continued - Grape and Wine Research and Development Corporation

continued - Grape and Wine Research and Development Corporation

continued - Grape and Wine Research and Development Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

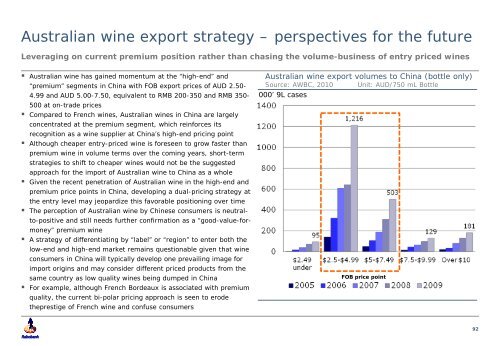

Australian wine export strategy – perspectives for the future<br />

Leveraging on current premium position rather than chasing the volume-business of entry priced wines<br />

� Australian wine has gained momentum at the “high-end” <strong>and</strong><br />

“premium” segments in China with FOB export prices of AUD 2.50-<br />

4.99 <strong>and</strong> AUD 5.00-7.50, equivalent to RMB 200-350 <strong>and</strong> RMB 350-<br />

500 at on-trade prices<br />

� Compared to French wines, Australian wines in China are largely<br />

concentrated at the premium segment, which reinforces its<br />

recognition as a wine supplier at China’s high-end pricing point<br />

� Although cheaper entry-priced wine is foreseen to grow faster than<br />

premium wine in volume terms over the coming years, short-term<br />

strategies to shift to cheaper wines would not be the suggested<br />

approach for the import of Australian wine to China as a whole<br />

� Given the recent penetration of Australian wine in the high-end <strong>and</strong><br />

premium price points in China, developing a dual-pricing strategy at<br />

the entry level may jeopardize this favorable positioning over time<br />

� The perception of Australian wine by Chinese consumers is neutralto-positive<br />

<strong>and</strong> still needs further confirmation as a “good-value-formoney”<br />

premium wine<br />

� A strategy of differentiating by “label” or “region” to enter both the<br />

low-end <strong>and</strong> high-end market remains questionable given that wine<br />

consumers in China will typically develop one prevailing image for<br />

import origins <strong>and</strong> may consider different priced products from the<br />

same country as low quality wines being dumped in China<br />

� For example, although French Bordeaux is associated with premium<br />

quality, the current bi-polar pricing approach is seen to erode<br />

theprestige of French wine <strong>and</strong> confuse consumers<br />

Australian wine export volumes to China (bottle only)<br />

Source: AWBC, 2010 Unit: AUD/750 mL Bottle<br />

000’ 9L cases<br />

FOB price point<br />

92