Bilancio Ansaldo - Ansaldo Energia

Bilancio Ansaldo - Ansaldo Energia

Bilancio Ansaldo - Ansaldo Energia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2011<br />

A N N U A L<br />

R E P O R T

<strong>Ansaldo</strong> <strong>Energia</strong> S.p.A.<br />

16152 Genoa - Italy - Via N. Lorenzi, 8<br />

Phone + 39 0106551 - Fax + 39 0106556209<br />

ansaldoenergia@aen.ansaldo.it<br />

www.ansaldoenergia.it

Disclaimer<br />

This Annual Report 2011 has been translated into English solely for the convenience of the international reader.<br />

In the event of conflict or inconsistency between the terms used in the Italian version of the report and the English version,<br />

the Italian version shall prevail, as the Italian version constitutes the sole official document.

CONTENTS<br />

06_Boards and Committees<br />

08_Report on operation<br />

15_<strong>Ansaldo</strong> <strong>Energia</strong> results in the three-year period 2009-2011<br />

16_Analysis of performance and financial position<br />

20_Financial position<br />

22_Transactions with related parties<br />

24_Alternative non-GAAP performance indicators<br />

28_Information on the management and coordination activities of the<br />

Company and transactions with related parties<br />

30_Performance<br />

40_Research, Development and Innovation<br />

44_Human resources<br />

48_Security Policy Statement<br />

50_Environment<br />

54_Health and safety at work<br />

56_Performance and highlights of the main Group companies<br />

60_Outlook<br />

62_Registered offices of the Company<br />

64_Report of the Board of Directors and proposals to the Shareholders’<br />

Meeting<br />

66_Financial statements and related notes at 31 December 2011<br />

68_Statement of Financial Position (Balance Sheet)<br />

70_Statement of cash flows<br />

71_Statement of Changes in Equity<br />

72_Statement of Comprehensive Income<br />

74_Notes to the financial statements at 31 December 2011<br />

74_1 General information<br />

74_2 Basis of preparation and accounting standards used<br />

75_3 Accounting standards adopted<br />

83_4 Significant issues

84_5 Significant non-recurring events or transactions<br />

86_6 Segment information<br />

87_7 Intangible assets<br />

88_8 Property, plant and equipment<br />

89_9 Equity investments<br />

90_10 Transactions with related parties<br />

93_11 Receivables and other non current assets<br />

94_12 Inventories<br />

95_13 Contract work in progress and advances received<br />

96_14 Trade and financial receivables<br />

97_15 Tax receivables and payables<br />

97_16 Other current assets<br />

98_17 Cash and cash equivalents<br />

98_18 Non current assets held for sale<br />

99_19 Shareholders’ equity<br />

101_20 Borrowings<br />

102_21 Provisions for risks and charges and contingent liabilities<br />

105_22 Employee obligations<br />

106_23 Other current and non current liabilities<br />

107_24 Trade payables<br />

107_25 Derivatives<br />

107_26 Guarantees and other commitments<br />

109_27 Economic transactions with third parties<br />

111_28 Revenues<br />

112_29 Other operating income (costs)<br />

112_30 Cost of goods and services<br />

113_31 Personnel costs<br />

114_32 Changes in inventories of finished goods, work in progress<br />

and semi-finished goods<br />

114_33 Depreciation, amortisation and impairment

114_34 Capitalisation of internal construction costs<br />

115_35 Financial income and expense<br />

115_36 Income taxes<br />

118_37 Cash flow from operating activities<br />

118_38 Financial risk management<br />

121_39 Key management personnel compensation<br />

122_Detailed schedules<br />

136_Report of the Board of Statutory Auditors<br />

140_Report of the independent auditors on the financial statements at 31<br />

December 2011<br />

ANSALDO ENERGIA ANNUAL REPORT 2011

Boards and Committees

BOARD<br />

OF DIRECTORS<br />

in office for the period 2011/2013<br />

appointed by the Shareholders’ Meeting<br />

on 6 June 2011<br />

Francesco Giuliani<br />

Chairman<br />

Luigi Calabria<br />

Vice Chairman<br />

Giuseppe Zampini<br />

Managing Director<br />

Mark Adrian McComiskey<br />

Director<br />

Giovanni Pontecorvo<br />

Director<br />

Giovanni Soccodato<br />

Director<br />

Ryan Nicolas Zafereo<br />

Director<br />

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

BOARD<br />

OF STATUTORY AUDITORS<br />

in office for the period 2011/2013<br />

appointed by the Shareholders’ Meeting<br />

on 6 June 2011<br />

Pietro Mastrapasqua<br />

Chairman<br />

Armando Cascio<br />

Standing Auditor<br />

Salvatore Randazzo<br />

Standing Auditor<br />

Enrico Casanova<br />

Alternate Auditor<br />

Silvio Tirdi<br />

Alternate Auditor<br />

INDEPENDENT AUDITORS<br />

engaged for the period 2009/2011<br />

PricewaterhouseCoopers S.p.A.<br />

7

Report on operations

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

9

Shareholders<br />

The main feature of the Italian and international economic scenario in 2011 was the high level of<br />

uncertainty, which had a particularly negative impact on decisions to invest in infrastructure.<br />

Despite a positive start of the year 2011, showing a growth in the main macroeconomic indicators<br />

such as world gross domestic product, industrial production and international trade indexes, several<br />

events then occurred during the year introducing high levels of uncertainty.<br />

These were the earthquake in Japan and the resulting incident at the Fukushima nuclear power plant,<br />

the highly turbulent political situation in several areas of the world (the Middle East and North Africa),<br />

and finally the sovereign debt crisis in several Euro area countries, including Italy, which has had<br />

serious repercussions on the banking system’s ability to fund investments at competitive costs.<br />

Against this difficult backdrop, your Company received new orders totalling Euro 1,250 million, in line<br />

with the previous year’s figure and maintaining backlog at about Euro 3,073 million. This is positive<br />

not only in quantitative terms, but also because your Company has shown at a difficult time that it is<br />

competitive enough to win orders in new markets (Turkey) or to defend its positions in markets where<br />

it already plays a leading role (Algeria). It should also be remembered that this figure does not include<br />

orders worth about Euro 330 million awarded to subsidiary company Yeni Aen Insaat A.S. in<br />

connection with the Gebze project.<br />

We would like to draw your attention in particular to the fact that in 2011 your Company and<br />

subsidiary Yeni Aen Insaat A.S. were awarded a contract worth a total Euro 638 million to build and<br />

then maintain a combined cycle plant rated about 825 MW in Istanbul’s Gebze industrial district in<br />

Turkey.<br />

<strong>Ansaldo</strong> <strong>Energia</strong>, in addition to its traditional role as turnkey builder of the plant, is also an investor in<br />

this specific case.<br />

Concurrently with the supply contract, your Company also stipulated an agreement with Unit NV to<br />

invest in the equity of Yeni Elektrik, which will build the power plant and operate it based on a<br />

merchant business model. Yeni Elektrik will finance the project, requiring the coverage of about USD<br />

1,000 million total costs (including interest during the construction stage), of which:

• 70% funded by a pool of four local banks (about US$ 700 million) and;<br />

• 30% in the form of share capital (about USD 300 million).<br />

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

11<br />

Under the terms of the investment agreement, your Company will acquire a 40% stake in the share<br />

capital of Yeni Elektrik and subscribe the capital increases needed to provide the company with the<br />

necessary funds, amounting to about USD 120 million (about Euro 86 million).<br />

The equity investment is accompanied by a series of additional agreements with partner Unit to<br />

ensure that the investment has a low risk profile.<br />

The agreement also stipulates the provision by your Company of contingent equity to cover events<br />

defined in the contract with the banks, in relation to which it has signed a contract with Finmeccanica<br />

S.p.A., which will take on this risk for the entire project duration against payment of an insurance<br />

premium in 2011.<br />

Revenues of Euro 1,231 million are about 6.8% down on 2010.<br />

It should be remembered that as a result of market stagnation and uncertainty over how long the<br />

recovery will take, investments during the year were limited and the policy of carefully assessing<br />

human resource needs continued.<br />

Profitability has remained very positive, with ROS standing at 10%, a fall on the previous year due to<br />

exceptional events.<br />

In September 2011, in the first stage of the legal process regarding the Enipower question, the Court<br />

of Milan found your Company guilty of violating Legislative Decree 231/2001. The Court ordered your<br />

