STRATEGIC PLAN,2010–2014 - Kenya Sugar Board

STRATEGIC PLAN,2010–2014 - Kenya Sugar Board

STRATEGIC PLAN,2010–2014 - Kenya Sugar Board

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

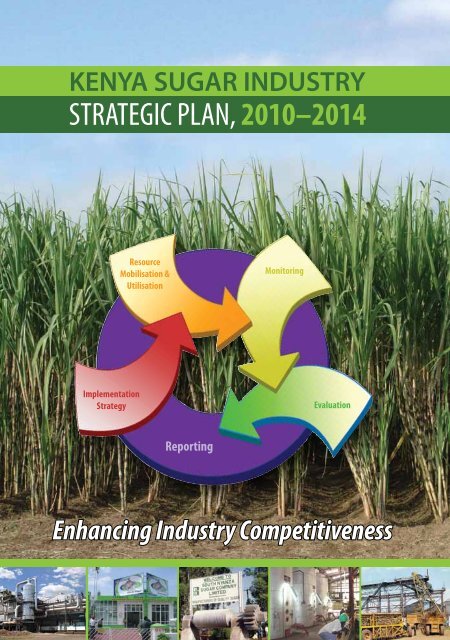

KENYA SUGAR INDUSTRY<br />

<strong>STRATEGIC</strong> <strong>PLAN</strong>, 2010–2014<br />

Implementation<br />

Strategy<br />

Resource<br />

Mobilisation &<br />

Utilisation<br />

Reporting<br />

Monitoring<br />

Evaluation<br />

Enhancing Industry Competitiveness<br />

Strategic Plan, 2010-2014 i

ii<br />

<strong>Kenya</strong> <strong>Sugar</strong> Industry

Table of Contents<br />

Acronyms ......................................................................................................................ii<br />

Foreword ......................................................................................................................iv<br />

Acknowledgements ....................................................................................................v<br />

Executive Summary ...................................................................................................vi<br />

Chapter 1: Introduction<br />

1.1 Historical Background .............................................................................................................1<br />

1.2 Importance of the <strong>Sugar</strong>cane Sector to the Economy................................................................2<br />

1.3 <strong>Sugar</strong> industry Stakeholders .....................................................................................................3<br />

1.4 Scope of Services......................................................................................................................4<br />

1.5 Methodology............................................................................................................................4<br />

Chapter 2: <strong>Kenya</strong>’s Development Agenda and Challenges .................................6<br />

2.1 Attaining Vision 2030 .............................................................................................................6<br />

2.2 Trade Environment for <strong>Kenya</strong>n <strong>Sugar</strong> ......................................................................................8<br />

Chapter 3: Review of the Strategic Plan 2004-2009 ........................................... 12<br />

3.1 Strategic Objectives (2004-2009) ...........................................................................................12<br />

3.2 Achievements.........................................................................................................................12<br />

3.3 Lessons from Plan Implementation ........................................................................................21<br />

3.4 Situational Analysis ................................................................................................................22<br />

Chapter 4: Strategic Plan 2010-2014 .................................................................... 24<br />

4.1 Rationale for the 2010-2014 Strategic Plan............................................................................24<br />

4.2 Vision, Mission and Core Values of the <strong>Sugar</strong> industry ..........................................................24<br />

4.3 Analysis of Challenges along the <strong>Sugar</strong> industry Value Chain.................................................25<br />

4.4 Strategic Goals (2010-2014) ..................................................................................................26<br />

4.5 Strategic Objectives (2010-2014) ...........................................................................................27<br />

Chapter 5: Implementation Strategy and Resource Requirements ................ 40<br />

5.1 Implementation Strategy........................................................................................................40<br />

5.2 Resource Mobilisation and Utilisation....................................................................................42<br />

5.3 Accountability .......................................................................................................................44<br />

5.4 Implementation Risks ............................................................................................................44<br />

Chapter 6: Monitoring, Evaluation and Reporting ............................................. 46<br />

6.1 Monitoring ...........................................................................................................................46<br />

6.2 Evaluation .............................................................................................................................46<br />

6.3 Reporting ..............................................................................................................................47<br />

6.4 Information Sharing ..............................................................................................................47<br />

6.5 Conclusion ............................................................................................................................47<br />

Annexes ...................................................................................................................... 48<br />

Strategic Plan, 2010-2014 iii

iv<br />

ACP African, Caribbean and Pacific Countries<br />

AgGDP Agricultural Gross Domestic Product<br />

AIDS Acquired Immune Deficiency Syndrome<br />

AMS Agricultural Management System<br />

BPO Business Process Outsourcing<br />

CDF Constituency Development Fund<br />

CET Common External Tariff<br />

CFC Common Fund for Commodities<br />

CIF Cost, Insurance and Freight<br />

COMESA Common Market for Eastern and Southern Africa<br />

CSR Corporate Social Responsibility<br />

CSS Customer Satisfaction Surveys<br />

CU Customs Union<br />

EAC East African Community<br />

ERSWEC Economic Recovery Strategy for Wealth and Employment Creation<br />

EU European Union<br />

GDP Gross Domestic Product<br />

GOK Government of <strong>Kenya</strong><br />

HIV Human Immunodeficiency Virus<br />

ICT Information and Communication Technology<br />

ISO International Organisation for Standardization<br />

KARI <strong>Kenya</strong> Agricultural Research Institute<br />

KECATRA <strong>Kenya</strong> Cane Transporters Association<br />

KenGen <strong>Kenya</strong> Electricity Generating Company<br />

KESGA <strong>Kenya</strong> <strong>Sugar</strong> Growers Associations<br />

KESMA <strong>Kenya</strong> <strong>Sugar</strong> Manufacturers Association<br />

KESREF <strong>Kenya</strong> <strong>Sugar</strong> Research Foundation<br />

KIRDI <strong>Kenya</strong> Industrial Research and Development Institute<br />

KPLC <strong>Kenya</strong> Power and Lighting Company<br />

KRB <strong>Kenya</strong> Roads <strong>Board</strong><br />

KSB <strong>Kenya</strong> <strong>Sugar</strong> <strong>Board</strong><br />

KSSCT <strong>Kenya</strong> Society of <strong>Sugar</strong>cane Technologist<br />

LATF Local Authority Transfer Fund<br />

M&E Monitoring and Evaluation<br />

MCI Millennium Cities Initiative<br />

MDG Millennium Development Goals<br />

MoA Ministry of Agriculture<br />

MoASP Ministry of Agriculture Strategic Plan<br />

MoE Ministry of Energy<br />

MoF Ministry of Finance<br />

MoI Ministry of Industrialization<br />

MoLG Ministry of Local Government<br />

MoR Ministry of Roads<br />

MoRDA Ministry of Regional Development Authority<br />

<strong>Kenya</strong> <strong>Sugar</strong> Industry<br />

Acronyms

MoT Ministry of Trade<br />

MoWI Ministry of Water and Irrigation<br />

MT Metric Tonne<br />

MTER Mid Term Evaluation and Review<br />

MTP Medium Term Plan<br />

NTB Non-Tariff Barriers<br />

OGC Outgrowers companies<br />

OTE Overall Time Efficiency<br />

PESTLE Political, Economic, Social, Technological, Legal and Environment<br />

PRSP Poverty Reduction Strategy Paper<br />

PS Permanent Secretary<br />

RRA Rural Roads Authority<br />

SACCO Savings and Credit Cooperatives<br />

SDF <strong>Sugar</strong> Development Fund<br />

SDL <strong>Sugar</strong> Development Levy<br />

SMART Specific, Measurable, Attainable, Realistic, Timed<br />

SMARTEST Specific, Measurable, Attainable, Realistic, Timed, Engaging, Siring, Team<br />

STI Science, Technology and Innovation<br />

SUCAM <strong>Sugar</strong> Campaign for Change<br />

SWOT Strengths, Weaknesses, Opportunities and Threats<br />

TARDA Tana and Athi Regional Development Authority<br />

TCD Tonnes Crushed per Day<br />

TCH Tonnes Crushed per Hour<br />

TNA Training Needs Assessment<br />

USA United States of America<br />

VCC Vale Columbia Center<br />

WTO World Trade Organisation<br />

Strategic Plan, 2010-2014 v

The sugar industry is a major contributor to the agricultural sector which is the mainstay of the<br />

economy and supports livelihoods of at least 25% of the <strong>Kenya</strong>n population. The subsector<br />

accounts for about 15% of the agricultural GDP, is the dominant employer and source of<br />

livelihoods for most households in Western <strong>Kenya</strong> comprising Nyanza, Rift Valley and Western<br />

