Bank FAQs - National Payments Corporation of India

Bank FAQs - National Payments Corporation of India

Bank FAQs - National Payments Corporation of India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Frequently asked Questions by <strong>Bank</strong>s for AEPS<br />

FREQUENTLY ASKED QUESTIONS<br />

BY<br />

BANKS<br />

FOR<br />

AADHAAR<br />

ENABLED<br />

PAYMENT<br />

SYSTEM<br />

Page 1

Frequently asked Questions by <strong>Bank</strong>s for AEPS<br />

1. What is AEPS?<br />

AEPS is a new payment service <strong>of</strong>fered by the <strong>National</strong> <strong>Payments</strong> <strong>Corporation</strong> <strong>of</strong> <strong>India</strong> to<br />

banks, financial institutions using ‘Aadhaar’ number and online UIDAI authentication through<br />

their respective Business correspondent service centres. This shall be known as ‘Aadhaar<br />

Enabled Payment System’ and may also be referred to as “AEPS”.<br />

2. Is this service approved by RBI?<br />

The Reserve <strong>Bank</strong> <strong>of</strong> <strong>India</strong> has approved the pilot <strong>of</strong> AEPS.<br />

3. Which system does this service use?<br />

AEPS functions through the <strong>National</strong> Financial Switch <strong>of</strong> NPCI, which is also used for routing<br />

inter bank ATM transactions and Interbank Mobile Payment Service (IMPS).<br />

4. What is the messaging format used for AEPS?<br />

AEPS transaction messages are as per the ISO 8583 standards.<br />

5. What is IIN?<br />

This number identifies the bank to which the customer has mapped his/her Aadhaar number.<br />

Each bank would be issued a unique Issuer Identification Number (IIN) NPCI. This is a six digit<br />

number.<br />

The customer service point will have the IIN number represented on the terminal by various<br />

bank logos/ bank names or the Business Correspondent (BC) agent will have a chart displayed <strong>of</strong><br />

various banks IIN in the customer service centre. Therefore the customer need not necessarily<br />

remember the IIN. It is however recommended that the customer be aware <strong>of</strong> their bank IIN to<br />

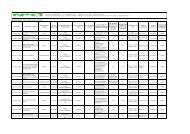

completely ensure an AEPS transaction. The banks currently in pilot using AEPS are as follows:<br />

