THE FOOTWEAR MARKET IN THE UNITED KINGDOM - CBI

THE FOOTWEAR MARKET IN THE UNITED KINGDOM - CBI

THE FOOTWEAR MARKET IN THE UNITED KINGDOM - CBI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

<strong>CBI</strong> <strong>MARKET</strong> SURVEY<br />

<strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

Publication date: May 2010<br />

Report summary<br />

This <strong>CBI</strong> market survey discusses the following highlights for the footwear market in the United<br />

Kingdom (UK):<br />

• The UK consumption of footwear was € 7.9 billion in 2008, or 331 million pairs, down 0.2%<br />

per annum on average, while production fell by an annual average of 6.3% to € 217 million,<br />

or 11 million pairs.<br />

• In 2008, the UK imported footwear valued at € 3.3 billion, or 415 million pairs. Since 2004,<br />

values were down by 1.2%, but volumes were up by an average annual rate of 3.5%.<br />

• More than 59% of imports by value (€ 1.9 billion) came from developing countries (82% by<br />

volume or 342 million pairs). The share of imports by developing countries is up from 46% in<br />

2004 in value (€ 1.6 billion), and up from 69% (251 million pairs) in volume terms. The UK<br />

has one of the highest shares of developing country imports of all EU countries. It is also an<br />

important gateway into the Irish market.<br />

This survey provides exporters of footwear with sector-specific market information related to<br />

gaining access to the UK. By focusing on a specific country, this survey provides additional<br />

information, complementary to the more general information and data provided in the <strong>CBI</strong><br />

market survey ‘The footwear market in the EU’, which covers the EU market in general. That<br />

survey also contains an overview and explanation of the selected products dealt with, some<br />

general remarks on the statistics used, as well as information on other available documents<br />

for this sector. It can be downloaded from http://www.cbi.eu/marketinfo<br />

1 Market description: consumption and production<br />

Consumption<br />

Total market size<br />

The footwear market in the United Kingdom was valued at € 7.9 billion in 2008 in terms of<br />

retail sales, registering an average annual decrease of 0.2% since 2004, being below the EU<br />

average of 0.3% over the same period. By value, the UK accounted for 16% of all footwear<br />

sales in the EU, being the third largest EU market for footwear. This was below Germany and<br />

France, and well ahead of the next largest country, Italy. The UK lags behind France in volume,<br />

but on a per capita basis UK consumption is higher than Germany.<br />

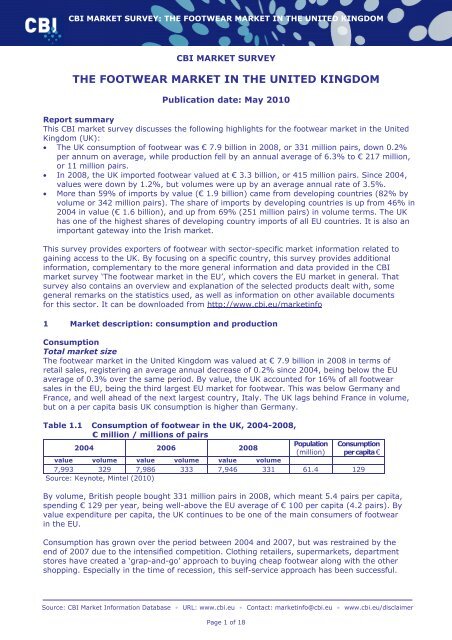

Table 1.1 Consumption of footwear in the UK, 2004-2008,<br />

€ million / millions of pairs<br />

2004 2006 2008<br />

Population<br />

(million)<br />

Consumption<br />

per capita €<br />

value volume value volume value volume<br />

7,993 329 7,986 333 7,946 331 61.4 129<br />

Source: Keynote, Mintel (2010)<br />

By volume, British people bought 331 million pairs in 2008, which meant 5.4 pairs per capita,<br />

spending € 129 per year, being well-above the EU average of € 100 per capita (4.2 pairs). By<br />

value expenditure per capita, the UK continues to be one of the main consumers of footwear<br />

in the EU.<br />

Consumption has grown over the period between 2004 and 2007, but was restrained by the<br />

end of 2007 due to the intensified competition. Clothing retailers, supermarkets, department<br />

stores have created a ‘grap-and-go’ approach to buying cheap footwear along with the other<br />

shopping. Especially in the time of recession, this self-service approach has been successful.<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 1 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

