Nordic operations, 362 KB, PDF - Telenor

Nordic operations, 362 KB, PDF - Telenor

Nordic operations, 362 KB, PDF - Telenor

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

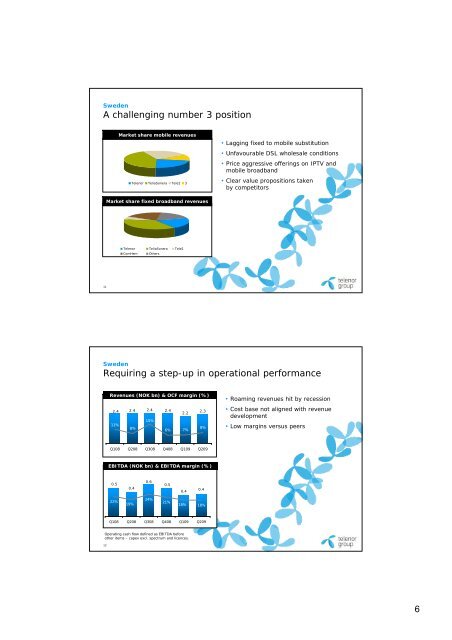

Sweden<br />

A challenging number 3 position<br />

11<br />

12<br />

Market share mobile revenues<br />

<strong>Telenor</strong> TeliaSonera Tele2 3<br />

Market share fixed broadband revenues<br />

<strong>Telenor</strong> TeliaSonera Tele2<br />

ComHem Others<br />

• Lagging fixed to mobile substitution<br />

• Unfavourable DSL wholesale conditions<br />

• Price aggressive offerings on IPTV and<br />

mobile broadband<br />

• Clear value propositions taken<br />

by competitors<br />

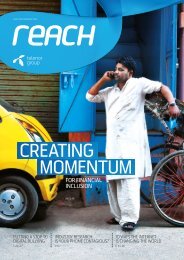

Sweden<br />

Requiring a step-up in operational performance<br />

Revenues (NOK bn) & OCF margin (%)<br />

2.4<br />

11%<br />

2.4<br />

8%<br />

2.4<br />

15%<br />

2.4<br />

6%<br />

2.2<br />

7%<br />

2.3<br />

8%<br />

Q108 Q208 Q308 Q408 Q109 Q209<br />

EBITDA (NOK bn) & EBITDA margin (%)<br />

0.5<br />

22%<br />

0.4<br />

19%<br />

0.6<br />

24%<br />

0.5<br />

21%<br />

0.4<br />

18%<br />

0.4<br />

18%<br />

Q108 Q208 Q308 Q408 Q109 Q209<br />

Operating cash flow defined as EBITDA before<br />

other items – capex excl. spectrum and licences.<br />

• Roaming revenues hit by recession<br />

• Cost base not aligned with revenue<br />

development<br />

• Low margins versus peers<br />

6