Página- 30 /4535. Livro <strong>de</strong> Termos <strong>de</strong> Ocorrência, como adquirir e utilizar?O livro Registro <strong>de</strong> Utilização <strong>de</strong> Documentos Fiscais e Termos <strong>de</strong> Ocorrências – RUDFTO,mo<strong>de</strong>lo 6, Anexo - 46, <strong>de</strong>stina-se à escrituração <strong>da</strong>s entra<strong>da</strong>s <strong>de</strong> impressos e <strong>de</strong> <strong>do</strong>cumentos fiscais,<strong>de</strong> que trata o art. 395, bem como à lavratura <strong>de</strong> termos <strong>de</strong> ocorrências fiscais. Po<strong>de</strong>m serconfecciona<strong>do</strong>s por estabelecimentos gráficos ou pelo próprio contribuinte. Normalmente é adquiri<strong>do</strong>pronto para uso, no comércio, <strong>de</strong>ven<strong>do</strong> ser corretamente preenchi<strong>do</strong> e assina<strong>do</strong> pelo titular ourepresentante legal <strong>da</strong> empresa.36. Po<strong>de</strong>-se corrigir uma Nota Fiscal que foi emiti<strong>da</strong> com erro (incorreção)?A resposta a esta questão encontra-se na resposta <strong>da</strong> pergunta número 13.37. Como se calcula o <strong>ICMS</strong> <strong>da</strong> substituição tributária (<strong>ICMS</strong>/ST) inci<strong>de</strong>nte sobre farinha <strong>de</strong> trigo eos seus <strong>de</strong>riva<strong>do</strong>s, quan<strong>do</strong> adquiri<strong>do</strong>s fora <strong>do</strong> Esta<strong>do</strong>?A – Farinha <strong>de</strong> trigo – importa<strong>da</strong> ou adquiri<strong>da</strong> em Uni<strong>da</strong><strong>de</strong> <strong>da</strong> Fe<strong>de</strong>raçãoO <strong>ICMS</strong>/ST será obti<strong>do</strong> multiplican<strong>do</strong>-se a quanti<strong>da</strong><strong>de</strong> <strong>de</strong> volumes pelo valor específico <strong>do</strong><strong>ICMS</strong>, conforme indica<strong>do</strong> nas tabelas I e II abaixo:I – operações com origem <strong>do</strong> exterior ou <strong>de</strong> Uni<strong>da</strong><strong>de</strong>s <strong>da</strong> Fe<strong>de</strong>ração não signatárias <strong>do</strong> Protocolo<strong>ICMS</strong> nº 46/00:FARINHA DE TRIGO Embalagem <strong>ICMS</strong> (R$) conforme a origem <strong>do</strong> produtoAlíquota interestadual - 7% 12% Importa<strong>do</strong>Adicional<strong>de</strong> 1%Comum 50 kg 10,26 7,93 13,99 0,47Especial 50 kg 11,42 8,83 15,58 0,52Comum (fds. 10x1) 10 kg 2,24 1,73 3,06 0,10Especial (fds. 10x1) 10 kg 2,52 1,94 3,43 0,11Com fermento (10x1) 10 kg 2,94 2,27 4,00 0,13Pré-mistura ou Aditiva<strong>da</strong> 25 kg 6,29 4,86 8,58 0,29A granel comum Tonela<strong>da</strong> 205,23 158,59 279,85 9,33A granel especial Tonela<strong>da</strong> 227,69 175,95 310,48 10,35A granel pré-mistura ou aditiva<strong>da</strong> Tonela<strong>da</strong> 245,89 190,01 335,30 11,18Exemplo: Farinha <strong>de</strong> trigo comum, em sacos <strong>de</strong> 50 kg, proveniente <strong>de</strong> Santa Catarina (SC)Alíquota interestadual = 7%<strong>ICMS</strong>/ST = (10,26 + 0,47) x Quanti<strong>da</strong><strong>de</strong> <strong>de</strong> sacos = 10,73 x Quanti<strong>da</strong><strong>de</strong> <strong>de</strong> sacosII – operações com origem nas Uni<strong>da</strong><strong>de</strong>s <strong>da</strong> Fe<strong>de</strong>ração signatárias <strong>do</strong> Protocolo <strong>ICMS</strong> nº 46/00,realiza<strong>da</strong>s por estabelecimento atacadista ou distribui<strong>do</strong>r:FARINHA DE TRIGO EMBALAGEM VALOR DO <strong>ICMS</strong> ADIC. 1%Comum 50 kg 6,61 0,39Especial 50 kg 7,36 0,43Comum (fds. 10x1) 10 kg 1,43 0,08Última atualização: 23 <strong>de</strong> junho <strong>de</strong> 2010, Equipe Plantão Fiscal – 48 perguntas <strong>freqüentes</strong>

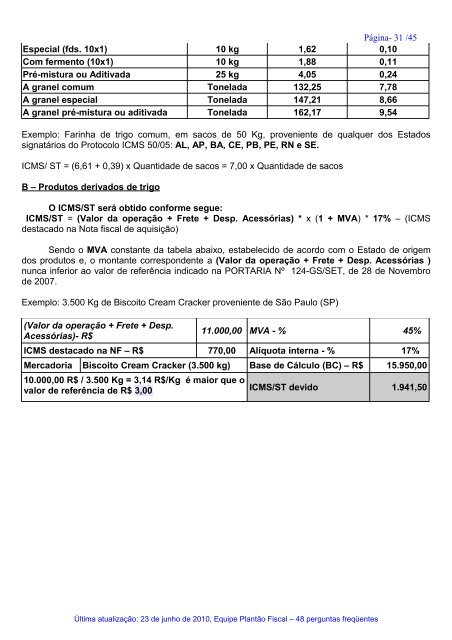

Página- 31 /45Especial (fds. 10x1) 10 kg 1,62 0,10Com fermento (10x1) 10 kg 1,88 0,11Pré-mistura ou Aditiva<strong>da</strong> 25 kg 4,05 0,24A granel comum Tonela<strong>da</strong> 132,25 7,78A granel especial Tonela<strong>da</strong> 147,21 8,66A granel pré-mistura ou aditiva<strong>da</strong> Tonela<strong>da</strong> 162,17 9,54Exemplo: Farinha <strong>de</strong> trigo comum, em sacos <strong>de</strong> 50 Kg, proveniente <strong>de</strong> qualquer <strong>do</strong>s Esta<strong>do</strong>ssignatários <strong>do</strong> Protocolo <strong>ICMS</strong> 50/05: AL, AP, BA, CE, PB, PE, RN e SE.<strong>ICMS</strong>/ ST = (6,61 + 0,39) x Quanti<strong>da</strong><strong>de</strong> <strong>de</strong> sacos = 7,00 x Quanti<strong>da</strong><strong>de</strong> <strong>de</strong> sacosB – Produtos <strong>de</strong>riva<strong>do</strong>s <strong>de</strong> trigoO <strong>ICMS</strong>/ST será obti<strong>do</strong> conforme segue:<strong>ICMS</strong>/ST = (Valor <strong>da</strong> operação + Frete + Desp. Acessórias) * x (1 + MVA) * 17% – (<strong>ICMS</strong><strong>de</strong>staca<strong>do</strong> na Nota fiscal <strong>de</strong> aquisição)Sen<strong>do</strong> o MVA constante <strong>da</strong> tabela abaixo, estabeleci<strong>do</strong> <strong>de</strong> acor<strong>do</strong> com o Esta<strong>do</strong> <strong>de</strong> origem<strong>do</strong>s produtos e, o montante correspon<strong>de</strong>nte a (Valor <strong>da</strong> operação + Frete + Desp. Acessórias )nunca inferior ao valor <strong>de</strong> referência indica<strong>do</strong> na PORTARIA Nº 124-GS/SET, <strong>de</strong> 28 <strong>de</strong> Novembro<strong>de</strong> 2007.Exemplo: 3.500 Kg <strong>de</strong> Biscoito Cream Cracker proveniente <strong>de</strong> São Paulo (SP)(Valor <strong>da</strong> operação + Frete + Desp.Acessórias)- R$11.000,00 MVA - % 45%<strong>ICMS</strong> <strong>de</strong>staca<strong>do</strong> na NF – R$ 770,00 Alíquota interna - % 17%Merca<strong>do</strong>ria Biscoito Cream Cracker (3.500 kg) Base <strong>de</strong> Cálculo (BC) – R$ 15.950,0010.000,00 R$ / 3.500 Kg = 3,14 R$/Kg é maior que ovalor <strong>de</strong> referência <strong>de</strong> R$ 3,00 <strong>ICMS</strong>/ST <strong>de</strong>vi<strong>do</strong> 1.941,50Última atualização: 23 <strong>de</strong> junho <strong>de</strong> 2010, Equipe Plantão Fiscal – 48 perguntas <strong>freqüentes</strong>