Growth in the UK was particularly strong up to 2007. However, 2008 was a difficult year as<br />

consumers stopped spending in the second half of that year due to the impact of the global<br />

economic recession that affected the UK quite badly. In addition, retailers faced difficulties<br />

in keeping low prices due to the devaluation of the Pound. In 2008, the Pound has declined<br />

by 30% against the US$.<br />

Different consumers are responding in different ways to the economic downturn. Some are<br />

buying less expensive footwear. Others are buying less but choosing to buy something that is<br />

comfortable, fits well and will last longer. Despite this, fashion continues to be an increasingly<br />

important aspect of buying footwear. British women regard footwear important, expressing<br />

their femininity and keenly follow the latest fashion trends.<br />

Product groups<br />

• Casual footwear continues to increase in UK footwear sales and accounted in 2008 for 44%<br />

of the market, or € 3.5 billion. The trend to more casual dress styles has seen a great increase<br />

in the sales of casual footwear.<br />

• Sports footwear, which has decreased since 2006, now accounting for 23% of the market,<br />

or € 1.9 billion. Whereas volumes continued to rise due to discounted sales of (retro) sneakers<br />

or metallic sneakers. However, developments within the sports footwear segments were<br />

different per type – see further at the <strong>CBI</strong> market survey ‘The EU market for Sports footwear’.<br />

• Formal footwear, with a decreasing share of the market, now accounting for 25% of the<br />

market, or € 2.0 billion.<br />

• Evening footwear, an increasing segment, now accounting for 7.7% of the market, or € 612<br />

million. Recent signs in the UK are of a fashion change to smarter types of dress clothing. This<br />

will result in increased demand for more formal or evening footwear.<br />

According to Keynote, the UK market by volume was roughly sub-divided in 2008 as follows:<br />

• Boots (from above the ankle) - 20% (used to be 15% in the past)<br />

• Sports footwear - 18%<br />

• Specialist footwear - 12%<br />

(flip-flops, indoor slippers, safety, waterproof footwear)<br />

• Town shoes - 50%<br />

(Casual and formal footwear sometimes referred to as ‘Trotteurs’)<br />

Unbranded footwear is still well represented in the UK market. However, the International<br />

designer brands have been successful in the UK, as well as brands of UK designers (LK Bennet,<br />

Dune) that approach the fine segment with less expensive ranges.<br />

In casual footwear, the following brands are the most prevalent brands in footwear stores:<br />

Clarks, Kickers, Geox, Converse/Allstars, Red or Dead, Bronx, Base London, Blundstone,<br />

Boxfresh, Fred Perry, Fly London, Ikon, Kangaroos, Rockport, Crogs, Uggs, Diesel, Camper,<br />

Sketchers, Dr Martin, eFlag, Vans, Timberland, CAT, Nike, Adidas, Reebok and New Balance.<br />

Market outlook<br />

As unemployment is expected to rise and the recession continues, 2009 probably shows<br />

continued falling market values. The UK footwear market will contract by around 1% in value<br />

to € 7,883 million with volumes decreasing by a lesser extent to 328 million pairs. The great<br />

diversity in footwear being available in different retail outlets may encourage impulse buying.<br />

On the other hand, the attitude towards the ‘throw away fashion’ has changed and people tend<br />

to buy quality footwear that lasts longer.<br />

The economic recovery in the UK is very fragile in 2010. Growth in 2011 is likely to be very<br />

modest. Areas for further growth beyond 2010/2011 will be in young fashionable footwear at<br />

competitive prices and comfortable footwear for people of 50 years and older. They are<br />

expected to make up a larger proportion of the British population. Another impulse to the UK<br />

market is a further development of market niches such as footwear for pre-teens, ethnic<br />

groups, well-designed green footwear, ethical footwear and functional or wellness footwear.<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 2 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

Market segmentation<br />

Segmentation can be very useful in this market as there is a wide range of shoe-types, styles,<br />

colours that can be linked to different types of consumers.<br />

• Segmentation by user<br />

The most common way to segment the market is by user. As Figure 1.1 indicates, women’s<br />

footwear is the largest segment.<br />

Women’s footwear was valued at € 4.0 billion in 2008, decreased in value since 2006, but<br />

increased in volume (53% in 2008). Women have been the most buoyant segment over the<br />

last five years, and they have responded to lower prices by buying far more items.<br />

