Untitled - Oerlikon Barmag

Untitled - Oerlikon Barmag

Untitled - Oerlikon Barmag

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL HIGHLIGHTS<br />

Key data<br />

(EUR 000) 2005 2004 1) Change in %<br />

Orders 1 463 793 1 689 834 –13.4<br />

Sales 1 569 786 1 593 100 –1.5<br />

Operating profit 88 289 92 248 –4.3<br />

% of sales 5.6% 5.8%<br />

Profit from continuing operations 55 160 49 157 12.2<br />

% of sales 3.5% 3.1%<br />

Profit for the period 55 160 67 368 –18.1<br />

% of sales 3.5% 4.2%<br />

Depreciation and amortization 63 918 73 124 –12.6<br />

% of sales 4.1% 4.6%<br />

EBITDA 152 207 165 372 -8.0<br />

Cash flow from operating activities 71 464 163 174 –56.2<br />

% of sales 4.6% 10.2%<br />

Capital expenditure 78 301 59 126 32.4<br />

Employees (full-time equivalents at year-end) 2) 10 021 8 852 13.2<br />

Total assets 1 265 079 1 300 901 –2.8<br />

Total shareholders‘ equity 574 976 516 725 11.3<br />

% equity financing 45.5% 39.7%<br />

Stock market capitalization (year-end) 811 825 617 544 31.5<br />

Share summary (EUR)<br />

Shareholders‘ equity per share 39.05 36.08<br />

Earnings per share 3.72 4.71<br />

Cash flow from operating activities 4.98 11.52<br />

Share summary (CHF)<br />

Shareholders‘ equity per share 60.73 55.74<br />

Earnings per share 5.76 7.27<br />

Cash flow from operating activities 7.71 17.79<br />

Capital repayment 3) 1.80 2.00<br />

1) Data for 2004 is restated to take account of Share-based Payment and Discontinued Operations.<br />

2) 2005: including 1 369 from acquisitions made in 2005.<br />

3) For 2005: proposal of the Board of Directors to the General Meeting of Shareholders.

INDEX<br />

002 / THE BUSINESS YEAR 2005<br />

032 / FINANCIAL REPORT 2005<br />

043 / CONSOLIDATED FINANCIAL STATEMENTS<br />

073 / MULTIPLE YEAR COMPARISON<br />

079 / THE FINANCIAL REPORT OF SAURER LTD.<br />

086 / CORPORATE GOVERNANCE<br />

103 / ADDRESSES WORLDWIDE<br />

109 / SHARE STATISTICS

PAGE 2<br />

The Business Year 2005<br />

THE BUSINESS YEAR 2005<br />

THE BUSINESS YEAR 2005<br />

Dear Shareholders,<br />

In 2005, Saurer’s business maintained a level similar to that<br />

of the previous year. Gradual growth continued in Transmis-<br />

sion Systems but was accompanied by declining volumes in<br />

the textile sector, caused mainly by weaker demand from<br />

China as expected. The business efficiency program TEMPUS<br />

was concluded, exceeding expectations and enabling cost<br />

savings of over EUR 50m, and alongside this, some important<br />

foundations were laid for Saurer’s growth in the next years.<br />

These derived from a step change in Saurer’s priorities. Out<br />

of the strong focus on business processes, the supply chain<br />

and cost reductions to minimize our exposure to cyclical<br />

business downturns (TEMPUS) came a series of projects in all<br />

business units to exploit new business opportunities with<br />

maximum energy and efficiency. This included significant in-<br />

vestments in development of new products, new production<br />

and sales structures in Asia, the acquisition of Fairfield, long-<br />

sought-after complement to Graziano, and a number of<br />

smaller technology companies acquired in the textile sector.<br />

Once they are fully integrated, these acquisitions collectively<br />

will have a sales potential of over EUR 300m with an above<br />

average profit contribution.<br />

However, even the very significant fixed cost reductions from<br />

the TEMPUS program – EUR 50m over the last two years –<br />

were not enough to compensate for the loss of margins<br />

caused by lower sales, the unfavorable product and country<br />

mix, the startup costs of the growth program and the ab-<br />

sence of last year’s non-recurring income.<br />

In 2005 Saurer’s order intake reached EUR 1 464m (–13%<br />

compared with EUR 1 690m in 2004). Sales were EUR 1 570m<br />

(–1.5% compared with EUR 1 593m in 2004). The decline in<br />

orders compared with a strong prior year is mainly due to re-<br />

duced demand from China in the Textile Solutions division.<br />

Orders and sales in Transmission Systems rose slightly, but<br />

not enough to compensate for the decline in Textile Solutions.<br />

Acquisitions contributed only EUR 42m to sales (EUR 41m to<br />

orders) in 2005. Saurer’s orders on hand as at December 31,<br />

2005, EUR 392m, are 15% below the year-end figure of<br />

2004.<br />

The net profit of the period of EUR 55m exceeded that of<br />

the previous year by EUR 6m (+12%) for continuing<br />

operations (prior year EUR 49m plus EUR 18m from the<br />

divested Surface Technology). This was achieved by the cost<br />

reductions of the TEMPUS program combined with an<br />

improved financial result, lower taxes and the absence of<br />

goodwill amortization in 2005. The operating profit<br />

(earnings before interest and tax) was EUR 88m (prior year<br />

EUR 92m plus EUR 19m from Surface Technology), which<br />

corresponds to a margin of 5.6% on sales. The RONOA<br />

(return on net operating assets) was 19.3% (prior year<br />

22.5%). The EBITDA (earnings before interest, tax, deprecia-<br />

tion and amortization) reached EUR 152m (10% of sales;<br />

prior year EUR 165m plus EUR 21m from Surface Tech-<br />

nology). Cash flow from operating activities amounted to<br />

EUR 71m, and net cash at the year-end was EUR 112m (prior<br />

year EUR 141m). The reduction in net cash is due partly to<br />

liquidity requirements for the recent acquisitions (EUR – 48m)<br />

and partly to the reversal of excess liquidity at the end of<br />

2004, in customer prepayments and creditor balances<br />

(EUR –35m). The acquisition of Fairfield Manufacturing Inc.<br />

has not reduced liquidity until January 2006.<br />

As previously announced, capital expenditure for ongoing<br />

operations rose by EUR 19m over the previous year, to a<br />

total of EUR 78m. Of this, EUR 50m were invested in the<br />

Textile Solutions division and EUR 28m in Transmission<br />

Systems. In both cases the funds were applied mainly to<br />

building up our activities in Asia, and to tooling up for<br />

manufacture of new products. In Textile Solutions, the<br />

capital requirement is expected to decrease somewhat<br />

again.

