Room for Improvement - Odlum Brown

Room for Improvement - Odlum Brown

Room for Improvement - Odlum Brown

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

odlum brown limited trust • vision • investment integrity<br />

ob report<br />

january 2012<br />

inside this issue<br />

<strong>Room</strong> <strong>for</strong> <strong>Improvement</strong><br />

> Page 1<br />

OB Model Portfolio<br />

> Page 3<br />

<strong>Odlum</strong> <strong>Brown</strong>’s 18th Annual<br />

Address > Page 4<br />

<strong>Odlum</strong> <strong>Brown</strong> Limited<br />

Suite 1100 – 250 Howe Street<br />

Vancouver BC Canada V6C 3S9<br />

Tel 604 669 1600<br />

Fax 604 681 8310<br />

Toll Free 1 888 886 3586<br />

in<strong>for</strong>mation@odlumbrown.com<br />

odlumbrown.com<br />

Kelowna 250 861 5700<br />

Victoria 250 952 7777<br />

Chilliwack 604 858 2455<br />

Courtenay 250 703 0637<br />

Campbell River 250 286 3151<br />

Member-Canadian Investor Protection Fund<br />

PLATINUM MEMBER<br />

> <strong>Room</strong> <strong>for</strong> <strong>Improvement</strong><br />

many canadians believe the united<br />

States is headed <strong>for</strong> an economic disaster.<br />

Yet despite high unemployment, consumer<br />

deleveraging, troubled banks, a trillion-plus<br />

dollar Federal deficit, and political gridlock,<br />

U.S. stocks led the world in 2011. For the year<br />

through to December 15, 2011, all three of<br />

the major U.S. stock benchmarks produced<br />

positive total returns, measured in Canadian<br />

dollars.<br />

Canadian stocks returned –12 per cent over<br />

the same period. Not surprisingly, the major<br />

European bourses were down even more.<br />

Emerging market stocks produced the worst<br />

returns, led by declines of 25 per cent and 32<br />

per cent in Brazil and India, respectively.<br />

Chinese stocks were down 15 per cent.<br />

The <strong>Odlum</strong> <strong>Brown</strong> Model Portfolio had an<br />

unspectacular yet respectable 2011. For the<br />

year through mid-December, the Model’s value<br />

was roughly unchanged. Owning <strong>for</strong>eign stocks,<br />

particularly U.S. multinational companies,<br />

helped its relative per<strong>for</strong>mance. The Model<br />

also benefitted by being underweight cyclical<br />

resource stocks and overweight less cyclical<br />

businesses in Consumer and Health Care<br />

sectors. At year-end, almost 50 per cent of the<br />

portfolio was invested outside of the country.<br />

The divergent returns between the U.S. and<br />

emerging markets provide two important and<br />

related insights. First, economic growth and<br />

stock market returns are not highly correlated.<br />

Second, it is change relative to expectations<br />

that drives investment per<strong>for</strong>mance, not the<br />

absolute condition of a stock, industry sector,<br />

or country.<br />

China is a prime example. The country has led<br />

global growth since the 2008/09 financial<br />

crisis, yet its stock market has been trending<br />

downward since mid-2009. From a rear-view<br />

mirror perspective, China’s economy looks<br />

great, but what matters to investors is where<br />

China is headed. While the country’s long-term<br />

potential seems bright, there are signs that<br />

China’s credit-driven investment boom is faltering.<br />

Chinese bank and property developer stocks<br />

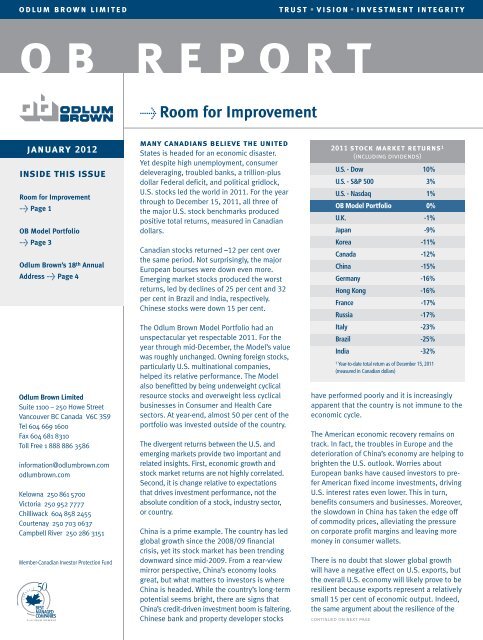

2011 stock market returns 1<br />

(including dividends)<br />

U.S. - Dow 10%<br />

U.S. - S&P 500 3%<br />

U.S. - Nasdaq 1%<br />

OB Model Portfolio 0%<br />

U.K. -1%<br />

Japan -9%<br />