The ratio of working women was close to static, from 65.6% to 65.8%, of all British women<br />

between 2004 and 2008, which is high compared to the EU average of 59.1%. An increase<br />

took place in the older age group (55 to 64 years), while the ratio of the younger age group<br />

(15 to 24 years) decreased. There is a growing number of women in higher professional roles,<br />

which means higher levels of disposable income.<br />

Working women tend to reward themselves with a new pair of designer shoes as ‘little luxury’<br />

as they did not go on holiday or bought a new car. While other women regarded new footwear<br />

to be an inexpensive way to update a style or new look. The rise in footwear offered in<br />

supermarkets, has enabled women to follow footwear trends more closely with more regular<br />

(impulsive) purchases at lower prices. Imitations of designs that are seen on the catwalk are<br />

being offered at a low to medium range price level. Most women are much more specific than<br />

men in the number of pairs of footwear they own.<br />

The major growth in women’s’ footwear in 2007/2008 was largely attributed to lambskin boots<br />

(Ugg-style), Cowboy boots, ballerinas, beaded sandals, gladiator style sandals, metallic<br />

sneakers and flip-flops and pumps. Other dynamic types of footwear sold in the UK were<br />

pumps (low, medium, high or wedged heels), sling back pumps and sandals, boots (knee,<br />

ankle, Oxford style), espadrilles, Mary-Jane’s, boot-sandals, retro-sneakers.<br />

Figure 1.1 UK footwear consumption by user<br />

% value 2008<br />

Child ren<br />

18.8%<br />

Men<br />

31.0%<br />

Source: Keynote (2010)<br />

Women<br />

50.2%<br />

Men’s footwear was valued at € 2.5 billion in 2008. The value share of men’s footwear has<br />

slightly increased over the period. Men often have very few pairs of shoes to suit a number of<br />

occasions, but spend more on a pair of shoes and wear them usually longer them women.<br />

Also for men, footwear has become more important for their look, particularly in the fine and<br />

luxury segments.<br />

For casual footwear, (retro-) sneakers, ankle boots, mountain-alike boots are important. The<br />

market leader C&J Clark, Shoe Zone (discount) and JD Sports, focussed on young men, have<br />

benefited from an increased demand for men’s footwear. The more buoyant end of the market<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 3 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

has been the men’s fashion segment. As formal elements like jackets and even ties have<br />

become popular again, this has stimulated sales of smart leather shoes, Chelseas and loafers.<br />

Children’s footwear was valued at € 1.5 billion in 2008, a decreasing share from 19.5% in 2004<br />

(by value). The children’s footwear segment has polarised between those with wealthy parents<br />

who have spent in line with designer styles, and the budget end of the market, where there has<br />

been fierce price competition. The lower birth rates will have the affect of restricting future<br />

growth in the children’s footwear segment. Sports retailers, supermarkets and on-line sellers<br />

have been particularly strong in children’s footwear. In general, the back-to-school period is the<br />

most important for children’s (school) footwear sales.<br />

• Segmentation by age group<br />

Footwear shoppers can be segmented according to their age. The following figure illustrates<br />

the development between 2005 and 2009 in how different age groups shop for footwear.<br />

Figure 1.2 gives a good illustration of how segmentation changes over time. For example, the<br />

increasing importance of 35-44 and 55-64 year old shoppers and the decreasing importance of<br />

65+ year old shoppers provide a useful insight into how to target potential customers, or<br />

which styles of footwear offer the best growth prospects. Each age segment will have footwear<br />

styles, which are specific to that target group. However, some styles transcend different age<br />

groups. Younger consumers tend to be more receptive to new footwear styles and respond<br />

more quickly to changes in fashion, whereas older consumers tend to be more conservative in<br />

their tastes and regard comfort and quality most important.<br />

Figure 1.2 Proportion of footwear shoppers by age bracket (share in %)<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

15-24 25-34 35-44 45-54 55-64 65+<br />

Source: Verdict Research 2010<br />

2005 2006 2007 2008 2009<br />

Market trends<br />

Here are some major trends and characteristics that influence demand for footwear in the UK:<br />