46<br />

2003<br />

49<br />

2004<br />

55<br />

2005<br />

Profit for the period 2003–2005<br />

in EUR m (continuing operations)<br />

2001<br />

-208<br />

THE BUSINESS YEAR 2005 PAGE 3<br />

Saurer net cash (debt) 2001–2005<br />

in EUR m<br />

2003<br />

-32<br />

2004 141<br />

2005 112<br />

The Business Year 2005

PAGE 4<br />

The Business Year 2005<br />

THE BUSINESS YEAR 2005<br />

TRANSMISSION SYSTEMS – CONSOLIDATION<br />

COMPLETED, PROMISING NEW PRODUCTS IN THE<br />

PIPELINE AND DYNAMIC NEW GROWTH WITH THE<br />

ACQUISITION OF FAIRFIELD<br />

Transmission Systems (Graziano Trasmissioni) confirmed and<br />

continued its sales growth of the second half of 2004, which<br />

led to a clear improvement in the first half of 2005 and in<br />

the second half a repeat of the high volumes seen in the<br />

previous year. In total, orders and sales rose by 4% to EUR<br />

397m, after 6% growth in the previous year.<br />

The higher sales volumes in agricultural and construction<br />

vehicles, which make up more than half of Transmission<br />

Systems’ business, continued into 2005. In the automobile<br />

sector demand stabilized at the level of the second half-year<br />

2004. Further growth came from the production runup for<br />

various new products such as the Aston Martin DB9 and the<br />

Volkswagen T5 Transporter. In 2005 Graziano Trasmissioni<br />

also received order commitments for a large number of new<br />

products which will form a basis for future growth, but<br />

which also put great pressure on the company’s develop-<br />

ment and prototyping resources. These projects included<br />

among others the rear differential for the Maserati Quattro-<br />

porte, the gearbox for the Audi Le Mans which will come<br />

onto the market at the end of 2006, the gearbox for the<br />

new Ferrari 599 – the successor model to the Maranello<br />

575 –, the front power take-off unit for the new Epsilon<br />

worldwide all-wheel drive platform by General Motors, new<br />

components for Triumph motorcycles, and gearboxes for var-<br />

ious low-volume luxury sports cars. These new orders will<br />

further strengthen Graziano Trasmissioni’s already strong<br />

position in the supply market for luxury sports vehicles and<br />

high-quality all-wheel drive components. In the area of agri-<br />

cultural and construction vehicles also some important new<br />

projects are being pursued where Graziano is treading new<br />

ground in technology, such as CVT (Continuous Variable<br />

Transmission) for small tractors, variable double-clutch trans-<br />

missions for tractors, axles for the new family of CNH motor<br />

graders, and axles for a new series of light wheel loaders<br />

by JCB.<br />

The consolidation phase of Graziano Trasmissioni was sub-<br />

stantially concluded in 2005, leading to closure of the Carr<br />

Hill (GB) plant and transfer of its production to the plant in<br />

India and to Italy. A future increase in production capacity in<br />

India was initiated with work starting on an extension to the<br />

plant which will come into operation in the third quarter<br />

2006. A start was made on the transfer of operations for the<br />

European market to the existing plant of Saurer Textile<br />

Solutions in the Czech Republic, with a view to starting<br />

production there from mid-2006. In December the Graziano<br />

building on the site of the new Saurer plant in Suzhou (China)<br />

was opened for business. Its first product will be axles for<br />

fork-lift trucks by Linde, destined for the Chinese market.<br />

Apart from business know-how in general, these moves to<br />

China and the Czech Republic show how Graziano can be-<br />

nefit substantially from the management experience and<br />

infrastructure of Saurer Textile division.<br />

The operating profit of Graziano Trasmissioni, EUR 31.5m<br />

(7.9% of sales) clearly exceeds that of the previous year<br />

(EUR 22.2m), which was still charged with EUR 6m of re-<br />

structuring cost. However, despite a great improvement in<br />

difficult market conditions, the operating result is still below<br />

our target for such a capital-intensive business. Price pressure<br />

from customers and greatly increased steel and energy costs<br />

must be met in future by increased use of low-cost produc-<br />

tion sources such as the Czech Republic and India, where fa-<br />

cilities are currently under construction. The TEMPUS project<br />

is well advanced in Transmission Systems and has already<br />

made a significant contribution to the problems of output<br />

price contention and rising input costs.<br />

Fairfield: the perfect strategic complement. For over two<br />

years Saurer has examined the market of transmission manu-<br />

facturers very systematically, looking for a suitable comple-<br />

mentary partner for Graziano. Important criteria for such a<br />

partner were:<br />

• Specialities provider with complementary products to<br />

those of Graziano Trasmissioni<br />

• in NAFTA or Asia<br />

• sales in excess of EUR 100m<br />

• demonstrable EBITA return of over 15% on the<br />

acquisition price after integration, no dilution of RONOA<br />

(return on net operating assets)<br />

At the end of 2006 Saurer acquired 100% of the share<br />

capital of Fairfield Manufacturing Company, Inc. In 2005<br />

Fairfield had sales of around USD 230m, 1 650 employees<br />

(thereof 600 in India) and achieved a net profit of over 7%.