Korea -11%<br />

Canada -12%<br />

China -15%<br />

Germany -16%<br />

Hong Kong -16%<br />

France -17%<br />

Russia -17%<br />

Italy -23%<br />

Brazil -25%<br />

India -32%<br />

1 Year-to-date total return as of December 15, 2011<br />

(measured in Canadian dollars)<br />

have per<strong>for</strong>med poorly and it is increasingly<br />

apparent that the country is not immune to the<br />

economic cycle.<br />

The American economic recovery remains on<br />

track. In fact, the troubles in Europe and the<br />

deterioration of China’s economy are helping to<br />

brighten the U.S. outlook. Worries about<br />

European banks have caused investors to prefer<br />

American fixed income investments, driving<br />

U.S. interest rates even lower. This in turn,<br />

benefits consumers and businesses. Moreover,<br />

the slowdown in China has taken the edge off<br />

of commodity prices, alleviating the pressure<br />

on corporate profit margins and leaving more<br />

money in consumer wallets.<br />

There is no doubt that slower global growth<br />

will have a negative effect on U.S. exports, but<br />

the overall U.S. economy will likely prove to be<br />

resilient because exports represent a relatively<br />

small 15 per cent of economic output. Indeed,<br />

the same argument about the resilience of the<br />

continued on next page

2/ob report<br />

“<br />

there is a lot more<br />

room <strong>for</strong> improvement<br />

and potential <strong>for</strong><br />

investors to be positively<br />

surprised following<br />

periods of economic<br />

adversity than periods<br />

of prosperity.<br />

”<br />

continued from page 1<br />

> <strong>Room</strong> <strong>for</strong> <strong>Improvement</strong><br />

insular U.S. economy proved to be prescient<br />

following the 1997/98 Asian financial crisis.<br />

Investors remain confident in the credit of the<br />

United States, even despite all the hoopla over<br />

the recent U.S. debt ceiling fiasco, the S&P debt<br />

downgrade, and the failure of the congressional<br />

“Super Committee” to <strong>for</strong>ge a budget compromise.<br />

The yield on 10-year U.S. Treasury bonds<br />

has fallen from more than 3.5 per cent in early<br />

2011 to less than two per cent, as of late.<br />

The monstrous U.S. budget deficit may rightfully<br />

scare investors, yet large deficits are normally<br />

followed by good stock market returns. The<br />

history of this seemingly counterintuitive reality<br />

is brilliantly chronicled in Ken Fisher’s latest book,<br />

Markets Never Forget (But People Do): How Your<br />

Memory is Costing You Money.<br />

While it is hard to believe, stocks generally<br />

per<strong>for</strong>m much better in the years following big<br />

budget deficits than they do following the years<br />

of surpluses (or smaller deficits). Consider what<br />

happened following the spike in the U.S. budget<br />

deficit during the nasty recession in 1982. Three<br />

years later, the S&P 500 was up more than 50<br />

per cent. Conversely, the budget surplus during<br />

Bill Clinton’s presidency in 1999 was anything but<br />

a recipe <strong>for</strong> good things to come. Three years later,<br />

the benchmark U.S. stock index was down more<br />

than 40 per cent. While we have highlighted a<br />

couple of extreme examples, the pattern is fairly<br />

consistent and there is actually a logical explanation<br />

<strong>for</strong> the outcome.<br />

There is a lot more room <strong>for</strong> improvement and<br />

potential <strong>for</strong> investors to be positively surprised<br />

following periods of economic adversity than<br />

