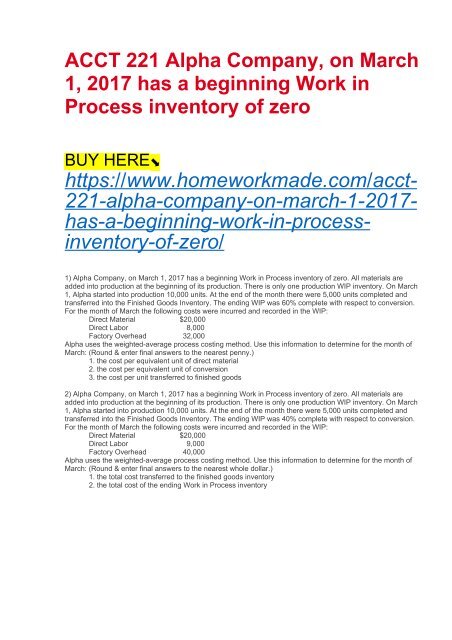

ACCT 221 Alpha Company, on March 1, 2017 has a beginning Work in Process inventory of zero

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<str<strong>on</strong>g>ACCT</str<strong>on</strong>g> <str<strong>on</strong>g>221</str<strong>on</strong>g> <str<strong>on</strong>g>Alpha</str<strong>on</strong>g> <str<strong>on</strong>g>Company</str<strong>on</strong>g>, <strong>on</strong> <strong>March</strong><br />

1, <strong>2017</strong> <strong>has</strong> a <strong>beg<strong>in</strong>n<strong>in</strong>g</strong> <strong>Work</strong> <strong>in</strong><br />

<strong>Process</strong> <strong>in</strong>ventory <strong>of</strong> <strong>zero</strong><br />

BUY HERE⬊<br />

https://www.homeworkmade.com/acct-<br />

<str<strong>on</strong>g>221</str<strong>on</strong>g>-alpha-company-<strong>on</strong>-march-1-<strong>2017</strong>-<br />

<strong>has</strong>-a-<strong>beg<strong>in</strong>n<strong>in</strong>g</strong>-work-<strong>in</strong>-process<strong>in</strong>ventory-<strong>of</strong>-<strong>zero</strong>/<br />

1) <str<strong>on</strong>g>Alpha</str<strong>on</strong>g> <str<strong>on</strong>g>Company</str<strong>on</strong>g>, <strong>on</strong> <strong>March</strong> 1, <strong>2017</strong> <strong>has</strong> a <strong>beg<strong>in</strong>n<strong>in</strong>g</strong> <strong>Work</strong> <strong>in</strong> <strong>Process</strong> <strong>in</strong>ventory <strong>of</strong> <strong>zero</strong>. All materials are<br />

added <strong>in</strong>to producti<strong>on</strong> at the <strong>beg<strong>in</strong>n<strong>in</strong>g</strong> <strong>of</strong> its producti<strong>on</strong>. There is <strong>on</strong>ly <strong>on</strong>e producti<strong>on</strong> WIP <strong>in</strong>ventory. On <strong>March</strong><br />

1, <str<strong>on</strong>g>Alpha</str<strong>on</strong>g> started <strong>in</strong>to producti<strong>on</strong> 10,000 units. At the end <strong>of</strong> the m<strong>on</strong>th there were 5,000 units completed and<br />

transferred <strong>in</strong>to the F<strong>in</strong>ished Goods Inventory. The end<strong>in</strong>g WIP was 60% complete with respect to c<strong>on</strong>versi<strong>on</strong>.<br />

For the m<strong>on</strong>th <strong>of</strong> <strong>March</strong> the follow<strong>in</strong>g costs were <strong>in</strong>curred and recorded <strong>in</strong> the WIP:<br />

Direct Material $20,000<br />

Direct Labor 8,000<br />

Factory Overhead 32,000<br />

<str<strong>on</strong>g>Alpha</str<strong>on</strong>g> uses the weighted-average process cost<strong>in</strong>g method. Use this <strong>in</strong>formati<strong>on</strong> to determ<strong>in</strong>e for the m<strong>on</strong>th <strong>of</strong><br />

<strong>March</strong>: (Round & enter f<strong>in</strong>al answers to the nearest penny.)<br />

1. the cost per equivalent unit <strong>of</strong> direct material<br />

2. the cost per equivalent unit <strong>of</strong> c<strong>on</strong>versi<strong>on</strong><br />

3. the cost per unit transferred to f<strong>in</strong>ished goods<br />

2) <str<strong>on</strong>g>Alpha</str<strong>on</strong>g> <str<strong>on</strong>g>Company</str<strong>on</strong>g>, <strong>on</strong> <strong>March</strong> 1, <strong>2017</strong> <strong>has</strong> a <strong>beg<strong>in</strong>n<strong>in</strong>g</strong> <strong>Work</strong> <strong>in</strong> <strong>Process</strong> <strong>in</strong>ventory <strong>of</strong> <strong>zero</strong>. All materials are<br />

added <strong>in</strong>to producti<strong>on</strong> at the <strong>beg<strong>in</strong>n<strong>in</strong>g</strong> <strong>of</strong> its producti<strong>on</strong>. There is <strong>on</strong>ly <strong>on</strong>e producti<strong>on</strong> WIP <strong>in</strong>ventory. On <strong>March</strong><br />

1, <str<strong>on</strong>g>Alpha</str<strong>on</strong>g> started <strong>in</strong>to producti<strong>on</strong> 10,000 units. At the end <strong>of</strong> the m<strong>on</strong>th there were 5,000 units completed and<br />

transferred <strong>in</strong>to the F<strong>in</strong>ished Goods Inventory. The end<strong>in</strong>g WIP was 40% complete with respect to c<strong>on</strong>versi<strong>on</strong>.<br />

For the m<strong>on</strong>th <strong>of</strong> <strong>March</strong> the follow<strong>in</strong>g costs were <strong>in</strong>curred and recorded <strong>in</strong> the WIP:<br />

Direct Material $20,000<br />

Direct Labor 9,000<br />

Factory Overhead 40,000<br />

<str<strong>on</strong>g>Alpha</str<strong>on</strong>g> uses the weighted-average process cost<strong>in</strong>g method. Use this <strong>in</strong>formati<strong>on</strong> to determ<strong>in</strong>e for the m<strong>on</strong>th <strong>of</strong><br />

<strong>March</strong>: (Round & enter f<strong>in</strong>al answers to the nearest whole dollar.)<br />

1. the total cost transferred to the f<strong>in</strong>ished goods <strong>in</strong>ventory<br />

2. the total cost <strong>of</strong> the end<strong>in</strong>g <strong>Work</strong> <strong>in</strong> <strong>Process</strong> <strong>in</strong>ventory