Government Pension Fund – Global Holding of ... - Norges Bank

Government Pension Fund – Global Holding of ... - Norges Bank

Government Pension Fund – Global Holding of ... - Norges Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

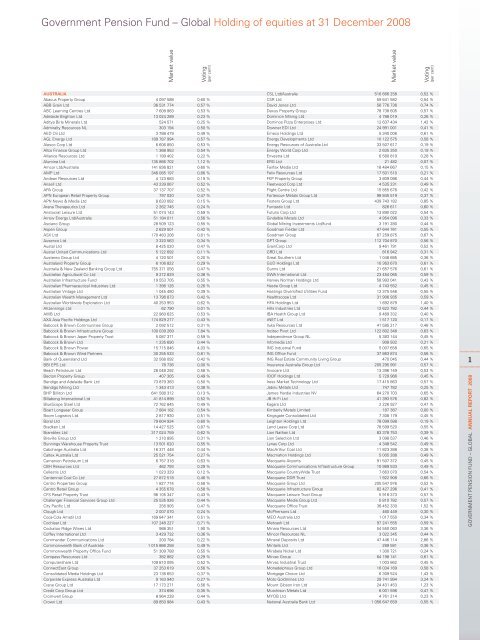

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>–</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> equities at 31 December 2008<br />

Market value<br />

Voting<br />

(per cent)<br />

AUSTRALIA<br />

Abacus Property Group 4 097 588 0,60 %<br />

ABB Grain Ltd 36 531 774 0,57 %<br />

ABC Learning Centres Ltd 7 608 983 0,53 %<br />

Adelaide Brighton Ltd 13 024 289 0,23 %<br />

Aditya Birla Minerals Ltd 524 571 0,25 %<br />

Admiralty Resources NL 303 194 0,50 %<br />

AED Oil Ltd 3 788 479 0,49 %<br />

AGL Energy Ltd 189 787 994 0,57 %<br />

Alesco Corp Ltd 6 606 850 0,53 %<br />

Allco Finance Group Ltd 1 368 953 0,54 %<br />

Alliance Resources Ltd 1 189 402 0,22 %<br />

Alumina Ltd 135 866 702 1,12 %<br />

Amcor Ltd/Australia 141 836 821 0,60 %<br />

AMP Ltd 346 085 197 0,66 %<br />

Andean Resources Ltd 4 123 683 0,19 %<br />

Ansell Ltd 43 239 067 0,52 %<br />

APA Group 37 137 707 0,52 %<br />

APN European Retail Property Group 797 020 0,47 %<br />

APN News & Media Ltd 8 633 082 0,15 %<br />

Arana Therapeutics Ltd 2 262 745 0,24 %<br />

Aristocrat Leisure Ltd 51 074 143 0,59 %<br />

Arrow Energy Ltd/Australia 51 184 011 0,56 %<br />

Asciano Group 28 509 123 0,55 %<br />

Aspen Group 2 629 501 0,42 %<br />

ASX Ltd 170 483 206 0,61 %<br />

Ausenco Ltd 3 320 563 0,34 %<br />

Austal Ltd 8 425 020 0,47 %<br />

Austar United Communications Ltd 5 122 692 0,11 %<br />

Austereo Group Ltd 4 120 501 0,20 %<br />

Australand Property Group 6 106 822 0,29 %<br />

Australia & New Zealand <strong>Bank</strong>ing Group Ltd 755 371 056 0,47 %<br />

Australian Agricultural Co Ltd 9 272 829 0,38 %<br />

Australian Infrastructure <strong>Fund</strong> 19 553 705 0,55 %<br />

Australian Pharmaceutical Industries Ltd 1 396 126 0,26 %<br />

Australian Vintage Ltd 1 045 480 0,39 %<br />

Australian Wealth Management Ltd 13 796 873 0,42 %<br />

Australian Worldwide Exploration Ltd 40 253 953 0,62 %<br />

AVJennings Ltd 62 790 0,01 %<br />

AWB Ltd 22 960 625 0,53 %<br />

AXA Asia Pacifi c <strong>Holding</strong>s Ltd 174 829 277 0,43 %<br />

Babcock & Brown Communities Group 2 092 512 0,31 %<br />

Babcock & Brown Infrastructure Group 100 039 269 7,84 %<br />

Babcock & Brown Japan Property Trust 5 087 371 0,59 %<br />

Babcock & Brown Ltd 1 235 690 0,44 %<br />

Babcock & Brown Power 15 715 846 4,03 %<br />

Babcock & Brown Wind Partners 30 255 533 0,81 %<br />

<strong>Bank</strong> <strong>of</strong> Queensland Ltd 32 568 092 0,42 %<br />

BBI EPS Ltd 78 736 0,00 %<br />

Beach Petroleum Ltd 28 048 292 0,58 %<br />

Becton Property Group 407 305 0,49 %<br />

Bendigo and Adelaide <strong>Bank</strong> Ltd 73 879 383 0,50 %<br />

Bendigo Mining Ltd 1 343 413 0,38 %<br />

BHP Billiton Ltd 641 588 312 0,13 %<br />

Billabong International Ltd 41 814 898 0,52 %<br />

BlueScope Steel Ltd 72 762 845 0,49 %<br />

Boart Longyear Group 7 884 182 0,54 %<br />

Boom Logistics Ltd 2 817 930 0,51 %<br />

Boral Ltd 79 604 934 0,60 %<br />

Bradken Ltd 14 427 525 0,87 %<br />

Brambles Ltd 317 024 759 0,62 %<br />

Breville Group Ltd 1 210 895 0,31 %<br />

Bunnings Warehouse Property Trust 13 501 620 0,55 %<br />

Cabcharge Australia Ltd 16 371 448 0,44 %<br />

Caltex Australia Ltd 25 521 754 0,27 %<br />

Carnarvon Petroleum Ltd 6 757 318 0,63 %<br />

CBH Resources Ltd 462 793 0,29 %<br />

Cellestis Ltd 1 023 329 0,12 %<br />

Centennial Coal Co Ltd 27 872 518 0,46 %<br />

Centro Properties Group 1 827 774 0,58 %<br />

Centro Retail Group 4 355 678 0,58 %<br />

CFS Retail Property Trust 96 105 347 0,43 %<br />

Challenger Financial Services Group Ltd 25 535 926 0,44 %<br />

City Pacifi c Ltd 256 905 0,47 %<br />

Clough Ltd 2 007 070 0,24 %<br />

Coca-Cola Amatil Ltd 169 847 341 0,51 %<br />

Cochlear Ltd 107 248 227 0,71 %<br />

Cockatoo Ridge Wines Ltd 988 351 1,90 %<br />

C<strong>of</strong>fey International Ltd 3 429 732 0,36 %<br />

Commander Communications Ltd 200 784 0,22 %<br />

Commonwealth <strong>Bank</strong> <strong>of</strong> Australia 1 015 866 258 0,49 %<br />

Commonwealth Property Offi ce <strong>Fund</strong> 51 309 788 0,55 %<br />

Compass Resources Ltd 382 882 0,29 %<br />

Computershare Ltd 109 810 095 0,52 %<br />

ConnectEast Group 37 253 619 0,56 %<br />

Consolidated Media <strong>Holding</strong>s Ltd 23 136 653 0,37 %<br />

Corporate Express Australia Ltd 9 163 940 0,27 %<br />

Crane Group Ltd 17 173 271 0,56 %<br />

Credit Corp Group Ltd 374 696 0,35 %<br />

Cromwell Group 8 964 228 0,44 %<br />

Crown Ltd 89 850 984 0,43 %<br />

Market value<br />

Voting<br />

(per cent)<br />

CSL Ltd/Australia 516 666 258 0,52 %<br />

CSR Ltd 59 641 582 0,54 %<br />

David Jones Ltd 56 776 736 0,74 %<br />

Dexus Property Group 78 738 605 0,57 %<br />

Dominion Mining Ltd 4 788 019 0,26 %<br />

Dominos Pizza Enterprises Ltd 12 637 434 1,42 %<br />

Downer EDI Ltd 24 991 001 0,41 %<br />

Emeco <strong>Holding</strong>s Ltd 5 340 006 0,61 %<br />

Energy Developments Ltd 10 122 575 0,58 %<br />

Energy Resources <strong>of</strong> Australia Ltd 33 507 617 0,19 %<br />

Energy World Corp Ltd 2 635 350 0,19 %<br />

Envestra Ltd 6 580 819 0,28 %<br />

ERG Ltd 21 482 0,07 %<br />

Fairfax Media Ltd 18 484 667 0,15 %<br />

Felix Resources Ltd 17 501 510 0,21 %<br />

FKP Property Group 3 809 086 0,44 %<br />

Fleetwood Corp Ltd 4 535 231 0,49 %<br />

Flight Centre Ltd 15 855 676 0,42 %<br />

Fortescue Metals Group Ltd 98 845 519 0,37 %<br />

Fosters Group Ltd 439 743 182 0,85 %<br />

Funtastic Ltd 826 611 0,60 %<br />

Futuris Corp Ltd 13 890 022 0,54 %<br />

Gindalbie Metals Ltd 4 954 096 0,33 %<br />

<strong>Global</strong> Mining Investments Ltd/fund 3 191 280 0,44 %<br />

Goodman Fielder Ltd 47 644 761 0,55 %<br />

Goodman Group 67 259 875 0,67 %<br />

GPT Group 112 704 870 0,56 %<br />

GrainCorp Ltd 9 461 791 0,52 %<br />

GRD Ltd 816 942 0,31 %<br />

Great Southern Ltd 1 048 685 0,36 %<br />

GUD <strong>Holding</strong>s Ltd 10 363 670 0,61 %<br />

Gunns Ltd 21 657 576 0,61 %<br />

GWA International Ltd 23 454 065 0,59 %<br />

Harvey Norman <strong>Holding</strong>s Ltd 58 993 041 0,43 %<br />

Hastie Group Ltd 4 743 552 0,45 %<br />

Hastings Diversifi ed Utilities <strong>Fund</strong> 12 375 546 0,55 %<br />

Healthscope Ltd 31 906 935 0,59 %<br />

HFA <strong>Holding</strong>s Ltd 1 692 879 1,40 %<br />

Hills Industries Ltd 12 622 782 0,44 %<br />

IBA Health Group Ltd 9 469 332 0,40 %<br />

iiNET Ltd 1 517 120 0,17 %<br />

Iluka Resources Ltd 41 585 217 0,48 %<br />

Incitec Pivot Ltd 122 802 348 0,63 %<br />

Independence Group NL 5 383 144 0,45 %<br />

Infomedia Ltd 908 932 0,21 %<br />

ING Industrial <strong>Fund</strong> 5 007 658 0,65 %<br />

ING Offi ce <strong>Fund</strong> 37 863 874 0,56 %<br />

ING Real Estate Community Living Group 470 045 0,44 %<br />

Insurance Australia Group Ltd 205 295 991 0,57 %<br />

Invocare Ltd 13 396 149 0,53 %<br />

IOOF <strong>Holding</strong>s Ltd 5 729 966 0,45 %<br />

Iress Market Technology Ltd 17 415 863 0,57 %<br />

Jabiru Metals Ltd 747 782 0,25 %<br />

James Hardie Industries NV 64 270 703 0,65 %<br />

JB Hi-Fi Ltd 41 393 576 0,82 %<br />

Kagara Ltd 2 226 927 0,47 %<br />

Kimberly Metals Limited 187 387 0,00 %<br />

Kingsgate Consolidated Ltd 7 308 179 0,45 %<br />

Leighton <strong>Holding</strong>s Ltd 78 099 588 0,19 %<br />

Lend Lease Corp Ltd 78 599 520 0,55 %<br />

Lion Nathan Ltd 83 378 753 0,39 %<br />

Lion Selection Ltd 3 098 537 0,46 %<br />

Lynas Corp Ltd 4 348 542 0,49 %<br />

MacArthur Coal Ltd 11 823 388 0,38 %<br />

Macmahon <strong>Holding</strong>s Ltd 5 005 288 0,49 %<br />

Macquarie Airports 91 507 372 0,45 %<br />

Macquarie Communications Infrastructure Group 10 989 533 0,49 %<br />

Macquarie CountryWide Trust 7 663 070 0,54 %<br />

Macquarie DDR Trust 1 922 908 0,66 %<br />

Macquarie Group Ltd 205 547 976 0,52 %<br />

Macquarie Infrastructure Group 82 427 296 0,41 %<br />

Macquarie Leisure Trust Group 5 916 373 0,57 %<br />

Macquarie Media Group Ltd 5 810 782 0,57 %<br />

Macquarie Offi ce Trust 36 452 330 1,52 %<br />

McPhersons Ltd 460 449 0,30 %<br />

MEO Australia Ltd 1 017 550 0,34 %<br />

Metcash Ltd 97 241 555 0,59 %<br />

Minara Resources Ltd 54 550 063 3,36 %<br />

Mincor Resources NL 3 022 345 0,44 %<br />

Mineral Deposits Ltd 47 446 114 2,86 %<br />

Mintails Ltd 289 581 0,36 %<br />

Mirabela Nickel Ltd 1 300 721 0,24 %<br />

Mirvac Group 64 198 141 0,61 %<br />

Mirvac Industrial Trust 1 003 862 0,45 %<br />

Monadelphous Group Ltd 16 034 169 0,58 %<br />

Mortgage Choice Ltd 6 309 524 1,43 %<br />

Moto Goldmines Ltd 29 741 994 3,24 %<br />

Mount Gibson Iron Ltd 24 431 453 1,23 %<br />

Murchison Metals Ltd 6 001 596 0,47 %<br />

MYOB Ltd 4 761 214 0,23 %<br />

National Australia <strong>Bank</strong> Ltd 1 056 647 659 0,55 %<br />

1<br />

GOVERNMENT PENSION FUND <strong>–</strong> GLOBAL ANNUAL REPORT 2008

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>–</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> equities at 31 December 2008<br />

