F:\LJ-010\893.Assignments\Current Document\F-2000-EH.893 ...

F:\LJ-010\893.Assignments\Current Document\F-2000-EH.893 ...

F:\LJ-010\893.Assignments\Current Document\F-2000-EH.893 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

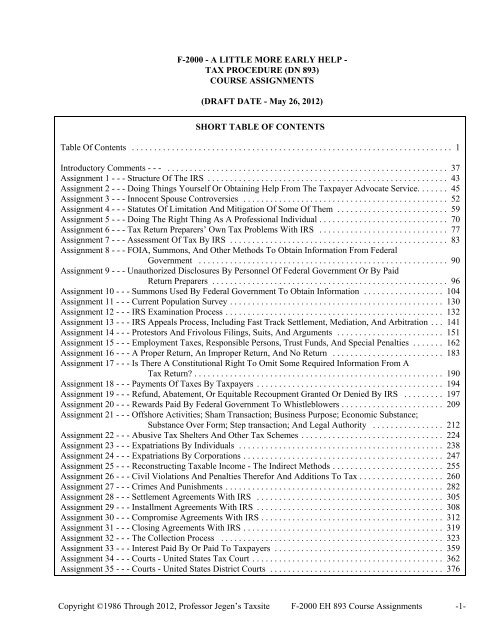

F-<strong>2000</strong> - A LITTLE MORE EARLY HELP -<br />

TAX PROCEDURE (DN 893)<br />

COURSE ASSIGNMENTS<br />

(DRAFT DATE - May 26, 2012)<br />

SHORT TABLE OF CONTENTS<br />

Table Of Contents ........................................................................ 1<br />

Introductory Comments - - - ............................................................... 37<br />

Assignment 1 - - - Structure Of The IRS ...................................................... 43<br />

Assignment 2 - - - Doing Things Yourself Or Obtaining Help From The Taxpayer Advocate Service....... 45<br />

Assignment 3 - - - Innocent Spouse Controversies .............................................. 52<br />

Assignment 4 - - - Statutes Of Limitation And Mitigation Of Some Of Them ......................... 59<br />

Assignment 5 - - - Doing The Right Thing As A Professional Individual ............................. 70<br />

Assignment 6 - - - Tax Return Preparers’ Own Tax Problems With IRS ............................. 77<br />

Assignment 7 - - - Assessment Of Tax By IRS ................................................. 83<br />

Assignment 8 - - - FOIA, Summons, And Other Methods To Obtain Information From Federal<br />

Government ........................................................ 90<br />

Assignment 9 - - - Unauthorized Disclosures By Personnel Of Federal Government Or By Paid<br />

Return Preparers ..................................................... 96<br />

Assignment 10 - - - Summons Used By Federal Government To Obtain Information .................. 104<br />

Assignment 11 - - - Current Population Survey ................................................ 130<br />

Assignment 12 - - - IRS Examination Process ................................................. 132<br />

Assignment 13 - - - IRS Appeals Process, Including Fast Track Settlement, Mediation, And Arbitration . . . 141<br />

Assignment 14 - - - Protestors And Frivolous Filings, Suits, And Arguments ........................ 151<br />

Assignment 15 - - - Employment Taxes, Responsible Persons, Trust Funds, And Special Penalties ....... 162<br />

Assignment 16 - - - A Proper Return, An Improper Return, And No Return ......................... 183<br />

Assignment 17 - - - Is There A Constitutional Right To Omit Some Required Information From A<br />

Tax Return?........................................................ 190<br />

Assignment 18 - - - Payments Of Taxes By Taxpayers .......................................... 194<br />

Assignment 19 - - - Refund, Abatement, Or Equitable Recoupment Granted Or Denied By IRS ......... 197<br />

Assignment 20 - - - Rewards Paid By Federal Government To Whistleblowers....................... 209<br />

Assignment 21 - - - Offshore Activities; Sham Transaction; Business Purpose; Economic Substance;<br />

Substance Over Form; Step transaction; And Legal Authority ................ 212<br />

Assignment 22 - - - Abusive Tax Shelters And Other Tax Schemes................................ 224<br />

Assignment 23 - - - Expatriations By Individuals .............................................. 238<br />

Assignment 24 - - - Expatriations By Corporations............................................. 247<br />

Assignment 25 - - - Reconstructing Taxable Income - The Indirect Methods ......................... 255<br />

Assignment 26 - - - Civil Violations And Penalties Therefor And Additions To Tax................... 260<br />

Assignment 27 - - - Crimes And Punishments................................................. 282<br />

Assignment 28 - - - Settlement Agreements With IRS .......................................... 305<br />

Assignment 29 - - - Installment Agreements With IRS .......................................... 308<br />

Assignment 30 - - - Compromise Agreements With IRS......................................... 312<br />

Assignment 31 - - - Closing Agreements With IRS............................................. 319<br />

Assignment 32 - - - The Collection Process .................................................. 323<br />

Assignment 33 - - - Interest Paid By Or Paid To Taxpayers ...................................... 359<br />

Assignment 34 - - - Courts - United States Tax Court........................................... 362<br />

Assignment 35 - - - Courts - United States District Courts ....................................... 376<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -1-

Assignment 36 - - - Courts - United States Court Of Federal Claims ............................... 406<br />

Assignment 37 - - - Courts - United States Bankruptcy Courts.................................... 416<br />

Assignment 38 - - - Courts - United States Courts Of Appeals .................................... 438<br />

Assignment 39 - - - Courts - United States District Of Columbia Circuit Court ....................... 455<br />

Assignment 40 - - - Courts - United States Court Of Appeals For The Federal Circuit ................. 462<br />

Assignment 41 - - - Courts - Supreme Court Of The United States................................. 465<br />

Assignment 42 - - - Reimbursements Of Costs Of Appeals And Of Litigation Or Of Damages;<br />

Determination Of The “Prevailing Party”................................. 471<br />

Assignment 43 - - - Injunctions And The Anti-Injunction Act .................................... 478<br />

Assignment 44 - - - Sovereign Immunity Of Federal Government ................................. 482<br />

Assignment 45 - - - Estoppel .............................................................. 484<br />

Assignment 46 - - - Tax Exempt Organizations................................................ 487<br />

