Pengerusi BersamaAgenda 8 : Ucapan Penutupan Oleh Pengerusi2

SENARAI KEHADIRANBIL. NAMA JAWATAN/ PERTUBUHAN1. Y.Bhg. Dato’ Hj. Ibrahim bin Hj. Jaapar2. Encik S. Raja Kumaran3. Y.Bhg. Dato’ Hajjah Mardina binti Haji Alwi4. Y.Bhg. Dato’ Khazali bin Haji AhmadKetua Pengarah <strong>Kastam</strong> Malaysia(Pengerusi)Dewan Perniagaan dan PerindustrianAntarabangsa (MICCI)(Pengerusi Bersama)Timbalan Ketua Pengarah <strong>Kastam</strong>(Perkastaman/ Cukai Dalam Negeri)Timbalan Ketua Pengarah <strong>Kastam</strong>(Pengurusan)5. Y.Bhg Dato’ Zaleha binti Hamzah Penasihat <strong>Kastam</strong>6. Y. Bhg. Dato’ Hajjah. Azizah binti Idris7. Y. Bhg. Dato’ Ismail bin Ibrahim8. Tuan Govinden a/l Mutosamy9. Tuan Ahmad Nadzri bin EmbongPengarahBahagian Cukai Dalam NegeriPengarahBahagian PerkastamanPengarahBahagian Perkhidmatan TeknikPengarahKhidmat Pengurusan & Sumber Manusia3

BIL. NAMA JAWATAN/ PERTUBUHAN10. Y. Arif Nik Suhaimi bin Nik SulaimanPengarahBahagian Perundangan11. Tuan Haji Md. Salleh bin Said Pengarah AKMAL, Melaka12. Tuan Ismail bin Saidi13. Tuan Wan Razali bin Wan Awang14. Tuan Mohammed Nasir bin Zakaria15. Tuan Abdul Shukor bin Md. Salleh16. Puan Norlinda Lim binti Abdullah17. Tuan Syed Mohri bin Syed Abu Bakar18. Tuan Chin Yue Hon19. Tuan Haji Md. Basri bin Bahron20. Tuan Wan Leng WhattTimbalan Pengarah <strong>Kastam</strong>Cawangan Perkhidmatan/ LatihanTimbalan PengarahCaw. Pengurusan Prestasi & TatatertibTimbalan PengarahCawangan Pengurusan KewanganTimbalan PengarahCawangan Pengurusan PerolehanTimbalan Pengarah <strong>Kastam</strong>Cawangan Teknologi MaklumatTimbalan Pengarah <strong>Kastam</strong>Caw. Imp./ Eks. & Kawalan SempadanTimbalan Pengarah <strong>Kastam</strong>Cawangan LogistikTimbalan Pengarah <strong>Kastam</strong>Cawangan Cukai JualanTimbalan Pengarah <strong>Kastam</strong>Cawangan Cukai Perkhidmatan4

BIL. NAMA JAWATAN/ PERTUBUHAN21. Tuan Subramaniam a/l Tholasy22. Puan Soria binti Osman23. Tuan Mohammed bin Jaafar24. Tuan Mohd Pudzi bin Man25. Tuan Ahmad bin Hassan26. Puan Azimah binti Ab. Hamid27. Tuan D. Martin Joseph28. Tuan Abdul Hadi bin Abdullah29. Puan Raden Tuminah binti S’aban30. Tuan Wan Din bin Wan Hassan31. Puan Hayatee HashimTimbalan Pengarah <strong>Kastam</strong>Cawangan Kawalan dan Kemudahan& Konsultasi Cukai Dalam NegeriTimbalan Pengarah <strong>Kastam</strong>Cawangan Pengurusan Penjenisan,Tarif dan GubalanTimbalan Pengarah <strong>Kastam</strong>Cawangan PenilaianTimbalan Pengarah <strong>Kastam</strong>Cawangan PendakwaanTimbalan Pengarah <strong>Kastam</strong>Cawangan Pasca ImportTimbalan Pengarah <strong>Kastam</strong>Cawangan Hal Ehwal AntarabangsaPenolong Kanan Pengarah <strong>Kastam</strong>Cawangan Import/ EksportPenolong Kanan Pengarah <strong>Kastam</strong>Cawangan NarkotikPenolong Kanan Pengarah <strong>Kastam</strong>Cawangan PerindustrianPenolong Kanan Pengarah <strong>Kastam</strong>Cawangan Auditan SyarikatPenolong Pengarah <strong>Kastam</strong>Cawangan Import / Eksport5

BIL. NAMA JAWATAN/ PERTUBUHAN32. Tuan Haji Zazuli bin Johan33. Tuan Zunaibi bin Mat Ali34. Puan Kamaliah bt. Hj. Kassim35. Tuan Samson a/l Sevanjanam36. Cik Wong Hin Wei37. En. Michael Hendroff38. En. Koh Siok Kiat39. En. Eyun Chew40. En. S. Saravana Kumar41. Cik Catherine An Yong42. En. Ong Whee Tiong43. Ms. Devi KrishnaPenolong Kanan Pengarah <strong>Kastam</strong> ICawangan Komunikasi AwamPenolong Pengarah <strong>Kastam</strong>Unit Audit DalamPenolong Pengarah <strong>Kastam</strong>Cawangan Komunikasi AwamPenolong Pengarah <strong>Kastam</strong>Cawangan Komunikasi AwamDewan Perniagaan Dan PerindustrianAntarabangsa (MICCI)Dewan Perniagaan Dan PerindustrianAntarabangsa (MICCI)Dewan Perniagaan Dan PerindustrianAntarabangsa (MICCI)Dewan Perniagaan Dan PerindustrianAntarabangsa (MICCI)Dewan Perniagaan Dan PerindustrianAntarabangsa (MICCI)Dewan Perniagaan Dan PerindustrianAntarabangsa (MICCI)Institut Setiausaha Dan PentadbiranBerkanun Malaysia (MAICSA)Institut Setiausaha Dan PentadbiranBerkanun Malaysia (MAICSA)6

BIL. NAMA JAWATAN/ PERTUBUHAN56. Encik Saif Har Shah Idris Miah57. Encik Kenneth Tiong58. Encik Wong Yem Yatt59. Encik Mohd Nazri Azizan60. Cik Poh Wan Kh’ng61. Encik Toon Teng Fatt62. Encik Tony Chia63. Encik Alvin Chua64. Puan Huang Shi Yang65. Puan Lee Ah Yem66. Puan Cheong Li Wei67. Puan Azlina ZakariaAirfreight Forwarders Association OfMalaysia (AFAM)Gabungan Dewan-Dewan Perniagaan DanPerindustrian Cina Malaysia (ACCCIM)Gabungan Dewan-Dewan Perniagaan DanPerindustrian Cina Malaysia (ACCCIM)Gabungan Dewan-Dewan Perniagaan DanPerindustrian Cina Malaysia (ACCCIM)Gabungan Dewan-Dewan Perniagaan DanPerindustrian Cina Malaysia (ACCCIM)Persekutuan Penghantaran Fret Malaysia(FMFF)Persekutuan Penghantaran Fret Malaysia(FMFF)Persekutuan Penghantaran Fret Malaysia(FMFF)Institut Akauntan Malaysia(MIA)Institut Akauntan Malaysia(MIA)Institut Akauntan Malaysia(MIA)Institut Akauntan Malaysia(MIA)8

BIL. NAMA JAWATAN/ PERTUBUHAN68. Encik Lau Haw Chong69. Encik V. Muthiah70. Encik Fong Keng Lun71. Encik Charles Subramaniam72. Encik Abdul Aziz Toha73. Encik Tan Eng Yew74. Cik Shamini Sakthinathan75. Cik Nur Hafizah Sulaiman76. Tuan Haji Abu Bakar bin Hussin77. Encik Amir Hamzah78. Cik Adilla binti Ramalan79. Encik Khadmudin Haji Mohd RafikMalaysia Association Of CompanySecretaries (MACS)Persekutuan Wakil-Wakil PerkapalanMalaysia (FOMSA)Persatuan Pemilik-pemilik KapalAntarabangsa Malaysia (SAM)Persatuan Pemilik-pemilik KapalAntarabangsa Malaysia (SAM)Persatuan Pemilik-pemilik KapalAntarabangsa Malaysia (SAM)Persekutuan Pekilang-Pekilang Malaysia(FMM)Persekutuan Pekilang-Pekilang Malaysia(FMM)Persekutuan Pekilang-Pekilang Malaysia(FMM)Persekutuan Perkapalan Wilayah Tengah(CRSA)Dewan Perniagaan Dan PerusahaanMelayu Malaysia (DPMM)Dewan Perniagaan Dan PerusahaanMelayu Malaysia (DPMM)Malaysian knitting ManufacturesAssociation (MKMA)9

BIL. NAMA JAWATAN/ PERTUBUHAN80. Dato’ Samsudin bin Abd. Rahman81. Haji Zainal bin Haji Jamin82. Dato’ Bahrin bin Mohamad83. Puan Hamidah binti Ali84. Puan Haniza binti Haji Abd. HamidPersatuan Pengusaha LogistikBumiputera Selangor (PPLBS)Persatuan Pengusaha LogistikBumiputera Selangor (PPLBS)Persatuan Pengusaha LogistikBumiputera Selangor (PPLBS)Majlis Perhubungan Industri NegeriSembilan Darul Khusus (NSILC)Majlis Perhubungan Industri NegeriSembilan Darul Khusus (NSILC)85. Encik Lee Yee Wah CAPEC86. Encik Freddie Heng CAPEC87. Cik Nazaina binti Nasir CAPEC88. En. Kamarul Azman CAPEC89. Encik Mohd Saifullizan Mohd Janis CAPEC90. En. Abdul Ghani Abdul Rahim CAPEC10

AGENDA 1Ucapan PengerusiBismillahir Rahmanir Rahim, Assalamualaikum, selamat pagi dan salam sejahtera. Y.Berusaha Mr.Raja Kumaran, Pengerusi bersama dari MICCI, Y.Berbahagia Dato’ Timbalan Ketua Pengarah <strong>Kastam</strong> , Dato’Mardina binti Hj. Alwi (Perkastaman dan Cukai Dalam Negeri). Dato’ Khazali, Timbalan Ketua PengarahPengurusan. Y. Bhg Dato’ Zaleha Penasihat <strong>Kastam</strong>, Y.Berusaha Dato’-dato’ Pengarah Bahagian, ahli-ahliMajlis <strong>Panel</strong> <strong>Perundingan</strong> <strong>Kastam</strong>–<strong>Swasta</strong>, Y.Berusaha wakil-wakil dari persatuan, Dato’-dato’, tuan-tuandan puan-puan yang dihormati sekalian. Alhamdulillah, saya bersyukur ke hadrat Allah s.w.t kerana denganlimpah kurnia dan izinNya dapat kita bersama-sama berkumpul pada pagi ini sempena <strong>Mesyuarat</strong> <strong>Panel</strong><strong>Perundingan</strong> <strong>Kastam</strong>-<strong>Swasta</strong> kali pertama pada tahun <strong>2009</strong>. Saya juga ingin mengalu-alukan kehadiranDato’-dato’, tuan-tuan dan puan-puan ahli mesyuarat terutama dari pihak swasta yang saya rasamenunjukkan apa itu komitmen.Terlebih dahulu, saya ingin merakamkan ucapan terima kasih kepada Y. Berusaha Encik RajaKumaran dari MICCI selaku Pengerusi Bersama <strong>Mesyuarat</strong> <strong>Panel</strong> <strong>Perundingan</strong> <strong>Kastam</strong>-<strong>Swasta</strong> pada kali ini.Saya turut juga ingin mengambil kesempatan ini untuk mengucapkan selamat datang kepada ahli mesyuaratyang baru pertama kali hadir ke Ibu Pejabat <strong>Kastam</strong> Diraja Malaysia. Saya dimaklumkan bahawa padamesyuarat kali ini seramai 55 orang mewakili pihak persatuan dan seramai 35 ahli mesyuarat mewakiliJabatan <strong>Kastam</strong> Diraja Malaysia (JKDM).11