Market value<br />

Voting<br />

(per cent)<br />

Navitas Ltd 9 045 106 0,22 %<br />

Newcrest Mining Ltd 571 766 129 0,76 %<br />

Nexus Energy Ltd 8 751 385 0,52 %<br />

Novogen Ltd 130 587 0,03 %<br />

NRW <strong>Holding</strong>s Ltd 1 447 340 0,55 %<br />

Nufarm Ltd 54 600 958 0,57 %<br />

Oakton Ltd 2 583 508 0,46 %<br />

Octaviar Ltd 4 014 531 0,17 %<br />

Oil Search Ltd 209 454 979 0,82 %<br />

OneSteel Ltd 61 965 440 0,58 %<br />

Orica Ltd 136 553 977 0,56 %<br />

Origin Energy Ltd 456 229 452 0,66 %<br />

OZ Minerals Ltd 40 665 852 0,49 %<br />

Pacifi c Brands Ltd 5 777 013 0,55 %<br />

Paladin Energy Ltd 33 438 908 0,45 %<br />

PanAust Ltd 2 822 980 0,47 %<br />

Panoramic Resources Ltd 4 707 465 0,52 %<br />

PaperlinX Ltd 16 256 222 0,79 %<br />

Perilya Ltd 623 440 0,38 %<br />

Perpetual Ltd 36 981 398 0,48 %<br />

Pharmaxis Ltd 3 199 610 0,28 %<br />

Platinum Asset Management Ltd 20 487 201 0,22 %<br />

Platinum Australia Ltd 3 199 200 0,52 %<br />

Platinum Capital Ltd 4 354 612 0,51 %<br />

PMP Ltd 4 696 287 0,57 %<br />

Primary Health Care Ltd 50 864 297 0,57 %<br />

Prime Retirement & Aged Care Property Trust/The 684 467 0,21 %<br />

Programmed Maintenance Services Ltd 7 303 116 0,50 %<br />

Qantas Airways Ltd 71 752 019 0,29 %<br />

QBE Insurance Group Ltd 795 360 227 0,64 %<br />

Queensland Gas Co Ltd 102 215 733 0,38 %<br />

Ramsay Health Care Ltd 38 190 897 0,43 %<br />

Redfl ex <strong>Holding</strong>s Ltd 5 258 962 0,36 %<br />

Resolute Mining Ltd 2 310 833 0,32 %<br />

Reverse Corp Ltd 9 705 641 1,96 %<br />

Ridley Corp Ltd 4 332 619 0,37 %<br />

RiverCity Motorway Group 2 427 490 0,36 %<br />

Riversdale Mining Ltd 11 115 460 0,50 %<br />

Roc Oil Co Ltd 7 191 306 0,50 %<br />

RP Data Ltd 1 622 648 0,60 %<br />

Rubicon America Trust 134 030 0,56 %<br />

SAI <strong>Global</strong> Ltd 9 650 555 0,58 %<br />

Salmat Ltd 6 644 647 0,27 %<br />

Santos Ltd 244 682 971 0,58 %<br />

Seek Ltd 47 613 617 1,07 %<br />

Senetas Corp Ltd 137 578 0,19 %<br />

Seven Network Ltd 20 115 683 0,30 %<br />

Sigma Pharmaceuticals Ltd 29 217 194 0,64 %<br />

Silex Systems Ltd 11 699 442 0,56 %<br />

Sims Metal Management Ltd 89 706 006 0,51 %<br />

Sino Gold Mining Ltd 33 710 053 0,47 %<br />

Skilled Group Ltd 2 288 100 0,27 %<br />

SMS Management & Technology Ltd 2 523 978 0,43 %<br />

Sonic Healthcare Ltd 157 416 980 0,58 %<br />

SP AusNet 29 922 411 0,29 %<br />

SP Telemedia Ltd 460 536 0,10 %<br />

Spark Infrastructure Group 1 586 606 0,02 %<br />

Specialty Fashion Group Ltd 1 047 330 0,45 %<br />

Spotless Group Ltd 17 998 816 0,60 %<br />

St Barbara Ltd 10 679 463 0,53 %<br />

Stockland 196 215 416 0,63 %<br />

Straits Resources Ltd 19 221 511 1,87 %<br />

STW Communications Group Ltd 2 668 299 0,38 %<br />

Suncorp-Metway Ltd 208 585 999 0,50 %<br />

Sundance Resources Ltd/Australia 2 607 385 0,35 %<br />

Sunland Group Ltd 4 678 070 0,40 %<br />

Super Cheap Auto Group Ltd 3 269 828 0,23 %<br />

Sylvania Resources Ltd 1 476 108 0,27 %<br />

TABCORP <strong>Holding</strong>s Ltd 101 432 875 0,56 %<br />

Tap Oil Ltd 3 355 293 0,57 %<br />

Tatts Group Ltd 128 001 041 0,74 %<br />

Telstra Corp Ltd 472 354 429 0,20 %<br />

Ten Network <strong>Holding</strong>s Ltd 14 244 439 0,27 %<br />

ThinkSmart Ltd 98 134 0,11 %<br />

Timbercorp Ltd 912 182 0,42 %<br />

Tishman Speyer Offi ce <strong>Fund</strong> 1 608 478 0,55 %<br />

Toll <strong>Holding</strong>s Ltd 116 040 309 0,56 %<br />

Tower Australia Group Ltd 24 150 302 0,56 %<br />

Transfi eld Services Ltd 11 431 058 0,36 %<br />

Transpacifi c Industries Group Ltd 18 835 432 0,38 %<br />

Transurban Group 187 636 436 0,56 %<br />

United Group Ltd 40 031 632 0,60 %<br />

Valad Property Group 2 376 078 0,57 %<br />

Ventracor Ltd 313 020 0,32 %<br />

Wattyl Ltd 1 381 052 0,42 %<br />

Wesfarmers Ltd 224 196 808 0,31 %<br />

West Australian Newspapers <strong>Holding</strong>s Ltd 9 735 757 0,17 %<br />

Western Areas NL 10 175 655 0,38 %<br />

Westfi eld Group 761 575 606 0,61 %<br />

Westpac <strong>Bank</strong>ing Corp 1 173 319 242 0,49 %<br />

WHK Group Ltd 4 774 640 0,42 %<br />

Market value<br />

Voting<br />

(per cent)<br />

Woodside Petroleum Ltd 532 289 590 0,43 %<br />

Woolworths Ltd 1 026 030 375 0,64 %<br />

WorleyParsons Ltd 88 006 939 0,55 %<br />

Wotif.com <strong>Holding</strong>s Ltd 27 893 869 0,75 %<br />

AUSTRIA<br />

Agrana Beteiligungs AG 10 892 405 0,22 %<br />

Andritz AG 251 187 864 2,73 %<br />

A-TEC Industries AG 12 049 079 0,71 %<br />

Atrium European Real Estate Ltd 94 387 084 1,73 %<br />

Austrian Airlines AG 15 460 093 0,45 %<br />

bwin Interactive Entertainment AG 165 253 228 3,90 %<br />

BWT AG 7 995 044 0,42 %<br />

CA Immo International AG 7 014 319 0,59 %<br />

CA Immobilien Anlagen AG 40 387 420 1,13 %<br />

Conwert Immobilien Invest SE 30 053 224 1,13 %<br />

Erste Group <strong>Bank</strong> AG 460 963 138 0,92 %<br />

EVN AG 55 678 802 0,32 %<br />

Flughafen Wien AG 38 627 680 0,60 %<br />

Immoeast AG 23 770 049 0,64 %<br />

IMMOFINANZ Immobilien Anlagen AG 27 674 435 1,26 %<br />

Intercell AG 287 746 322 2,87 %<br />

Lenzing AG 8 775 312 0,15 %<br />

Mayr Melnh<strong>of</strong> Karton AG 58 094 368 0,53 %<br />

Oesterreichische Post AG 125 611 798 0,76 %<br />

OMV AG 439 547 348 0,80 %<br />

Palfi nger AG 12 335 180 0,32 %<br />

Raiffeisen International <strong>Bank</strong> <strong>Holding</strong> AG 111 790 418 0,38 %<br />

RHI AG 44 104 781 1,07 %<br />

Schoeller-Bleckmann Oilfi eld Equipment AG 84 316 383 2,47 %<br />

Semperit AG <strong>Holding</strong> 17 566 129 0,74 %<br />

Strabag SE 65 133 559 0,36 %<br />

Telekom Austria AG 400 803 310 0,87 %<br />

Uniqa Versicherungen AG 58 302 429 0,25 %<br />

Verbund - Oesterreichische Elektrizitaetswirtschafts AG 176 770 589 0,37 %<br />

Vienna Insurance Group 173 437 022 0,58 %<br />

Voestalpine AG 329 267 147 1,37 %<br />

Wienerberger AG 121 345 831 1,25 %<br />

Zumtobel AG 10 503 221 0,43 %<br />

BELGIUM<br />

Ackermans & van Haaren NV 121 769 475 1,03 %<br />

AGFA-Gevaert NV 34 353 258 1,47 %<br />

Anheuser-Busch InBev NV 2 033 156 767 1,07 %<br />

Arseus NV 9 214 791 0,49 %<br />

Banque Nationale de Belgique 41 802 936 0,44 %<br />

Barco NV 25 181 688 1,14 %<br />

Befi mmo SCA Sicafi 108 023 913 1,27 %<br />

Bekaert SA 97 734 517 1,05 %<br />

Belgacom SA 955 989 057 1,06 %<br />

Brederode SA 7 883 029 0,19 %<br />

Cie du Bois Sauvage 414 907 0,02 %<br />

C<strong>of</strong>i nimmo 112 136 503 1,12 %<br />

Colruyt SA 260 666 162 0,52 %<br />

Compagnie dEntreprises CFE 33 760 077 0,91 %<br />

Compagnie Maritime Belge SA 45 361 789 0,74 %<br />

Deceuninck NV 2 751 304 0,50 %<br />

Delhaize Group 749 941 730 1,74 %<br />

Dexia SA 291 337 210 0,53 %<br />

Dieteren SA 26 876 253 0,66 %<br />

Elia System Operator SA/NV 4 675 801 0,04 %<br />

Euronav NV 33 278 536 0,67 %<br />

EVS Broadcast Equipment SA 40 259 765 1,17 %<br />

Exmar NV 9 241 109 0,37 %<br />

Fluxys 12 859 886 0,59 %<br />

Fortis 270 825 879 1,27 %<br />

Gimv NV 27 907 739 0,40 %<br />

Groupe Bruxelles Lambert SA 1 603 196 796 1,80 %<br />

Intervest Offi ces 7 418 207 0,31 %<br />

Ion Beam Applications 9 087 621 0,45 %<br />

KBC Ancora 38 671 603 0,41 %<br />

KBC Groep NV 676 988 770 0,91 %<br />

Melexis NV 14 259 874 0,68 %<br />

Mobistar SA 150 115 309 0,50 %<br />

Nationale A Portefeuille 146 571 379 0,39 %<br />

Nyrstar 28 336 582 1,33 %<br />

Omega Pharma SA 67 241 674 1,06 %<br />

Option NV 6 735 987 0,88 %<br />

Recticel SA 4 746 943 0,42 %<br />

RHJ International 28 143 520 0,97 %<br />

Roularta Media Group NV 3 425 637 0,25 %<br />

RTL Group SA 55 069 432 0,09 %<br />

Sioen Industries NV 891 577 0,12 %<br />

S<strong>of</strong>i na SA 90 996 842 0,53 %<br />

Solvay SA 266 668 434 0,61 %<br />

Telenet Group <strong>Holding</strong> NV 133 276 468 1,03 %<br />

Tessenderlo Chemie NV 69 755 536 1,20 %<br />

UCB SA 521 575 789 1,25 %<br />

Umicore 211 457 982 1,26 %<br />

Van de Velde 7 428 899 0,23 %<br />

Warehouses De Pauw SCA 20 881 598 0,83 %<br />

Wereldhave Belgium NV 5 119 676 0,21 %<br />

2<br />

GOVERNMENT PENSION FUND <strong>–</strong> GLOBAL ANNUAL REPORT 2008

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>–</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> equities at 31 December 2008<br />