BROADER TABLE OF CONTENTS<br />

Table Of Contents ........................................................................ 1<br />

INTRODUCTORY COMMENTS .......................................................... -36-<br />

The function of the regulations ...................................................... -38-<br />

The three types of regulations....................................................... -39-<br />

Private IRC publishers ............................................................ -39-<br />

Table of contents................................................................. -40-<br />

Index .......................................................................... -40-<br />

Each section of the regulations ...................................................... -40-<br />

Regulation §301.6201 ............................................................. -41-<br />

To repeat some of the comments above without so many words, read the following ............ -41-<br />

Legal memoranda ................................................................ -41-<br />

Does the IRC have a Topical Index? ................................................. -41-<br />

What organization issues the Income Tax Regulations?................................... -41-<br />

Compare section 164 and the regulations for that section ................................. -42-<br />

Compare the regulations' numbering for section 164 with its numbering for section 6201 ........ -42-<br />

Note the various units into which the regulations may be divided ........................... -42-<br />

Does your copy of the regulations have page numbers.................................... -42-<br />

In legal memorandums ............................................................ -42-<br />

If a regulation has been amended .................................................... -42-<br />

ASSIGNMENTS ....................................................................... -42-<br />

Assignment 1 - - - Structure Of The IRS ..................................................... -42-<br />

Examine the following nine provisions of the Constitution Of The United States Of America ..... -42-<br />

Examine the following IRC sections ................................................. -43-<br />

Application of Internal Revenue Laws ......................................... -43-<br />

Examine the following other federal statutes ........................................... -43-<br />

Examine the following facts, issues, opinions, and decisions............................... -43-<br />

Examine the following Federal Regulation provisions.................................... -43-<br />

Examine the following IRS’ IR Manual sections ........................................ -43-<br />

Organization and staffing.................................................... -43-<br />

Examine the following IRS Publications and similar IRS documents ........................ -43-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents .... -43-<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -2-

Some abbreviations and some documents ....................................... -43-<br />

Treasury Department (TD), TD News Releases (TDNR) ..................... -44-<br />

IRS’ nonacquiescence of court decisions ........................................ -44-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto ............... -44-<br />

Examine the following articles, letters, etc. from professional individuals .................... -44-<br />

Examine the following documents of Professor Jegen .................................... -44-<br />

Assignment 2 - - - Doing Things Yourself Or Obtaining Help From The Taxpayer Advocate Service ..... -45-<br />

Examine the following nine provisions of the Constitution Of The United States Of America ..... -45-<br />

Examine the following IRC sections ................................................. -45-<br />

Powers of Taxpayer Advocate Service ......................................... -45-<br />

Failure to keep records, provide notice, or original issue discount information .......... -45-<br />

Examine the following other federal statutes ........................................... -45-<br />

Examine the following facts, issues, opinions, and decisions............................... -45-<br />

Circular 230 contingent fee restrictions ......................................... -45-<br />

Two important cases concerning statute of limitations are as follows .................. -45-<br />

Cases which involve the two-year statute of limitations ............................ -46-<br />

Cases which involve the three-year statute of limitations (section 6501(a)) ............. -46-<br />

Cases which involve the six-year statute of limitations (section 6501(e)) ............... -47-<br />

Mitigation of statute of limitations ............................................ -47-<br />

90-day period to petition Tax Court after notice of deficiency ....................... -48-<br />

Statutes of limitations to enforce tax assessments under 6502(a)(1) ................... -48-<br />

Examine the following Federal Regulation provisions.................................... -48-<br />

Examine the following IRS’ IR Manual sections ........................................ -49-<br />

Organization and staffing.................................................... -49-<br />

Servicewide policy and authorities ............................................ -49-<br />

Resource guide for managers................................................. -49-<br />

Records and information management.......................................... -49-<br />

Taxpayer Advocate case procedure ............................................ -49-<br />

Systemic advocacy ......................................................... -49-<br />

National Taxpayer Advocate (NTA) Toll-Free Program............................ -49-<br />

TAS TAMIS Guide ........................................................ -49-<br />

Taxpayer Advocate Service communications .................................... -49-<br />

Examine the following IRS Publications and similar IRS documents ........................ -49-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents .... -50-<br />

Some abbreviations and some documents ....................................... -50-<br />

Treasury Department (TD), TD News Releases (TDNR) ........................... -50-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto ............... -50-<br />

Examine the following articles, letters, etc. from professional individuals .................... -51-<br />

Examine the following documents by Professor Jegen ................................... -51-<br />

Assignment 3 - - - Innocent Spouse Controversies ............................................. -51-<br />

Examine the following nine provisions of the Constitution Of The United States Of America ..... -51-<br />

Examine the following IRC sections ................................................. -52-<br />

Examine the following other federal statutes ........................................... -52-<br />

Examine the following facts, issues, opinions, and decisions............................... -52-<br />

Five important cases concerning innocent spouse controversies are as follows .......... -52-<br />

Innocent spouse winners .................................................... -52-<br />

Partial innocent spouse winners............................................... -53-<br />

Innocent spouse losers ...................................................... -53-<br />

Innocent spouse jurisdiction ................................................. -55-<br />

Examine the following Federal Regulation provisions.................................... -55-<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -3-

Examine the following IRS’ IR Manual sections ........................................ -56-<br />

Examining officers guide (EOG) .............................................. -56-<br />

Relief from joint and several liability .......................................... -56-<br />

Examine the following IRS Publications and similar IRS documents ........................ -56-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents .... -57-<br />

Some abbreviations and some documents ....................................... -57-<br />

Treasury Department (TD), TD News Releases (TDNR) ..................... -57-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto ............... -57-<br />

Examine the following articles, letters, etc. from professional individuals .................... -57-<br />

Examine the following documents of Professor Jegen .................................... -58-<br />

Assignment 4 - - - Statutes Of Limitation And Mitigation Of Some Of Them ........................ -58-<br />

Examine the following nine provisions of the Constitution Of The United States Of America ..... -58-<br />

Examine the following IRC sections ................................................. -58-<br />

General provisions ......................................................... -58-<br />

Periods of limitation on suits ................................................. -58-<br />

Mitigation of statutes of limitation ............................................. -58-<br />