periods of prosperity. During economic setbacks,<br />

stocks fall out of fashion and become inexpensive,<br />

as corporate profits and government finances<br />

deteriorate. Conversely, government finances<br />

improve during booms, as do corporate profitability,<br />

investor sentiment and stock prices. Stock market<br />

returns are greatly influenced by starting<br />

valuations, which are best during troubled times.<br />

We are enthusiastic about the outlook <strong>for</strong> the<br />

U.S. economy and favour many U.S. listed<br />

securities simply because there is lot of room<br />

<strong>for</strong> the U.S. economy to recover. Positive change<br />

will not happen overnight, but it should not<br />

take much marginal improvement to move<br />

valuations off depressed levels.<br />

Europe is commonly cited as the biggest risk <strong>for</strong><br />

2012. While the economic and political issues in<br />

the Eurozone are complex and <strong>for</strong>midable, we<br />

think that most of the concern has already been<br />

reflected in stock prices. Europe’s big problems<br />

could be setting the stage <strong>for</strong> excellent stock<br />

returns, much like big budget deficits. Collectively,<br />

the governments of the European Union have<br />

less debt leverage than the United States. The<br />

distribution of the debt is the problem and the<br />

reason why it will take time to develop and<br />

institute policies that will ease investor concerns.<br />

Nonetheless, we are hopeful because there is<br />

scope <strong>for</strong> positive change in Europe.<br />

We are cautious regarding the outlook <strong>for</strong><br />

Canada’s economy and stock market. While our<br />

country will benefit from renewed U.S. economic<br />

strength, there is simply not much room <strong>for</strong><br />

improvement. Home ownership is at a record<br />

high and consumer debt leverage has never been<br />

higher. In fact, Canadian consumers are now<br />

more leveraged than their American and British<br />

counterparts. Housing investment has been a big<br />

driver of Canada’s economy in recent years, but<br />

with consumers increasingly tapped out and<br />

home prices on the richer side of fair, there is not<br />

much latitude <strong>for</strong> Canada’s housing market to get<br />

even better. The resource sector is another area<br />

that has been a boon <strong>for</strong> the Canadian economy<br />

in recent years, yet it too will likely be less of a<br />

growth factor going <strong>for</strong>ward if China’s credit-driven<br />

property boom comes to an end.<br />

Our government managed to balance the books<br />

while the housing and resource sectors were<br />

booming, but now that both have slowed, the<br />

Federal budget is in the red. Canada remains in<br />

excellent fiscal shape relative to other developed<br />

nations and the country will undoubtedly benefit<br />

from the U.S. economic recovery. Still, Canadian<br />

investors would be wise to diversify beyond our<br />

borders.<br />

Overall, we believe that the global economy will<br />

muddle through in 2012. America’s economic<br />

strength and resilience will be the big surprise<br />

this year. Good businesses will continue to find<br />

room <strong>for</strong> improvement and add shareholder<br />

value. Those that embrace quality investments<br />

and <strong>for</strong>eign diversification should do well. Happy<br />

New Year.<br />

murray leith, bcomm, cfa<br />

vice president and director,<br />

investment research

FINANCIALS<br />

Toronto-Dominion Bank (TD)<br />