Provinces.<br />

In 2008/2009, the industry produced close to 520,000 tonnes of sugar operating at 56 percent of the<br />

installed capacity. The industry has the potential of producing over 1 million tonnes of sugar if operated<br />

at 89 percent of the installed capacity. This would meet the domestic needs, currently standing at about<br />

700,000 tonnes, and provide a sustained surplus for export.<br />

By February 2012, the industry will begin operating under a liberalized trade regime after the COMESA<br />

safeguard measures lapse. In such environment, the industry will have to enhance its competitiveness<br />

along the entire value chain and reduce production costs by at least 39% to be in line with EAC partner<br />

states and COMESA sugar producing countries.<br />

At the moment, the industry is facing several challenges including capacity underutilization, lack of<br />

regular factory maintenance, poor transport infrastructure and weak corporate governance. Consequently,<br />

most factories have accumulated large debts amounting KSh. 58 billion. In the new Plan, the industry<br />

will require KSh 51.1 billion. KSh. 15.3 billion will be used to initiate power co-generation projects in<br />

various factories. KSh. 12.8 billion will be used to initiate ethanol production projects. The remaining<br />

KSh. 23 billion will be used to carry out other activities outlined in this Plan.<br />

As a matter of urgency, the Government through the Privatization Commission has appointedTransaction<br />

Advisors to work out the final details for the privatization of all publicly owned factories. Alongside the<br />

privatization, the Government will initiate a programme for financial restructuring of indebted public<br />

factories. This will be in addition to the continued Government support in the development of essential<br />

infrastructure such as roads, irrigation as well as basic research and extension.<br />

The 2010-2014 <strong>Kenya</strong> <strong>Sugar</strong> Industry Strategic Plan is intended to be the basis of facilitating the<br />

transformation required in the sugar subsector. It sets out the framework that will enable the industry<br />

achieve its vision of being ‘a world class multi-product sugarcane industry’ in the next five years. Despite<br />

the challenges the industry faces, this Plan underlines the industry’s commitment of being efficient,<br />

diversified and globally competitive.<br />

It is my hope that the objectives, strategies and activities recommended in this Plan will be implemented<br />

fully to revamp and resuscitate the sugar industry. I am therefore pleased to launch the <strong>Kenya</strong> <strong>Sugar</strong><br />

Industry Strategic Plan 2010-2014.<br />

Hon. William S. Ruto, M.P,<br />

Minister for Agriculture<br />

vi<br />

<strong>Kenya</strong> <strong>Sugar</strong> Industry<br />

Foreword

Acknowledgements<br />

The formulation of the <strong>Kenya</strong> <strong>Sugar</strong> Industry Strategic Plan 2010-2014 comes at a time when<br />

the industry needs to rethink its direction as it approaches the liberalization of the sugar trade<br />

regime in 2012. The industry needs to find ways of repositioning itself competitively. This<br />

would require that the industry goes beyond sugar, think more about sugarcane as a whole and exploit<br />

market opportunities that the broader sugarcane industry provides.<br />

The sugar industry stakeholders have been at the forefront in championing for a better, efficient and<br />

diversified sugarcane industry. It was through their efforts that considerable achievements were realised<br />

in the outgoing plan. It was also due to their participation and concurrence that the formulation and<br />

preparation of the incoming Plan became possible.<br />

First, I wish to thank His Excellency the President of the Republic of <strong>Kenya</strong>, Hon. Mwai Kibaki,<br />

EGH, MP and the Right Honourable Prime Minister of the Republic of <strong>Kenya</strong>, Hon. Raila Amollo<br />

Odinga, MP for their unwavering support for the sugar sub-sector. I am also grateful for the Minister for<br />

Agriculture, Hon. William S. Ruto for his robust support and vision for the development of the sugar<br />

industry.<br />

Secondly, I would like to thank the <strong>Board</strong> members and management team of <strong>Kenya</strong> <strong>Sugar</strong> <strong>Board</strong> for<br />

their invaluable contributions in setting the agenda for the new Plan. Special thanks to Ms. Rosemary<br />

Mkok, Chief Executive Officer, <strong>Kenya</strong> <strong>Sugar</strong> <strong>Board</strong> and her management team for the leadership they<br />

provided in the preparation of this Strategic Plan.<br />

Thirdly, I wish to express my deepest gratitude and appreciation to all industry stakeholders for their<br />

active participation in the preparation of this Strategic Plan.<br />

Lastly, I thank Log Associates consultants for facilitating the review and preparation of this Plan. I am<br />

confident that this Strategic Plan will serve as the industry’s framework for decision making, planning,<br />

resource mobilisation and performance monitoring in the next five years.<br />

Thank you.<br />

Z. Okoth Obado<br />

<strong>Board</strong> Chairman, <strong>Kenya</strong> <strong>Sugar</strong> <strong>Board</strong><br />

Strategic Plan, 2010-2014 vii

viii<br />

Executive Summary<br />

I. Background<br />

The <strong>Kenya</strong>n sugarcane industry is a major employer and contributor to the national economy. <strong>Sugar</strong>cane<br />

is one of the most important crops in the economy alongside tea, coffee, horticulture and maize. By far,<br />

the largest contribution of the sugarcane industry is its silent contribution to the fabric of communities<br />

and rural economies in the sugar belts. Farm households and rural businesses depend on the injection<br />

of cash derived from the industry. The survival of small towns and market places is also dependent on<br />

the incomes from the same. The industry is intricately weaved into the rural economies of most areas in<br />

western <strong>Kenya</strong>.<br />

Besides the socio-economic contributions, the industry also provides raw materials for other industries<br />

such as bagasse for power co-generation and molasses for a wide range of industrial products including<br />

ethanol. Molasses is also a key ingredient in the manufacturing of various industrial products such as<br />

beverages, confectionery and pharmaceuticals.<br />

II. Methodology<br />

In preparing this Strategic Plan, the consultant adopted a participatory and collaborative approach and<br />

methodology comprising Literature Review, Key Informants Interviews (KII), Focused Group Discussions<br />

(FDGs) and Stakeholder Consultative Workshops. Consultations were held with industry stakeholders in<br />

structured discussions as well as personal interviews with key informants. The consultant also held a validation<br />

workshop and discussed the recommendations of the Draft Strategic Plan 2010-2014. The validation workshop<br />

was attended by board members and management team of the <strong>Kenya</strong> <strong>Sugar</strong> <strong>Board</strong>.<br />

III. Structure of the Report<br />

This Plan is set out in six chapters. After an introduction in chapter one, <strong>Kenya</strong>’s Development Agenda<br />

and Challenges is outlined in chapter two followed by a review of the 2004-2009 Strategic Plan in chapter<br />

three. The proposed Strategic Plan 2010-2014 is discussed in chapter four. Implementation Strategy<br />

and Resource Requirements is presented in chapter five. The document concludes with a discussion on<br />

Monitoring, Evaluation and Reporting in chapter six.<br />

IV. 2004-2009 Strategic Plan Review Findings<br />

A review of the 2004-2009 Strategic Plan showed that:<br />

1. The Plan goals of creating a world class sugar industry were ambitious and had not been<br />

realized, having been set at a time when the industry was still a high cost producer<br />

2. The consumption-production gap still persists and growing, delaying the industry’s goal of<br />

being a net exporter<br />

3. Yield levels declined from a modest yield level of 73 tonnes per hectare to about 70 tonnes<br />

per hectare over the last five years.<br />

4. Farmer support services provided by outgrower institutions and contractors were inadequate<br />

in quality and timeliness including seed cane, fertilizer supplies, and cane harvesting and<br />

transportation.<br />

<strong>Kenya</strong> <strong>Sugar</strong> Industry

5. Most the factories, that are the backbone of the industry were struggling in debt and were<br />

unable to maintain effective crushing capacity, carry out routine maintenance and essential<br />

rehabilitation and pay farmers on time.<br />

6. Funding to the industry was inadequate to meet infrastructural development needs such as<br />

irrigation, roads, research and factories modernization<br />

7. The safeguards that were put in place to protect the industry including COMESA region<br />

quotas and taxes had many loopholes<br />

8. Governance in many of the industry institutions including outgrower institutions and<br />

publicly owned factories continued to be a big challenge<br />

Overall, even though the goals of the 2004-2009 Strategic Plan were ambitious, the Plan instrument<br />

assisted in getting the industry stakeholders to seek a common ground for the good of the industry.<br />