Criminal periods of limitation ................................................ -59-<br />

Limitations on making assessments ............................................ -59-<br />

General civil periods of limitation (some for taxpayer and some for IRS) .............. -59-<br />

Limitations involved with respect to innocent spouse relief ......................... -59-<br />

Examine the following other federal statutes ........................................... -59-<br />

Examine the following facts, issues, opinions, and decisions............................... -59-<br />

Two important cases concerning statute of limitations are as follows .................. -59-<br />

Cases which involve the two-year statute of limitation ............................. -59-<br />

Cases which involve the three-year statute of limitation (section 6501(a)) .............. -60-<br />

Cases which involve the six-year statute of limitation (section 6501(e)) ............... -63-<br />

Mitigation of statute of limitations ............................................. -65-<br />

Agreement to extend statute of limitations by execution of installment agreement ....... -65-<br />

90 day period to petition Tax Court after Notice of Deficiency ...................... -66-<br />

Statute of limitations to enforce tax assessments under 6502(a)(1) .................... -66-<br />

Statute of limitations to bring suit from the date of levy under section 6532 ............ -66-<br />

Examine the following Federal Regulation provisions.................................... -67-<br />

Examine the following IRS’ IR Manual sections ........................................ -68-<br />

Examination Returns Control System (ERCS) ................................... -68-<br />

Bankruptcy............................................................... -68-<br />

Field collecting procedures .................................................. -68-<br />

Installment agreements ..................................................... -68-<br />

Appeals statute responsibility ................................................ -68-<br />

Statute of limitations ....................................................... -68-<br />

Examine the following IRS Publications and similar IRS documents ........................ -68-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents .... -68-<br />

Some abbreviations and some documents ....................................... -69-<br />

Treasury Department (TD), TD News Releases (TDNR) ..................... -69-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto ............... -69-<br />

Examine the following articles, letters, etc. from professional individuals .................... -69-<br />

Examine the following documents of Professor Jegen .................................... -69-<br />

Assignment 5 - - - Doing The Right Thing As A Professional Individual ............................ -70-<br />

Examine the following nine provisions of the Constitution Of The United States Of America ..... -70-<br />

Examine the following IRC sections ................................................. -70-<br />

Failure to keep records, provide notice, or original issue discount information .......... -70-<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -4-

My list of some of the rights of taxpayers ....................................... -70-<br />

General provisions ......................................................... -71-<br />

Frivolous suits, delays, and other frivolous and other abusive activities ................ -71-<br />

Filing fraudulent documents or failing to produce/file a document ................... -71-<br />

Income tax preparers ....................................................... -71-<br />

Unauthorized use of information by preparers of returns ........................... -71-<br />

Failing to comply with information reporting requirements ......................... -71-<br />

Examine the following other federal statutes ........................................... -72-<br />

Examine the following facts, issues, opinions, and decisions............................... -72-<br />

Examine the following Federal Regulation provisions.................................... -73-<br />

Examine the following IRS’ IR Manual sections ........................................ -74-<br />

Servicewide policies and authorities ........................................... -74-<br />

Returns and documents analysis .............................................. -74-<br />

Examination of returns...................................................... -74-<br />

Examine the following IRS Publications and similar IRS documents ........................ -74-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents .... -74-<br />

Some abbreviations and some documents ....................................... -74-<br />

Treasury Department (TD), TD News Releases (TDNR) ..................... -74-<br />

Department Of Justice (DOJ), DOJ Press Release (DOJ PR) ........................ -75-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto ............... -76-<br />

Examine the following articles, letters, etc. from professional individuals .................... -76-<br />

Examine the following documents of Professor Jegen .................................... -76-<br />

Assignment 6 - - - Tax Return Preparer’s Own Tax Problems With IRS ............................ -76-<br />

Examine the following nine provisions of the Constitution Of The United States Of America ..... -76-<br />

Examine the following IRC sections ................................................. -77-<br />

Tax returns or statements .................................................... -77-<br />

Additions to the tax, additional amounts, and assessable penalties .................... -77-<br />

Unauthorized use of information by preparers of returns ........................... -77-<br />

Failing to comply with information reporting requirements ......................... -77-<br />

Examine the following other federal statutes ........................................... -77-<br />

Examine the following facts, issues, opinions, and decisions............................... -77-<br />

Examine the following Federal Regulation provisions.................................... -78-<br />

Examine the following IRS’ IR Manual sections ........................................ -80-<br />

International returns and document analysis ..................................... -80-<br />

Planning and special programs ............................................... -80-<br />

Examining officers guide (EOG) .............................................. -80-<br />

Employment tax........................................................... -80-<br />

Abusive tax avoidance transactions (ATAT)..................................... -80-<br />

Penalties worked in appeals .................................................. -80-<br />

Penalty handbook .......................................................... -80-<br />

Examine the following IRS Publications and similar IRS documents ........................ -80-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents .... -81-<br />

Some abbreviations and some documents ....................................... -81-<br />

Treasury Department (TD), TD News Releases (TDNR) ..................... -81-<br />

Department Of Justice (DOJ), DOJ Press Release (DOJ PR) .................. -81-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto ............... -81-<br />

Examine the following articles, letters, etc. from professional individuals .................... -82-<br />

Examine the following documents of Professor Jegen .................................... -82-<br />

Assignment 7 - - - Assessment Of Tax By IRS ................................................ -82-<br />

Examine the following nine provisions of the Constitution Of The United States Of America ..... -82-<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -5-

Examine the following IRC sections ................................................. -82-<br />

Assessment procedures ..................................................... -82-<br />

Deficiencies .............................................................. -83-<br />

Jeopardy assessments ....................................................... -83-<br />

Receiverships ............................................................. -83-<br />

Transferees and fiduciaries .................................................. -83-<br />

Additions to the tax, additional amounts, and assessable penalties .................... -83-<br />

Partnerships .............................................................. -83-<br />

Failure to keep records, provide notice, or original issue discount information .......... -83-<br />

Failing to comply with information reporting requirements ......................... -84-<br />

Procedural requirements .................................................... -84-<br />

Suit for damages .......................................................... -84-<br />

Examine the following other federal statutes ........................................... -84-<br />

