FLIGHT

FLIGHT

FLIGHT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

HORNET DILEMMA<br />

AUSTRALIANS IN<br />

TWO MINDS OVER<br />

FUTURE FIGHTERS<br />

AVALON PREVIEW<br />

747-8 SLOTS ALERT<br />

Boeing says it could be<br />

forced to slow production<br />

of revamped jumbo if new<br />

orders fail to emerge 13<br />

FREE AND SINGLE<br />

Ironically, failure of BAE<br />

merger has helped give<br />

EADS what it sought –<br />

less state interference 22<br />

<strong>FLIGHT</strong><br />

flightglobal.com<br />

19-25 FEBRUARY 2013<br />

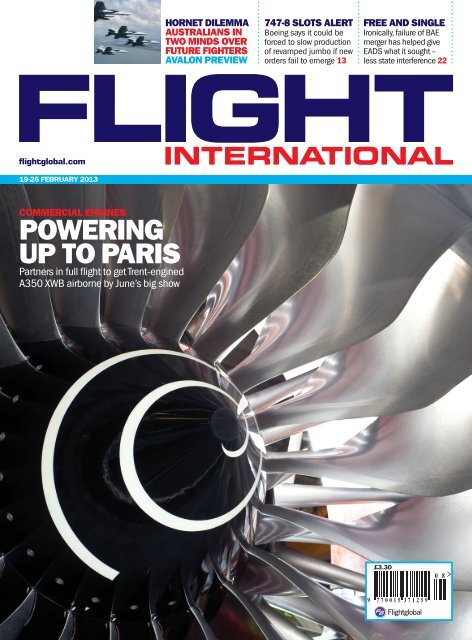

COMMERCIAL ENGINES<br />

POWERING<br />

UP TO PARIS<br />

Partners in full flight to get Trent-engined<br />

A350 XWB airborne by June’s big show<br />

INTERNATIONAL<br />

£3.30<br />

� ������ ������<br />

� �

Celebrating the very best<br />

Although most achievements in aviation<br />

����������������������������������<br />

����������������������������������������<br />

there have always been individuals who<br />

���������������������������������������������<br />

�������������������������������������<br />

pressure or leadership qualities.<br />

sponsored by<br />

The Flightglobal Achievement Awards are designed to recognise the<br />

contribution of the single human being – or small groups of individuals – to<br />

industry breakthroughs or great moments in aviation and the search has begun<br />

for 2013’s worthy winners.<br />

������������������������������������������������������������������������������<br />

�������������������������������������������������������������������������������<br />

winner. We want to recognise the best people in aviation and we’d like you - the<br />

������������������������������������������������������������������������<br />

We are also looking for the 2013 Boeing Engineering Student of the Year award<br />

which recognises an outstanding engineering student working on aeronautical<br />