Company to pay a Euro 150,000 fine and the confiscation of a presumed 10% contract profit<br />

quantified in Euro 98,700,000.<br />

This proceeding, which has been pending for several years before the Court of Milan, has been duly<br />

reported in the notes to the financial statements in recent years, but without making any provision<br />

based on the unlikelihood to be found guilty.<br />

After the aforementioned sentence was handed down, while reiterating its full confidence that the<br />

sentence will be overturned when the case goes to appeal, your Company has made provision for the<br />

fair value of this liability, estimated on the basis of the presumed residual duration of the proceeding<br />

in the amount of Euro 82,548,000.<br />

This provision had a negative impact on the result for the year, which would otherwise have been<br />

largely positive.<br />

REPORT ON OPERATIONS

On 26 September 2011, in the framework of a wider ranging project to reorganize and rationalize the<br />

activities of your Company, the merger of subsidiary <strong>Ansaldo</strong> Fuel Cells S.p.A was completed.<br />

The company already held the entire share capital of <strong>Ansaldo</strong> Fuel Cells S.p.A. since 1 January 2011.<br />

This merger has and will continue to allow better use to be made of <strong>Ansaldo</strong> Fuel Cells’ highly<br />

specialised resources, with significant streamlining of staff activities and maximization of the value of<br />

intellectual property in the Fuel Cells product.<br />

Looking at the most significant events in 2011 in more detail, it should first be pointed out that the<br />

fall in volumes mainly affected the service segment, whereas plants and machinery are basically<br />

unchanged on the previous year.<br />

There was also strong growth in the renewable energy sector as a result of new orders received last<br />

year.<br />

Free operating cash flow stands at Euro -16.2 million, while the net financial position, after distributing<br />

a dividend on previous year net income of Euro 65 million, stands at Euro 384 million.<br />

In fact your Company was kept busiest during the year by financial management activities. As<br />

described above, the global economic crisis put both customers and suppliers under strong pressure,<br />

and the results reported were achieved only by maintaining a constant focus on financial issues.<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

REVENUES BY BUSINESS AREA<br />

3<br />

24 28<br />

76 69 72<br />

2009 2010 2011<br />

n Renewable energy n Service activities n Plants and components<br />

4<br />

24

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

13<br />

Your Company operates in a business sector featuring extensive internationalization, strong supply<br />

side concentration and high technological and management complexity, resulting in general risks and<br />

uncertainties, in addition to risks linked to the type of business and specifically to your Company.<br />

General risks<br />

Demand for goods and services in the power generation sector is driven by GDP and demographic<br />

trends in individual countries. This market is also affected by specific environmental policies and the<br />

price trend of the main fossil and other fuels used to generate electricity.<br />

In 2011, despite the general uncertainty described above, demand for electric power held up and this<br />

trend had a different impact on the various types of technology. There was significant recovery in gas<br />

cycles, which have lower initial investments, shorter completion times and fewer risks because they<br />

are based on consolidated technologies.<br />

The foreseeable development scenario points to a gradual return of the market to pre-crisis levels in<br />

2014, but with a different mix of energy sources featuring more gas cycles and renewable sources, at<br />

the expense of conventional coal and nuclear thermal cycles.<br />

This situation is also very diversified according to geographical area.<br />

So far as demographics are concerned, there do not seem to be any specific signs of risk in this area.<br />

International environmental policies are consistent with the development roadmap for the products<br />

manufactured by your Company; it should be remembered that your Company’s main product (gas<br />

turbines for combined and open cycles) represents the technology with the least environmental impact<br />

compared to alternative forms of power generation using fossil fuels.<br />

Finally, in 2011 the price of the main fossil fuels remained way below the maximum values touched in<br />

the first half of 2008. At the present time there is no reason to believe that the price of fossil fuels<br />

will vary significantly in 2012 and no specific future risks have therefore been identified for your<br />

Company.<br />

Risks relating to type of business<br />

The international market in which your Company operates exposes it to financial risks. The Company<br />

adopts an extremely prudent policy to the coverage of risks of a financial nature. Significant<br />

REPORT ON OPERATIONS

operations in currencies other than the Euro subject to exchange risk are hedged by means of specific<br />

forward contracts. To eliminate or minimize the credit risk, deriving in particular from work in foreign<br />

countries, the Company adopts a policy of carefully analyzing commercial operations right from the<br />

outset, closely examining the terms and conditions of payment to propose in offers and subsequently<br />

in contracts of sale.<br />

Specifically, according to the value of the contract, the type of customer and the importing country, all<br />

the necessary precautions are taken to limit risk as regards both payment terms and the financial<br />

instruments used, with recourse in the most complicated cases to insurance coverage or providing<br />

assistance to help the Customer obtain supply financing.<br />

Typical risks for your Company<br />

Fierce competition in the reference markets in which your Company operates is reflected in risks<br />

connected with its ability to maintain adequate levels of investment in innovative technology, in order<br />

to ensure that the product portfolio remains competitive with that offered by the competition. So far<br />

as the main gas turbine product is concerned, your Company has investment programmes under way<br />

to ensure that the technical characteristics of the main models remain competitive.<br />

The risk of a paradigm shift in technology introduced by the competition, such as to make your<br />

Company’s products obsolete, cannot at the present time be assessed.<br />

Uncertainty over the global economic trend in 2012 makes it impossible to have a high level of<br />

confidence in forecasts. However, the substantial order backlog, a solid financial position and the<br />

prospects for several negotiations currently in progress, lead us to believe that financial 2012 should<br />

allow your Company to confirm or slightly improve on its economic results in 2011.<br />

Finally, there were no significant events after the closure of the accounts such as to require comment<br />

on their possible economic and financial effects.

<strong>Ansaldo</strong> <strong>Energia</strong> results for the three-year period 2009-2011<br />

Euro milioni<br />

Euro million<br />

Euro million<br />

1,750<br />

1,500<br />

1,250<br />

1,000<br />

750<br />

500<br />

250<br />

0<br />

180<br />

150<br />

120<br />

90<br />

60<br />

30<br />

0<br />

90<br />

75<br />

60<br />

45<br />

30<br />

15<br />

0<br />

-15<br />

-30<br />

1561<br />

REVENUES<br />

ADJUSTED EBIT<br />

NET RESULT<br />

Euro million<br />

Units<br />

NET FINANCIAL POSITION<br />

0<br />

2009 2010 2011 2009 2010 2011<br />

154<br />

2009 2010 2011<br />

83<br />

1322<br />

140<br />

65<br />

1231<br />

124<br />

-16.3<br />

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

15<br />

EMPLOYEES<br />

2009 2010 2011<br />

ORDERS<br />

0<br />

2009 2010 2011 2009 2010 2011<br />

Euro million<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

3,200<br />

3,000<br />

2,800<br />

2,600<br />

2,400<br />

2,200<br />

2,000<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

530<br />

3014<br />

1107<br />

501<br />

384<br />

2935 2937<br />

1271 1250<br />

REPORT ON OPERATIONS

Analysis of performance<br />

and financial position

The financial statements of <strong>Ansaldo</strong> <strong>Energia</strong> S.p.A.<br />