The company’s headquarters and largest production facility<br />

are in Lafayette, IN, USA, and Fairfield also has a manu-<br />

facturing presence in Belgaum, India.<br />

Fairfield’s most important products are planetary gear drives<br />

(under the Torque Hub ® trade name), custom gears (predom-<br />

inately large diameter gears), and customgear assemblies.<br />

Primary end markets which rely on the Torque Hub ® plane-<br />

tary gear drive include aerial work platforms and offshore<br />

platforms, agricultural and road construction equipment.<br />

Custom gear end-market applications include rail, mining,<br />

agricultural, construction, offshore platforms and material<br />

handling. Custom gear assemblies are utilized for numerous<br />

speciality applications including track drives, power takeoffs,<br />

pump drives, and drop boxes for defence, oil and energy,<br />

underground and aboveground mining and agricultural<br />

applications.<br />

Fairfield’s customer base includes many well-recognized in-<br />

dustrial companies, including AGCO, Allison Transmission,<br />

Case New Holland, Caterpillar, Electro Motive Diesel, Gen-<br />

eral Electric, John Deere, JLG, Joy Global, SPX and Terex.<br />

Many of them are long-standing customers of Graziano Tras-<br />

missioni.<br />

The combination of Fairfield and Graziano Trasmissioni cre-<br />

ates a globally leading solution provider for speciality trans-<br />

missions and gears. Fairfield adds attractive specialities to<br />

Saurer’s product portfolio, grants access to new applications,<br />

provides Graziano a manufacturing footprint in the NAFTA<br />

region, and offers better access to U.S. customers. In return,<br />

Graziano and Saurer provide a platform for Fairfield to further<br />

penetrate the European market. In addition to the synergies<br />

that are created in Europe and North America, the combined<br />

business will be in a stronger position to exploit market op-<br />

portunities and production bases in China and India.<br />

EBIT<br />

THE BUSINESS YEAR 2005 PAGE 5<br />

16%<br />

AMERICA<br />

2003<br />

79%<br />

EUROPE<br />

2004<br />

5%<br />

ASIA<br />

Worldwide sales distribution 2005<br />

Transmission Systems<br />

363<br />

384<br />

397<br />

2005<br />

28.6 22.2 31.5<br />

MARGIN 7.9% 5.8% 7.9%<br />

Sales 2003–2005<br />

Transmission Systems in EUR m<br />

The Business Year 2005

PAGE 6<br />

The Business Year 2005<br />

THE BUSINESS YEAR 2005<br />

TEXTILE SOLUTIONS – STRONG MARKET POSITION<br />

IN ASIA AND ACQUISITIONS TO STRENGTHEN<br />

PRODUCT PORTFOLIO<br />

In Textile Solutions the order intake for 2005, EUR 1 067m,<br />

was below the high level of the previous year (EUR 1 306m,<br />

–18%). The main reason for this was the decline in demand<br />

from China, principally for major projects for filament instal-<br />

lations, texturing and synthetic staple fibers – a decline<br />

which first became apparent in the second half of 2004.<br />

Sales for the year were EUR 1 173m, 3% below the previous<br />

year’s sales of EUR 1 209m. Our Chinese customers’ uncer-<br />

tainty in reaction to the trade disputes surrounding textile<br />

imports in the first half of 2005, together with the high in-<br />

vestment levels of earlier years and the government’s<br />

attempts to restrain the economy (soft landing), all had a<br />

bad effect on investment in textile machinery. In the second<br />

half of 2005 sales of EUR 615m were achieved, almost the<br />

level of the previous year (EUR 621m). In total, Asian markets<br />

continued to dominate in the textile sector with 67% of<br />

sales, however, in 2005 only 28% came from China compared<br />

with 38% in the previous year. In an encouraging contrast,<br />

the Indian market appears to be in continuing good health.<br />

The individual business areas within Textile Solutions devel-<br />

oped very differently; the record volumes of winding systems<br />

(cotton) contrasted sharply with extremely low sales of<br />

texturing machines.<br />

Saurer’s rapid adaptation to changes in the demand profile<br />

demonstrates our capability to react in quick response to<br />

market dynamics. Particularly important in this connection<br />

are our local teams of well-trained service engineers and<br />

product specialists in India and China, who can now be de-<br />

ployed anywhere in the world. Although it has improved<br />

slightly, the performance of the service, repair and spare<br />

parts business in Asia is still well behind expectations based<br />

on comparable volumes in other markets. Following the ac-<br />

quisition in 2005 of the component companies Heberlein<br />

Fiber Technology and Temco, this important area will benefit<br />

from an increased product range and a stronger presence in<br />

the market.<br />

Lower sales, significant preparatory costs of just over EUR<br />

6m in our growth program MUSANGALA and an unsatisfac-<br />

tory product/country mix led to a lower operating result for<br />

Textile Solutions of EUR 63m, which represents a margin of<br />

5.4% on sales (prior year EUR 76m, 6.3%). The result for<br />

the year benefited from cost reductions from the TEMPUS<br />

program and from greatly increased value added in Asia,<br />

however, these were not sufficient to compensate for the<br />

other negative factors. The new assets of the acquisitions<br />

contributed only a little to sales and earnings, yet a RONOA<br />

for the division as a whole of 25% (prior year 35%) was<br />

achieved and the average capital turn was further improved.<br />

Successful management of capital employed, besides<br />

operating profit, has proved its value in recent years as a<br />

major element of Senior Management compensation.<br />

However, although we can explain it, such a result is unsatis-<br />

factory and shows the gap which our growth program must<br />

close in the next two years if we are to achieve our target of<br />

8% recurring operating profit.<br />

In 2005 we acquired seven textile-technology companies,<br />

operating in the areas of nonwovens, textile machine com-<br />

ponents and recycling. These companies’ total sales for 2005<br />

were approximately EUR 112m, of which EUR 42m were<br />

consolidated in 2005, and in future they will contribute sig-<br />

nificantly to our growth in Textile Solutions.<br />

Acquired companies Business Area Saurer Business Unit<br />

Autefa Nonwovens Neumag<br />

Kortec Nonwovens Neumag<br />

Fehrer Nonwovens Neumag<br />

Ermafa Plastics recycling <strong>Barmag</strong> Spinning Systems<br />

Heberlein Fiber Technology Textile machine components Components<br />

Fincarde Nonwovens Neumag<br />

Jinsheng Staple fiber spinning Jinsheng<br />

Temco (2006) Textile machine components Components

Leader in total solutions and innovation. In recent years,<br />

Saurer has repeatedly secured its market leadership in ma-<br />

chinery and equipment for yarn production, and today we<br />

offer a broader range of applications than any of our com-<br />

petitors. Our new acquisitions will strengthen this capability<br />

further. We see significant advantages and opportunities de-<br />

riving from this:<br />

• Saurer’s diversified market segments with their different<br />

cycles smooth out the volatility of the individual seg-<br />

ments, so that business years with extreme downturns<br />

are less frequent.<br />

.• Saurer’s profound and comprehensive understanding of<br />

yarn production qualifies us to adopt and develop our<br />

role as provider of total solutions.<br />

• Saurer’s broad knowledge of development and engineer-<br />

ing puts us in a strong position to bring new technologies<br />

to the point of breakthrough, including difficult and ex-<br />

pensive technologies. Building on our product leadership<br />

we can differentiate ourselves from our competitors and<br />

secure our market share.<br />

• Saurer’s experience in our individual business units of<br />

building up and managing production and sales units in<br />

China and in India allow us to exploit business opportunities<br />

in Asia intensively.<br />

• Saurer’s decentralized worldwide sales and service orga-<br />

nization, together with our hard-learned knowledge of<br />

how to manage cyclical businesses efficiently, enable us<br />

to integrate smaller businesses with complementary pro-<br />

duct portfolios rapidly into the group and realize their<br />

added value at once.<br />

With its deeply rooted Total Solution capability, Saurer is de-<br />

veloping more and more from a textile machine manufac-<br />