V. The 2010-2014 Strategic Plan<br />

Rationale for the Plan<br />

The <strong>Kenya</strong> <strong>Sugar</strong> Industry Strategic Plan for 2010-2014 provides a road map of how the industry intends<br />

to be a “world class multi-product sugarcane industry.” To enable the Government achieve its strategic<br />

objectives of being a middle-income country by the year 2030, this revised strategic plan aims at making<br />

the industry more efficient, diversified and globally competitive to contribute to the overall objective<br />

outlined in the Agricultural Sector Development Strategy (2009-2020) and the <strong>Kenya</strong> Vision 2030.<br />

The Plan provides a framework for setting goals, defining key actions, and mobilizing resources for<br />

funding programmes in the industry. It is a unifying instrument at the strategic level for industry<br />

stakeholders, who otherwise are autonomous operators. It lays the ground for enhanced performance of<br />

the sugar industry premised on a rational utilization of all resources in the sector.<br />

Vision<br />

The new vision for the industry is to be ‘a world-class multi-product sugarcane industry’.<br />

Mission<br />

The new mission of the industry is to ‘facilitate a multi-product sugarcane industry that is efficient,<br />

diversified and globally competitive’ through: enhanced industry’s competitiveness through cost reduction<br />

strategies and efficiency improvements, expanded product base, improved infrastructure and strengthened<br />

regulatory framework.<br />

Strategic Goals<br />

The formulation of this Plan came at a time when the industry needs to rethink its direction as it<br />

approaches the liberalization of the sugar trade regime in 2012. The industry needs to find ways of<br />

repositioning itself competitively. This would require that the industry goes beyond sugar, think more<br />

about sugarcane as a whole, and exploit market opportunities presented by multiple sugarcane products.<br />

This Plan will therefore put new pressure on the industry to find and invest resources in the new direction<br />

where the industry needs to go. In the light of the above, the 2010-2014 Strategic Plan is intended to<br />

seek a more limited but achievable set of goals. The stakeholders have identified and endorsed four<br />

strategic goals.<br />

1. Enhancing Competitiveness in the industry in order to transform it to a leaner, lower cost industry<br />

that can take on its competitors through:<br />

Strategic Plan, 2010-2014 ix

x<br />

n Reduction in farm level risks<br />

n Efficient, reliable harvesting and transport operations<br />

n Effective, efficient, milling operations<br />

n Enhanced human resource capacity<br />

n Streamlined corporate governance<br />

2. Expanding the product base to take advantage of opportunities created in the production process<br />

and increase factory profitability through value addition and product diversification by:<br />

n Initiating power co-generation projects<br />

n Initiating ethanol production projects<br />

n Producing industrial sugar and alcohol<br />

n Encouraging intensification to increase food security<br />

3. Investing more in infrastructure by:<br />

n Improving road transport<br />

n Investing in irrigation<br />

n Investing in and promoting the use of ICT<br />

n Increasing funding in Research and Development<br />

n Modernisation of mills<br />

4. Strengthening the policy, institutional and legal environment by:<br />

n Improving the management of the sugar import policy<br />

n Strengthening Corporate Governance<br />

n Finalising and implementing the <strong>Sugar</strong> Regulations<br />

n Finalising the implementation of the privatisation programme<br />

n Establishing a coordination mechanism for roads maintenance in the sugar zones<br />

n Supporting measures to develop a comprehensive policy on co-generations and exploitation<br />

of bio-fuels and other sugarcane products<br />

VI. Implementation Strategy and Resource Requirements<br />

Reporting the progress of implementation will be critical in adjusting strategic directions and measuring<br />

performance. Progress reports will be made on quarterly basis. The reports will outline in summary<br />

form projected targets, achievements, facilitating factors and challenges. The reports will be prepared<br />

and submitted by UCs to the SRF where a summary report will be prepared and submitted to the MC<br />

for review. Issues that will require policy interventions will be forwarded to the NICC through the KSB<br />

<strong>Board</strong>.<br />

<strong>Kenya</strong> <strong>Sugar</strong> Industry

1.1 Historical Background<br />

Chapter<br />

Introduction<br />

Industrial sugarcane farming was introduced in <strong>Kenya</strong> in 1902. The first sugarcane factory was set-up<br />

at Miwani 10km north of Kisumu in 1922 and later at Ramisi in the Coast Province in 1927. After<br />

independence, the Government explicitly expanded its vision of the role and importance of the sugar<br />

industry as set out in Sessional Paper No 10 of 1965 which sought, inter alia, to:<br />

n Accelerate socio-economic development<br />

n Redress regional economic imbalances<br />

n Promote indigenous entrepreneurship<br />

n Promote foreign investment through joint ventures<br />

In pursuit of the above goals, the Government established five additional factories in the 1960s and<br />

1970s: Muhoroni (1966), Chemelil (1968), Mumias (1973), Nzoia (1978), and South Nyanza (1979).<br />

Later, several more were to come on stream: West <strong>Kenya</strong> (1981), Soin <strong>Sugar</strong> Factory (2006) and Kibos<br />

<strong>Sugar</strong> & Allied Industries (2007), bringing the total number of milling companies to ten (10). The two<br />

older factories ceased operations: Ramisi sugar factory collapsed in 1988 and Miwani sugar factory was<br />

put under receivership.<br />

The establishment of the publicly owned factories was predicated on the need to:<br />

n Achieve self sufficiency in sugar with a surplus for export in a globally competitive market<br />

n Generate gainful employment and create wealth<br />

n Supply raw material for sugar related industries<br />

n Promote economic development in the rural economy and beyond through activities linked<br />

to the sugar industry<br />

In support of the above goals, the Government invested heavily in sugar factories, holding about 83% of<br />

the equity, later reduced to 70% after it divested 36% of its interest in Mumias <strong>Sugar</strong> Company. These<br />

resource injections into the subsector were in addition to the resources from the <strong>Sugar</strong> Development<br />

Fund (SDF), set up in 1992, that has contributed about KSh. 11 billion into the industry for cane<br />

development, factory rehabilitation, research and infrastructure development.<br />

These investments did not, however, help achieve the self-sufficiency in sugar as consumption continued<br />

to outstrip production. Total sugar production grew from 368,970 tonnes in 1984 to 520,000 tonnes<br />

in 2008 leaving <strong>Kenya</strong> a net importer of sugar with imports rising from 4,000 to 220,000 tonnes over<br />

the same period. The deficit is being met through imports from the COMESA region and other sugar<br />

producing countries including Brazil, United Kingdom and Mexico. Figure 1.1 shows production and<br />

consumption status since 2001.<br />

In 2003, the Government set up a Task Force on the <strong>Sugar</strong> Industry Crisis 1 whose objective was to<br />

examine the problems facing the sugar subsector and make recommendations for revitalizing the industry.<br />

1 Otherwise known as the Amayo Task Force Report dated 1st July 2003<br />

1<br />

Strategic Plan, 2010-2014 1

Following the Task Force’s recommendations, the Government made the following decisions:<br />

(a) Made changes in the management of all publicly owned milling companies with a view to<br />

improving corporate governance<br />

(b) Reduced lending rates on SDF loans from 10% to 5%<br />

(c) Wrote off KSh. 4.7 billion on accrued interest and penalties on SDF loans<br />

(d) Disbursed KSh. 800 million towards settling arrears owed by milling companies to farmers<br />

(e) Increased research funding from the <strong>Sugar</strong> Development Levy by (SDL) doubling the<br />

allocation from 0.5% to 1%<br />

(f) Successfully negotiated for a four-year COMESA safeguard to give the industry time to<br />

restructure and become globally competitive<br />

2<br />

Tonnes (x10000)<br />

80<br />

60<br />

40<br />

20<br />

0<br />

2001<br />

Fig. 1.1: <strong>Sugar</strong> Production, Consumption, Imports and Exports Trends<br />

Concurrent with the structural reforms the Government was implementing, the industry continued to<br />

expand its processing capacity: <strong>Kenya</strong> <strong>Sugar</strong> <strong>Board</strong> (KSB) registered three new mill white sugar factories,<br />

namely: Butali, Kwale International <strong>Sugar</strong> Co. Ltd and Trans Mara <strong>Sugar</strong> Companies with a combined<br />

potential capacity of 5,000 TCD. It is also expected that an additional mill would be established in the<br />

Tana River basin, with a potential capacity of 9,000 TCD. With the operationalisation of these new<br />

factories and the upgrading of the existing mills, the industry’s capacity would be close to 38,000 TCD,<br />

which would result in a production of about 1 million tonnes of sugar per annum.<br />