• Prices starting to increase despite the recession. The era of cheap fashion has gone as<br />

far as it can go. Retailers have no more scope to reduce prices further. Other factors such<br />

as the weakness of the Pound and price increases from suppliers mean that prices have<br />

been cut by almost as much as they can. The trend to purchases from discount retailers and<br />

supermarkets will continue but this will also result in a homogenisation of the market and<br />

reduction of choice.<br />

• Interest in styling remains. This idea follows the popularity of the ‘It Bag’, which are<br />

must-have items of an expensive designer brand (Jimmy Choo, Mulberry, D&G, Louboutin,<br />

Fendi, Prada). Wearing these shoes give women a special look or ‘personality’. Despite the<br />

recession, interest in footwear styling remains, especially in the fine and luxury segments,<br />

for which younger working women are prepared to pay a premium.<br />

• Back to functionality. Consumers have been moving more towards functional footwear<br />

and away from quality brands for fashion, design or style reasons. This is principally due to<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 4 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

the declining credit positions of most consumers. After many years in which shoes have<br />

become lifestyle statements, consumers now confronted with larger and more pressing<br />

outgoings, are reverting to buying only when necessary.<br />

• Green footwear surviving the downturn. Many commentators have thought that ‘green<br />

footwear’ or ‘environmental footwear’ would struggle in the downturn. This has proven not<br />

to be the case, partly because consumer values are changing. Taking care of the<br />

environment has become an extra dimension to their purchase. In addition, now green<br />

footwear have become better designed. For example, the Ethical Wares’ brand –<br />

http://www.ethicalwares.com – offers vegan footwear, i.e. made of non-animal materials,<br />

which are breathable and are made of recycled material. They offer boots, ballerinas and<br />

sneakers at affordable prices. Another example is http://www.beyondskin.co.uk offering<br />

trendy footwear, including a bridal footwear range. Other brands are: Holster, Ipanema,<br />

Riva, Powder, Made By and Jackie Brazil.<br />

• Online sales continue to grow. Despite the economic downturn this sales channel has<br />

continued to grow, with new fashion-based websites continuing to open. Success stories have<br />

been dedicated sites such as http://www.mywardrobe.com, which only sells online and only<br />

sells the latest fashion clothing and footwear. One reason for the success of these websites is<br />

their use of well-known brand names to attract consumers to visit them. Another successful<br />

site is the footwear retail site http://www.javari.co.uk which is operated by Amazon.<br />

• Seasonal trends - see http://www.purelondon.com/footwear were for the Spring/Summer<br />

season 2010 ‘Mixing street style with durability’ was an important theme. Trends can be also<br />

found at the fashion blog http://girldir.com and at the Annexes of the <strong>CBI</strong> market surveys<br />

covering the Italian and French footwear markets and Appendix E of the EU market survey.<br />

Production<br />

Total production<br />

The value of footwear production in the UK was estimated to be € 217 million in 2008,<br />

representing an average annual decrease of 6.3% since 2004. This was the equivalent of 11<br />

million pairs, with a decrease of 5.9% in volume. Overall EU production fell by 2.7% each year<br />

on average, so the UK reduction is quite marked. The UK was the tenth largest footwear<br />

producer in the EU in 2008, behind Poland and Slovakia. The UK accounted for just 1.2% of all<br />

EU footwear production. Significant falls in the early part of the review period were caused by<br />

the industry being very slow to react to the massive growth of low cost imports, particularly<br />

from China and Vietnam. The industry has become more competitive now, which has slowed<br />

down the rate of decline.<br />

Table 1.2 Production of footwear in the UK, 2004-2008,<br />

€ million / millions of pairs<br />

2004 2006 2008<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 5 of 18<br />

Number of<br />

companies<br />

2008<br />

Number of<br />

employees<br />

2008<br />

value volume value volume value volume<br />

269 14 241 12 217 11 121 3,408<br />

Source: Keynote, ONS- National Statistics (2010)<br />

This fall in production is expected to continue in the future as lower cost imports continue to<br />

enter the market in large numbers. Manufacturers in the UK are resorting to advertising and,<br />

in the case of sports footwear, sponsorship. For example, Umbro has sponsored the English<br />