Market value<br />

Voting<br />

(per cent)<br />

BERMUDA<br />

Genpact Ltd 14 395 071 0,12 %<br />

Maiden <strong>Holding</strong>s Ltd 39 449 831 0,00 %<br />

MF <strong>Global</strong> Ltd 13 623 936 0,79 %<br />

BRAZIL<br />

AES Tiete SA 42 159 710 0,11 %<br />

All America Latina Logistica SA 63 406 988 0,37 %<br />

Amil Participacoes SA 13 835 772 0,18 %<br />

Anglo Ferrous Brazil SA 1 061 097 0,00 %<br />

Aracruz Celulose SA 18 979 989 0,00 %<br />

B2W Cia <strong>Global</strong> Do Varejo 46 587 102 0,57 %<br />

Banco Bradesco SA 497 361 893 0,00 %<br />

Banco do Brasil SA 167 073 796 0,15 %<br />

Banco do Estado do Rio Grande do Sul 50 341 947 0,00 %<br />

Banco Itau <strong>Holding</strong> Financeira SA 540 666 480 0,00 %<br />

Banco Nossa Caixa SA 34 768 505 0,16 %<br />

BM&FBOVESPA SA 213 618 003 0,58 %<br />

BR Malls Participacoes SA 15 241 628 0,33 %<br />

Bradespar SA 64 525 260 0,01 %<br />

Brascan Residential Properties SA 2 734 167 0,14 %<br />

Brasil Telecom Participacoes SA 84 475 608 0,21 %<br />

Brasil Telecom SA 25 090 883 0,00 %<br />

Braskem SA 18 761 414 0,00 %<br />

Centrais Eletricas Brasileiras SA 306 918 016 0,14 %<br />

Cia Brasileira de Distribuicao Grupo Pao de Acucar 62 409 846 0,00 %<br />

Cia de Bebidas das Americas 239 859 647 0,04 %<br />

Cia de Concessoes Rodoviarias 103 947 667 0,36 %<br />

Cia de Gas de Sao Paulo 12 674 206 0,00 %<br />

Cia de Saneamento Basico do Estado de Sao Paulo 149 285 347 0,22 %<br />

Cia de Saneamento de Minas Gerais-COPASA 14 554 747 0,22 %<br />

Cia de Tecidos do Norte de Minas - Coteminas 2 402 674 0,00 %<br />

Cia de Transmissao de Energia Eletrica Paulista 20 550 107 0,00 %<br />

Cia Energetica de Minas Gerais 146 455 571 0,08 %<br />

Cia Energetica de Sao Paulo 42 606 490 0,00 %<br />

Cia Energetica do Ceara 2 853 444 0,00 %<br />

Cia Paranaense de Energia 46 041 990 0,00 %<br />

Cia Siderurgica Nacional SA 213 528 115 0,31 %<br />

Cia Vale do Rio Doce 1 311 785 183 0,18 %<br />

Confab Industrial SA 9 286 021 0,00 %<br />

Contax Participacoes SA 4 513 272 0,00 %<br />

Cosan Ltd 39 587 353 0,94 %<br />

Cosan SA Industria e Comercio 48 218 546 0,44 %<br />

CPFL Energia SA 450 924 0,00 %<br />

Cyrela Brazil Realty SA 36 643 654 0,37 %<br />

Cyrela Commercial Properties SA Empreendimentos e<br />

Participacoes 5 150 178 0,32 %<br />

Diagnosticos da America SA 27 194 998 0,70 %<br />

Drogasil SA 26 652 419 1,41 %<br />

Duratex SA 15 196 905 0,00 %<br />

EDP - Energias do Brasil SA 16 890 406 0,16 %<br />

Empresa Brasileira de Aeronautica SA 94 706 901 0,48 %<br />

Fertilizantes Fosfatados SA 22 001 593 0,00 %<br />

Gafi sa SA 19 245 691 0,46 %<br />

Gerdau SA 150 211 943 0,11 %<br />

<strong>Global</strong> Village Telecom <strong>Holding</strong> SA 133 779 633 1,37 %<br />

Gol Linhas Aereas Inteligentes SA 7 030 252 0,00 %<br />

Grendene SA 4 449 918 0,12 %<br />

Guararapes Confeccoes SA 3 255 310 0,19 %<br />

Investimentos Itau SA 282 884 705 0,00 %<br />

JBS SA 40 806 832 0,19 %<br />

Klabin SA 29 653 040 0,00 %<br />

Light SA 34 374 979 0,26 %<br />

LLX Logistica SA 2 373 999 0,00 %<br />

Localiza Rent A CAR 9 998 368 0,23 %<br />

Lojas Americanas SA 30 980 499 0,00 %<br />

Lojas Renner SA 30 535 716 0,53 %<br />

LPS Brasil Consultoria de Imoveis SA 3 347 711 0,34 %<br />

Lupatech SA 17 730 261 0,53 %<br />

Mahle-Metal Leve SA Industria e Comercio 572 868 0,00 %<br />

Marcopolo SA 4 806 509 0,00 %<br />

Marfrig Frigorifi cos e Comercio de Alimentos SA 7 670 813 0,13 %<br />

Metalurgica Gerdau SA 68 510 045 0,00 %<br />

MMX Mineracao e Metalicos SA 4 558 749 0,18 %<br />

MPX Energia SA 3 026 637 0,11 %<br />

MRV Engenharia e Participacoes SA 51 259 0,00 %<br />

Multiplan Empreendimentos Imobiliarios SA 14 728 217 0,33 %<br />

Natura Cosmeticos SA 40 499 991 0,17 %<br />

NET Servicos de Comunicacao SA 39 311 140 0,00 %<br />

Odontoprev SA 40 885 895 2,32 %<br />

OGX Petroleo e Gas Participacoes SA 56 068 910 0,11 %<br />

PDG Realty SA Empreendimentos e Participacoes 16 481 726 0,34 %<br />

Perdigao SA 141 166 959 0,48 %<br />

Petroleo Brasileiro SA 2 344 448 206 0,22 %<br />

Porto Seguro SA 16 998 627 0,19 %<br />

Pr<strong>of</strong>arma Distribuidora de Produtos Farmaceuticos SA 8 234 629 1,42 %<br />

Randon Participacoes SA 9 634 034 0,00 %<br />

Redecard SA 105 344 606 0,20 %<br />

Rossi Residencial SA 9 876 411 0,45 %<br />

Sadia SA 43 700 902 0,00 %<br />

Santos Brasil Participacoes SA 4 017 413 0,00 %<br />

Sao Paulo Alpargatas SA 4 903 458 0,00 %<br />

Market value<br />

Voting<br />

(per cent)<br />

SLC Agricola SA 6 696 434 0,16 %<br />

Souza Cruz SA 52 051 152 0,13 %<br />

Suzano Papel e Celulose SA 30 183 712 0,00 %<br />

Tam SA 56 153 518 0,00 %<br />

Tele Norte Leste Participacoes SA 142 787 231 0,23 %<br />

Telecomunicacoes de Sao Paulo SA 35 582 183 0,07 %<br />

Telemar Norte Leste SA 26 285 943 0,00 %<br />

Telemig Celular Participacoes SA 10 008 721 0,17 %<br />

Terna Participacoes SA 11 765 444 0,00 %<br />

Tim Participacoes SA 113 866 563 0,19 %<br />

Totvs SA 13 149 860 0,38 %<br />

Tractebel Energia SA 90 613 532 0,25 %<br />

Ultrapar Participacoes SA 64 515 835 0,00 %<br />

Uniao de Industrias Petroquimicas SA 5 265 507 0,00 %<br />

Usinas Siderurgicas de Minas Gerais SA 113 128 582 0,17 %<br />

Vivo Participacoes SA 112 450 161 0,36 %<br />

Votorantim Celulose e Papel SA 22 921 168 0,00 %<br />

Weg SA 53 116 423 0,23 %<br />

CANADA<br />

Absolute S<strong>of</strong>tware Corp 3 492 032 0,39 %<br />

Addax Petroleum Corp 158 502 182 0,85 %<br />

Aecon Group Inc 13 600 676 0,43 %<br />

AGF Management Ltd 17 377 414 0,00 %<br />

Agnico-Eagle Mines Ltd 152 173 735 0,28 %<br />

Agrium Inc 348 629 389 0,94 %<br />

Alamos Gold Inc 15 841 833 0,33 %<br />

Alimentation Couche Tard Inc 90 389 517 0,79 %<br />

Anvil Mining Ltd 1 470 541 0,34 %<br />

Astral Media Inc 31 652 666 0,00 %<br />

Atco Ltd 40 907 318 0,00 %<br />

Atrium Innovations Inc 9 969 705 0,42 %<br />

ATS Automation Tooling Systems Inc 9 624 669 0,44 %<br />

Aura Minerals Inc 1 322 927 0,25 %<br />

Aurizon Mines Ltd 13 201 082 0,39 %<br />

Ballard Power Systems Inc 1 906 744 0,31 %<br />

<strong>Bank</strong> <strong>of</strong> Montreal 335 628 782 0,35 %<br />

<strong>Bank</strong> <strong>of</strong> Nova Scotia 1 628 924 201 0,87 %<br />

BCE Inc 168 079 441 0,15 %<br />

Biovail Corp 31 721 929 0,31 %<br />

Birchcliff Energy Ltd 13 972 380 0,43 %<br />

Boardwalk Real Estate Investment Trust 34 832 525 0,49 %<br />

Bombardier Inc 166 135 810 0,19 %<br />

Brookfi eld Asset Management Inc 335 751 001 0,55 %<br />

Brookfi eld Properties Corp 84 577 655 0,41 %<br />

CAE Inc 47 911 149 0,41 %<br />

Calfrac Well Services Ltd 5 532 731 0,30 %<br />

Calloway Real Estate Investment Trust 23 256 639 0,46 %<br />

Cameco Corp 415 506 379 0,94 %<br />

Canaccord Capital Inc 5 082 257 0,41 %<br />

Canadian Apartment Properties REIT 27 992 955 0,47 %<br />

Canadian Hydro Developers Inc 7 665 345 0,32 %<br />

Canadian Imperial <strong>Bank</strong> <strong>of</strong> Commerce/Canada 1 003 598 712 0,91 %<br />

Canadian National Railway Co 585 277 250 0,49 %<br />

Canadian Natural Resources Ltd 783 625 666 0,52 %<br />

Canadian Pacifi c Railway Ltd 209 275 838 0,59 %<br />

Canadian Real Estate Investment Trust 35 469 506 0,45 %<br />

Canadian Tire Corp Ltd 100 392 710 0,00 %<br />

Canadian Utilities Ltd 59 885 031 0,00 %<br />

Canadian Western <strong>Bank</strong> 17 633 386 0,40 %<br />

Canam Group Inc 5 113 474 0,29 %<br />

Canfor Corp 15 798 394 0,26 %<br />

Cangene Corp 315 574 0,01 %<br />

CanWest <strong>Global</strong> Communications Corp 1 387 106 0,31 %<br />

Cardiome Pharma Corp 15 185 263 0,75 %<br />

Cascades Inc 18 007 702 0,94 %<br />

Catalyst Paper Corp 1 717 931 0,26 %<br />

CCL Industries 17 850 392 0,00 %<br />

Celestica Inc 27 946 412 0,44 %<br />

Celtic Exploration Ltd 12 073 265 0,41 %<br />

Centerra Gold Inc 8 343 901 0,15 %<br />

CGI Group Inc 60 464 221 0,41 %<br />

Chartwell Seniors Housing Real Estate Investment Trust 12 185 145 0,40 %<br />

CML Healthcare Income <strong>Fund</strong> 22 949 707 0,35 %<br />

Cogeco Cable Inc 22 788 382 0,35 %<br />

Cominar Real Estate Investment Trust 16 980 245 0,41 %<br />

Compton Petroleum Corp 2 595 450 0,38 %<br />

Connacher Oil and Gas Ltd 3 577 988 0,40 %<br />

Corridor Resources Inc 3 562 252 0,32 %<br />

Corus Entertainment Inc 6 078 032 0,00 %<br />

Cott Corp 1 677 878 0,27 %<br />

Crescent Point Energy Trust 43 013 892 0,25 %<br />

Crew Energy Inc 9 194 692 0,43 %<br />

Crystallex International Corp 6 202 665 1,78 %<br />

Denison Mines Corp 4 804 179 0,29 %<br />

Detour Gold Corp 8 354 739 0,39 %<br />

Dorel Industries Inc 22 648 007 0,49 %<br />

Dundee Corp 8 931 719 0,37 %<br />

Dundee Real Estate Investment Trust 5 522 712 0,47 %<br />

DundeeWealth Inc 7 114 662 0,18 %<br />

Eastern Platinum Ltd 42 560 418 3,29 %<br />

Eldorado Gold Corp 92 364 201 0,46 %<br />

3<br />

GOVERNMENT PENSION FUND <strong>–</strong> GLOBAL ANNUAL REPORT 2008

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>–</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> equities at 31 December 2008<br />

