Tax Neutrality on Islamic Banking and Takaful - Chartered Tax ...

Tax Neutrality on Islamic Banking and Takaful - Chartered Tax ...

Tax Neutrality on Islamic Banking and Takaful - Chartered Tax ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

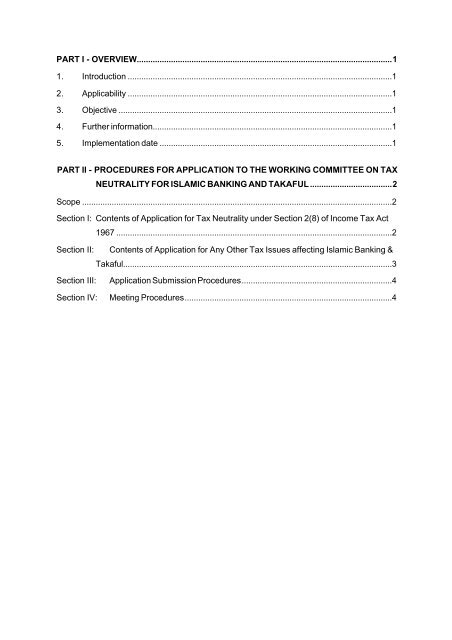

PART I - OVERVIEW................................................................................................................11. Introducti<strong>on</strong> ....................................................................................................................12. Applicability ....................................................................................................................13. Objective ........................................................................................................................14. Further informati<strong>on</strong>.........................................................................................................15. Implementati<strong>on</strong> date ......................................................................................................1PART II - PROCEDURES FOR APPLICATION TO THE WORKING COMMITTEE ON TAXNEUTRALITY FOR ISLAMIC BANKING AND TAKAFUL ....................................2Scope ........................................................................................................................................2Secti<strong>on</strong> I: C<strong>on</strong>tents of Applicati<strong>on</strong> for <str<strong>on</strong>g>Tax</str<strong>on</strong>g> <str<strong>on</strong>g>Neutrality</str<strong>on</strong>g> under Secti<strong>on</strong> 2(8) of Income <str<strong>on</strong>g>Tax</str<strong>on</strong>g> Act1967 .........................................................................................................................2Secti<strong>on</strong> II: C<strong>on</strong>tents of Applicati<strong>on</strong> for Any Other <str<strong>on</strong>g>Tax</str<strong>on</strong>g> Issues affecting <strong>Islamic</strong> <strong>Banking</strong> &<strong>Takaful</strong>......................................................................................................................3Secti<strong>on</strong> III:Secti<strong>on</strong> IV:Applicati<strong>on</strong> Submissi<strong>on</strong> Procedures..................................................................4Meeting Procedures...........................................................................................4

BNM/RH/GL 009-2<strong>Islamic</strong> <strong>Banking</strong> & <strong>Takaful</strong>DepartmentGuideline <strong>on</strong> <str<strong>on</strong>g>Tax</str<strong>on</strong>g> <str<strong>on</strong>g>Neutrality</str<strong>on</strong>g> for<strong>Islamic</strong> <strong>Banking</strong> <strong>and</strong> <strong>Takaful</strong>Page1 of 5PART I - OVERVIEW1. Introducti<strong>on</strong>1.1 Bank Negara Malaysia has established the Working Committee <strong>on</strong> <str<strong>on</strong>g>Tax</str<strong>on</strong>g><str<strong>on</strong>g>Neutrality</str<strong>on</strong>g> for <strong>Islamic</strong> <strong>Banking</strong> <strong>and</strong> <strong>Takaful</strong> following the introducti<strong>on</strong> of Secti<strong>on</strong>2(8) of the Income <str<strong>on</strong>g>Tax</str<strong>on</strong>g> Act 1967 (ITA) where authority has been given forBank Negara Malaysia to approve a scheme of financing based <strong>on</strong> Shariahprinciples as being eligible for tax neutrality treatment. The WorkingCommittee comprises senior officials from Ministry of Finance (MOF) <strong>and</strong> theInl<strong>and</strong> Revenue Board in additi<strong>on</strong> to BNM officers. Bank Negara Malaysia isthe Secretariat for the Working Committee.2. Applicability2.1 This guideline is applicable to the following eligible applicants:-(i) Those licensed under the <strong>Islamic</strong> <strong>Banking</strong> Act 1983;(ii) Instituti<strong>on</strong>s licensed under the <strong>Banking</strong> <strong>and</strong> Financial Instituti<strong>on</strong>s Act1989 (BAFIA) that participates in the <strong>Islamic</strong> banking scheme aspermitted under Secti<strong>on</strong> 124 of BAFIA; <strong>and</strong>(iii) Those licensed under the <strong>Takaful</strong> Act 1984.3. Objective3.1 The objective of this guideline is to provide eligible applicants with theappropriate procedures that they must adhere to in applying for tax neutralityor tax incentive.4. Further Informati<strong>on</strong>4.1 The eligible applicants may seek clarificati<strong>on</strong> through the Secretariat of theWorking Committee at Bank Negara Malaysia.5. Implementati<strong>on</strong> Date5.1 This guideline has taken effect since 29 August 2006.