at 31 December 2011 have been prepared in<br />

accordance with the International Accounting<br />

Standards and the International Financial Reporting<br />

Standards (IAS/IFRS) endorsed by the European<br />

Commission and supplemented by the relevant<br />

interpretations (Standing Interpretations Committee<br />

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

17<br />

– SIC and International Financial Reporting<br />

Interpretations Committee – IFRIC) issued by the<br />

International Accounting Standard Board (IASB).<br />

Reclassified statements have been prepared and<br />

commented on to provide further information about<br />

the performance and financial position of <strong>Ansaldo</strong><br />

<strong>Energia</strong> S.p.A.<br />

Euro/thousand 2011 2010<br />

Revenues 1,231,970 1,321,859<br />

Costs for purchases and personnel (1,093,671) (1,161,890)<br />

Amortisation and depreciation (25,016) (23,183)<br />

Write-downs<br />

Other net operating revenues (costs) 11,020 2,809<br />

Adjusted EBITA 124,303 139,595<br />

Adjustments 82,548<br />

EBIT 41,755 139,595<br />

Net financial income (charges) (4,695) (22,512)<br />

Income taxes (53,332) (51,704)<br />

NET PROFIT BEFORE DISCONTINUED OPERATIONS (16,272) 65,379<br />

Result of discontinued operations<br />

NET PROFIT (16,272) 65,379<br />

2011 closed reporting a drop in revenues of about<br />

6.8%. This fall is mainly attributable to the service<br />

segment (-20%) and to a lesser extent to the plant<br />

and machinery area, while renewable and distributed<br />

energy sources are growing (+37%) compared with<br />

2010. In the service segment, against a slight<br />

increase of 3% in the contribution of long term<br />

service agreements, there was a reduction of the<br />

same amount in current services, with a fall of 25%<br />

in spare parts and 83% in the solutions product<br />

segment.<br />

Service business represents about 24.4% of<br />

revenues (28.5% in 2010) and about 45.6% of the<br />

gross margin generated during the year.<br />

EBIT fell Euro 97.8 million and stands at 3.4% of<br />

revenues (10.5% in 2010).<br />

The total includes non-recurring costs amounting to<br />

about Euro 85.8 million; without these costs EBIT<br />

would have stood at Euro 127.6 million or 10.4%.<br />

In 2010 EBIT included Euro 6.5 million attributable<br />

to management fees charged by Finmeccanica<br />

S.p.A.; without these costs EBIT would have stood at<br />

Euro 146 million or 11.1% of revenues.<br />

Non-recurring charges in 2011 include the provision<br />

of about Euro 82.5 million to the litigation risk<br />

reserve set up to cover the sanctions imposed by<br />

the Court of Milan, which found your Company guilty<br />

pursuant to law 231 on the administrative<br />

responsibility of legal persons for crimes committed<br />

by their employees.<br />

Your Company has set aside the fair value of this<br />

liability, calculated on the best possible estimate of<br />

the duration of the next two stages in the legal<br />

process (Courts of Appeal and Cassation); EBIT also<br />

includes provisions to the incentive plan reserve of<br />

Euro 2.6 million and Euro 0.7 million management<br />

fees.<br />

Research and development expenditure rose to Euro<br />

29.6 million in 2011, of which Euro 18.6 million was<br />

recognized in the income statement and Euro 11<br />

million capitalized to intangible assets, against Euro<br />

31.3 million in 2010, of which Euro 21.3 million was<br />

recognized in the income statement and Euro 10<br />

million capitalized.<br />

ANALYSIS OF PERFORMANCE AND FINANCIAL POSITION

The balance of other net operating revenues/(costs)<br />

was a negative Euro 71.5 million, as opposed to a<br />

positive Euro 2.8 million in 2010.<br />

This item includes the provision for risks described<br />

above, the Euro 3.0 million provision to the<br />

guarantee reserve, indirect taxes for the year<br />

amounting to Euro 2.8 million net of insurance<br />

refunds totaling Euro 14.2 million, the release of<br />

reserves of Euro 1.5 million relating to <strong>Ansaldo</strong> Fuel<br />

Cells set aside in previous years, exchange<br />

differences on cost items of Euro 0.6 million and<br />

other minor items.<br />

Amortization and depreciation rose by about Euro 2<br />

million, attributable to the rise in tangible fixed<br />

assets as a result of investments.<br />

Of net financial income/(costs), standing at a<br />

negative Euro 4.7 million, Euro 1,9 million refers to<br />

the dividend received from subsidiary <strong>Ansaldo</strong><br />

Nucleare S.p.A. and the release of investment writedown<br />

provisions relating to Indian company ASPL<br />

amounting to Euro 0.9 million.<br />

The prospects and profitability of <strong>Ansaldo</strong><br />

Thomassen and <strong>Ansaldo</strong> ESG were carefully analyzed<br />

and their fair value calculated, requiring a write-down<br />

of Euro 7.0 million and Euro 1.5 million respectively<br />

due a permanent loss of value of the investments.<br />

Financial income associated with financial<br />

management stands at Euro 3.9 million, while<br />

financial exchange rate differences total Euro -1.3<br />

million.<br />

The 2010 value of Euro -22.5 million included,<br />

among other amounts, the write-down of the<br />

investment in <strong>Ansaldo</strong> Fuel Cells of about 25.0<br />

million due to a permanent loss of value.<br />

Income tax amounting to Euro 53.3 million (Euro 52<br />

million in 2010) includes, in addition to Euro 31.3<br />

million IRES (corporate income tax), Euro 9.4 million<br />

IRAP (regional business tax) and Euro 7 million<br />

foreign taxes, net of compensation in connection<br />

with extra income tax set aside in previous years<br />

amounting to Euro 0.5 million.<br />

Taxation rose on the previous year, despite the fall in<br />

income, due to the non-deductibility of non-recurring<br />

charges, as a result of which the IRAP and IRES tax<br />

bases are higher than in 2010.<br />

The table below breaks down the balance sheet at<br />

31 December 2011, with comparative information at<br />

31 December 2010:<br />

Euro/thousand 12.31.2011 12.31.2010<br />

Non current assets 278,820 177,987<br />

Non current liabilities 281,729 117,581<br />

(2,909) 60,406<br />

Inventories 371,221 359,090<br />

Trade receivables 296,727 234,733<br />

Trade payables 988,831 1,007,306<br />

Working capital (320,883) (413,483)<br />

Provisions for short term risks and charges 39,686 50,233<br />

Other net current assets (liabilities) (6,454) (3,872)<br />

Net working capital (367,023) (467,588)<br />

Net invested capital (369,932) (407,182)<br />

Shareholders’ equity 13,693 94,672<br />

Net financial debt (cash and cash equivalents) (383,625) (501,187)<br />

Net (assets) liabilities held for sale – 667<br />

Non current assets are basically attributable to<br />

intangible assets (Euro 25.1 million), property, plant<br />

and equipment (Euro 131.1 million), other<br />

receivables (Euro 111.0 million), equity investments<br />

(Euro 10.6 million) and deferred tax assets (Euro<br />

0.9 million).

Other receivables rose against the previous year as<br />

a result of the quota paid into Yeni Elektrik (Euro<br />

26.2 million) and prepaid income deriving from the<br />

acquisition by parent company Finmeccanica S.p.A.<br />

of the right to use the <strong>Ansaldo</strong> <strong>Energia</strong> trademark<br />