Examine the following facts, issues, opinions, and decisions............................... -84-<br />

Normal method of assessment of tax ........................................... -84-<br />

Taxpayer files timely and proper return and pays full amount of tax due ........ -84-<br />

Taxpayer files timely and proper return but does not pay total tax due .......... -84-<br />

Tax Assessment timely and properly applied by IRS .............................. -84-<br />

Taxpayer does not file return nor pay total tax due ......................... -85-<br />

Jeopardy assessment ....................................................... -85-<br />

Termination of taxpayer’s current taxable year -.................................. -86-<br />

Suit for damages and exhaust administrative remedies ............................. -86-<br />

Examine the following Federal Regulation provisions.................................... -86-<br />

Examine the following IRS’ IR Manual sections ........................................ -87-<br />

Revenue accounting........................................................ -87-<br />

Accounting and data control ................................................. -87-<br />

AIMS processing .......................................................... -87-<br />

Jeopardy/Termination assessments ............................................ -87-<br />

Employment tax........................................................... -87-<br />

Field collecting procedures .................................................. -87-<br />

Trust fund................................................................ -88-<br />

Notice of levy............................................................. -88-<br />

Legal reference guide for revenue officers ...................................... -88-<br />

Abusive tax avoidance transactions (ATAT)..................................... -88-<br />

Technical and procedural guidelines ........................................... -88-<br />

Individual tax returns ....................................................... -88-<br />

Statute of limitations ....................................................... -88-<br />

Decisions, orders of dismissal, and other final judgements .......................... -88-<br />

Post opinion activities ...................................................... -88-<br />

Examine the following IRS Publications and similar IRS documents ........................ -88-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents .... -88-<br />

Some abbreviations and some documents ....................................... -88-<br />

Treasury Department (TD), TD News Releases (TDNR) ..................... -88-<br />

Internal Revenue Service Revenue rulings, revenue procedures, notices, etc. ........... -89-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto ............... -89-<br />

Examine the following articles, letters, etc. from professional individuals .................... -89-<br />

Examine the following documents of Professor Jegen ................................... -89-<br />

Assignment 8 - - - FOIA, Summons, And Other Methods To Obtain Information From Federal Government<br />

.............................................................................. -89-<br />

Examine the following nine provisions of the Constitution Of The United States Of America ..... -89-<br />

Examine the following IRC sections ................................................. -90-<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -6-

Miscellaneous provisions.................................................... -90-<br />

Assessment ............................................................... -90-<br />

Crimes, other offenses, and forfeitures ......................................... -90-<br />

Proceedings by taxpayers and third parties ...................................... -90-<br />

Examine the following other federal statutes ........................................... -90-<br />

Examine the following facts, issues, opinions, and decisions............................... -90-<br />

Freedom of Information requests.............................................. -90-<br />

Granted ........................................................... -90-<br />

Denied............................................................ -91-<br />

Other means to obtain information from the federal government ..................... -91-<br />

Demand of FOIA sent ...................................................... -91-<br />

Examine the following Federal Regulation provisions.................................... -91-<br />

Examine the following IRS’ IR Manual sections ........................................ -93-<br />

Internal management documents system ........................................ -93-<br />

Disclosure of official information ............................................. -93-<br />

Summons ................................................................ -94-<br />

Freedom of information act chief counsel records................................. -94-<br />

Disclosure ............................................................... -94-<br />

Examine IRS Publications and similar IRS documents ................................... -94-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents. . . . -94-<br />

Some abbreviations and some documents ....................................... -94-<br />

Treasury Department (TD), TD News Releases (TDNR) ..................... -94-<br />

Internal Revenue Service Revenue rulings, revenue procedures, notices, etc. ........... -94-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto ............... -95-<br />

Examine the following articles, letters, etc. from professional individuals .................... -95-<br />

Examine the following documents of Professor Jegen ................................... -95-<br />

Assignment 9 - - - Unauthorized Disclosures By Personnel Of Federal Government Or By Paid Return Preparers<br />

.............................................................................. -95-<br />

Examine the following nine provisions of the Constitution Of The United States Of America ..... -95-<br />

Examine the following IRS sections.................................................. -95-<br />

General procedures ........................................................ -95-<br />

Specific to tax preparers and inspectors......................................... -95-<br />

Failure to disclose information ............................................... -96-<br />

Unauthorized use of information by preparers of returns ........................... -96-<br />

Examine the following other federal statutes ........................................... -96-<br />

Additional Statutes......................................................... -96-<br />

Examine the following facts, issues, opinions, and decisions............................... -96-<br />

Authorized disclosures (or not) by Personnel Federal Government ................... -96-<br />

Unauthorized disclosure (or not) by Personnel of Federal Government ................ -96-<br />

Private preparer-disclosure authorized.......................................... -97-<br />

Unauthorized (or not) disclosure by paid return preparers .......................... -98-<br />

Partially authorized disclosures by personnel of Federal Government ................. -98-<br />

Partially authorized disclosures by paid return preparers ........................... -99-<br />

Examine the following Federal Regulation provisions.................................... -99-<br />

Disclosure requirements and process ........................................... -99-<br />

Rules governing scope of what can be disclosed ................................. -100-<br />

Rules governing tax preparers ............................................... -100-<br />

Examine the following IRS’ IR Manual sections ....................................... -100-<br />

Statewide policies and activities ............................................. -100-<br />

General examining procedures............................................... -101-<br />

Bank Secrecy Act......................................................... -101-<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -7-

Field collecting procedures ................................................. -101-<br />

Bankruptcy and other solvencies ............................................. -101-<br />

Exempt organizations disclosure procedures.................................... -101-<br />

Appeals function ......................................................... -101-<br />

Disclosure and publicity ................................................... -101-<br />

Disclosure of official information ............................................ -101-<br />

Disclosure, testimony, and production of documents ............................. -102-<br />

Sections 6110 and 6103 of Title 26 ........................................... -102-<br />

Examine the following IRS Publications and similar IRS documents ....................... -102-<br />

General information ....................................................... -102-<br />

Disclosure-Specific Publications ............................................. -102-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents . . . -102-<br />

Some abbreviations and some documents ...................................... -102-<br />