Market value<br />

Voting<br />

(per cent)<br />

Emera Inc 49 003 398 0,35 %<br />

Empire Co Ltd 12 297 776 0,00 %<br />

Enbridge Inc 415 863 640 0,50 %<br />

EnCana Corp 1 251 032 762 0,52 %<br />

Ensign Energy Services Inc 48 700 166 0,42 %<br />

Entree Gold Inc 3 504 091 0,62 %<br />

Equinox Minerals Ltd 16 099 736 0,35 %<br />

European Goldfi elds Ltd 12 141 897 0,37 %<br />

Evertz Technologies Ltd Com 3 899 509 0,07 %<br />

Extendicare Real Estate Investment Trust 7 116 587 0,30 %<br />

Fairborne Energy Ltd 12 324 156 0,43 %<br />

Fairfax Financial <strong>Holding</strong>s Ltd 175 858 550 0,47 %<br />

Finning International Inc 62 605 134 0,43 %<br />

First Capital Realty Inc 15 480 029 0,16 %<br />

First National Financial Income <strong>Fund</strong> 13 708 665 1,82 %<br />

First Quantum Minerals Ltd 23 519 221 0,34 %<br />

First Uranium Corp 55 915 251 4,11 %<br />

FirstService Corp 4 707 636 0,19 %<br />

Flint Energy Services Ltd 4 933 751 0,26 %<br />

FNX Mining Co Inc 4 379 270 0,30 %<br />

Fortis Inc 109 700 695 0,47 %<br />

Forzani Group Ltd/The 4 830 399 0,39 %<br />

Franco-Nevada Corp 545 638 390 4,51 %<br />

Fronteer Development Group Inc 3 084 462 0,27 %<br />

Gabriel Resources Ltd 35 744 348 1,62 %<br />

Galleon Energy Inc 18 842 093 0,89 %<br />

Gammon Gold Inc 90 815 136 1,98 %<br />

Gennum Corp 60 819 0,01 %<br />

George Weston Ltd 78 305 121 0,18 %<br />

Gerdau Ameristeel Corp 60 062 408 0,33 %<br />

Gildan Activewear Inc 43 923 872 0,45 %<br />

Goldcorp Inc 611 049 695 0,38 %<br />

Golden Star Resources Ltd 5 664 195 0,34 %<br />

Great Canadian Gaming Corp 7 298 658 0,43 %<br />

Great-West Lifeco Inc 96 142 782 0,09 %<br />

Groupe Aeroplan Inc 38 401 206 0,39 %<br />

H&R Real Estate Investment Trust 29 887 850 0,48 %<br />

Hanfeng Evergreen Inc 6 824 366 0,35 %<br />

Harry Winston Diamond Corp 6 429 214 0,33 %<br />

Highpine Oil & Gas Ltd 8 408 076 0,42 %<br />

Home Capital Group Inc 18 453 200 0,48 %<br />

HudBay Minerals Inc 10 964 360 0,41 %<br />

Husky Energy Inc 189 350 053 0,13 %<br />

IAMGOLD Corp 35 413 853 0,28 %<br />

IGM Financial Inc 85 763 808 0,16 %<br />

Imperial Oil Ltd 332 499 235 0,16 %<br />

Industrial Alliance Insurance and Financial Services Inc 48 983 666 0,46 %<br />

ING Canada Inc 29 100 400 0,14 %<br />

Inmet Mining Corp 19 953 460 0,37 %<br />

InnVest Real Estate Investment Trust 6 804 624 0,42 %<br />

InterOil Corp 9 433 000 0,28 %<br />

iShares CDN S&P/TSX 60 Index <strong>Fund</strong> 21 613 977 0,00 %<br />

Iteration Energy Ltd 4 935 883 0,38 %<br />

Ivanhoe Mines Ltd/CA 107 012 955 1,50 %<br />

Jean Coutu Group PJC Inc/The 20 716 781 0,37 %<br />

Katanga Mining Ltd 613 149 0,13 %<br />

Kingsway Financial Services Inc 7 020 965 0,35 %<br />

Kinross Gold Corp 714 846 995 0,84 %<br />

Kirkland Lake Gold Inc 3 636 797 0,26 %<br />

Laurentian <strong>Bank</strong> <strong>of</strong> Canada 17 326 292 0,37 %<br />

Linamar Corp 4 973 012 0,37 %<br />

Loblaw Cos Ltd 243 558 887 0,45 %<br />

Lundin Mining Corp 8 317 650 0,32 %<br />

MacDonald Dettwiler & Associates Ltd 20 995 132 0,42 %<br />

MagIndustries Corp 8 738 326 3,00 %<br />

Magna International Inc 105 264 428 0,45 %<br />

Major Drilling Group International 6 739 840 0,40 %<br />

Manitoba Telecom Services Inc 27 215 979 0,21 %<br />

Manulife Financial Corp 881 672 805 0,46 %<br />

Maple Leaf Foods Inc 60 089 437 0,84 %<br />

Martinrea International Inc 3 318 005 0,36 %<br />

MDS Inc 14 193 187 0,28 %<br />

MEGA Brands Inc 292 875 0,39 %<br />

Melcor Developments Ltd 1 124 684 0,14 %<br />

Mercator Minerals Ltd 540 924 0,32 %<br />

Methanex Corp 34 725 127 0,48 %<br />

Metro Inc 17 305 845 0,08 %<br />

Molson Coors Canada Inc 9 287 083 0,00 %<br />

Morguard Real Estate Investment Trust 8 817 280 0,23 %<br />

National <strong>Bank</strong> <strong>of</strong> Canada 104 777 552 0,37 %<br />

New Gold Inc 6 482 772 0,30 %<br />

Newmont Mining Corp <strong>of</strong> Canada Ltd 39 817 711 0,25 %<br />

Nexen Inc 446 393 015 0,70 %<br />

Niko Resources Ltd 51 926 203 0,44 %<br />

Norbord Inc 1 986 364 0,33 %<br />

Nortel Networks Corp 2 961 618 0,33 %<br />

Northbridge Financial Corp 15 531 581 0,15 %<br />

Northgate Minerals Corp 3 945 523 0,27 %<br />

Nova Chemicals Corp 26 185 402 0,95 %<br />

Novagold Resources Inc 18 659 909 1,69 %<br />

NuVista Energy Ltd 14 798 698 0,38 %<br />

Market value<br />

Voting<br />

(per cent)<br />

Oilexco Inc 1 735 757 0,48 %<br />

Onex Corp 25 590 742 0,20 %<br />

Open Text Corp 50 521 289 0,46 %<br />

OPTI Canada Inc 59 441 724 2,97 %<br />

Osisko Mining Corp 9 001 711 0,26 %<br />

Pacifi c Rubiales Energy Corp 9 983 327 0,38 %<br />

PAN American Silver Corp 34 644 809 0,36 %<br />

Paramount Resources Ltd 5 802 380 0,22 %<br />

Pason Systems Inc 20 177 880 0,31 %<br />

Patheon Inc 20 340 197 1,78 %<br />

Petro Andina Resources Inc 4 904 759 0,35 %<br />

Petrobank Energy & Resources Ltd 40 052 589 0,42 %<br />

Petro-Canada 390 239 627 0,53 %<br />

Potash Corp <strong>of</strong> Saskatchewan 1 248 446 038 0,81 %<br />

Power Corp <strong>of</strong> Canada/Canada 230 375 395 0,44 %<br />

Power Financial Corp 170 959 505 0,18 %<br />

Precision Drilling Trust 7 703 282 0,10 %<br />

Primaris Retail Real Estate Investment Trust 15 272 531 0,40 %<br />

ProEx Energy Ltd 17 724 160 0,47 %<br />

QLT Inc 1 010 978 0,08 %<br />

Quadra Mining Ltd (3 335 544) 0,00 %<br />

Quebecor Inc 15 993 444 0,34 %<br />

Red Back Mining Inc 36 274 505 0,36 %<br />

Reitmans Canada Ltd 15 939 829 0,00 %<br />

Research In Motion Ltd 922 243 703 0,58 %<br />

RioCan Real Estate Investment Trust 77 243 926 0,45 %<br />

Rogers Communications Inc 504 247 020 0,00 %<br />

RONA Inc 95 316 295 1,21 %<br />

Royal <strong>Bank</strong> <strong>of</strong> Canada 1 157 583 380 0,40 %<br />

Russel Metals Inc 58 750 506 0,89 %<br />

Saputo Inc 55 215 550 0,21 %<br />

Savanna Energy Services Corp 24 872 820 0,93 %<br />

Sears Canada Inc 12 193 217 0,11 %<br />

Shaw Communications Inc 405 164 300 0,00 %<br />

ShawCor Ltd 28 471 115 0,47 %<br />

Sherritt International Corp 56 144 336 1,07 %<br />

Shoppers Drug Mart Corp 139 944 499 0,24 %<br />

Shore Gold Inc 1 258 956 0,27 %<br />

Sierra Wireless Inc 3 794 209 0,30 %<br />

Silver Standard Resources Inc 197 345 601 2,82 %<br />

Silver Wheaton Corp 56 307 721 0,49 %<br />

Silvercorp Metals Inc 7 605 383 0,34 %<br />

Sino-Forest Corp 31 940 129 0,35 %<br />

SNC-Lavalin Group Inc 150 136 918 0,44 %<br />

Stantec Inc 28 289 013 0,36 %<br />

Storm Exploration Inc 7 448 275 0,22 %<br />

Sun Life Financial Inc 405 087 623 0,45 %<br />

Suncor Energy Inc 849 986 337 0,67 %<br />

SunOpta Inc 9 004 818 1,27 %<br />

Talisman Energy Inc 475 455 803 0,67 %<br />

Taseko Mines Ltd 1 521 522 0,26 %<br />

Teck Cominco Ltd 71 876 520 0,44 %<br />

TELUS Corp 129 357 828 0,12 %<br />

Theratechnologies Inc 688 276 0,10 %<br />

Thompson Creek Metals Co Inc 10 916 537 0,32 %<br />

Thomson Reuters Corp 18 835 035 0,01 %<br />

Timminco Ltd 3 868 030 0,19 %<br />

TMX Group Inc 43 592 651 0,40 %<br />

Toromont Industries Ltd 38 793 222 0,46 %<br />

Toronto-Dominion <strong>Bank</strong> 1 828 918 918 0,87 %<br />

Torstar Corp 10 295 991 0,00 %<br />

TransAlta Corp 109 378 099 0,40 %<br />

Transat AT Inc 7 821 296 0,36 %<br />

TransCanada Corp 524 805 793 0,46 %<br />

Transcontinental Inc 13 348 086 0,37 %<br />

Trican Well Service Ltd 23 784 114 0,42 %<br />

Trinidad Drilling Ltd 10 303 824 0,42 %<br />

TriStar Oil and Gas Ltd 40 096 672 0,66 %<br />

Uex Corp 2 461 988 0,36 %<br />

Universal Energy Group Ltd 2 275 043 0,20 %<br />

Uranium One Inc 20 132 507 0,42 %<br />

Uranium Participation Corp 15 382 054 0,52 %<br />

UTS Energy Corp 8 316 156 0,39 %<br />

Viterra Inc 56 721 715 0,44 %<br />

West Fraser Timber Co Ltd 17 258 885 0,24 %<br />

Westaim Corp 487 748 0,38 %<br />

WesternZagros Resources Ltd 18 105 0,00 %<br />

Westport Innovations Inc 19 276 641 0,00 %<br />

Yamana Gold Inc 96 148 456 0,25 %<br />

Zarlink Semiconductor Inc 1 018 773 0,46 %<br />

CAYMAN ISLANDS<br />

Commoditrade Inc 1 051 102 0,52 %<br />

CHILE<br />

Banco de Chile 24 114 932 0,08 %<br />

Banco de Credito e Inversiones 6 351 762 0,05 %<br />

Banco Santander Chile 57 425 787 0,14 %<br />

CAP SA 43 914 367 0,40 %<br />

Centros Comerciales Sudamericanos SA 40 713 872 0,18 %<br />

Cia Cervecerias Unidas SA 34 588 690 0,27 %<br />

Cia de Telecomunicaciones de Chile SA 2 573 472 0,02 %<br />

Cia Sudamericana de Vapores SA 8 240 828 0,23 %<br />

4<br />

GOVERNMENT PENSION FUND <strong>–</strong> GLOBAL ANNUAL REPORT 2008

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>–</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> equities at 31 December 2008<br />