until 31 December 2035 for Euro 91.8 million, net<br />

of Euro 3.7 million amortization and depreciation<br />

recognized in the income statement and the<br />

reclassification of the same amount to short term;<br />

intangible assets rose Euro 9 million on the<br />

previous year, mainly as a result of the capitalization<br />

of development costs for the AE94.3A and AE94.2<br />

model gas turbines, net of about Euro 2 million<br />

amortization in the period calculated using the<br />

‘‘stamp method’’ of accounting.<br />

Investments in subsidiaries fell Euro 7,6 million<br />

following the write-down of the carrying value of<br />

subsidiary companies <strong>Ansaldo</strong> Thomassen (Euro -<br />

7.0 million) and <strong>Ansaldo</strong> ESG (Euro -1.5 million), net<br />

of the increase resulting from the payment of Euro<br />

0.9 million equity into Turboenergy S.r.l. Non-current<br />

liabilities include severance pay and other definedbenefit<br />

plans for employees amounting to Euro 30.7<br />

million (Euro 34.8 million in 2010) and provisions<br />

for risks of Euro 245.6 million against Euro 80<br />

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

19<br />

million in 2010. Of the increase in this item, about<br />

Euro 77.5 million is attributable to the net increase<br />

in the reserve for post-order closure costs incurred<br />

to complete projects nearing completion in Algeria<br />

(Euro +85.5 million), net of uses in 2011 for other<br />

projects; Euro 82.5 million to the provision to cover<br />

the sanctions imposed by the Court of Milan; and<br />

Euro 4.5 million to the increase in provisions for<br />

taxes.<br />

Net working capital rose Euro 100.6 million.<br />

This deterioration is entirely attributable to<br />

operating items because operating working capital<br />

(inventory, work in progress net of advances and<br />

trade payables and receivables) increased Euro<br />

92.6 million.<br />

Shareholders’ equity stands at Euro 13.7 million<br />

and is represented by share capital amounting to<br />

Euro 12.0 million, reserves generated by conversion<br />

to IAS/IFRS, and retained earnings and other<br />

reserves amounting to Euro 18 million, in addition<br />

to the loss for the year of Euro 16.3 million.<br />

Cash flow before strategic investments is a<br />

negative Euro 16.2 million, while Funds From<br />

Operations stand at Euro 22.1 million, a fall of Euro<br />

37.6 million on the previous year.<br />

Euro/thousand 2011 2010<br />

Cash and cash equivalents at 1 January 16,831 30,135<br />

Cash flow from operating activities 151,652 167,235<br />

Changes in other operating assets and liabilities (129,457) (107,452)<br />

Funds From Operations (FFO) 22,195 22,195 59,783 59,783<br />

Change in working capital (22,072) 36,230<br />

Cash flow generated by (used in)<br />

investing activities 123 96,013<br />

Cash flow from ordinary investment activities (16,303) (25,294)<br />

Free operating cash-flow (FOCF) (16,180) 70,719<br />

Strategic operations<br />

Changes in other financing activities (36,044) (18,624)<br />

Cash flow generated by (used in)<br />

investing activities (52,347) (43,918)<br />

Dividends paid (65,338) (82,000)<br />

Cash flow from other financing activities 129,432 15,672<br />

Cash flow generated by (used in)<br />

investing activities 64,094 (66,328)<br />

Exchange rate differences on cash and cash equivalents 929<br />

Cash and cash equivalents at 31 December 28,701 16,831<br />

ANALYSIS OF PERFORMANCE AND FINANCIAL POSITION

Financial position

Net cash and cash equivalents at 31 December<br />

2011 are reported in the table below, with<br />

comparative information at 31 December 2010.<br />

The net financial position fell as a result of the<br />

payment of a Euro 65.3 million dividend to the<br />

shareholder and negative cash flow during the year.<br />

Of financial receivables from related parties, Euro<br />

357.2 million refers to cash and cash equivalents<br />

deposited according to Group policy with<br />

Finmeccanica, as part of a cash pooling scheme<br />

which benefits all group companies by rationalising<br />

and optimizing recourse to the banking system.<br />

Cash and cash equivalents are remunerated at the<br />

best market conditions, also with recourse to<br />

temporary investments.<br />

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

21<br />

<strong>Ansaldo</strong> <strong>Energia</strong> also pools the treasury<br />

management of its subsidiaries, applying the same<br />

market rates.<br />

This justifies the presence of financial payables to<br />

related parties, basically attributable to the cash<br />

and cash equivalents of <strong>Ansaldo</strong> Nucleare and<br />

<strong>Ansaldo</strong> Esg, while receivables include financing for<br />

the activities of <strong>Ansaldo</strong> Thomassen and Indian<br />

subsidiary company ASPL.<br />

Receivables and payables from/to the banking<br />

system should therefore be considered as residual<br />

and, so far as payables are concerned, attributable<br />

for the most part to term deposits or foreign<br />

currency which cannot be transferred in connection<br />

with local activities.<br />

Euro/thousand 12.31.2011 12.31.2010<br />

Short term financial payables 2,089 1,280<br />

Medium/long-term financial payables<br />

Cash or cash equivalents 28,701 16,831<br />

BANK AND BOND DEBT (26,612) (15,551)<br />

Securities<br />

Financial receivables from related parties (357,180) (489,658)<br />

Other financial receivables<br />

FINANCIAL RECEIVABLES AND SECURITIES (357,180) (489,658)<br />

Financial payables to related parties 3,855<br />

Other short term financial payables 167 167<br />

Other medium/long term financial payables<br />

OTHER FINANCIAL PAYABLES 167 4,022<br />

NET FINANCIAL DEBT (CASH AND CASH EQUIVALENTS) (383,625) (501,187)<br />

FINANCIAL POSITION

Transactions with related<br />

parties

Transactions with related parties refer to ordinary<br />

management activities and are carried out at arm’s<br />

length, as is settlement of interest bearing<br />

receivables and payables when not governed by<br />

specific contractual conditions.<br />

They mainly relate to the exchange of goods, the<br />

performance of services and the provision and use<br />

of funds from and to the parent company and<br />

subsidiary and associated companies, joint<br />

ventures and consortia.<br />

Furthermore, the application of the revised version<br />

of IAS 24 has had disclosure-related effects with<br />

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

23<br />

regard to related parties and required the<br />

modification of comparative data referring<br />

exclusively to the related parties presented in the<br />

income, equity and cashflow statements, in order to<br />

account for the related parties which are companies<br />

subject to significant control or influence by the<br />

Italian Ministry of the Economy and Finance (MEF).<br />

Income and equity balances with related parties,<br />

and their percentage of the total, are detailed in the<br />

section containing the Financial Statements and<br />

Related Notes at 31 December 2011.<br />

TRANSACTIONS WITH RELATED PARTIES

Alternative non-GAAP<br />

performance indicators

Management assesses the Company’s economic<br />

and financial performance using several indicators<br />

not envisaged by IFRSs.<br />

As required by Communication CESR/05 - 178b,<br />

the components of each of these indicators are<br />

described below:<br />

EBIT - Equal to the pre-tax and pre-financial<br />

income/expense result, without any adjustments.<br />

EBIT also excludes income and expense deriving from<br />

the management of non consolidated equity<br />

investments and securities, as well as the results of<br />

any transfers of consolidated equity investments,<br />

which are classified in the “financial income and<br />

expenses” tables or, so far as concerns equity<br />

investments assessed on a shareholders’ equity<br />

basis, under the item “effects of the assessment of<br />

equity investments on a shareholders’ equity basis”.<br />

The value of this indicator in 2011 stands at Euro<br />

41.8 million, against Euro 139.6 million in 2010.<br />

