Town of Coloma-Real.pdf - Waushara County

Town of Coloma-Real.pdf - Waushara County

Town of Coloma-Real.pdf - Waushara County

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

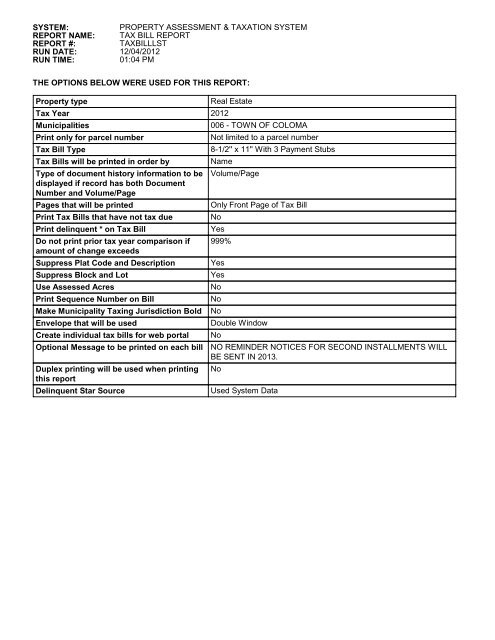

SYSTEM:<br />

REPORT NAME:<br />

REPORT #:<br />

RUN DATE:<br />

RUN TIME:<br />

PROPERTY ASSESSMENT & TAXATION SYSTEM<br />

TAX BILL REPORT<br />

TAXBILLLST<br />

12/04/2012<br />

01:04 PM<br />

THE OPTIONS BELOW WERE USED FOR THIS REPORT:<br />

Property type <strong>Real</strong> Estate<br />

Tax Year 2012<br />

Municipalities 006 - TOWN OF COLOMA<br />

Print only for parcel number Not limited to a parcel number<br />

Tax Bill Type 8-1/2'' x 11'' With 3 Payment Stubs<br />

Tax Bills will be printed in order by Name<br />

Type <strong>of</strong> document history information to be<br />

displayed if record has both Document<br />

Number and Volume/Page<br />

Volume/Page<br />

Pages that will be printed Only Front Page <strong>of</strong> Tax Bill<br />

Print Tax Bills that have not tax due No<br />

Print delinquent * on Tax Bill Yes<br />

Do not print prior tax year comparison if<br />

amount <strong>of</strong> change exceeds<br />

999%<br />

Suppress Plat Code and Description Yes<br />

Suppress Block and Lot Yes<br />

Use Assessed Acres No<br />

Print Sequence Number on Bill No<br />

Make Municipality Taxing Jurisdiction Bold No<br />

Envelope that will be used Double Window<br />

Create individual tax bills for web portal No<br />

Optional Message to be printed on each bill NO REMINDER NOTICES FOR SECOND INSTALLMENTS WILL<br />

BE SENT IN 2013.<br />

Duplex printing will be used when printing<br />

this report<br />

No<br />

Delinquent Star Source Used System Data

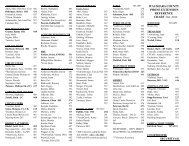

Assessed Value Land<br />

2,500<br />

Taxing Jurisdiction<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Property Address<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

80 LLC<br />

W614 TECUMSEH DR<br />

NEW HOLSTEIN WI 53061<br />

Total<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

Ass'd Value Improve<br />

1,500<br />

PFC/MFL<br />

$5.63<br />

PAY 1ST INSTALLMENT OF:<br />

$99.46<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

669<br />

Parcel #<br />

006-02524-0000<br />

Alt. Parcel #<br />

690062180825240000<br />

80 LLC<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

4,000<br />

97,500<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

0.9602<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

Est. Fair Mkt. Land<br />

2,600<br />

2011<br />

Net Tax<br />

0.69<br />

25.53<br />

8.55<br />

27.40<br />

7.26<br />

69.43<br />

32.68<br />

36.75<br />

IMPORTANT: Be sure this description covers your property. This description<br />

is for property tax bill only and may not be a full legal description.<br />

470/464 298/202 ACRES: 40.000<br />

SEC 25, T 18 N, R 08 E<br />

SE1/4 OF NW1/4 & ROW<br />

2012<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$0.00<br />

Pay to <strong>County</strong> Treasurer<br />

By July 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

WAUSHARA CO. TREASURER<br />

ELAINE WEDELL<br />

P.O. BOX 489<br />

WAUTOMA WI 54982<br />

(920) 787-0445<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

669<br />

Parcel #<br />

006-02524-0000<br />

Alt. Parcel #<br />

690062180825240000<br />

80 LLC<br />

Include This Stub With Your Payment<br />

Est. Fair Mkt. Improve<br />

1,600<br />

PFC/MFL<br />

0.71<br />

26.74<br />

8.51<br />

30.55<br />

8.20<br />

74.71<br />

36.48<br />

38.23<br />

% Tax<br />

Change<br />

Net Assessed Value Rate<br />

(Does NOT reflect credits)<br />

0.018679724<br />

RETAIN THIS<br />

PORTION AS<br />

YOUR COPY<br />

NO REMINDER NOTICES FOR SECOND<br />

INSTALLMENTS WILL BE SENT IN 2013.<br />

BILL NO. 669<br />

Correspondence should refer to parcel number<br />

PARCEL#: 006-02524-0000<br />

ALT. PARCEL #: 690062180825240000<br />

Total Est. Fair Mkt.<br />

4,200<br />

101,500<br />

Gross Property Tax<br />

First Dollar Credit<br />

2.9% Lottery Credit<br />

4.7% Net Property Tax<br />

-0.5%<br />

MFL 2004 - CLOSED<br />

11.5%<br />

12.9%<br />

A star in this box means<br />

unpaid prior year taxes<br />

7.6%<br />

11.6%<br />

TOTAL DUE FOR FULL PAYMENT<br />

4.0% PAY BY January 31, 2013<br />

$<br />

99.46<br />

OR PAY FULL AMOUNT OF:<br />

$99.46<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

74.71<br />

-36.48<br />

38.23<br />

61.23<br />

Warning: If not paid by due dates, installment option<br />

is lost and total tax is delinquent subject to interest<br />

and, if applicable, penalty.<br />

Failure to pay on time. See reverse.<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

669<br />

Parcel #<br />

006-02524-0000<br />

Alt. Parcel #<br />

690062180825240000<br />

80 LLC<br />

Include This Stub With Your Payment

Assessed Value Land<br />

Taxing Jurisdiction<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

Ass'd Value Improve<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Property Address<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