Apart from the regular sugar mills, there are four licensed and operational jaggery millers, namely:<br />

Lubao, Shajanand, Farm Industries and Homa Lime Jaggeries, who have a combined capacity of about<br />

300 TCD. There are also in excess of three hundred informal and mostly mobile jaggeries, each of which<br />

crushes between 3-35 tonnes of sugarcane per day.<br />

1.2 Importance of the <strong>Sugar</strong>cane Sector to the Economy<br />

The <strong>Kenya</strong>n sugarcane industry is a major employer and contributor to the national economy. It is<br />

one of the most important crops alongside tea, coffee, horticulture and maize. Currently, the industry<br />

directly supports approximately 250,000 small-scale farmers who supply over 92 percent of the cane<br />

milled by the sugar companies. An estimated six million <strong>Kenya</strong>ns derive their livelihoods directly or<br />

<strong>Kenya</strong> <strong>Sugar</strong> Industry<br />

2002 2003 2004 2005<br />

Year<br />

2006 2007 2008<br />

Production Consumption Imports Exports

indirectly from the industry. In 2008, the industry employed about 500,000 people directly or indirectly<br />

in the sugarcane business chain from production to consumption. In addition, the industry saves <strong>Kenya</strong><br />

in excess of USD 250 million (about KSh. 19.3 billion) in foreign exchange annually and contributes<br />

tax revenues to the exchequer (VAT, Corporate Tax, personal income taxes, cess). In the sugarbelt<br />

zones, the sugar industry contributes to infrastructure development through road construction and<br />

maintenance; construction of bridges; and to social amenities such as education, health, sports and<br />

recreation facilities 2,3 .<br />

The sugarcane industry provides raw materials for other industries such as bagasse for power cogeneration<br />

and molasses for a wide range of industrial products including ethanol. Molasses is also a<br />

key ingredient in the manufacturing of various industrial products such as beverages, confectionery and<br />

pharmaceuticals.<br />

By far, the largest contribution of the industry is its silent contributions to the fabric of communities and<br />

rural economies in the sugarcane belt. Farm households and rural businesses depend on the injection<br />

of cash derived from sugarcane. The survival of small towns and market places is also dependent on the<br />

incomes from the same. The industry is intricately weaved into the rural economies of most areas in<br />

Western <strong>Kenya</strong>.<br />

1.3 <strong>Sugar</strong> industry Stakeholders<br />

The <strong>Kenya</strong> <strong>Sugar</strong> industry has a wide range of stakeholders, each with a role to play.<br />

(i) The Government of <strong>Kenya</strong> (GoK)<br />

The Government of <strong>Kenya</strong> (GoK) through the Ministry of Agriculture (MoA) has the overall<br />

responsibility for the industry’s development. The GoK has a role of supporting the industry through<br />

regulation, enhancement of competition and fairplay, and provision of an enabling environment for all<br />

stakeholders. Currently, the GoK is the largest shareholder in the industry.<br />

(ii) The <strong>Kenya</strong> <strong>Sugar</strong> <strong>Board</strong> (KSB)<br />

The <strong>Kenya</strong> <strong>Sugar</strong> <strong>Board</strong> (KSB) is a public body set up by the <strong>Sugar</strong> Act, 2001, under the Ministry of<br />

Agriculture. The <strong>Board</strong> is mandated to:<br />

i. Regulate, develop and promote the sugar industry<br />

ii. Co-ordinate the activities of individuals and organisations in the industry<br />

iii. Facilitate equitable access to the benefits and resources of the industry by all interested<br />

parties<br />

(iii) <strong>Kenya</strong> <strong>Sugar</strong> Research Foundation (KESREF)<br />

The <strong>Kenya</strong> <strong>Sugar</strong> Research Foundation (KESREF) established in 2001, is the scientific wing of the<br />

industry mandated to develop and transfer appropriate technology in the sugar sub-sector. It also<br />

carries out socio-economic studies to enhance the development of sugar as a commercial business.<br />

The Foundation is funded mainly through grants from the <strong>Sugar</strong> Development Fund (SDF). It has its<br />

headquarters in Kibos, Kisumu with sub-stations in Mumias, Mtwapa and Opapo.<br />

2 Bracing for COMESA: <strong>Kenya</strong>n <strong>Sugar</strong> industry, Mumias <strong>Sugar</strong> Company Bulletin 2008<br />

3 <strong>Kenya</strong> <strong>Sugar</strong> <strong>Board</strong> Strategic Plan (2008-2012) and Year Book of Statistics (2008)<br />

Strategic Plan, 2010-2014 3

(iv) Cane Growers/Outgrower Institutions<br />

<strong>Sugar</strong>cane farmers (outgrowers) supply 92% of the cane milled. A large number of institutions including<br />

Outgrower Institutions, Societies, Unions and SACCOs represent these farmers. The role of these<br />

institutions is to promote, represent and protect the interest of the farmers. The institutions operate<br />

under the <strong>Kenya</strong> <strong>Sugar</strong>cane Growers Association (KESGA).<br />

(v) Cane Transporters<br />

Cane transporters are responsible for provision of cane transportation services in the industry.Transporters<br />

operate under the <strong>Kenya</strong> Cane Transporters Association (KECATRA).<br />

(vi) Millers/Jaggeries<br />

The role of the millers is to make fair return on investment through efficient operation of the sugar mills<br />

or jaggeries for the production of sugar and other products for sale and making timely payments to cane<br />

growers. The millers operate under an apex institution known as the <strong>Kenya</strong> <strong>Sugar</strong> Manufacturers Association<br />

(KESMA). Millers are a critical node in the sugarcane industry because of the role they play in value addition.<br />

The profitability and hence strength of the industry depends on how efficiently they operate.<br />

(vii) Other Industry Stakeholders<br />

Other industry stakeholders include:<br />

n Importers<br />

n Financial institutions<br />

n Consumers<br />

n Special interest groups<br />

• <strong>Kenya</strong> Society of <strong>Sugar</strong>cane Technologist (KSSCT)<br />

• <strong>Sugar</strong> Campaign for Change (SUCAM)<br />

1.4 Scope of Services<br />

The scope of services outlined in the Terms of Reference for the preparation of the 2010-2014 Strategic<br />

Plan, were as follows:<br />

i. Review the current strategic plan and other relevant documentation which shall include, but<br />

not limited to the National Vision 2030; the Ministry of Agriculture Strategic Plan 2006-<br />

2010; the <strong>Sugar</strong> Act 2001; Guidelines for the preparation of strategic plans 2008-2010 from<br />

the office of the Prime Minister, Ministry of State for Planning, National Development and<br />

Vision 2030; and prepare a critique of issues for consideration<br />

ii. Conduct a stakeholders’ workshop to collect views on possible amendment to the current<br />

document<br />

iii. Arising from (1) and (2) above, prepare a draft industry strategic plan 2010-2014<br />

iv. Conduct a workshop for the <strong>Board</strong> and Management Team to take them through the draft<br />

industry strategic plan 2010-2014<br />

v. Prepare a final draft to be presented to the <strong>Board</strong>, Management Team and sugar<br />

stakeholders<br />

vi. Prepare and present the final document<br />

1.5 Methodology<br />

In reviewing the strategic plan, the consultant adopted a participatory and collaborative approach<br />

comprising Literature Review, Key Informant Interviews (KII), Focused Group Discussions (FDGs) and<br />

Stakeholder Consultative Workshops.<br />

4<br />

<strong>Kenya</strong> <strong>Sugar</strong> Industry

1.5.1 Literature Review<br />

The consultant reviewed a wide range of published materials and documents in the course of<br />

the assignment, including:<br />

i. <strong>Kenya</strong> <strong>Sugar</strong> Industry Strategic Plan (2004-2009)<br />

ii. <strong>Kenya</strong> <strong>Sugar</strong> <strong>Board</strong> Strategic Plan (2008-2012)<br />

iii. <strong>Kenya</strong> Vision 2030, A Globally Competitive and Prosperous <strong>Kenya</strong><br />

iv. Sessional Paper of 2008 on Revitalisation of <strong>Sugar</strong> industry (March 2008)<br />

v. Agriculture Sector Development Strategy (2009-2020)<br />

vi. Economic Recovery Strategy for Wealth and Employment Creation<br />

vii. Report of the Task Force on <strong>Sugar</strong> industry Crisis, 1 st July 2003<br />

viii. Guidelines for Preparation of Vision 2030 based Strategic Plans<br />

ix. Report on Cost of Cane and <strong>Sugar</strong> Production (KSB, 2006, 2007)<br />

x. Year Book of <strong>Sugar</strong> Statistics (KSB, 2008)<br />

xi. <strong>Kenya</strong> <strong>Sugar</strong> industry Report (EPZA, 2005)<br />

xii. Working Papers (Millennium Cities Initiative & Vale Columbia Center, 2008)<br />

xiii. National Policy on <strong>Sugar</strong> industry (GoK, April 2001)<br />

xiv. National <strong>Sugar</strong> Conference Report (October, 2004)<br />

xv. Economic Governance Reform in the <strong>Sugar</strong> Subsector (February, 2005)<br />

xvi. Energy Act, 2006<br />

xvii. Various internet sources<br />

1.5.2 Stakeholder Consultative Workshops<br />

The consultant held two stakeholder consultative workshops in Kisumu. The first workshop<br />

was held on 21 and 22 May 2009. The second workshop was held on 17 June 2009. The<br />

workshops’ participants comprised representatives of Outgrower Institutions (OGIs), Millers,<br />