<strong>Mesyuarat</strong> <strong>Panel</strong> <strong>Perundingan</strong> antara JKDM dan swasta diadakan sebanyak 2 kali setahun. Forumseumpama ini adalah selaras dengan konsep persyarikatan Malaysia (Malaysia Incoporated) yang telahdiperkenalkan oleh kerajaan pada suatu masa dahulu. Di antara lain matlamat mesyuarat ini diadakanadalah bagi mengeratkan hubungan silaturahim antara pihak JKDM dan pihak swasta. JKDM sangatmengalu-alukan inisiatif seumpama ini sebagai satu cara untuk mewujudkan majlis musyawarah bagimembincangkan isu dan perkara yang mempunyai kepentingan bersama.Sebagai sebuah negara yang bergantung kepada pasaran bebas dan juga perdagangan antarabangsa,Malaysia mesti sentiasa memastikan bahawa urusan perjalanan kegiatan ekonomi berjalan dengan lancar.Sehubungan itu, adalah menjadi tanggungjawab pelbagai pihak termasuk economic players seperti tuan-tuandan puan-puan untuk memastikan bahawa kepentingan ekonomi dan perdagangan Malaysia akan sentiasaterjamin terutama sekali di dalam masa semua negara-negara di dunia saling bersaing untukmempertingkatkan economic well being negara masing-masing. <strong>Panel</strong> <strong>Perundingan</strong> <strong>Kastam</strong>-<strong>Swasta</strong> yang telahsekian lama wujud adalah merupakan langkah terbaik yang dapat membantu usaha kerajaan di dalammeningkatkan daya saing negara terutama sekali di dalam situasi negara berdepan dengan kelembapanekonomi yang melanda seluruh negara termasuk Malaysia.JKDM telah memperkenalkan pendekatan baru di dalam melaksanakan fungsi dan matlamatmesyuarat ini. Pendekatan yang saya maksudkan ialah JKDM dan pihak swasta telah mengadakanperbincangan awal terhadap sebanyak 44 isu yang telah dibangkitkan. Hasil daripada perbincangan awaltersebut, sebanyak 11 isu telah berjaya diselesaikan sebelum mesyuarat pada hari ini. Ini membuktikanbahawa kedua-dua pihak sentiasa saling berhubung tanpa menunggu mesyuarat seumpama pagi ini untukmencari penyelesaian terhadap isu-isu yang boleh menyekat atau menghalang kemajuan perdagangannegara.12

Saya ingin memberi jaminan bahawa JKDM akan sentiasa memperbaiki dan juga menambah baiksistem penyampaian agar urusan pihak swasta dapat berjalan lancar. Saya berpegang kepada prinsipbahawa JKDM harus sentiasa berperanan to facilitate, not to frustrate. Dalam masa yang sama JKDM jugasentiasa berharap agar pihak swasta turut berperanan untuk memberikan cadangan serta memberikanmaklumat yang tepat untuk membolehkan JKDM membuat kajian dan pertimbangan dan sekiranyacadangan atau saranan yang dikemukakan dapat dilaksanakan, ianya akan dilaksanakan secepat mungkin.Saya berharap mesyuarat kali ini akan menghasilkan idea-idea yang baru dan bernas yang dapat kita kongsibersama di dalam usaha meningkatkan pencapaian kita di dalam pelbagai aspek. Setakat ini ucapan saya,dan saya menjemput Mr Raja Kumaran, Pengerusi bersama <strong>Panel</strong> <strong>Perundingan</strong> <strong>Kastam</strong>-<strong>Swasta</strong> untukmemberikan kata-kata aluan.13

AGENDA 2Ucapan Pengerusi BersamaY. Bhg Dato’ Hj Ibrahim bin Hj Jaapar, Ketua Pengarah <strong>Kastam</strong> Malaysia. Y.Bhg Dato’ Mardina binti Hj.Alwi Timbalan Ketua Pengarah <strong>Kastam</strong> Malaysia Perkastaman dan Cukai dalam Negeri , Y. Bhg Dato’ Khazalibin Hj. Ahmad Timbalan Ketua Pengarah Pengurusan, Y. Bhg Dato’ Zaleha, Customs Advisor, Dato’–dato’Pengarah, Tuan-tuan dan Puan-puan.I would like to personally wish everyone a very good morning and would like to thank the RoyalMalaysian Customs Department (JKDM) for hosting the Consultative <strong>Panel</strong> Meeting for <strong>2009</strong>. The Customs-Private Sector Consultative <strong>Panel</strong> Meeting has become the most important forum for the private sectors toengage with the JKDM to share their view and expertise especially in this challenging economic environment.I hope the policy decisions made in this meeting will be in line with the concept of One Malaysia, so that wecan work as one team in order to achieve one goal, which is towards a developed nation by 2020. Towardsthis we note that the JKDM have had pre-consultative meetings with individual state associations to resolvesome of the issues raised. We think that is a very good idea and this is in line with the concept of OneMalaysia. I would like congratulate the JKDM on this matter. As the country becomes developed, there mustbe less Customs intervention on the operations of our business. For example, applying for facilities such assales tax for raw materials, able to download forms from the internet and there should be reduction in some14

of the information JKDM requires when we apply for exemptions. And to date, we still note from our membersthat they are still inconsistencies of information needed by different states. This actually delays businessesbecause you need to know exactly what JKDM Penang wants which differs from what JKDM Johore wants.And this is not consistent and hope the JKDM will address this. I think one of the challenges the governmentis facing is to computerise everything. Because, the moment we can download information from the internetour standards go up to the business hierarchy under the World Bank’s criteria. I know the JKDM is puttingeffort to computerise everything, but maybe this needs to be accelerated, so that everyone can benefit fromthis. I’m sure the Pengarah <strong>Kastam</strong> will help the JKDM to achieve this goal of having mutual recognition withother countries. This will definitely be beneficial for us. I would like to thank Dato’ for giving the privatesectors the opportunity to put out our views and aspirations and again I would like to thank everyone.15

AGENDA 3MENGESAHKAN MINIT MESYUARAT BIL. 2/2008Pengesahan <strong>Minit</strong> <strong>Mesyuarat</strong> <strong>Bil</strong>. 2/2008<strong>Minit</strong> <strong>Mesyuarat</strong> <strong>Panel</strong> <strong>Perundingan</strong> <strong>Kastam</strong>-<strong>Swasta</strong> 2/2008 disahkan dengan rasminya.Pencadang :Penyokong :Encik Toon Teng Fatt dari FMFFEncik V.Muthiah dari FOMSA.16

AGENDA 4MEMBINCANGKAN PERKARA BERBANGKITNO. PERKARA KEDUDUKAN / TINDAKAN1. Tajuk:Re-importation of Rejected GoodsRequiring Import LicenseJawapan :UsulTindakanAgenda:::FMMBahagian Perkastaman4Telah mendapat kelulusan MOF dan MITI. Jabatandalam proses penggubalan perintah.Pengecualian permit import adalah atas pengimportan‘rejected goods’ yang disenaraikan seperti di LampiranA sahaja.<strong>Bil</strong>.:1 (m.s. 15 – <strong>Minit</strong> 1/2008)Untuk Makluman2. TajukUsulTindakan:::Meningkatkan syarat pengisianBorang <strong>Kastam</strong> 1A, iaitu, baranganbernilai RM 10,000 ke RM100,000FMFFBahagian Perkhidmatan TeknikJawapan :Tindakan sedang diambil untuk mewartakannilai barangan bercukai dari RM10,000 ke RM20,000.Untuk MaklumanAgenda:4<strong>Bil</strong>.:3 (m.s. 15 – <strong>Minit</strong> 1/2008)17

NO. PERKARA KEDUDUKAN / TINDAKAN3. TajukUsulTindakanAgenda<strong>Bil</strong>.:::::Excise Duty is not refunded forreturned damaged goods.MICCIBahagian Cukai Dalaman44 (m.s. 16 – <strong>Minit</strong> 1/2008)Jawapan :JKDM bersetuju untuk melaksanakan garis panduanyang telah dikeluarkan. Keperluan mengeluarkanperuntukan khas adalah tidak perlu buat masa inikerana permohonan untuk refund boleh dibuatdibawah Seksyen 11(2)(b) Akta Eksais 1975.Selesai4. TajukUsul::Payment of Excise Dutieselectronically for beer & stoutproducts.MICCIJawapan :Sistem e-payment melalui Portal JKDM dijangka siapsebelum akhir tahun 2010.Tindakan:Bahagian KPSMSelesaiAgenda:4<strong>Bil</strong>:5 (m.s. 16 – <strong>Minit</strong> 1/2008)18

NO. PERKARA KEDUDUKAN / TINDAKAN5. TajukUsulTindakan:::Kursus Ejen <strong>Kastam</strong> (KEK) olehUUMFMFF & AFAMBhg. Korporat, Bhg. Perkastaman,Unit Latihan Ibu Pejabat & AKMALJawapan :JKDM telah menghantar surat ke UUM untukmewujudkan mekanisma pelaksanaan kursus inisecara persetujuan bersama di antara UUM denganPersatuan Agen Penghantaran. Tempoh 3 bulan dari01 Julai <strong>2009</strong> diberi untuk penyelesaian.Agenda:4Tindakan : TKPK (Pengurusan)<strong>Bil</strong>:6 (m.s. 16 – <strong>Minit</strong> 1/2008)6. TajukUsulTindakanAgenda::::Freight Forwarder (FF) tidakdikawal oleh KDRMFMFF & FOMSABahagian Perkastaman4Jawapan :Hasil mesyuarat yang telah diadakan pada10 April <strong>2009</strong>, FF tidak perlu dilesenkan di bawahAkta <strong>Kastam</strong> 1967. Kedudukan FF adalah status quo.Selesai<strong>Bil</strong>:7 (m.s. 17 – <strong>Minit</strong> 1/2008)19