Brookfield Asset Management Inc. (BAM.A) 1<br />

Onex Corp. (OCX)<br />

Intact Financial Corp. (IFC)<br />

JPMorgan Chase & Co. (JPM)*<br />

The Howard Hughes Corp (HHC)*<br />

Berkshire Hathaway Inc. (BRK.B)* 2<br />

28.6%<br />

Manulife Financial Corp. (MFC)<br />

Royal Bank of Canada (RY)<br />

Bank of Nova Scotia (BNS)<br />

MATERIALS<br />

Barrick Gold Corp. (ABX)<br />

Potash Corporation (POT)<br />

Agrium Inc. (AGU)<br />

ENERGY<br />

Royal Dutch Shell PLC (RDS.B)* 3<br />

Cenovus Energy Inc. (CVE)<br />

TransCanada Corp. (TRP)<br />

Nexen Inc. (NXY)<br />

EnCana Corp. (ECA)<br />

Trinidad Drilling Ltd. (TDG)<br />

INDUSTRIALS<br />

Canadian National Railway Co. (CNR)<br />

3M Co. (MMM)*<br />

United Parcel Service Inc. (UPS)*<br />

Ritchie Bros. Auctioneers Inc. (RBA)<br />

CONSUMER DISCRETIONARY<br />

Starbucks Corp. (SBUX)*<br />

Lowe’s Companies Inc. (LOW)*<br />

Thomson Reuters Corp. (TRI)<br />

INFO TECH<br />

Syntel Inc. (SYNT)*<br />

Dell Inc. (DELL)*<br />

Cisco Systems Inc. (CSCO)*<br />

Apple (AAPL)*<br />

Google (GOOG)*<br />

STMicroelectronics NV (STM)*<br />

CONSUMER STAPLES<br />

The Coca-Cola Co. (KO)*<br />

Diageo PLC (DEO)*<br />

Colgate-Palmolive Co. (CL)*<br />

Sysco Corp. (SYY)*<br />

Loblaw Companies Inc. (L)<br />

Wal-Mart Stores Inc. (WMT)*<br />

TELECOM SERVICES<br />

BCE Inc. (BCE)<br />

UTILITIES<br />

Fortis Inc. (FTS)<br />

HEALTH CARE<br />

Stryker Corp. (SYK)*<br />

Novartis AG ADR (NVS)*<br />

Becton Dickinson and Co. (BDX)*<br />

SUB TOTAL<br />

SHORT-TERM INVESTMENTS<br />

PORTFOLIO TOTAL<br />

odlum brown model portfolio<br />

S&P/TSX<br />

Weight<br />

22.4%<br />

26.6%<br />

5.7%<br />

4.1%<br />

1.4%<br />

2.9%<br />

5.1%<br />

1.9%<br />

1.4%<br />

100%<br />

Dec 15/11<br />

Price<br />

$71.85<br />

$27.39<br />

$32.70<br />

$58.13<br />

$31.76<br />

$45.10<br />

$74.90<br />

$10.25<br />

$48.29<br />

$48.74<br />

$45.79<br />

$40.25<br />

$67.12<br />

$72.44<br />

$31.00<br />

$43.10<br />

$15.02<br />

$18.71<br />

$7.09<br />

$75.03<br />

$78.86<br />

$71.55<br />

$20.48<br />

$43.40<br />

$24.66<br />

$27.02<br />

$45.26<br />

$15.05<br />

$18.04<br />

$378.94<br />

$619.54<br />

$5.52<br />

$66.89<br />

$84.51<br />

$90.58<br />

$28.99<br />

$36.55<br />

$57.95<br />

$40.53<br />

$32.23<br />

$46.63<br />

$56.11<br />

$71.15<br />

Shares Cost Market<br />

Value<br />

1,600<br />

3,700<br />

2,700<br />

1,200<br />

2,000<br />

1,300<br />

600<br />

3,700<br />

750<br />

750<br />

1,900<br />

1,550<br />

900<br />

1,500<br />

1,900<br />

1,400<br />

3,100<br />

2,000<br />

3,900<br />

800<br />

650<br />

650<br />

2,000<br />

1,800<br />

2,500<br />

500<br />

1,500<br />

4,000<br />

3,400<br />

120<br />

75<br />

3,000<br />

1,000<br />

700<br />

550<br />

1,200<br />

900<br />

550<br />

2,000<br />

2,500<br />

1,400<br />

1,050<br />

700<br />

$71,826<br />

$89,816<br />

$49,293<br />

$43,380<br />

$77,846<br />

$63,704<br />

$49,545<br />

$82,991<br />

$23,805<br />

$15,713<br />

$90,915<br />

$64,434<br />

$43,227<br />

$90,034<br />

$65,792<br />

$21,550<br />

$96,024<br />

$66,178<br />

$46,800<br />

$42,264<br />

$56,003<br />

$50,735<br />

$41,880<br />

$41,912<br />

$58,391<br />

$20,605<br />

$29,558<br />

$61,149<br />

$53,270<br />

$39,079<br />

$38,148<br />

$31,490<br />

$49,982<br />

$48,931<br />

$45,094<br />

$42,458<br />

$38,214<br />

$31,394<br />

$69,350<br />

$58,375<br />

$75,744<br />

$57,696<br />

$51,043<br />

$2,285,639<br />

* = Prices in U.S. dollars U.S. Exchange ($US/$CDN) $0.9675 Foreign Weight 49.0%<br />