80 LLC<br />

W614 TECUMSEH DR<br />

NEW HOLSTEIN WI 53061<br />

Total<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

PFC/MFL<br />

$0.00<br />

PAY 1ST INSTALLMENT OF:<br />

$62.80<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

670<br />

Parcel #<br />

006-02531-0000<br />

Alt. Parcel #<br />

690062180825310000<br />

80 LLC<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

100,000<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

0.9602<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

Est. Fair Mkt. Land<br />

2011<br />

Net Tax<br />

IMPORTANT: Be sure this description covers your property. This description<br />

is for property tax bill only and may not be a full legal description.<br />

470/464 298/202 ACRES: 40.000<br />

SEC 25, T 18 N, R 08 E<br />

NE1/4 OF SW1/4 & ROW<br />

2012<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$0.00<br />

Pay to <strong>County</strong> Treasurer<br />

By July 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

WAUSHARA CO. TREASURER<br />

ELAINE WEDELL<br />

P.O. BOX 489<br />

WAUTOMA WI 54982<br />

(920) 787-0445<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

670<br />

Parcel #<br />

006-02531-0000<br />

Alt. Parcel #<br />

690062180825310000<br />

80 LLC<br />

Include This Stub With Your Payment<br />

Est. Fair Mkt. Improve<br />

0.00<br />

0.00<br />

0.00<br />

0.00<br />

0.00<br />

PFC/MFL<br />

% Tax<br />

Change<br />

Net Assessed Value Rate<br />

(Does NOT reflect credits)<br />

0.018679724<br />

RETAIN THIS<br />

PORTION AS<br />

YOUR COPY<br />

NO REMINDER NOTICES FOR SECOND<br />

INSTALLMENTS WILL BE SENT IN 2013.<br />

BILL NO. 670<br />

Correspondence should refer to parcel number<br />

PARCEL#: 006-02531-0000<br />

ALT. PARCEL #: 690062180825310000<br />

Total Est. Fair Mkt.<br />

104,100<br />

Gross Property Tax<br />

First Dollar Credit<br />

Lottery Credit<br />

Net Property Tax<br />

MFL 2004 - CLOSED<br />

A star in this box means<br />

unpaid prior year taxes<br />

TOTAL DUE FOR FULL PAYMENT<br />

PAY BY January 31, 2013<br />

$<br />

62.80<br />

OR PAY FULL AMOUNT OF:<br />

$62.80<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

0.00<br />

62.80<br />

Warning: If not paid by due dates, installment option<br />

is lost and total tax is delinquent subject to interest<br />

and, if applicable, penalty.<br />

Failure to pay on time. See reverse.<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

670<br />

Parcel #<br />

006-02531-0000<br />

Alt. Parcel #<br />

690062180825310000<br />

80 LLC<br />

Include This Stub With Your Payment

Assessed Value Land<br />

34,100<br />

Taxing Jurisdiction<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

Ass'd Value Improve<br />

71,400<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Total<br />

Property Address<br />

N915 6TH AVE<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

CLIFFORD N & PEGGY C ABITZ<br />

N915 6TH AVE<br />

COLOMA WI 54930<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

$ 148.42<br />

PAY 1ST INSTALLMENT OF:<br />

$876.78<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

634<br />

Parcel #<br />

006-02344-0120<br />

Alt. Parcel #<br />

690062180823440120<br />

ABITZ, CLIFFORD N & PEGGY C<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