NO. PERKARA KEDUDUKAN / TINDAKAN7. TajukUsul::Sales of taxable goods by licensedmanufacturer to exempt personMIAJawapan :Pindaan kepada Butiran 71, Jadual B, Perintah CukaiJualan (Pengecualian) 2008TindakanAgenda<strong>Bil</strong>:::Bahagian Cukai Dalam Negeri & MIA412 (m.s. 20 – <strong>Minit</strong> 1/2008)Tindakan susulan akan dibuat dengan MOF dan akandigazetkan sebaik sahaja kelulusan diterima.Untuk Makluman8. Tajuk:Refund of bad debtsJawapan :UsulTindakan::MIA & MICPABahagian Cukai Dalam NegeriGaris panduan (guide line) telah diedar ke negeri /stesen melalui laman web. Perkara ini telahdimaklumkan pada MIA dan MICPA melalui e-mel.Agenda<strong>Bil</strong>::415 (m.s. 21 – <strong>Minit</strong> 1/2008)Selesai20

NO. PERKARA KEDUDUKAN / TINDAKAN9. TajukUsulTindakan:::Agen perkapalan dikecualikandaripada menghadiri Kursus Ejen<strong>Kastam</strong> (KEK)FOMSAAKMALJawapan :Pihak swasta diminta menyelesaikan perselisihanpendapat mengenai keperluan kursus secaramuktamad sebelum mengemukakan maklum balaske pihak JKDM. Kerjasama penyediaan modulhendaklah diteruskan.Agenda<strong>Bil</strong>::515 (m.s. 44 – <strong>Minit</strong> 1/2008)Surat ke SAM (Ruj:KE.HE(44)001/01-3(A)/Klt.3(68) bertarikh 8.7.<strong>2009</strong>) adalah berkaitan.Tindakan : AKMAL & FOMSA21

AGENDA 5MEMBINCANGKAN USUL-USUL MINIT 2/2008NO. PERKARA ISU / KEDUDUKAN / TINDAKAN1. TajukUsulTindakan:::Submission Of HouseManifest (K4, K5, K6) by FFISOABahagian PerkastamanJawapan :Hasil mesyuarat yang telah di adakan pada 10 April <strong>2009</strong>, FFbersetuju untuk tidak dilesenkan di bawah sek. 90 Akta<strong>Kastam</strong> 1967. <strong>Mesyuarat</strong> bersetuju untuk kekalkankedudukan sekarang (status quo).Agenda:5Selesai<strong>Bil</strong>:1c (m.s. 26 – <strong>Minit</strong> 2/2008)2. TajukUsulTindakanAgenda::::Import Shipments SubjectedTo Approved Permits (APs)ACCCIMBahagian Perkastaman5Jawapan :Pertukaran stesen diluluskan oleh stesen untuk PengecualianPerbendaharaan sahaja. Tiada kelulusan diberi untukpertukaran stesen untuk Permit Import.Selesai<strong>Bil</strong>:4 (m.s. 29 – <strong>Minit</strong> 2/2008)22

NO. PERKARA ISU / KEDUDUKAN / TINDAKAN3. TajukUsulTindakanAgenda<strong>Bil</strong>:::::Permohonan Kerja LebihMasaFMFFBahagian Perkastaman56 (m.s. 32 – <strong>Minit</strong> 2/2008)Jawapan :JKDM berpandangan prosedur semasa JKDM adalahmencukupi untuk syarikat mengemukakan permohonan kerjalebih masa satu jam sebelum pejabat ditutup.Bagi kawasan di Zon Bebas, selaras dengan Peraturan9,Peraturan-Peraturan Zon Bebas 1991, pejabat JKDM adalahdibuka untuk berurusan dengan orang awam sepanjang masadan setiap hari.Walau bagaimanapun, JKDM mencadangkan usul ini boleh dikaji semula di gudang-gudang yang menunjukkan peningkatanaktiviti pengimportan / pengeksportan. Pihak swasta bolehjuga mengemukakan kajian menyeluruh bagi setiap gudanguntuk menyokong permintaan tersebut.Dasar JKDM adalah flexible dimana bagi gudang yangmenunjukkan kekerapan aktiviti pelepasan / pemindahanseperti di Gudang Intergrated Forwarding & Shipping danFelda Bulkers dibenarkan untuk beroperasi 24 jam dimanaPegawai <strong>Kastam</strong> ditempat berkenaan berkerja secara giliran.Selesai23

NO. PERKARA ISU / KEDUDUKAN / TINDAKAN4. TajukUsulTindakanAgenda<strong>Bil</strong>:::::Penglibatan Pihak PersatuanSebelum SesuatuImplementasi Oleh JKDMFMFFBahagian Perkastaman510 (m.s. 38 – <strong>Minit</strong> 2/2008)Jawapan :The JKDM takes note of the issue. However in implementing apolicy, especially where it involves enforcement and complianceit may not be in the best interest of the JKDM to discuss inadvance with the industry. The JKDM however is willing todiscuss policy pertaining to issues other than the above with theindustry before it is implemented.Selesai5. TajukUsulTindakanAgenda::::CEPT Rates for IntermediaryProducts sold by LMWsFMMBahagian Perkastaman5Jawapan :Dasar Percukaian Jualan Tempatan Bagi Syarikat LMW danFIZ yang dikeluarkan oleh Kementerian Kewangan disertakanuntuk makluman seperti di Lampiran N.Selesai<strong>Bil</strong>:12 (m.s. 41 – <strong>Minit</strong> 2/2008)24

NO. PERKARA ISU / KEDUDUKAN / TINDAKAN6. TajukUsul::Extend Drawback Section 93to Include RepackingActivities.FMMJawapan :Cadangan ini telah disetujui oleh MOF dan deraf pindaansedang di rangka oleh JKDM.Tindakan:Bahagian PerkhidmatanTeknikSelesaiAgenda:5<strong>Bil</strong>:13 (m.s. 42 – <strong>Minit</strong> 2/2008)7. TajukUsulTindakan:::Banker’s Guaranteeimposing 3 times againstthe face value of chequeissued for payments ofduties.ACCCIMBahagian PerkhidmatanTeknikJawapan :The JKDM has revised the the earlier ruling of producing BankGuarantees by importers for the payment of Import Duty / SalesTax / Excise Duty, from 3 times against the face value ofcheques issued to the actual payment of duties (for payments bycheque only). The new ruling is effective from 15 May <strong>2009</strong>.(Ref : KE.HM(90)051/05/Klt.4(12) dated 24 April <strong>2009</strong>)SelesaiAgenda:5<strong>Bil</strong>:17 (m.s. 49 – <strong>Minit</strong> 2/2008)25

NO. PERKARA ISU / KEDUDUKAN / TINDAKAN8. TajukUsulTindakanAgenda<strong>Bil</strong>:::::24-Hours Common MobileHand-phoneAFAMBahagian Penguatkuasaan519 (m.s. 51 – <strong>Minit</strong> 2/2008)Jawapan :The JKDM is currently in the process of implementing its ownCall Centre based in Kelana Jaya which will be operative in thenear future. However, it is not going to run on a 24-hour basis.Alternatively, the JKDM has its own Hotline (1-800-88-8855) forthe public to call. The Hotline is operated by Unit Semboyan atLevel 3, JKDM Headquarters, Putrajaya. The Hotline for allJKDM stations located nationwide is manned by 2 officers.Selesai9. Tajuk:Service Level AgreementsJawapan :UsulTindakanAgenda<strong>Bil</strong>::::AFAMBahagian PerancanganKorporat520 (m.s. 52 – <strong>Minit</strong> 2/2008)Bahagian Perancangan Korporat, Ibu Pejabat telah mengambiltindakan menyeragamkan Piagam Pelanggan supayaperkhidmatan yang dijanjikan dapat diseragamkan di seluruhnegara. Pada masa ini cadangan penyeragaman PiagamPelanggan tersebut telah dikemukakan kepada Pengarah-Pengarah Bahagian Ibu Pejabat untuk mengenalpastiperkhidmatan-perkhidmatan yang perlu diseragamkan.Tindakan : Bahagian Perancangan Korporat26

NO. PERKARA ISU / KEDUDUKAN / TINDAKAN10. Tajuk:CorrespondenceJawapan :UsulTindakanAgenda<strong>Bil</strong>::::AFAMCawangan Komunikasi Awam(CKA)521 (m.s. 53 – <strong>Minit</strong> 2/2008)The JKDM has several channels for the public to raise theircomplaints or proposals. These channels include e-mail,telephone (hotline), letters and fax. All correspondences wouldbe treated with strict confidence. Listed below are contactdetails of CKA, JKDM :-e-mail : kastam@customs.gov.my / aduan@customs.gov.myTelephone : 03-88822414 / 413 / 412Fax : 03-88895884 (Hotline : 1-800-88-8855)Write-in :Cawangan Komunikasi Awam (CKA),Ibu Pejabat <strong>Kastam</strong> Diraja Malaysia,Aras 7 Utara, Kompleks Kementerian Kewangan,No.3, Persiaran Perdana, Presint 2, 62596 Putrajaya.Selesai11. TajukUsulTindakan:::Import Of General Cargo NotMeeting SpecificationsAFAMBahagian PerkastamanJawapan :Garis panduan prosedur eksport semula barangan import yanggagal memenuhi kehendak standard dari pelbagai agensikerajaan yang berkaitan telah dikeluarkan oleh Ibu PejabatJKDM (Ruj : KE.HE(-)379/12/Klt.7(22) bertarikh 11.5.<strong>2009</strong>).Agenda:5Selesai<strong>Bil</strong>:22 (m.s. 54 – <strong>Minit</strong> 2/2008)27

NO. PERKARA ISU / KEDUDUKAN / TINDAKAN12. Tajuk:Public Bonded WarehousesJawapan :Usul:AFAMDasar Baru GBA terbahagi kepada 2 Kategori;TindakanAgenda<strong>Bil</strong>:::Bahagian Perkastaman523 (m.s. 55 – <strong>Minit</strong> 2/2008)A-Permohonan GBA yang menggundang barang-barangtidak berisiko tinggi dengan syarat;-Modal berbayar sekurang-kurangnya RM250,000.00-Keluasan gudang sekurang-kurangnya 20,000 ka per.-Jumlah Jaminan Bank 10% daripada duti / cukaiterlibat dalam setahunB -Permohonan GBA yang menggundang barang-barangberisiko tinggi dengan syarat;-Modal berbayar sekurang-kurangnya RM1,000,000.00-Keluasan gudang sekurang-kurangnya 50,000 ka per.-Nilai barangan yang disimpan dalam 1 tahun tidakkurang dari RM3.5 juta-Jumlah Jaminan Bank 10% daripada duti / cukaiterlibat dalam setahunIsu ini telah di bincang dgn pihak AFAM pada 08/07/09 &JKDM bersetuju utk mengkaji semula perkara ini dgn MOF.JKDM bersetuju untuk mengkaji semula syarat-syaratkelulusan terutamanya tentang keluasan gudang, BankGuarantee dan paid up capital.Tindakan : Bahagian Perkastaman28

NO. PERKARA ISU / KEDUDUKAN / TINDAKAN13. Tajuk:Forwarding Agents’ MainLicenseJawapan :Usul:AFAMSurat kepada AFAM telah dihantar pada 15 Disember 2008TindakanAgenda::Bahagian Perkastaman5Selesai<strong>Bil</strong>:24 (m.s. 56 – <strong>Minit</strong> 2/2008)14. Tajuk:Forwarding Agents LicenseJawapan :UsulTindakanAgenda<strong>Bil</strong>::::AFAMBahagian Perkastaman525 (m.s. 57 – <strong>Minit</strong> 2/2008)The JKDM is of the opinion that the installation of front endsoftware is a business decision. The Kedai EDI is establishedto cater for agents who find it more economical to use theirservice.AFAM cadangkan kemudahan pay per use pada DagangNet.Maklumat kos dari DagangNet adalah seperti di Lampiran STindakan : Bahagian Perkastaman29