Transporters, Cane Researchers, Universities, Ministry of Agriculture, KESREF and <strong>Kenya</strong><br />

<strong>Sugar</strong> <strong>Board</strong>. These workshops were used as discussion forums to gather information on key<br />

issues affecting the industry and the way forward.<br />

1.5.3 Debriefing Workshops<br />

The consultant conducted three debriefing workshops. The first workshop was held on 10 July<br />

2009 with the management team of the <strong>Kenya</strong> <strong>Sugar</strong> <strong>Board</strong>. The second and third workshops<br />

were held on 27 July 2009 and 14 August 2009 respectively with the <strong>Board</strong> and Management<br />

Team of KSB. The comments and suggestions from the three debriefing workshops have been<br />

incorporated in this report.<br />

Strategic Plan, 2010-2014 5

6<br />

<strong>Kenya</strong> <strong>Sugar</strong> Industry<br />

Chapter<br />

2<br />

<strong>Kenya</strong>’s Development Agenda<br />

and Challenges<br />

2.1 Attaining Vision 2030<br />

<strong>Kenya</strong>’s medium and long-term development agenda is set out in the <strong>Kenya</strong> Vision 2030. The Vision is<br />

built on the foundation of the Economic Recovery Strategy for Wealth and Employment Creation (ERWEC)<br />

2003-2007. It is the country’s new development blueprint covering the period 2008-2030. The vision<br />

aims to transform <strong>Kenya</strong> into a newly industrialising, middle-income country providing a high quality life<br />

to all its citizens in a clean and secure environment by the year 2030. The Vision is also expected to be<br />

a major vehicle for the realisation of the Millennium Development Goals (MDGs). The vision is based<br />

on three pillars: the economic, the social and the political. These pillars are anchored on macroeconomic<br />

stability; continuity in governance reforms; enhanced equity and wealth creation opportunities for the<br />

poor; infrastructure; energy; science, technology and innovation (STI); land reform; human resources<br />

development; security as well as public sector reforms. The sugar industry will contribute to the<br />

attainment of three pillars through various interventions discussed below:<br />

2.1.1 Economic Pillar<br />

The economic pillar aims to attain an average Gross Domestic Product (GDP) growth rate of<br />

ten per cent (10 %) per annum and sustain it to 2030. The programs envisaged to move the<br />

economy up the value chain are tourism, agriculture, wholesale and retail trade, manufacturing,<br />

business process outsourcing and financial services. The sugarcane industry will play a key role<br />

in the attainment of the goals set for the programmes in agriculture and manufacturing; and<br />

to benefit substantially from programmes envisaged in the wholesale and retail, and financial<br />

services programmes.<br />

Agricultural Sector: The sugarcane industry already accounts for about 15% of agricultural GDP. In<br />

the Vision 2030, <strong>Kenya</strong> aims to build an agricultural sector that is innovative, business oriented and<br />

modern through:<br />

n Transforming key institutions to promote agricultural growth<br />

n Increasing productivity in the sector<br />

n Land policy and land use reforms<br />

n Expanding irrigation in arid and semi-arid lands<br />

n Improving market access for smallholders through better supply chain management<br />

Torealisetheaboveobjectives,theVisionhasidentifiedsevenflagshipprojectsforimplementation<br />

by the year 2012. Three of the projects that are relevant to the sugar subsector include irrigation<br />

development along the Tana River Basin; development and implementation of a 3-tiered fertilizer<br />

cost reduction programme; and development of an Agriculture land use Master Plan.

Wholesale and Retail Trade: The 2030 vision for wholesale and retail trade is to move<br />

towards greater efficiency in the country’s marketing system by lowering transaction costs<br />

through institutional reforms. This involves strengthening informal trade (through investment<br />

in infrastructure, training and linking it to wider local and global markets). This is expected<br />

to raise the market share of products (including sugar and co-products) sold through normal<br />

channels such as supermarkets from 5% to 30% by 2012. The envisaged flagship projects<br />

such as creation of wholesale hubs, building of retail markets and a free trade port are market<br />

opportunities that will be exploited by the sugar industry in the incoming planning period.<br />

Manufacturing Sector: <strong>Kenya</strong> aims to have a robust, diversified and competitive manufacturing<br />

sector through:<br />

n Restructuring local industries that use local materials but are currently uncompetitive e.g<br />

sugar and paper manufacturing<br />

n Exploiting opportunities in value addition to local agricultural produce<br />

n Adding value to intermediate imports<br />

With fuller exploitation of forward linkages in the value chain, the industry has an opportunity<br />

to increase significantly its contribution to the manufacturing sector.<br />

Financial Sector: The 2030 vision for financial services is to create a vibrant and globally<br />

competitive financial sector in <strong>Kenya</strong>. The sector is expected to create jobs and promote high<br />

levels of savings to finance investment needs. One of the most urgent steps towards creating a<br />

competitive financial environment in <strong>Kenya</strong> is introducing legal and institutional reforms that<br />

will enhance transparency in all transactions, build trust and make enforcement of justice more<br />

efficient. This will be achieved by:<br />

n Undertaking legal and institutional reforms to make <strong>Kenya</strong> more competitive as a financial<br />

centre<br />

n Consolidation of banks to make them larger and stronger<br />

n Introduction of credit referencing<br />

n Strengthening informal and micro-finance institutions and SACCOs<br />

n Deepening financial markets by raising institutional capital through pension funds,<br />

expanding bond and equity markets as well as tapping external sources of capital<br />

The reforms are also expected to strengthen the regulatory and oversight authority which<br />

in turn will help increase investor confidence in the economy and thus increase investment<br />

opportunities in the sugarcane sector as well. Increased investment in the sector will lead to<br />

higher production of sugar and co-products, which will then contribute to the realisation of<br />

the envisaged 10% GDP growth rate.<br />

To fully utilize the potential in the sugarcane industry, some essential reforms have been<br />

identified in the Agricultural Sector Development Strategy 2009-2020 to complement the<br />

broad reforms envisaged under Vision 2030, these include:<br />

n Land reforms to reduce inequality and increase intensification<br />

n Improving efficiencies in the supply chain e.g. enhancing access to input markets, raising<br />

cane yields, reducing post-harvest losses and upgrading factory capacity<br />

n Increasing access to credit facilities particularly for farmers<br />

n Increasing value addition by more processing and product diversification<br />

n Strengthening corporate governance in the sugarcane industry<br />

Strategic Plan, 2010-2014 7

8<br />

2.1.2 Social Pillar<br />

The social component addresses issues of equity and social justice; national cohesion, security<br />

and environmental concerns. It lays great emphasis on the development of education and<br />

training, better healthcare, improved water and sanitation, sustainable and better environmental<br />

management as well as vital national attention to gender equity, youth, vulnerable groups,<br />

housing, and poverty reduction.<br />

Developments envisaged in the social pillar will be important in providing opportunities for<br />

social safety nets and greater mobility in the social space. The sugar industry will contribute<br />

significantly to the social development through provision of employment opportunities and<br />

wealth creation in the rural areas of <strong>Kenya</strong>. As a social tool, a vibrant sugar industry will act<br />

as a catalyst for raising the standards of living in various rural households through direct and<br />

indirect incomes. The sugar industry will also contribute to the realisation of the goals of<br />

the social pillar through its corporate responsibility activities in health, education, water and<br />

sanitation, and recreation activities.<br />

2.1.3 Political Pillar<br />

The political component aims to realise a democratic political system predicated on greater<br />

economic and political devolution, respect for the rule of law, and protection of rights and<br />