Market value<br />

Voting<br />

(per cent)<br />

Colbun SA 44 391 509 0,23 %<br />

CorpBanca SA 3 456 818 0,06 %<br />

Distribucion y Servicio D&S SA 35 323 586 0,19 %<br />

Embotelladora Andina SA 17 938 356 0,00 %<br />

Empresa Nacional de Electricidad SA/Chile 168 491 201 0,08 %<br />

Empresa Nacional de Telecomunicaciones SA 43 281 336 0,24 %<br />

Empresas COPEC SA 117 657 027 0,17 %<br />

Enersis SA 143 579 741 0,09 %<br />

Farmacias Ahumada SA 3 403 737 0,26 %<br />

La Polar SA 27 907 632 1,07 %<br />

Lan Airlines SA 42 980 278 0,21 %<br />

SACI Falabella 49 208 420 0,11 %<br />

Sociedad Quimica y Minera de Chile SA 109 728 095 0,54 %<br />

Sonda SA 4 810 138 0,09 %<br />

CHINA<br />

Advanced Semiconductor Manufacturing Corp 1 432 647 0,98 %<br />

Air China Ltd 36 909 421 0,14 %<br />

AirMedia Group Inc 3 935 740 0,18 %<br />

Aluminum Corp <strong>of</strong> China Ltd 40 562 634 0,08 %<br />

Angang Steel Co Ltd 31 645 784 0,06 %<br />

Anhui Conch Cement Co Ltd 110 249 508 0,20 %<br />

Anhui Expressway Co 6 020 747 0,14 %<br />

Asia Cement China <strong>Holding</strong>s Corp 9 476 578 0,17 %<br />

AviChina Industry & Technology Co 6 059 958 0,14 %<br />

Baidu.com 50 650 237 0,00 %<br />

<strong>Bank</strong> <strong>of</strong> China Ltd 360 927 311 0,07 %<br />

<strong>Bank</strong> <strong>of</strong> Communications Co Ltd 177 528 822 0,07 %<br />

Baoshan Iron & Steel Co Ltd 19 970 355 0,02 %<br />

Baoye Group Co Ltd 38 289 205 3,92 %<br />

Beijing Capital International Airport Co Ltd 45 559 319 0,30 %<br />

Beijing Capital Land Ltd 6 594 128 0,29 %<br />

Beijing Hualian Hypermarket 1 594 092 0,05 %<br />

Beijing Jingkelong Co Ltd 9 772 150 0,97 %<br />

Beijing North Star Co 3 298 040 0,08 %<br />

Beijing Shunxin Agriculture Co 3 929 228 0,08 %<br />

Bengang Steel Plates Co 6 486 775 0,09 %<br />

BOE Technology Group Co Ltd 5 809 905 0,19 %<br />

Byd Co Ltd 130 162 337 0,55 %<br />

BYD Electronic International Co Ltd 4 691 250 0,08 %<br />

Central China Real Estate 19 243 985 1,50 %<br />

Changsha Zoomlion Heavy Industry Science and<br />

Technology Developme 1 604 335 0,01 %<br />

China BlueChemical Ltd 27 518 031 0,21 %<br />

China Citic <strong>Bank</strong> 209 318 131 0,22 %<br />

China Coal Energy Co 108 188 561 0,15 %<br />

China Communications Construction Co Ltd 315 957 642 0,25 %<br />

China Communications Services Corp Ltd 117 464 849 0,46 %<br />

China Construction <strong>Bank</strong> Corp 535 210 943 0,06 %<br />

China COSCO <strong>Holding</strong>s Co Ltd 107 057 916 0,21 %<br />

China CYTS Tours <strong>Holding</strong> Co Ltd 15 170 321 0,47 %<br />

China Dongxiang Group Co 94 631 906 0,98 %<br />

China Eastern Airlines Corp Ltd 9 065 380 0,18 %<br />

China Enterprise Co Ltd 5 320 095 0,08 %<br />

China Fiberglass Co Ltd 2 684 272 0,04 %<br />

China International Marine Containers Co Ltd 17 049 291 0,17 %<br />

China Life Insurance Co Ltd 1 036 563 140 0,17 %<br />

China Medical Technologies Inc 13 329 689 0,29 %<br />

China Merchants <strong>Bank</strong> Co Ltd 168 244 339 0,09 %<br />

China Merchants Property Development Co Ltd 8 358 936 0,07 %<br />

China Minsheng <strong>Bank</strong>ing Corp Ltd 6 632 814 0,01 %<br />

China Molybdenum Co Ltd 45 817 524 0,30 %<br />

China National Building Material Co Ltd 293 841 678 1,58 %<br />

China National Medicines Corp Ltd 2 153 257 0,03 %<br />

China Oilfi eld Services Ltd 40 091 635 0,16 %<br />

China Petroleum & Chemical Corp 316 852 145 0,09 %<br />

China Railway Construction Corp 87 934 576 0,07 %<br />

China Railway Group Ltd 82 190 299 0,08 %<br />

China Railway Tielong Container Logistics Co Ltd 1 567 161 0,03 %<br />

China Resources Microelectronics Ltd 221 0,00 %<br />

China Shenhua Energy Co Ltd 238 227 159 0,08 %<br />

China Shipping Container Lines Co Ltd 21 823 085 0,18 %<br />

China Shipping Development Co Ltd 44 871 009 0,19 %<br />

China South Locomotive and Rolling Stock Corp 5 506 803 0,01 %<br />

China Southern Airlines Co Ltd 8 125 732 0,11 %<br />

China Telecom Corp Ltd 197 047 227 0,09 %<br />

China United Telecommunications Corp Ltd 23 317 943 0,02 %<br />

China Vanke Co Ltd 47 848 810 0,08 %<br />

China Yangtze Power Co A 2 891 968 0,00 %<br />

Chongqing Iron & Steel Co Ltd 4 225 347 0,14 %<br />

Citic Securities Co Ltd/China 12 466 591 0,01 %<br />

CNinsure Inc 63 136 535 0,00 %<br />

CSG <strong>Holding</strong> Co Ltd 14 711 006 0,30 %<br />

Ctrip.com International Ltd 58 060 853 0,52 %<br />

Dalian Port PDA Co Ltd 33 833 093 0,66 %<br />

Dalian Zhangzidao Fishery Group Co Ltd 3 717 361 0,10 %<br />

Daqin Railway Co Ltd 8 637 092 0,01 %<br />

Dashang Group Co Ltd 19 913 826 0,37 %<br />

Datang International Power Generation Co Ltd 67 348 388 0,15 %<br />

Dazhong Transportation Group Co Ltd 13 704 351 0,29 %<br />

Dongfang Electric Corp Ltd 27 216 524 0,18 %<br />

Dongfeng Motor Group Co Ltd 42 436 148 0,22 %<br />

Market value<br />

Voting<br />

(per cent)<br />

Double Coin <strong>Holding</strong>s Ltd 158 0,00 %<br />

Eastcom Peace Smart Card Co Ltd 2 214 185 0,22 %<br />

Financial Street <strong>Holding</strong> Co Ltd 18 916 219 0,10 %<br />

First Tractor Co 6 712 736 0,47 %<br />

Focus Media <strong>Holding</strong> Ltd 11 475 931 0,14 %<br />

Fujian Longxi Bearing Group Co Ltd 7 406 797 0,49 %<br />

Fuyao Group Glass Industries Co Ltd 12 751 311 0,16 %<br />

Golden Meditech Co Ltd 47 432 543 3,25 %<br />

Great Wall Motor Co Ltd 6 331 406 0,24 %<br />

Gree Electric Appliances Inc 21 251 726 0,09 %<br />

Guangdong Electric Power Development Co Ltd 18 071 911 0,30 %<br />

Guangdong Provincial Expressway Development Co Ltd 3 159 483 0,10 %<br />

Guangshen Railway Co Ltd 21 787 732 0,12 %<br />

Guangzhou Baiyun International Airport Co Ltd 1 911 546 0,02 %<br />

Guangzhou Pharmaceutical Co Ltd 4 876 227 0,25 %<br />

Guangzhou R&F Properties Co Ltd 41 030 506 0,16 %<br />

Guangzhou Shipyard International Co Ltd 72 562 073 0,54 %<br />

Hainan Airlines Co Ltd 215 0,00 %<br />

Haitian International <strong>Holding</strong>s Ltd 13 906 263 0,93 %<br />

Hangzhou Steam Turbine Co 15 462 274 0,69 %<br />

Harbin Power Equipment Co Ltd 14 732 978 0,18 %<br />

Henan Shuanghui Investment & Development Co Ltd 4 429 611 0,02 %<br />

Huadian Power International Co 32 385 548 0,32 %<br />

Huaneng Power International Inc 176 881 993 0,16 %<br />

Huangshan Tourism Development Co Ltd 5 690 455 0,20 %<br />

Huaxin Cement Co Ltd 24 084 416 0,57 %<br />

Hunan Huatian Great Hotel Co Ltd 14 367 094 0,73 %<br />

Hunan Non-Ferrous Metal Corp Ltd 14 004 923 0,38 %<br />

Hunan Valin Steel Co Ltd 12 396 207 0,10 %<br />

Industrial & Commercial <strong>Bank</strong> <strong>of</strong> China 926 630 993 0,08 %<br />

Industrial <strong>Bank</strong> Co Ltd 12 704 950 0,02 %<br />

Inner Mongolia Eerduosi Cashmere Products Co Ltd 11 775 099 0,30 %<br />

Inner Mongolia Yitai Coal Co 25 890 644 0,20 %<br />

JA Solar <strong>Holding</strong>s Co Ltd 14 674 417 0,29 %<br />

Jiangsu Expressway Co Ltd 39 735 847 0,15 %<br />

Jiangsu Jiangnan High Polymer Fiber Co Ltd 13 583 923 0,89 %<br />

Jiangsu Kanion Pharmaceutical Co Ltd 4 299 606 0,09 %<br />

Jiangsu Xincheng Real Estate Co Ltd 7 668 454 0,74 %<br />

Jiangxi Copper Co Ltd 26 597 753 0,17 %<br />

Jilin Sino-Microelectronics Co Ltd 10 501 485 0,56 %<br />

Kailuan Clean Coal Co Ltd 20 984 599 0,29 %<br />

Keda Industrial Co Ltd 928 353 0,04 %<br />

Kweichow Moutai Co Ltd 12 338 912 0,01 %<br />

Lianhua Supermarket <strong>Holding</strong>s Co Ltd 8 526 278 0,16 %<br />

Lingbao Gold Co Ltd 3 448 956 0,25 %<br />

Luthai Textile Co Ltd 3 509 815 0,10 %<br />

Mayinglong Pharmaceutical Group Co Ltd 4 395 777 0,19 %<br />

Memtech International Ltd 158 449 0,08 %<br />

Mindray Medical International Ltd 81 765 762 0,86 %<br />

Maanshan Iron & Steel 15 684 661 0,08 %<br />

Netease.com 114 930 159 0,61 %<br />

Neus<strong>of</strong>t Corp 4 378 873 0,04 %<br />

New Oriental Education & Technology Group 68 861 319 0,12 %<br />

Ningbo Donly Transmission Equipment Co Ltd 1 972 328 0,12 %<br />

Offshore Oil Engineering Co Ltd 4 973 396 0,01 %<br />

PetroChina Co Ltd 826 890 437 0,06 %<br />

PICC Property & Casualty Co Ltd 63 249 141 0,48 %<br />

Ping An Insurance Group Co <strong>of</strong> China Ltd 354 496 573 0,14 %<br />