S. No. <strong>Bank</strong> <strong>Bank</strong>’s IIN<br />

1. <strong>Bank</strong> Of <strong>India</strong><br />

2. <strong>Corporation</strong> <strong>Bank</strong><br />

3. Syndicate <strong>Bank</strong><br />

4. Union <strong>Bank</strong> <strong>of</strong> <strong>India</strong><br />

508505<br />

508507<br />

508508<br />

508500<br />

Page 2

Frequently asked Questions by <strong>Bank</strong>s for AEPS<br />

S. No. <strong>Bank</strong> <strong>Bank</strong>’s IIN<br />

5. The Federal <strong>Bank</strong> Limited<br />

6. Dhanlaxmi <strong>Bank</strong> LTD<br />

7. Axis <strong>Bank</strong><br />

8. ICICI <strong>Bank</strong><br />

9. Allahabad <strong>Bank</strong><br />

10. <strong>India</strong>n Overseas <strong>Bank</strong><br />

11. The Lakshmi Vilas <strong>Bank</strong> Ltd<br />

12. Central <strong>Bank</strong> <strong>of</strong> <strong>India</strong><br />

13. Dena <strong>Bank</strong><br />

14. State <strong>Bank</strong> <strong>of</strong> <strong>India</strong><br />

508523<br />

508528<br />

508533<br />

508534<br />

508540<br />

508541<br />

508542<br />

508546<br />

508547<br />

508548<br />

Page 3

6. What does the architecture look like?<br />

Frequently asked Questions by <strong>Bank</strong>s for AEPS<br />

Page 4

7. What is the Process flow <strong>of</strong> AEPS?<br />

Frequently asked Questions by <strong>Bank</strong>s for AEPS<br />

I. Aadhaar Authentication - Process flow<br />

Customer’s Inputs:<br />

� IIN<br />

� AADHAAR Number<br />

� Finger Print Data<br />

Page 5

Frequently asked Questions by <strong>Bank</strong>s for AEPS<br />

II. Aadhaar Initiated Interbank Balance Enquiry - Process flow<br />

Customer’s Inputs:<br />

� IIN<br />

� AADHAAR Number<br />

� Finger Print Data<br />

Page 6

Frequently asked Questions by <strong>Bank</strong>s for AEPS<br />

III. Aadhaar Initiated Interbank Cash Deposit - Process flow<br />

Customer’s Inputs:<br />

� IIN<br />

� AADHAAR Number<br />

� Amount <strong>of</strong> Cash to be Deposited<br />

� Finger Print Data<br />

Page 7

Frequently asked Questions by <strong>Bank</strong>s for AEPS<br />

IV. Aadhaar initiated Interbank Cash Withdrawal – Process<br />

flow<br />

Customer’s Inputs:<br />

� IIN<br />

� AADHAAR Number<br />

� Amount <strong>of</strong> Cash to be Withdrawn<br />

� Finger Print Data<br />

Page 8

Frequently asked Questions by <strong>Bank</strong>s for AEPS<br />

V. Aadhaar to Aadhaar Interbank Funds Transfer - Process<br />

flow<br />

Remitting Customer’s Inputs:<br />

� IIN<br />

� Aadhaar Number<br />

� Amount to be remitted<br />

� Finger Print Data<br />

Beneficiary’s Details:<br />

� IIN<br />

� Aadhaar Number<br />

Page 9

Frequently asked Questions by <strong>Bank</strong>s for AEPS<br />

8. Does the customer need to have a bank account for availing AEPS?<br />

Yes, the customer needs to have a bank account linked to his/ her Aadhaar number with the<br />

bank <strong>of</strong>fering the AEPS service.<br />

9. Does the customer need to specifically register to conduct transactions through AEPS?<br />

During the Aadhaar enrolment exercise you may have been asked or filled the KYC form where<br />

you may have indicated the need for a “no frills” bank account. In this case you need not<br />

specifically enrol for the AEPS service.<br />

In case you chose only to get the Aadhaar number during the enrolment exercise then you need<br />

to approach your bank branch and ask for the form to link your Aadhaar number to your existing<br />

bank account. Once this is confirmed by your bank, you are ready to use the AEPS service<br />

through any bank Business Correspondent centre providing the AEPS service.<br />

10. Can a customer link more than one account to the same Aadhaar number within a bank?<br />

Yes. However the bank shall keep only one <strong>of</strong> the accounts as primary account which would<br />

receive all AEPS transactions.<br />

11. What details does the customer need to affect an AEPS transaction?<br />

Three inputs are required:<br />

� Customer Aadhaar number<br />

� Customers fingerprint on the MicroATM for online verification<br />

� IIN number<br />

12. What happens to the transaction if there is a communication failure between banks and<br />

NPCI at the time <strong>of</strong> transaction?<br />

NPCI has systems to identify which leg <strong>of</strong> the transaction has timed out for any network failure<br />

reason. Depending upon which leg has timed out a reversal message gets generated. If there is<br />

any transaction which still does not get reconciled at bank then the Dispute Management Module<br />

available to <strong>Bank</strong>s in AEPS network will be able to raise necessary adjustments, representments<br />

or chargeback as the case may be.<br />

13. How does reconciliation take place for AEPS transactions?<br />

NPCI generates three types <strong>of</strong> file on a daily basis containing the Settlement file; raw data file<br />

and verification file which contains the transactions pertaining to respective <strong>Bank</strong>s. NPCI will<br />

provide login details to aces them online for download. It is the bank’s responsibility to reconcile<br />

these transactions with their AEPS and CBS system transaction log file on a daily basis.<br />

14. Is there an amount limit for the participating banks for their transactions?<br />

Yes, the limit allocated to the banks is called Net Debit Cap (NDC). The NDC calculated by NPCI at<br />

any instant for the AEPS will be net <strong>of</strong> total outward and inward for the day. This is the<br />

maximum allowable debit for a particular bank for a day. This value is decided on the basis <strong>of</strong> the<br />

participating bank’s contribution to the Settlement Guarantee Fund.<br />

Page 10

Frequently asked Questions by <strong>Bank</strong>s for AEPS<br />

15. Is there any limit with respect to amount for AEPS transactions?<br />

Aadhaar based accounts would be opened on the basis <strong>of</strong> simplified KYC guidelines, where as<br />

<strong>Bank</strong>s will have to adhere to a certain limit, based on banks business rules for specific type <strong>of</strong><br />

account opened.<br />

16. Who is responsible to monitor the amount limits at account level for AEPS transactions?<br />

The participating banks have to monitor and control the amount limits as prescribed by RBI for<br />

Guidelines for engaging <strong>of</strong> Business Correspondents (BCs) at the time <strong>of</strong> debit.<br />

17. What are the charges levied by NPCI for AEPS transactions?<br />

In view <strong>of</strong> helping the participating banks to promote AEPS transactions NPCI is not charging<br />

any transaction fees for the pilot <strong>of</strong> this service. Post Pilot it will be `0.25 per AEPS transaction<br />

and for gateway authentication service in case banks chose to route ONUS transactions for UIDAI<br />

authentication will be charged at `0.10 per request.<br />

18. When does the settlement happen?<br />

The cutover <strong>of</strong> AEPS transactions happens to 23:00 hours each day. All transactions before this<br />

time are included in the settlement for that particular day.<br />

19. How is the settlement affected?<br />

The settlement is affected by NPCI’s Real Time Gross Settlement (RTGS). As a joining procedure,<br />

the participating banks need to submit a mandate for crediting and debiting their RTGS accounts<br />

with the RBI in favour <strong>of</strong> NPCI. On the basis <strong>of</strong> this mandate NCPI would affect the settlement by<br />

debiting/ crediting respective bank’s Current Account/s with such sums as may be specified by<br />

the NPCI in its settlement instructions. The draft for all the documents will be provided by the<br />