105,500<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

0.9602<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

Est. Fair Mkt. Land<br />

35,500<br />

2011<br />

Net Tax<br />

18.15<br />

673.25<br />

225.39<br />

722.78<br />

191.49<br />

1,831.06<br />

55.56<br />

73.53<br />

1,701.97<br />

IMPORTANT: Be sure this description covers your property. This description<br />

is for property tax bill only and may not be a full legal description.<br />

509/762 454/653 ACRES: 13.330<br />

SEC 23, T 18 N, R 08 E<br />

PT OF SE1/4 SE1/4 & PT OF SW1/4<br />

SE1/4, LOT 2 CSM #3014<br />

2012<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$956.69<br />

Pay to <strong>County</strong> Treasurer<br />

By July 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

WAUSHARA CO. TREASURER<br />

ELAINE WEDELL<br />

P.O. BOX 489<br />

WAUTOMA WI 54982<br />

(920) 787-0445<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

634<br />

Parcel #<br />

006-02344-0120<br />

Alt. Parcel #<br />

690062180823440120<br />

ABITZ, CLIFFORD N & PEGGY C<br />

Include This Stub With Your Payment<br />

Est. Fair Mkt. Improve<br />

74,400<br />

18.65<br />

705.23<br />

224.49<br />

805.96<br />

216.38<br />

1,970.71<br />

57.33<br />

79.91<br />

1,833.47<br />

% Tax<br />

Change<br />

Net Assessed Value Rate<br />

(Does NOT reflect credits)<br />

0.018679724<br />

RETAIN THIS<br />

PORTION AS<br />

YOUR COPY<br />

NO REMINDER NOTICES FOR SECOND<br />

INSTALLMENTS WILL BE SENT IN 2013.<br />

BILL NO. 634<br />

Correspondence should refer to parcel number<br />

PARCEL#: 006-02344-0120<br />

ALT. PARCEL #: 690062180823440120<br />

Total Est. Fair Mkt.<br />

109,900<br />

Gross Property Tax<br />

First Dollar Credit<br />

2.8% Lottery Credit<br />

4.8% Net Property Tax<br />

-0.4%<br />

11.5%<br />

13.0%<br />

7.6%<br />

3.2%<br />

8.7%<br />

7.7%<br />

A star in this box means<br />

unpaid prior year taxes<br />

TOTAL DUE FOR FULL PAYMENT<br />

PAY BY January 31, 2013<br />

$<br />

1,833.47<br />

1,970.71<br />

-57.33<br />

-79.91<br />

1,833.47<br />

Warning: If not paid by due dates, installment option<br />

is lost and total tax is delinquent subject to interest<br />

and, if applicable, penalty.<br />

Failure to pay on time. See reverse.<br />

Installments may be paid as follows:<br />

876.78 DUE BY 01/31/2013<br />

956.69 DUE BY 07/31/2013<br />

OR PAY FULL AMOUNT OF:<br />

$1,833.47<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

634<br />

Parcel #<br />

006-02344-0120<br />

Alt. Parcel #<br />

690062180823440120<br />

ABITZ, CLIFFORD N & PEGGY C<br />

Include This Stub With Your Payment

Assessed Value Land<br />

24,700<br />

Taxing Jurisdiction<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

Ass'd Value Improve<br />

73,600<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Total<br />

Property Address<br />

N920 6TH AVE<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

FRANK D & KAREN A ABITZ<br />

N920 6TH AVE<br />

COLOMA WI 54930<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

$ 138.29<br />

PAY 1ST INSTALLMENT OF:<br />

$809.53<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

633<br />

Parcel #<br />

006-02344-0110<br />

Alt. Parcel #<br />

690062180823440110<br />

ABITZ, FRANK D & KAREN A<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

98,300<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

0.9602<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

Est. Fair Mkt. Land<br />

25,700<br />

2011<br />

Net Tax<br />

16.91<br />

627.31<br />

210.01<br />

673.44<br />

178.43<br />

1,706.10<br />

55.56<br />

73.53<br />

1,577.01<br />

IMPORTANT: Be sure this description covers your property. This description<br />

is for property tax bill only and may not be a full legal description.<br />

512/434 509/762 ACRES: 6.670<br />

SEC 23, T 18 N, R 08 E<br />

PT OF SE1/4 SE1/4, LOT 1 CSM #3014<br />

2012<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$889.44<br />

Pay to <strong>County</strong> Treasurer<br />

By July 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

WAUSHARA CO. TREASURER<br />

ELAINE WEDELL<br />

P.O. BOX 489<br />

WAUTOMA WI 54982<br />

(920) 787-0445<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

633<br />

Parcel #<br />

006-02344-0110<br />

Alt. Parcel #<br />

690062180823440110<br />

ABITZ, FRANK D & KAREN A<br />

Include This Stub With Your Payment<br />

Est. Fair Mkt. Improve<br />

76,700<br />

17.37<br />

657.10<br />

209.17<br />

750.96<br />

201.61<br />

1,836.21<br />

57.33<br />

79.91<br />

1,698.97<br />

% Tax<br />

Change<br />

Net Assessed Value Rate<br />

(Does NOT reflect credits)<br />

0.018679724<br />

RETAIN THIS<br />

PORTION AS<br />

YOUR COPY<br />

NO REMINDER NOTICES FOR SECOND<br />

INSTALLMENTS WILL BE SENT IN 2013.<br />

BILL NO. 633<br />

Correspondence should refer to parcel number<br />

PARCEL#: 006-02344-0110<br />

ALT. PARCEL #: 690062180823440110<br />

Total Est. Fair Mkt.<br />

102,400<br />

Gross Property Tax<br />

First Dollar Credit<br />

2.7% Lottery Credit<br />

4.7% Net Property Tax<br />

-0.4%<br />

11.5%<br />

13.0%<br />

7.6%<br />

3.2%<br />

8.7%<br />

7.7%<br />

A star in this box means<br />

unpaid prior year taxes<br />

TOTAL DUE FOR FULL PAYMENT<br />

PAY BY January 31, 2013<br />

$<br />

1,698.97<br />

1,836.21<br />

-57.33<br />

-79.91<br />

1,698.97<br />

Warning: If not paid by due dates, installment option<br />

is lost and total tax is delinquent subject to interest<br />

and, if applicable, penalty.<br />

Failure to pay on time. See reverse.<br />

Installments may be paid as follows:<br />

809.53 DUE BY 01/31/2013<br />

889.44 DUE BY 07/31/2013<br />

OR PAY FULL AMOUNT OF:<br />

$1,698.97<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

633<br />

Parcel #<br />

006-02344-0110<br />

Alt. Parcel #<br />

690062180823440110<br />

ABITZ, FRANK D & KAREN A<br />

Include This Stub With Your Payment

Assessed Value Land<br />

20,500<br />

Taxing Jurisdiction<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

Ass'd Value Improve<br />

12,900<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Total<br />

Property Address<br />

N129 CZECH DR<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

GERALD M & VICKI L ADAMS<br />

N126 CZECH DR<br />

COLOMA WI 54930<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

$46.99<br />

PAY 1ST INSTALLMENT OF:<br />

$283.28<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

1027<br />

Parcel #<br />

006-03357-0210<br />

Alt. Parcel #<br />

690062180833570210<br />

ADAMS, GERALD M & VICKI L<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

33,400<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

0.9602<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

Est. Fair Mkt. Land<br />

21,300<br />

2011<br />

Net Tax<br />

5.75<br />

213.14<br />

71.36<br />

228.82<br />

60.62<br />

579.69<br />

55.56<br />

524.13<br />

IMPORTANT: Be sure this description covers your property. This description<br />

is for property tax bill only and may not be a full legal description.<br />

841/88 643/590 560/119 ACRES: 1.280<br />

SEC 33, T 18 N, R 08 E, SW¼ <strong>of</strong> SW¼<br />

PT OF GOV LOT 7 (SW-SW), LOT 1 CSM<br />

5511<br />

2012<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$283.28<br />

Pay to <strong>County</strong> Treasurer<br />

By July 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

WAUSHARA CO. TREASURER<br />

ELAINE WEDELL<br />

P.O. BOX 489<br />

WAUTOMA WI 54982<br />

(920) 787-0445<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

1027<br />

Parcel #<br />

006-03357-0210<br />

Alt. Parcel #<br />

690062180833570210<br />

ADAMS, GERALD M & VICKI L<br />

Include This Stub With Your Payment<br />

Est. Fair Mkt. Improve<br />

13,400<br />

5.90<br />

223.27<br />

71.07<br />

255.15<br />

68.50<br />

623.89<br />

57.33<br />

566.56<br />

% Tax<br />

Change<br />

Net Assessed Value Rate<br />

(Does NOT reflect credits)<br />

0.018679724<br />

RETAIN THIS<br />

PORTION AS<br />

YOUR COPY<br />

NO REMINDER NOTICES FOR SECOND<br />

INSTALLMENTS WILL BE SENT IN 2013.<br />

BILL NO. 1027<br />

Correspondence should refer to parcel number<br />

PARCEL#: 006-03357-0210<br />

ALT. PARCEL #: 690062180833570210<br />

Total Est. Fair Mkt.<br />

34,700<br />

Gross Property Tax<br />

First Dollar Credit<br />

2.6% Lottery Credit<br />

4.8% Net Property Tax<br />

-0.4%<br />

11.5%<br />

13.0%<br />

A star in this box means<br />

unpaid prior year taxes<br />

7.6%<br />

3.2%<br />

TOTAL DUE FOR FULL PAYMENT<br />

8.1% PAY BY January 31, 2013<br />

$<br />

566.56<br />

Installments may be paid as follows:<br />

283.28 DUE BY 01/31/2013<br />

283.28 DUE BY 07/31/2013<br />

OR PAY FULL AMOUNT OF:<br />

$566.56<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

623.89<br />

-57.33<br />

566.56<br />

Warning: If not paid by due dates, installment option<br />

is lost and total tax is delinquent subject to interest<br />

and, if applicable, penalty.<br />

Failure to pay on time. See reverse.<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