�������������������������������������������������������������������������<br />

����������������������������������<br />

sponsored by<br />

So please take the time to nominate now at ����������������������������

VOLUME 182 NUMBER 5378<br />

forced to slow production merger has helped give<br />

of revamped jumbo if new EADS what it sought –<br />

orders fail to emerge 13 less state interference 22<br />

<strong>FLIGHT</strong><br />

���������������<br />

19-25 FEBRUARY 2013<br />

COMMERCIAL ENGINES<br />

POWERING<br />

UP TO PARIS<br />

Partners in full flight to get Trent-engined<br />

A350 XWB airborne by June’s big show<br />

flightglobal.com<br />

HORNET DILEMMA 747-8 SLOTS ALERT FREE AND SINGLE<br />

AUSTRALIANS IN Boeing says it could be Ironically, failure of BAE<br />

TWO MINDS OVER<br />

FUTURE FIGHTERS<br />

AVALON PREVIEW<br />

INTERNATIONAL<br />

� ������ ������<br />

COVER IMAGE<br />

This was taken as the first<br />

Rolls-Royce Trent XWB<br />

was delivered for Airbus’s<br />

flight-test A350. Our cover<br />

story, a programme update,<br />

leads an engines package<br />

that also focuses on CFM<br />

International’s Leap.<br />

See Cover Story P24<br />

NEWS<br />

THIS WEEK<br />

8 Split loyalties for new airline giant<br />

9 A330-200 eyed as Beluga successor.<br />

USAF refuses to reopen ‘flawed’ Raptor<br />

inquiry<br />

10 Turmoil as arrests rock Finmeccanica.<br />

Regulator searches for UAV integration<br />

test sites<br />

11 Booming sales prompt Mexico move.<br />

Airframers to fight soft market with new<br />

launches<br />

£3.30<br />

AIR TRANSPORT<br />

12 Rolls-Royce focus turns to A350-1000<br />

powerplant<br />

13 Empty slots could slow 747-8 output.<br />

Longer-range Superjet is airborne<br />

14 Crashed An-28 denied terrain warning.<br />

Aeroflot technical snags prompt Superjet<br />

defence<br />

15 Jat aims to revive latent Airbus deal<br />

DEFENCE<br />

16 SOCOM places urgent Insitu UAV order<br />

to fill critical gap.<br />

New Zealand’s NH90s clear testing<br />

milestone<br />

17 Russian Altius design is inadvertently<br />

revealed.<br />

� �<br />

Rolls-Royce<br />

PIC OF THE WEEK<br />

YOUR PHOTOGRAPH HERE<br />

Keith Campbell gave this Panavia Tornado<br />

shot the title “Evening playtime” when he<br />

added it to his “sunshine band” AirSpace<br />

gallery. Our latest World Air Forces directory<br />

lists 119 Tornados in the UK’s fleet. Open a<br />

gallery in flightglobal.com’s AirSpace<br />

community for a chance to feature here<br />

flightglobal.com/imageoftheday<br />

Skimmer conversion kit offered<br />

18 UK reviews decision to retire Sentinel.<br />

United Aircraft chief urges full Medium<br />

Transport Aircraft contract<br />

BUSINESS AVIATION<br />

19 MEBAA offers to referee Rizon row.<br />

Chinese business jet fleet grew 40%<br />

in 2012<br />

20 Airbus Corporate Jets pins hopes on<br />

market rebound.<br />

Europe opens way to G280 deliveries<br />

TECHNOLOGY<br />

21 Rotor blade pressure may hold key to<br />

dynamic stall.<br />

Warning – weightlessness can ruin your<br />

eyesight<br />

BUSINESS<br />

22 Fruits of freedom for EADS<br />

REGULARS<br />

7 Comment<br />

42 Straight & Level<br />

45 Classified<br />

47 Jobs<br />

51 Working Week<br />

48 JOB OF THE WEEK Air traffic controller,<br />

Alderney Airport<br />

Proven and arriving soon at a gate near you.<br />

PurePower ® Engines<br />

Sunshine band gallery on flightglobal.com/AirSpace<br />

<strong>FLIGHT</strong><br />

INTERNATIONAL<br />

19-25 FEBRUARY 2013<br />

Eurocopter to invest $100 million in aerostructures facility<br />

in Mexico P11. US services issue new budget cuts<br />

warning P17<br />

COVER STORY<br />

24 COMMERCIAL ENGINES All eyes on<br />

XWB Rolls-Royce turns its attention to<br />

proving the maturity of the A350’s Trent<br />

XWB powerplant<br />

FEATURES<br />

28 COMMERCIAL ENGINES Leap of faith<br />

CFM’s A320neo engine has the edge on<br />

P&W’s rival offering, but the battle remains<br />

fierce as orders hang in the balance<br />

32 AUSTRALIA SPECIAL REPORT Fighting<br />

chance We analyse how the aerospace<br />

market is being reshaped in our country<br />

special<br />

NEXT WEEK HELICOPTERS SPECIAL<br />

Test pilot Peter Gray (above) runs the rule<br />

over Sikorsky’s S-92 in an exclusive flight<br />

evaluation. Plus: reports on the Bell 525,<br />

safety, aerial filming and the war on rats<br />

19-25 February 2013 | Flight International | 3<br />

Sikorsky<br />

Eurocopter, US Air Force

CONTENTS<br />

IN THIS ISSUE<br />

Companies listed<br />

Aeroflot ..........................................................8<br />

AgustaWestland ...........................................10<br />

Airbus ..........................8, 9, 11, 12, 15, 20, 22<br />

Air Lease ......................................................12<br />

Air Tractor .....................................................11<br />

American Airlines ...........................................8<br />

Antonov ...................................................8, 14<br />

Astrium ........................................................22<br />

ATR ..............................................................15<br />

Australian Helicopters ..................................19<br />

Aviadvigatel .................................................18<br />

Avincis Group ..............................................19<br />

BAE Systems ...............................................22<br />

Ball Aerospace .............................................23<br />

Boeing .........................................8, 12, 15, 21<br />

Bombardier ...........................................18, 19<br />

Bond Helicopters .........................................19<br />

Cassidian ....................................................22<br />

Cathay Pacific ..............................................25<br />

Cessna ........................................................19<br />

CFM International ..................................18, 28<br />

Comac .........................................................28<br />

Dassault ......................................................11<br />

DLR .............................................................21<br />

EADS ...........................................................22<br />

Elbit Systems .................................................8<br />

Engine Alliance ............................................23<br />

Eurocopter .......................................11, 20, 22<br />

Europe Airpost .............................................15<br />

Finmeccanica ........................................10, 22<br />

GE Aviation ..................................................23<br />

Gulfstream .......................................11, 19, 20<br />

Hindustan Aeronautics ...........................16, 18<br />

Ilyushin ....................................................8, 18<br />

Inaer ............................................................19<br />

Insitu ...........................................................16<br />

Interjet .........................................................14<br />

Irkut .............................................................18<br />

Israel Aerospace Industries ....................17, 20<br />

Jat Airways ...................................................15<br />

Jat Tehnika ...................................................15<br />

Jet2 .............................................................15<br />

Kongsberg ...................................................23<br />

Lockheed Martin ......................................9, 17<br />

Messier-Bugatti-Dowty .................................14<br />

Milestone Aviation ..........................................19<br />

NH Industries..................................................16<br />

Norsk Helikopterservice ..................................19<br />

Northrop Grumman ..................................16, 18<br />

Petropavlovk-Kamchatsky Aviation Enterprise .14<br />

Pilatus ...................................................16, 18<br />

Pratt & Whitney ............................................23<br />

Qatar Airways ...............................................19<br />

Raytheon .....................................................18<br />

RBC Bearings ...............................................23<br />

Recaro .........................................................23<br />

Rizon Jet ......................................................19<br />

Rolls-Royce ..................................................12<br />

Saab ...........................................................23<br />

Safran .........................................................22<br />

Signature Flight Support ..............................20<br />

Snecma .......................................................28<br />

South Airlines ................................................8<br />

Spirit AeroSystems .......................................13<br />

Sukhoi .........................................................13<br />

Thales ..........................................................22<br />

Thrush Aircraft ..............................................11<br />

Transaero .................................................8, 15<br />

Sikorsky .......................................................19<br />

Sukhoi .........................................................14<br />

Superjet International ..................................14<br />

United Aircraft ..............................................18<br />

US Airways .....................................................8<br />

UTair ..............................................................8<br />

Zenith Jet .....................................................11<br />

High-fidelity trainer and fighter ground-based training systems.<br />

4 | Flight International | 19-25 February 2013<br />

BEHIND THE<br />

HEADLINES<br />

Washington DC-based Americas<br />

air transport reporter Edward<br />

Russell travelled to Fort Worth<br />

to report on the proposed merger<br />

between American Airlines<br />

and US Airways (P8). In January,<br />

Russell had covered the former<br />

carrier’s inaugural Boeing<br />

777-300ER flight from Fort<br />

Worth to São Paulo Guarulhos<br />

– and had his photograph taken<br />

with chief executive Tom Horton<br />

(below, right). And our business<br />

editor Dan Thisdell crossed<br />

the Atlantic from our UK headquarters<br />

to Queretaro, for the<br />

opening of a Eurocopter factory<br />

in the Mexican aerospace<br />

hotspot (P11).<br />

For a full list of reader services, editorial<br />

and advertising contacts see P43<br />

EDITORIAL<br />

+44 20 8652 3842<br />

flight.international@flightglobal.com<br />

DISPLAY ADVERTISING<br />

+44 20 8652 3315<br />

gillian.cumming@rbi.co.uk<br />

CLASSIFIED ADVERTISING<br />

+44 20 8652 4897<br />

flight.classified@flightglobal.com<br />

RECRUITMENT ADVERTISING<br />

+44 20 8652 4900<br />

recruitment.services@rbi.co.uk<br />

WEBMASTER<br />

webmaster@flightglobal.com<br />

SUBSCRIPTIONS<br />

+44 1444 445 454<br />

flightinternational.subs@qss-uk.com<br />

REPRINTS<br />

+44 20 8652 8612<br />

reprints@rbi.co.uk<br />

<strong>FLIGHT</strong> DAILY NEWS<br />

+44 20 8652 3096<br />

flightdailynews@flightglobal.com<br />

THE WEEK ON THE WEB<br />

flightglobal.com<br />

On defence blog The DEW Line, Dave Majumdar highlighted<br />

an “awesome video from the cockpit of a VFA-103 Boeing<br />

F/A-18F Super Hornet flying off the deck of USS Dwight D<br />

Eisenhower”. The footage was<br />

produced by Carrier Strike<br />

Group 8 last year. “But if the<br />

dire predictions of what might<br />

happen under sequestration<br />

come to fruition, we may not<br />

see many more videos like<br />

this in the near future,” warned Majumdar. Pay a visit to<br />

flightglobal.com/superhornetvideo to enjoy it while it lasts.<br />

Elswhere on the same blog, a stunning Eurofighter shot of a<br />

Typhoon over Ferrari World in Abu Dhabi (above) ran with a<br />

post on the combat aircraft type’s competitive joust with the<br />

Lockheed Martin F-35. And on Ariel View, Arie Egozi noted<br />

that Israel Aerospace Industries chief Joseph Weiss had<br />

chosen his words carefully at Aero India, where he said, “I<br />

urge my colleagues in the Israeli industries to make every<br />

effort to promote co-operation.”<br />

Find all these items at flightglobal.com/wotw<br />

QUESTION OF THE WEEK<br />

Last week, we asked what you think of Iran’s stealth fighter. You said:<br />

Domestic propaganda It’ll never fly<br />

Sign of things to come<br />

68%<br />

Total votes: 2,091 23% 9%<br />

This week, we ask for your take on the American Airlines and US<br />

Airways merger: ��Obvious synergies ��Culture clash ahead<br />

��Won’t fix US sector’s problems<br />

Vote at flightglobal.com/poll<br />

HIGH FLIERS<br />

The top five stories for the week just gone:<br />

1 Boeing warns about unclaimed 747-8 production slots<br />

2 Lockheed claims F-35 kinematics ‘better than or equal to’ Typhoon<br />

3 Airbus restores large American order to firm backlog<br />

4 Airbus leans towards A330-200 to replace Beluga fleet<br />

5 Embraer quietly unveils improved E-Jet with American Airlines order<br />

Flightglobal reaches up to 1.3 million visitors from 220<br />

countries viewing 7.1 million pages each month<br />

Download the Military Simulator<br />

Census online now.<br />

www.flightglobal.com/milisim<br />

flightglobal.com

���������������������������������������<br />

�����������������������������<br />

We didn’t build this company to be historic.�������������������������������������������<br />

��������������������������������������������������������������������������������������������<br />

������������������������������������������������������Learn more at www.i-a-e.com.