Football Association. This is in recognition that consumers primarily make their choice of<br />

footwear on the basis of brand name rather than retail outlet.<br />

The heart of the UK footwear industry is in the East Midlands of England, although there is not<br />

much remaining compared to decades ago. The principle exception to the gloomy conditions<br />

is C&J Clark, a manufacturer that was established in 1825, but continues to defy the general<br />

footwear industry trends. Its success is based upon its reputation for the quality manufacturing<br />

of comfortable shoes. They have a strong retail presence in the UK and increasingly have an<br />

international presence. Globally the company produces more than 40 million pairs of shoes and

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

boots each year. However, UK production has reduced over the years in favour of outsourcing<br />

or building factories overseas.<br />

Some high quality production is still surviving, and some of the traditional leather footwear<br />

manufacturers are enjoying some success in export markets, capitalising on the skills and<br />

tradition of their reputation. Other manufacturers are specialising in footwear for problem feet,<br />

odd sizes, wedding shoes or nurse shoes.<br />

In terms of product groups, leather footwear dominated production value. According to Eurostat:<br />

• Nearly 73% of all production value (€ 158 million) or 65% of production volume was leather<br />

footwear. The majority of this was outdoor footwear, of which 47% (€ 74 million) was men’s<br />

footwear, 36% (€ 57 million) women’s footwear and 17% (€ 27 million) children’s footwear.<br />

• Around 2% (€ 5 million) of all production was indoor footwear, 70% of which was leather<br />

and the remainder rubber or plastic.<br />

• The remainder, being 25% (€ 54 million) can be sub-divided by:<br />

o Footwear parts, 7% (€ 17 million) but 29% by volume<br />

o Textile footwear 16% (€ 33 million), or 31% by volume<br />

o Rubber or plastic footwear, 2% (€ 4 million), or 6% by volume.<br />

There used to be sizeable levels of waterproof footwear production, but none has been recorded<br />

since 2004. The main production trend over the period – apart from the large decline in output –<br />

has been a shift in proportion from primarily leather footwear to higher levels of footwear parts<br />

and other types of material.<br />

Main and interesting players<br />

• The main manufacturer in the UK is C&J Clark (http://www.clarks.co.uk). It is still among<br />

the world’s largest producers and distributors of general footwear. It has been the largest<br />

designer, manufacturer, exporter, distributor and retailer of footwear since the British Shoe<br />

Corporation collapsed in the early 1990s.<br />

• Dr Martens is a manufacturer of leather footwear, being a well-known brand. They offer<br />

fashionable boots and shoes (http://www.drmartens.com).<br />

• Browning Group, located in London, is a designer and manufacturer of fashionable<br />

footwear for women, men and children. They offer footwear for medium market segments<br />

(http://www.browninggroup.co.uk).<br />

• Barker, located in Northampton, is a designer and producer of high quality leather footwear.<br />

They offer casual and formal style. This is an old family company established in 1880<br />

(http://www.barker-shoes.co.uk).<br />

• Hotter, located in Skelmersdale, is a company established in 1959. This company is a<br />

manufacturer of very comfortable and high quality footwear. They offer casual and fashion<br />

footwear (http://www.hottershoes.com).<br />

• John Lobb, located in London, is a designer and a producer of high quality leather footwear.<br />

They offer formal and casual footwear. They sell on line (http://www.johnlobb.com).<br />

Trends in production<br />

The major trends in and characteristics of footwear production in the UK are:<br />

• Celebrity endorsement. Manufacturers have been struggling to maintain their market<br />

presence. In order to maintain a brand’s visibility, some manufacturers have been using<br />

celebrity endorsement as a means of keeping their products in the public attention.<br />

• Outsourcing. This has been a feature of this industry for many years but it continues to<br />

be important. Due to global inflation and the weak pound, production prices of current<br />

outsourcing countries (China, Vietnam, India) increased. So, there is a move to locations<br />

that are cheaper and/or closer to guarantee fast delivery and regular updates of footwear<br />

collections along with the seasonal changes in fashion.<br />

• Joint ventures with Chinese companies. UK manufacturers who think there may also be<br />

an opportunity to sell their footwear products in the emerging Chinese market encourage<br />

this trend. Some manufacturers are also looking closely at possibilities in the emerging<br />

Indian market.<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 6 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

