MARKET STRUCTURE AND ENTRY: WHERE'S THE BEEF? - CEPR

MARKET STRUCTURE AND ENTRY: WHERE'S THE BEEF? - CEPR

MARKET STRUCTURE AND ENTRY: WHERE'S THE BEEF? - CEPR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.4. Entry and Market Structure<br />

In Table III we give some statistics relating to the number of outlets, and the<br />

number of entries. As can be seen, McD is clearly larger than BK. Our sample includes a<br />

clearly larger proportion of McD than BK outlets: the main explanation for this is are<br />

BK’s smaller size and its relatively larger number of transit outlets (these constitute 25%<br />

of BK’s, but only 7% of McD’s stock). Although BK has grown faster in relative terms<br />

during our sample period, McD has grown faster in absolute terms. Notice also the large<br />

difference in the proportion of franchised outlets.<br />

[TABLE III HERE]<br />

[ FIGURE 1 HERE]<br />

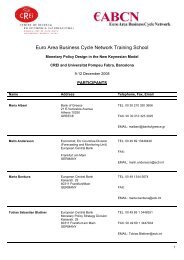

Let us take a first look at the market structure and entry data. In Figure 1 we<br />

detail the proportions in which different market structures are observed, and display the<br />

firms’ entry behavior conditional on market structure. A code (M,B) refers to a market<br />

structure where McD has M, and BK B, outlets at the beginning of the period. Some<br />

market structures (e.g., (0,3)) are never observed in the data, and others appear very<br />

infrequently. We have therefore included as final categories market structures with firm i<br />

having 3 or more outlets, and firm j either 0 outlets (labeled (G,0) and (0,G)), or fewer<br />

outlets than firm i ((G,