PROSPECTUS (incorporated with limited liability under the laws of ...

PROSPECTUS (incorporated with limited liability under the laws of ...

PROSPECTUS (incorporated with limited liability under the laws of ...

Sie wollen auch ein ePaper? Erhöhen Sie die Reichweite Ihrer Titel.

YUMPU macht aus Druck-PDFs automatisch weboptimierte ePaper, die Google liebt.

Variation <strong>of</strong> Terms and<br />

Conditions:<br />

Programme, <strong>with</strong> a denomination <strong>of</strong> at least € 1,000, will be <strong>the</strong> CSSF.<br />

Subject <strong>the</strong>reto, each series <strong>of</strong> Notes will be in denominations specified in <strong>the</strong><br />

Final Terms subject to compliance <strong>with</strong> all applicable legal and/or regulatory<br />

and/or central bank or equivalent requirements.<br />

The Issuer may agree <strong>with</strong> any Dealer(s) that Notes may be issued in a form<br />

not contemplated <strong>under</strong> “Terms and Conditions <strong>of</strong> <strong>the</strong> Notes”. The applicable<br />

Final Terms toge<strong>the</strong>r <strong>with</strong> any relevant supplement to this Prospectus will<br />

describe <strong>the</strong> effect <strong>of</strong> <strong>the</strong> agreement reached in relation to such Notes.<br />

Alternatively, <strong>the</strong> Issuer may publish such fur<strong>the</strong>r or additional prospectus<br />

which may incorporate by reference all or any part or parts <strong>of</strong> this Prospectus<br />

for <strong>the</strong> purpose <strong>of</strong> describing <strong>the</strong> effect <strong>of</strong> any such agreement.<br />

Taxation: All payments by <strong>the</strong> Issuer in respect <strong>of</strong> <strong>the</strong> Notes (o<strong>the</strong>r than Pfandbriefe and<br />

Jumbo-Pfandbriefe) will be made <strong>with</strong>out <strong>with</strong>holding or deduction for or on<br />

account <strong>of</strong> Austrian taxes subject as provided <strong>under</strong> “Terms and Conditions <strong>of</strong><br />

<strong>the</strong> Notes – Taxation”.<br />

Status: Unsubordinated Notes (“Ordinary Notes“) will be direct, unconditional and<br />

unsecured obligations <strong>of</strong> <strong>the</strong> Issuer and shall rank pari passu <strong>with</strong>out any<br />

preference among <strong>the</strong>mselves and equally <strong>with</strong> all o<strong>the</strong>r outstanding,<br />

unsecured and unsubordinated obligations <strong>of</strong> <strong>the</strong> Issuer present and future<br />

(save to <strong>the</strong> extent that <strong>laws</strong> affecting creditors’ rights generally in a<br />

bankruptcy or winding-up may give preference to any <strong>of</strong> such o<strong>the</strong>r unsecured<br />

obligations).<br />

Notes may be issued on a subordinated basis as described in <strong>the</strong> applicable<br />

Final Terms. Subordinated Notes will be direct, unsecured and subordinated<br />

obligations and shall rank pari passu <strong>with</strong>out any preference among<br />

<strong>the</strong>mselves after Senior Creditors <strong>of</strong> <strong>the</strong> Issuer.<br />

Pfandbriefe will constitute unsubordinated obligations (i) in <strong>the</strong> case <strong>of</strong> Public<br />

Sector Pfandbriefe ranking pari passu <strong>with</strong> all o<strong>the</strong>r obligations <strong>of</strong> <strong>the</strong> Issuer<br />

<strong>under</strong> Public Sector Pfandbriefe and (ii) in <strong>the</strong> case <strong>of</strong> Mortgage Pfandbriefe<br />

pari passu <strong>with</strong> all o<strong>the</strong>r obligations <strong>of</strong> <strong>the</strong> Issuer <strong>under</strong> Mortgage<br />

Pfandbriefe.<br />

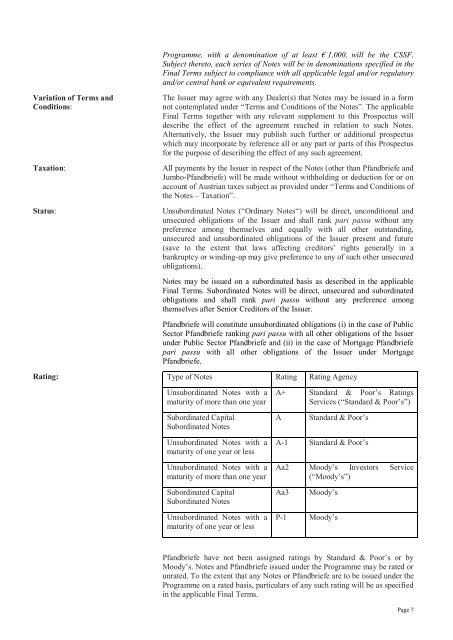

Rating: Type <strong>of</strong> Notes Rating Rating Agency<br />

Unsubordinated Notes <strong>with</strong> a<br />

maturity <strong>of</strong> more than one year<br />

Subordinated Capital<br />

Subordinated Notes<br />

Unsubordinated Notes <strong>with</strong> a<br />

maturity <strong>of</strong> one year or less<br />

Unsubordinated Notes <strong>with</strong> a<br />

maturity <strong>of</strong> more than one year<br />

Subordinated Capital<br />

Subordinated Notes<br />

Unsubordinated Notes <strong>with</strong> a<br />

maturity <strong>of</strong> one year or less<br />

A+ Standard & Poor’s Ratings<br />

Services (“Standard & Poor’s”)<br />

A Standard & Poor’s<br />

A-1 Standard & Poor’s<br />

Aa2 Moody’s Investors Service<br />

(“Moody’s”)<br />

Aa3 Moody’s<br />

P-1 Moody’s<br />

Pfandbriefe have not been assigned ratings by Standard & Poor’s or by<br />

Moody’s. Notes and Pfandbriefe issued <strong>under</strong> <strong>the</strong> Programme may be rated or<br />

unrated. To <strong>the</strong> extent that any Notes or Pfandbriefe are to be issued <strong>under</strong> <strong>the</strong><br />

Programme on a rated basis, particulars <strong>of</strong> any such rating will be as specified<br />

in <strong>the</strong> applicable Final Terms.<br />

Page 7