ACCT 220 Alpha Company had the following events during FY 2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ACCT</strong> <strong>220</strong> <strong>Alpha</strong> <strong>Company</strong> <strong>had</strong> <strong>the</strong><br />

<strong>following</strong> <strong>events</strong> <strong>during</strong> <strong>FY</strong> <strong>2017</strong><br />

BUY HERE⬊<br />

https://www.homeworkmade.com/acct-<br />

<strong>220</strong>-alpha-company-<strong>had</strong>-<strong>the</strong>-<strong>following</strong><strong>events</strong>-<strong>during</strong>-fy-<strong>2017</strong>/<br />

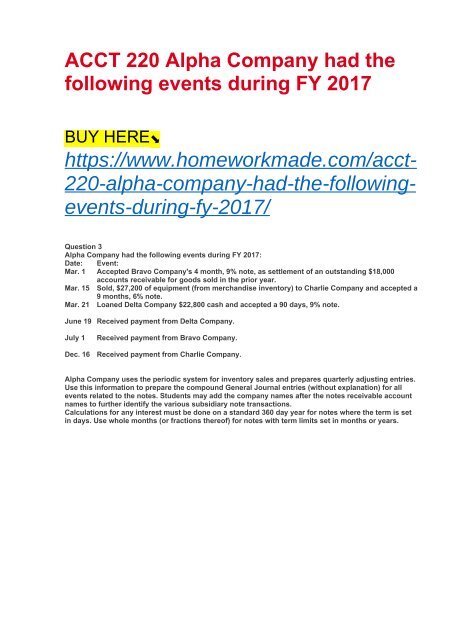

Question 3<br />

<strong>Alpha</strong> <strong>Company</strong> <strong>had</strong> <strong>the</strong> <strong>following</strong> <strong>events</strong> <strong>during</strong> <strong>FY</strong> <strong>2017</strong>:<br />

Date: Event:<br />

Mar. 1 Accepted Bravo <strong>Company</strong>'s 4 month, 9% note, as settlement of an outstanding $18,000<br />

accounts receivable for goods sold in <strong>the</strong> prior year.<br />

Mar. 15 Sold, $27,200 of equipment (from merchandise inventory) to Charlie <strong>Company</strong> and accepted a<br />

9 months, 6% note.<br />

Mar. 21 Loaned Delta <strong>Company</strong> $22,800 cash and accepted a 90 days, 9% note.<br />

June 19 Received payment from Delta <strong>Company</strong>.<br />

July 1<br />

Received payment from Bravo <strong>Company</strong>.<br />

Dec. 16 Received payment from Charlie <strong>Company</strong>.<br />

<strong>Alpha</strong> <strong>Company</strong> uses <strong>the</strong> periodic system for inventory sales and prepares quarterly adjusting entries.<br />

Use this information to prepare <strong>the</strong> compound General Journal entries (without explanation) for all<br />

<strong>events</strong> related to <strong>the</strong> notes. Students may add <strong>the</strong> company names after <strong>the</strong> notes receivable account<br />

names to fur<strong>the</strong>r identify <strong>the</strong> various subsidiary note transactions.<br />

Calculations for any interest must be done on a standard 360 day year for notes where <strong>the</strong> term is set<br />

in days. Use whole months (or fractions <strong>the</strong>reof) for notes with term limits set in months or years.