turer to become a provider of total solutions to our customers<br />

worldwide, able to offer turnkey solutions for all yarn pro-<br />

duction requirements. This capability has been further refined,<br />

and five new total solution concepts have been developed<br />

for natural and synthetic yarns.<br />

Success of the Saurer network. Innovation will continue to<br />

be a driving force in Saurer’s market positioning. The TTM<br />

process (time to money) which the TEMPUS program intro-<br />

duced as a product generation process covers not only the<br />

THE BUSINESS YEAR 2005 PAGE 7<br />

product development phase but embraces the whole pro-<br />

cess from the original idea to solve a customer problem right<br />

through to market introduction including evaluation of suc-<br />

cess in terms of cash flow. Projects are developed on a multi-<br />

disciplinary basis in mixed teams made up from marketing,<br />

sales, development, production and service. In this way the<br />

use of scarce resources is measured against a shared target<br />

for planned cash inflows. New products with enhanced cus-<br />

tomer value, clearly differentiated from our competitors’ of-<br />

ferings, are an essential tactic in preserving Saurer from a<br />

single-dimensional price war.<br />

Textile Solutions’ worldwide sales and service network was<br />

further consolidated in 2005, and the common systems<br />

handling administration and logistics were unified further.<br />

This promotes sharing of market information and efficient<br />

exchange of production capacity. In cooperation with IMD<br />

in Lausanne, over 250 Saurer employees worldwide were<br />

trained in Saurer’s intensive approach to customer service.<br />

The central focus was on recognizing and categorizing cus-<br />

tomer needs, then converting these rapidly into products<br />

with a clear analysis of value to the customer.<br />

We must continue to watch carefully for opportunities to in-<br />

crease the flexibility of the organization. Following the initial<br />

component outsourcing effort which is now more or less<br />

complete, our focus is now on increasing the level of original<br />

manufacture and value added in Asia and in dollar-related<br />

areas. To this end, after completion of its planning phase the<br />

new Saurer logistics and production center in Suzhou (China)<br />

was built and occupied in 2005. All Saurer’s activities in the<br />

area are now grouped at this location, which will increase<br />

flexibility and reduce administration costs. The site was plan-<br />

ned to accommodate other Saurer activities if required, and<br />

the first to take advantage of this was Transmission Systems,<br />

who is just starting production of axles for fork-lift trucks.<br />

Our previous factory building in Suzhou, occupied for three<br />

years and now too small, was cleared and sold towards the<br />

end of 2005. Components and subassemblies are increas-<br />

ingly sourced locally, partly with the aim of reducing the<br />

currently dominant dependency on the euro. However, our<br />

worldwide supply network remains the basis for flexible and<br />

cost-efficient supply in all business areas.<br />

The Business Year 2005

PAGE 8<br />

The Business Year 2005<br />

THE BUSINESS YEAR 2005<br />

Our company culture is subject to daily scrutiny by our cus-<br />

tomers, and we are very conscious that there remains much<br />

to be done, despite the tangible changes of recent years.<br />

Our aim is for all employees to develop a sense of value to<br />

the customer, external or internal, in everything they do, and<br />

always to question the need and efficiency of what they are<br />

doing. This is a continuing management challenge at all<br />

levels. One very positive development is that efficient and<br />

unprejudiced cooperation between colleagues from diffe-<br />

rent regions has become the norm within Saurer. Our latest<br />

plans for referral of projects to Asia, joint development of<br />

new products for local markets, adaptation of marketing<br />

initiatives to other regions, all bear witness to this. Here we<br />

see how Saurer is moving in large steps from being a<br />

successful exporter of textile machines to becoming a global<br />

provider of total solutions for the textile industry.<br />

EBIT<br />

17%<br />

AMERICA<br />

2003<br />

16%<br />

EUROPE<br />

2004<br />

67%<br />

ASIA<br />

Worldwide sales distribution 2005<br />

Textile Solutions<br />

1275<br />

1209<br />

1173<br />

2005<br />

62.2 76.0 62.9<br />

MARGIN 4.9% 6.3% 5.4%<br />

Sales 2003–2005<br />

Textile Solutions in EUR m

Neumag – Total Solution for nonwovens. Neumag had<br />

another very good year. Efforts of recent years in develop-<br />

ment of new installations, machines and other equipment<br />

formed the basis for success in all markets, which led to a<br />

clear increase in sales and profits. The new staple fiber pro-<br />

duction installation was successfully installed in 2005 with a<br />

number of customers in China. This included the largest<br />

staple fiber installation ever, with 6 times 200 tons daily pro-<br />

duction capacity, which requires 100 large trucks daily to<br />

transport the product to the customer. Thanks to the new<br />

carpet yarn equipment S5 and S3, Neumag’s market positi-<br />

on in this segment was reinforced and substantial orders<br />

from U.S. and Turkey were won and delivered. Strenuous ef-<br />

Neumag nonwovens technology portfolio<br />

Preparation/<br />

Spinning<br />

Formation<br />

Bonding<br />

Packaging/Winding<br />

Airlaid<br />

Short fibers<br />

Airlaid<br />

M&J<br />

THE BUSINESS YEAR 2005 PAGE 9<br />

forts were devoted to development of the new nonwovens<br />

business. Decisive steps were completion of the pilot line in<br />

Neumünster for process development and customer sampling,<br />

and also the acquisition of four technology companies (Au-<br />

tefa, Kortec, Fehrer and Fincarde) which will help to position<br />

Neumag as a provider of total solutions in the nonwoven<br />

market. Another important milestone was delivery, installa-<br />

tion and production go-ahead for the largest spunbond in-<br />

stallation in Italy, for Procter & Gamble.<br />

Carding<br />

Long fibers<br />

Spunlace Needle Punching<br />

Festooning<br />

Fehrer<br />

Kortec<br />

Carding<br />

F.O.R<br />

Crosslapping<br />

Autefa<br />

Thermal bonding<br />

Winding<br />

Spunbond<br />

Granulate, polymer<br />

Spinning<br />

Meltblown<br />

Neumag<br />

Neumag<br />

Chemical bonding<br />

In-house technology Technology provided by partners<br />

The Business Year 2005

PAGE 10<br />

The Business Year 2005<br />

THE BUSINESS YEAR 2005<br />

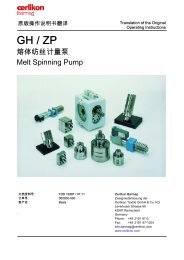

<strong>Barmag</strong> Spinning Systems – higher sales despite weak<br />

markets in China. <strong>Barmag</strong> Spinning Systems again exceeded<br />

their sales of the previous year, although order intake was<br />

considerably lower. Together with cost improvements from<br />

the TEMPUS program this led to a further improved result. In<br />

China particularly order levels dropped dramatically, and al-<br />

though some larger orders were received from India, these<br />

could not compensate. Increasing market pressure from Chi-<br />

na forces firms in the other textile-producing countries of<br />

Asia to invest in modern, high-quality equipment, which of<br />

course offers opportunities for Saurer. Among higher quality<br />

yarns such as supermicrofilaments, or extremely strong<br />

yarns as used in tyre manufacture, new applications and cus-<br />

tomer needs have recently surfaced and were successfully<br />

supplied using the Total Solution approach. Further business<br />

potential was won by presentation of new and innovative<br />

products such as the 20 times FDY installation and the<br />

supermicrotechnology with up to 400 filaments. With the<br />

acquisition of ERMAFA in Chemnitz a foundation stone was<br />

laid for a broader entry into the recycling of plastics. Rapidly<br />

rising prices for energy and raw materials are opening up a<br />

broad field of new applications for recycling.<br />

<strong>Barmag</strong> Texturing Systems – innovation in a downturn.<br />

The market for texturing systems weakened clearly in 2004,<br />

then it halved itself again in 2005 to reach a level around<br />

one-third of it was in 2003. Practically all regions were affected<br />

by this contraction of demand, particularly China. Although<br />

<strong>Barmag</strong> was able to build up its market share in this very dif-<br />