freedoms for all citizens. Under this component, <strong>Kenya</strong>’s development agenda is to improve<br />

accountability, reduce impunity and begin the real fight against corruption, and thus promote<br />

efficiency in the governance and management of public affairs. Good corporate governance<br />

in the sugar industry is essential in order to create a climate of fairness, transparency and<br />

accountability especially now when major decisions are needed to make the industry leaner,<br />

efficient and more competitive.<br />

2.2 Trade Environment for <strong>Kenya</strong>n <strong>Sugar</strong><br />

2.2.1 Global Trade Environment and Obligations<br />

In the last two decades, the world has witnessed rapid economic growth and expansion of trade,<br />

driven primarily by emerging Asian Tiger economies. The rapid and continued strong growth<br />

in China and India will further put upward pressure on prices of crude oil. This will continue<br />

to cause major challenges to <strong>Kenya</strong>’s sugar industry that is significantly dependent on fossil<br />

fuel for cane transportation. In addition, there is evidence to suggest that financial market<br />

challenges in the United States of America (USA) and Europe, are affecting global markets<br />

thus impacting negatively on <strong>Kenya</strong>’s trade performance in goods and services. The overall<br />

effect of the credit crunch will be felt in terms of reduced purchasing power of foreign buyers<br />

of <strong>Kenya</strong>n goods, and lower domestic access to credit, grants, and donor support. Capital<br />

markets will also be more concerned at the likely impact of reducing global trade flows on the<br />

creditworthiness of countries like <strong>Kenya</strong>.<br />

The European Commission (EU) trading block, despite cutting prices by 36%, will still be an<br />

attractive sugar export destination. At an average price of 22 cents per pound, the EU price is<br />

still 4 cents above the open trade price.<br />

International competition from low cost sugar producers is a big challenge to the local sugar<br />

industry. The average cost of sugar production in 2006/07 in <strong>Kenya</strong> was KSh. 42,192 (USD<br />

680) per tonne. The world average cost of production for the same is USD 263 per tonne. As<br />

a result, importers view <strong>Kenya</strong> as an attractive market. <strong>Kenya</strong> needs to bring its cost structure,<br />

<strong>Kenya</strong> <strong>Sugar</strong> Industry

productivity and quality control to levels comparable to those of its competitors in order to<br />

exploit the opportunities availed by the global market.<br />

<strong>Kenya</strong>’s is a signatory to World Trade Organization (WTO), the Cotonou Partnership<br />

Agreements (ACP-EU), COMESA Free Trade Agreement and the East African Community<br />

Customs Union. <strong>Sugar</strong> imports and exports are affected by what happens in these trade<br />

regimes.<br />

2.2.2 COMESA and East African Community Customs Union Obligations<br />

The <strong>Kenya</strong>n sugar industry is protected by COMESA safeguard measures. The safeguards were<br />

first granted in 2004 and were to expire in February 2008. Despite the remarkable progress<br />

made during the safeguard period, the industry was not ready for an open trade regime in<br />

sugar. <strong>Kenya</strong> therefore sought and was granted an additional four years of protection from<br />

March 2008 to February 2012, with a declining tariff and an increasing quota (Table 2.1).<br />

Table 2.1: COMESA Import Quota<br />

Year Quota (tonnes) Tariff Rate (%)<br />

2008/09 220,000 100<br />

2009/10 260,000 70<br />

2010-2014/11 300,000 40<br />

2011/12 340,000 10<br />

1 March 2012 Open market 0<br />

The extension was granted subject to certain conditions, including:<br />

i. Rising sugar import quota in tandem with a declining tariff as shown in Table 2.1<br />

ii. The Government adopts a privatization plan within the first 12 months and takes<br />

verifiable steps to privatize the remaining publicly owned factories by 2011<br />

iii. The industry to implement cane payment system based on sucrose content instead of<br />

weight<br />

iv. The Government adopts an energy policy aimed at promoting co-generation and<br />

other forms of bio-fuel production that will contribute to making the industry more<br />

competitive<br />

v. <strong>Kenya</strong> <strong>Sugar</strong> <strong>Board</strong> (KSB) to increase funding for research on high yielding and early<br />

maturing varieties and spearhead its dissemination by farmers<br />

vi. The Government to increase funding for road infrastructure<br />

vii. The Government to submit twice yearly performance reports to the COMESA Council<br />

on all measures, activities and improvements on the sugar sector’s competitiveness<br />

<strong>Sugar</strong> prices in <strong>Kenya</strong> need to drop by at least 39% to be in line with COMESA levels. Such<br />

a price drop in less than 3 years is drastic and requires major cost reduction strategies for the<br />

industry. Although there are eight sugar mills in production, industry sources indicate that<br />

only West <strong>Kenya</strong>, Mumias and Kibos & Allied Industries would survive if the safeguards were<br />

to be lifted now because they can produce sugar at costs similar to other COMESA countries.<br />

These factories are equipped with modern facilities that can process sugarcane efficiently 4 .<br />

4 KSB (2008), Cost of Cane and <strong>Sugar</strong> Production and Personal Interviews<br />

Strategic Plan, 2010-2014 9

10<br />

Table 2.2: Cost of <strong>Sugar</strong> Production in COMESA and Selected EAC countries<br />

<strong>Kenya</strong> <strong>Sugar</strong> Industry<br />

Country Cost USD/ tonne<br />

<strong>Kenya</strong> 415-500<br />

Sudan 250-340<br />

Egypt 250-300<br />

Swaziland 250-300<br />

Zambia 230-260<br />

Malawi 200-230<br />

Uganda 140-180<br />

Tanzania 180-190<br />

While Tanzania is not a member of COMESA, Uganda is not a signatory to the COMESA<br />

Free Trade Agreement. Consequently, the two countries can and do import sugar from outside<br />

COMESA. These sugars find their way into <strong>Kenya</strong> through Informal Cross Border Trade<br />

(ICBT), which poses an unfair competition to the local sugar producers. Similar problems also<br />

occur through transhipment of sugar via other COMESA countries (such as Egypt) from non-<br />

COMESA countries (such as Brazil).<br />

The East African Community (EAC) commenced implementation of a common customs<br />

union in 2005. The Customs Union encompasses the removal of internal tariffs, application<br />

of a Common External Tariff (CET) and elimination of Non-tariff barriers (NTB). The CET<br />

applies zero tariff rates for raw materials, 10% for intermediate goods and 25% for finished<br />

products. Whilst this is a welcome move, it is worth noting that within the EAC, the cost<br />

of sugar production is lowest in Uganda followed by Tanzania then <strong>Kenya</strong>. The practical<br />

consequence is that even within the EAC; a duty free movement of sugar would imply that<br />

Uganda and Tanzania producers would pose a challenge to their <strong>Kenya</strong>n counterparts. The<br />

EAC Customs Union also include Burundi and Rwanda who are also members of the EAC.<br />

Ultimately, the custom union might include Southern Sudan and the Democratic Republic of<br />

the Congo in future. Therefore, it is necessary that domestic production be more efficient and<br />

competitive and internal prices be realigned with regional levels for the industry is to survive<br />

the anticipated regional sugar trade liberalization.<br />

2.2.3 National Challenges<br />

The country is facing a monumental task of overcoming poverty: 56% of the population lives<br />

below the poverty line; an unemployment rate in excess of 40%, compounded by an increasing<br />

number of youths leaving school who are looking for white-collar jobs. These problems are<br />

exacerbated by high inequality in income and asset distribution and a deteriorating gender<br />

inequality. The pressure to create jobs in the economy is therefore very high and the sugar<br />

industry is expected to play a significant role.<br />

These adverse trends have led to considerable disparities in development among the<br />

different regions of the country, which is posing a serious challenge to national cohesion and<br />

development. In addition, insecurity in neighbouring Somalia coupled with homegrown<br />

criminality, including the emergence of organized gangs and militia and availability of illegal<br />

firearms have combined to create an adverse investment climate and have put considerable<br />

pressure on state resources.