Treasury Department (TD), TD News Releases (TDNR) .................... -102-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto .............. -103-<br />

Examine the following articles, letters, etc. from professional individuals ................... -103-<br />

Examine the following documents of Professor Jegen .................................. -103-<br />

Assignment 10 - - - Summons Used By Federal Government To Obtain Information ................. -103-<br />

Examine the following nine provisions of the Constitution Of The United States Of America .... -103-<br />

Examine the following IRC sections ................................................ -103-<br />

Unauthorized use of information by preparers of returns .......................... -103-<br />

Returns and records ....................................................... -104-<br />

Assessment procedures .................................................... -104-<br />

Jeopardy assessments ...................................................... -104-<br />

Fraud .................................................................. -104-<br />

Additions to the tax, additional amounts, and assessable penalties ................... -104-<br />

Partnerships ............................................................. -104-<br />

Collection............................................................... -104-<br />

Service and Enforcement of summons......................................... -104-<br />

Confidentiality and disclosure ............................................... -105-<br />

Crimes involving summonses ............................................... -105-<br />

Failure to disclose information .............................................. -105-<br />

Suits for damages and awards ............................................... -105-<br />

Examine the following other federal statutes .......................................... -105-<br />

Examine the following facts, issues, opinions, and decisions.............................. -105-<br />

The leading case which provides the tests for having a valid summons ............... -105-<br />

General summonses ....................................................... -106-<br />

Third-party summonses .................................................... -109-<br />

Powell tests not met ....................................................... -115-<br />

Enforcement of summons .................................................. -116-<br />

John Doe summonses ..................................................... -120-<br />

Work product accrual workpapers ........................................... -121-<br />

Summons to obtain software ................................................ -121-<br />

Summons issued to a State.................................................. -122-<br />

First, Second, Fourth, Fifth, and Sixth Amendments Of Constitution Of U.S.A. - ....... -123-<br />

Court orders individual to deliver documents to IRS ............................. -124-<br />

Motion to Quash IRS Subpoena ............................................. -125-<br />

Firm not compelled to produce documents in tax shelter investigation................ -125-<br />

Examine the following Federal Regulation provisions................................... -125-<br />

Examine the following IRS’ IR Manual sections ....................................... -126-<br />

Legal reference guide for revenue officers ..................................... -126-<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -8-

Abusive tax avoidance transactions (ATAT).................................... -126-<br />

Summons ............................................................... -126-<br />

Suits brought by the United States ............................................ -126-<br />

Examine the following IRS Publications and similar IRS documents ....................... -126-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents . . . -126-<br />

Some abbreviations and some documents ...................................... -126-<br />

Treasury Department (TD), TD News Releases (TDNR) .................... -126-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto .............. -127-<br />

Examine the following articles, letters, etc. from professional individuals ................... -127-<br />

Examine the following documents of Professor Jegen .................................. -128-<br />

Assignment 11 - - - Current Population Survey ............................................... -129-<br />

Examine the following nine provisions of the Constitution Of The United States Of America . . . -129-<br />

Examine the following IRC sections ................................................ -129-<br />

Examine the following other federal statutes .......................................... -129-<br />

Examine the following facts, issues, opinions, and decisions.............................. -129-<br />

Examine the following Federal Regulation provisions................................... -129-<br />

Examine the following IRS’ IR Manual sections ....................................... -129-<br />

Organization and staffing................................................... -129-<br />

Statistics of income processing .............................................. -129-<br />

Statistics of income processing .............................................. -129-<br />

Examine the following IRS Publications and similar IRS documents ....................... -129-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents . . . -129-<br />

Some abbreviations and some documents ...................................... -130-<br />

Treasury Department (TD), TD News Releases (TDNR) .................... -130-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto .............. -130-<br />

Examine the following articles, letters, etc. from professional individuals ................... -130-<br />

Examine the following documents of Professor Jegen ................................... -130-<br />

Assignment 12 - - - IRS Examination Process ................................................ -130-<br />

Examine the following nine provisions of the Constitution Of The United States Of America .... -130-<br />

Examine the following IRC sections ................................................ -130-<br />

Miscellaneous provisions................................................... -130-<br />

Examination and inspection................................................. -130-<br />

Accounting periods ....................................................... -131-<br />

Crimes, other offenses and forfeiture .......................................... -131-<br />

Civil Actions by the United States............................................ -131-<br />

Assessment .............................................................. -131-<br />

Collection............................................................... -131-<br />

Jeopardy ................................................................ -131-<br />

Judicial proceedings ....................................................... -131-<br />

Additions to the tax, additional amounts, and assessable penalties ................... -131-<br />

Partnerships ............................................................. -132-<br />

Failure to keep records, provide notice, or original issue discount information ......... -132-<br />

Failing to comply with information reporting requirements ........................ -132-<br />

Procedural requirements ................................................... -132-<br />

Examine the following other federal statutes .......................................... -132-<br />

Examine the following facts, issues, opinions, and decisions.............................. -132-<br />

Examine the following Federal Regulation provisions................................... -133-<br />

Examine the following IRS’ IR Manual sections ....................................... -134-<br />

General IR Manual examination sections ...................................... -134-<br />

Servicewide policies and authorities .................................... -134-<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -9-

Resource guide for managers ......................................... -134-<br />

Records and information management .................................. -134-<br />

Planning and special programs ........................................ -134-<br />

General examining procedures ........................................ -134-<br />

Examination of returns .............................................. -134-<br />

Miscellaneous provisions ............................................ -135-<br />

Jeopardy/Termination assessments ..................................... -135-<br />

Special Enforcement Program (SEP) ................................... -135-<br />

Liability determination .............................................. -135-<br />

National Research Program (NRP) ..................................... -135-<br />

Employment tax ................................................... -135-<br />

Bank Secrecy Act .................................................. -135-<br />

Bankruptcy ....................................................... -135-<br />

Examination specialization ........................................... -135-<br />

Abusive tax avoidance transactions (ATAT) ............................. -135-<br />

Appeals .......................................................... -135-<br />

Pre-90-day and 90-day cases ......................................... -136-<br />

Investigative techniques ............................................. -136-<br />

Criminal investigation management information system (CIMIS)............. -136-<br />