ficult market, thanks to the new MPS product range, and<br />

despite rigorous cost savings introduced in the previous year<br />

which gave higher contribution margins, the massive sales<br />

recession could not be compensated and the business unit<br />

closed with a loss. Construction of production facilities in<br />

Suzhou (China) continued apace, together with resizing of<br />

capacities in Europe. The new generation of automatic tex-<br />

turizing systems MPS was tested successfully by various<br />

customers in 2005, and the first large order, for 48 systems,<br />

was delivered and installed in the fourth quarter. Also, 30 of<br />

a new low-cost machine developed in China and based on<br />

the FK6-1000 were sold in the last quarter.<br />

Schlafhorst Rotor Spinning Systems – success with new<br />

Autocoro 360. The rotor spinning business stayed at the low<br />

level of the previous year; a slight improvement in sales was<br />

matched by a small reduction in orders. Business improved<br />

in China, U.S. und India but declined in other markets. In<br />

2005 the Autocoro 312 was replaced by the fully automated<br />

Autocoro 360. The new machine’s increased productivity, its<br />

high flexibility which also permits production of special ef-<br />

fect yarns, and also the further perfected magnetic bearings,<br />

qualify it as best of class by a clear margin. This included<br />

the market launch of a new yarn quality monitoring system<br />

Corolab XQ, developed by Schlafhorst. These digital sensors<br />

are fully integrated in the Autocoro and enable valuable new<br />

perspectives over the yarn quality and fault detection. The<br />

technological progress marked by the Autocoro, together<br />

with the weak market demand, forced our competitors to<br />

reduce their prices to preserve their market share. Satis-<br />

factory business was done also with the manual and semi-<br />

automatic rotor spinning machines made in China and the<br />

Czech Republic, mainly for projects in Asia.<br />

Zinser Ring Spinning Systems – accelerated engagement<br />

in Asia. Zinser was unable to maintain its momentum of re-<br />

cent years. Recessive demand in the traditional Zinser mar-<br />

kets of Europe, Near and Middle East and U.S. put a damper<br />

on sales which could not be compensated fully by better<br />

business in Asian markets. This shift in the market was ex-<br />

pected, but came with unexpected speed and led to a more<br />

radical rethink and rebuild of Zinser in the direction of India<br />

and China, which will bear fruit in 2006 with new products<br />

for these markets. Zinser’s product range will be radically re-<br />

thought for the Asian market, as production starts in the<br />

new plant in Suzhou and in cooperation with our new part-<br />

ner Jinsheng, in whose business Saurer acquired a majority<br />

shareholding at the end of 2005. Production of roving<br />

frames for the Indian market, which started last year, is<br />

going well and clearly exceeded its sales targets in 2005.<br />

Schlafhorst Winding Systems – strong demand for cot-<br />

ton spinning leads to another record year. Winding Sys-<br />

tems’ business enjoyed another record year in sales and prof-<br />

its. The robust, technically unchallenged Autoconer winding<br />

machine did well in almost all markets. Particularly in China<br />

and India, which are by far the largest markets, the steps we<br />

have taken in sales and service areas have led to better mar-<br />

ket penetration and a higher market share. By virtue of strict<br />

cost management, innovative new components and flexible<br />

process management directed toward the volatile markets,

margins were held despite intense price competition. The<br />

successful market launch of the Autoconer Gold Edition and<br />

our various equipment and accessory packages designed for<br />

different markets and customers further enhanced customer<br />

acceptance. The new Ecopack with its exact length measure-<br />

ment in thousandths reduces the loss of yarn by up to 80%<br />

in subsequent processing, which has great appeal for our<br />

cost-conscious and demanding clientele.<br />

Volkmann Twisting Systems – FOCUS well established in<br />

Asian market. After a poor year in 2004, the twisting<br />

business revived a little this year, but sales volumes were still<br />

unsatisfactory overall. The slight revival in sales together<br />

with further cost reductions from TEMPUS led to a clearly<br />

positive operating result. FOCUS, a new low-cost twisting<br />

machine for cotton yarn, developed and built in China, was<br />

very well received by our Asian customers especially in Chi-<br />

na, India and Pakistan, and over 200 were delivered in the<br />

first year alone. The CompactTwister, a twisting machine in<br />

the upper price/performance category, also profited from<br />

our increased market presence and achieved high sales. The<br />

cabling equipment business for carpet yarns also went well;<br />

particularly in America our Total Solution approach, together<br />

with Neumag’s spinning systems, found favor with cus-<br />

tomers. In 2005 the first of a new generation of glass-fiber<br />

twisting machines, developed with a Czech partner, was<br />

delivered to a customer in China.<br />

Saurer Embroidery Systems – profitable in a downturn.<br />

Over the past two years Saurer Embroidery Systems has been<br />

renewing its sales program and clearing out its product<br />

palette. This, together with rigorous fixed cost reductions<br />

from the TEMPUS program, enabled the business unit to<br />

achieve a clearly positive result despite drop in market<br />

demand by almost a half. This is the benchmark for flexibility<br />

in the Saurer group. After a strong prior year, demand for<br />

shuttle embroidery was enormously reduced in almost all<br />

markets. The single and multihead embroidery business –<br />

the new AMAYA machine from Melco – did not attain its<br />

high growth targets either. The slow, still unsatisfactory<br />

growth in Asia was almost completely set off by the low<br />

volumes in the traditional U.S. market. Despite improvements<br />

that have been made, the potential of this system is now-<br />

here near being exhausted. The first large-scale installation<br />

of WINPRO spinning/twisting machines, the new high<br />

THE BUSINESS YEAR 2005 PAGE 11<br />

performance technique for wool spinning, was delivered to<br />

an Italian customer. Preparing the system for a broader<br />

range of applications is proving to be more time-consuming<br />

than was originally expected, and the financial circumstances<br />

of many of our customers have delayed their decision<br />

process considerably. However, by the fourth quarter the<br />

system was undergoing evaluation by several important<br />

customers and opinion leaders in the market.<br />

The Business Year 2005

PAGE 12<br />

OUTLOOK<br />

The Business Year 2005<br />

THE BUSINESS YEAR 2005<br />

Saurer has successfully concluded a phase of consolidation<br />

with emphasis on improvement of business processes and<br />

cost structures, together with realignment of the company’s<br />

culture. After thus looking inward with the aim of reducing<br />

risk, our full concentration is now directed outward again,<br />

aiming to seize every business opportunity, but without ne-<br />

glecting the virtues we have learned from the TEMPUS pro-<br />

gram. This change of direction from optimizing existing pro-<br />

cesses to new growth was clearly evident in 2005, both in<br />

Textile Solutions and Transmission Systems. Growth plans<br />

with steps clearly defined, time and cost budgets for new<br />

products, areas of application and markets have been<br />

worked up in all business areas and approved by Board of<br />

Directors. Our recent investments in technology companies,<br />

acquisition of know-how to form the basis for new products<br />

and the construction of our new facilities in Asia, are all part<br />

of this program.<br />

THANK-YOU<br />

The Board of Directors and the Management would like to<br />

thank all employees for their effort and commitment to<br />

Saurer. The will to change, and the active pursuit of change,<br />

Prof. Dr. Giorgio Behr<br />

Chairman of the Board<br />

The strong cash flow of recent years and our balance sheet,<br />

still in robust good health after several acquisitions, form the<br />

basis for a return to profitable growth. The expansion of our<br />

production capacity in Asia and resizing of our real estate in<br />

Europe are making good progress.<br />

In accordance with Saurer’s dividend policy, the Board of<br />

Directors proposes a capital repayment of CHF 1.80 per<br />

registered share. This gives Saurer scope for further attrac-<br />

tive acquisitions to expand its operations.<br />

For 2006, Saurer does not expect to see organic growth. Our<br />

acquisitions of 2005 will however contribute to increased<br />

sales in the textile sector (approx. EUR +80m) and to a much<br />

larger sales volume in Transmission Systems (approx. +EUR<br />

175m / consolidation of Fairfield from February 2006). Devel-<br />

opments in the volatile textile business are hard to predict,<br />

so the forecast of sales of Saurer Textile Solutions contains a<br />

degree of uncertainty.<br />

have strengthened Saurer and given us all a healthy base for<br />

a new phase of growth.<br />

Heinrich Fischer<br />

CEO and Board Delegate

MUSANGALA<br />

Growth starts with needs, ideas and energy.<br />

A company is more than its balance sheet and income statement, its products and markets,<br />

its machines and factories. A company’s success stems largely from the spirit which drives it,<br />

from the shared values and the goals which guide its people in their daily work.<br />

In the long term the worth of a company depends on the value it creates for its customers,<br />

its employees and its shareholders. A company wishing to grow must create new value and<br />

only through growth can it break out of the endless spiral of competition, improvements in<br />

efficiency and value lost in costs or in lost people. “We must seek success (value) in the<br />

heads of our customers” 1 – that is, the success of products or services depends largely<br />

on making customer attitudes and values the basis of business decisions. Growth will<br />

be achieved only by those who understand their customers’ view of the world better and<br />

can quickly provide solutions for their needs. The difficulty is that customer needs are as<br />

individual and varied as the customers themselves. Nowadays we have to adapt to each<br />

individual customer. The hard factors such as value for money, technology and product<br />

quality must all be in order; this is basic and the market demands it. Increasingly, it is the soft<br />

factors which are decisive, such as mutual trust, working well together, customer relations<br />

in general. Whether hard factors or soft: “The soul of our firm must be obsessed with our<br />

customers.”<br />

1 Peter Kruse (expert in human cognition)<br />

The Business Year 2005

To grow, the company must be in good health. Our good health comes from the TEMPUS<br />

program. To this underlying rhythm of efficient business processes and a customer and team<br />

oriented company culture has been added a second beat, since mid-2004, which will give us<br />

a new overall rhythm. MUSANGALA should give Saurer profitable growth of EUR 600m,<br />

without neglecting the virtues of TEMPUS. However, that tangible sense of relief from<br />

our colleagues over this change of direction is premature. It is a lot harder to generate prof-<br />

itable growth than it is to optimize business processes and reduce costs. New ideas cannot<br />

simply be ordered up. They need a background of creativity and openness, a readiness to<br />

take risks, and the courage to turn back when we go wrong.<br />

Recognizing the need and having the right idea is hard enough. To succeed, we need energy<br />

to achieve results quickly and to overcome setbacks; we must persevere and always keep<br />

our eye on the ultimate goal. Does Saurer have the right people in all the right places,<br />

people whose energy and competence will assure us of success? To have better people than<br />

the competition will be a vital success factor in MUSANGALA and an important challenge<br />

for our leaders.<br />

However, not all forms of growth are healthy and wanted, not every idea is a good idea and<br />

worthy of realization. But without ideas, many ideas, to choose from, nothing new can be<br />

created. Just as in our garden we distinguish between flowers and weeds, we must often<br />

cut back to give promising young branches the light and space they need for growth.<br />

I think that TEMPUS has prepared and qualified us for this new challenge. If we can attack<br />

the next phase with humility and respect for the scale of the task, mixed with unquestioning<br />

faith in our own ability and strength, then I see no reason why our MUSANGALA program<br />

should not be crowned with success.<br />

The Business Year 2005<br />

Heinrich Fischer CEO

034 / MANAGEMENT’S DISCUSSION OF RESULTS<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

045 / CONSOLIDATED INCOME STATEMENT<br />

046 / CONSOLIDATED BALANCE SHEET<br />

047 / CONSOLIDATED CASH FLOW STATEMENT<br />

048 / CONSOLIDATED STATEMENT OF<br />

SHAREHOLDERS’ EQUITY<br />

049 / ACCOUNTING POLICIES<br />

054 / NOTES TO THE CONSOLIDATED FINANCIAL<br />

STATEMENTS<br />

071 / PRINCIPAL COMPANIES AND INVESTMENTS<br />

072 / REPORT OF THE GROUP AUDITORS<br />

MULTIPLE YEAR COMPARISON<br />

074 / MULTIPLE YEAR COMPARISON<br />

FINANCIAL REPORT OF SAURER LTD.<br />

080 / INCOME STATEMENT<br />

081 / BALANCE SHEET<br />

082 / NOTES TO THE FINANCIAL STATEMENTS<br />

084 / PROPOSAL TO THE GENERAL MEETING<br />

085 / REPORT OF THE STATUTORY AUDITORS

PAGE 34<br />

The Business Year<br />

MANAGEMENT’S DISCUSSION OF RESULTS<br />

In 2005 Saurer generated lower order intake and slightly lower sales than in 2004. Although Transmission Systems showed moderate growth it was<br />

not sufficient to compensate for Saurer Textile Solutions‘ lower sales volume and declining margins. Consequently, operating results were down,<br />

despite further cost savings and efficiency improvements made in the year. The net income from continuing operations however has improved by<br />

EUR 6m thanks to lower financial and tax expense.<br />

In the textile division both sales and orders were down on the previous year. After the high investment levels of last year, trade disputes and the result-<br />

ing uncertainty affecting the textile industry held back demand from China, and put constant pressure on margins in the textile machine business.<br />

However, thanks to strict cost management, Saurer Textile Solutions managed to achieve a satisfactory result for the year, with still high return on<br />

capital employed.<br />

Transmission Systems‘ business continued to improve. A strong first half-year, stable market conditions with good margins and significantly lower<br />

restructuring costs than the previous year, all contributed to a significant increase in the operating result.<br />

Following the divestment of the Surface Technology division, completed last year, and the successful implementation of Saurer‘s TEMPUS program<br />

promoting business efficiency, 2005 was a year marked by a number of new investments in the textile division. These were mainly in the areas of<br />

nonwovens and textile components and in the reporting year increased the group‘s net assets while reducing its net cash. However, there was only a<br />

minor impact from the new acquisitions on the operating result in 2005.<br />

Employee numbers increased with the acquisitions by 1 369 but were reduced by 200 as a result of restructuring measures. The year closed with total<br />

employees of 10 021.<br />

The Surface Technology division was fully discontinued in 2004 and made no contribution to 2005 results. The 2004 figures were restated accord-<br />

ingly. A further restatement of 2004 results was made due to changes in the IFRS standards regarding accounting for stock option plans, resulting in<br />

EUR 2.3m higher operating expense in both years.<br />

In the following tables all currency amounts are stated in EUR 000.<br />

Management’s discussion of results Saurer 2005

Order Intake<br />

MANAGEMENT’S DISCUSSION OF RESULTS PAGE 35<br />

Change Adjusted change<br />

2005 2004 1) in % in % 2)<br />

Saurer Textile Solutions 1 066 663 1 306 144 –18.3 –21.1<br />

Europe 188 390 180 074 4.6<br />

North and South America 217 908 188 326 15.7<br />

Middle/Far East, Rest of World 660 365 937 744 –29.6<br />

Transmission Systems 397 130 383 690 3.5 3.5<br />

Europe 311 996 298 700 4.5<br />

North and South America 63 657 68 439 –7.0<br />

Middle/Far East, Rest of World 21 477 16 551 29.8<br />

Total Saurer 1 463 793 1 689 834 –13.4 –15.6<br />

Europe 500 386 478 774 4.5<br />

North and South America 281 565 256 765 9.7<br />

Middle/Far East, Rest of World 681 842 954 295 –28.6<br />

1) Restated.<br />

2) Adjusted for currency effects and acquisitions.<br />

Order intake for 2005 was well below the previous year. This was mainly influenced by the market development in China and Turkey. In India, how-<br />

ever, both Saurer Textile Solutions and Transmission Systems reported increased order volumes.<br />