While others struggle to get a truly<br />

advanced jet engine out of the gate…<br />

Ours could be departing from yours.<br />

They’ve been figuring. We’ve been flying. Not just anybody can turn decades of jet engine technology into<br />

something truly new. Truly ecological, economical and dependable. Proven over thousands of hours of<br />

aggressive rig, ground and flight testing. It takes Pratt & Whitney ingenuity and experience to produce<br />

a PurePower ® Geared Turbofan engine, the game-changing choice of the world’s major airlines. And<br />

the future destination of jet engine technology. Again, Pratt & Whitney leads. With next-generation<br />

engines today. Get the truth about the dependable PurePower engine at PurePowerEngines.com.<br />

Power People Depend On.

flightglobal.com<br />

How the West won<br />

US Airways stands poised to join the long list of legacy<br />

airline brands, including Pan Am, Eastern,<br />

TWA, Northwest and Continental, to pass into history.<br />

But the proposed merger of American Airlines and<br />

US Airways upsets the typical post-deregulation narrative.<br />

For the first time, an airline launched since the Airline<br />

Deregulation Act of 1978 can buy the third-largest<br />

US carrier and become the largest airline in the world.<br />

It all began in 1981, when airline consultant Ed Beauvais<br />

founded America West Airlines in Phoenix, starting<br />

humbly with three leased Boeing 737s and plans to<br />

expand to a booming Las Vegas market. Like many of its<br />

post-deregulation peers, America West introduced<br />

cross-utilisation to lower costs and onboard ticketing to<br />

attract more revenue. Unlike many of those peers,<br />

America West survived bankruptcy and reorganisation<br />

during the lean early ‘90s. America West actually<br />

reached a high point in growth and profitability by the<br />

late ‘90s, but the boom was short-lived. After 9/11,<br />

America West needed a government loan to survive.<br />

Doug Parker, then America West’s chief executive,<br />

recalled last March an agonising flight back to Phoenix<br />

from Washington DC on an America West flight. Parker’s<br />

meeting earlier that day with the airline stabilisation<br />

board over the airline’s pending loan request had not<br />

gone well. Parker recalled hoping the flight attendants<br />

would not recognise him, because he didn’t think he<br />

could hide his concern about their company’s future.<br />

The following week, America West resubmitted its loan<br />

COMMENT<br />

The deal struck by US Airways and American Airlines marks the watershed at which a carrier<br />

launched post-deregulation of the US sector can, via merger, become the world’s biggest<br />

The US Airways victory is really<br />

the victory of the deregulation<br />

entrepreneurs of America West<br />

A name to remember<br />

application, and this time it was approved.<br />

Upon regaining its strength, America West tried to<br />

take over US Airways in 2005, pulling off a reversemerger<br />

the next year. The new airline retained the US<br />

Airways brand, but was led by the America West team.<br />

That achievement was followed by a series of missteps,<br />

including two failed attempts to merge with Delta<br />

Air Lines and United Airlines. The bankruptcy filing by<br />

American Airlines on 31 November 2011 offered the<br />

last chance for the original America West.<br />

If regulators approve the pending merger, many questions<br />

await. For Airbus, it means having a friendly management<br />

team in charge of the world’s largest airline<br />

serving still the largest market. Parker’s team must rebalance<br />

the merged carrier’s domestic network, expand its<br />

international offerings and keep the unions on side.<br />

But the US Airways victory is really the victory of the<br />

deregulation entrepreneurs of America West, now seated<br />

at the top of the global airline industry. �<br />

See This Week P8<br />

Impressing in Mexico a must for Sukhoi<br />

Sukhoi’s own technical snags with its Superjet might<br />

not have attracted the same degree of scrutiny as<br />

to customer confidence, nor has it managed to push<br />

more than about a dozen aircraft out of its factory in the<br />

those affecting the Boeing 787.<br />

space of nearly two years.<br />

But they are arguably more critical to a programme Sukhoi can’t even take much solace from the home<br />

that symbolises one of the few remaining chips Russia front, once a closed door to non-Soviet production.<br />

is still able to play from its dwindling pile at the aero- Even if the Embraer 190, newly certificated in Russia,<br />

space industry’s gambling table.<br />

remains a relatively expensive option, it plonks 90-seat<br />

While its first aircraft for Mexican customer Interjet competition firmly on Sukhoi’s porch.<br />

is nearing completion, Sukhoi is still dealing with All this makes the Interjet debut a high-stakes affair<br />

gripes from Aeroflot.<br />

for Sukhoi, if the airframer ever hopes to find a niche in<br />

For expert reaction to breaking<br />

news from the airline industry,<br />

visit our Airline Business blog<br />

The airframer rightly notes that every new aircraft<br />

type experiences operational problems for the first few<br />

months – witness the mighty 787’s grounding. But Su-<br />

the increasingly cut-throat regional airliner market. It’s<br />

likely to find the international spotlights far brighter<br />

than the ones in Moscow. �<br />

at flightglobal.com/abblog khoi doesn’t have an 800-strong backlog as testimony See Air Transport P14<br />

19-25 February 2013 | Flight International | 7<br />

AirTeamImages

THIS WEEK<br />

BRIEFING<br />

<strong>FLIGHT</strong> TESTS BEGIN ON EMBATTLED 787<br />

OPERATIONS Boeing started conducting test flights with a 787 on<br />

9 February, the first since the grounding of the global fleet on 16<br />

January. The airframer is studying the in-flight performance of the<br />

lithium-ion batteries linked to two incidents on Japanese 787s. Test<br />

aircraft ZA005 landed after a 2h 21min flight spanning nearly<br />

800nm (1,480km), operated between the southwest corner of<br />

Washington state to the Puget Sound. Boeing’s original flightplan<br />

proposed only a 2h test, but it was extended late in the sortie. No<br />

changes to the batteries were made prior to the test, Boeing says.<br />

BOEING, ELBIT MAKE MUSIC PACT<br />

SELF-PROTECTION Elbit Systems has signed a memorandum of<br />

understanding to provide its Music-series directed infrared countermeasures<br />