The state of infrastructure is unsatisfactory in terms of adequacy and quality because of years<br />

of deferred maintenance. Roads in particular, require a major effort for rehabilitation and<br />

maintenance; irrigation infrastructure has stagnated at very low levels since the 1970s – the<br />

share of irrigated agricultural output is less than 10% of AgGDP. The limited use of irrigation<br />

has increased farm level risks and hindered a sustainable increase in yields. The infrastructure<br />

problems are likely to persist unless there is a clear plan and programme of implementation<br />

over the medium and long-term. For the sugar industry, the process of seeking to build a<br />

competitive industry will be impeded by an inadequate and poor quality infrastructure.<br />

Corporate governance has been a challenge for the industry for a long time. The sugar industry<br />

needstotransformitselftoprofitabilityandefficiencypaththroughsoundmanagementpractices.<br />

There is need to develop and implement policies that would ensure that the principles of good<br />

governance are instituted and maintained. This would ensure competitiveness, transparency,<br />

accountability and sustainability of the industry.<br />

Land is an important factor of production as it provides the foundation for all other activities<br />

such as agriculture, water, settlement, tourism, wildlife and forestry, and infrastructural activities.<br />

However, over the years, administration and management of land has been a challenge due to<br />

lack of a comprehensive land tenure policy. This has led to fragmentation of land into small and<br />

uneconomic land units. Small land sizes has led to strong competition for land between food<br />

crops and sugarcane, which has increased food insecurity. The agricultural sector is developing<br />

a National Land Use Policy and Master Plan, which will provide guidelines regarding the use<br />

of land.<br />

Development projects recommended under Vision 2030 will increase demand on <strong>Kenya</strong>’s energy<br />

supply. Currently, <strong>Kenya</strong>’s energy costs are higher than those of her competitors. <strong>Kenya</strong> must,<br />

therefore, generate more energy at a lower cost and increase efficiency in energy consumption.<br />

To help meet the energy needs, the industry will invest in co-generation with the aim of selling<br />

surplus power to the national grid.<br />

Strategic Plan, 2010-2014 11

12<br />

<strong>Kenya</strong> <strong>Sugar</strong> Industry<br />

Chapter<br />

3<br />

Review of the Strategic Plan<br />

2004-2009<br />

3.1 Strategic Objectives (2004-2009)<br />

To turn around the sugar industry, the outgoing Plan identified nine (9) Strategic objectives for<br />

implementation during the period 2004-2009. These objectives and actions are presented in Annex I.<br />

3.2 Achievements<br />

A review of the outgoing Plan revealed that the level of implementation of activities was only about 30%<br />

of what was intended, many of the activities are work-in progress. The poor implementation of the plan<br />

was attributed to the fact that the objectives were way too ambitious, not SMART 5 hence extremely<br />

difficult to implement and monitor. Implementation of some activities was delayed by lack of funds.<br />

3.2.1 Attainment of the Mission<br />

The <strong>Kenya</strong> <strong>Sugar</strong> Industry Strategic Plan (2004-2009) set out the mission of the industry as to:<br />

“consistently achieve self-sufficiency and capacity for export of sugar and related products through<br />

implementation of competitive global industry best practices.” However, this mission was not<br />

achieved during the Plan period. The industry is still a net exporter. The goal of being globally<br />

competitive is still a dream because the industry did not implement the structural measures<br />

that would have brought down costs and increased its competitiveness. But of great concern,<br />

is the focus on sugar and self-sufficiency without regard to profitability and efficiency. It<br />

became clear that the sugar industry could not simultaneously seek self-sufficiency and global<br />

competitiveness. As illustrated by the COMESA conditionality for granting an extension of its<br />

safeguards, the industry needs to become competitive through major structural changes. This<br />

calls for a review of the mission.<br />

3.2.2 Analysis of the <strong>Sugar</strong> Industry Performance (2004-2009)<br />

I. Increased <strong>Sugar</strong>cane Production and Productivity<br />

Area under Cane<br />

Area under cane grew from 131,507 hectares in 2004 to 169,421 hectares in 2008 (Fig 3.1),<br />

representing an increase of 28.8%. The increase in cane area was attributed to the addition of<br />

Kibos and Soin <strong>Sugar</strong> Zones as new cane areas. Additionally, apart from SONY <strong>Sugar</strong> Company<br />

and Miwani, all the other companies increased areas under cane. Most of the increase was from<br />

the West <strong>Kenya</strong> zone, which rose by 198.2% (Table 3.1)<br />

5 Specific, Measurable, Attainable, Realistic, Timed

Area under cane (Ha)<br />

169,421<br />

158,568<br />

147,730<br />

144,765<br />

131,507<br />

122,580<br />

126,826<br />

117,131<br />

Fig. 3.1: Area under Cane (2001-2008) 6<br />

Source: Year Book of <strong>Sugar</strong> Statistics, KSB, 2008<br />

Table 3.1: Area under Cane<br />

Company<br />

2001<br />

Year<br />

2004 2008 Increase/<br />

Decrease<br />

Increase/<br />

(Decrease)<br />

Ha Ha Ha %<br />

Chemelil 10,219 13,341 3,122 30.6<br />

Muhoroni 11,146 14,259 3,113 27.9<br />

Mumias (+Busia Zone) 56,792 64,637 7,845 13.8<br />

Nzoia 19,449 23,899 4,450 22.9<br />

SONY 20,941 19,322 -1,619 (7.7)<br />

Miwani 5,560 4,633 -927 (16.7)<br />

Kibos - 2,622 2,622 New zone<br />

West <strong>Kenya</strong> 7,400 22,070 14,670 198.2<br />

Soin - 4,638 4,638 New zone<br />

Total 131,507 169,421 37,914 28.8<br />

Source: Year Book of <strong>Sugar</strong> Statistics, KSB, 2008<br />

Cane Varieties<br />

2002 2003 2004 2005<br />

In 2008, cane variety CO 945 occupied 35.72% of the total area under cane. Varieties CO 421,<br />

CO 617 and N14 occupied 28.4%, 13.29%, 10.95% of the total area respectively. KESREF<br />

developed four new cane varieties (KEN 82-062, KEN 82-472, EAK 73-335 and D8484)<br />

in 2007. However, the area under cane for <strong>Kenya</strong>n bred varieties remained just under 5% of<br />

the gross area. The slow adoption rate to <strong>Kenya</strong>n varieties is attributed to inefficient factory<br />

utilisation capacity that translates into delayed harvesting which raises the risks to the farmers,<br />

and to some extent weak research-extension-farmer linkages. Most farmers do not want to<br />

adopt early maturing cane varieties because they deteriorate faster and the factories do not have<br />

the capacity to harvest in good time.<br />

6 Source: <strong>Kenya</strong> <strong>Sugar</strong> <strong>Board</strong> Strategic Plan (2008-2012), Year Book of <strong>Sugar</strong> Statistics<br />

Year<br />

2006 2007 2008<br />

Strategic Plan, 2010-2014 13

14<br />

Area Harvested, Cane Deliveries and Cane Yields<br />

Area Harvested: Total area harvested in the nucleus estates and the outgrower farms was<br />

54,465 hectares in 2008 compared to 54,191 hectares in 2004, indicating an increase of 0.51%.<br />

This does not however include the area harvested by non-contracted farmers. The mean area<br />

harvested over the entire planning period was 38.9% of the total area with a standard deviation<br />

of ±3.4. The largest area harvested was recorded in 2007 (Fig. 3.2). However, the best industry<br />

average was achieved in 2002, when 42.6% of the area under cane was harvested.<br />

Average yield (Tonnes/Ha)<br />

75<br />

73<br />

71<br />

69<br />

67<br />

65<br />

63<br />

2001<br />

Fig. 3.2: Area Harvested (2001-2008) 7<br />

Cane Deliveries: Total cane deliveries for the year 2008 were 5,125,821 tonnes against<br />

4,660,995 tonnes in 2004, representing a cane supply increase of approximately 10% over<br />

the planning period. The best supply was recorded in 2007 at 5,204,214. The decrease in cane<br />

supply in 2008 was attributed to poor rains, post election related violence including a spike in<br />

cane burning cases which affected operations at the farm, transportation and factory levels.<br />

Cane Yields: The average cane yield for the year 2008 was 72.9 TC/Ha against 73.8 TC/Ha<br />

in 2004 representing a decrease of 1.2% (Fig. 3.3). The mean yield for the entire planning<br />

period was 70.4 TC/Ha with a standard deviation of ±3.1. Highest cane yields were recorded in<br />

SONY sugar belt (five-year average, 86.0TC/Ha) followed by Nzoia <strong>Sugar</strong> company (five-year<br />

average, 83.6TC/Ha) then Mumias <strong>Sugar</strong> Company (five year average, 70.9TC/Ha). Lowest<br />

yields were recorded in Chemelil (five-year average, 60.3TC/Ha). The challenge remains in<br />

respect of raising cane yields.<br />

7 Source: <strong>Kenya</strong> <strong>Sugar</strong> <strong>Board</strong> Strategic Plan (2008-2012), Year Book of <strong>Sugar</strong> Statistics<br />