NO. PERKARA ISU / KEDUDUKAN / TINDAKAN15. TajukUsul::Standardise Procedures forRe-importation of Goodsthat Can Be ReusedFMMJawapan :MOF telah bersetuju cadangan FMM dan Bahagian <strong>Kastam</strong>akan membuat pindaan keatas Butiran 94 PDK(P)1988 danButiran 46 PDCJ(P)P 2008. JKDM dalam proses penggubalan.Tindakan:Bahagian PerkhidmatanTeknikTindakan : Bahagian Perkhidmatan TeknikAgenda:5<strong>Bil</strong>:26 (m.s. 58 – <strong>Minit</strong> 2/2008)30

AGENDA 6USUL BARU DAN JAWAPAN MESYUARAT PANEL PERUNDINGAN KASTAM – SWASTABIL 1/<strong>2009</strong>NO. PERKARA TINDAKAN JKDM1. Tajuk:CUSTOMS VERIFICATION INITIATIVE (CVI)Jawapan :UsulIsu::AFAMThe CVI was introduced for risk management andtargeted to identify unscrupulous importers whounder declare invoice values, use differentcustoms tariff code to avoid duty payment etc. Thedeclarations from these suspected importers arethen blocked in the SMK by JKDM Headquarters.The stations are unable to unblock these as it iscontrolled at headquarters level. Unfortunately,the JKDM Headquarters does not work onweekends and public holidays and as such theseshipments are stuck although the consignee maybe able to produce necessary clarification on theshipment being imported.Panduan yang menjelaskan keputusan bagimenahan (BLOCK) dan melepaskan (UNBLOCK)konsaimen dagangan yang berisiko akandilaksanakan oleh ketua stesen yang terlibat danbukannya CVI Ibu Pejabat. Taklimat berkaitanpanduan baru ini telah diberikan dalam masaterdekat kepada stesen-stesen utama. Keputusanini berkuatkuasa pada 1.7.<strong>2009</strong>.SelesaiCadanganAFAM:JKDM Headquarters should either work 24hours and also on weekends and publicholidays to facilitate the processing ofsuspected shipments. There are also no clearguidelines on the actual purpose andworkings of the CVI at station levels. A clearguideline needs to be communicated to allstations.Tindakan:Bahagian Perkhidmatan Teknik31

NO. PERKARA TINDAKAN JKDM2. Tajuk:BUKIT KAYU HITAMJawapan :UsulIsu::AFAMJKDM at the BKH checkpoint currentlyoperates from 8.00am till 8.30pm fromSundays to Thursdays. The checkpoint isclosed to cargo on Fridays and Saturdays.The closure of the checkpoint at 8.30pm hascaused disruptions of cargo flow between thetwo countries. This results in the cargo ladentrucks to camp outside the check pointovernight and create traffic congestion in themornings when the check point reopens.Telah berbincang dengan AFAM. Buat masasekarang stesen Bukit Kayu Hitam akan di bukadari jam 6.00 pagi hingga 12.00 malam.JKDM akan mengeluarkan surat ke persatuandalam masa yang terdekat.SelesaiJawapanAFAM:JKDM to extend the operating hours to 24hours basis 7 days a week to facilitate themovement of cargo between the 2 countries.Tindakan:Bahagian Perkastaman32

NO. PERKARA TINDAKAN JKDM3. Tajuk:TANJUNG PUTERIJawapan :UsulIsu::AFAMJKDM at the TP checkpoint currently onlyallows the movement of perishable & livestock between midnight & 5.30am.The facilityis closed for general cargo between thesetimes. The closure of the checkpoint atmidnight has caused disruptions of cargo flowbetween the 2 countries. It results in the cargoladen trucks to camp outside the checkpointovernight & create traffic congestion in themornings when the check point re-opens.Bagi Tanjung Puteri, JKDM tiada sebaranghalangan. Walau bagaimanapun perbincanganperlu diadakan dengan MOT.Tindakan : Bahagian PerkastamanCadanganAFAM:JKDM to extend the operating hours to 24hours basis to facilitate the movement of cargobetween the two countries.Tindakan:Bahagian Perkastaman33

NO. PERKARA TINDAKAN JKDM4. Tajuk:SERVICE LEVEL AGREEMENTJawapan :UsulIsu::AFAMIn view of the reduction of the Free StoragePeriod at the ports, we have requested for aservice level agreement from the JKDM in theclearance of the following categories ofshipments:1. Direct release2. Physical examination3. CVIThis will have a direct impact on theforwarding agents & their customers as itwould have financial implications shouldthere be any delay by any one party in theclearance process. The service levelagreement would then be the standardbenchmark and it would then alleviate theprobability of accusations by those concernedA comprehensive client charter is being developedby the corporate division which encompases all theactivities carried out by the JKDM which involvesthe public. The client charter is targeted to beimplemented by December <strong>2009</strong>.SelesaiCadanganAFAM:JKDM to issue a service level agreement assoon as possible.Tindakan:Bahagian Perkastaman &Bahagian Perkhidmatan Teknik34

NO. PERKARA TINDAKAN JKDM5. Tajuk:BUMIPUTRA EQUITYJawapan :UsulIsu::AFAMThe present policy governing the issuance offorwarding agent’s license stipulates that all newagencies must have Bumiputra participation of atleast 51% with regards to share capital,management and capital. The requirement doesnot apply to certain categories of companies suchas companies and agencies which are fully ownedby Malaysian citizens etc. These directives arehowever not being complied with by JKDM.Isu ekuiti Bumiputra bagi kelulusan agenpenghantaran adalah satu dasar MOF dan pihakAFAM dinasihatkan merujuk pada Kementerianberkenaan. Surat bertarikh 09 Julai <strong>2009</strong> keAFAM adalah berkaitan.Garispanduan untuk Integrated Logistic Services(ILS) & International Integrated Logistic Services(IILS) adalah dibawah bidangkuasa MIDA.CadanganAFAM:Companies, agencies and soleproprietorships/partnerships/family ownershipsowned by Malaysians should be accordedlicenses without any conditions as stipulated inthe NEP. They should also be able to qualify forthe status of ILS (Integrated Logistics Services) byamending the guidelines from owning assets tomanaging assets similar to the guidelinesaccorded to the IILS (International IntegratedLogistics Services) companies.SelesaiIn view also of the globalization trend, foreigncompanies which have invested huge sums ofmoney in their businesses in Malaysia andopening up their global networks for the country’sbenefit are benefiting through total exemptions ofthe equity participation through the introduction ofIILS (International Integrated Logistics Services)Tindakan:Bahagian Perkastaman35

NO. PERKARA TINDAKAN JKDM6. Tajuk:PUBLIC BONDED WAREHOUSEJawapan :UsulIsu::AFAMJKDM has changed the criteria for theapproval of Public Bonded Warehouse license.They are now imposing criteria’s as followsfor Critical Items:1. Value of goods stored in 1 year to be ofa minimum value of RM 3.5 million.2. Bank guarantee of 10% of the total taxinvolved over a period of 1 year.Dasar Baru Gudang Berlesen Awam (GBA)terbahagi kepada 2 Kategori;A. Permohonan GBA yang menggundangbarang-barang tidak berisiko tinggi dengansyarat ;-Modal berbayar sekurang-kurangnyaRM250,000.00-Keluasan gudang sekurang-kurangnya 20,000 kp.-Jumlah Jaminan Bank 10% daripada duti / cukaiterlibat dalam setahunCadanganAFAMTindakan::This new requirement for value of goods overa period of 1 year is unrealistic and has gotno business relevance. The need for bankguarantee of 10% of the total tax is alsounjustified as it only ties up the companiescash reserves and would affect their cashflow.The two mentioned criteria to be removed fromthe requirements for the issuance of PublicBonded Warehouse License.Bahagian PerkastamanB. Permohonan GBA yang menggundang barangbarangberisiko tinggi dengan syarat;-Modal berbayar sekurang-kurangnyaRM1,000,000.00-Keluasan gudang sekurang-kurangnya 50,000 kp.-Nilai barangan yang disimpan dalam 1 tahuntidak kurang dari RM3.5 juta-Jumlah Jaminan Bank 10% daripada duti / cukaiterlibat dalam setahunIsu ini telah di bincang dgn pihak AFAM pada08/07/09 & JKDM bersetuju utk mengkaji semulaperkara ini dgn MOF. JKDM bersetuju untukmengkaji semula syarat-syarat kelulusanterutamanya tentang keluasan gudang, BankGuarantee dan paid up capital.Tindakan : Bhg. Perkastaman36

NO. PERKARA TINDAKAN JKDM7 Tajuk:MOBILE PHONES AND SPARESJawapan :UsulIsu::AFAMJKDM recently issued a directive to stop thetransfer of mobile phones and its spares usingCustoms No 8 form. The manufacturers arenow left in a lurch as they are unable totransfer goods from one Free Commercial Zoneto another Free Commercial Zone. Thistransfer is normally done when one companydoes a particular process while anothercompany in a different Free Commercial Zonecontinues with another process. By this banon the In Transit using Customs No 8 willcripple the mobile phone industry in thecountry.Dasar pemindahan secara 'in-transit' telefon bimbitbertarikh 29 April 2008 akan ditarikbalik dansatu mekanisma bagi mengukuhkan kawalan<strong>Kastam</strong> akan dibangunkan.Surat maklum telah diedarkan kepada persatuan.(Ruj : KE.HE(44)690/02-4/Klt.6(19) bertarikh13.7.<strong>2009</strong>.SelesaiCadanganAFAM:JKDM to cancel the above directive in the bestinterests of the players in the mobile phoneindustry.Tindakan:Bahagian Perkastaman37

NO. PERKARA TINDAKAN JKDM8. Tajuk:AUTHORISED ECONOMIC OPERATORJawapan :UsulIsuCadanganAFAM:::AFAMJKDM has introduced a facility calledAuthorized Economic Operator in line with theCustoms Golden Client policy. Among theobjectives of this policy is to develop a smartpartnership between JKDM and the privatesector to achieve supply chain security. This ishowever restricted to Malaysianmanufacturers and traders. The freightforwarders who form an integral part of thesupply chain have however been left out. Theforwarders constitute to 99% of all shipmentscleared within the country.JKDM to develop a policy which wouldrecognize freight forwarders who havedemonstrated a high level of compliance tocustoms legal and regulatory requirementsand accord them the similar benefits.AEO is a facility which is accorded to partiesinvolved in international movement of goodscomplying with WCO or equivalent supply chainsecurity standards. JKDM has not accorded AEOstatus to any company. JKDM has a limited versionof AEO which is called the Customs Golden Client.The Customs Golden Clients facility is only accordedto importers who demonstrate high compliance interms of regulatory and accounting practices. Thecompanies are vetted to ensure compliance. Thisfacility cannot be accorded to Customs Agentsbecause they will be clearing for their clients whoare not Customs Golden Clients. Customs agentshowever are allowed to clear for heir clients whohave been accorded Customs Golden Clients status.Customs agents are encouraged to have their clientsapply for this facility.Untuk MaklumanTindakan:Bahagian Perkastaman38