equipment with Boeing-produced military and civilian aircraft<br />

and helicopters. Capable of protecting against surface-to-air<br />

missile threats, the technology has previously been selected by the<br />

Israeli government to protect the nation’s commercial airline fleets.<br />

RUSSIAN AIR FORCE COULD DITCH AN-70<br />

AIRLIFT Russia’s air force command could withdraw from the<br />

Antonov An-70 transport programme with Ukraine by the end of<br />

2013, after complaining about its slow progress, Russia’s Izvestia<br />

newspaper claims. Military Transport Aviation commander Col Gen<br />

Vladimir Benediktov says the service will get 48 Ilyushin Il-76MD-90A<br />

transports, rather than the 39 announced in a contract last year.<br />

INQUIRY PROBES FATAL AN-24 DONETSK CRASH<br />

ACCIDENT Ukraine’s government has opened an inquiry after an<br />

Antonov An-24 crashed on landing at Donetsk airport, killing five of<br />

the 52 occupants. The country’s emergency situations ministry<br />

states that the twin-engined aircraft (UR-WRA) exited the runway<br />

while landing, then overturned and broke up. Flight YG8971 was arriving<br />

after a domestic service from Odessa at 18:09 on 13<br />

February. Donetsk weather data shows the presence of fog and reduced<br />

runway visibility at the time of the crash. Odessa-based South<br />

Airlines had been operating the 40-year-old airframe, which came to<br />

rest inverted with its empennage detached.<br />

RUNWAY EXCURSIONS STAY STUBBORNLY HIGH<br />

SAFETY Runway excursions in 2012 remained broadly unchanged<br />

from 2010 levels, despite concentrated efforts to increase awareness<br />

of the risks. Dutch aerospace research organisation NLR’s Air<br />

Transport Safety Institute found 106 excursions involving commercial<br />

and executive aircraft operations worldwide last year, compared<br />

with 98 in 2011 and 107 in 2010. There were eight fatal runway excursions<br />

between 2010 and 2012, it adds, while total annual traffic<br />

volumes were stable during these three years.<br />

SKY GUARDS TO COMBAT AIR RAGE IN RUSSIA<br />

SECURITY Russia’s civil aviation regulator is supporting proposals<br />

to deploy specially equipped guards on flights to deal with disruptive<br />

passengers. Rosaviatsia security department chief Yuri Saprykin<br />

told a conference in Moscow that several leading airlines – including<br />

Aeroflot, Transaero and UTair – have asked permission to add inhouse<br />

security staff to flightcrews. “We are in favour of that initiative,”<br />

Saprykin said. “The main objective is to preclude air rage<br />

incidents by confronting troublemakers on board aircraft. There has<br />

been an upsurge of such incidents over the past few months.”<br />

8 | Flight International | 19-25 February 2013<br />

For a round-up of our latest online news,<br />

feature and multimedia content visit<br />

flightglobal.com/wotw<br />

Boeing 757-200s are one of the few overlaps in inventory<br />

STRATEGY STEPHEN TRIMBLE WASHINGTON DC<br />

Split loyalties for<br />

new airline giant<br />

Bringing together American Airlines and US Airways creates<br />

world’s largest carrier – but one with divergent fleet policies<br />

American Airlines and US Airways<br />

are to merge in an $11<br />

billion deal that will create the<br />

world’s largest airline.<br />

The combined carrier will<br />

transport more than 170 million<br />

passengers and generate revenues<br />

of more than $38.7 billion annually,<br />

based on 2012’s figures. It<br />

will retain the American name,<br />

be based in Fort Worth, Texas and<br />

be a Oneworld member.<br />

Merging the two US majors<br />

will create the world’s largest<br />

mainline fleet of 944 jets, and also<br />

one of its most complex. There<br />

will be few overlapping pieces<br />

and a mix-and-match order backlog<br />

comprising hundreds of single-aisle<br />

and long-haul jets.<br />

It would be hard to find two<br />

merging airlines with a more dissimilar<br />

historical philosophy for<br />

fleet acquisitions. The two share<br />

few common preferences in aircraft<br />

type or manufacturer.<br />

The two notable exceptions are<br />

a common and ageing fleet of<br />

Boeing 757-200s and 767-200ERs,<br />

but most of these are marked for<br />

retirement within the decade.<br />

And that is where the similarities<br />

end in their in-service fleets.<br />

American Airlines has an all-<br />

Boeing widebody fleet, to which<br />

it is adding at least 15 777-300ERs<br />

and 42 787-8s and -9s. US Airways,<br />

meanwhile, is replacing<br />

767s with A330s, plus its orderbook<br />

includes 18 A350-800s and<br />

four -900s.<br />

The single-aisle strategies of<br />

both carriers show a similar split.<br />

Again, American Airlines has<br />

showed a strong preference for<br />

Boeing products, operating 103<br />

757-200s, 199 737-800s and 186<br />

Boeing MD-80s. On top of this, it<br />

has orders for 100 re-engined 737<br />

Max 8s, which adds to 107 unfilled<br />

commitments for 737-800s.<br />

Airbus has had a look-in however.<br />

In July 2011, American ordered<br />

130 re-engined A321neos<br />

and a total of 130 A319s and<br />

A321s. And although the A320family<br />

jets have been removed<br />

from the backlog, American says<br />

it has already agreed to re-sign for<br />

those aircraft.<br />

US Airways, however, has yet<br />

to order re-engined narrowbodies,<br />

but a 240-strong Airbus single-aisle<br />

fleet, with a further 46 on<br />

order, shows its loyalties.<br />

The airlines hope to close the<br />

deal during the third quarter.<br />

However it requires approval of<br />

the bankruptcy court, US Airways<br />

shareholders and US antitrust<br />

regulators. �<br />

Additional reporting by Edward<br />

Russell in Fort Worth<br />

For more coverage on the<br />

landmark merger go to<br />

flightglobal.com/aa-us<br />

flightglobal.com<br />

AirTeamImages

flightglobal.com<br />

Turmoil as<br />

probe rocks<br />

Finmeccanica<br />

THIS WEEK P10<br />

INVESTIGATION DAVE MAJUMDAR WASHINGTON DC<br />

USAF refuses to reopen<br />

‘flawed’ Raptor inquiry<br />

The US Air Force will not reopen<br />

the Accident Investigation<br />

Board (AIB) which examined<br />

the 16 November 2010 crash of a<br />

Lockheed Martin F-22 Raptor, despite<br />

a review of the process finding<br />

its conclusions were flawed.<br />

Raptor pilot Capt Jeff Haney, assigned<br />

to the 525th Fighter Squadron<br />

based at Joint Base Elmendorf-<br />

Richardson, Alaska, lost his life in<br />

the accident. The original AIB report<br />

issued in December 2011<br />

concluded that even though the<br />

Raptor’s life-support systems had<br />

shut down, and the emergency<br />

oxygen system was difficult to<br />

use, the crash was Haney’s fault<br />

because he had not acted quickly<br />

enough to save himself.<br />

The USAF says it will reconvene,<br />

and not reopen, the board to<br />

address issues of clarity identified<br />

in its report. The service’s regulations<br />

would require new evidence<br />

to emerge before it could reopen an<br />

investigation, it adds.<br />

The Inspector General, however,<br />

recommends that the AIB<br />

report be re-evaluated because of<br />

the numerous flaws discovered<br />

by its investigation. The AIB’s<br />

finding, it says, “was not supported<br />

by the facts within the… report”.<br />

In adds: “Our conclusion<br />

was supported by five individual<br />

findings, and we recommended<br />

that the AIB report be re-evaluated<br />

in light of those.”<br />

Despite this, the USAF remains<br />

adamant its AIB report simply<br />

needs to be rewritten for clarity, despite<br />

the investigative lapses exposed<br />

by the inspector general. �<br />

SAFETY<br />

Swift return for grounded F-35B<br />

Lockheed Martin’s F-35B short<br />

take-off and vertical landing<br />

(STOVL) variant of the Joint Strike<br />

Fighter has returned to flight after a<br />

25-day grounding.<br />

“F-35B flight clearance was restored<br />

February 12, rescinding a<br />

cautionary suspension issued<br />

January 18 after a fueldraulic hose<br />

failure,” the F-35 Joint Program<br />

Office (JPO) says.<br />

“Government and industry engineering<br />

teams conducted a root<br />

cause investigation and determined<br />

that the hose was improperly<br />

crimped,” it adds.<br />

The fueldraulic hose powers the<br />

actuator movement for the F-35B’s<br />

STOVL thrust vectoring exhaust system.<br />

Hoses on all 25 F-35B aircraft<br />

in the US Marine Corps and UK inventory<br />

have been inspected. Those<br />

aircraft found to have defective parts<br />

will have improperly crimped hoses<br />

replaced, the JPO states. It had said<br />

earlier that the investigating team<br />

found a total of seven aircraft had<br />

the manufacturing defect. �<br />

An improperly crimped fueldraulic hose was behind the problems<br />

Lockheed Martin<br />

FUTURE A330-200XL AND -300XL PROPOSALS<br />

A330-300XL<br />

A330-200XL<br />

Flightglobal al<br />

A350 and A320 fuselage sections<br />

A350 wing sections<br />

Airbus has tentatively identified<br />

an A330-200 derivative<br />

as the most promising long-term<br />

candidate to replace its five A300-<br />

600ST Beluga oversize transports.<br />

The airframer has already embarked<br />

on a programme to restructure<br />

its A300-600ST operations<br />

to cope with the demands of<br />

ramped-up production during<br />

the next four or five years.<br />

This programme, designated<br />

Fly 10,000, is intended to increase<br />

the flight work performed<br />

by the transport fleet to 10,000h<br />

per year in 2017, from the current<br />

level of about 6,000h.<br />

Airbus says it is changing “ways<br />

of working, opening hours and organisation”<br />

to meet this demand,<br />

which would double the number<br />

of weekly flights to about 120.<br />

The greater Beluga workload<br />

will primarily arise from a surge<br />

in A350 output. However, Airbus<br />

will also require capacity for the<br />

A400M military airlifter, which<br />

will partly offset a decline in<br />

A330 production, while A320<br />

and A320neo rates are set to remain<br />