Adjusted (Adj) EBITA - Obtained by eliminating the<br />

following components from EBIT, as defined above:<br />

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

25<br />

� any goodwill adjustments (impairment);<br />

� amortization of the portion of the purchase price<br />

allocated to intangible assets as regards nonrecurring<br />

operations (business combination), in<br />

accordance with IFRS 3;<br />

� restructuring charges with regard to major plans<br />

defined;<br />

� other non-recurring income or charges<br />

attributable to particularly significant events not<br />

relating to ordinary business.<br />

The Adjusted EBITA determined in this way is used<br />

to calculate ROS (Return On Sales) and ROI<br />

(Return On Investment) (the ratio between Adjusted<br />

EBITA and the average value of invested capital in<br />

the two financial years presented for the purposes<br />

of comparison). The value of this indicator in 2011<br />

stands at Euro 124.3 million against Euro 139.6<br />

million in 2010.<br />

The reconciliation between the result before<br />

taxation and financial items and Adjusted EBITA for<br />

the current and previous years is given below:<br />

Euro/thousand 12.31.2011 12.31.2010<br />

EBIT 41,755 139,595<br />

Provision for risks 82,548<br />

Adjusted EBITA 124,303 139,595<br />

Adjusted Net Income - Obtained from the net<br />

income reported in the financial statements by<br />

eliminating the positive and negative income items<br />

attributable to events considered to be nonrecurring<br />

because of their significance and the fact<br />

Euro/migliaia 12.31.2011 12.31.2010<br />

Net profit (loss) (16,272) 139,595<br />

Provision for risks 82,548<br />

Adjusted pre-tax profit 66,276 139,595<br />

Free Operating Cash-Flow (FOCF) - The sum of cash<br />

flow generated from/(used in) operations and the<br />

cash flow generated from/(used in)<br />

investments/divestments of tangible/intangible<br />

assets and equity investments, net of cash flow<br />

deriving from the acquisition or sale of equity<br />

that they cannot be regarded as forming part of the<br />

company’s ordinary operations.<br />

The reconciliation between Net Income and<br />

Adjusted Net Income is given below:<br />

investments which, in relation to their nature and<br />

importance, are considered as “strategic<br />

investments”. The formation of FOCF for<br />

comparison with previous years is presented in the<br />

reclassified cash flow reported in the previous<br />

paragraph. The value of FOCF at 31 December<br />

ALTERNATIVE NON-GAAP PERFORMANCE INDICATORS

2011 stands at Euro -16.2 million, a sharp fall<br />

against Euro 71 million at 31 December 2010.<br />

Funds From Operations (FFO) - Given by cash flow<br />

generated from operations, net of the change in<br />

working capital.<br />

The formation of FFO for comparison with previous<br />

years is presented in the reclassified cash flow<br />

reported in the previous paragraph. The value of<br />

FFO at 31 December 2011 stands at Euro 22.1<br />

million, against Euro 59.8 million at 31 December<br />

2010.<br />

Economic Value Added (EVA) - This indicator is the<br />

difference between Adjusted EBITA net of taxation<br />

and the cost of the average value of invested<br />

capital in the two years presented for the purposes<br />

of comparison, measured on the weighted average<br />

cost of capital (WACC). In 2011 EVA stands at Euro<br />

111.4 million, against Euro 131.2 million in 2010.<br />

The WACC rate used for both 2011 and 2010 is<br />

10.4%.<br />

Working Capital - Includes trade receivables and<br />

payables, work in progress and advances from<br />

customers. At 31 December 2011 Working Capital<br />

amounts to Euro -320.9 million, against Euro -<br />

413.5 million at 31 December 2010.<br />

Net Working Capital - This indicator is given by<br />

Working Capital net of the reserve for current risks<br />

and other current assets and liabilities. At 31<br />

December 2011 Net Working Capital stands at<br />

Euro -367 million, against Euro -467.6 at 31<br />

December 2010.<br />

Net Invested Capital - This indicator is defined as<br />

the sum of non current assets, non current<br />

liabilities and Net Working Capital. Net Invested<br />

Capital at 31 December 2011 stands at Euro<br />

369.9 million, against Euro -407.2 million at 31<br />

December 2010.<br />

Net Financial Indebtedness - The method of<br />

calculation complies with the provisions of<br />

paragraph 127, CESR/05-054b recommendations,<br />

which implement Regulation (EC) no. 809/2004.<br />

The amount at 31 December 2011 stands at Euro -<br />

383.6 million, against Euro -501.2 million in 2010.<br />

Orders - This indicator is given by the sum of<br />

contracts signed with customers during the year,<br />

with contract characteristics such as to be<br />

recorded in the order book. New orders in 2011<br />

amount to about Euro 1,250 million, against Euro<br />

1,271 million in 2010.<br />

Order backlog - This indicator is given by the<br />

difference between new orders and turnover<br />

(economic) in the reference period, net of the<br />

change in contract work in progress. This<br />

difference is added to the backlog in the previous<br />

period. The Order backlog at 31 December 2011<br />

stands at Euro 3,072 million (Euro 3,132 million in<br />

2010).<br />

Employees - This indicator is given by the number<br />

of employees entered on the payroll on the last day<br />

of the financial year. At 31 December 2011, 2,937<br />

employees were entered on the payroll (2,935 in<br />

2010). The average number of employees on the<br />

payroll in 2011 (taking account of part-time<br />

reductions, maternity leave, sabbaticals, etc.)<br />

stands at 2,901 (2,942 in 2010).<br />

Return On Sales (ROS) - (calculated as the ratio of<br />

Adj EBITA to revenues) stands at 10.1% against<br />

10.6% in 2010.<br />

Return On Investment (ROI) - (calculated as the<br />

ratio of Adj EBITA to the average value of net<br />

invested capital in the previous two years<br />

presented for comparison purposes).<br />

The indicator is not applicable.<br />

Return on Equity (ROE) - (calculated as the ratio<br />

between net result and the average value of<br />

shareholders’ equity in the two years presented for<br />

comparison purposes) stands at -30% against<br />

63.81% in 2010. This indicator is not very<br />

meaningful due to the limited amount of<br />

shareholders’ equity.

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

27<br />

ALTERNATIVE NON-GAAP PERFORMANCE INDICATORS

Information on the management<br />

and coordination activities of<br />

the Company and transactions<br />

with related parties

In accordance with the provisions of Article 2497<br />

bis of the Italian Civil Code, it should be noted that<br />

the Company is subject to management and<br />

coordination by the Group Parent Finmeccanica<br />

S.p.A. and First Reserve Power.<br />

Highlights of the latest financial statements<br />

approved by Finmeccanica S.p.A. are given in<br />

Appendix no. 12.<br />

Below are the figures for transactions with related<br />

parties in 2011 and in the previous year (details by<br />

company are provided in Notes 10 and 26).<br />

Related parties include not only the Group Parent<br />

and the companies in which <strong>Ansaldo</strong> <strong>Energia</strong> S.p.A.<br />

has direct or indirect interests, but also the other<br />

related parties as defined by International<br />

Accounting Standards.<br />

Euro/thousand Parent Companies Subsidiaries Associates (*) Companies Total<br />

controlled<br />

or subject to<br />

significant influence<br />

by the Italian MEF<br />

Current receivables<br />

- financial 309,330 47,850 357,180<br />

- trade 385 10,441 4,081 37,367 52,274<br />

- other 25,867 25,867<br />

Current payables<br />

- financial –<br />

- trade 13,641 1,504 7,051 1,994 24,190<br />

- other 18,096 18,096<br />

Revenues 5,298 2,718 16,165 24,181<br />

Other operating revenues 192 192<br />

Costs 20,709 1,440 17,253 3,327 42,729<br />

Financial income 2,994 719 3,713<br />

Financial charges 24 27 8 59<br />

(*) Companies subject to direction, control and coordination by Finmeccanica S.p.A.<br />