$114,960<br />

$101,343<br />

$88,290<br />

$69,756<br />

$65,654<br />

$60,600<br />

$46,450<br />

$37,925<br />

$36,218<br />

$36,555<br />

$87,001<br />

$62,388<br />

$60,408<br />

$112,311<br />

$58,900<br />

$60,340<br />

$46,562<br />

$37,420<br />

$27,651<br />

$60,024<br />

$52,981<br />

$48,070<br />

$40,960<br />

$80,745<br />

$63,721<br />

$13,510<br />

$70,171<br />

$62,223<br />

$63,397<br />

$47,001<br />

$48,027<br />

$17,116<br />

$69,138<br />

$61,145<br />

$51,493<br />

$35,957<br />

$32,895<br />

$32,943<br />

$81,060<br />

$80,575<br />

$67,475<br />

$60,895<br />

$51,478<br />

$2,503,732<br />

$21,382<br />

$2,525,114<br />

Portfolio<br />

Weight<br />

26.0%<br />

4.6%<br />

4.0%<br />

3.5%<br />

2.8%<br />

2.6%<br />

2.4%<br />

1.8%<br />

1.5%<br />

1.4%<br />

1.4%<br />

8.3%<br />

3.4%<br />

2.5%<br />

2.4%<br />

13.6%<br />

4.4%<br />

2.3%<br />

2.4%<br />

1.8%<br />

1.5%<br />

1.1%<br />

8.0%<br />

2.4%<br />

2.1%<br />

1.9%<br />

1.6%<br />

6.3%<br />

3.2%<br />

2.5%<br />

0.5%<br />

12.2%<br />

2.8%<br />

2.5%<br />

2.5%<br />

1.9%<br />

1.9%<br />

0.7%<br />

11.2%<br />

2.7%<br />

2.4%<br />

2.0%<br />

1.4%<br />

1.3%<br />

1.3%<br />

3.2%<br />

3.2%<br />

3.2%<br />

3.2%<br />

7.1%<br />

2.7%<br />

2.4%<br />

2.0%<br />

99.2%<br />

0.8%<br />

100%<br />

Dividend<br />

Yield<br />

3.8%<br />

1.9%<br />

0.3%<br />

2.5%<br />

3.1%<br />

0.0%<br />

0.0%<br />

1.0%<br />

4.5%<br />

4.3%<br />

1.4%<br />

0.7%<br />

0.7%<br />

4.6%<br />

2.6%<br />

3.9%<br />

1.3%<br />

4.4%<br />

2.8%<br />

1.7%<br />

2.8%<br />

2.9%<br />

2.2%<br />

1.6%<br />

2.3%<br />

4.7%<br />

0.5%<br />

0.0%<br />

1.3%<br />

0.0%<br />

0.0%<br />

7.2%<br />

2.8%<br />

3.8%<br />

2.6%<br />

3.7%<br />

2.3%<br />

2.5%<br />

5.4%<br />

3.7%<br />

1.8%<br />

4.2%<br />

2.5%<br />

$87.00<br />

$40.00<br />

$44.00<br />

$67.00<br />

$50.00<br />

$75.00<br />

$120.00<br />

$21.00<br />

$55.00<br />

$55.00<br />

$71.00<br />

$62.00<br />

$101.00<br />

$105.00<br />

$47.00<br />

$45.00<br />

$34.00<br />

$20.00<br />

$12.00<br />

$85.00<br />

$105.00<br />

$85.00<br />

$25.00<br />

$48.00<br />

$30.00<br />

$37.21<br />

$65.00<br />

$20.00<br />

$22.00<br />

$525.00<br />

$730.00<br />

$13.00<br />

$80.00<br />

$95.00<br />

$105.00<br />

$36.00<br />

$46.00<br />

$60.00<br />

$42.00<br />

$34.50<br />

$71.00<br />

$70.00<br />

$95.00<br />

1 Class A shares elect on-half of the company’s Board of Directors.<br />

2 A share of Class B common stock has the rights of 1/1,500 th of a share of Class A common stock except that a Class B share has 1/10,000 th of<br />