high.<br />

Airbus recently indicated to<br />

Flightglobal that the A300-600ST<br />

fleet would probably remain in<br />

service for another 10 years or so.<br />

But while the fleet stay in use<br />

until about 2025, the cost of operating<br />

the type will increase as the<br />

aircraft age. The airframer has ini-<br />

THIS WEEK<br />

FLEETS DAVID KAMINSKI-MORROW LONDON<br />

A330-200 eyed as<br />

Beluga successor<br />

Rising output across Airbus product range drives airframer<br />

to consider options for next iteration of oversize transport<br />

tiated a study to replace the A300-<br />

600ST fleet in the long term.<br />

“No decision for immediate<br />

launch has been taken,” it stresses.<br />

But to address any capacity limitations<br />

beyond the Fly 10,000<br />

scheme, as well as the ageing of the<br />

current Beluga fleet, Airbus is likely<br />

to aim for 2018-2020 as a window<br />

to have a new aircraft available.<br />

Several airframes are being<br />

considered as a platform for a Beluga<br />

successor, notably the A330-200<br />

and -300, as well as the A340-500<br />

and even the A300-600.<br />

While the current Beluga fleet<br />

is carrying A350-900 sections, the<br />

size of the A350-1000 central fuselage<br />

assembly will determine<br />

the final cross-section for the<br />

freight hold of the new transport.<br />

The A300-600ST has a hold diameter<br />

of about 23ft (7.1m).<br />

As well as the requirement for<br />

high payload capabilities, airfield<br />

landing limitations at its UK wing<br />

facility in Broughton will also determine<br />

the eventual choice of<br />

base airframe.<br />

Airbus believes an A330-200<br />

variant – tentatively designated<br />

the A330-200XL – could potentially<br />

cope with the landing criteria<br />

at projected weights of<br />

about 135t, and is the most<br />

promising option. �<br />

More on the Beluga – past,<br />

present and future – on<br />

flightglobal.com/beluga<br />

19-25 February 2013 | Flight International | 9

THIS WEEK<br />

10 | Flight International | 19-25 February 2013<br />

For a round-up of our latest online news,<br />

feature and multimedia content visit<br />

flightglobal.com/wotw<br />

AIRSPACE ZACH ROSENBERG WASHINGTON DC<br />

Regulator searches for UAV integration test sites<br />

The integration of unmanned<br />

air vehicles into US civil airspace<br />

has moved a step closer<br />

after the US Federal Aviation<br />

Administration revealed it will<br />

begin a competition for six unmanned<br />

air vehicle test sites by<br />

the end of February.<br />

FAA deputy administrator Jim<br />

Williams revealed the move during<br />

a 13 February meeting of the<br />

Association for Unmanned Vehi-<br />

cle Systems International. The<br />

fiscal year 2012 FAA reauthorisation,<br />

as approved by Congress,<br />

contains a measure establishing<br />

six test sites to experiment with<br />

UAV integration into national airspace,<br />

which is strictly regulated.<br />

Although the nature of the<br />

sites is not specified, the selection<br />

is anticipated by low-traffic<br />

airports that are hoping to attract<br />

new business.<br />

A notice of proposed rulemaking<br />

(NPRM) for small UAVs in the<br />

national airspace will also be issued<br />

by the agency by the end of<br />

2013. And, although it remains<br />

hopeful that the release could<br />

come sooner, it notes “the process<br />

is very deliberate”.<br />

In any case, small civil UAVs<br />

will be in use before the NPRM is<br />

issued. Beginning in mid-2013,<br />

UAVs less than about 23kg (50lb)<br />

will be allowed to fly for commercial<br />

purposes in a large area off<br />

the coast of Alaska. That zone,<br />

defined by Congress, covers thousands<br />

of square miles of ocean off<br />

the north and west coasts of the<br />

state. It will be the only area in<br />

which UAVs are allowed to operate<br />

for commercial purposes. �<br />

For more about unmanned air<br />

vehicle operations, visit<br />

flightglobal.com/uav<br />

INQUIRY CRAIG HOYLE LONDON<br />

Turmoil as arrests rock Finmeccanica<br />

Italian giant forced into management shake-up as bribery investigation into Indian helicopter deal claims chief executive<br />

Italy’s aerospace champion Finmeccanica<br />

has been rocked by<br />

corruption allegations levelled at<br />

two top executives as part of an<br />

ongoing probe linked to the 2010<br />

sale of 12 VIP-roled AgustaWestland<br />

AW101s to the Indian defence<br />

ministry.<br />

Finmeccanica chief executive<br />

Giuseppe Orsi was detained by<br />

Italian police on 12 February,<br />

with the company confirming<br />

that “precautionary measures”<br />

were issued against him, and<br />

also against AgustaWestland<br />

chief executive Bruno Spagnolini<br />

in relation to the investigation.<br />

The latter has been placed<br />

under house arrest. No charges<br />

have been brought and both deny<br />

any wrongdoing.<br />

Orsi, who headed AgustaWestland<br />

at the time the €560 million<br />

($753 million) deal was signed,<br />

was swiftly replaced as Finmeccanica<br />

chief executive on 13 February<br />

by Alessandro Pansa, who<br />

will also retain his current duties<br />

as chief operating officer. Pansa<br />

will additionally take on some of<br />

Orsi’s duties as chairman, although<br />

the latter has yet to resign<br />

from the post.<br />

The move is aimed at “ensuring<br />

comprehensive management of<br />

the company and group”, it says.<br />

A board meeting is scheduled for<br />

early April, where further changes<br />

to the company’s executive team<br />

Orsi became chief executive in May 2011 with a mission to reverse the company’s fortunes<br />

are likely to be made.<br />

It adds: “Finmeccanica expresses<br />

support for its chairman<br />

and CEO, with the hope that clarity<br />

is established quickly, whilst<br />

reaffirming its confidence in the<br />

judges. The operating activities<br />

and ongoing projects of the company<br />

will continue as usual.”<br />

However, there was no immediate<br />

suggestion Spagnolini had<br />

relinquished his duties as Agusta-<br />

Westland chief.<br />

Finmeccanica and AgustaWestland<br />

previously denied allegations<br />

that illegal payments were<br />

made in relation to the sale.<br />

Orsi was only appointed as<br />

Finmeccanica chief executive in<br />

May 2011, following the resignation<br />

of his predecessor, Pier Francesco<br />

Guarguaglini, to successfully<br />

fight corruption charges. Orsi had<br />

been considered a reformer and<br />

had been tasked with reshaping<br />

the company and improving its financial<br />

performance.<br />

Meanwhile, India’s defence<br />

ministry has reacted to the claims<br />

by referring the AW101 acquisition<br />

to the country’s Central Bureau<br />

of Investigation (CBI).<br />

The ministry says it decided to<br />

refer the case to the CBI for inquiry<br />

after it sought more information<br />

from the UK and Italian govern-<br />

ments following media reports of<br />

the arrest of the two executives.<br />

“No specific inputs were, however,<br />

received substantiating the allegations,”<br />

it adds. The contract<br />

signed with AgustaWestland included<br />

“specific contractual provisions<br />

against bribery and the use<br />

of undue influence as well as an<br />

integrity pact,” it says.<br />

The acquisition was signed in<br />

February 2010, with the first three<br />

rotorcraft already delivered and<br />

the remainder due to be handed<br />

over by the end of 2013. �<br />

Additional reporting by Dominic<br />

Perry in London and Ellis Taylor<br />

in Singapore<br />

flightglobal.com<br />

Finmeccanica

Eurocopter has joined the<br />

growing number of aerospace<br />

majors in Mexico’s Queretaro<br />

manufacturing cluster with the<br />

formal opening of a $100 million<br />

factory that will be its sole-source<br />

supplier of AS350 Ecureuil tail<br />

booms and the A320, A330 and<br />

A340 cargo and emergency exit<br />

doors that it builds for sister company<br />

Airbus.<br />

Initial operations will see the<br />

assembly of imported kits but machinery<br />

will, from this year, be installed<br />

to carry out machining,<br />

sheet metal fabrication and surface<br />

treatment in Queretaro. Total<br />

investment could eventually<br />

reach $550 million. The Ecureuil<br />

series is Eurocopter’s biggest seller,<br />

last year taking in orders for<br />

249 units, or 53% of the airframer’s<br />

total. Assembly takes place<br />

both in Europe and at the aiframer’s<br />

Brazilian subsidiary Helibras.<br />

flightglobal.com<br />

Focus turns to<br />

A350-1000<br />

powerplant<br />

AIR TRANSPORT P12<br />

The fabrication of Airbus doors<br />

is being transferred from an undisclosed<br />

Asian subcontractor,<br />

adds global supply chain executive<br />

vice-president Joseph Saporito.<br />

Saporito expects the plant to<br />

be performing both component<br />

manufacture and assembly in<br />

2014-2015.<br />

Around 200 new jobs will have<br />

been created by mid-2014 in the<br />

manufacturing plant and an attached<br />

maintenance, repair and<br />

overhaul facility.<br />

Saporito says the Queretaro<br />

plant “kills three birds with one<br />

stone” in achieving Eurocopter’s<br />

three key objectives in its overseas<br />

deployment strategy – offsets, increased<br />

exposure to a dollar zone<br />

cost base and competitiveness. He<br />

declines to detail Mexican costs<br />

but describes them as “competitive”<br />

– as shown by the move of<br />

the Airbus door work.<br />

An intensive training programme<br />

being carried out on site<br />

– with the aeronautical university<br />

of Queretaro and in Eurocopter facilities<br />

in Europe – should have<br />

the plant running with mostly<br />

Mexican staff and a “handful” of<br />

Europeans by 2017, says Saporito.<br />

THIS WEEK<br />

PRODUCTION DAN THISDELL QUERETARO<br />

Booming sales prompt Mexico move<br />

Promise of lower-cost manufacturing persuades Eurocopter to invest $100 million in Queretaro aerostructures facility<br />