1027<br />

Parcel #<br />

006-03357-0210<br />

Alt. Parcel #<br />

690062180833570210<br />

ADAMS, GERALD M & VICKI L<br />

Include This Stub With Your Payment

Assessed Value Land<br />

225,800<br />

Taxing Jurisdiction<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

Ass'd Value Improve<br />

146,600<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Total<br />

Property Address<br />

N126 CZECH DR<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

GERALD M & VICKI L ADAMS<br />

N126 CZECH DR<br />

COLOMA WI 54930<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

$ 523.90<br />

PAY 1ST INSTALLMENT OF:<br />

$3,559.59<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

1063<br />

Parcel #<br />

006-03375-0500<br />

Alt. Parcel #<br />

690062180833750500<br />

ADAMS, GERALD M & VICKI L<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

372,400<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

0.9602<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

Est. Fair Mkt. Land<br />

235,200<br />

2011<br />

Net Tax<br />

64.07<br />

2,376.48<br />

795.60<br />

2,551.29<br />

675.95<br />

6,463.39<br />

55.56<br />

73.53<br />

6,334.30<br />

IMPORTANT: Be sure this description covers your property. This description<br />

is for property tax bill only and may not be a full legal description.<br />

629/980 434/134 433/454 340/571<br />

SEC 33, T 18 N, R 08 E<br />

PT OF GOV LOTS 6 & 7 (W1/2 SW1/4),<br />

WEST SHORE PARK LOTS 5, 6 & 7 BLK 1<br />

2012<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$3,449.50<br />

Pay to <strong>County</strong> Treasurer<br />

By July 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

WAUSHARA CO. TREASURER<br />

ELAINE WEDELL<br />

P.O. BOX 489<br />

WAUTOMA WI 54982<br />

(920) 787-0445<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

1063<br />

Parcel #<br />

006-03375-0500<br />

Alt. Parcel #<br />

690062180833750500<br />

ADAMS, GERALD M & VICKI L<br />

Include This Stub With Your Payment<br />

Est. Fair Mkt. Improve<br />

152,700<br />

65.82<br />

2,489.37<br />

792.43<br />

2,844.92<br />

763.79<br />

6,956.33<br />

57.33<br />

79.91<br />

6,819.09<br />

% Tax<br />

Change<br />

Net Assessed Value Rate<br />

(Does NOT reflect credits)<br />

0.018679724<br />

RETAIN THIS<br />

PORTION AS<br />

YOUR COPY<br />

NO REMINDER NOTICES FOR SECOND<br />

INSTALLMENTS WILL BE SENT IN 2013.<br />

BILL NO. 1063<br />

Correspondence should refer to parcel number<br />

PARCEL#: 006-03375-0500<br />

ALT. PARCEL #: 690062180833750500<br />

Total Est. Fair Mkt.<br />

387,900<br />

Gross Property Tax<br />

First Dollar Credit<br />

2.7% Lottery Credit<br />

4.8% Net Property Tax<br />

-0.4%<br />

PLEASANT LAKE MGT DI<br />

11.5%<br />

13.0%<br />

7.6%<br />

3.2%<br />

8.7%<br />

7.7%<br />

A star in this box means<br />

unpaid prior year taxes<br />

TOTAL DUE FOR FULL PAYMENT<br />

PAY BY January 31, 2013<br />

$<br />

7,009.09<br />

6,956.33<br />

-57.33<br />

-79.91<br />

6,819.09<br />

190.00<br />

Warning: If not paid by due dates, installment option<br />

is lost and total tax is delinquent subject to interest<br />

and, if applicable, penalty.<br />

Failure to pay on time. See reverse.<br />

Installments may be paid as follows:<br />

3559.59 DUE BY 01/31/2013<br />

3449.50 DUE BY 07/31/2013<br />

OR PAY FULL AMOUNT OF:<br />

$7,009.09<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

1063<br />

Parcel #<br />

006-03375-0500<br />

Alt. Parcel #<br />

690062180833750500<br />

ADAMS, GERALD M & VICKI L<br />

Include This Stub With Your Payment

Assessed Value Land<br />

4,200<br />

Taxing Jurisdiction<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

Ass'd Value Improve<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Property Address<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