Penalty handbook .................................................. -136-<br />

Account resolution ................................................. -136-<br />

Fraud handbook ................................................... -136-<br />

Summons ........................................................ -136-<br />

Statute of limitations................................................ -136-<br />

Relief from joint and several liability ................................... -136-<br />

Some IR Manual sections which are specifically applicable to exempt organizations .... -136-<br />

Exempt organizations examination procedures ........................... -136-<br />

Examine the following IRS Publications and similar IRS documents ....................... -137-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents . . . -137-<br />

Some abbreviations and some documents ...................................... -137-<br />

Treasury Department (TD), TD News Releases (TDNR) .................... -137-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto .............. -138-<br />

Examine the following articles, letters, etc. from professional individuals ................... -139-<br />

Examine the following documents of Professor Jegen .................................. -139-<br />

Assignment 13 - - - IRS Appeals Process, Including Fast Track Settlement, Mediation, And Arbitration . . -139-<br />

Examine the following nine provisions of the Constitution Of The United States Of America .... -139-<br />

Examine the following IRC sections ................................................ -139-<br />

Examination and Inspection................................................. -139-<br />

Accounting periods ....................................................... -140-<br />

Miscellaneous provisions................................................... -140-<br />

Assessment .............................................................. -140-<br />

Closing agreements and confidentiality ........................................ -140-<br />

Collection............................................................... -140-<br />

Jeopardy ................................................................ -140-<br />

Proceedings by Taxpayers and Third Parties .................................... -140-<br />

Court Review of Tax Court Decisions......................................... -140-<br />

Examine the following other federal statutes .......................................... -140-<br />

Examine the following facts, issues, opinions, and decisions.............................. -140-<br />

General appeals procedure.................................................. -140-<br />

Fast track settlement ....................................................... -141-<br />

Mediation ............................................................... -141-<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -10-

Arbitration .............................................................. -141-<br />

Examine the following Federal Regulation provisions................................... -141-<br />

Examine the following IRS’ IR Manual sections ....................................... -141-<br />

Appeals ................................................................ -141-<br />

Organization and staffing ............................................ -141-<br />

Servicewise policies and authorities .................................... -141-<br />

Resource guide for managers ......................................... -142-<br />

AIMS processing .................................................. -142-<br />

Examination of returns .............................................. -142-<br />

Audit reconsideration ............................................... -142-<br />

Jeopardy/Termination assessments ..................................... -142-<br />

Special Enforcement Program (SEP) ................................... -142-<br />

Bank Secrecy Act .................................................. -142-<br />

LMSB examinations ................................................ -142-<br />

TE/GE examinations................................................ -142-<br />

Field collecting procedures........................................... -142-<br />

Federal tax liens ................................................... -142-<br />

Installment agreement............................................... -142-<br />

Liability collection ................................................. -143-<br />

Appeals .......................................................... -143-<br />

Appeals function ................................................... -143-<br />

Pre-90-day and 90-day cases ......................................... -143-<br />

Appeals docketed cases .............................................. -143-<br />

Conference and settlement practices .................................... -143-<br />

Technical and procedural guidelines ................................... -143-<br />

Appeals reports and projects.......................................... -144-<br />

Penalties worked in appeals .......................................... -144-<br />

Closing agreements................................................. -144-<br />

Settlement computations and statutory notices of deficiency ................. -144-<br />

Valuation assistance ................................................ -144-<br />

Appeals pass-through entity handbook .................................. -144-<br />

Appeals case processing manual ....................................... -144-<br />

Appeals statute responsibility ......................................... -145-<br />

Collection due process .............................................. -145-<br />

Offer in compromise ................................................ -145-<br />

Collection appeals program and jeopardy levy appeals ..................... -145-<br />

Alternative dispute resoltions (ADR) program............................ -145-<br />

Investigative techniques ............................................. -145-<br />

Criminal investigation management information system (CIMIS)............. -145-<br />

Penalty handbook .................................................. -145-<br />

Relief from joint and several liability ................................... -146-<br />

Legal advice ...................................................... -146-<br />

Settlement procedures ............................................... -146-<br />

Settlement procedures ............................................... -146-<br />

Guiding principles for appeals ........................................ -146-<br />

Appeal/Certiorari recommendations .................................... -146-<br />

Examine the following IRS Publications and similar IRS documents ....................... -146-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents. . . -147-<br />

Some abbreviations and some documents ...................................... -147-<br />

Treasury Department (TD), TD News Releases (TDNR) .................... -147-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto .............. -148-<br />

Examine the following articles, letters, etc. from professional individuals ................... -149-<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -11-

Examine the following documents of Professor Jegen .................................. -149-<br />

Assignment 14 - - - Protestors And Frivolous Filings, Suits, And Arguments ....................... -149-<br />

Examine the following nine provisions of the Constitution Of The United States Of America .... -149-<br />

Examine the following IRC sections ................................................ -149-<br />

Returns and records ....................................................... -149-<br />

Additions to the tax, additional amounts, and assessable penalties ................... -150-<br />

Fraud .................................................................. -150-<br />

Collections .............................................................. -150-<br />

Suits brought by the United States ............................................ -150-<br />

Examine the following other federal statutes .......................................... -150-<br />

Examine the following facts, issues, opinions, and decisions.............................. -150-<br />

Protesters ............................................................... -150-<br />

Collections, frivolous arguments ............................................. -156-<br />

Assessment of tax ........................................................ -157-<br />

Individuals making tax-protestor arguments is liable for deficiencies, additional to tax . . . -157-<br />

Examine the following Federal Regulation provisions................................... -157-<br />

Examine the following sections of the IRS’ IR Manual .................................. -157-<br />

Examination of returns..................................................... -157-<br />

Abusive tax avoidance transactions ........................................... -157-<br />

Examine the following IRS Publications and similar IRS documents ....................... -157-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents . . . -158-<br />

Some abbreviations and some documents ...................................... -158-<br />

Treasury Department (TD), TD News Releases (TDNR) .................... -158-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto .............. -159-<br />

Examine the following articles, letters, etc. from professional individuals ................... -160-<br />

Examine the following documents of Professor Jegen .................................. -160-<br />