The new facility will supply tail booms for the AS350 Ecureuil<br />

He stresses that moving too<br />

quickly from assembly to manufacturing<br />

is inviting failure, so<br />

Eurocopter is edging forward cautiously.<br />

However, he says, Eurocopter<br />

has been “very positively<br />

impressed” by the quality of the<br />

workforce in Queretaro. �<br />

FORECAST STEPHEN TRIMBLE WASHINGTON DC<br />

Airframers to fight soft market with new launches<br />

Business jet demand will not<br />

recover to its 2008 peak during<br />

the next 10 years but airframers<br />

will still forge ahead with a<br />

number of new aircraft, predicts a<br />

new forecast released by a Montreal-based<br />

business aviation services<br />

agency.<br />

Zenith Jet’s 10-year outlook also<br />

SALES<br />

Helicopters, crop sprayers offer ray of light for GAMA<br />

Helicopters remained a bright spot<br />

and agricultural aviation boosted<br />

otherwise flat sales for general and<br />

business aviation manufacturers in<br />

2012, says the General Aviation<br />

Manufacturers Association (GAMA).<br />

Fixed-wing shipments grew by<br />

0.6% compared with 2011, largely<br />

driven by a surge in demand for turboprop-powered<br />

crop-sprayers, such<br />

as Thrush Aircraft and Air Tractor<br />

models, GAMA says.<br />

Rotorcraft shipments, meanwhile,<br />

anticipates the launch of at least<br />

nine more clean-sheet or major derivative<br />

programmes, including<br />

new families of business jet widebodies<br />

by Dassault and Gulfstream.<br />

The projected new-starts will compete<br />

with existing programmes to<br />

claim 9,400 expected deliveries<br />

until 2022, the forecast says.<br />

leapt 21.5% to 1,044 deliveries, the<br />

group adds.<br />

“2012 was kind of mixed,” says<br />

Brad Mottier, chairman of GAMA and<br />

vice-president and general manager<br />

for GE Aviation’s business and general<br />

aviation unit. “We think we see<br />

the turboprops and the agricultural<br />

market are going to continue to<br />

thrive. There are more and more<br />

needs for those types of specialised<br />

aircraft around the world.”<br />

GAMA, however, was unable to offer<br />

That prediction reflects an increasingly<br />

grim outlook taking<br />

hold in the business jet industry.<br />

It means Zenith Jet’s analysts<br />

have slashed future deliveries<br />

over the next decade by 9.4%<br />

since 2012, as the industry acknowledges<br />

that some buyers<br />

which exited the market during<br />

a similarly positive outlook for 2013<br />

for the rest of its fixed-wing manufacturing<br />

members, especially as the US<br />

fiscal outlook remains uncertain.<br />

The Obama Administration and<br />

Congress are poised to allow automatic<br />

budget cuts to take effect in<br />

early March, removing about $100<br />

billion in government spending from<br />

the economy and forcing federal agencies,<br />

including the Federal Aviation<br />

Administration, to furlough employees<br />

for perhaps several weeks. �<br />

the post-2008 recession will not<br />

return. “The reason is simple: a<br />

significant portion of that narrowbody<br />

[customer] base was new to<br />

business aviation and the recession<br />

had a profound effect in<br />

shaking their appetite for ownership,”<br />

Zenith Jet says.<br />

The only market segment immune<br />

to this trend is the ultralong-range<br />

sector, which will<br />

grow by 8.7%, with 1,577 projected<br />

deliveries during the 10year<br />

period.<br />

That is expected to draw new<br />

competitors into large-cabin segments.<br />

Zenith Jet anticipates Dassault<br />

will launch three new aircraft<br />

– the 5X, 6X and 9X – to<br />

replace the 2000LX, 900LX and<br />

7X. Gulfstream also could replace<br />

the G350/450/550 series with new<br />

aircraft which Zenith calls the<br />

G380, G480 and G580. �<br />

For news from the business and<br />

general aviation sectors, go to<br />

flightglobal.com/bizav<br />

19-25 February 2013 | Flight International | 11<br />

Eurocopter

AIR TRANSPORT<br />

12 | Flight International | 19-25 February 2013<br />

Check out our collection of online dynamic<br />

aircraft profiles for the latest news, images<br />

and information on civil and military<br />

programmes at flightglobal.com/profiles<br />

PROPULSION DAVID KAMINSKI-MORROW LONDON<br />

Focus turns to A350-1000 powerplant<br />

Work begins on prototype for higher-thrust Trent XWB to equip largest Airbus twinjet following certification of basic engine<br />