CLARA T ADAMSKI<br />

19539 101ST<br />

BRISTOL WI 53104<br />

Total<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

$5.91<br />

PAY 1ST INSTALLMENT OF:<br />

$78.45<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

643<br />

Parcel #<br />

006-02412-0100<br />

Alt. Parcel #<br />

690062180824120100<br />

ADAMSKI, CLARA T<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

4,200<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

0.9602<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

Est. Fair Mkt. Land<br />

2011<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$0.00<br />

Pay to <strong>County</strong> Treasurer<br />

By July 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

WAUSHARA CO. TREASURER<br />

ELAINE WEDELL<br />

P.O. BOX 489<br />

WAUTOMA WI 54982<br />

(920) 787-0445<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

643<br />

Parcel #<br />

006-02412-0100<br />

Alt. Parcel #<br />

690062180824120100<br />

ADAMSKI, CLARA T<br />

Include This Stub With Your Payment<br />

Est. Fair Mkt. Improve<br />

Net Assessed Value Rate<br />

(Does NOT reflect credits)<br />

Total Est. Fair Mkt.<br />

See Reverse, Use Value Assessment<br />

0.71<br />

26.16<br />

8.76<br />

28.09<br />

7.44<br />

71.16<br />

71.16<br />

IMPORTANT: Be sure this description covers your property. This description<br />

is for property tax bill only and may not be a full legal description.<br />

425/172 423/346 ACRES: 36.000<br />

SEC 24, T 18 N, R 08 E<br />

NW1/4 OF NE1/4 EXC CSM #2574<br />

2012<br />

Net Tax<br />

0.74<br />

28.08<br />

8.94<br />

32.08<br />

8.61<br />

78.45<br />

78.45<br />

% Tax<br />

Change<br />

0.018679724<br />

RETAIN THIS<br />

PORTION AS<br />

YOUR COPY<br />

NO REMINDER NOTICES FOR SECOND<br />

INSTALLMENTS WILL BE SENT IN 2013.<br />

BILL NO. 643<br />

Correspondence should refer to parcel number<br />

PARCEL#: 006-02412-0100<br />

ALT. PARCEL #: 690062180824120100<br />

Gross Property Tax<br />

First Dollar Credit<br />

4.2% Lottery Credit<br />

7.3% Net Property Tax<br />

2.1%<br />

14.2%<br />

15.7%<br />

10.2%<br />

A star in this box means<br />

unpaid prior year taxes<br />

TOTAL DUE FOR FULL PAYMENT<br />

10.2% PAY BY January 31, 2013<br />

$<br />

78.45<br />

OR PAY FULL AMOUNT OF:<br />

$78.45<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

78.45<br />

78.45<br />

Warning: If not paid by due dates, installment option<br />

is lost and total tax is delinquent subject to interest<br />

and, if applicable, penalty.<br />

Failure to pay on time. See reverse.<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

643<br />

Parcel #<br />

006-02412-0100<br />

Alt. Parcel #<br />

690062180824120100<br />

ADAMSKI, CLARA T<br />

Include This Stub With Your Payment

Assessed Value Land<br />

8,000<br />

Taxing Jurisdiction<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

RANDY & MARILYN ADLER<br />

W10639 STATE ROAD 21<br />

COLOMA WI 54930<br />

Ass'd Value Improve<br />

13,600<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Total<br />

Property Address<br />

W13124 N FRONT ST<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

$30.39<br />

PAY 1ST INSTALLMENT OF:<br />

$173.08<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

255<br />

Parcel #<br />

006-01034-0330<br />

Alt. Parcel #<br />

690062180810340330<br />

ADLER, RANDY & MARILYN<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

21,600<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

Est. Fair Mkt. Land<br />

0.9602 8,300 14,200<br />

22,500 *<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

2011<br />

Net Tax<br />

3.72<br />

137.84<br />

46.15<br />

147.98<br />

39.21<br />

374.90<br />

55.56<br />

319.34<br />

IMPORTANT: Be sure this description covers your property. This description<br />

is for property tax bill only and may not be a full legal description.<br />

525/58 465/924 345/220 ACRES: 1.200<br />

SEC 10, T 18 N, R 08 E<br />

PT OF SE1/4 SW1/4, LOT 1 CSM #1389<br />

2012<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$173.07<br />

Pay to <strong>County</strong> Treasurer<br />

By July 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

WAUSHARA CO. TREASURER<br />

ELAINE WEDELL<br />

P.O. BOX 489<br />

WAUTOMA WI 54982<br />

(920) 787-0445<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

255<br />

Parcel #<br />

006-01034-0330<br />

Alt. Parcel #<br />

690062180810340330<br />

ADLER, RANDY & MARILYN<br />

Include This Stub With Your Payment<br />

Est. Fair Mkt. Improve<br />

3.82<br />

144.39<br />

45.96<br />

165.01<br />

44.30<br />

403.48<br />

57.33<br />

346.15<br />

% Tax<br />

Change<br />

Net Assessed Value Rate<br />

(Does NOT reflect credits)<br />

0.018679724<br />

RETAIN THIS<br />

PORTION AS<br />

YOUR COPY<br />

NO REMINDER NOTICES FOR SECOND<br />

INSTALLMENTS WILL BE SENT IN 2013.<br />

BILL NO. 255<br />

Correspondence should refer to parcel number<br />

PARCEL#: 006-01034-0330<br />

ALT. PARCEL #: 690062180810340330<br />

Total Est. Fair Mkt.<br />

Gross Property Tax<br />

First Dollar Credit<br />

2.7% Lottery Credit<br />

4.8% Net Property Tax<br />

-0.4%<br />

11.5%<br />

13.0%<br />

A star in this box means<br />

unpaid prior year taxes<br />

7.6%<br />

3.2%<br />

TOTAL DUE FOR FULL PAYMENT<br />

8.4% PAY BY January 31, 2013<br />

$<br />

346.15<br />

Installments may be paid as follows:<br />

173.08 DUE BY 01/31/2013<br />

173.07 DUE BY 07/31/2013<br />

OR PAY FULL AMOUNT OF:<br />

$346.15<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

403.48<br />

-57.33<br />

346.15<br />

Warning: If not paid by due dates, installment option<br />

is lost and total tax is delinquent subject to interest<br />

and, if applicable, penalty.<br />

Failure to pay on time. See reverse.<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

255<br />

Parcel #<br />

006-01034-0330<br />

Alt. Parcel #<br />

690062180810340330<br />

ADLER, RANDY & MARILYN<br />

Include This Stub With Your Payment

Assessed Value Land<br />

6,200<br />

Taxing Jurisdiction<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

Ass'd Value Improve<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Property Address<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

AGRITEK FARMS INC<br />

900 CRESTLINE DR<br />

NORMAL IL 61761<br />

Total<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

$8.72<br />

PAY 1ST INSTALLMENT OF:<br />

$57.92<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

179<br />

Parcel #<br />

006-00812-0000<br />

Alt. Parcel #<br />

690062180808120000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

6,200<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

0.9602<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

Est. Fair Mkt. Land<br />

2011<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$57.91<br />

Pay to <strong>County</strong> Treasurer<br />

By July 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

WAUSHARA CO. TREASURER<br />

ELAINE WEDELL<br />

P.O. BOX 489<br />

WAUTOMA WI 54982<br />

(920) 787-0445<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

179<br />

Parcel #<br />

006-00812-0000<br />

Alt. Parcel #<br />

690062180808120000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment<br />