Qingdao Haier Co Ltd 7 090 075 0,06 %<br />

Qinghai Salt Lake Potash A 4 271 829 0,01 %<br />

Renhe Commercial <strong>Holding</strong>s Co Ltd 53 304 934 0,25 %<br />

SAIC Motor Corp Ltd 7 072 807 0,02 %<br />

Shandong Chenming Paper <strong>Holding</strong>s Ltd 92 105 366 1,56 %<br />

Shandong Dong-E E-Jiao-A 3 904 992 0,05 %<br />

Shandong Gold Mining Co Ltd 7 295 497 0,04 %<br />

Shandong Pharmaceutical Glass Co Ltd 22 620 770 0,90 %<br />

Shandong Weigao Group Medical Polymer Co Ltd 254 996 349 2,41 %<br />

Shanghai Bailian Group Co 2 466 218 0,03 %<br />

Shanghai Electric Group Co Ltd 90 077 460 0,25 %<br />

Shanghai Forte Land Co 4 373 679 0,15 %<br />

Shanghai Fosun Pharmaceutical Group Co Ltd 7 461 894 0,06 %<br />

Shanghai International Airport Co Ltd 13 089 086 0,06 %<br />

Shanghai International Port Group Co Ltd 3 213 454 0,00 %<br />

Shanghai Jinfeng Wine Co Ltd 5 330 454 0,13 %<br />

Shanghai Kehua Bio-Engineering Co Ltd 5 592 830 0,07 %<br />

Shanghai Lujiazui Finance & Trade Zone Development Co Ltd 12 042 068 0,10 %<br />

Shanghai Mechanical and Electrical Industry Co Ltd 4 552 254 0,11 %<br />

Shanghai New World Co Ltd 2 185 675 0,06 %<br />

Shanghai Pudong Development <strong>Bank</strong> 2 175 649 0,00 %<br />

Shanghai Tunnel Engineering Co Ltd 6 897 361 0,08 %<br />

Shanghai Zhangjiang High-Tech Park Development Co Ltd 18 264 126 0,12 %<br />

Shanghai Zhenhua Port Machinery Co 27 417 041 0,17 %<br />

Shanghai Zhixin Electric Co Ltd 3 648 863 0,04 %<br />

Shanxi Luan Environmental Energy Development Co Ltd 14 361 484 0,10 %<br />

Shenyang Chemical Industry 1 439 221 0,05 %<br />

Shenzhen Agricultural Products Co Ltd 4 951 554 0,07 %<br />

Shenzhen Chiwan Wharf <strong>Holding</strong>s Ltd 2 548 428 0,07 %<br />

Shenzhen Expressway Co Ltd 9 774 065 0,18 %<br />

Shenzhen Fiyta <strong>Holding</strong>s Ltd 2 428 927 0,20 %<br />

Sinopec Shanghai Petrochemical Co Ltd 21 129 064 0,16 %<br />

Sinopec Yizheng Chemical Fibre Co Ltd 5 199 670 0,16 %<br />

5<br />

GOVERNMENT PENSION FUND <strong>–</strong> GLOBAL ANNUAL REPORT 2008

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>–</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> equities at 31 December 2008<br />

Market value<br />

Voting<br />

(per cent)<br />

Sinotrans Ltd 80 873 523 1,40 %<br />

Suning Appliance Co Ltd 10 711 938 0,02 %<br />

Suzhou New District Hi-Tech Industrial Co Ltd 6 927 656 0,25 %<br />

TBEA Co Ltd 11 140 857 0,04 %<br />

Tianjin Capital Environmental Protection Group Co Ltd 5 001 701 0,29 %<br />

Tianjin Port Co Ltd 1 605 194 0,01 %<br />

Tong Ren Tang Technologies Co Ltd 37 344 443 3,33 %<br />

Travelsky Technology Ltd 53 369 623 0,98 %<br />

Tsingtao Brewery Co Ltd 23 681 485 0,12 %<br />

Uni-President China <strong>Holding</strong>s Ltd 16 342 019 0,25 %<br />

Want Want China <strong>Holding</strong>s Ltd 172 558 913 0,45 %<br />

Weichai Power Co Ltd 113 049 682 1,03 %<br />

Weihai Guangtai Airport Equipment Co Ltd 2 364 713 0,12 %<br />

Weiqiao Textile Co 6 745 767 0,23 %<br />

Wuhan Zhongbai Group Co Ltd 5 924 838 0,11 %<br />

Wuliangye Yibin Co Ltd 9 214 167 0,02 %<br />

Xiamen International Port Co Ltd 3 541 218 0,16 %<br />

Xiamen King Long Motor Co Ltd 1 694 999 0,08 %<br />

Xinhua Finance Media Ltd 1 345 704 0,43 %<br />

Xining Special Steel Co 6 700 923 0,21 %<br />

Xinjiang Chalkis Co Ltd 2 208 450 0,10 %<br />

Xinjiang Guanghui Industry Co Ltd 3 743 758 0,05 %<br />

Xinjiang Joinworld Co Ltd 2 659 424 0,09 %<br />

Yantai Changyu Pioneer Wine Co 23 947 657 0,18 %<br />

Yantai North Andre Juice Co 36 433 693 3,15 %<br />

Yantai Wanhua Polyurethanes Co Ltd 16 653 350 0,10 %<br />

Yanzhou Coal Mining Co Ltd 39 707 261 0,16 %<br />

Yueyang Paper Co Ltd 1 413 648 0,04 %<br />

Yunnan Baiyao Group Co Ltd 8 077 975 0,04 %<br />

Yunnan Yunwei Co Ltd 7 483 546 0,26 %<br />

Zhaojin Mining Industry Co Ltd 181 988 466 2,30 %<br />

Zhejiang Expressway Co Ltd 70 341 616 0,39 %<br />

Zhejiang Guyuelongshan 3 505 449 0,13 %<br />

Zhengzhou Yutong Bus Co Ltd 12 630 002 0,26 %<br />

Zhong An Real Estate Ltd 7 001 838 0,30 %<br />

Zhuzhou CSR Times Electric Co Ltd 20 328 153 0,33 %<br />

Zijin Mining Group Co Ltd 193 471 071 0,31 %<br />

ZTE Corp 60 203 435 0,24 %<br />

CYPRUS<br />

<strong>Bank</strong> <strong>of</strong> Cyprus Public Co Ltd 418 404 0,00 %<br />