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

29<br />

INFORMATION ON THE MANAGEMENT AND COORDINATION ACTIVITIES

Performance

Market prospects and competitive<br />

positioning<br />

Global performance of the power generation market<br />

and prospects<br />

The trend in the global electric power market is<br />

closely linked to the global macroeconomic<br />

situation.<br />

After the dramatic global financial crisis in 2009<br />

and modest recovery in 2010, the main feature of<br />

2011 was a worsening of the situation, with the<br />

transformation of the financial crisis into a<br />

sovereign debt crisis, particularly in Europe and in<br />

the US, and a stabilization of growth in emerging<br />

economies.<br />

The ongoing sovereign debt crisis has led, among<br />

other things, to a downward revision of global<br />

economic growth forecasts for 2012-2013, from<br />

about 5% to about 4%, while the clear disconnect<br />

between growth in advanced and emerging<br />

economies has been confirmed.<br />

As a result, demand for electric power in 2009 fell<br />

for the first time since the Great Depression of<br />

1929. In 2010 it reported an increase of about<br />

4.5% against 2009, while in 2011 lower growth of<br />

about 4% is estimated against 2010 figures<br />

(Economist Intelligence Unit). This increase is<br />

mostly attributable to growth in emerging<br />

economies.<br />

So far as concerns medium to long term<br />

prospects, the benchmark scenario established by<br />

the International Energy Agency (WEO, November<br />

2011) estimates an annual increase in demand for<br />

electric power of 2.4% for the next 25 years.<br />

However, it is undeniable that other events have<br />

had an impact on this market, including for<br />

example the incident in 2011 at the Fukushima<br />

Dai-ichi power plant, which affected public opinion<br />

in certain countries, causing delays in the short<br />

term, accelerated decommissioning and the<br />

cancellation of national nuclear programmes in<br />

some cases.<br />

The consequences of the incident will also have an<br />

impact in the mid to long term as the loss of<br />

electricity production from nuclear power will have<br />

to be replaced by other energy sources.<br />

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

31<br />

Some international forecasters (WEO 2011 - IEA)<br />

are even talking about a possible “golden age” of<br />

gas, which could replace some of the lost future<br />

production from nuclear sources, because of the<br />

operating flexibility it offers.<br />

So far as concerns the mix of fuels used to<br />

generate electric power, today coal is the main<br />

source at over 40%, followed by gas at 21%;<br />

nuclear power contributes 13% and hydroelectric<br />

power 16%, while oil represents a marginal 4%.<br />

In 2011 other renewable sources (biomasses,<br />

wind, solar) therefore contributed about 5% of<br />

world electric power production (source: World<br />

Energy Outlook 2011 - EIA).<br />

The global market for power generation plant and<br />

machinery in 2011 is estimated at about 270 GW,<br />

or slightly higher than in 2010, but about 25-30%<br />

lower than the values in the peak 2007/2008<br />

period and in any case in line with the historical<br />

global growth trend in the sector.<br />

In more detail, in 2011 orders for coal-fired plants<br />

are expected to hold up, while a slight rise is<br />

forecast for gas-fired plants.<br />

We also draw your attention to the fact that<br />

following the Fukushima incident, there was a<br />

strong contraction in new nuclear segment orders,<br />

although certain key countries confirmed their<br />

interest in investing in this sector, including China,<br />

India and Russia.<br />

Finally, power production from renewable sources,<br />

driven in part by the incentive schemes recently<br />

introduced in many countries, continues to show<br />

the strong growth trend that has been a feature of<br />

the segment in recent years.<br />

It seems unlikely that the worsening current<br />

macroeconomic scenario will contribute to a<br />

positive review of the investment plans drawn up<br />

by the main utilities operating in the power<br />

generation sector, most importantly in the US and<br />

Europe.<br />

The mix of fuels is expected to evolve with a<br />

significant rise in gas for electric power generation<br />

for the following reasons: the discovery of new<br />

non-conventional, lower cost gas reserves (shale<br />

gas), potential growth in Chinese demand as a<br />

result of constraints on the use of coal, the use of<br />

gas as a back-up for renewables and, finally, the<br />

PERFORMANCE

ongoing transition in the rest of the world from<br />

more polluting sources (coal and petrol) to cleaner<br />

fuels such as gas.<br />

However, a great deal will depend on the<br />

international policies introduced in the short term<br />

to reduce pollutant emissions and increase energy<br />

security. In the absence of new binding<br />

international agreements, electric power generation<br />

will nevertheless continue to depend for the most<br />

part in coming decades on increasingly efficient<br />

plants fired by fossil fuels (mainly gas).<br />

The use of sources with a reduced environmental<br />

impact will continue in the coming years,<br />

supported by various factors including: continuing<br />

government incentives; a post Fukushima recovery<br />

in nuclear power (China, India and Russia in<br />

particular); the policies introduced by the main<br />

economies regarding procurement security for<br />

fossil fuels and protection against the risk of price<br />

volatility.<br />

Performance of the reference market<br />

and prospects<br />

The main reference market for <strong>Ansaldo</strong> <strong>Energia</strong> is<br />

represented by countries with 50Hz networks<br />

(excluding China), where gas plants (open or<br />

combined cycle) are sold that use gas turbines<br />

rated over 50MW.<br />

Figures for 2011 point to an increase in demand in<br />

this segment, estimated at about 10% compared<br />

with 2010 values (orders for about 24 GW).<br />

However, market conditions worsened in the last<br />

semester of the year, basically due to the<br />

worsening of the sovereign debt crisis.<br />

Of the areas of interest to <strong>Ansaldo</strong> <strong>Energia</strong>, Europe<br />

is the most affected by the aforementioned crisis<br />

and continues to report very low order levels, while<br />

there are signs of market recovery in Russia and<br />

Turkey.<br />

MENA (Middle East and North Africa), however,<br />

continues to hold up despite the geopolitical<br />

tensions that initially blocked new orders.<br />

South East Asia, and India in particular, confirms<br />

that it is extremely interesting in terms of the<br />

number of orders raised.<br />

If we look at orders for gas turbines (used for open<br />

or combined cycle plants) in the main reference<br />

market, <strong>Ansaldo</strong> <strong>Energia</strong> market share in 2011<br />

stands at around 8%, a slight improvement on 7%<br />

in 2010.<br />

In 2011, in the same reference market, while<br />

General Electric confirmed its leadership (35%), it<br />

lost market share to Siemens (more than 25%).<br />

Alstom and MHI seem to be starting to recover<br />

from the deep crisis that was a feature of 2009<br />

and 2010.<br />

BHEL, as a new market player, reports a market<br />

share of about 5%.<br />

In the medium term, based on the macroeconomic<br />

and geopolitical situation, the two-year period<br />

2012-2013 is expected to be difficult, with Europe<br />

looking for a way out of the crisis, MENA stabilising<br />

and South East Asian countries looking to confirm<br />

their recent high growth trends.<br />

In general terms we can see the increasing<br />

importance of orders in South East Asian<br />

countries, which could be confirmed in the mid<br />

term too.<br />

In the long term the importance of gas is<br />

confirmed as the primary energy source for electric<br />

power generation, most importantly with a view to<br />

environmental concerns and as a backup for<br />

renewables.<br />

Sales<br />

In 2011 <strong>Ansaldo</strong> <strong>Energia</strong> received total orders<br />

worth Euro 1,250 million.<br />

This represents a slight fall of 1.7% due to the<br />

combined effect of growth in new units (+21%) and<br />

a reduction in renewables (-85.5%) and service<br />

activities (-8.4%).<br />

In the service segment, flow activities rose 59.7%<br />

while LTSAs fell significantly by 81.3%. We remind<br />

you however with regard to the Gebze-Yeni Elektrik<br />

operation, that the LTSA contract (worth Euro<br />

141.4 million) was awarded to subsidiary company<br />

Yeni AEN.<br />

2011 orders break down as follows by type of<br />

supply and geographical area, with 2010 results<br />

provided for comparison:

36<br />

2<br />

0,5<br />

ORDERS BY TYPE OF SUPPLY (EURO/MILLION)<br />

2011 2010<br />

% 38<br />

%<br />

63<br />

2011<br />

Plant and machinery 783<br />

Service activities 448<br />

Renewable energy 20<br />

ORDERS BY GEOGRAPHICAL AREA (EURO/MILLION)<br />

5<br />

4<br />

Italy 312<br />

Europe 355<br />

Middle East 71<br />

Plant and machinery 647<br />

Service activities 489<br />

Renewable energy 135<br />

2010<br />

38.5 % 36 %<br />

2<br />

1<br />

Italy 335<br />

Europe 389<br />

Middle East 28<br />

31<br />

27<br />

Africa 479<br />

Asia 3<br />

Americas 15<br />

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

33<br />

11<br />

2<br />

25<br />

28<br />

51<br />

Africa 461<br />

Asia 51<br />

Americas 21<br />

PERFORMANCE

Plant and machinery<br />

New orders for plant and machinery in 2011<br />

improved on 2010, confirming the lasting effects of<br />

the economic crisis and its impact on investments<br />

in the sector.<br />

So far as geographical distribution is concerned,<br />

the market in western Europe continued to<br />

stagnate, making the internationalisation of<br />

<strong>Ansaldo</strong> <strong>Energia</strong> increasingly necessary in non<br />

traditional markets too.<br />

2011 was a positive year for your Company’s<br />

international growth.<br />

The volume of new orders, standing at about Euro<br />

782.6 million, while penalised by the sharp drop in<br />

demand, exceeded the 2010 figure.<br />

The main new orders during the year were:<br />

� the supply of machinery for the 800 MW Gebze<br />

combined cycle plant in Turkey, to be built on a<br />

joint basis with subsidiary company Yeni Aen;<br />

� the supply of two 300 MW simple cycle plants in<br />

Algeria;<br />

� the supply of a 350 MW steam turbine for the<br />

Bahna power plant (Egypt);<br />

� the supply of two 350 MW steam turbines for<br />

the Giza power plant (Egypt), with an option for a<br />

third unit;<br />

� the supply of 3 geothermal steam turbines for<br />

Enel Green Power in Italy.<br />

The current world scenario, featuring deep<br />

uncertainty about how long it will really take to<br />

recover from the financial crisis and strong political<br />

instability, particularly in traditional markets, has<br />

driven <strong>Ansaldo</strong> <strong>Energia</strong> to increase its activities,<br />

presence and supply capacity in new areas and<br />

particularly in Eastern Europe, South America and<br />

the Middle East.<br />

Agreements have been signed with international<br />

EPC players and local partners in order to give the<br />

company a more effective presence in these new<br />

countries. The confidence shown by customers in<br />

<strong>Ansaldo</strong> <strong>Energia</strong>’s technical capabilities, flexibility<br />