NO. PERKARA TINDAKAN JKDM9. Tajuk:CLAIMS FOR CONTRIBUTIONS /SPONSORSHIPSJawapan :UsulIsuCadanganAFAMTindakan::::AFAMThere have been various parties who havebeen soliciting for funds using the name ofJKDM. These parties are ex- JKDM officialsand or from the JKDM clubs. They continue todo so despite an official directive from JKDMto halt such activities.DG of JKDM to officially ban such solicitationof funds and take necessary police action iffound to continue.Bahagian Khidmat Pengurusan SumberManusia & KewanganJKDM telah mengeluarkan surat pada 18 April2008 dan 14 Ogos 2008 kepada semua NGOJabatan ini supaya tidak meminta derma daripadamana-mana pihak. Persatuan-Persatuan adalahseperti berikut :i. Persatuan Pegawai-Pegawai Kanan <strong>Kastam</strong>Malaysiaii. Persatuan Pegawai Kanan Sabahiii.Kesatuan Pegawai-Pegawai <strong>Kastam</strong>Semenanjung Malaysiaiv. Kesatuan Sekerja <strong>Kastam</strong> Sabahv. Kesatuan Pegawai <strong>Kastam</strong> Sarawakvi. Persatuan Pegawai <strong>Kastam</strong> Marinvii.Persatuan Penduduk Kediaman <strong>Kastam</strong>,Kelana JayaJabatan juga telah mewar-warkan melalui akhbarakhbartempatan pada 28 Jun <strong>2009</strong>.Selesai39

NO. PERKARA TINDAKAN JKDM10. Tajuk:CHANGES IN POLICYJawapan :UsulIsuCadanganAFAMTindakan::::AFAMThe JKDM Headquarters has off late madechanges to existing policies without consultingthe industry players in advance to gatherinputs. This then leads to dissatisfactionamong the industry players when the policiesare deemed to be non-workable and onlyhinders progressJKDM must convene dialogues and haveconsultative meetings to discuss proposedpolicy changes with the industry and give theindustry at least 30 days notice in advanceprior to implementation.Bahagian Perancangan KorporatJKDM mengambil maklum mengenai isu ini.Dalam melaksanakan sesuatu polisi atau dasartidak semestinya JKDM berbincang dengan pihakindustri terlebih dahulu sebelum ianyadilaksanakan khususnya dasar atau polisi yangmelibatkan penguatkuasaan dan pematuhan.JKDM bersedia untuk mengadakan perbincangandengan pihak industri terlebih dahulu pada masahadapan sebelum sesuatu polisi atau dasar barudilaksanakan dan akan memberi time frame untukpelaksanaan sesuatu polisi baru.Walau bagaimanapun, bukan semua polisi ataudasar yang akan dibincangkan dengan pihakswasta.Selesai40

NO. PERKARA TINDAKAN JKDM11. TajukUsulIsu:::FORWARDING AGENT LICENSE RENEWAL-EPF CONTRIBUTION SLIPSAFAMJKDM still insists that Forwarding Agentssubmit copies of EPF contributions of theirstaff when submitting applications forrenewal of their Forwarding Agents license.On the other hand, the requirement to submita breakdown of salary structure of staff hasbeen discontinued by the directive from MITI.Jawapan :JKDM has issued a letter reminding the stations notto request the EPF slip when applying for renewal ofForwarding Agent approval. The Agents’associations have also been informed of this on29 Jun <strong>2009</strong>SelesaiCadanganAFAM:The requirement to submit copies of staff EPFcontributions are to be discontinued.Tindakan:Bahagian Perkastaman12. Tajuk:SERVICE TAX (ST) PAYMENT – ON-LINEJawapan :UsulIsu::AFAMPresently all FF have to physically travel torespective JKDM stations to submit theircheques for their ST. This is inconvenient inthis modern technological era where mosttransactions can be done on-line.Sistem pembayaran cukai on-line sedangdibangunkan melalui Portal JKDM. Dijangka siapsebelum akhir tahun 2010.SelesaiCadanganAFAM:Payment of ST to be done electronicallysimilar of Electronic Fund Transfer (EFT).Tindakan:Bahagian Cukai Dalam Negeri41

NO. PERKARA TINDAKAN JKDM13. TajukUsulIsuCadanganAFAM::::PRINTING OF CUSTOMS OFFICIALRECEIPTS (COR)AFAMAll COR are only printed at the JKDMpayment counters thus requiring the CustomsAgents to leave their offices just to collect thereceipts. This is counter productive in thismodern technological era in a paperlessenvironment.JKDM to modify the present system to allowthe printing of COR to be done at the agents’premises.Jawapan :The printing of COR at the agents’ premises hasbeen agreed in principle. The legal and operationalissues are being worked out. Once these issues areresolved with MOF, AG & Audit, the printing of CORat the agents’ premises will be implemented.Currently the COR is printed only at the JKDMoffice.Tindakan : Bhg. Perkastaman & CawanganTeknologi MaklumatTindakan:Bahagian Perkastaman &Cawangan Teknologi Maklumat42

NO. PERKARA TINDAKAN JKDM14. Tajuk:HANGING FORMS IN SMKJawapan :UsulIsu::AFAMWhenever there is a system failure with theSMK, JKDM forms cannot be submittedelectronically. Although the forms are keyed inthe system but due to the system’s failure,forwarding agents then revert to manualsubmissions. They are required to cancelthese electronic submissions once the systemcomes online again. They would then have tosubmit all relevant documentation which mayhave already been attached to shipment &delivered to the consignee. Retrieval of thesedocs can be extremely cumbersome.JKDM agrees to this proposal. System requirementsand operational issues need to be worked out.AFAM has also agreed in a meeting held on08/07/09 to provide information on how to solvethis issue.JKDM perlu mewujudkan task force bersamadengan pihak agen untuk menyelesaikan masalahini.Tindakan : Bahagian Perkastaman & CawanganTeknologi MaklumatCadanganAFAM:JKDM to modify the SMK system so thatJKDM personnel can delete & cancel theelectronic submissions in the event of systemfailure after sighting the manual submissions.Tindakan:Bahagian Perkastaman & CawanganTeknologi Maklumat43

NO. PERKARA TINDAKAN JKDM15. Tajuk:CUSTOMS PASSESJawapan :UsulIsu::AFAMThe procedure & authority for the issuance ofJKDM passes in Port Klang goes against allnorms. The JKDM passes are issued by athird party who is not associated to JKDM.How can a third party issue a JKDM passand even collect RM20 as a fee? There is alsoa requirement that JKDM pass can only beissued to personnel that have attended theKAAK course and have a valid certificate ofpassing this exam. Is this a new policy?JKDM to study this proposal. A discussion withAFAM and FMFF will take place at a date to be fixedlater.Tindakan : Bahagian PerkastamanCadanganAFAM:JKDM Port Klang to take over theresponsibility of the issuance of JKDM passesand also abolish the requirement for the needof personnel to have a valid certificate ofpassing the KAAK exam.Tindakan:Bahagian Perkastaman44

NO. PERKARA TINDAKAN JKDM16. Tajuk:KEDAI EDIJawapan :UsulIsu::AFAMThere are presently many forwarders who areusing the services of Kedai EDI to do Customsdeclaration via the EDI system as they haveyet to install the software in their offices.These forwarders will be affected whenJKDM fully implement the paperlessdeclaration and transaction which will be endto endThe JKDM is of the opinion that the installation offront end software is a business decision. The KedaiEDI is established to cater for agents who find itmore economical to use their service.AFAM juga telah mencadangkan kemudahan payper use pada DagangNet.Maklumat kos yang diterima dari DagangNetadalah seperti di Lampiran S.CadanganAFAM:JKDM to make it compulsory for CustomsAgents to install a Customs declarationsystem in their premisesUntuk MaklumanTindakan:Bahagian Perkastaman45

NO. PERKARA TINDAKAN JKDM17. Tajuk:CUSTOMS K1A - RESUBMISSIONJawapan :UsulIsuCadanganAFAM:::AFAM1 st time imports of shipments where invoicevalue is over RM10,000.00 requires theadditional submissions of Customs K1A formwhich came into effect in year 2000. Asubsequent import of the same shipment(commodity) however does not require the resubmissionof Customs K1A form. This ishowever not practiced in Port Klang whereJKDM insists on re-submission of CustomsK1A for all shipments regardless whether theshipment has been imported before.JKDM Headquarters to issue a directive onthe actual requirements for the submissions ofCustoms K1A forms i.e. that a shipment whichhas a invoice value of over RM10,000.00 buthas previously be imported using a CustomsK1A form need not resubmit a new CustomsK1A form when re-imported.Arahan telah dikeluarkan kepada semua Pengarah<strong>Kastam</strong> Negeri pada 19 Jun <strong>2009</strong> dengan merujukkepada pindaan Surat Pekeliling PentadbiranPenilaian <strong>Kastam</strong> <strong>Bil</strong> 1 bertarikh 10 Ogos 2002yang menyatakan seperti berikut:-“Borang <strong>Kastam</strong> K1A hendaklah dikemukakanhanya sekali bagi setiap kontrak jual beli /perjanjian antara penjual dengan pembeli,bukannya pada setiap borang ikrar K1”Arahan ini berkuatkuasa serta merta dan semuaKetua Bahagian <strong>Kastam</strong> Negeri, telah pundimaklumkan pada 24 Jun <strong>2009</strong> di <strong>Mesyuarat</strong>Ketua-Ketua Bahagian <strong>Kastam</strong>.Jawapan kepada AFAM melalui surat rujukanKE.HT(-)379/12(25) bertarikh 25 Jun <strong>2009</strong>telahpun dikemukakan.SelesaiTindakan:Bahagian Perkhidmatan Teknik46

NO. PERKARA TINDAKAN JKDM18. Tajuk:CUSTOMS K1A – RM10,000 TO RM20,000Jawapan :UsulIsu::AFAMThe JKDM Headquarters has on 19 thDecember 2008 revised its policy on theinvoice value for 1 st time import shipmentswhich requires the submission of K1A formsfrom RM 10,000.00 to RM 20,000.00. Thisnew policy comes into effect in January <strong>2009</strong>.This is however not practiced in Port Klangwhere the invoice value of shipments requiringsubmission of K1A remains at RM 10,000.00per shipment.Cadangan untuk meminda Peraturan-Peraturan<strong>Kastam</strong> 1977 (Pindaan No.7:1999) telah dimajukankepada Perbendaharaan dan pada masa ini JKDMsedang menunggu kelulusan Menteri Kewanganuntuk diwartakan. Pihak swasta akandimaklumkan apabila pindaan ini telahdiwartakan. Sehingga diwartakan, cadanganpindaan ini tidak dapat dilaksanakan oleh JKDM.Jawapan pada AFAM melalui surat rujukanKE.HT(-)379/12(25) bertarikh 25 Jun <strong>2009</strong>telahpun dikemukakan.CadanganAFAM:The JKDM Headquarters to issue a directiveon the change in the invoice value whichrequires the submissions of Customs K1Aform from RM 10,000.00 to RM 20,000.O0.SelesaiTindakan:Bahagian Perkhidmatan Teknik47