Est. Fair Mkt. Improve<br />

Net Assessed Value Rate<br />

(Does NOT reflect credits)<br />

Total Est. Fair Mkt.<br />

See Reverse, Use Value Assessment<br />

1.05<br />

38.93<br />

13.03<br />

41.79<br />

11.07<br />

105.87<br />

105.87<br />

IMPORTANT: Be sure this description covers your property. This description<br />

is for property tax bill only and may not be a full legal description.<br />

239/534 213/109 ACRES: 40.000<br />

SEC 08, T 18 N, R 08 E<br />

NW1/4 OF NE1/4<br />

2012<br />

Net Tax<br />

1.10<br />

41.45<br />

13.19<br />

47.37<br />

12.72<br />

115.83<br />

115.83<br />

% Tax<br />

Change<br />

0.018679724<br />

RETAIN THIS<br />

PORTION AS<br />

YOUR COPY<br />

NO REMINDER NOTICES FOR SECOND<br />

INSTALLMENTS WILL BE SENT IN 2013.<br />

BILL NO. 179<br />

Correspondence should refer to parcel number<br />

PARCEL#: 006-00812-0000<br />

ALT. PARCEL #: 690062180808120000<br />

Gross Property Tax<br />

First Dollar Credit<br />

4.8% Lottery Credit<br />

6.5% Net Property Tax<br />

1.2%<br />

13.4%<br />

14.9%<br />

9.4%<br />

A star in this box means<br />

unpaid prior year taxes<br />

TOTAL DUE FOR FULL PAYMENT<br />

9.4% PAY BY January 31, 2013<br />

$<br />

115.83<br />

Installments may be paid as follows:<br />

57.92 DUE BY 01/31/2013<br />

57.91 DUE BY 07/31/2013<br />

OR PAY FULL AMOUNT OF:<br />

$115.83<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

115.83<br />

115.83<br />

Warning: If not paid by due dates, installment option<br />

is lost and total tax is delinquent subject to interest<br />

and, if applicable, penalty.<br />

Failure to pay on time. See reverse.<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

179<br />

Parcel #<br />

006-00812-0000<br />

Alt. Parcel #<br />

690062180808120000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment

Assessed Value Land<br />

9,000<br />

Taxing Jurisdiction<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

Ass'd Value Improve<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Property Address<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

AGRITEK FARMS INC<br />

900 CRESTLINE DR<br />

NORMAL IL 61761<br />

Total<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

$12.66<br />

PAY 1ST INSTALLMENT OF:<br />

$84.06<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

180<br />

Parcel #<br />

006-00813-0000<br />

Alt. Parcel #<br />

690062180808130000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

9,000<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

0.9602<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

Est. Fair Mkt. Land<br />

2011<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$84.06<br />

Pay to <strong>County</strong> Treasurer<br />

By July 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

WAUSHARA CO. TREASURER<br />

ELAINE WEDELL<br />

P.O. BOX 489<br />

WAUTOMA WI 54982<br />

(920) 787-0445<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

180<br />

Parcel #<br />

006-00813-0000<br />

Alt. Parcel #<br />

690062180808130000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment<br />

Est. Fair Mkt. Improve<br />

Net Assessed Value Rate<br />

(Does NOT reflect credits)<br />

Total Est. Fair Mkt.<br />

See Reverse, Use Value Assessment<br />

1.51<br />

56.16<br />

18.80<br />

60.28<br />

15.97<br />

152.72<br />

152.72<br />

IMPORTANT: Be sure this description covers your property. This description<br />

is for property tax bill only and may not be a full legal description.<br />

239/534 213/109 ACRES: 40.000<br />

SEC 08, T 18 N, R 08 E<br />

SW1/4 OF NE1/4<br />

2012<br />

Net Tax<br />

1.59<br />

60.16<br />

19.15<br />

68.76<br />

18.46<br />

168.12<br />

168.12<br />

% Tax<br />

Change<br />

0.018679724<br />

RETAIN THIS<br />

PORTION AS<br />

YOUR COPY<br />

NO REMINDER NOTICES FOR SECOND<br />

INSTALLMENTS WILL BE SENT IN 2013.<br />

BILL NO. 180<br />

Correspondence should refer to parcel number<br />

PARCEL#: 006-00813-0000<br />

ALT. PARCEL #: 690062180808130000<br />

Gross Property Tax<br />

First Dollar Credit<br />

5.3% Lottery Credit<br />

7.1% Net Property Tax<br />

1.9%<br />

14.1%<br />

15.6%<br />

10.1%<br />

A star in this box means<br />

unpaid prior year taxes<br />

TOTAL DUE FOR FULL PAYMENT<br />

10.1% PAY BY January 31, 2013<br />

$<br />

168.12<br />

Installments may be paid as follows:<br />

84.06 DUE BY 01/31/2013<br />

84.06 DUE BY 07/31/2013<br />

OR PAY FULL AMOUNT OF:<br />

$168.12<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

168.12<br />

168.12<br />

Warning: If not paid by due dates, installment option<br />

is lost and total tax is delinquent subject to interest<br />

and, if applicable, penalty.<br />

Failure to pay on time. See reverse.<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

180<br />

Parcel #<br />

006-00813-0000<br />

Alt. Parcel #<br />

690062180808130000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment

Assessed Value Land<br />

11,700<br />

Taxing Jurisdiction<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

Ass'd Value Improve<br />

4,000<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Property Address<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

AGRITEK FARMS INC<br />

900 CRESTLINE DR<br />

NORMAL IL 61761<br />

Total<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

$22.09<br />

PAY 1ST INSTALLMENT OF:<br />

$117.97<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

182<br />

Parcel #<br />

006-00821-0000<br />

Alt. Parcel #<br />

690062180808210000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

15,700<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

0.9602<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

Est. Fair Mkt. Land<br />

2011<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$117.97<br />

Pay to <strong>County</strong> Treasurer<br />

By July 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

WAUSHARA CO. TREASURER<br />

ELAINE WEDELL<br />

P.O. BOX 489<br />

WAUTOMA WI 54982<br />

(920) 787-0445<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

182<br />

Parcel #<br />

006-00821-0000<br />

Alt. Parcel #<br />

690062180808210000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment<br />