the voting rights of a Class A share.<br />

3 Class A shares have a Dutch source <strong>for</strong> tax purposes, and the Class B shares have a UK source.<br />

Target<br />

Price<br />

Total<br />

Return<br />

Potential<br />

25%<br />

48%<br />

35%<br />

18%<br />

61%<br />

66%<br />

60%<br />

106%<br />

18%<br />

17%<br />

56%<br />

55%<br />

51%<br />

50%<br />

54%<br />

8%<br />

128%<br />

11%<br />

72%<br />

15%<br />

36%<br />

22%<br />

24%<br />

12%<br />

24%<br />

42%<br />

44%<br />

33%<br />

23%<br />

39%<br />

18%<br />

143%<br />

22%<br />

16%<br />

18%<br />

28%<br />

28%<br />

6%<br />

9%<br />

11%<br />

54%<br />

29%<br />

36%<br />

ob report/3<br />

The <strong>Odlum</strong> <strong>Brown</strong> Model<br />

Portfolio was established on<br />

December 15, 1994 with a<br />

hypothetical investment of<br />

$250,000. The Model provides a<br />

basis with which to measure the<br />

quality of our advice. It also<br />

facilitates an understanding of<br />

how we believe individual<br />

security recommendations could<br />

be used within the context of a<br />

client portfolio. Trades are made<br />

using the closing price on the<br />

day a change is announced.<br />

Per<strong>for</strong>mance figures do not<br />

include any allowance <strong>for</strong> fees.<br />

Past per<strong>for</strong>mance is not<br />

indicative of future per<strong>for</strong>mance.<br />

The <strong>Odlum</strong> <strong>Brown</strong> Model<br />

Portfolio is an all-equity portfolio.<br />

It is important to note that a<br />

well-diversified portfolio should<br />

also include an appropriate mix<br />

of fixed income and money<br />

market instruments, which<br />

will depend on an investor’s risk<br />

tolerance and individual<br />

circumstances.

4/ob report<br />

please read our odlum<br />

brown limited disclaimer &<br />

disclosure / it is important<br />

<strong>Odlum</strong> <strong>Brown</strong> Limited is an independent, full-service<br />

investment firm focused on providing professional investment<br />

advice and objective research. We respect your right<br />

to be in<strong>for</strong>med of relationships with the issuers or strategies<br />

referred to in this report which might reasonably be<br />

expected to indicate potential conflicts of interest with<br />

respect to the securities or any investment strategies discussed<br />

or recommended in this report. We do not act as a<br />

market maker in any securities and do not provide investment<br />

banking or advisory services to, or hold significant positions<br />

in, the issuers covered by our research. Analysts and<br />

their associates may, from time to time, hold securities of<br />

issuers discussed or recommended in this report because<br />

they personally have the conviction to follow their own<br />

research, but we have implemented internal policies that<br />

impose restrictions on when and how an Analyst may buy<br />

or sell securities they cover and any such interest will be<br />

disclosed in our report in accordance with regulatory policy.<br />

Our Analysts receive no direct compensation based on<br />

revenue from investment banking services. We describe<br />

our research policies in greater detail, including a description<br />

of our rating system and how we disseminate<br />

our research, on the <strong>Odlum</strong> <strong>Brown</strong> Limited website at<br />

odlumbrown.com.<br />

This report has been prepared by <strong>Odlum</strong> <strong>Brown</strong> Limited and<br />

is intended only <strong>for</strong> persons resident and located in all the<br />

provinces and territories of Canada, where <strong>Odlum</strong> <strong>Brown</strong><br />

Limited's services and products may lawfully be offered <strong>for</strong><br />

sale, and therein only to clients of <strong>Odlum</strong> <strong>Brown</strong> Limited.<br />

This report is not intended <strong>for</strong> distribution to, or use by, any<br />

person or entity in any jurisdiction or country including the<br />

United States, where such distribution or use would be<br />

contrary to law or regulation or which would subject <strong>Odlum</strong><br />