Assignment 15 - - - Employment Taxes, Responsible Persons, Trust Funds, And Special Penalties ...... -160-<br />

Examine the following nine provisions of the Constitution Of The United States Of America .... -160-<br />

Examine the following IRC sections ................................................ -160-<br />

Definitions .............................................................. -160-<br />

Liability for tax .......................................................... -161-<br />

FICA tax on employees .................................................... -161-<br />

FICA tax on employers .................................................... -161-<br />

FICA general provisions ................................................... -161-<br />

FUTA rates and credits .................................................... -161-<br />

FUTA state laws ......................................................... -161-<br />

FUTA general provisions................................................... -161-<br />

Withholding from wages ................................................... -161-<br />

Liens, levies, hearings, etc. ................................................. -162-<br />

Collection, deductibility, and errors ........................................... -162-<br />

Agents and third parties .................................................... -162-<br />

Civil penalties ........................................................... -162-<br />

Crimes and punishments ................................................... -162-<br />

Miscellaneous provisions................................................... -162-<br />

Returns ................................................................. -163-<br />

Judicial proceedings by taxpayers ............................................ -163-<br />

Examine the following other federal statutes .......................................... -163-<br />

Examine the following facts, issues, opinions, and decisions.............................. -163-<br />

Who is an “employer”? .................................................... -163-<br />

Who is an “employee”? .................................................... -164-<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -12-

Deduction of tax from wages................................................ -167-<br />

Responsible persons for trust fund penalty assessment ............................ -167-<br />

Who is a "responsible person"? ............................................. -168-<br />

Foreclosure of tax liens to satisfy employment taxes ............................. -172-<br />

Who owes the 100% penalty of section 6672? .................................. -172-<br />

Meaning of “willfulness” test in section 6672 ................................... -172-<br />

What is “reasonable cause”? ................................................ -174-<br />

Examine the following Federal Regulation provisions................................... -176-<br />

Examine the following IRS’ IR Manual sections ....................................... -177-<br />

Statewide financial policies and procedures .................................... -177-<br />

Returns and document analysis .............................................. -177-<br />

Error resolution .......................................................... -177-<br />

ISRP system............................................................. -177-<br />

AIMS processing ......................................................... -177-<br />

Employment tax.......................................................... -177-<br />

Bank Secrecy Act......................................................... -178-<br />

Legal reference guide for revenue officers ..................................... -178-<br />

Trust fund compliance ..................................................... -178-<br />

Installment agreements .................................................... -178-<br />

Liability collection ........................................................ -178-<br />

Exempt organizations determinations manual ................................... -178-<br />

Appeals function ......................................................... -178-<br />

Trust fund recovery penalty (TFRP) .......................................... -178-<br />

Disclosure of official information ............................................ -179-<br />

Penalty handbook ......................................................... -179-<br />

Interest ................................................................. -179-<br />

Examine the following IRS Publications and similar IRS documents ....................... -179-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents . . . -179-<br />

Some abbreviations and some documents ...................................... -179-<br />

Treasury Department (TD), TD News Releases (TDNR) .................... -179-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto .............. -180-<br />

Examine the following articles, letters, etc. from professio nal individuals ................... -180-<br />

Examine the following documents of Professor Jegen ................................... -181-<br />

Assignment 16 - - - A Proper Return, An Improper Return, And No Return ........................ -181-<br />

Examine the following nine provisions of the Constitution Of The United States Of America .... -181-<br />

Examine the following IRC sections ................................................ -181-<br />

Additions to the tax, additional amounts, and assessable penalties ................... -181-<br />

Miscellaneous provisions................................................... -181-<br />

Failure to keep records, provide notice, or original issue discount information ......... -182-<br />

Failing to comply with information reporting requirements ........................ -182-<br />

Examine the following other federal statutes .......................................... -182-<br />

Examine the following facts, issues, opinions, and decisions.............................. -182-<br />

....................................................................... -182-<br />

When is a return a return? .................................................. -182-<br />

Improper return .......................................................... -183-<br />

No return ............................................................... -184-<br />

Examine the following Federal Regulation provisions................................... -185-<br />

Examine the following IRS’ IR Manual sections ....................................... -186-<br />

Returns and documents analysis ............................................. -186-<br />

Error resolution .......................................................... -187-<br />

AIMS processing ......................................................... -187-<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -13-

Examination of returns..................................................... -187-<br />

Nonfiled returns .......................................................... -187-<br />

Collecting process ........................................................ -187-<br />

Penalty handbook ......................................................... -187-<br />

Examine the following IRS Publications and similar IRS documents ....................... -187-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents. . . -188-<br />

Some abbreviations and some documents ...................................... -188-<br />

Treasury Department (TD), TD News Releases (TDNR) .................... -188-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto .............. -188-<br />

Examine the following articles, letters, etc. from professional individuals ................... -188-<br />

Examine the following documents of Professor Jegen ................................... -188-<br />

Assignment 17 - - - Is There A Constitutional Right To Omit Some Required Information From A Tax Return?<br />

-188-<br />

Examine the following nine provisions of the Constitution Of The United States Of America .... -188-<br />

Examine the following IRC sections ................................................ -189-<br />

Examine the following other federal statutes .......................................... -189-<br />

Examine the following facts, issues, opinions, and decisions.............................. -189-<br />

Examine the following Federal Regulation provisions................................... -190-<br />

Examine the following IRS’ IR Manual sections ....................................... -190-<br />

Examine the following IRS Publications and similar IRS documents ....................... -190-<br />

Returns and documents analysis ............................................. -190-<br />

Error resolution .......................................................... -190-<br />

AIMS processing ......................................................... -191-<br />

Examination of returns..................................................... -191-<br />

Collecting process ........................................................ -191-<br />

Penalty handbook ......................................................... -191-<br />

Fraud handbook .......................................................... -191-<br />

Statute of limitations ...................................................... -191-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents . . . -191-<br />

Some abbreviations and some documents ...................................... -191-<br />

Treasury Department (TD), TD News Releases (TDNR) .................... -191-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto .............. -192-<br />

Examine the following articles, letters, etc. from professional individuals ................... -192-<br />

Examine the following documents of Professor Jegen ................................... -192-<br />

Assignment 18 - - - Payments Of Taxes By Taxpayers ......................................... -192-<br />