Est. Fair Mkt. Improve<br />

Net Assessed Value Rate<br />

(Does NOT reflect credits)<br />

Total Est. Fair Mkt.<br />

See Reverse, Use Value Assessment<br />

2.67<br />

98.91<br />

33.11<br />

106.19<br />

28.13<br />

269.01<br />

55.56<br />

213.45<br />

IMPORTANT: Be sure this description covers your property. This description<br />

is for property tax bill only and may not be a full legal description.<br />

239/534 213/109 ACRES: 40.000<br />

SEC 08, T 18 N, R 08 E<br />

NE1/4 OF NW1/4<br />

2012<br />

Net Tax<br />

2.77<br />

104.95<br />

33.41<br />

119.94<br />

32.20<br />

293.27<br />

57.33<br />

235.94<br />

% Tax<br />

Change<br />

0.018679724<br />

RETAIN THIS<br />

PORTION AS<br />

YOUR COPY<br />

NO REMINDER NOTICES FOR SECOND<br />

INSTALLMENTS WILL BE SENT IN 2013.<br />

BILL NO. 182<br />

Correspondence should refer to parcel number<br />

PARCEL#: 006-00821-0000<br />

ALT. PARCEL #: 690062180808210000<br />

Gross Property Tax<br />

First Dollar Credit<br />

3.7% Lottery Credit<br />

6.1% Net Property Tax<br />

0.9%<br />

12.9%<br />

14.5%<br />

A star in this box means<br />

unpaid prior year taxes<br />

9.0%<br />

3.2%<br />

TOTAL DUE FOR FULL PAYMENT<br />

10.5% PAY BY January 31, 2013<br />

$<br />

235.94<br />

Installments may be paid as follows:<br />

117.97 DUE BY 01/31/2013<br />

117.97 DUE BY 07/31/2013<br />

OR PAY FULL AMOUNT OF:<br />

$235.94<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

293.27<br />

-57.33<br />

235.94<br />

Warning: If not paid by due dates, installment option<br />

is lost and total tax is delinquent subject to interest<br />

and, if applicable, penalty.<br />

Failure to pay on time. See reverse.<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

182<br />

Parcel #<br />

006-00821-0000<br />

Alt. Parcel #<br />

690062180808210000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment

Assessed Value Land<br />

6,200<br />

Taxing Jurisdiction<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

Ass'd Value Improve<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Property Address<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

AGRITEK FARMS INC<br />

900 CRESTLINE DR<br />

NORMAL IL 61761<br />

Total<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

$8.72<br />

PAY 1ST INSTALLMENT OF:<br />

$57.92<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

186<br />

Parcel #<br />

006-00824-0000<br />

Alt. Parcel #<br />

690062180808240000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

6,200<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

0.9602<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

Est. Fair Mkt. Land<br />

2011<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$57.91<br />

Pay to <strong>County</strong> Treasurer<br />

By July 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

WAUSHARA CO. TREASURER<br />

ELAINE WEDELL<br />

P.O. BOX 489<br />

WAUTOMA WI 54982<br />

(920) 787-0445<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

186<br />

Parcel #<br />

006-00824-0000<br />

Alt. Parcel #<br />

690062180808240000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment<br />

Est. Fair Mkt. Improve<br />

Net Assessed Value Rate<br />

(Does NOT reflect credits)<br />

Total Est. Fair Mkt.<br />

See Reverse, Use Value Assessment<br />

1.05<br />

38.93<br />

13.03<br />

41.79<br />

11.07<br />

105.87<br />

105.87<br />

IMPORTANT: Be sure this description covers your property. This description<br />

is for property tax bill only and may not be a full legal description.<br />

239/534 213/109 ACRES: 40.000<br />

SEC 08, T 18 N, R 08 E<br />

SE1/4 OF NW1/4<br />

2012<br />

Net Tax<br />

1.10<br />

41.45<br />

13.19<br />

47.37<br />

12.72<br />

115.83<br />

115.83<br />

% Tax<br />

Change<br />

0.018679724<br />

RETAIN THIS<br />

PORTION AS<br />

YOUR COPY<br />

NO REMINDER NOTICES FOR SECOND<br />

INSTALLMENTS WILL BE SENT IN 2013.<br />

BILL NO. 186<br />

Correspondence should refer to parcel number<br />

PARCEL#: 006-00824-0000<br />

ALT. PARCEL #: 690062180808240000<br />

Gross Property Tax<br />

First Dollar Credit<br />

4.8% Lottery Credit<br />

6.5% Net Property Tax<br />

1.2%<br />

13.4%<br />

14.9%<br />

9.4%<br />

A star in this box means<br />

unpaid prior year taxes<br />

TOTAL DUE FOR FULL PAYMENT<br />

9.4% PAY BY January 31, 2013<br />

$<br />

115.83<br />

Installments may be paid as follows:<br />

57.92 DUE BY 01/31/2013<br />

57.91 DUE BY 07/31/2013<br />

OR PAY FULL AMOUNT OF:<br />

$115.83<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

115.83<br />

115.83<br />

Warning: If not paid by due dates, installment option<br />

is lost and total tax is delinquent subject to interest<br />

and, if applicable, penalty.<br />

Failure to pay on time. See reverse.<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

186<br />

Parcel #<br />

006-00824-0000<br />

Alt. Parcel #<br />

690062180808240000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment

Assessed Value Land<br />

11,900<br />

Taxing Jurisdiction<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

Ass'd Value Improve<br />

4,000<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Property Address<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

AGRITEK FARMS INC<br />

900 CRESTLINE DR<br />

NORMAL IL 61761<br />

Total<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

$22.37<br />

PAY 1ST INSTALLMENT OF:<br />

$119.84<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

445<br />

Parcel #<br />

006-01733-0000<br />

Alt. Parcel #<br />

690062180817330000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

15,900<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

0.9602<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

Est. Fair Mkt. Land<br />

2011<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$119.84<br />

Pay to <strong>County</strong> Treasurer<br />

By July 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

WAUSHARA CO. TREASURER<br />

ELAINE WEDELL<br />

P.O. BOX 489<br />

WAUTOMA WI 54982<br />

(920) 787-0445<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

445<br />

Parcel #<br />

006-01733-0000<br />

Alt. Parcel #<br />

690062180817330000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment<br />