BNM/RH/GL 009-2<strong>Islamic</strong> <strong>Banking</strong> & <strong>Takaful</strong>DepartmentGuideline <strong>on</strong> <str<strong>on</strong>g>Tax</str<strong>on</strong>g> <str<strong>on</strong>g>Neutrality</str<strong>on</strong>g> for<strong>Islamic</strong> <strong>Banking</strong> <strong>and</strong> <strong>Takaful</strong>Page2 of 5PART II - PROCEDURES FOR APPLICATION TO THE WORKING COMMITTEEON TAX NEUTRALITY FOR ISLAMIC BANKING AND TAKAFULScope• Eligible issues:<str<strong>on</strong>g>Tax</str<strong>on</strong>g> <strong>and</strong> stamp duty issues c<strong>on</strong>cerning or affecting the applicants, or theircustomers as a result of using <strong>Islamic</strong> banking <strong>and</strong> takaful products or service.Secti<strong>on</strong> I: C<strong>on</strong>tents of Applicati<strong>on</strong> for <str<strong>on</strong>g>Tax</str<strong>on</strong>g> <str<strong>on</strong>g>Neutrality</str<strong>on</strong>g> under Secti<strong>on</strong> 2(8) ofIncome <str<strong>on</strong>g>Tax</str<strong>on</strong>g> Act 1967The following minimum informati<strong>on</strong> must be included in the applicati<strong>on</strong>:1. Describe with sufficient details:-(i) the structure of the scheme of financing (please include a diagram);(ii) the applicant instituti<strong>on</strong>’s role; <strong>and</strong>(iii) the identity of all the parties including other financier(s) <strong>and</strong>customer(s) involved.2. C<strong>on</strong>firm whether the product has complied with the Guidelines <strong>on</strong> Introducti<strong>on</strong>of New Products <strong>and</strong> provide the date when the relevant approval(s)was/were obtained, if applicable.3. List the transacti<strong>on</strong> instruments which will be executed for the scheme to beimplemented <strong>and</strong> briefly describe each instrument.4. State the ec<strong>on</strong>omic effect that the scheme intends to achieve (e.g. structuredto have the ec<strong>on</strong>omic effect of a term loan, project financing or homemortgage).5. Based <strong>on</strong> Item 4 above:-(i) Tabulate the transacti<strong>on</strong> documents against c<strong>on</strong>venti<strong>on</strong>al financingdocuments;

BNM/RH/GL 009-2<strong>Islamic</strong> <strong>Banking</strong> & <strong>Takaful</strong>DepartmentGuideline <strong>on</strong> <str<strong>on</strong>g>Tax</str<strong>on</strong>g> <str<strong>on</strong>g>Neutrality</str<strong>on</strong>g> for<strong>Islamic</strong> <strong>Banking</strong> <strong>and</strong> <strong>Takaful</strong>Page3 of 5(ii)(iii)(iv)State which document(s) are further <strong>and</strong> in additi<strong>on</strong> to c<strong>on</strong>venti<strong>on</strong>altransacti<strong>on</strong> documents;State what is the applicable stamp duty for each instrument; <strong>and</strong>Also state whether the applicant believes there is any existingexempti<strong>on</strong> that the transacti<strong>on</strong> or part of the transacti<strong>on</strong> may qualify for,the reas<strong>on</strong> for the applicant belief <strong>and</strong> state the exempti<strong>on</strong> order in full.6. Provide the names, designati<strong>on</strong>, teleph<strong>on</strong>e numbers <strong>and</strong> email addresses ofthe officers which Bank Negara Malaysia may c<strong>on</strong>tact for clarificati<strong>on</strong> orfurther informati<strong>on</strong>.Secti<strong>on</strong> II: C<strong>on</strong>tents of Applicati<strong>on</strong> for Any Other <str<strong>on</strong>g>Tax</str<strong>on</strong>g> Issues Affecting <strong>Islamic</strong><strong>Banking</strong> & <strong>Takaful</strong>The following minimum informati<strong>on</strong> must be included in the applicati<strong>on</strong>:-1. Describe with sufficient details, the background to the issue, how the issuearose <strong>and</strong> how the applicant instituti<strong>on</strong> is affected by the issue.2. Recommend the appropriate tax treatment <strong>and</strong> provide the rati<strong>on</strong>ale for suchrecommendati<strong>on</strong>. The applicant should clearly state whether the applicantwould like to apply for tax neutrality or tax incentive <strong>and</strong> provide str<strong>on</strong>gjustificati<strong>on</strong> why it should be granted.3. If there are transacti<strong>on</strong> documents involved, please describe them <strong>and</strong> if thetransacti<strong>on</strong> is intended to have the ec<strong>on</strong>omic effect of a c<strong>on</strong>venti<strong>on</strong>alfinancing transacti<strong>on</strong>, please state what the c<strong>on</strong>venti<strong>on</strong>al equivalent is.4. Provide the names, designati<strong>on</strong>, teleph<strong>on</strong>e numbers <strong>and</strong> email addresses ofthe officers which Bank Negara Malaysia may c<strong>on</strong>tact for clarificati<strong>on</strong> orfurther informati<strong>on</strong>.