CZECH REPUBLIC<br />

CEZ 1 489 336 648 0,88 %<br />

Komercni <strong>Bank</strong>a AS 204 282 263 0,50 %<br />

Philip Morris CR AS 19 019 853 0,46 %<br />

Telefonica O2 Czech Republic AS 235 957 614 0,48 %<br />

Unipetrol 46 587 002 0,47 %<br />

Zentiva NV 74 121 099 0,50 %<br />

DENMARK<br />

A P Moller - Maersk AS 960 079 296 0,60 %<br />

ALK-Abello AS 45 956 236 0,73 %<br />

Alm Brand AS 9 620 556 0,62 %<br />

Amagerbanken AS 2 882 745 1,02 %<br />

Auriga Industries 12 183 147 0,57 %<br />

Bang & Olufsen AS 10 546 034 1,24 %<br />

Bavarian Nordic AS 7 143 723 0,53 %<br />

Carlsberg AS 247 001 601 0,24 %<br />

Coloplast AS 173 595 900 0,86 %<br />

D/S Norden 35 217 997 0,33 %<br />

D/S Torm AS 52 460 801 0,97 %<br />

Danisco AS 164 289 058 1,20 %<br />

Danske <strong>Bank</strong> AS 579 262 096 1,22 %<br />

Dfds AS 20 043 380 0,48 %<br />

DSV AS 189 762 041 1,35 %<br />

East Asiatic Co Ltd AS 50 189 577 1,54 %<br />

EBH <strong>Bank</strong> AS 2 204 0,38 %<br />

FLSmidth & Co AS 148 677 072 1,18 %<br />

Genmab AS 97 024 327 0,82 %<br />

GN Store Nord 34 007 581 1,22 %<br />

H Lundbeck AS 170 739 369 0,60 %<br />

IC Companys AS 5 863 838 0,59 %<br />

Jyske <strong>Bank</strong> AS 111 441 403 1,33 %<br />

NKT <strong>Holding</strong> AS 34 033 242 1,04 %<br />

Nordicom AS 727 377 0,26 %<br />

Novo Nordisk AS 2 464 556 574 1,32 %<br />

Novozymes AS 269 195 796 0,91 %<br />

Ringkjoebing Landbobank AS 7 392 857 0,36 %<br />

Rockwool International AS 11 006 942 0,32 %<br />

Roskilde <strong>Bank</strong> 51 655 0,90 %<br />

Royal UNIBREW AS 6 434 034 0,74 %<br />

Schouw & Co 15 275 226 0,52 %<br />

SimCorp AS 44 171 173 1,16 %<br />

Sjaelso Gruppen 5 530 562 0,79 %<br />

Spar Nord <strong>Bank</strong> AS 19 038 176 0,60 %<br />

Sydbank AS 73 686 389 1,30 %<br />

Topdanmark AS 196 475 633 1,40 %<br />

Trigon Agri AS 1 383 098 0,22 %<br />

TrygVesta AS 81 819 364 0,28 %<br />

Vestas Wind Systems AS 880 635 899 1,20 %<br />

William Demant <strong>Holding</strong> 73 193 387 0,43 %<br />

EGYPT<br />

Market value<br />

Voting<br />

(per cent)<br />

Alexandria Mineral Oils Co 7 527 070 0,14 %<br />

Arab Cotton Ginning 11 849 142 1,00 %<br />

Asek Co for Mining 4 312 730 0,05 %<br />

Commercial International <strong>Bank</strong> 68 949 179 0,50 %<br />

Delta Sugar Co 3 199 002 0,11 %<br />

Egyptian Co for Mobile Services 40 178 556 0,22 %<br />

Egyptian Financial & Industrial Co 11 783 284 0,53 %<br />

Egyptian Financial Group-Hermes <strong>Holding</strong> 29 982 795 0,35 %<br />

Egyptian for Tourism Resorts 13 138 143 0,55 %<br />

Egyptian Kuwaiti <strong>Holding</strong> Co 7 945 354 0,11 %<br />

El Ezz Steel Co 19 635 075 0,28 %<br />

ElSwedy Cables <strong>Holding</strong> Co 24 897 888 0,18 %<br />

Heliopolis Housing 8 102 466 0,32 %<br />

Housing & Development <strong>Bank</strong> 4 937 478 0,24 %<br />

Medinet Nasr Housing 11 845 184 0,33 %<br />

Nile Cotton Ginning 7 627 848 0,92 %<br />

Olympic Group Financial Investments 1 758 271 0,10 %<br />

Orascom Construction Industries 85 208 724 0,22 %<br />

Orascom Telecom <strong>Holding</strong> SAE 151 117 192 0,00 %<br />

Oriental Weavers 3 789 762 0,17 %<br />

Sidi Kerir Petrochemcials Co 9 154 076 0,13 %<br />

Six <strong>of</strong> October Development & Investment 7 909 518 0,52 %<br />

South Valley Cement 23 432 286 0,68 %<br />

Talaat Moustafa Group 29 633 926 0,38 %<br />

Telecom Egypt 35 083 645 0,10 %<br />

FINLAND<br />

Ahlstrom OYJ 12 597 864 0,42 %<br />

Alma Media 36 235 654 1,01 %<br />

Amer Sports OYJ 42 852 916 1,12 %<br />

Cargotec Corp 42 785 417 0,99 %<br />

Citycon Oyj 30 321 709 0,84 %<br />

Cramo OYJ 12 436 519 0,91 %<br />

Elektrobit Corp 1 643 416 0,40 %<br />

Elisa OYJ 315 123 744 1,58 %<br />

Finnair OYJ 37 667 040 0,62 %<br />

Finnlines OYJ 108 595 952 4,25 %<br />

Fortum Oyj 1 071 507 645 0,81 %<br />

F-Secure Oyj 12 058 048 0,42 %<br />

HKScan Oyj 8 985 420 0,62 %<br />

Huhtamaki Oyj 55 753 706 1,23 %<br />

Kemira OYJ 45 814 084 0,63 %<br />

Kesko OYJ 148 411 135 1,30 %<br />

Kone OYJ 290 231 828 0,88 %<br />

Konecranes Oyj 95 026 110 1,32 %<br />

Lassila & Tikanoja Oyj 28 138 651 0,68 %<br />

Lemminkainen Oyj 10 021 813 0,46 %<br />

Metso Oyj 197 368 190 1,68 %<br />

M-real OYJ 165 619 227 2,42 %<br />

Neste Oil OYJ 141 179 026 0,54 %<br />

Nokia OYJ 4 927 631 372 1,15 %<br />

Nokian Renkaat OYJ 105 968 112 1,10 %<br />

Oriola-KD OYJ 8 826 946 0,49 %<br />

Orion Oyj 124 088 384 0,09 %<br />

Outokumpu OYJ 119 313 265 0,82 %<br />

Outotec Oyj 160 064 555 3,63 %<br />

Pohjola <strong>Bank</strong> PLC 146 901 780 0,97 %<br />

Poyry Oyj 34 124 419 0,76 %<br />

Ramirent Oyj 30 268 633 0,88 %<br />

Rautaruukki OYJ 142 234 648 0,86 %<br />

Ruukki Group Oyj 33 100 173 1,02 %<br />

Sampo Oyj 1 497 584 808 2,04 %<br />

Sanoma Oyj 47 934 487 0,33 %<br />

Sponda OYJ 31 171 506 0,93 %<br />

Stockmann Oyj Abp 29 901 183 0,90 %<br />

Stora Enso Oyj 1 251 406 087 0,49 %<br />

Tietoenator Oyj 68 337 320 1,25 %<br />

UPM-Kymmene Oyj 2 629 620 895 5,77 %<br />

Uponor Oyj 66 216 450 1,21 %<br />

Vacon Plc 24 616 915 0,90 %<br />

Vaisala Oyj 8 225 474 0,26 %<br />

Wartsila Oyj 387 441 612 1,92 %<br />

YIT OYJ 78 405 387 1,38 %<br />

FRANCE<br />

Accor SA 1 015 473 420 1,32 %<br />

Aeroports de Paris 164 060 973 0,35 %<br />

Air France-KLM 160 765 356 0,60 %<br />

Air Liquide SA 1 899 195 165 1,14 %<br />

Alcatel-Lucent 389 437 567 1,05 %<br />

Alstom SA 1 394 180 960 1,20 %<br />

Alten Ltd 44 745 424 0,95 %<br />

Altran Technologies SA 34 304 512 0,91 %<br />

April Group 146 883 388 2,04 %<br />

ArcelorMittal 2 235 564 558 0,93 %<br />

Areva SA 94 295 922 0,00 %<br />

Arkema SA 88 714 629 1,22 %<br />

Assystem 8 700 441 0,78 %<br />

Atos Origin SA 137 854 649 1,13 %<br />

AXA SA 4 169 503 146 1,29 %<br />

Beneteau SA 32 219 662 0,56 %<br />

BioMerieux 132 567 724 0,58 %<br />

BNP Paribas 3 778 244 143 1,41 %<br />

6<br />

GOVERNMENT PENSION FUND <strong>–</strong> GLOBAL ANNUAL REPORT 2008

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>–</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> equities at 31 December 2008<br />

Market value<br />

Voting<br />

(per cent)<br />

Boiron SA 6 710 828 0,18 %<br />

Bollore 97 216 000 0,48 %<br />

Bonduelle S.C.A. 21 808 161 0,48 %<br />

Bongrain SA 17 698 122 0,25 %<br />

Bourbon SA 125 175 244 1,29 %<br />

Boursorama 7 841 551 0,20 %<br />

Bouygues 1 142 209 082 1,13 %<br />

Bull SA 12 057 638 1,11 %<br />

Bureau Veritas SA 136 421 887 0,45 %<br />

CA Nord de France CCI 43 353 0,00 %<br />

Canal + 30 816 392 0,61 %<br />

Cap Gemini SA 456 882 089 1,17 %<br />

Carbone Lorraine 33 021 269 1,33 %<br />

Carrefour SA 2 505 847 419 1,33 %<br />

Casino Guichard Perrachon SA 251 553 277 0,49 %<br />

Christian Dior SA 999 818 093 1,40 %<br />

Cie de Saint-Gobain 1 510 767 008 1,21 %<br />

Cie Generale de Geophysique-Veritas 162 958 335 1,05 %<br />

Cie Generale dOptique Essilor International SA 809 739 683 1,18 %<br />

Ciments Francais SA 89 796 845 0,42 %<br />

Club Mediterranee 47 957 014 2,12 %<br />

CNP Assurances 416 671 855 0,56 %<br />

Compagnie des Alpes 6 621 881 0,16 %<br />

Compagnie Generale des Etablissements Michelin 580 518 278 1,09 %<br />

Credit Agricole SA 1 159 503 770 0,67 %<br />

Dassault Systemes SA 217 435 293 0,58 %<br />

Delachaux SA 155 803 330 2,79 %<br />

Derichebourg SA 29 961 730 1,12 %<br />

EDF 1 531 950 455 0,21 %<br />

EDF Energies Nouvelles SA 86 785 546 0,46 %<br />

Eiffage SA 306 295 703 0,92 %<br />

Eramet 151 142 600 0,43 %<br />

Esso SA Francaise 21 181 516 0,24 %<br />

Etablissements Maurel et Prom 120 554 380 1,26 %<br />

Etam Developpement SA 9 119 248 1,11 %<br />

Euler Hermes SA 210 195 957 1,37 %<br />

Eurazeo 111 321 310 0,62 %<br />

Euro Disney SCA 5 994 920 0,44 %<br />

Eur<strong>of</strong>i ns Scientifi c 25 893 169 0,53 %<br />

Eutelsat Communications 294 343 614 0,81 %<br />

Faiveley SA 32 809 106 0,49 %<br />

Faurecia 6 706 148 0,29 %<br />

Fimalac 28 370 100 0,42 %<br />

Fonciere Des Regions 135 958 027 0,69 %<br />

France Telecom SA 3 890 168 946 0,77 %<br />

GameL<strong>of</strong>t 45 618 163 4,25 %<br />

GDF Suez 5 704 851 133 0,76 %<br />

Gecina SA 114 499 146 0,38 %<br />

Gemalto NV 203 699 445 1,33 %<br />

Generale de Sante 8 865 414 0,13 %<br />

GFI Informatique 10 784 453 0,79 %<br />

GL Events 9 863 045 0,44 %<br />

Groupe Danone 3 007 822 674 1,39 %<br />

Groupe Eurotunnel SA 108 633 927 1,14 %<br />

Groupe Partouche 3 595 115 0,31 %<br />

Groupe Steria SCA 21 072 866 0,95 %<br />

Guerbet 9 450 207 0,30 %<br />

Guyenne et Gascogne SA 29 525 155 0,73 %<br />

Haulotte Group 7 541 929 0,53 %<br />

Havas SA 78 399 745 1,28 %<br />

Hermes International 943 541 269 0,92 %<br />

Iliad SA 192 515 481 0,59 %<br />

Imerys SA 70 655 955 0,35 %<br />

IMS-Intl Metal Service 21 392 502 1,32 %<br />

Ingenico 38 547 372 0,75 %<br />

Ipsen SA 198 419 301 0,87 %<br />

IPSOS 58 860 567 0,93 %<br />

JC Decaux SA 93 085 025 0,35 %<br />

Kaufman & Broad SA 7 132 091 0,41 %<br />

Klepierre 174 043 939 0,61 %<br />

Lafarge SA 618 052 861 0,75 %<br />

Lagardere SCA 418 343 585 1,13 %<br />

Laurent-Perrier 102 662 709 3,01 %<br />

Legrand SA 169 377 769 0,48 %<br />

LISI 14 169 836 0,55 %<br />

LOreal SA 2 034 888 874 0,56 %<br />

LVMH Moet Hennessy Louis Vuitton SA 1 284 546 856 0,56 %<br />

M6-Metropole Television 168 690 318 0,97 %<br />

Maisons France Confort 14 321 390 1,81 %<br />

Manitou BF SA 14 349 228 0,48 %<br />

Meetic 9 455 278 0,56 %<br />

Mercialys SA 84 436 073 0,51 %<br />

Natixis 128 874 958 0,36 %<br />

Neopost SA 247 346 897 1,26 %<br />

Nexans SA 142 780 507 1,23 %<br />

Nexity 58 532 991 1,03 %<br />

NicOx SA 47 840 059 1,34 %<br />

Norbert Dentressangle 11 707 664 0,44 %<br />

NRJ Group 13 654 706 0,31 %<br />

Orco Property Group 12 558 201 1,82 %<br />

Orpea 49 549 716 0,53 %<br />

Market value<br />

Voting<br />

(per cent)<br />

Outremer Telecom 1 640 572 0,20 %<br />

PagesJaunes Groupe 73 412 996 0,38 %<br />

Parrot SA 5 352 128 0,96 %<br />

Pernod-Ricard SA 1 002 325 304 0,88 %<br />

Peugeot SA 261 613 785 0,95 %<br />

Pierre & Vacances 19 324 298 0,59 %<br />

Plastic Omnium SA 5 695 334 0,43 %<br />

Poweo 8 748 141 0,81 %<br />

PPR 553 096 437 0,96 %<br />

Publicis Groupe 196 012 354 0,56 %<br />

Rallye SA 36 854 662 0,56 %<br />

Recylex SA 6 534 201 1,13 %<br />

Remy Cointreau SA 76 970 221 0,56 %<br />

Renault SA 568 975 294 1,11 %<br />

Rexel SA 27 659 393 0,23 %<br />

Rhodia SA 59 661 639 1,35 %<br />

Rodriguez Group 1 511 566 0,90 %<br />

Rubis 30 754 711 0,68 %<br />

Sa des Ciments Vicat 32 283 860 0,20 %<br />

Saft Groupe SA 46 879 435 1,35 %<br />

San<strong>of</strong>i -Aventis SA 6 172 282 861 0,98 %<br />

Schneider Electric SA 1 522 007 788 1,19 %<br />

SCOR SE 555 802 115 1,89 %<br />

SEB SA 80 059 865 0,75 %<br />

Seche Environnement SA 27 158 931 0,73 %<br />

Sechilienne-Sidec 117 124 412 1,35 %<br />

SeLoger.com 14 403 055 0,85 %<br />

Sequana 8 783 410 0,42 %<br />

SES SA 585 099 453 1,31 %<br />

Societe BIC SA 175 956 398 0,90 %<br />

Societe de la Tour Eiffel 19 581 393 1,15 %<br />

Societe Des Autoroutes Paris-Rhin-Rhone 125 546 362 0,23 %<br />

Societe Fonciere Financiere et de Participations FFP 16 484 041 0,29 %<br />

Societe Generale 2 759 814 149 1,36 %<br />

Societe Immobiliere de Location pour lIndustrie et le<br />

Commerce 108 383 234 0,96 %<br />

Societe Television Francaise 1 116 027 953 0,54 %<br />

Sodexo 588 856 341 0,97 %<br />

SOITEC 39 662 038 1,51 %<br />

Sopra Group SA 14 253 675 0,50 %<br />

Sperian Protection 16 723 273 0,50 %<br />

Spir Communication 4 022 513 0,33 %<br />

Stallergenes 39 071 449 0,81 %<br />

STMicroelectronics NV 357 502 949 0,84 %<br />

Suez Environnement SA 410 518 382 0,71 %<br />

Synergie SA 4 709 843 0,34 %<br />

Technip SA 429 398 286 1,85 %<br />

Teleperformance 140 667 352 1,29 %<br />

Theolia SA 16 298 557 1,41 %<br />

Thomson 42 926 768 1,70 %<br />

Total SA 11 313 967 564 1,26 %<br />

Trigano SA 3 484 619 0,38 %<br />

UBISOFT Entertainment 223 492 295 1,76 %<br />

Unibail-Rodamco 1 123 111 277 1,32 %<br />

Union Financiere de France BQE SA 7 495 886 0,23 %<br />

Uniross Batteries SAS 612 656 0,75 %<br />

Valeo SA 94 364 552 1,17 %<br />

Vallourec 564 521 487 1,33 %<br />

Veolia Environnement 1 424 825 739 1,40 %<br />

Vilmorin & Cie 96 303 937 1,01 %<br />

Vinci SA 1 991 777 778 1,38 %<br />

Virbac SA 31 707 282 0,65 %<br />

Vivendi 3 363 146 261 1,27 %<br />

Wendel 108 256 604 0,62 %<br />

Zodiac SA 136 035 105 0,97 %<br />

GEORGIA<br />

<strong>Bank</strong> <strong>of</strong> Georgia JSC 3 649 677 0,40 %<br />

GERMANY<br />

Adidas AG 907 752 928 1,73 %<br />

Air Berlin PLC 25 982 582 0,86 %<br />

Aixtron AG 54 982 701 1,32 %<br />

Allianz SE 4 688 033 520 1,42 %<br />

AMB Generali <strong>Holding</strong> AG 69 833 245 0,18 %<br />

Arcandor AG 35 806 479 0,47 %<br />

Arques Industries AG 8 458 156 1,30 %<br />

AWD <strong>Holding</strong> AG 4 031 453 0,04 %<br />

Balda AG 623 777 0,23 %<br />

BASF SE 3 181 040 719 1,28 %<br />

Bauer AG 59 724 166 1,22 %<br />

Bayer AG 4 248 950 518 1,38 %<br />

Bayerische Motoren Werke AG 593 103 676 0,06 %<br />

BayWa AG 44 638 802 0,54 %<br />

Bechtle AG 27 225 630 0,97 %<br />

Beiersdorf AG 329 644 780 0,32 %<br />

Bilfi nger Berger AG 135 385 284 1,00 %<br />

Carl Zeiss Meditec AG 19 121 552 0,28 %<br />

CAT Oil AG 3 426 249 0,35 %<br />

Celesio AG 182 796 812 0,57 %<br />

Centrotherm Photovoltaics AG 27 207 800 0,87 %<br />

Colonia Real Estate AG 6 259 267 0,99 %<br />

Comdirect <strong>Bank</strong> AG 19 073 835 0,22 %<br />

7<br />

GOVERNMENT PENSION FUND <strong>–</strong> GLOBAL ANNUAL REPORT 2008

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>–</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> equities at 31 December 2008<br />

