2008 - 2009 - Tata Investment Corporation Limited

2008 - 2009 - Tata Investment Corporation Limited

2008 - 2009 - Tata Investment Corporation Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

46<br />

Seventy-second annual report <strong>2008</strong> - <strong>2009</strong><br />

<strong>Tata</strong> <strong>Investment</strong> <strong>Corporation</strong> <strong>Limited</strong><br />

6. Foreign exchange currency exposures not covered with regard to the deposit placed with Hatton National Bank, Colombo, of Sri Lankan Rs.64.25 lacs;<br />

Previous Year Sri Lankan Rs.64.25 lacs (Equivalent Indian Rs.28.08 lacs; Previous Year Equivalent Indian Rs.23.90 lacs).<br />

7. As the Company has no activities other than those of an investment company, the segment reporting under Accounting Standard 17 – “Segment<br />

Reporting“ is not applicable. The Company does not have any reportable geographical segment.<br />

8. In terms of the Letter of Offer, the Rights Issue proceeds of Rs.44774.23 lacs received during the year have been utilised towards the objects of the<br />

issue of Zero Coupon Convertible Bonds (ZCCB) to make investments in a diversifi ed portfolio of quoted and unquoted securities including equity<br />

shares / equity-linked securities, mutual funds, debenture / bonds, government securities, preference shares, deposits in companies and includes issue<br />

related expenses.<br />

9. Related Parties Disclosures<br />

a) List of Related Parties and Relationship<br />

Promoter and holding company<br />

<strong>Tata</strong> Sons Ltd.<br />

Associates<br />

<strong>Tata</strong> Asset Management Ltd.<br />

<strong>Tata</strong> Trustee Company Pvt. Ltd.<br />

Landmark Ltd. (from 2.5.<strong>2008</strong> till 26.3.<strong>2009</strong>)<br />

Key Management Person (KMP)<br />

Mr. M. J. Kotwal<br />

Other subsidiaries of Promoter :- (with whom the Company has transactions)<br />

1. Ewart <strong>Investment</strong>s <strong>Limited</strong> 2. Infi niti Retail <strong>Limited</strong><br />

3. Panatone Finvest <strong>Limited</strong> 4. <strong>Tata</strong> Consultancy Services <strong>Limited</strong><br />

5. <strong>Tata</strong> Realty and Infrastructure <strong>Limited</strong> 6. <strong>Tata</strong> Securities <strong>Limited</strong><br />

7. <strong>Tata</strong> Sky <strong>Limited</strong> 8. <strong>Tata</strong> Teleservices (Maharashtra) <strong>Limited</strong><br />

9. <strong>Tata</strong> Teleservices <strong>Limited</strong><br />

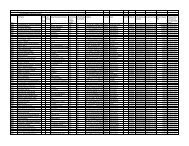

b) Related Party Transactions Rupees (in lacs)<br />

<strong>2008</strong>-09 2007-08<br />

Promoter Associates Other<br />

Subsidiaries<br />

of Promoter<br />

KMP Promoter Associates Other<br />

Subsidiaries<br />

of Promoter<br />

1. Subscription to equity/preference shares/<br />

convertible debentures — 39.70 — — 2000.00 — 107.33 —<br />

2. Redemption proceeds of preference shares — — — — 1000.00 — — —<br />

3. Dividends received 207.50 342.25 32.53 — 138.90 236.95 — —<br />

4. Dividends Paid 2842.14 — 81.51 0.23 2090.50 — — 1.44<br />

5. Standby arrangement fees received 112.36 — — — — — — —<br />

6. Paid for services rendered in connection with<br />

Rights Issue 28.09 — — — — — — —<br />

7. Deposits placed 5000.00 — 11000.00 — — — 1100.00 —<br />

8. Deposits withdrawn — — 7600.00 — — — — —<br />

9. Interest on deposit placed 250.07 — 464.07 — — — 15.94 —<br />

10. Purchase of investments 270.66 — — — — — — —<br />

11. Subscription towards zero coupon convertible bonds 40010.82 — 706.45 5.14 — — — —<br />

12. Brand equity subscription expense 59.55 — — — 59.00 — — —<br />

13. Rent Reimbursement 0.51 — — — 0.51 — — —<br />

14. Brokerage paid — — 4.40 — — — 1.14 —<br />

15. Telephone call charges — — 1.03 — — — 0.18 —<br />

16. Other expenses 44.49 — — — 33.24 — — —<br />

17. Remuneration paid — — — 70.93 — — — 65.21<br />

Debit balance outstanding at year end<br />

outstanding receivables 5102.31 — 4529.33 — — — 1115.94 —<br />

Credit balance outstanding at year end<br />

outstanding payables 147.68 — 0.07 25.00 101.09 — 0.05 25.00<br />

KMP