In China, a number of large-scale investment projects were completed in recent years and the downturn in the market was to be expected. Despite<br />

this, Asia was still by far the most important market in the textile machine business also in 2005.<br />

Transmission Systems enjoyed positive business development leading to increased demand, mainly in Europe and India. Whereas orders increased also<br />

in North America, in South America market demand was clearly reduced.<br />

Management’s discussion of results Saurer 2005

PAGE 36<br />

Sales<br />

MANAGEMENT’S DISCUSSION OF RESULTS<br />

Change Adjusted change<br />

2005 2004 1) in % in % 2)<br />

Saurer Textile Solutions 1 172 656 1 209 410 –3.0 –6.3<br />

Europe 192 455 172 092 11.8<br />

North and South America 196 405 167 872 17.0<br />

Middle/Far East, Rest of World 783 796 869 446 –9.9<br />

Transmission Systems 397 130 383 690 3.5 3.5<br />

Europe 311 996 298 700 4.5<br />

North and South America 63 657 68 439 –7.0<br />

Middle/Far East, Rest of World 21 477 16 551 29.8<br />

Total Saurer 1 569 786 1 593 100 –1.5 –3.9<br />

Europe 504 451 470 792 7.1<br />

North and South America 260 062 236 311 10.1<br />

Middle/Far East, Rest of World 805 273 885 997 –9.1<br />

1) Restated.<br />

2) Adjusted for currency effects and acquisitions.<br />

Saurer‘s consolidated sales for 2005 were down EUR 23m compared with 2004. The high order book at the start of the year helped Saurer Textile<br />

Solutions to contain an otherwise greater sales reduction in difficult market conditions. The new acquisitions account for EUR 42m of sales in 2005.<br />

A slight revival of business for Transmission Systems compensated only partially for the declining sales of Textile Solutions. In Transmission Systems<br />

order lead times are short, so the same market conditions as described above for order income apply to sales.<br />

Orders on Hand<br />

2005 2004<br />

Saurer Textile Solutions 392 008 459 613<br />

Transmission Systems – –<br />

Total Saurer 392 008 459 613<br />

As a result of the currently hesitant market demand in the highly cyclical textile machine business, orders on hand are down by EUR 68m compared<br />

to the previous year. However, a comparison over several years shows that this level of orders lies within the typical range of demand fluctuation for<br />

the textile machine business.<br />

Management’s discussion of results Saurer 2005

Saurer Textile Solutions<br />

MANAGEMENT’S DISCUSSION OF RESULTS PAGE 37<br />

(EUR 000) 2005 % 2004 1) %<br />

Sales 1 172 656 100.0 1 209 410 100.0<br />

Operating profit 62 850 5.4 76 027 6.3<br />

Depreciation and amortization 34 227 39 115<br />

EBITDA 97 077 8.3 115 142 9.5<br />

Capital expenditure 50 411 33 449<br />

Net Operating Assets (including goodwill) 399 262 298 951<br />

Employees (full-time equivalents at year-end) 7 099 5 861<br />

of which from acquisitions made in 2005 1 369 –<br />

1) Restated.<br />

The textile sector suffered from reduced sales and constant pressure on margins, and despite rigorous cost management and high operating flexibility<br />

the operating result of the previous year was not attained. However, achievements in cost reduction can be seen clearly over the years: Saurer Textile<br />

Solutions‘ operating profit of 2005 is close to double the operating profit of 2002, a business year with comparable sales volume.<br />

The various business areas underwent different cycles and this supported a more or less constant business performance for textile machines overall:<br />

low sales in texturing, ring spinning and embroidery machines were compensated by volume increases in the other business areas, with a record year<br />

for winding. The high level of capital expenditure in 2005 compared with 2004 was directed mainly to completion of the new plant in Suzhou, China,<br />

and includes EUR 18m for this purpose.<br />

In the important markets for components, Saurer‘s market presence and product portfolio were enhanced by the acquisition of Heberlein (Switzerland<br />

and Germany) at the end of the year. The staple fiber portfolio of Saurer in future will be expanded by the new 70% joint venture with Jinsheng in<br />

China.<br />

Due to the acquisitions at year-end net operating assets were increased, but as the acquired companies were not consolidated for the whole year there<br />

was only a minor impact on the operating result.<br />

Outlook<br />

Saurer has made a number of strategic acquisitions with a view to building up its market leadership as provider of total solutions in the textile machine<br />

business, thereby enhancing its process and technology competence as well as securing its market position and the stability of its margins for the<br />

future. The completion of the plant in Suzhou (China) and the joint venture with Jinsheng (China) strengthen the local presence in the important Asian<br />

markets. This will enable Saurer to benefit from the next cyclical recovery in the textile machine business. Alongside further process improvements and<br />

cost reduction targets the focus is on building up total solution capability both internally and externally, and on integration and further development<br />

of new acquisitions. With a growing level of value added sourced from Asia and other low-cost as well as Euro-independent countries the market-led<br />

moves on the demand side of our business will be further matched on the purchasing side.<br />

For the year 2006 we have a rather cautious outlook. Saurer is starting with a reduced backlog of orders, markets in many segments are at the lower<br />

end of the industry cycle. The integration of the acquisitions, while holding a lot of potential for the future, will in the short-term deliver an operating<br />

performance below the normal level.<br />

Management’s discussion of results Saurer 2005

PAGE 38<br />

Transmission Systems<br />

MANAGEMENT’S DISCUSSION OF RESULTS<br />

2005 % 2004 1) %<br />

Sales 397 130 100.0 383 690 100.0<br />

Operating profit 31 501 7.9 22 155 5.8<br />

Depreciation and amortization 29 558 33 823<br />

EBITDA 61 059 15.4 55 978 14.6<br />

Capital expenditure 27 845 25 641<br />

Net Operating Assets (including goodwill) 221 361 216 987<br />

Employees (full-time equivalents at year-end) 2 905 2 970<br />

of which from acquisitions made in 2005 – –<br />

1) Restated.<br />

In Transmission Systems the improved demand which had been noted in 2004 continued into 2005, with higher orders for components for agricul-<br />

tural and construction vehicles, Graziano Trasmissioni‘s core business, and stable sales volumes in the automotive market. In particular Graziano‘s<br />

home market of Europe developed very well, but business was also good in India.<br />

With the transfer of business activity from the Carr Hill plant (Great Britain) to India and Italy the consolidation phase of Graziano‘s operations was<br />

successfully completed. In planning its new operations in China and the Czech Republic, Graziano is able to draw support and benefit from Saurer<br />

Textile Solutions‘ country-specific experience and existing resources.<br />

During 2005 a number of prestigious customers selected Graziano Trasmissioni as supplier for a series of new multiple-year projects, some of which<br />

will explore new uses of technology, such as the stepless CVT (Continuous Variable Transmission). Thanks to higher sales volumes with good margins<br />

and a significant reduction of restructuring costs the start-up costs of these new customer projects were well covered and the operating profit<br />

improved in comparison with 2004. However, considering the capital-intensive nature of the Transmission Systems business the results achieved and<br />

the improved returns do not yet meet Saurer‘s targets.<br />

Outlook<br />

Before new customer projects will make the Graziano business grow again in 2007, 2006 will be a rather flat year. However, early in 2006 Transmission<br />

Systems acquired Fairfield Manufacturing Company Inc. (USA), which will strengthen its presence on the American continent and open the way to<br />

new transmission applications in niche markets. Besides Graziano‘s existing customer applications, transmissions can now be offered for mobile man<br />

lifts, cranes, drilling platforms, railways, mining and material transport systems and other applications.<br />

Realizing the synergies of their union from improved market access as well as the market potential of a broader product spectrum will be key to<br />

opening and exploiting new growth opportunities for Graziano Trasmissioni and Fairfield. Continued development of production facilities in India,<br />