NO. PERKARA TINDAKAN JKDM19. TajukUsulIsuCadanganAFAM::::DUTY PAYMENT WITH THE SURETY OFBANK GUARANTEEAFAMPresently payment of Customs duties bycheque is done by the prior placement of bankguarantees with JKDM at the respectiveJKDM stations. This process involves theplacement of cash or other financialinstruments with the banks in return for theissuance of the bank guarantee. This againties down the cash flow of the respectiveForwarding Agent.The bank guarantee to be replaced by aCustoms General Bond similar to the presentK18 form and it should be accepted by allJKDM stations for Pan Malaysian licenseholders.Jawapan :Perkara ini telah pun dikaji dan hasil kajianjaminan bank telah dikurangkan dari 3 kali jumlahduti / cukai kepada 1 kali jumlah duti /cukai yangberkuatkuasa pada bulan Mei <strong>2009</strong>.Jawapan kepada AFAM melalui surat ruj.KE.HT(-)379/12(25) bertarikh 25.6.09 telah dikemukakan.Berkenaan dengan cadangan menggantikanjaminan bank dengan bon am, buat masa iniJKDM hanya membenarkan penggunaan bon amuntuk kilang-kilang yang dilesenkan sebagaiGudang Pengilangan Berlesen sahaja. JKDM masihbelum lagi bersedia untuk melaksanakannya bagikategori pengimport yang lain.SelesaiTindakan:Bahagian Perkhidmatan Teknik48

NO. PERKARA TINDAKAN JKDM20. Tajuk:COMMON CUSTOMS STATION CODEJawapan :UsulIsuCadanganAFAMTindakan::::AFAMPresently each JKDM station is identified withan individual station code which must beentered into the SMK system when makingdeclarations. A Forwarding Agent is unable tomake declarations at a different JKDM stationif his company is not registered at the station.This does not augur well in a globalisedenvironment.Forwarding Agents should be allowed tosubmit declarations’ using a common JKDMstation code and the SMK system should bemodified to accept such submissions.Cawangan Teknologi Maklumat & BahagianPerkastamanDasar pendaftaran agen penghantaran perludihalusi terlebih dahulu dan harusnya jelassupaya pemantauan dan kawalan ke atas agenagenpenghantaran yang dilesenkan masih dapatdilaksanakan oleh Jabatan. Pindaan pada SMKdengan hanya menggunakan kod stesen yangsama (common) seperti yang dicadangkan tidakmerupakan satu cadangan yang efisien. Kod stesenyang merujuk kepada stesen-stesen yang berkaitanmasih diperlukan dalam proses pengikraranborang <strong>Kastam</strong>.JKDM perlu mengkaji keperluan untukmemusatkan pendaftaran agen pendaftaran danmewujudkan kaedah pemantauan yangbersesuaian ke atas agen penghantaran jikadibenarkan berurusan di seluruh negara tanpamengira lokasi syarikat berkenaan didaftarkan.Setelah dasar yang jelas dibangunkan, barulahSMK dapat membuat pindaan. Tarikh ’cut-over’juga perlu difikirkan jika dasar baru diwujudkan.Pindaan pada SMK juga melibatkan pindaan padaperisian front-end DNT.Tindakan : Cawangan Teknologi Maklumat &Bahagian Perkastaman49

NO. PERKARA TINDAKAN JKDM21. TajukUsulIsu:::RENEWAL OF FORWARDING AGENTS’LICENSEAFAMJKDM still insists Forwarding Agents’ submitvarious documents when applying for renewalof their license. These documents are alreadyin the possession of JKDM when theForwarding Agent first applies for theirlicense. This is only adding additionalpaperwork both for the forwarding agents aswell as JKDM.Jawapan :JKDM bersetuju dengan cadangan tersebut danakan mengeluarkan surat arahan baru mengenaiperkara ini. Surat JKDM KE.HE(44)001/01-3(A)/Klt.3(77) bertarikh 15.7.<strong>2009</strong> adalahberkaitan.SelesaiCadanganAFAM:JKDM to dispense with all these paperworkexcept for the copy of the Customs GeneralBond and make it mandatory for theForwarding Agents’ to provide copies on anynew changes in their existing structure whichrequires JKDM notificationTindakan:Bahagian Perkastaman50

NO. PERKARA TINDAKAN JKDM22. Tajuk:TARIFF CODE CHANGESJawapan :UsulIsuCadanganAFAM:::AFAMThere are instances when JKDM officersdisagree to the tariff code used for declarationof shipments. They then amend these tariffcodes which will invariably change theamount of duties to be paid. This change ishowever not available on the front endsoftware of the Forwarding Agent who wouldhave to travel to the JKDM office to find outwhich item in the declaration wasamended/changed. They have to go back totheir office to notify the importer of change.JKDM must upgrade their present system toallow the Forwarding Agent to be able to seewhich item in their declaration was amendedor changed. This would reduce theunnecessary travel time of the ForwardingAgent.Keperluan ini memerlukan pindaan kepadaperisian ’front-end’ yang disediakan oleh SyarikatDNT. Sistem ’front-end’ DNT didapati hanyainterface dengan SMK dan oleh itu, tidak dapatmemaparkan sebarang pindaan yang telah dibuatdi pihak JKDM. Walau bagaimanapun, JKDMsedang dalam proses untuk mewujudkan PortalJKDM yang dijangka siap pada akhir 2010. Melaluiportal JKDM, pengikrar dapat menyemak statusdan sebarang pindaan ke atas borang <strong>Kastam</strong> yangdiikrarnya.Tindakan : Cawangan Teknologi MaklumatTindakan:Cawangan Teknologi Maklumat51

NO. PERKARA TINDAKAN JKDM23. Tajuk:DEMINIMUS VALUEJawapan :UsulIsuCadanganAFAMTindakan::::AFAMAt present only air express companies havethe dispensation of not having to formally usea JKDM form to declare shipments of inv.value of RM500 & below. This privilege ishowever not extended to the forwardingindustry.The same privilege should be accorded to theforwarding industry to make it uniformed.Bahagian PerkastamanThis is a special exemption given by the Minister ofFinance under the provision of S14(1) Customs Act1967, and is limited to importers using air courierservices only. AFAM is advised to write to MOFregarding this issue.JKDM telah menghantar surat (ruj : KE.HE(-)379/12/Klt.7(54) bertarikh 14.7.<strong>2009</strong>) ke AFAMsupaya merujuk perkara tersebut ke MOF.Selesai52

NO. PERKARA TINDAKAN JKDM24. Tajuk:CUSTOMS GOLDEN CLIENTJawapan :UsulIsuCadanganAFAM:::AFAMWe have been made to understand thatcompanies who have been accorded CustomsGolden Client status are exempted fromsubmitting Customs declaration via EDI.A criterion should be established to allowForwarding Agents to be also accordedCustoms Golden Client status.The Customs Golden Clients (CGCs) facility is onlyaccorded to importers who demonstrate highcompliance in terms of regulatory and accountingpractices. The companies are vetted to ensurecompliance. This facility cannot be accorded toCustoms Agents because they will be clearing fortheir clients who are not CGCs. Customs agentshowever are allowed to clear for their clients whohave been accorded CGC status. Customs agentsare encouraged to have their clients apply for thisfacility.Tindakan:Bahagian PerkastamanUntuk Makluman53

NO. PERKARA TINDAKAN JKDM25. Tajuk:COMMITMENT UNDER ASEAN FREETRADE AREA (AFTA)Jawapan :UsulIsu::MICCIMalaysia has agreed (amongst others) that by1 January 2010 the ASEAN tariff rate fortropical fruits, sugar, tobacco andtobacco products be set at the CEPT rate of5%. This is pursuant to the AFTA Protocol onthe Special Agreement for Sensitive andHighly Sensitive Products dated 30 September1999- Article II Para 1.JKDM akan menyediakan deraf pindaan PerintahASEAN Free Trade Area (AFTA) sebelum ianyadiwartakan oleh MITI pada 1.1.2010, sebagai satulangkah persediaan.Untuk MaklumanFrom the inception of the AFTA agreement,Malaysia has gone through various tariffelimination and reduction exercises. In someyears, the reduction/elimination wasannounced with retrospective effect.As an example, in the year 2007, the gazetteon reduction from 5% to 0% for fruits such asfigs, avocado, apples, pear, selected citrusfruits, selected fresh fruits and others wereissued on 15 March 2007 but came into forceon 1 January 2007.54

NO. PERKARA TINDAKAN JKDMThe delay in the announcement of the ASEANtariff reduction in Malaysia has caused greatinconvenience to businesses in terms of cashflow and administrative work. Furthermore,the application for refund on the dutiesoverpaid is also quite complex and requires alot of management attention.CadanganMICCITindakan::Overall the delay in reducing tariffs underAFTA does not reflect well on Malaysia in itsquest to build greater trade and industriallinkages among ASEAN member countriesTo fulfill Malaysia’s AFTA commitment, and tofacilitate Malaysian businesses, we proposethat necessary actions and steps be identifiedby the respective government authorities inensuring that the implementation of the CEPTrate for products like tropical fruits, sugar,tobacco and tobacco products be carriedout by 1 January 2010.Thus, the gazette by the government on theimplementation of the CEPT rate must beissued no later than 31 December <strong>2009</strong>.Bahagian Perkhidmatan Teknik55

NO. PERKARA TINDAKAN JKDM26. Tajuk:CUSTOMS RULING – SERVICE TAXJawapan :UsulIsu::MICCIRegulation 3 (1) of the Service Tax (CustomsRuling) Regulations states that the DirectorGeneral shall issue a Customs ruling within90 days after receipt of the relevantdocumentationJKDM berjanji akan selesaikan segera semua failfailyang tertunggak dan tempoh 3 bulan akandipatuhi bagi permohonan-permohonan yang akandatang.Dato’ Pengerusi memberi tempoh 1 bulan untukmenyelesaikan fail-fail tertunggak.CadanganMICCI:We find that numerous rulings have not beenmade within the stipulated time frame. In fact,in some instances, we have not even beeninformed of any requests for furtherinformation in respect of the rulingapplications made by us on behalf of clientswell after the 3 month time frame has lapsed.Tindakan : Bahagian Cukai Dalam NegeriTindakan:Bahagian Cukai Dalam Negeri56

NO. PERKARA TINDAKAN JKDM27. Tajuk:CUSTOMS RULINGJawapan :UsulIsuCadanganMICCI:::MICCIWe find that certain branches are reluctant tomake any decisions on their own, and insteadask us to submit ruling applications on themost routine issues. For example – updatedproduct valuation submissions, etc.Are there any guidelines as to what branchescan and cannot make decisions on?Di setiap negeri terdapat Bahagian/CawanganPerkhidmatan Teknik yang menguruskan semuaperkara berkaitan dengan penjenisan danpenilaian barangan kecuali permohonan yangmelibatkan ketetapan <strong>Kastam</strong>, bayaran duti secarabantahan dan rayuan penjenisan di manabahagian Perkhidmatan Teknik Negeri perlumengemukakan permohonan kepada Ibu Pejabatuntuk kelulusan. Panduan berkenaan perkara initelah pun dikeluarkan kepada negeri.Tindakan:Bahagian Perkhidmatan TeknikSekiranya Pegawai Teknik Negeri tidak membantuuntuk menyelesaikan masalah pelanggan, perkaraini bolehlah dilaporkan kepada Pengarah <strong>Kastam</strong>Negeri atau Ibu Pejabat untuk tindakan lanjut.Selesai57