AEPS NPCI team when a bank envisages interest in joining the network.<br />

20. What are the settlement files that a bank can receive from NPCI for AEPS?<br />

For the convenience <strong>of</strong> banks, the settlement files and reports are developed similar to that <strong>of</strong><br />

<strong>National</strong> Financial Switch. The participating banks can download reports from the site using<br />

login id and password issued to them by NPCI.<br />

The bank may download raw data files (Acquirer & Issuer), settlement file (Acquirer &<br />

Issuer), verification file (Acquirer & Issuer) and Daily Settlement Report from NPCI’s AEPS<br />

Dispute Management System.<br />

Page 11

Frequently asked Questions by <strong>Bank</strong>s for AEPS<br />

21. How can a bank raise disputes with reference to AEPS transactions?<br />

or<br />

Is there any mechanism/system to address the disputes raised by member banks during<br />

AEPS?<br />

The disputes can be raised by participant banks using Dispute Management System provided by<br />

NPCI. This service has also been developed similar to NFS for the convenience <strong>of</strong> participating<br />

banks.<br />

22. Which banking services can the customer avail using AEPS?<br />

A customer can avail the following four services using AEPS:<br />

a. Cash Withdrawal<br />

b. Cash Deposit<br />

c. Balance Enquiry<br />

d. Fund Transfer<br />

23. How are the Customer’s IIN & Aadhaar Number added in the respective fields on the<br />

MicroATM terminal?<br />

At the MicroATM Terminal the customer has two options. He can either manually input the<br />

required information in the respective fields or he can swipe a RuPay ATM & MicoATM card with<br />

Aadhaar number that would extract the relevant data from card and present for further<br />

transaction processing<br />

24. What are the steps to be followed by banks to issue RuPay ATM & MicroATM Card?<br />

Steps to be followed by banks to issue RuPay ATM & MicroATM card are as under:<br />

a. <strong>Bank</strong> to apply to NPCI with IIN agreement form<br />

b. Once NPCI receives bank application, we shall process<br />

c. NPCI shall assign ISO IIN to bank<br />

d. <strong>Bank</strong> card artwork to be approved by NPCI team<br />

e. <strong>Bank</strong> to share 30 test cards for NPCI NFS & MicroATM testing<br />

f. Certification on NFS ATMs for RuPay ATM & MicroATM card<br />

g. Certification on MicroATM for acceptance RuPay ATM & MicroATM card<br />

25. Is there any membership fees?<br />

a) All existing members <strong>of</strong> <strong>National</strong> Financial Switch (NFS) are eligible to participate in AEPS.<br />

NFS members intending to participate in AEPS may apply for membership.<br />

b) A bank that is not a member <strong>of</strong> NFS can also join AEPS provided :<br />

i) The applicant bank is a type A member <strong>of</strong> the RBI’s Real Time Gross Settlement<br />

System.<br />

ii) The applicant bank undertakes to join NFS within 3 months on payment <strong>of</strong> a onetime<br />

membership fee <strong>of</strong> `3,00,000.00 (Rupees Three lakh only)<br />

iii) The applicant bank is willing to contribute to the Settlement Guarantee Fund <strong>of</strong> NPCI.<br />

Page 12

Frequently asked Questions by <strong>Bank</strong>s for AEPS<br />

26. What are the security measures taken for AEPS?<br />

AEPS is a safe, convenient channel enabling micropayments. Every terminal has the encryption<br />

as per UIDAI norms which are a pre-requisite. Any terminal not having this encryption or not<br />

having this as per UIDAI standards will be unable to affect transaction under AEPS as they will<br />

get rejected with an error code as “invalid encryption” on the terminal.<br />

AEPS only supports real time online biometric verification using the Aadhaar number. The<br />

fingerprints submitted during the enrolment <strong>of</strong> the individual need to match at the UIDAI server<br />

end to make any transaction successful.<br />

27. Which banks are members <strong>of</strong> AEPS?<br />

Currently, the banks that are members <strong>of</strong> AEPS are ICICI <strong>Bank</strong>, Union <strong>Bank</strong> <strong>of</strong> <strong>India</strong>, <strong>Bank</strong> <strong>of</strong><br />

<strong>India</strong>. A link is provided in AEPS section <strong>of</strong> NPCI website which will host current banks under<br />

certification.<br />

Page 13