CorporateGuard Premier - Corporate Liability Insurance - Chartis

CorporateGuard Premier - Corporate Liability Insurance - Chartis

CorporateGuard Premier - Corporate Liability Insurance - Chartis

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

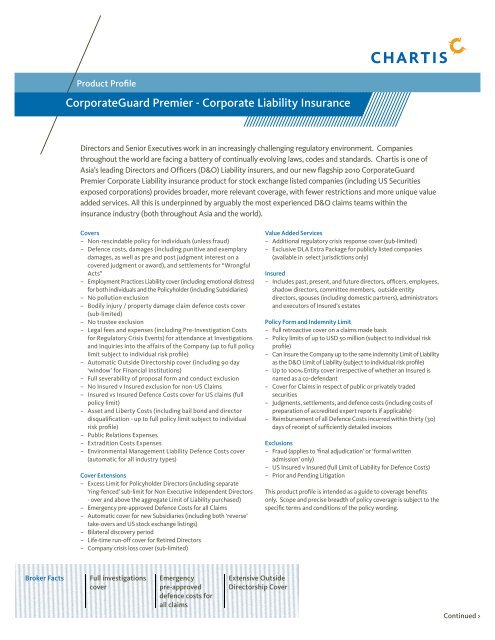

Product Profile<br />

<strong><strong>Corporate</strong>Guard</strong> <strong>Premier</strong> - <strong>Corporate</strong> <strong>Liability</strong> <strong>Insurance</strong><br />

Directors and Senior Executives work in an increasingly challenging regulatory environment. Companies<br />

throughout the world are facing a battery of continually evolving laws, codes and standards. <strong>Chartis</strong> is one of<br />

Asia’s leading Directors and Officers (D&O) <strong>Liability</strong> insurers, and our new flagship 2010 <strong><strong>Corporate</strong>Guard</strong><br />

<strong>Premier</strong> <strong>Corporate</strong> <strong>Liability</strong> insurance product for stock exchange listed companies (including US Securities<br />

exposed corporations) provides broader, more relevant coverage, with fewer restrictions and more unique value<br />

added services. All this is underpinned by arguably the most experienced D&O claims teams within the<br />

insurance industry (both throughout Asia and the world).<br />

Covers<br />

– Non-rescindable policy for individuals (unless fraud)<br />

– Defence costs, damages (including punitive and exemplary<br />

damages, as well as pre and post judgment interest on a<br />

covered judgment or award), and settlements for “Wrongful<br />

Acts”<br />

– Employment Practices <strong>Liability</strong> cover (including emotional distress)<br />

for both individuals and the Policyholder (including Subsidiaries)<br />

– No pollution exclusion<br />

– Bodily injury / property damage claim defence costs cover<br />

(sub-limited)<br />

– No trustee exclusion<br />

– Legal fees and expenses (including Pre-Investigation Costs<br />

for Regulatory Crisis Events) for attendance at Investigations<br />

and Inquiries into the affairs of the Company (up to full policy<br />

limit subject to individual risk profile)<br />

– Automatic Outside Directorship cover (including 90 day<br />

‘window’ for Financial Institutions)<br />

– Full severability of proposal form and conduct exclusion<br />

– No Insured v Insured exclusion for non-US Claims<br />

– Insured vs Insured Defence Costs cover for US claims (full<br />

policy limit)<br />

– Asset and Liberty Costs (including bail bond and director<br />

disqualification - up to full policy limit subject to individual<br />

risk profile)<br />

– Public Relations Expenses<br />

– Extradition Costs Expenses<br />

– Environmental Management <strong>Liability</strong> Defence Costs cover<br />

(automatic for all industry types)<br />

Cover Extensions<br />

– Excess Limit for Policyholder Directors (including separate<br />

‘ring-fenced’ sub-limit for Non Executive Independent Directors<br />

- over and above the aggregate Limit of <strong>Liability</strong> purchased)<br />

– Emergency pre-approved Defence Costs for all Claims<br />

– Automatic cover for new Subsidiaries (including both ‘reverse’<br />

take-overs and US stock exchange listings)<br />

– Bilateral discovery period<br />

– Life-time run-off cover for Retired Directors<br />

– Company crisis loss cover (sub-limited)<br />

Broker Facts Full investigations<br />

cover<br />

Emergency<br />

pre-approved<br />

defence costs for<br />

all claims<br />

Extensive Outside<br />

Directorship Cover<br />

Value Added Services<br />

– Additional regulatory crisis response cover (sub-limited)<br />

– Exclusive DLA Extra Package for publicly listed companies<br />

(available in select jurisdictions only)<br />

Insured<br />

– Includes past, present, and future directors, officers, employees,<br />

shadow directors, committee members, outside entity<br />

directors, spouses (including domestic partners), administrators<br />

and executors of Insured’s estates<br />

Policy Form and Indemnity Limit<br />

– Full retroactive cover on a claims made basis<br />

– Policy limits of up to USD 50 million (subject to individual risk<br />

profile)<br />

– Can insure the Company up to the same indemnity Limit of <strong>Liability</strong><br />

as the D&O Limit of <strong>Liability</strong> (subject to individual risk profile)<br />

– Up to 100% Entity cover irrespective of whether an Insured is<br />

named as a co-defendant<br />

– Cover for Claims in respect of public or privately traded<br />

securities<br />

– Judgments, settlements, and defence costs (including costs of<br />

preparation of accredited expert reports if applicable)<br />

– Reimbursement of all Defence Costs incurred within thirty (30)<br />

days of receipt of sufficiently detailed invoices<br />

Exclusions<br />

– Fraud (applies to ‘final adjudication’ or ‘formal written<br />

admission’ only)<br />

– US Insured v Insured (full Limit of <strong>Liability</strong> for Defence Costs)<br />