<strong>Kenya</strong> <strong>Sugar</strong> Industry<br />

2002 2003 2004 2005<br />

Year<br />

2006 2007 2008

Harvested area (Ha)<br />

Thousands<br />

61<br />

59<br />

57<br />

55<br />

53<br />

51<br />

49<br />

47<br />

2001<br />

Fig. 3.3: Average Yield, Tonnes/Ha 8<br />

II. Increased <strong>Sugar</strong> Production<br />

Cane Crushed, <strong>Sugar</strong> Made and Recoveries<br />

In 2008, a total of 5,165,786 tonnes of cane was crushed at a sugar recovery rate of 10.03% to<br />

make 518,026 tonnes of sugar. In 2004, a total of 4,805,887 tonnes of cane was milled to make<br />

512,835 tonnes of sugar, giving a recovery rate of 10.67. Some sugar factories such as Chemelil<br />

and Muhoroni are still recording sugar recoveries below the industry standard of 10.1%. The<br />

industry’s long-term target is to achieve recovery levels of 11.5%.<br />

Quality of sugarcane crushed deteriorated during the outgoing planning period. In 2008, the<br />

weighted average pole % cane as a measure of cane quality reduced to 12.7% from 13.2% in<br />

2004 (Fig.3.4). This was still lower than the industry’s long-term target of 13.50%. The average<br />

fibre % cane rose to 17.72% from 17.46% in 2004 (Fig.3.4). The long-term industry’s target<br />

for fibre is 15.50%.<br />

8 Source: Year Book of <strong>Sugar</strong> Statistics, KSB, 2008<br />

2002 2003 2004 2005<br />

Year<br />

2006 2007 2008<br />

Future Outlook for the <strong>Sugar</strong> industry:<br />

According to the mini-survey conducted in January<br />

2009, it was revealed that all zones except West<br />

<strong>Kenya</strong> and Kibos have “excess” cane. The industry is<br />

projected to produce 8,146,913 tonnes against a<br />

consumption of 6,377,453 tonnes leaving an<br />

“excess” of 1,769,560 tonnes (28%)<br />

Strategic Plan, 2010-2014 15

16<br />

Cane quality (%)<br />

Fig. 3.4: Cane Quality (2001-2008) 9<br />

Time Account<br />

During the outgoing planning period, the total gross time available for grinding was 70,112<br />

hours. The actual hours used for grinding over the same period was 40,188 hours representing<br />

57.3% of the gross grinding time. The industry grinding time standard deviation was computed<br />

as±417.5 hours (±4.8%). Figure 3.5 shows account of the factory time within the planning<br />

period under review.<br />

Time (Hours)<br />

19.0<br />

18.0<br />

17.0<br />

16.0<br />

15.0<br />

14.0<br />

13.0<br />

12.0<br />

Hundreds<br />

95<br />

85<br />

75<br />

65<br />

55<br />

45<br />

35<br />

2001<br />

Fig. 3.5: Factory Time Account 10<br />

9 Source: Year Book of <strong>Sugar</strong> Statistics, KSB, 2008<br />

10 Source: Year Book of <strong>Sugar</strong> Statistics, KSB, 2008<br />

<strong>Kenya</strong> <strong>Sugar</strong> Industry<br />

2001<br />

2002 2003 2004<br />

Year<br />

2005<br />

Pol % cane Fibre % cane<br />

2002 2003 2004<br />

Gross grinding time<br />

Year<br />

2005<br />

2006 2007 2008<br />

2006 2007 2008<br />

Actual grinding time

Causes of time losses:<br />

i. Lack of cane resulting mostly from delays in harvesting and transportation<br />

ii. Frequent factories’ breakdowns due to lack of maintenance<br />

Based on the above, none of the sugar factories met the standard for Factory Time Efficiency<br />

(FTE) of 92%. Additionally, all the sugar factories with the exception of Mumias <strong>Sugar</strong><br />

Company, failed to meet the industry’s standard of Overall Time Efficiency (OTE) of 82%.<br />

Capacity Utilisation<br />

The combined installed capacity of sugar factories in the country is 24,040 TCD. This could<br />

produce about 883,691 tonnes of sugar per year. However, during the planning period, the<br />

average capacity utilised was 13,522.50TCD (56.25%), and even though this was a modest<br />

increase over the previous period, it is still far below optimal (Fig. 3.6). The decline in capacity<br />

utilisation needs to be addressed first before expensive options such as capacity expansion are<br />

sought.<br />

Capacity utilisation (%)<br />

70<br />

65<br />

60<br />

55<br />

50<br />

45<br />

2001<br />

Fig. 3.6: Average Factories’ Capacity Utilization (2001-2008) 11<br />

11 Source: Year Book of <strong>Sugar</strong> Statistics, KSB, 2008<br />

2002 2003 2004 2005<br />

Year<br />

Future Outlook for the <strong>Sugar</strong> industry: The<br />

excess cane in the sugar industry has been occasioned<br />

mainly by inefficiency in the utilization of the milling<br />

capacity which currently stands at 56.25%.<br />

Stakeholders’ Concern: ‘Why can’t KSB address the issue<br />

of the factories’ inability to crush existing cane?<br />

2006 2007 2008<br />

Strategic Plan, 2010-2014 17

18<br />

III. Expanded Product Base<br />

Very little was achieved under this strategic direction. Plans for expanding the product base<br />

were largely tentative. Partly because the industry was beset with debts and pressing demand<br />

for factory rehabilitation. The industry also lacked a comprehensive legislation to undertake<br />

the same.<br />

During the outgoing planning period, Mumias <strong>Sugar</strong> Company was the exception, having<br />

launched a co-generation plant to generate electricity to supply the national grid. Some sugar<br />

factories such as Muhoroni, despite their indebtedness, were giving out bagasse freely to small<br />

business entrepreneurs for the production of briquettes and soft boards. Currently, no feasibility<br />

study has been carried out on the production of ethanol and other cane products.<br />

Industry records indicate that production of power alcohol was undertaken for sometime at<br />

the Agro-Chemical and Food Company for blending with petrol. This programme could not<br />

be sustained because there was no policy and legal framework to regulate its use. In addition,<br />

there was resistance from the multi-national petroleum companies who feared a reduction in<br />

their market share.<br />

This strategic direction needs to be pursued in the next planning period.<br />

Challenges to Product Diversification:<br />

i. Co-generation: Uncompetitive pricing mechanism<br />

ii. Limited technology and factory capacities<br />

iii. Weak legal and regulatory framework<br />

IV. Policy and Legal Framework<br />

The major achievements under this strategic direction were:<br />

i. The Cabinet approved the Privatisation Plan<br />

ii. Commenced implementation of the Privatisation Programme<br />

iii. Drafting of the <strong>Sugar</strong> Act, 2001 Amendment Bill<br />

iv. Drafting of the <strong>Sugar</strong> (General) Regulations<br />

v. Classification of sugar as a special commodity under the East African Community<br />

Customs Union hence a CET of 100% or USD 200 per tonne whichever is higher<br />

vi. ISO certification is on going in some sugar factories. Already five factories (Mumias,<br />

Muhoroni, Chemelil, Nzoia and West <strong>Kenya</strong>) are ISO certified. It should be noted that<br />

ISO certification focuses mainly on the process audits that may not be an indicator of<br />

satisfactory performance in terms of service delivery.<br />

<strong>Kenya</strong> <strong>Sugar</strong> Industry<br />

Stakeholders’ Concerns:<br />

1. There are no concrete steps towards<br />

diversification<br />

2. Needs to accelerate its intensification programme<br />

e.g. introducing sweet sorghum in the farming<br />

community as a way of complementing<br />

cane farming

Finalization and implementation of all pending policy and legal instruments will be a major<br />

milestone in the incoming Plan. Pending actions include:<br />

i. Passing of the <strong>Sugar</strong> Amendment Bill<br />

ii. Gazetting of the <strong>Sugar</strong> General Rules<br />

iii. Reclassification of sugar as a food<br />

iv. Finalisation of regulations to restructure outgrower institutions<br />

V. Privatisation of the <strong>Sugar</strong> Industry<br />

During the period under review, the Privatisation Bill was passed by parliament and recently<br />

the Privatization Commission has commenced preparatory work towards offering the candidate<br />

factories for privatization. Speed will be of essence because of the urgency to restructure in<br />

good time to realign factories with the new trade regime expected after the expiry of COMESA<br />

safeguard measures in 2012.<br />

Work in progress:<br />

Stakeholders’ Concerns: Delay in the<br />