Market value<br />

Voting<br />

(per cent)<br />

Commerzbank AG 636 582 720 1,36 %<br />

Conergy AG 48 647 410 1,26 %<br />

Continental AG 1 082 316 289 0,50 %<br />

CropEnergies AG 6 261 199 0,26 %<br />

CTS Eventim AG 19 549 217 0,35 %<br />

DAB <strong>Bank</strong> AG 4 799 633 0,26 %<br />

Daimler AG 2 777 094 758 1,11 %<br />

Demag Cranes AG 48 337 810 1,25 %<br />

Deutsche <strong>Bank</strong> AG 1 933 009 054 1,25 %<br />

Deutsche Beteiligungs AG 21 190 722 1,30 %<br />

Deutsche Boerse AG 1 840 852 658 1,97 %<br />

Deutsche Euroshop AG 109 247 407 1,34 %<br />

Deutsche Lufthansa AG 344 975 688 0,69 %<br />

Deutsche Post AG 1 321 458 144 0,94 %<br />

Deutsche Postbank AG 161 915 092 0,49 %<br />

Deutsche Telekom AG 5 532 984 105 1,20 %<br />

Deutsche Wohnen AG 20 463 000 0,84 %<br />

Deutz AG 34 422 767 1,23 %<br />

DIC Asset AG 16 680 906 0,88 %<br />

Douglas <strong>Holding</strong> AG 162 091 937 1,32 %<br />

Draegerwerk AG & Co KGaA 15 774 512 0,00 %<br />

Duerr AG 8 679 177 0,42 %<br />

Dyckerh<strong>of</strong>f AG 7 358 401 0,00 %<br />

E.ON AG 9 089 589 165 1,64 %<br />

ElringKlinger AG 49 174 005 1,26 %<br />

EM.Sport Media AG 15 278 923 0,81 %<br />

Epcos AG 4 263 200 0,04 %<br />

Escada AG 3 555 930 0,52 %<br />

Fielmann AG 79 061 466 0,42 %<br />

Fraport AG Frankfurt Airport Services Worldwide 128 526 322 0,47 %<br />

Freenet AG 42 136 962 0,81 %<br />

Fresenius Medical Care AG & Co KGaA 868 537 913 0,91 %<br />

Fresenius SE 1 070 491 586 1,07 %<br />

Fuchs Petrolub AG 108 014 998 1,21 %<br />

GAGFAH SA 21 983 533 0,25 %<br />

GEA Group AG 578 669 510 2,66 %<br />

Gerresheimer AG 27 748 580 0,47 %<br />

Gerry Weber International AG 40 090 447 0,87 %<br />

GFK AG 26 163 707 0,34 %<br />

Gildemeister AG 49 527 091 1,50 %<br />

GPC Biotech AG 2 910 526 0,76 %<br />

Grenkeleasing AG 8 845 964 0,37 %<br />

H&R WASAG AG 23 613 358 0,74 %<br />

Hamburger Hafen und Logistik AG 68 093 472 0,41 %<br />

Hannover Rueckversicherung AG 114 122 131 0,43 %<br />

HeidelbergCement AG 62 499 425 0,16 %<br />

Heidelberger Druckmaschinen AG 51 876 874 1,13 %<br />

Henkel AG & Co KGaA 1 020 688 292 0,60 %<br />

Hochtief AG 274 556 178 1,13 %<br />

Hugo Boss AG 36 626 182 0,02 %<br />

Hypo Real Estate <strong>Holding</strong> AG 75 143 086 1,20 %<br />

IDS Scheer AG 8 135 184 0,43 %<br />

IKB Deutsche Industriebank AG 9 597 989 0,97 %<br />

Indus <strong>Holding</strong> AG 12 815 772 0,53 %<br />

Infi neon Technologies AG 75 317 300 1,08 %<br />

Interseroh SE 17 497 111 0,51 %<br />

IVG Immobilien AG 71 261 942 1,10 %<br />

Jenoptik AG 19 549 614 0,77 %<br />

Jungheinrich AG 16 709 140 0,00 %<br />

K+S AG 775 131 820 1,21 %<br />

Kizoo AG 9 337 485 0,59 %<br />

Kloeckner & Co SE 71 982 712 1,29 %<br />

Kloeckner-Werke AG 12 645 713 0,14 %<br />

Koenig & Bauer AG 10 817 400 0,69 %<br />

Kontron AG 43 601 789 1,21 %<br />

Krones AG 65 246 449 0,68 %<br />

KUKA AG 47 058 252 1,43 %<br />

Lanxess AG 129 971 848 1,17 %<br />

Leoni AG 59 980 470 1,60 %<br />

Linde AG 1 386 574 272 1,41 %<br />

MAN AG 894 370 548 1,68 %<br />

Manz Automation AG 19 885 018 1,09 %<br />

Medion AG 23 707 139 0,80 %<br />

Merck KGAA 480 643 502 1,18 %<br />

Metro AG 466 060 459 0,52 %<br />

MLP AG 94 960 913 0,92 %<br />

MPC Muenchmeyer Petersen Capital AG 4 608 336 0,44 %<br />

MTU Aero Engines <strong>Holding</strong> AG 96 537 951 0,97 %<br />

Muenchener Rueckversicherungs AG 2 674 970 946 1,20 %<br />

MVV Energie AG 38 698 565 0,19 %<br />

Norddeutsche Affi nerie AG 138 245 452 1,24 %<br />

Nordex AG 39 034 307 0,60 %<br />

Patrizia Immobilien AG 6 030 215 0,73 %<br />

Pfeiffer Vacuum Technology AG 47 072 337 1,15 %<br />

Pfl eiderer AG 14 669 880 0,43 %<br />

Phoenix Solar AG 23 668 437 1,45 %<br />

Porsche Automobil <strong>Holding</strong> SE 528 723 900 0,00 %<br />

Praktiker Bau- und Heimwerkermaerkte AG 63 593 824 1,44 %<br />

Premiere AG 47 947 699 1,18 %<br />

ProSiebenSat.1 Media AG 82 335 454 0,00 %<br />

Puma AG Rudolf Dassler Sport 104 488 552 0,48 %<br />

Market value<br />

Voting<br />

(per cent)<br />

Q-Cells SE 122 143 078 0,60 %<br />

Qiagen NV 242 392 199 1,02 %<br />

QSC AG 13 025 707 0,79 %<br />

Rational AG 43 946 322 0,47 %<br />

Rheinmetall AG 42 742 417 0,53 %<br />

Rhoen Klinikum AG 296 257 409 1,72 %<br />

RWE AG 3 504 679 584 1,02 %<br />

Salzgitter AG 301 443 710 0,94 %<br />

SAP AG 2 903 862 462 0,96 %<br />

Sartorius AG 5 245 048 0,00 %<br />

SGL Carbon AG 191 071 792 1,27 %<br />

Siemens AG 6 267 179 388 1,34 %<br />

Singulus Technologies 13 395 199 1,06 %<br />

Sixt AG 22 479 556 0,69 %<br />

SMA Solar Technology AG 59 125 602 0,47 %<br />

S<strong>of</strong>tware AG 108 344 146 0,97 %<br />

Solar Millennium AG 2 867 171 0,20 %<br />

Solarworld AG 147 960 035 0,90 %<br />

Solon SE 24 749 954 1,41 %<br />

Stada Arzneimittel AG 159 789 448 1,36 %<br />

Suedzucker AG 75 704 278 0,38 %<br />

Symrise AG 152 543 242 1,33 %<br />

Takkt AG 11 814 711 0,21 %<br />

Telegate AG 4 776 138 0,38 %<br />

Thielert AG 525 417 0,73 %<br />

ThyssenKrupp AG 859 578 418 0,91 %<br />

Tognum AG 111 733 076 0,97 %<br />

TUI AG 236 701 962 1,20 %<br />

United Internet AG 103 512 287 0,67 %<br />

Vivacon AG 7 544 235 1,00 %<br />

Volkswagen AG 2 618 613 452 0,15 %<br />

Vossloh AG 115 024 082 1,00 %<br />

Wacker Chemie AG 136 765 172 0,36 %<br />

Wincor Nixdorf AG 135 532 779 1,25 %<br />

Wirecard AG 40 321 936 0,99 %<br />

Aareal <strong>Bank</strong> AG 31 253 375 1,31 %<br />

GREECE<br />

Aegean Marine Petroleum Network Inc 74 732 909 1,48 %<br />

Agricultural <strong>Bank</strong> <strong>of</strong> Greece 30 301 531 0,25 %<br />

Alapis <strong>Holding</strong> Industrial and Commercial SA <strong>of</strong><br />

Pharmaceutical Che 53 020 345 1,03 %<br />

Alpha <strong>Bank</strong> AE 311 938 523 1,16 %<br />

Anek Lines SA 9 950 024 0,79 %<br />

Astir Palace Hotel SA 3 434 768 0,16 %<br />

Athens Medical Center SA 4 869 255 0,48 %<br />

Athens Water Supply & Sewage Co SA/The 18 755 398 0,35 %<br />

Attica <strong>Holding</strong>s SA 3 963 226 0,08 %<br />

Babis Vovos International Construction SA 88 068 597 2,98 %<br />

<strong>Bank</strong> <strong>of</strong> Attica 8 131 041 0,21 %<br />

Coca Cola Hellenic Bottling Co SA 103 928 239 0,28 %<br />

EFG Eurobank Ergasias SA 235 197 613 0,80 %<br />

Ellaktor SA 117 515 212 1,59 %<br />

Elval Aluminium Process Co 2 846 669 0,27 %<br />

Emporiki <strong>Bank</strong> SA 18 414 414 0,25 %<br />

Eurobank Properties Real Estate Investment Co 11 278 791 0,00 %<br />

Folli - Follie SA 17 899 486 0,96 %<br />

Forthnet SA 52 867 114 4,92 %<br />

Fourlis <strong>Holding</strong>s SA 71 275 619 2,87 %<br />

Frigoglass SA 7 797 103 0,59 %<br />

GEK Terna SA 47 752 195 2,24 %<br />

Geniki <strong>Bank</strong> 7 237 177 0,42 %<br />

Halcor SA 3 179 100 0,43 %<br />

Hellenic Duty Free Shops SA 6 366 604 0,22 %<br />

Hellenic Exchanges SA <strong>Holding</strong> Clearing Settlement and<br />

Registry 44 550 027 1,16 %<br />

Hellenic Petroleum SA 69 457 169 0,43 %<br />

Hellenic Telecommunications Organization SA 455 211 022 0,80 %<br />

Heracles General Cement Co SA 7 082 262 0,12 %<br />

Iaso SA 11 565 434 0,50 %<br />

Intracom <strong>Holding</strong>s SA 7 922 928 0,84 %<br />

Intralot SA-Integrated Lottery Systems & Services 51 421 305 1,11 %<br />

J&P-Avax SA 5 617 488 0,33 %<br />

JUMBO SA 79 590 075 1,55 %<br />

Kleeman Hellas SA 10 896 785 2,52 %<br />

Lambrakis Press SA 8 619 635 0,51 %<br />

Lamda Development SA 1 611 102 0,09 %<br />

Marfi n Investment Group SA 200 189 335 0,95 %<br />

Metka SA 16 802 906 0,50 %<br />

Michaniki SA 15 642 968 1,41 %<br />

MJ Maillis SA 1 225 116 0,52 %<br />

Motodynamic SA 127 554 0,14 %<br />

Motor Oil Hellas Corinth Refi neries SA 42 552 942 0,52 %<br />

Mytilineos <strong>Holding</strong>s SA 41 770 247 0,93 %<br />

National <strong>Bank</strong> <strong>of</strong> Greece SA 785 592 162 1,23 %<br />

OPAP SA 522 419 008 0,81 %<br />

Piraeus <strong>Bank</strong> SA 239 323 579 1,17 %<br />

Proton <strong>Bank</strong> SA 3 995 301 1,07 %<br />

Public Power Corp SA 102 683 144 0,39 %<br />