China and the Czech Republic will lead to further cost reductions and will help to stay ahead not just with superior customer value, but also with<br />

attractive prices.<br />

Discontinuing Operations (Surface Technology)<br />

The divestment of the Surface Technology division was completed in 2004. No operational activities were left in 2005. For the prior year numbers<br />

please refer to the notes to the financial statements on page 58.<br />

Outlook<br />

Guarantees granted and all possible future obligations arising from the sale of Surface Technology have been evaluated at the balance sheet date and<br />

appropriately provided for in the accounts.<br />

Management’s discussion of results Saurer 2005

Financial and Group Results<br />

MANAGEMENT’S DISCUSSION OF RESULTS PAGE 39<br />

2005 2004 1)<br />

Operating profit before amortization of goodwill and other intangible assets (EBITA) 91 692 102 827<br />

Amortization of goodwill and other intangible assets –3 403 –10 579<br />

Operating profit 88 289 92 248<br />

Financial expense (net) –9 762 –16 601<br />

Income taxes –23 367 – 26 490<br />

Result from discontinued operations (Surface Technology) – 18 211<br />

Profit for the period 55 160 67 368<br />

1) Restated.<br />

Financial expense was EUR 7m less than the previous year. Higher average net cash during 2005 and repayment of the 2 1 /4% convertible bond in June<br />

2005 led to higher interest income and lower interest expense. Also, income from marketable securities was increased, adverse currency effects were<br />

lower and the interest cost relating to pensions was reduced. In accordance with IAS 32, interest expense amounting to EUR 1.8m was charged to<br />

the income statement for the 2 1 /4% convertible bond although only an amount of EUR 0.9m was actually paid. The effective tax rate for the group<br />

was reduced slightly despite lower income before taxes and the fixed character of deferred tax asset write-offs and the Italian tax on personnel<br />

expense (IRAP).<br />

Cash Flow<br />

2005 2004 1)<br />

Cash flow from operating activities 71 464 163 174<br />

Capital expenditure (net of capital grants) –78 301 –60 604<br />

Proceeds from sale of fixed assets 23 704 10 786<br />

Free cash flow 16 867 113 356<br />

Divestment (acquisition) of investments –12 886 82 392<br />

Assumption of debt (acquisitions), release of debt (divestments) –35 225 –<br />

Repayment of capital, purchase and sale of treasury shares / options –6 012 –17 610<br />

Other net cash movements 7 533 –4 276<br />

Increase (Decrease) Net Cash –29 723 173 862<br />

1) Restated.<br />

In 2005 a substantial cash flow was again generated from operating activity, although EUR 92m less than the high level of 2004. This was partly<br />

caused by the extended utilization of provisions mainly related to restructuring activities. Also, as already shown, the excess liquidity of EUR 35m<br />

deriving from receivables and payables which enhanced the cash flow in 2004 had the opposite effect in 2005. The increase in capital expenditure<br />

related to the expansion in Asia is partially offset by the proceeds from sale of fixed assets, mainly cash from the sale of real estate in Great Britain,<br />

Germany, and Switzerland. The relatively small cash flow in 2005 was mainly used for acquisitions amounting to a total of EUR 48m in cash payments<br />

and assumed debt. In January 2006 net cash was reduced by more than EUR 200m due to the acquisitions of Fairfield and Temco. For the acquisitions<br />

of Fairfield and Jinsheng Saurer used USD 280m of bridge financing from four Banks. This bridge financing will be replaced by mid 2006.<br />

Management’s discussion of results Saurer 2005

PAGE 40<br />

Net Cash and Equity<br />

MANAGEMENT’S DISCUSSION OF RESULTS<br />

2005 2004 1)<br />

Net Cash 111 762 141 485<br />

Liquid assets 165 888 265 679<br />

Short-term debt –29 066 –9 935<br />

Convertible bond (repayment in June 2005) – –82 703<br />

Long-term debt –25 060 –31 556<br />

Net Tangible Worth (Equity minus Goodwill) 459 097 420 668<br />

Shareholders‘ equity 574 976 516 725<br />

Goodwill –115 879 –96 057<br />

Ratios<br />

Equity in % of Total Assets 45.5% 39.7%<br />

Net Tangible Worth in % of Total Assets 36.3% 32.3%<br />

1) Restated.<br />

The repayment of the 2 1 /4% convertible bond in June 2005 was made from available liquid funds. The comfortable net cash position secures the<br />

financing for the Fairfield acquisition announced shortly after the year-end. Further, the increased equity ratio emphasises Saurer‘s strong financial<br />

position and potential for future growth and debt capacity.<br />

Management’s discussion of results Saurer 2005

Business Risks<br />

Saurer Textile Solutions<br />

Shortening market cycles<br />

MANAGEMENT’S DISCUSSION OF RESULTS PAGE 41<br />

Market cycles are getting shorter. In 2003 the business unit Texturing saw its order volume reduced by 65% within three months. In 2004, Embroidery<br />

has experienced a reduction in orders of 50% over twelve months. In the past years, Saurer Textile Solutions has taken many measures to encounter<br />

the shortening market cycles: The TEMPUS program has resulted in a hefty reduction of the fixed costs. Significant transfers of production and<br />

sourcing have taken place from high costs regions (Western Europe) to low cost regions (China, India), further will follow. As a consequence, Saurer<br />

Textile Solutions has been able to maintain a relative constant profitability over the last years, while the volatility of some markets has been dramatic.<br />

Risk mitigation is also supported by the number of business units with partially very different market cycles, strongly reducing the volatility of Saurer<br />

Textile Solutions as a whole.<br />

Pressure on service and spare parts business<br />

Due to the shift in markets in the last years, the installed machine basis has grown significantly in Asia. The world-wide installed machine basis has<br />

always helped a constant revenue stream for service and spare parts. As customers in Asia traditionally have a different view on service, preventative<br />

maintenance and the value of quality spare parts than customers in the traditional markets, the business from spare parts and after market services<br />

has been under constant pressure. Such pressures are being encountered by systematic marketing activities, segmented sales channels, focused<br />

acquisitions, and customer value offerings for high end as well as low end segments.<br />

Growing importance of low-end and mid-range markets<br />

In the past Saurer Textile Solutions was active mainly in the premium market segments, based on its technological leadership. We are however witness-<br />

ing a growing importance of the lower-end segments. This has motivated Saurer Textile Solutions to play in all fields of the markets. With the recent<br />

acquisition of the majority shareholding in Jinsheng (China), with successful development and market introduction of our own low end machines,<br />

with the opening of our new 70 000 m 2 plant in Suzhou, Saurer Textile Solutions is preparing itself to play not just successfully in the high end, but<br />

also in the low end of the market.<br />

Transmission Systems<br />

Pricing pressure and Far East competition<br />

While exposure to steel and energy costs is a known risk in the industry, it is also expected that competition from the Far East will increase in future.<br />

In order to prepare for these pressures, Graziano Trasmissioni has product cost reduction programs in tight coordination with customers and is<br />

continuously optimizing its manufacturing processes. Additionally, Graziano Trasmissioni is lowering its cost basis by transferring activities to our India<br />

facility and to the Saurer location in Suzhou, China.<br />

Dependence on construction and agricultural markets<br />

Graziano Trasmissioni has a relatively high dependence on the construction equipment and agricultural machinery markets. In order to decrease their<br />

dependence, Graziano Trasmissioni has been looking for a diversification of its existing business. Subsequent to year-end, such diversification was<br />

completed by the acquisition of Fairfield Manufacturing Company.<br />

Management’s discussion of results Saurer 2005

CONSOLIDATED FINANCIAL STATEMENTS

CONSOLIDATED INCOME STATEMENT for the years ended December 31, PAGE 45<br />

(EUR 000) Note* 2005 % 2004** %<br />

Sales 1 1 569 786 100.0 1 593 100 100.0<br />

Cost of goods sold –1 254 557 –79.9 –1 252 070 –78.6<br />

Gross profit 315 229 20.1 341 030 21.4<br />

Selling and distribution –80 134 –5.1 –79 156 –5.0<br />

Research and development –71 545 –4.6 –74 069 –4.6<br />

Administration and other 2 –75 261 –4.8 –95 557 –6.0<br />

Operating expenses –226 940 –14.5 –248 782 –15.6<br />

Operating profit 3 88 289 5.6 92 248 5.8<br />

Financial expense (net) 4 –9 762 –0.6 –16 601 –1.1<br />

Profit before income taxes 78 527 5.0 75 647 4.7<br />

Income taxes 5 –23 367 –1.5 –26 490 –1.6<br />

Profit from continuing operations 55 160 3.5 49 157 3.1<br />

Result from discontinued operations 6 – – 18 211 1.1<br />

Profit for the period 55 160 3.5 67 368 4.2<br />

Attributable to<br />

Shareholders of Saurer Ltd. 53 392 66 774<br />

Minority interests 1 768 594<br />

55 160 67 368<br />

* For details see the notes to the consolidated financial statements, pages 54–70. These are an integral part of the consolidated financial statements.<br />