Est. Fair Mkt. Improve<br />

Net Assessed Value Rate<br />

(Does NOT reflect credits)<br />

Total Est. Fair Mkt.<br />

See Reverse, Use Value Assessment<br />

2.72<br />

100.83<br />

33.76<br />

108.24<br />

28.68<br />

274.23<br />

55.56<br />

218.67<br />

IMPORTANT: Be sure this description covers your property. This description<br />

is for property tax bill only and may not be a full legal description.<br />

239/534 213/109 ACRES: 40.000<br />

SEC 17, T 18 N, R 08 E<br />

SW1/4 OF SW1/4<br />

2012<br />

Net Tax<br />

2.81<br />

106.29<br />

33.83<br />

121.47<br />

32.61<br />

297.01<br />

57.33<br />

239.68<br />

% Tax<br />

Change<br />

0.018679724<br />

RETAIN THIS<br />

PORTION AS<br />

YOUR COPY<br />

NO REMINDER NOTICES FOR SECOND<br />

INSTALLMENTS WILL BE SENT IN 2013.<br />

BILL NO. 445<br />

Correspondence should refer to parcel number<br />

PARCEL#: 006-01733-0000<br />

ALT. PARCEL #: 690062180817330000<br />

Gross Property Tax<br />

First Dollar Credit<br />

3.3% Lottery Credit<br />

5.4% Net Property Tax<br />

0.2%<br />

12.2%<br />

13.7%<br />

A star in this box means<br />

unpaid prior year taxes<br />

8.3%<br />

3.2%<br />

TOTAL DUE FOR FULL PAYMENT<br />

9.6% PAY BY January 31, 2013<br />

$<br />

239.68<br />

Installments may be paid as follows:<br />

119.84 DUE BY 01/31/2013<br />

119.84 DUE BY 07/31/2013<br />

OR PAY FULL AMOUNT OF:<br />

$239.68<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

297.01<br />

-57.33<br />

239.68<br />

Warning: If not paid by due dates, installment option<br />

is lost and total tax is delinquent subject to interest<br />

and, if applicable, penalty.<br />

Failure to pay on time. See reverse.<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

445<br />

Parcel #<br />

006-01733-0000<br />

Alt. Parcel #<br />

690062180817330000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment

Assessed Value Land<br />

6,300<br />

Taxing Jurisdiction<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

Ass'd Value Improve<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Property Address<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

AGRITEK FARMS INC<br />

900 CRESTLINE DR<br />

NORMAL IL 61761<br />

Total<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

$8.86<br />

PAY 1ST INSTALLMENT OF:<br />

$58.84<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

446<br />

Parcel #<br />

006-01734-0000<br />

Alt. Parcel #<br />

690062180817340000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

6,300<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

0.9602<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

Est. Fair Mkt. Land<br />

2011<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$58.84<br />

Pay to <strong>County</strong> Treasurer<br />

By July 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

WAUSHARA CO. TREASURER<br />

ELAINE WEDELL<br />

P.O. BOX 489<br />

WAUTOMA WI 54982<br />

(920) 787-0445<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

446<br />

Parcel #<br />

006-01734-0000<br />

Alt. Parcel #<br />

690062180817340000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment<br />

Est. Fair Mkt. Improve<br />

Net Assessed Value Rate<br />

(Does NOT reflect credits)<br />

Total Est. Fair Mkt.<br />

See Reverse, Use Value Assessment<br />

1.07<br />

39.57<br />

13.25<br />

42.48<br />

11.25<br />

107.62<br />

107.62<br />

IMPORTANT: Be sure this description covers your property. This description<br />

is for property tax bill only and may not be a full legal description.<br />

239/534 213/109 ACRES: 40.000<br />

SEC 17, T 18 N, R 08 E<br />

SE1/4 OF SW1/4<br />

2012<br />

Net Tax<br />

1.11<br />

42.11<br />

13.41<br />

48.13<br />

12.92<br />

117.68<br />

117.68<br />

% Tax<br />

Change<br />

0.018679724<br />

RETAIN THIS<br />

PORTION AS<br />

YOUR COPY<br />

NO REMINDER NOTICES FOR SECOND<br />

INSTALLMENTS WILL BE SENT IN 2013.<br />

BILL NO. 446<br />

Correspondence should refer to parcel number<br />

PARCEL#: 006-01734-0000<br />

ALT. PARCEL #: 690062180817340000<br />

Gross Property Tax<br />

First Dollar Credit<br />

3.7% Lottery Credit<br />

6.4% Net Property Tax<br />

1.2%<br />

13.3%<br />

14.8%<br />

9.3%<br />

A star in this box means<br />

unpaid prior year taxes<br />

TOTAL DUE FOR FULL PAYMENT<br />

9.3% PAY BY January 31, 2013<br />

$<br />

117.68<br />

Installments may be paid as follows:<br />

58.84 DUE BY 01/31/2013<br />

58.84 DUE BY 07/31/2013<br />

OR PAY FULL AMOUNT OF:<br />

$117.68<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

117.68<br />

117.68<br />

Warning: If not paid by due dates, installment option<br />

is lost and total tax is delinquent subject to interest<br />

and, if applicable, penalty.<br />

Failure to pay on time. See reverse.<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

446<br />

Parcel #<br />

006-01734-0000<br />

Alt. Parcel #<br />

690062180817340000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment

Assessed Value Land<br />

6,500<br />

Taxing Jurisdiction<br />

School taxes reduced by<br />

School levy tax credit<br />

Please inform the treasurer <strong>of</strong> any address change.<br />

Ass'd Value Improve<br />

4,000<br />

STATE OF WISCONSIN<br />

WAUSHARA COUNTY<br />

TOWN OF COLOMA<br />

WESTFIELD SCH DIST<br />

FOX VALLEY VTAE DIST<br />

Property Address<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

AGRITEK FARMS INC<br />

900 CRESTLINE DR<br />

NORMAL IL 61761<br />

Total<br />

SEE REVERSE SIDE FOR<br />

IMPORTANT INFORMATION<br />

$14.77<br />

PAY 1ST INSTALLMENT OF:<br />

$69.41<br />

Pay to Local Treasurer<br />

By January 31, 2013<br />

Amount Enclosed: $__________________<br />

Make Check Payable to:<br />

TOWN OF COLOMA TREASURER<br />

TERRI JACKSON<br />

W13494 BURR OAK CT<br />

COLOMA WI 54930<br />

715-228-2056<br />

2012 <strong>Real</strong> Estate Property Bill #<br />

475<br />

Parcel #<br />

006-01844-0000<br />

Alt. Parcel #<br />

690062180818440000<br />

AGRITEK FARMS INC<br />

Include This Stub With Your Payment<br />

STATE OF WISCONSIN<br />

REAL ESTATE PROPERTY TAX BILL FOR 2012<br />

TOWN OF COLOMA<br />

WAUSHARA COUNTY<br />

Total Assessed Value<br />

10,500<br />

2011<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

34,458<br />

120,220<br />

398,713<br />

36,007<br />

589,398<br />

First Dollar Credit<br />

Lottery & Gaming Credit<br />

Net Property Tax<br />

Ave. Assmt. Ratio<br />

0.9602<br />

2012<br />

Est. State Aids<br />

Allocated Tax Dist.<br />

38,448<br />

120,117<br />

365,668<br />

37,771<br />

562,004<br />

Est. Fair Mkt. Land<br />

2011<br />

Net Tax<br />

AND PAY 2ND INSTALLMENT OF:<br />

$69.41<br />

Pay to <strong>County</strong> Treasurer<br />