– Prior and Pending Litigation<br />

This product profile is intended as a guide to coverage benefits<br />

only. Scope and precise breadth of policy coverage is subject to the<br />

specific terms and conditions of the policy wording.<br />

Continued >

China<br />

Shanghai<br />

Tel: (86) 21 3857 8000<br />

Fax: (86) 21 3857 8111<br />

Guangzhou<br />

Tel: (86) 20 3819 5111<br />

Fax: (86) 20 3819 5000<br />

Shenzhen<br />

Tel: (86) 755 3685 6000<br />

Fax: (86) 755 3685 6100<br />

Beijing<br />

Tel: (86) 10 5969 2888<br />

Fax: (86) 10 5969 2999<br />

Guam<br />

Tel: (1) 671 472 6816<br />

Fax: (1) 671 477 5273<br />

Hong Kong<br />

Tel: (852) 3555 0000<br />

Fax: (852) 2834 5676<br />

Indonesia<br />

Tel: (62) 21 5291 4888<br />

Fax: (62) 21 5291 4889<br />

Malaysia<br />

Tel: 1 800 88 88 11<br />

Fax: 60 3 2058 5500<br />

Philippines<br />

Tel: (632) 815 3000<br />

Fax: (632) 815 3710<br />

Singapore<br />

Tel: (65) 6419 1000<br />

Fax: (65) 6225 6772<br />

Taiwan<br />

Tel: (886) 2 8758 6666<br />

Fax: (886) 2 2723 2050<br />

Thailand<br />

Tel: (66) 2 649 1000<br />

Fax: (66) 2 649 1599<br />

Vietnam<br />

Tel: (84) 8 3914 0065<br />

Fax: (84) 8 3914 0067<br />

<strong><strong>Corporate</strong>Guard</strong> <strong>Premier</strong> - <strong>Corporate</strong> <strong>Liability</strong> <strong>Insurance</strong><br />

Broker Facts<br />

Partial Reinstatement of Limit of<br />

<strong>Liability</strong> for Policyholder’s<br />

Directors<br />

Non-rescindable Policy<br />

for Individuals<br />

Assists the Company to reassure the parent company Directors (both<br />

executive and non-executive) by providing an additional Limit of <strong>Liability</strong><br />

above and beyond the overall policy Limit of <strong>Liability</strong> (including a ‘ringfenced’<br />

limit for the benefit of the Policyholder’s Non Executive<br />

Independent Directors only).<br />

“Sleep-easy” reassurance for directors that, once the policy is incepted,<br />

cover will not be withdrawn because of errors or fraudulent non-disclosure<br />

in the policy form that may have been completed by another director.<br />

Full Investigations Cover A frequent source of claim and a coverage that is often sub-limited in value<br />

by insurers throughout Asia. <strong>Chartis</strong> with its 2010 <strong><strong>Corporate</strong>Guard</strong> <strong>Premier</strong><br />

<strong>Corporate</strong> <strong>Liability</strong> policy, can provide cover up to the full policy Limit of<br />

<strong>Liability</strong> (subject to individual risk profile)<br />

Extensive Outside<br />

Directorship Cover<br />

Emergency Pre-approved<br />

Defence Costs<br />

Regulatory Crisis<br />

Response Cover<br />

Lifetime Runoff for<br />

Retired Directors<br />

Bodily Injury/Property<br />

Damage Defence Costs<br />

No Pollution or Trustee<br />

Exclusions<br />

Blanket cover provided automatically for all commercial industry types<br />

(excluding US securities traded companies).<br />

To facilitate a Insured’s best defence in the event of an emergency,<br />

emergency Defence Costs can be incurred (without <strong>Chartis</strong>’ prior<br />

agreement) up to a limit of 10% of the Limit of <strong>Liability</strong>.<br />

A specific fund of up to USD100,000 is available to use at the Insured’s<br />

discretion in facing a regulatory crisis (such as a dawn raid). This is over and<br />

above specific investigations cover.<br />

“Sleep-easy” cover for directors who have retired or resigned from the<br />

company (except where there has been a Transaction).<br />

Applies where a claim is made against an individual Insured for bodily injury<br />

or property damage for extra protection (sub-limited)<br />

Examples of how <strong><strong>Corporate</strong>Guard</strong> is there for the reassurance and<br />

protection of individuals in an even greater number of circumstances.<br />

Public Relations (PR) Costs PR costs now available as soon as an individual faces a claim or<br />

investigation to protect their professional reputation (sub-limited)<br />

<strong>Chartis</strong> is a world leading property-casualty and general insurance organization serving more than 40 million clients in over 160 countries and jurisdictions. With a<br />

90-year history, one of the industry’s most extensive ranges of products and services, deep claims expertise and excellent financial strength, <strong>Chartis</strong> enables its<br />

commercial and personal insurance clients alike to manage virtually any risk with confidence.<br />

<strong>Chartis</strong> is the marketing name for the worldwide property-casualty and general insurance operations of <strong>Chartis</strong> Inc.<br />

All products are written by insurance company subsidiaries or affiliates of <strong>Chartis</strong> Inc. Coverage may not be available in all jurisdictions and is subject to actual<br />

policy language.