association representative handbook - Alabama Education ...

association representative handbook - Alabama Education ...

association representative handbook - Alabama Education ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

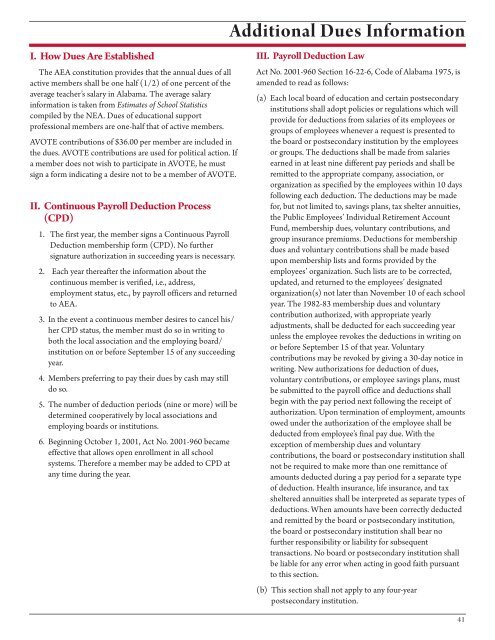

I. How Dues Are EstablishedThe AEA constitution provides that the annual dues of allactive members shall be one half (1/2) of one percent of theaverage teacher’s salary in <strong>Alabama</strong>. The average salaryinformation is taken from Estimates of School Statisticscompiled by the NEA. Dues of educational supportprofessional members are one-half that of active members.AVOTE contributions of $36.00 per member are included inthe dues. AVOTE contributions are used for political action. Ifa member does not wish to participate in AVOTE, he mustsign a form indicating a desire not to be a member of AVOTE.II. Continuous Payroll Deduction Process(CPD)1. The first year, the member signs a Continuous PayrollDeduction membership form (CPD). No furthersignature authorization in succeeding years is necessary.2. Each year thereafter the information about thecontinuous member is verified, i.e., address,employment status, etc., by payroll officers and returnedto AEA.3. In the event a continuous member desires to cancel his/her CPD status, the member must do so in writing toboth the local <strong>association</strong> and the employing board/institution on or before September 15 of any succeedingyear.4. Members preferring to pay their dues by cash may stilldo so.5. The number of deduction periods (nine or more) will bedetermined cooperatively by local <strong>association</strong>s andemploying boards or institutions.6. Beginning October 1, 2001, Act No. 2001-960 becameeffective that allows open enrollment in all schoolsystems. Therefore a member may be added to CPD atany time during the year.Additional Dues InformationIII. Payroll Deduction LawAct No. 2001-960 Section 16-22-6, Code of <strong>Alabama</strong> 1975, isamended to read as follows:(a) Each local board of education and certain postsecondaryinstitutions shall adopt policies or regulations which willprovide for deductions from salaries of its employees orgroups of employees whenever a request is presented tothe board or postsecondary institution by the employeesor groups. The deductions shall be made from salariesearned in at least nine different pay periods and shall beremitted to the appropriate company, <strong>association</strong>, ororganization as specified by the employees within 10 daysfollowing each deduction. The deductions may be madefor, but not limited to, savings plans, tax shelter annuities,the Public Employees’ Individual Retirement AccountFund, membership dues, voluntary contributions, andgroup insurance premiums. Deductions for membershipdues and voluntary contributions shall be made basedupon membership lists and forms provided by theemployees’ organization. Such lists are to be corrected,updated, and returned to the employees’ designatedorganization(s) not later than November 10 of each schoolyear. The 1982-83 membership dues and voluntarycontribution authorized, with appropriate yearlyadjustments, shall be deducted for each succeeding yearunless the employee revokes the deductions in writing onor before September 15 of that year. Voluntarycontributions may be revoked by giving a 30-day notice inwriting. New authorizations for deduction of dues,voluntary contributions, or employee savings plans, mustbe submitted to the payroll office and deductions shallbegin with the pay period next following the receipt ofauthorization. Upon termination of employment, amountsowed under the authorization of the employee shall bededucted from employee’s final pay due. With theexception of membership dues and voluntarycontributions, the board or postsecondary institution shallnot be required to make more than one remittance ofamounts deducted during a pay period for a separate typeof deduction. Health insurance, life insurance, and taxsheltered annuities shall be interpreted as separate types ofdeductions. When amounts have been correctly deductedand remitted by the board or postsecondary institution,the board or postsecondary institution shall bear nofurther responsibility or liability for subsequenttransactions. No board or postsecondary institution shallbe liable for any error when acting in good faith pursuantto this section.(b) This section shall not apply to any four-yearpostsecondary institution.41