BNM/RH/GL 009-2<strong>Islamic</strong> <strong>Banking</strong> & <strong>Takaful</strong>DepartmentGuideline <strong>on</strong> <str<strong>on</strong>g>Tax</str<strong>on</strong>g> <str<strong>on</strong>g>Neutrality</str<strong>on</strong>g> for<strong>Islamic</strong> <strong>Banking</strong> <strong>and</strong> <strong>Takaful</strong>Page4 of 5Secti<strong>on</strong> III: Applicati<strong>on</strong> Submissi<strong>on</strong> Procedures1. All applicati<strong>on</strong>s must have been approved by the applicant <strong>and</strong> signed by theChief Executive Officer or a Director of the instituti<strong>on</strong> c<strong>on</strong>cerned.2. Submissi<strong>on</strong> of completed applicati<strong>on</strong>s must be made to:-SecretariatWorking Committee <strong>on</strong> <str<strong>on</strong>g>Tax</str<strong>on</strong>g> <str<strong>on</strong>g>Neutrality</str<strong>on</strong>g> in <strong>Islamic</strong> <strong>Banking</strong> & <strong>Takaful</strong>c/o Financial Infrastructure Development<strong>Islamic</strong> <strong>Banking</strong> <strong>and</strong> <strong>Takaful</strong> DepartmentBank Negara MalaysiaJalan Dato’ Onn50480 Kuala Lumpur3. Electr<strong>on</strong>ic applicati<strong>on</strong>s or facsimile applicati<strong>on</strong>s are not allowed.4. Depending <strong>on</strong> availability of the Working Committee members, the Secretariatendeavours to c<strong>on</strong>vene a meeting within fourteen (14) working days of receiptof completed informati<strong>on</strong>.Secti<strong>on</strong> IV: Meeting Procedures1. The Secretariat will review the applicati<strong>on</strong> <strong>and</strong> may ask for further informati<strong>on</strong>as necessary. Once all outst<strong>and</strong>ing informati<strong>on</strong> has been duly received, aWorking Committee Meeting will be fixed. In this regard, Bank NegaraMalaysia endeavours to give at least three (3) working days advance writtennotice to the applicant.2. The Secretariat will inform the instituti<strong>on</strong> c<strong>on</strong>cerned of the date, time <strong>and</strong>venue of the meeting by notice in writing where the applicant will be requiredto:-

BNM/RH/GL 009-2<strong>Islamic</strong> <strong>Banking</strong> & <strong>Takaful</strong>DepartmentGuideline <strong>on</strong> <str<strong>on</strong>g>Tax</str<strong>on</strong>g> <str<strong>on</strong>g>Neutrality</str<strong>on</strong>g> for<strong>Islamic</strong> <strong>Banking</strong> <strong>and</strong> <strong>Takaful</strong>Page5 of 5(i)(ii)c<strong>on</strong>duct a slide presentati<strong>on</strong> of their applicati<strong>on</strong> together with printedcopies for circulati<strong>on</strong>; <strong>and</strong>have their tax advisors or tax pers<strong>on</strong>nel present to answer anyclarificati<strong>on</strong>s which the Working Committee members may need <strong>on</strong> theapplicati<strong>on</strong> in additi<strong>on</strong> to the presence of the relevant c<strong>on</strong>tactpers<strong>on</strong>nel.3. The Working Committee will deliberate <strong>on</strong> the matter <strong>and</strong> a decisi<strong>on</strong> will bemade <strong>and</strong> communicated to the applicant.4. If the Working Committee requires further informati<strong>on</strong>, the applicant will beasked to provide the same <strong>and</strong> the decisi<strong>on</strong> will be deferred to the nextmeeting where the matter will be deliberated.5. The decisi<strong>on</strong> of the Working Committee will be communicated in writing to theapplicant within seven (7) working days, setting out whether the applicati<strong>on</strong> isapproved, rejected or taken up for appropriate recommendati<strong>on</strong> to thegovernment.6. If a decisi<strong>on</strong> is deferred, the deferment will be notified to the applicant <strong>and</strong> notbe communicated in writing as the matter will be adjourned to anothermeeting after receipt of additi<strong>on</strong>al informati<strong>on</strong>.7. Unless there are subsequent intervening events, all decisi<strong>on</strong> will bec<strong>on</strong>sidered final <strong>and</strong> no appeals will be entertained.8. Bank Negara Malaysia reserves the right to publish statistics <strong>and</strong> generalinformati<strong>on</strong> <strong>on</strong> the matters deliberated by the Working Committee.