Examine the following nine provisions of the Constitution Of The United States Of America .... -192-<br />

Examine the following IRC sections ................................................ -192-<br />

Examine the following other federal statutes .......................................... -192-<br />

Examine the following facts, issues, opinions, and decisions.............................. -192-<br />

Examine the following Federal Regulation provisions................................... -193-<br />

Examine the following IRS’ IR Manual sections ....................................... -194-<br />

Accounting and data control ................................................ -194-<br />

AIMS processing ......................................................... -194-<br />

Examination collectability .................................................. -194-<br />

Field collecting procedures ................................................. -194-<br />

Trust fund compliance ..................................................... -194-<br />

Bankruptcy and other insolvency............................................. -194-<br />

Installment agreements .................................................... -194-<br />

Interest ................................................................. -194-<br />

Decisions, orders of dismissal, and other final judgements ......................... -194-<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -14-

Examine the following IRS Publications and similar IRS documents ....................... -194-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents . . . -195-<br />

Some abbreviations and some documents ...................................... -195-<br />

Treasury Department (TD), TD News Releases (TDNR) .................... -195-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto .............. -195-<br />

Examine the following articles, letters, etc. from professional individuals ................... -195-<br />

Examine the following documents of Professor Jegen ................................... -195-<br />

Assignment 19 - - - Refund, Abatement, Or Equitable Recoupment Granted Or Denied By IRS ........ -195-<br />

Examine the following nine provisions of the Constitution Of The United States Of America .... -195-<br />

Examine the following IRC sections ................................................ -196-<br />

Assessment .............................................................. -196-<br />

Abatements, Credits, and Refunds ............................................ -196-<br />

Limitations on Credit or Refund ............................................. -196-<br />

Interest ................................................................. -196-<br />

Receiverships ............................................................ -196-<br />

Judicial Proceedings ....................................................... -196-<br />

Miscellaneous Provisions................................................... -196-<br />

Examine the following other federal statutes .......................................... -196-<br />

Examine the following facts, issues, opinions, and decisions.............................. -196-<br />

Refunds granted .......................................................... -196-<br />

Refunds denied ........................................................... -197-<br />

Refunds partially granted and partially denied .................................. -200-<br />

Abatements ............................................................. -201-<br />

Granted .......................................................... -201-<br />

Denied........................................................... -201-<br />

Estate tax refund claim dismissed ............................................ -202-<br />

Tax refund suit dismissed for lack of jurisdiction ................................ -202-<br />

Refunds erroneously made .................................................. -202-<br />

Equitable recoupment ..................................................... -202-<br />

Granted .......................................................... -202-<br />

Denied........................................................... -202-<br />

Cases which involve the two-year statute of limitations ..................... -203-<br />

Examine the following Federal Regulation provisions................................... -204-<br />

Examine the following IRS’ IR Manual sections ....................................... -205-<br />

Accounting and data control ................................................ -205-<br />

AIMS processing ......................................................... -205-<br />

Employment tax.......................................................... -205-<br />

Excise tax............................................................... -205-<br />

Field collecting procedures ................................................. -206-<br />

Trust fund compliance ..................................................... -206-<br />

Interest ................................................................. -206-<br />

Refund inquiries .......................................................... -206-<br />

Suits brought against the United States ........................................ -206-<br />

Examine the following IRS Publications and similar IRS documents ....................... -206-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents . . . -206-<br />

Some abbreviations and some documents ...................................... -206-<br />

Treasury Department (TD), TD News Releases (TDNR) .................... -206-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto .............. -206-<br />

Examine the following articles, letters, etc. from professional individuals ................... -207-<br />

Examine the following documents of Professor Jegen ................................... -207-<br />

Copyright ©1986 Through 2012, Professor Jegen’s Taxsite F-<strong>2000</strong> EH 893 Course Assignments -15-

Assignment 20 - - - Rewards Paid By Federal Government To Whistleblowers...................... -207-<br />

Examine the following nine provisions of the Constitution Of The United States Of America .... -207-<br />

Examine the following IRC sections ................................................ -207-<br />

Judicial Proceedings ....................................................... -207-<br />

Discovery of Liability and Enforcement of Title ................................. -207-<br />

Examine the following other federal statutes .......................................... -207-<br />

Examine the following facts, issues, opinions, and decisions.............................. -207-<br />

Whistleblower claim denied................................................. -207-<br />

Whistleblower petitions tax court to review rejection of claim ...................... -208-<br />

Examine the following Federal Regulation provisions................................... -208-<br />

Examine the following IRS’ IR Manual sections ....................................... -208-<br />

Organization and staffing................................................... -208-<br />

Information and whistleblower awards ........................................ -209-<br />

Examine the following IRS Publications and similar IRS documents ....................... -209-<br />

Examine the following Treasury Department’s, IRS’, and Department Of Justice’s documents . . . -209-<br />

Some abbreviations and some documents ...................................... -209-<br />

Treasury Department (TD), TD News Releases (TDNR) .................... -209-<br />

Examine the following IRS, TIGTA, and FBI forms and the instructions thereto .............. -209-<br />

Examine the following articles, letters, etc. from professional individuals ................... -209-<br />

Examine the following documents of Professor Jegen ................................... -210-<br />

Assignment 21 - - - Offshore Activities; Sham Transaction; Business Purpose; Economic Substance;<br />

Substance Over Form; Step transaction; And, Legal Authority ............... -210-<br />

Examine the following nine provisions of the Constitution Of The United States Of America .... -210-<br />

Examine the following IRC sections ................................................ -210-<br />

Income from Sources without the United States ................................. -210-<br />

Records, Statements, and Special Returns ...................................... -210-<br />

Additions to the Tax and Additional Amounts .................................. -211-<br />

Assessable Penalties ....................................................... -211-<br />

Judicial Proceedings ....................................................... -211-<br />

Miscellaneous Provisions................................................... -211-<br />

Examination and Inspection................................................. -211-<br />

Definitions .............................................................. -211-<br />

Examine the following other federal statutes .......................................... -211-<br />

Doctrines often discussed in opinions dealing with offshore activities. ...................... -212-<br />

Sham transaction doctrine .................................................. -212-<br />