CBRE CAP RATE SURVEY

CBRE CAP RATE SURVEY

CBRE CAP RATE SURVEY

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IN THIS ISSUE:<br />

Overview<br />

Office<br />

Multihousing<br />

Retail<br />

Industrial<br />

Hotels Hotel<br />

Appendix<br />

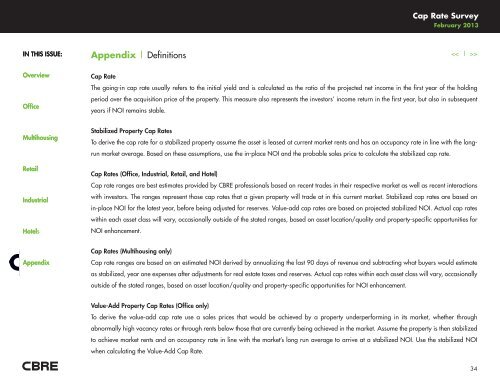

Appendix | Definitions<br />

Cap Rate<br />

Cap Rate Survey<br />

February 2013<br />

><br />

The going-in cap rate usually refers to the initial yield and is calculated as the ratio of the projected net income in the first year of the holding<br />

period over the acquisition price of the property. This measure also represents the investors’ income return in the first year, but also in subsequent<br />

years if NOI remains stable.<br />

Stabilized Property Cap Rates<br />

To derive the cap rate for a stabilized property assume the asset is leased at current market rents and has an occupancy rate in line with the long-<br />

run market average. Based on these assumptions, use the in-place NOI and the probable sales price to calculate the stabilized cap rate.<br />

Cap Rates (Office, Industrial, Retail, and Hotel)<br />

Cap rate ranges are best estimates provided by <strong>CBRE</strong> professionals based on recent trades in their respective market as well as recent interactions<br />

with investors. The ranges represent those cap rates that a given property will trade at in this current market. Stabilized cap rates are based on<br />

in-place NOI for the latest year, before being adjusted for reserves. Value-add cap rates are based on projected stabilized NOI. Actual cap rates<br />

within each asset class will vary, occasionally outside of the stated ranges, based on asset location/quality and property-specific opportunities for<br />

NOI enhancement.<br />

Cap Rates (Multihousing only)<br />

Cap rate ranges are based on an estimated NOI derived by annualizing the last 90 days of revenue and subtracting what buyers would estimate<br />

as stabilized, year one expenses after adjustments for real estate taxes and reserves. Actual cap rates within each asset class will vary, occasionally<br />

outside of the stated ranges, based on asset location/quality and property-specific opportunities for NOI enhancement.<br />

Value-Add Property Cap Rates (Office only)<br />

To derive the value-add cap rate use a sales prices that would be achieved by a property underperforming in its market, whether through<br />

abnormally high vacancy rates or through rents below those that are currently being achieved in the market. Assume the property is then stabilized<br />

to achieve market rents and an occupancy rate in line with the market’s long run average to arrive at a stabilized NOI. Use the stabilized NOI<br />

when calculating the Value-Add Cap Rate.<br />

34