Opportunities and threats<br />

+ As UK consumers have become accustomed to such low prices for footwear, retailers are<br />

always looking for new sources of supply in order to find comfortable footwear at<br />

competitive prices of a good design. This is an opportunity for developing country<br />

producers, provided sensible pricing strategies are used.<br />

+ DC exporters can also benefit from the trend towards ethical fashion. Many consumers<br />

are becoming cynical towards big business, particularly with publicity about large retailers<br />

using companies that exploit workers in developing countries. If you can prove that you are<br />

not doing so, and if you can offer a strong product range, and are able to communicate this<br />

clearly, you will have a good opportunity.<br />

+ The trend to online sales can provide opportunities. Online retailers do not have the same<br />

issues as high street retailers in terms of stock holding and distribution. In many cases<br />

their suppliers hold stock on their behalf. This enables an online retailer to present a much<br />

wider range of products and will consequently be more receptive to new suppliers.<br />

+/- The importance of fashion continues to grow. This is both an opportunity and a threat for<br />

exporters from developing countries. On the one hand, it creates a continuing demand<br />

for new products. However, it also presents challenges. Unless a DC exporter has a strong<br />

design capability and can produce new styles very quickly, he will struggle to compete.<br />

+/- Brands are playing a larger role in consumer’s purchasing decision when buying clothing<br />

and footwear. This makes it difficult for unbranded footwear from exporters of DCs to<br />

enter the UK market. However, some opportunities can be found in outsourced production<br />

for UK brand manufacturers.<br />

- As the UK is outside of the Euro zone, currency movements impact on the perceived value<br />

of imports. The pound has been relatively weak since 2008. This will make UK imports<br />

more expensive.<br />

Equally, any of these trends can be an opportunity for one exporter, but a threat to another.<br />

British buyers are not always loyal to particular overseas suppliers, so you may lose out to a<br />

supplier from your own country or neighbouring country.<br />

See chapter 7 of the EU survey “The footwear market in the EU” for more information on<br />

opportunities and threats.<br />

Useful sources<br />

• There are a number of commercial research organisations that regularly produce reports<br />

on various sectors of the UK footwear market, but these can only be obtained at a cost.<br />

They include Verdict, who specialise in retailing (http://www.verdict.co.uk), Mintel<br />

(http://www.mintel.co.uk) and Keynote (http://www.keynote.co.uk).<br />

• Production information can be obtained from UK National Statistics<br />

(http://www.statistics.gov.uk), as well as Eurostat.<br />

• Details of other important trade associations can be found in chapter 6.<br />

2 Trade channels for market entry<br />

Trade channels<br />

The distribution of footwear in the UK varies depending on the segment. In the economical<br />

and medium segments, the non-specialist distribution dominate the sales. The role of department<br />

stores is important for footwear and sales through supermarkets and discounters are increasing.<br />

Clothing retailers and online sellers continue to expand their footwear ranges as well - see Table<br />

2.1. Many non-specialist buy direct from overseas suppliers.<br />

In addition to the traditional importers and wholesalers, these growing non-specialist channels<br />

would be interesting to contact. For example, if you make sports footwear, you may obtain<br />

better results by approaching sports retailers direct.<br />

In the specialist distribution, footwear buying groups can be contacted. Some independent retailers<br />

are using buying groups in order to improve their buying power. STAG is one of the largest footwear<br />

buying groups (http://www.stagbuyinggroup.com). Another is Associated Independent Stores,<br />

although they do not specialise exclusively in footwear (http://www.aistores.co.uk).<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 7 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

Within the fine and luxury segments, footwear specialists remain most important. They are<br />

in many cases specialising and concentrating on higher quality designer footwear in order to<br />

offer some point of difference. Exporters need to appreciate this trend if they choose to use<br />

the wholesale sector to reach the market.<br />

For smaller exporters from developing countries, the wholesale sector that serves smaller<br />

outlets, or the use of an agent, who may also work for other manufacturers, would be the<br />

most appropriate channels. Many follow the option of producing on behalf of UK retailers or<br />

manufacturers, through outsourcing.<br />

For the wholesale sector, a list of suppliers can be found in the Wholesaler UK Directory -<br />

http://www.thewholesaler.co.uk. Here you can find footwear wholesalers. There are two main<br />

associations of commercial agents in the UK, the British Agents Register -<br />

http://www.agentsregister.com - and the Manufacturers’ Agents Association -<br />

http://www.themaa.co.uk. According to Eurostat, there were 1,802 agents involved in the sale<br />

of clothing, footwear or leather goods in 2007.<br />

Interesting footwear specialised importers and wholesalers include:<br />

• A2Z Footwear, located in Cardiff, imports, exports and distributes a range of footwear.<br />