Rolls-Royce is preparing a prototype<br />

demonstration for the<br />

higher-thrust Trent XWB-97 engine<br />

which will be used on the<br />

A350-1000. The basic XWB-84<br />

engine for the A350-900 has been<br />

newly certificated. It is capable of<br />

delivering 84,000lb (370kN) of<br />

thrust and the certification also<br />

covers the XWB-75 and -79 versions<br />

for the smaller A350-800.<br />

However, the XWB-97 powerplant<br />

for the A350-1000 – put forward<br />

as part of the larger type’s<br />

redesign in 2011 – is undergoing<br />

a separate development and approval<br />

process.<br />

The prototype will be built<br />

from an XWB-84 engine platform<br />

with additional turbine technology<br />

fitted, says Trent XWB programme<br />

director Chris Young. He<br />

says this will allow the manufacturer<br />

to “run it as close as possible<br />

to [more demanding] conditions<br />

and temperatures”.<br />

Rolls-Royce intends to construct<br />

two demonstrators this<br />

year, with initial build about to<br />

begin. Young expects the first<br />

runs will start around the middle<br />

of 2013. It held a preliminary design<br />

review for the XWB-97 powerplant<br />

in January. Young says<br />

this allows the manufacturer to<br />

move into detailed design of individual<br />

components, and work on<br />

the machining definition and initial<br />

casting to “get the prototype<br />

engine in place”.<br />

Rolls-Royce is to perform freightloading<br />

tests for its Trent XWB engine<br />

at the UK’s East Midlands<br />

airport, to verify transport procedures<br />

for the powerplant.<br />

The engine is the first Trent family<br />

member too large to fit into a<br />

Boeing 747 freighter while still<br />

wholly assembled.<br />

Trent XWB programme director<br />

Chris Young says the manufacturer<br />

has developed tooling allowing the<br />

fan and the core to be split and<br />

Air Lease has underpinned confidence with an order for up to 10<br />

The XWB-97’s basic dimensions<br />

– such as the fan size,<br />

mounting points and interfaces –<br />

remain the same as those for the<br />

XWB-84. “But we take more flow<br />

through the fan by spinning the<br />

fan faster and changing some aerodynamics<br />

in the fan system,”<br />

says Young.<br />

The changes include an inflected<br />

annulus and a larger core, and<br />

technical changes to extract more<br />

power. Technological advancements<br />

will include shroudless<br />

high-pressure turbine blades and<br />

an adaptive cooling system.<br />

Young points out that the<br />

XWB-84 engine has already been<br />

run at thrusts “well in excess” of<br />

100,000lb, and that the growth is<br />

“more about restoring margins<br />

than airflow”.<br />

OPERATIONS<br />

Split-loading procedures to be tested using 747 freighter<br />

loaded separately. “Previously,<br />

we’ve trialled the tooling and gone<br />

through a mock-up of a 747 door,”<br />

he says. “This time we’re fully proving<br />

the tooling.”<br />

Rolls-Royce intends to take its<br />

first-produced XWB engine – which it<br />

uses for training – to East Midlands<br />

during February to carry out the<br />

standard loading procedure in conjunction<br />

with a 747 operator.<br />

With certification on the XWB for<br />

the A350-900 achieved, Young says<br />

Detailed design work on the<br />

Airbus A350-1000 is set to begin<br />

early this year, the type having secured<br />

a reassuring endorsement<br />

from former critic Air Lease.<br />

Air Lease, which will take up<br />

to 10 of the type as part of a broad<br />

A350 order, had expressed concerns<br />

about the aircraft’s lack of<br />

thrust, and claimed it needed<br />

greater maximum take-off weight,<br />

before the airframer unveiled a<br />

more powerful, higher-weight redesign<br />

in June 2011.<br />

Even after this revamp, Air<br />

Lease chief executive Steven Udvar-Hazy<br />

pointed out the commonality<br />

disjoint on the -1000’s engines<br />

and was still reserved about<br />

its ability to compete with the<br />

Boeing 777-300ER.<br />

However, Rolls-Royce’s design<br />

the focus in the test programme will<br />

move to proving on-wing capability<br />

and the “full robustness of the engine”.<br />

“We’ve done the very complex<br />

tests, with lots of<br />

instrumentation but limited test<br />

hours,” he says. “We’ll see test<br />

hours start to accelerate very quickly<br />

this year.” Rolls-Royce has been<br />

testing the XWB powerplant on an<br />

Airbus A380 testbed, and Young<br />

says this will remain a “key element<br />

of the programme”. �<br />

Airbus<br />

review has confirmed the higherthrust<br />

engine will have 80% commonality<br />

with the XWB-84 in<br />

terms of line-replaceable units,<br />

with only fuel pumps and metering<br />

systems not retained.<br />

Rolls-Royce has completed the<br />

latest build of its EFE technology<br />

platform in Bristol in the UK<br />

which is based on the Trent 1000<br />

core, and has carried out tests of<br />

high-temperature thermal paint.<br />

Young says using a platform “as<br />

representative as possible” for the<br />

XWB-97 prototype will help with<br />

“risk reduction” during the powerplant’s<br />

development.<br />

Air Lease’s agreement to take<br />

the -1000, following a similar acceptance<br />

from outspoken customer<br />

Qatar Airways, will give<br />

the type a backlog of 110 aircraft<br />

The XWB-97’s basic<br />

dimensions – such as<br />

the fan size, mounting<br />

points and interfaces<br />

– remain the same as<br />

those for the XWB-84<br />

once the lessor’s deal is firmed.<br />

But Airbus appears to be dismissing<br />

the possibility of a further<br />

stretch to the A350, despite the<br />

capacity gap between the A350-<br />

1000 and the A380.<br />

While Airbus positioned the<br />

A350-900 as the central platform<br />

for the three-member family, the<br />

backlog of the smaller A350-800 is<br />

eroding in favour of the larger variants.<br />

But the airframer does not<br />

see room for a further stretch beyond<br />

the A350-1000. “A double<br />

stretch has never been shown to<br />

work in this industry,” claimed<br />

Airbus chief operating officer for<br />

customers John Leahy, speaking<br />

in Toulouse in January. “We<br />

couldn’t do it. And we don’t think<br />

[Boeing] could do it either.” �<br />

See Cover Story P24<br />

More about Rolls-Royce’s development<br />

of the Trent XWB at<br />

flightglobal.com/trentxwb<br />

flightglobal.com

United Aircraft<br />

flightglobal.com<br />

Crashed An-28<br />

denied terrain<br />

warning<br />

AIR TRANSPORT P14<br />

AIR TRANSPORT<br />

TESTING<br />

Longer-range Superjet is airborne<br />

Sukhoi has conducted the first flight of a longer-range Superjet 100,<br />

starting a test programme which will last three to four months. The<br />

twin-engined aircraft, designated the SSJ100LR, will have a range of<br />

nearly 2,470nm (4,570km), some 50% greater than the basic variant.<br />

Sukhoi says the first airframe, 95032, performed its maiden<br />

flight on 12 February. It expects to secure certification for the twinjet<br />

in 2014. It adds that the SSJ100LR will require a runway length of<br />

6,730ft (2,050m). The first operator is yet to be confirmed.<br />

PRODUCTION STEPHEN TRIMBLE WASHINGTON DC<br />

Empty slots could slow 747-8 output<br />

Maintaining monthly rate for Boeing’s high-capacity aircraft might result in airframer resorting to building unsold jets<br />

Boeing could be forced to slow<br />

production or build unsold<br />

747-8s after 2013, the company has<br />

warned in a US regulatory filing.<br />

The airframer says a “number” of<br />

unsold production slots for the<br />

747-8 Freighter, as well as the Intercontinental<br />

passenger model,<br />

must be filled after 2013 to keep<br />

production on track at a rate of<br />

two aircraft per month.<br />

“If we are unable to obtain orders<br />

for multiple Freighter aircraft<br />

in 2013 consistent with our nearterm<br />

production plans, we may be<br />

required to take actions,” it states,<br />

adding this may include “reducing<br />

the number of airplanes produced”<br />

or “building airplanes for which<br />

we have not received firm orders”.<br />

Boeing made the notification to<br />

the US Securities and Exchange<br />

Commission. As of 31 January,<br />

Boeing had 67 unfilled orders for<br />

747-8s, including 39 747-8Fs and<br />

28 747-8Is. The company is building<br />

747-8s at a rate of 24 per year,<br />

but customers have not claimed<br />

all the delivery slots for 2013.<br />

The market does not appear to<br />

have turned in Boeing’s favour.<br />

Air cargo demand remains weak<br />

and strong interest in the passenger<br />

model has yet to materialise.<br />

Boeing says it will continue to<br />

focus on reducing travelled work,<br />

improving supply chain efficiency<br />

and implementing cost cuts. “If<br />

market and production risks cannot<br />

be mitigated,” it adds, “the<br />

programme could face an additional<br />

reach-forward loss that may<br />

be material.” Spirit AeroSystems<br />

manufactures structures including<br />

the 747-8 nose section but has<br />

not adjusted its production plans,<br />

says chief executive Jeff Turner.<br />

“Right now, we’re assuming that<br />

those [unclaimed positions] are<br />

going to fill in,” he says. �<br />

DEVELOPMENT<br />

Extra design changes hike type’s empty weight to 220t<br />

Boeing has updated the empty<br />

weight of the 747-8 passenger variant<br />

to reflect a 3% increase driven<br />

by additional design changes since<br />

the previous estimate set in 2008.<br />

The empty weight of the 747-8<br />

has risen by about 6,800kg<br />

(15,000lb) to 220,000kg, according<br />

to Boeing’s latest update to airport<br />

planning documents. Actual weights<br />

in service vary with each airline.<br />

The weight of the 747-8 grew<br />

during the development phase as<br />

Boeing engineers struggled with the<br />

initial design of the new supercritical<br />

airfoil. “We changed the airfoils<br />

on the 747-8 to a deeper chord supercritical<br />

design,” says Boeing.<br />

“This caused the weight of the wing<br />

to increase.”<br />

Boeing had previously also described<br />

a migrating series of weightrelated<br />

design problems in the<br />

development phase. Changes to the<br />

wing shifted the centre of gravity.<br />

That shift, in turn, required Boeing to<br />

������������������������������<br />

�������������������������������<br />

Strong demand for the passenger variant has yet to materialise<br />

redesign portions of the tail to rebalance<br />

the loads, which caused further<br />

design changes elsewhere. But<br />

Boeing remains confident that the<br />

effort to attach a supercritical wing<br />

to the 747 airframe achieved most<br />

of the desired results.<br />

It claims a 15% fuel-burn reduction<br />

over the 747-400. Lufthansa<br />

has measured the difference as<br />

more than 10%, but Boeing is to<br />

offer an improved General Electric<br />

GEnx-2B engine in 2014. �<br />

19-25 February 2013 | Flight International | 13<br />

Slider gallery on flightglobal.com/AirSpace

AIR TRANSPORT<br />

14 | Flight International | 19-25 February 2013<br />

Check out our collection of online dynamic<br />

aircraft profiles for the latest news, images<br />

and information on civil and military<br />

programmes at flightglobal.com/profiles<br />

INVESTIGATION DAVID KAMINSKI-MORROW LONDON<br />

Crashed An-28 denied terrain warning<br />

Pilot intoxication cited after collision with mountain but aircraft should have been fitted with ground-proximity system<br />