<strong>Brown</strong> Limited to any registration requirement within such<br />

jurisdiction or country. As no regard has been made as to<br />

the specific investment objectives, financial situation, and<br />

other particular circumstances of any person who may<br />

receive this report, clients should seek the advice of a registered<br />

investment advisor and other professional advisors,<br />

as applicable, regarding the appropriateness of investing in<br />

any securities or any investment strategies discussed or<br />

recommended in this report.<br />

This report is <strong>for</strong> in<strong>for</strong>mation purposes only and is neither a<br />

solicitation <strong>for</strong> the purchase of securities nor an offer of<br />

securities. The in<strong>for</strong>mation contained in this report has<br />

been compiled from sources we believe to be reliable, however,<br />

we make no guarantee, representation or warranty,<br />

expressed or implied, as to such in<strong>for</strong>mation’s accuracy or<br />

completeness. All opinions and estimates contained in this<br />

report, whether or not our own, are based on assumptions<br />

we believe to be reasonable as of the date of the report and<br />

are subject to change without notice.<br />

Please note that, as at the date of this report, the Research<br />

Analyst responsible <strong>for</strong> the recommendations herein, associates<br />

of such Analyst and/or other individuals directly<br />

involved in the preparation of this report hold securities of<br />

the issuer(s) referred to directly or through derivatives.<br />

No part of this publication may be reproduced without the<br />

express written consent of <strong>Odlum</strong> <strong>Brown</strong> Limited. <strong>Odlum</strong><br />

<strong>Brown</strong> Limited is a Member-Canadian Investor Protection<br />

Fund.<br />

<strong>Odlum</strong> <strong>Brown</strong> Limited respects your time and your privacy. If<br />

you no longer wish us to retain and use your personal in<strong>for</strong>mation<br />

preferring to have your name removed from our mailing list,<br />

please let us know. For more in<strong>for</strong>mation on our Privacy Policy<br />

please visit our website at odlumbrown.com.<br />

> <strong>Odlum</strong> <strong>Brown</strong> , s 18 th Annual Address<br />

Debra Hewson, President and Chief Executive Officer, invites you and your guests to <strong>Odlum</strong><br />

<strong>Brown</strong>’s 18 th Annual Address. Join us <strong>for</strong> an in<strong>for</strong>mative discussion on the current investment<br />

environment featuring Vice President and Director of Investment Research, Murray Leith, and<br />

Fixed Income Strategist, Hank Cunningham.<br />

Presentations will take place throughout the province beginning February 13.<br />

Debra Hewson, President<br />

and Chief Executive Officer<br />

west vancouver<br />

Monday, February 13, 7PM<br />

Kay Meek Centre<br />

1700 Mathers Avenue<br />

RSVP by February 6 to Jennifer at<br />

604-844-5338 or jhadley@odlumbrown.com<br />

vancouver<br />

Tuesday, February 14<br />

afternoon session 2PM<br />

Fairmont Waterfront Vancouver<br />

Waterfront Ballroom<br />

900 Canada Place Way<br />

RSVP by February 7 to Jennifer at<br />

604-844-5338 or jhadley@odlumbrown.com<br />

victoria<br />

Wednesday, February 15, 7PM<br />

Delta Victoria Ocean Pointe, Ballroom<br />

45 Songhees Road<br />

RSVP by February 8 to Monica at<br />

250-952-7775 or mpratt@odlumbrown.com<br />

Murray Leith, Vice President and<br />

Director of Investment Research<br />

chilliwack<br />

Thursday, February 16, 7PM<br />

Coast Chilliwack Hotel, Rosedale <strong>Room</strong><br />

45920 First Avenue<br />

RSVP by February 9 to Matt at<br />

604-824-3376 or mehrenreich@odlumbrown.com<br />

Hank Cunningham,<br />

Fixed Income Strategist<br />

south surrey<br />

Tuesday, February 21, 7PM<br />

Morgan Creek Golf Course<br />

3500 Morgan Creek Way<br />

RSVP by February 14 to Jennifer at<br />

604-844-5338 or jhadley@odlumbrown.com<br />

courtenay<br />

Wednesday, February 22<br />

afternoon session 2PM<br />

Crown Isle Resort, Ballroom<br />

399 Clubhouse Drive<br />

RSVP by February 15 to Richard at<br />

250-703-0637 or rdobbs@odlumbrown.com<br />

kelowna<br />

Thursday, February 23, 7PM<br />

The Coast Capri, Ballroom<br />

1171 Harvey Avenue<br />

RSVP by February 16 to Nicole at<br />

250-861-5700 or npelletier@odlumbrown.com<br />

Register online via the<br />

Client Centre at odlumbrown.com<br />

Reserve seating early as space is limited.