Aktuel skat ved økonomikonsulenterne Majbritt N ... - LandboNord

Aktuel skat ved økonomikonsulenterne Majbritt N ... - LandboNord

Aktuel skat ved økonomikonsulenterne Majbritt N ... - LandboNord

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

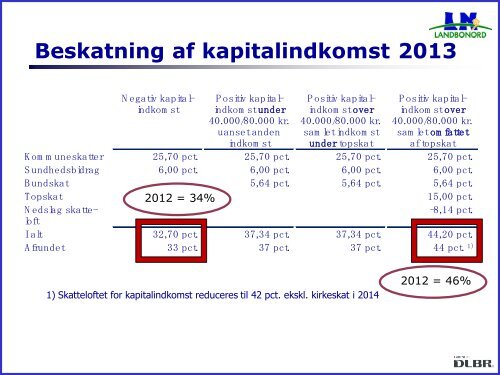

Be<strong>skat</strong>ning af kapitalindkomst 2013<br />

N egativ kapitalindkom<br />

st<br />

P ositiv kapitalindkom<br />

st under<br />

40.000/80.000 kr.<br />

uanset anden<br />

indkom st<br />

P ositiv kapitalindkom<br />

st over<br />

40.000/80.000 kr.<br />

sam let indkom st<br />

under top<strong>skat</strong><br />

1) Skatteloftet for kapitalindkomst reduceres til 42 pct. ekskl. kirke<strong>skat</strong> i 2014<br />

P ositiv kapitalindkom<br />

st over<br />

40.000/80.000 kr.<br />

sam let om fattet<br />

af top<strong>skat</strong><br />

K om m une<strong>skat</strong>ter 25,70 pct. 25,70 pct. 25,70 pct. 25,70 pct.<br />

S undhedsbidrag 6,00 pct. 6,00 pct. 6,00 pct. 6,00 pct.<br />

B und<strong>skat</strong> 5,6 4 pct. 5,6 4 pct. 5,6 4 pct.<br />

Top<strong>skat</strong> 15,00 pct.<br />

N edslag <strong>skat</strong>teloft<br />

-8,14 pct.<br />

I alt 32,70 pct. 37,34 pct. 37,34 pct. 44,2 0 pct.<br />

A frundet 33 pct. 37 pct. 37 pct. 44 pct. 1)<br />

2012 = 34%<br />

2012 = 46%