Investigators have determined<br />

that an Antonov An-28 that collided<br />

with high terrain on a domestic<br />

service in eastern Russia should<br />

have been fitted with a groundproximity<br />

warning system.<br />

The inquiry into the loss of the<br />

Petropavlovsk-Kamchatsky<br />

Aviation Enterprise aircraft near<br />

Palana found that the An-28 had<br />

been among the types required to<br />

fit GPWS by 1 July 2012.<br />

While the ministry had intended<br />

to postpone the deadline to<br />

October, the Interstate Aviation<br />

Committee (MAK) says this order<br />

was not registered with the justice<br />

ministry at the time of the accident<br />

on 12 September 2012.<br />

Investigators had previously determined<br />

that the pilots had been<br />

intoxicated with alcohol, despite<br />

passing a pre-flight medical check.<br />

MAK suggests “impaired concentration”<br />

of the crew contributed<br />

to a “lack of response” to<br />

radio altimeter indications that<br />

the aircraft was approaching high<br />

ground. Fitting of GPWS avionics<br />

Sukhoi has defended the technical<br />

record of its Superjet<br />

100s after two recent incidents<br />

involving landing-gear retraction<br />

problems on Aeroflot aircraft.<br />

The airframer insists that design<br />

“deficiencies” emerge during<br />

the first two years of commercial<br />

operations on any aircraft type.<br />

Russia’s transport ministry has<br />

highlighted two incidents this<br />

year during which Aeroflot Superjets<br />

experienced landing-gear<br />

retraction issues.<br />

“could possibly have prevented”<br />

the accident, says MAK.<br />

Flight 251 from Yelizovo,<br />

transporting 12 passengers and<br />

two crew, had been intending to<br />

approach Palana’s runway 11.<br />

This required maintaining flight<br />

level 70 (minimum 2,150m,<br />

7,000ft) until reaching Palana’s<br />

non-directional beacon (NDB),<br />

then entering a hold to descend<br />

The first involved aircraft 95017<br />

departing Moscow Sheremetyevo<br />

on 18 January, while the second,<br />

four days later, centred on 95019<br />

on take-off from Kharkov. Crews<br />

received “gear fault” and “door not<br />

closed” messages. The ministry<br />

has asked for checks on the landing-gear<br />

and for results to be sent<br />

to the federal aviation regulator.<br />

Sukhoi’s civil aircraft division<br />

says the incidents are “isolated”<br />

and adds: “Aircraft at the plant<br />

are improved during the produc-<br />

to 1,200m before exiting to the<br />

final approach.<br />

But the aircraft had been far off<br />

course. It had been approaching<br />

the NDB from the south but the<br />

crew gave an incorrect position<br />

report to air traffic control. Despite<br />

being 43 nautical miles (80km)<br />

from the airport, the An-28 prematurely<br />

descended to 1,700m and<br />

subsequently to 1,200m.<br />

tion process.” It says commercial<br />

operations with the twinjet type,<br />

which is in service with three carriers,<br />

have turned up problems<br />

with erroneous leakage-detection<br />

signals as well as slat extension.<br />

Slat-extension incidents on<br />

two other Aeroflot Superjets –<br />

numbers 95008 and 95010 – arose<br />

last year, prompting an airworthiness<br />

directive in June. Aeroflot<br />

has 10 Superjets.<br />

Both matters have been “isolated”,<br />

the airframer says, with service<br />

bulletins developed, and the<br />

in-service fleet is being modified<br />

accordingly. The landing-gear<br />

problem is not systemic, adds Sukhoi,<br />

and is “being solved” in cooperation<br />

with undercarriage specialist<br />

Messier-Bugatti-Dowty.<br />

“Gear-up faults do not qualify<br />

as in-flight emergencies,” it says.<br />

MAK says the crew effectively<br />

followed an “arbitrary” approach<br />

to the airport. As the aircraft continued<br />

to descend, it started turning<br />

left, possibly to cross the coast<br />

of the Sea of Okhotsk and then<br />

turn inbound to the airport.<br />

But this track instead took it<br />

towards high terrain, which was<br />

shrouded with cloud. Flight-data<br />

recorder information revealed a<br />

sudden elevator deflection, pitch<br />

up, which MAK believes to be a<br />

crew reaction to obstacles in the<br />

aircraft’s path. But this failed to<br />

avert a collision with trees at a<br />

height of 330m.<br />

The impact occurred at 135kt<br />

(250km/h) and the aircraft lost<br />

power in both engines.<br />

It pitched up but the loss of<br />

thrust caused its speed to bleed to<br />

70kt and the An-28 stalled, hitting<br />

the trees again before breaking<br />

up. It came to rest 10.7km<br />

from the airport.<br />

Both crew members and eight<br />

passengers were killed in the accident,<br />

but four others survived. �<br />

SAFETY DAVID KAMINSKI-MORROW LONDON<br />

Aeroflot technical snags prompt Superjet defence<br />

Interjet’s first airframe emerges sporting its full paint scheme<br />

Four of the 14 occupants survived the impact outside of Palana<br />

Superjet International<br />

Interstate Aviation Committee<br />

“All other aircraft have been<br />

checked and no landing-gear<br />

problems were detected.”<br />

Sukhoi’s marketing operation<br />

Superjet International is nearing its<br />

first delivery to a Western customer,<br />

with the initial aircraft for Mexico’s<br />

Interjet nearing completion.<br />

Aircraft 95023 has been rolled<br />

out from the Venice paint facility<br />

carrying the Interjet colour<br />

scheme, although the interior installation<br />

has yet to be finished.<br />

Interjet has ordered 20 of the 93seat<br />

twinjets. The first is to be delivered<br />

in spring. Its second aircraft,<br />

95024, has been delivered to<br />

Venice for completion work.<br />

Superjet International says a<br />

new full-flight simulator is undergoing<br />

certification at its Venice<br />

training centre, and Interjet pilots<br />

will use the device from March. �<br />

flightglobal.com

flightglobal.com<br />

AIR TRANSPORT<br />

Out of the embattled airline’s 14 aircraft only seven are operating<br />

STRATEGY IGOR SALINGER BELGRADE<br />

Jat aims to revive<br />

latent Airbus deal<br />

Troubled Serbian flag carrier faces fleet shortage and intends<br />

to slash workforce as part of broad restructuring programme<br />

Serbian flag carrier Jat Airways<br />

claims the government commission<br />

responsible for the troubled<br />

airline has accepted a restructuring<br />

plan proposed by the<br />

operator, which includes axing<br />

nearly 50% of jobs and leasing<br />

additional aircraft.<br />

Under the plan, Jat would lease<br />

four Airbus A320-family jets and<br />

two ATR 72-500 turboprops to<br />

cope with a fleet shortage.<br />

The airline confirms that out of<br />

14 aircraft – 10 Boeing 737s and<br />

four ATR 72s – only seven are<br />

currently in operation, forcing it<br />

to revise timetables and cut frequencies<br />

to some destinations.<br />

Sources familiar with the situation<br />

indicate the airline has received<br />

a $10 million loan to be<br />

used for maintenance and repayment<br />

of debts to fuel suppliers.<br />

Jat Airways’ escape plan includes<br />

cutting its workforce to<br />

740 personnel, including 156<br />

flightcrew, down from 1,138 employees.<br />

It will also “revise” its<br />

relationship with Belgrade airport,<br />

its fuel supplier, caterer and<br />

handling agent, and maintenance<br />

firm Jat Tehnika – some of which<br />

were formerly an integral part of<br />

the airline before being spun off<br />

as independent companies. Jat<br />

started the year with some 5.5 billion<br />

dinars ($66 million) of debt,<br />

mostly towards these companies.<br />

It hopes to introduce two new<br />

Airbus A319s and two A320s, as<br />

well as two ATR 72-500s, before<br />

June, and operate 14 aircraft for<br />

the summer peak.<br />

This could lead to resurrection<br />

and restructuring of the long-<br />

dormant order for eight A319s. Jat<br />

intends the revised fleet and reduced<br />

workforce, along with<br />

amended relations with domestic<br />

suppliers, to halve losses and<br />

help increase passenger numbers<br />

to 1.5 million – up from 1.36 million<br />

in 2012.<br />

Jat Tehnika managing director<br />

Srđan Mišković says the maintenance<br />

company has received the<br />

necessary certificates to be “fully<br />

capable” of offering both line and<br />

heavy support for A320-family<br />

jets. It currently services Boeing<br />

737 and ATR fleets, and last year<br />

recorded a “steady” turnover<br />

with a “slightly positive, yet to be<br />

specified” result.<br />

About half of its work is performed<br />

for Jat Airways, the rest for<br />

third-party clients such as Jet2,<br />

Europe Airpost and Transaero. �<br />

Igor Salinger

DEFENCE<br />

PROGRAMMES<br />

GREG WALDRON BENGALURU<br />

Indian air force<br />

chief lambasts<br />

HAL trainers<br />

India’s air force chief of staff has<br />

cast further doubt on the future<br />

of the Hindustan Aeronautics<br />

(HAL) HTT-40 basic trainer, while<br />

also criticising the company’s<br />

HJT-36 Sitara intermediate jet<br />

trainer and describing the service’s<br />

relationship with the airframer<br />

as “functional”.<br />

Speaking at the Aero India<br />

show near Bengaluru, Air Chief<br />

Marshal NAK Browne gave a<br />

fresh insight into the bad relations<br />

between HAL and its biggest<br />

customer.<br />