NO. PERKARA TINDAKAN JKDM28. Tajuk:SERVICE TAX – REFUND ON BAD DEBTSJawapan :UsulIsu::MICCIWe understand that during the Customs–Private Sector discussion 2/2008, the InternalTaxes division, announced that guidelineswere being issued to address the refundclaims on bad debts specifically for theTelecommunication industry.Garispanduan telah siap diedarkan kepada semuastesen untuk makluman pemegang-pemeganglesen dan orang awam. Garispanduan dalambentuk brosur telah dimuatkan dalam laman webJKDM.SelesaiCadanganMICCI:This industry is unique in that they have a lotof debtors for minimal sums, that taking legalaction on all debtors would not be costeffective. It has been 5 months since that lastmeeting – has the guidelines been finalised?Tindakan:Bahagian Cukai Dalam Negeri58

NO. PERKARA TINDAKAN JKDM29. TajukUsulIsu:::CLEAR DEFINITION OF TAXABLE SERVICES INSECOND SCHEDULE OF THE SERVICE TAXREGULATIONS, 1975MICCIThis issue has been raised before (please refer to Item11 of the Minutes of Meeting of Customs-Private Sect.Consultative <strong>Panel</strong> 1/2007) & JKDM responded bymentioning that they will sought to revise circulars andguidebook that has been issued. They will also publishdecisions made relating to service tax for distribution tolicensees for reference & guidance.Jawapan :Pengerusi Bersama membangkitkan isu perkhidmatanbercukai seperti dalam Jadual Kedua, Peraturan-peraturanCukai Perkhidmatan perlu dikaji semula. Sebagai contoh,perkhidmatan pengurusan adalah terlalu umum dan terbukakepada berbagai interpretasi. JKDM sedang mengkajiperkara ini.Tindakan : Bahagian Cukai Dalam NegeriCadanganMICCI:Despite the above pledge by JKDM, the service taxguidebook issued in April 2008 does not appear to haveexplained the taxable services in greater details. Theguidebook mainly focused on the requirements of theservice tax law. We are also not aware of anypublication of decisions made by JKDM for publicreference and information.As previously recommended, JKDM should adopt thepublic ruling mechanism whereby new rulings /decisions are published and made known to the publicon a timely basis. The identity of the taxpayers shouldnot be disclosed. These notifications can be publishedin the JKDM official website for easy access by thepublic and not confined to only licensees.We would like to however commend the JKDM on theefforts made to improve the contents of their website.Keep it up!Tindakan:Bahagian Cukai Dalam Negeri59

NO. PERKARA TINDAKAN JKDM30. Tajuk:(i) REVIEW OF PAYMENT OF SALES TAX FROMTHE 10 TH TO THE 15 TH OF EVERY MONTHJawapan :UsulIsu::MICCIUnder the current sales tax legislation,payments of sales tax on petroleum productshave to be made to the relevant Customsstation by the 10 th of every month. Due to thecurrent downstream Automatic PricingMechanism (APM), the sales tax may vary foreach month and the Ministry of Finance (MOF)will issue notification letters to all oilcompanies on the sales tax rate payable foreach month, and this is typically issued in thefirst week of the month. As sales tax arepayable by the 10 th of each month, the timingis constrained for the preparation and deliveryof checks to each JKDM station where theterminal operates.JKDM sedang menyediakan kertas kajian dankertas kajian tersebut akan dihantar ke MOFsecepat mungkin.Tindakan : Bahagian Cukai Dalam NegeriCadanganMICCI:We recommend that the payment due date beamended from the 10 th to the 15 th of everymonth, which coincides with the due date forsubsidy claims submissions to the respectiveJKDM stations. This will provide the oilcompanies with the required sufficient leadtime to prepare timely payment of sales tax tothe local JKDM stations.Tindakan:Bahagian Cukai Dalam Negeri60

NO. PERKARA TINDAKAN JKDM31. TajukUsulIsu:::(ii) REMITTANCE OF SALES TAX TOLOCAL JKDM STATION BYTELEGRAPHIC TRANSFER (TT)MICCICurrently, the payment of monthly sales taxon petroleum products released at therespective Oil Companies’ terminals / depot,are made via checks to the relevant JKDMstation that oversees the terminal/depot.Jawapan :JKDM dalam usaha membangunkan Portal JKDMdimana pembayaran melalui elektronik akandibenarkan. Ianya dijangka akan siap akhir tahun2010.Untuk MaklumanCadanganMICCI:We recommend that remittance should beallowed to be made directly to the relevantJKDM State bank account (similar to themonthly income tax installments made to theMalaysian Inland Revenue Board) by way oftelegraphic transfer (TT). This would save theprocessing and logistics efforts required in thepreparation, handing and delivery of checksto each local JKDM station.Tindakan:Bahagian Cukai Dalam Negeri61

NO. PERKARA TINDAKAN JKDM32. TajukUsulIsu:::(iii) PLACING A BLANKET BANKGUARANTEE WITH JKDM HQMICCICurrently, all downstream oil companies arerequired to lodge a bank guarantee withJKDM HQ as security for payment of salestax for the release of petroleum products fromthe terminals/depots. These bank guaranteesare issued by local banks.Jawapan :Kajian sedang dibuat mengenai kesesuaian BonAm dan akan dimajukan untuk keputusan KetuaPengarah <strong>Kastam</strong>.Tindakan : Bhg. Cukai Dalam NegeriCadanganMICCI:For cost efficiencies, we recommend a JKDMbond in replacement of bank guarantees.With a JKDM Bond, the JKDM could stillexercise their legal rights under the Sales TaxAct 1972 to ensure full compliance by the oilcompanies.Tindakan:Bahagian Cukai Dalam Negeri62

NO. PERKARA TINDAKAN JKDM33. Tajuk:CUSTOMS FORWARDING LICENSEJawapan :UsulIsu::ACCCIM51% bumiputera equity on share ownershipand management structure for the applicationof Customs Forwarder Licensing (CFL)Isu ini adalah berkaitan dengan dasar MOF. PihakACCCIM dinasihati supaya mengemukakan isutersebut terus kepada pihak MOF untukpertimbangan.CadanganACCCIM:CFL should be issued in line with ShippingLic. which requires 30% bumiputera equity.SelesaiTindakan:Bahagian Perkastaman34. Tajuk:ISSUANCE OF ALCOHOL &TOBACCO LICENSEJawapan :UsulIsu::ACCCIMDelay of Issuance of alcohol / tobacco licenseChecklist baru telah dikemaskini dan akandimaklumkan kepada pihak ACCCIM pada20.7.<strong>2009</strong>.CadanganACCCIM:Although Issuance of alcohol & tobacco licenseis allowed to be processed at State JKDMStations, majority of applicants still encountercumbersome proc. on the application forms,resulting in approval taking months to obtain.JKDM should further simplify the procedureand for trade facilitation to approve newlicenses, renewals, applications for additionalimport quantities and new products, with adeadline preferably within 2 weeks afterproper documents are submittedSelesaiTindakan:Bahagian Perkastaman63

NO. PERKARA TINDAKAN JKDM35. TajukUsul::THRESHOLD OF RM100,000 IN SALESTAX ACT 1972ACCCIMJawapan :Kertas kajian cadangan bajet 2010 telahdikemukakan ke Kementerian Kewangan.Isu:Threshold of RM100, 000.00 in Sale Tax Act1972 is too low and significantly hampers thedevelopment of small businesses.SelesaiCadanganACCCIM:Over the years, cost of production especiallylabor & materials had increasedsubstantially. Resulting in high product price.Thus we proposed that the threshold valueshould be increased to at least RM300,000.Tindakan:Bahagian Cukai Dalam Negeri64

NO. PERKARA TINDAKAN JKDM36. TajukUsul::SMES IN FOUNDRY, ALUMINIUM ANDSTAINLESS STEEL.ACCCIMJawapan :ACCCIM diminta untuk mengemukakan cadanganterus ke MOF.Isu:Most of the SMEs basically involved infoundry, aluminium and stainless steelfabrication industries.SelesaiTheir business activities are multiple.Involving sales, fabrications and repairs insmall scale and with low turnover.CadanganACCCIM:Since SMEs in such businesses are not soleproducer of specific products under a certainbrand or in large quantities, we propose thatthis category of business be exempted fromthe Sales Tax Act 1972.Tindakan:Bahagian Cukai Dalam Negeri65

NO. PERKARA TINDAKAN JKDM37. Tajuk:LICENSED MANUFACTURING WAREHOUSE(LMW) AND DUTY EXEMPTION.Jawapan :Usul:ACCCIMIsu:LMW are given duty exemption of raw materials,machinery and spare parts used directly for themanufacture of their products and 80% of thefinished goods are to be exported. LMW statuscould be abused as follow:• Disposing the finished products in the localmarket at lower price and competing withprotected local market;• Disposing more than the 20% limit of theirfinish goods in the local market.CadanganACCCIM:i). Monthly inventory report on raw mats. &finished goods furnished by LMW holders toJKDM to be verified with physical goods onrandom basis;i). Verification of inventory report is done according to aplanned schedule.ii). Customs to ensure LMW holders comply withthe conditions of LMW especially exporting atleast 80% of their finished goods;ii). JKDM Audit section will carry out the inspection todetermine compliance of conditions.iii). Appointment of internationally certifiedauditors to audit compliance with LMW status,cost of audit will be borne by manufacturers;iii). Our Officers are more familiar with JKDMrequirements.Tindakan:iv). Application for AP to submit StatutoryDeclaration to MITI that raw material used is inline with LMW rules and MITI license.Bahagian Perkastamaniv). The requirement for applicants of AP to submit tostatutory declaration to MITI should be referred to MITISelesai66

NO. PERKARA TINDAKAN JKDM38. TajukUsulIsuCadanganACCCIM::::CONTROLLED GOOD UNDER OTHERTARIFFACCCIMDeclaring controlled goods under other tariffcode where AP is not required.• Vigilant enforcement by the JKDM,including physically verifying items asstated in the import declaration forms;Smart program with JKDM on education ofproduct knowledgeJawapan :ACCCIM is welcomed to discuss about the smartprogram with JKDM Valuation Branch. Currentlythere is already a smart program with Mega Steel.Untuk MaklumanTindakan:Bahagian Perkastaman39. TajukUsulIsuCadanganACCCIM::::UNDER DECLARING THE WEIGHT ONIMPORTED FINISHED PRODUCTSACCCIMUnder declaring the weight of the importedfinished products so as to deem tally with theapproved weight in APs as no weigh-bridgesare available at certain entry points,particularly at borders• Install weighing facilities at entry pointscomplement proper JKDM checkings.Importing of finished products via JohorBahru causeway and Bukit Kayu Hitam entrypoints should not be allowed.Jawapan :There are weigh bridges in place in Padang Besar.In Bukit Kayu Hitam there is a weigh bridge forexport whereas there has been a application toimmigration to have a weigh bridge for import.In Johor Bahru The second link has weigh bridgefacilities for import, however there are no suchfacilities at Tanjung Putri.JKDM cannot prevent importation of goods via JohorBaru & Bukit Kayu Hitam as they are gazettedimport stations. However, JKDM will look into thematter.Untuk MaklumanTindakan:Bahagian Perkastaman67