and efficient execution put our company in the<br />

best position to pursue its growth and expansion<br />

path in new markets.<br />

Service activities<br />

The rising trend in Service segment orders was<br />

reversed in 2011, with a drop of 8.4% to a total of<br />

Euro 447.6 million new orders.<br />

This does not include the LTSA contract for the<br />

Gebze power plant, which was awarded to<br />

subsidiary company Yeni AEN as a result of the<br />

sales effort by your Company.<br />

If this contract were taken into account, the<br />

positive trend would have been confirmed (+20%<br />

vs. 2010), despite the economic crisis which has<br />

affected the sector since 2008 and which has not<br />

yet come to an end.<br />

There was a negligible rise in European energy<br />

demand in the first half of 2011 and a weak<br />

recovery in the second half, but <strong>Ansaldo</strong> <strong>Energia</strong>,<br />

despite the widespread crisis in the area,<br />

successfully managed to win 75% of the company’s<br />

total new orders in this area.<br />

In this framework, Service activities have improved<br />

on the results expected, mainly because of the<br />

loyalty of major customers like Enipower in Italy<br />

and the acquisition of new European customers<br />

like the Turkish Yeni Elektrik.<br />

Current service activities (spare parts, repairs,<br />

maintenance and repowering) reported a rise on<br />

the previous year.<br />

The following paragraphs comment on performance<br />

in the various geographical areas in 2011.<br />

Italy<br />

Although the energy market has felt the European<br />

crisis, <strong>Ansaldo</strong> <strong>Energia</strong> has maintained its<br />

leadership position on the domestic market, which<br />

represents 62% of the total volume of service<br />

orders in 2011, demonstrating that it can provide<br />

valuable technical support for companies that have<br />

to comply with the new European directives on<br />

industrial emissions by the end of 2012, at the<br />

same time as increasing their operating flexibility.<br />

With this in mind, Enipower has set a major<br />

programme in motion to optimise the performance<br />

of its plants and increase their rating and flexibility.<br />

Overall, the volume of orders received from<br />

Enipower alone represented about 40% of total<br />

service orders in 2011, confirming its position of

top-ranking customer for the year. Also worthy of<br />

note in terms of volume are Tirreno Power and<br />

Enel, confirming the confidence these customers<br />

have in your Company.<br />

Europe<br />

The European market represents about 12.4% of<br />

new orders in 2011 by volume. <strong>Ansaldo</strong> <strong>Energia</strong>’s<br />

operations in the Iberian peninsula were<br />

consolidated by the new long term contract worth<br />

over Euro 35 million to maintain the Escatron and<br />

Algeciras combined cycle thermoelectric power<br />

stations owned by E.ON Generación.<br />

Africa<br />

This area confirms that it is critical in terms of<br />

current service activity growth.<br />

The result reported of about Euro 69 million is<br />

basically attributable to orders for the new Labreg<br />

and Ain D’jesser plants. Subsidiary company<br />

<strong>Ansaldo</strong> Thomassen delivered a good result in the<br />

area with the LTSA contract worth about Euro 10<br />

million stipulated in Ghana with public entity VRA.<br />

America<br />

This area, which continues to be of great interest<br />

with new orders worth about Euro 15 million, has<br />

been affected mainly by delays on a major<br />

repowering project.<br />

The results are nevertheless satisfying, with new<br />

orders in the competitive hydro segment and the<br />

reinstatement of the Bolivian EVH as a customer.<br />

The main customers in the area, in addition to<br />

NA.SA, are AES Chile, AES Argentina, Endesa Chile,<br />

E-CL and Tractebel <strong>Energia</strong> (both GDF Suez<br />

companies) and Covalco Ecuador.<br />

Middle East<br />

Despite a strong local presence, this is the area,<br />

and Dubai in particular, most affected by the<br />

international crisis and by the widespread social<br />

and political upheaval that has had an impact on<br />

many Arab countries which are important for<br />

<strong>Ansaldo</strong> <strong>Energia</strong>.<br />

Some important initiatives have been delayed.<br />

These problems have be offset in part by the<br />

Damanhour and Giza contracts in Egypt, by the<br />

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

35<br />

renewal of the LTPA agreement for Barka (Oman)<br />

and by the performance of subsidiary company<br />

ATG.<br />

Asia and Oceania<br />

This area represents a great opportunity because<br />

of its enormous market development prospects,<br />

even though <strong>Ansaldo</strong> <strong>Energia</strong> does not have a<br />

significant installed fleet. In 2011 it was<br />

particularly penalised by organisational changes<br />

and the postponement of several important<br />

projects in India. The new local service structure is<br />

expected to deliver an important boost in 2012.<br />

Renewable and Distributed Energy Resources<br />

In 2011 there were significant legislative<br />

developments in Italy regarding the incentive<br />

system for photovoltaic plants and the Company<br />

decided it was appropriate to devote more effort to<br />

creating the conditions for consolidation.<br />

Orders in 2011 were therefore limited to two major<br />

supplies for photovoltaic plants, one in Montenero<br />

di Bisaccia, for HFV Montenero srl, and one in<br />

Stigliano for General Construction S.p.A., as well<br />

as a revenue-increasing variant for a completed<br />

photovoltaic plant.<br />

In the meantime, marketing and technology<br />

development initiatives have identified important<br />

new opportunities in the field of Concentrated<br />

Solar Power (CSP), in the biomass treatment sector<br />

and in the installation of photovoltaic and/or wind<br />

power plants abroad.<br />

In CSP, <strong>Ansaldo</strong> <strong>Energia</strong> has successfully qualified<br />