** Restated. For details see page 50.<br />

Earnings per share (EUR) 2005 2004<br />

Continuing operations<br />

Basic earnings per share 3.72 3.43<br />

Diluted earnings per share 3.70 3.41<br />

Discontinued operations<br />

Basic earnings per share – 1.28<br />

Diluted earnings per share – 1.27<br />

Total<br />

Basic earnings per share 3.72 4.71<br />

Diluted earnings per share 3.70 4.68<br />

See note 7, page 58.<br />

Consolidated financial statements Saurer 2005

PAGE 46<br />

CONSOLIDATED BALANCE SHEET as at December 31,<br />

(EUR 000) Note* 2005 % 2004** %<br />

Assets<br />

Cash and cash equivalents 120 950 216 196<br />

Marketable securities and time deposits (due after 90 days) 44 938 49 483<br />

Liquid assets 165 888 13.1 265 679 20.4<br />

Accounts receivable, trade 8 251 345 226 685<br />

Inventories 9 231 920 233 436<br />

Current income taxes 8 576 6 852<br />

Prepayments and accrued income 2 014 3 356<br />

Other receivables 51 431 83 724<br />

Current assets 711 174 56.2 819 732 63.0<br />

Non-current financial assets 10 17 770 18 921<br />

Deferred income taxes 5 31 077 34 841<br />

Property, plant and equipment 11 375 874 325 211<br />

Intangible assets 12 129 184 102 196<br />

Non-current assets 553 905 43.8 481 169 37.0<br />

Total assets 1 265 079 100.0 1 300 901 100.0<br />

Liabilities and shareholders‘ equity<br />

Short-term debt 13 18 735 3<br />

Short-term portion of long-term debt 13 10 331 92 635<br />

Accounts payable, trade 167 387 196 003<br />

Accruals and deferred income 85 686 83 221<br />

Current income taxes due within 1 year 11 946 4 622<br />

Short-term provisions 14 55 947 77 447<br />

Other current liabilities 106 915 88 250<br />

Current liabilities 456 947 36.1 542 181 41.7<br />

Long-term debt 13 25 060 31 556<br />

Long-term provisions 14 9 987 9 235<br />

Current income taxes due after 1 year 624 526<br />

Deferred income taxes 5 18 358 25 738<br />

Long-term employee benefits 15 178 923 174 829<br />

Other non-current liabilities 204 111<br />

Non-current liabilities 233 156 18.4 241 995 18.6<br />

Total liabilities 690 103 54.5 784 176 60.3<br />

Minority interests 11 494 0.9 2 938 0.2<br />

Share capital 16 85 853 110 228<br />

Group reserves 429 828 398 302<br />

Treasury shares and options –5 591 –61 517<br />

Profit for the period attributable to shareholders of Saurer Ltd. 53 392 66 774<br />

Equity attributable to shareholders of Saurer Ltd. 563 482 44.6 513 787 39.5<br />

Shareholders‘ equity 574 976 45.5 516 725 39.7<br />

Total liabilities and shareholders‘ equity 1 265 079 100.0 1 300 901 100.0<br />

* For details see the notes to the consolidated financial statements, pages 54–70. These are an integral part of the consolidated financial statements.<br />

** Restated. For details see page 50.<br />

Consolidated financial statements Saurer 2005

CONSOLIDATED CASH FLOW STATEMENT for the years ended December 31, PAGE 47<br />

(EUR 000) Note* 2005 2004**<br />

Cash flow from operating activities<br />

Profit for the period 55 160 67 368<br />

Income tax expense, including discontinued operations 23 367 27 164<br />

Depreciation and amortization, including discontinued operations 63 918 75 526<br />

Changes in net working capital 17 –39 712 38 023<br />

Gain on sale of fixed assets (net) –290 –12 472<br />

Profit on sale of discontinuing operations – –16 202<br />

Movements in provisions –27 757 –10 573<br />

Other non-cash items 4 708 11 599<br />

Interest expense (net) 9 322 12 889<br />

Interest received 3 760 3 249<br />

Interest paid –4 962 –7 317<br />

Income taxes paid –16 050 –26 080<br />

Cash flow from operating activities 71 464 163 174<br />

Cash flow from investing activities<br />

(Acquisition) divestment of subsidiaries and other equity investments (net) 18 –12 886 82 392<br />

Repayment of loans and other financial assets 3 448 523<br />

Capital expenditure –78 301 – 60 834<br />

Government grants received – 230<br />

Sale (purchase) of marketable securities 8 918 – 45 153<br />

Proceeds from sale of fixed assets 23 704 10 786<br />

Cash flow from investing activities –55 117 –12 056<br />

Cash flow from financing activities<br />

Increase of debt financing 2 751 161<br />

Repayment of debt financing – 26 404 – 16 109<br />

Repayment/repurchase of 2 1 /4% convertible bond 2000–2005 –83 726 –5 499<br />

Dividends to minority shareholders –1 373 –245<br />

Sale (purchase) of treasury shares and options (net) 12 568 –17 610<br />

Capital repayment to the shareholders of Saurer Ltd. – 18 580 –<br />

Cash flow from financing activities –114 764 –39 302<br />

Foreign exchange differences on cash and cash equivalents 3 171 –1 073<br />

Net (decrease) increase in cash and cash equivalents – 95 246 110 743<br />

Cash and cash equivalents as at 01.01. 216 196 105 453<br />

Cash and cash equivalents as at 31.12. 120 950 216 196<br />

Included in the cash flows reported above are the following cash flows from discontinued operations (see Note 6):<br />

Cash flow from operating activities – 8 851<br />

Cash flow from investing activities (including proceeds from divestment) 1 122 87 334<br />

Cash flow from financing activities – –265<br />

* For details see the notes to the consolidated financial statements, pages 54–70. These are an integral part of the consolidated financial statements.<br />

** Restated. For details see page 50.<br />

Consolidated financial statements Saurer 2005

PAGE 48<br />

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY<br />

Capital Foreign currency<br />

Share and legal translation Hedging Treasury shares Retained Minority Total<br />

(EUR 000) capital reserves reserve reserve and options earnings interests equity<br />

Balance as at 01.01.2004 as reported 110 228 110 555 –10 603 6 524 –63 598 314 765 2 720 470 591<br />

Effect of IFRS 2 (Share-based Payment) – – – – – –1 995 – –1 995<br />

Balance as at 01.01.2004 restated 110 228 110 555 –10 603 6 524 –63 598 312 770 2 720 468 596<br />

Movements in cash flow hedges – – – 978 – – – 978<br />

Foreign currency translation – – –4 750 18 – – –104 –4 836<br />

Net income recognized directly in equity – – –4 750 996 – – –104 –3 858<br />

Profit for the period – – – – – 66 774 594 67 368<br />

Total recognized income for 2004 – – –4 750 996 – 66 774 490 63 510<br />

Dividends to minority shareholders – – – – – – –245 –245<br />

2 1 /4% convertible bond 2000–2005 – –521 – – – 521 – –<br />

Changes in structure (minority shareholders) – – – – – – –27 –27<br />

Change in treasury shares and options – –5 417 1 572 – 2 081 –13 345 – –15 109<br />

Balance as at 31.12.2004 110 228 104 617 –13 781 7 520 –61 517 366 720 2 938 516 725<br />

Movements in cash flow hedges – – – –8 523 – – – –8 523<br />

Foreign currency translation – – 11 192 –354 – – 195 11 033<br />

Net income recognized directly in equity – – 11 192 –8 877 – – 195 2 510<br />

Profit for the period – – – – – 53 392 1 768 55 160<br />

Total recognized income for 2005 – – 11 192 –8 877 – 53 392 1 963 57 670<br />

Capital reduction –18 074 – –706 – 200 – – –18 580<br />

Cancelation of share capital –6 301 –36 432 –1 585 – 44 318 – – –<br />

Dividends to minority shareholders – – – – – – –1 373 –1 373<br />

2 1 /4% convertible bond 2000–2005 – –8 000 – – – 8 000 – –<br />

Changes in structure (minority shareholders) – – – – – – 7 966 7 966<br />

Change in treasury shares and options – –15 824 28 – 11 408 16 956 – 12 568<br />