NO. PERKARA TINDAKAN JKDM40. TajukUsulIsu:::FALSIFYING THE SIZE AND GRADE OFTHE IMPORTED ITEMSACCCIMFalsifying the size and grade of the importeditems to show that they are not within therange that are produced by LocalManufacturers.Jawapan :ACCCIM is welcome to discuss about the smartprogram with JKDM Valuation Branch. Currentlythere is already a smart program with Mega Steel.Untuk MaklumanCadanganACCCIM:• Vigilant enforcement by the JKDM,including physically verifying items asstated in the import declaration forms;• Create greater awareness at JKDMstations of the size and grade of the flatsteel products produced by localmanufacturers through Smart program;• Weekly briefing/dialogue between MITIand producers to scrutinize AP applicationand detect extra ordinaryapplication/imports.Tindakan:Bahagian Perkastaman68

NO. PERKARA TINDAKAN JKDM41. Tajuk:PURCHASING PROHIBITED ITEMS THATHAD BEEN CONFISCATED BY CUSTOMSJawapan :Usul:ACCCIMIsu:Purchasing prohibited items that had beenconfiscated by JKDM and using the samereceipt issued by JKDM to cover up for goodssmuggled from other channels.CadanganACCCIM:1. JKDM to review existing tenderingprocedures for confiscated items to ensuretransparency;1. JKDM tidak menerima sebarang aduan dari orgawam mengenai penggunaan semula resit jualankeatas brg lucuthak JKDM utk melindungibarangan seludup. Peruntukan perundanganmembenarkan KPK melupuskan brg. larangan ygdilucuthak dgn cara menjualnya kpd orang ramai.Bagaimanapun adalah menjadi dasar JKDM padamasa ini, brg larangan yang dilucuthak sepertimercun, bunga api, rokok, minuman keras, vcd,barangan elektrik dsb. akan dimusnahkan. Hanyakenderaan lucuthak & diluluskan oleh JPJ shjdijual secara tender kpd org ramai. Keputusantender dibuat melalui jawatankuasa khas bagimemastikan ketelusan dan integriti. Statistikpelupusan brg lucuthak secara pemusnahanadalah spt di Lampiran J.2. Prohibited items that had been confiscatedby JKDM should not be sold locally but mustbe re-exported2. Cadangan ini tidak dapat dipertimbang untukdilaksanakan oleh kerana ia boleh terdedahkepada penyelewengan.Tindakan:Bahagian PenguatkuasaanSelesai69

NO. PERKARA TINDAKAN JKDM42. TajukUsulIsu:::PENAHANAN KONTENA ATAS KESALAHANCUBAAN PENYELUDUPAN DAN IKRARPALSUSAMPenahanan Kontena Atas Kesalahan CubaanPenyeludupan Dan Ikrar Palsu "FalseDeclaration" mengambil masa terlalu lamaatas sebab-sebab siasatan dan kegagalanuntuk mendapatkan pihak yangbertanggung jawab pihak syarikatperkapalan mengalami kerugian yang besaratas kos-kos storage, detention dan kawalanelektrik dan penjagaan bagi kontena sejukbeku dan kontena serba guna (gp) keranapenahanan kontena yang terlalu lama.Long detention of containers by JKDM. Thisissue was raised on several occasions withboth JKDM Putrajaya and JKDM Selangor.However, containers were still detained fortoo long. Some examples containers held byJKDM Wilayah Persekutuan and NegeriSembilan - details given in the attachment.Jawapan :JKDM sentiasa berusaha untuk melepaskankontena yang disita dalam tempoh 2 bulan daritarikh sitaan. Sebahagian besar kontena yangdisita untuk siasatan telah dapat dilepaskansemula dengan kadar segera.Kecuali di dalam kes-kes tertentu ianya mengambiltempoh lebih lama untuk diselesaikan keranasyarikat pengimport di dapati tidak wujud.JKDM telah membuat ketetapan bahawa apabilasesuatu kontena sejuk disita, kesemua cajberkaitan storage dan kos elektrik dibiayaisepenuhnya oleh JKDM. Pada masa ini JKDMsedang dalam proses untuk menyediakankemudahan tapak penahanan kontena sejuk disemua setor penguatkuasaan di seluruh negara.Ketua Pengarah <strong>Kastam</strong> telah mengarahkanBahagian Penguatkuasaan membuat kajiantempoh masa untuk pelepasan kontena dan jugamengadakan perjumpaan dengan pihak SAM.70

NO. PERKARA TINDAKAN JKDMCadanganSAM:Mengambil tindakan ke atas pihak consigneeatau pemilik cargo tanpa mengambil kirapenukaran konsaini oleh pemilik/pengimpotasal seperti yang di ikrarkan melalui K4 yangasal. Tindakan ini akan dapatmempercepatkan siasatan kes dan kontenadapat di kembalikan kepada pihak syarikatperkapalan pihak syarikat perkapalan akanmemberikan kerja sama penuh dalammemberikan maklumat yang di perlukanbagi tujuan mempercepatkan siasatan kes.JKDM should return /release emptycontainers to the shipping agents/lines within2 months from the date of detention. Ifinvestigations are not completed by the end of2 months, JKDM should unload the cargofrom the containers and return the emptycontainers.Kedudukan kontena yang dibangkitkan.Wilayah Persekutuan KLKontena No: WHLU 2617646, WHLU2821855 danWHLU 5199600 ECMU9294109, HU8091468 danFSCU9747130Status: Belum dilepaskan kerana masih dalamsiasatan.SelangorKontena No: GLDU3579284Status: Telah dilepaskan kepada pihak shippingpada 1 Jun <strong>2009</strong>.Negeri SembilanKontena No: KLFU1946170, KLFU1958253 danKLFU7174933Status: Akan dilepaskan bulan Julai <strong>2009</strong>,barang telah ditender.Tindakan:Bahagian PenguatkuasaanTindakan : Bahagian Penguatkuasaan71

NO. PERKARA TINDAKAN JKDM43. TajukUsulIsuCadanganISOA::::LIBERALIZATION OF 27 SERVICESECTORSSAMPM's announcement on liberalization of 27service sectors. to date unable to getclarification whether shipping and forwardingagencies are included in the list of 27 servicesunder maritime agency services (cpc 7454)Request JKDM to enlighten us on this matter.Jawapan :Syarat 30% ekuiti Bumiputra yang kinidikenakan ke atas agen perkapalan adalahdibatalkan, mulai tarikh 22 April <strong>2009</strong> bagipemohonan baru. Walau bagaimanapun syarat51% ekuiti Bumiputra yang kini dikenakan keatas agen penghantaran masih kekal. Surat telahdiedar kepada pihak AFAM (Ruj :KE.HE(44)001/01-3(A)Klt.3(75)bertarikh13.7.<strong>2009</strong>).SelesaiTindakan:Bahagian Perkastaman44. Tajuk:E-MANIFEST AT PENANGJawapan :UsulIsuCadanganISOA:::SAMPort Klang and Penang have implemented e-manifest. In Penang there seems to be verylittle effort towards implementing the e-Manifest.Recommend that JKDM to give priority in thismatter and implement it A.S.A.P. in Penang.Pilot run pelaksanaan e-manifest telah dijadualkanpada awal September <strong>2009</strong> di Pulau Pinang.Roadmap akan diedarkan kepada pihak SAMdalam tempoh masa yang terdekat.Tindakan : Bhg. PerkastamanTindakan:Bahagian Perkastaman72

AGENDA 7Ucapan Penutup Pengerusi BersamaThank you Ketua Pengarah.I’m sure lots of issues were dicussed this morning and although there were some raised voices, but I thinkthis can be taken in the spirit of good faith and resolve these issues within the JKDM community.So, I would like to thank the Ketua Pengarah <strong>Kastam</strong> again for having had this meeting. I’m sure theoutstanding issues will be resolved soon. I also appreciate the JKDM for allowing me to address this forum.Thank you.73

AGENDA 8Ucapan Penutup PengerusiTerima kasih Encik Raja Kumaran.Sebelum itu, saya ingin memohon rakan-rakan saya di JKDM, apabila pihak swasta ada masalahdengan usul, kita berbincang secara terbuka. Kita boleh berkongsi pendapat atau maklumat. Adakalanyapihak swasta lebih arif mengenai sesuatu isu daripada kita. Penilaian dari pihak kita perlu dibuat bagimenyelesaikan sesuatu masalah dengan cepat. Ini akan meningkatkan taraf ekonomi negara melalui deliverysystems kita dan sebagainya. Melalui cara ini, kita akan dapat mencapai manfaat yang lebih berbandingdaripada sistem bersaing dengan negara-negara yang lain. Jadi saya minta perancangan dibuat bagi manamanausul yang kita terima dan saya berharap supaya kita tidak menunggu sehingga enam bulan untukmenyelesaikan sesuatu masalah itu. Apabila sesuatu usul telah selesai, kita perlu mengeluarkan surat danmaklumkan apa tindakan yang telah diambil.74

Pihak swasta telah membawa 68 perkara dan kita telahpun membincangkan kesemua perkaratersebut. Saya amat berterima kasih di atas semua maklumat perbincangan yang diutarakan serta diatassemua maklum balas yang diberikan oleh pihak swasta dan juga pihak <strong>Kastam</strong>. Pada saya adalah perkarabiasa dalam mana-mana perbincangan, kadang-kadang ada pencangahan pendapat. Ini adalah perkaranormal dan saya percaya kita dapat menyelesaikan isu-isu tersebut. Kepada semua pegawai, saya inginmenegaskan bahawa kita dapat memberi kerjasama dan perkhidmatan yang baik kepada pihak swasta demiuntuk kemakmuran negara. Saya percaya kita tidak sempurna dari segi pengetahuan dan saya amatmengalu-alukan pandangan membina dari semua pihak kerana sekiranya ini dapat dilakukan, isu-isuberkaitan dengan pengurusan JKDM dapat diselesaikan secara positif.Saya ingin menyatakan bahawa kemungkinan sesetengah isu ini yang dibincangkan di sini akan jugadibawa ke dalam forum yang lain, contohnya dialog MITI. Saya mohon supaya isu-isu yang diputuskandalam mesyuarat ini akan mempunyai keputusan dan penyelesaian yang sama walaupun ianyadibincangkan dalam forum yang lain. Kita seharusnya menjadi profesional dalam menangani sesuatu isu.Akhir kata, saya ucapkan terima kasih di atas segala sumbangan yang diberikan di dalam mesyuaratini dan insyaAllah kita akan jumpa lagi di mesyuarat yang akan datang. Sekian, saya sudahi denganwabillahi taufik walhidayah wassalammualikum warahmatullah hiwabarakatuh. Terima kasih.75