for a tender in Algeria as part of a consortium with<br />

an international partner and has begun to market<br />

itself as a supplier of steam turbines. In the<br />

biomass segment, <strong>Ansaldo</strong> <strong>Energia</strong> has<br />

established business relations with possible users<br />

of gasifiers, focusing marketing actions on<br />

applications of the solutions it will shortly be able<br />

to provide.<br />

Turning to plants in foreign countries, the target<br />

markets have been identified and plants will be<br />

built in these countries if and where the contingent<br />

international situation is favourable.<br />

PERFORMANCE

Production<br />

Despite the continuing global economic crisis and<br />

its negative effect on the energy market, there was<br />

only a slight fall in volumes of both turnkey plants<br />

and individual machines, with a limited reduction in<br />

both factory and engineering workload.<br />

The company therefore continued its policy of not<br />

introducing measures which could have a<br />

significant social impact, and of optimising<br />

planning and outsourcing.<br />

The following machines were delivered in 2011:<br />

1 turnkey simple cycle gas turbine plant (6th<br />

October);<br />

1 single shaft combined cycle (Sousse);<br />

1 dual shaft combined cycle (Deir Ali);<br />

18 separate components.<br />

Design work is underway on 3 turnkey plants.<br />

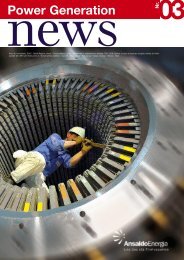

Manufacturing<br />

In 2011, the Genoa Campi production facility<br />

manufactured, assembled and delivered the<br />

following complete machines:<br />

5 AE943A gas turbines;<br />

6 AE942 gas turbines;<br />

8 steam turbines;<br />

15 turbogenerators;<br />

1 hydraulic generator;<br />

for a total of 35 units.<br />

It should also be pointed out that in 2011 the hot<br />

blade line achieved the production target of about<br />

12,000 hot blades.<br />

Work sites and plant start-ups<br />

2011 confirmed the trend established in previous<br />

years of a growing presence on foreign markets.<br />

The following plants/machines were completed<br />

and delivered:<br />

• Bayet (400 MW combined cycle);<br />

• Dunamenti (Hungary - AE 94.3A);<br />

• Pervomaiskaya 3 and 4 (Russia – AE 64.3A);<br />

• S.West 1 and 2 (Russia – AE 64.3A);<br />

• Vlore (Albania - single shaft, 100 MW);<br />

• Angamos (Cile - 1 ST RT30 250 MW).<br />

Erection and start-up work was performed on these<br />

plants in 2011:<br />

• Sixth October (Egypt, open cycle - 4 x AE 94.2<br />

700 MW);<br />

• Gebze (Turkey – 800 MW combined cycle);<br />

• Sylet (Bangladesh - 1 x AE 64.3A);<br />

• Forssa (Finland - 2 x AE 94.2);<br />

• Dier Ali (Syria - 2 x AE 94.3° + ST);<br />

• Sousse (Tunisia - 400 MW single shaft);<br />

• Tzsafit (Israel - 1 x ST MT15 150 MW);<br />

• Batna 2 (Algeria, open cycle - 2 x AE 94.2 265<br />

MW);<br />

• Labreg (Algeria, open cycle - 2 x AE 94.2 281<br />

MW);<br />

• Campiche (Cile - 1 x ST RT30 300 MW);<br />

• Marcinelle (Belgium - 400 MW single shaft).<br />

The main production activities for the domestic<br />

market were:<br />

• Delivery of the S. Severo plant (400 MW<br />

combined cycle);<br />

• Delivery of Torino Nord (1 x AE 94.3A);<br />

• Delivery of the Turano Lodigiano plant (800 MW<br />

combined cycle);<br />

• Erection / start-up of the Aprilia plant (800 MW<br />

combined cycle).<br />

Service segment<br />

In 2011 we saw the first effects of the economic<br />

crisis, with production volumes falling by about<br />

20% on the previous year.<br />

This drop is basically due to reduced machine<br />

usage by leading European customers and<br />

therefore fewer maintenance calls and fewer parts<br />

to replace with spares.<br />

Production for the year was also affected by a<br />

reduction in the number of short cycle orders due<br />

to belt-tightening by customers.<br />

This reduction was in part offset by production<br />

relating to the renewal of the Servola contract with<br />

customer Elettra, to the supply of the generator<br />

stator for Enel’s Nove 71 hydroelectric power plant<br />

and the turbine and generator rotors for Neyveli in<br />

India, and to production for the Isab contract as a<br />

result of contract renewal.<br />

Production was also healthy as regards work in<br />

South America, and in particular at the Embalse<br />

power plant in Argentina.<br />

The second operation to transform an AE94.3A2

turbine into a latest generation AE94.3A4 was<br />

successfully completed for customer Eni.<br />

This will be followed by other similar operations<br />

during 2012.<br />

LTSAs also came into effect regarding the Aprilia<br />

and Turano plants.<br />

During the year work continued on initiatives to<br />

strengthen on-site capabilities and on a targeted<br />

investment programme to acquire the equipment<br />

needed to satisfy new requirements.<br />

Contract management<br />

In 2011 production for international contracts was<br />

consolidated, confirming sales plan predictions.<br />

Economic and financial results continued to<br />

improve and customer satisfaction was high.<br />

Billing milestones were successfully achieved for<br />

plants under construction and there were no<br />

significant disputes with customers.<br />

Further consolidating the company’s role as EPC<br />

contractor, Provisional Acceptance Certificates<br />

(PAC) were signed for the San Severo and Bayet<br />

(France) single-shaft combined cycle plants, both<br />

rated 400 MW, for customer Alpiq.<br />

Provisional acceptance was also issued for the<br />

AE94.3A4 gas turbines at the Dunamenti<br />

combined cycle plant in Hungary for customer<br />

Nunamenti Eromu zrt, for the steam turbines and<br />

relative alternators for units 1 and 2 at the<br />

Angamos plant (Chile) for customer POSCO, for the<br />

AE64.3A gas turbines and relative alternators for<br />

units 3 and 4 at the Pervomayskaya power plant<br />

for customer OJSC Power Machines (Russia), and<br />

the AE64.3A gas turbines and relative alternators<br />

for units 1 and 2 at the West St. Petersburg power<br />

plant for customer PJSC Stroytransgaz (Russia),<br />

after successfully passing the necessary tests to<br />

both the customer’s and our satisfaction.<br />

Final acceptance certificates have been issued for<br />

the Napoli Levante power plant (400 MW combined<br />

cycle) by customer Tirreno Power; the AE94.2 gas<br />

unit and relative alternator for the Sumenoja plant<br />

by customer Fortum Power and Heat OY (Finland);<br />

and the steam turbine unit for Amarceour 1 by<br />

customer Electrabel GDF Suez (Belgium).<br />

ANSALDO ENERGIA ANNUAL REPORT 2011<br />

37<br />

Renewable and Distributed Energy Resources<br />

In 2011, revenues in the Renewable and<br />

Distributed Energy Resources segment grew 34%<br />

on 2010 (Euro 47.1 million against Euro 35.1<br />

million the previous year).<br />

This increase in production was accompanied by<br />

rising profitability, encouraged by the completion on<br />

time and with the expected performance levels of<br />

three big photovoltaic plants.<br />

Production involves the realisation as EPC<br />

contractor of multi-MW solar and wind power plants<br />

and subsequently their operation and management<br />

(O&M).<br />

In 2011, the contracts reporting most cost and<br />

revenue progress were supplies for: the Bisaccia<br />

(near Avellino) 66 MWp wind plant; the Stigliano<br />

(near Matera) 5 MWp photovoltaic plant; the<br />

Montenero di Bisaccia (near Campobasso) 3.5<br />

MWp photovoltaic plant; and the Francofonte (near<br />

Siena) 3.4 MWp photovoltaic plant.<br />

Also in 2011, PACs were issued for the Martano<br />

and Soleto (in Puglia) photovoltaic plants<br />

completed in 2010.<br />

At the Montenero site, despite a series of<br />

authorisation issues arisen during construction<br />

(the customer’s responsibility), <strong>Ansaldo</strong> <strong>Energia</strong><br />

successfully completed the plant a month ahead of<br />

schedule, enabling the investor to obtain a higher<br />

incentivated price. Work on the Bisaccia wind plant<br />

is proceeding on schedule and should be<br />

concluded in 2012, with the potential for early<br />

completion in this case too.<br />

Organisation and process/product<br />

developments<br />

Manufacturing<br />

The new production model (NeMO) was fully<br />

introduced across all gas turbine, steam turbine<br />

and generator products.<br />

As a result of the integration of the new production<br />

model with the other projects coming online during<br />

the year (Team Center Manufacturing, 5S, OEE,<br />

etc.), the improvement in the efficiency of<br />

workshop activities was confirmed and the positive<br />

effect deriving from the entry into service of new<br />

PERFORMANCE

machine tools continued in 2011. Once again in<br />

2011, outsourcing related to workload issues was<br />

significantly reduced compared with previous years,<br />

thanks in part to detailed planning to optimise<br />

machine tool performance.<br />

The hot blade product was managed with special<br />

care to achieve the objective of reducing<br />

production while maintaining previous year<br />

employment levels.<br />

There was a special focus on keeping working<br />

capital under control and therefore on closely<br />

monitoring the warehouse levels of articles<br />

manufactured for stock (higher turnover) or to<br />

order, achieving stock levels at the end of 2011<br />

that are aligned with the financial equilibrium goals<br />

your Company set itself.<br />

Service Segment<br />

With confirmation of <strong>Ansaldo</strong> <strong>Energia</strong>’s expansion<br />

into international markets by acquiring new plant<br />

orders and the ongoing desire to raise the profile<br />

of the international installed fleet, the organisation<br />

of service activities was reviewed to improve<br />

regional focus at operational level too, with the aim<br />

of increasing proximity to customers and<br />

competitiveness.<br />

In 2011 customers continued to demand ever<br />

higher levels of availability and flexibility.<br />

This forced <strong>Ansaldo</strong> <strong>Energia</strong> to realign the type and<br />

quality of technical and operating support services<br />

available, in addition to their capabilities,<br />

particularly in terms of organisation, in order to<br />

provide an immediate response to customers in<br />

terms of quality and reduced outages.<br />

Finally, the greater maturity of the resources<br />

involved, combined with organisational synergy, has<br />

made it possible to improve diagnostic capabilities<br />

still further, and to develop best of breed solutions,<br />

providing added value both for customers and<br />

<strong>Ansaldo</strong> <strong>Energia</strong> itself. Development and testing<br />

work also continued on new combustion systems,<br />