They offer fashionable and formal women, men and children’s footwear. They sell online<br />

(http://www.a2zfootwear.com).<br />

• Benny, located in Northamptonshire, is a wholesaler of women, men and children’s<br />

footwear. They sell their products online (http://www.bennies.co.uk).<br />

• Collers, located in Somerset, deals with branded footwear for the whole family. They have<br />

a shop on line (http://www.somersetfootwear.co.uk).<br />

• A Wave Shoes, located in Olney, is a wholesaler of casual and formal footwear for men.<br />

They sell on line. (http://www.awaveshoes.co.uk).<br />

• Edge Shoes is an importer and wholesaler of fashion footwear like boots, sandals.<br />

(http://www.edgeshoes.com).<br />

Retail trade<br />

According to Mintel, there were 9,764 retail outlets involved in the sale of footwear and leather<br />

goods in 2007, down from over 10,000 in 2003. This indicates a reduction in the number of small<br />

specialists and a growing preference for shopping in department stores, the growing involvement<br />

of other non-specialists and the surge in online purchasing.<br />

As Table 2.1 indicates, footwear specialists continue to decline, while home shopping (includes<br />

Internet sellers), clothing specialists, department stores and sports specialist have experienced<br />

increases in share. As far as footwear specialist are concerned, the main trend has been a<br />

substantial decline of independent specialists, while major multiple specialists could keep up<br />

their relative position.<br />

Table 2.1 Retail distribution of footwear in the UK, 2004 – 2008<br />

€ million, % value<br />

Outlet type 2004 2008<br />

Footwear specialists 55 44<br />

Major multiple specialists 39 39<br />

Independent shops 16 5<br />

Non-specialists 45 56<br />

Sports specialists 15 16<br />

Clothing specialists 8 9<br />

Super/Hypermarkets 3 7<br />

Home shopping (incl. Argos) 9 11<br />

Department stores 7 8<br />

Other 3 5<br />

Total 100 100<br />

Source: Keynote, Mintel (2010)<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 8 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

The leading footwear multiple specialist is C&J Clark (http://www.clarks.co.uk), which<br />

holds a 9.8% share of the whole market. Clark’s have over 550 of their own outlets, but their<br />

products are stocked by a further 2,000 outlets. They have revamped their stores in 2008<br />

which has proven to be successful.<br />

Shoe Zone, a budget specialist with a market share of 5.5%, expanded rapidly by the<br />

acquisition of Shoefayre in 2007 and Stead & Simpson in 2008 to have a total store portfolio<br />

of 570 outlets (http://www.shoezone.net).<br />

Stylo, is another footwear specialist (3.2% share), which has a number of different retail<br />

formats, including Barratts and PriceLess and operate around 320 separate outlets<br />

(http://www.stylo.co.uk). Stylo has taken over Dolcis that went bankrupt early in 2008.<br />

However, since 2009, Stylo was placed into administration as its PriceLess and Barratts shoe<br />

shop chains had suffered from the economic recession.<br />

Other footwear specialists include Kurt Geiger (2.6% share), The Show Studio Group (2.1% share),<br />

Brantano (1.9% share) and Schuh (German owned and 2.0% share).<br />

Many smaller footwear retailers have struggled to survive the competition from Shoezone,<br />

sports retailers and clothing retailers. However, some of them are successful in their<br />

differentiation from the multiples by following the latest trends. Footwear worn by celebrities<br />

is being sought after by some UK female shoppers who wish to emulate the lifestyles they see.<br />

This might be indicative of future footwear styles. Another opportunity is to specialise further<br />

in terms of offering more fitting option, half sizes, more colour choice, comfort, style and<br />

service.<br />

The non-specialists sector is big. As far as non-specialists are concerned, the department<br />

store Marks & Spencer held a second position in the UK footwear market. M&S represented a<br />

market share of over 7% in 2008 (http://www.marksandspencer.com). The performance of<br />

footwear in Marks & Spencer is very much dependent on the success of its clothing ranges.<br />

The clothing chain Next, with a share of 3.6%, has been one of the most successful nonspecialist<br />

retailers in the footwear market due to its general appeal as a lifestyle brand and<br />

expansion of its number of stores (http://www.next.co.uk).<br />

New Look (3.7 % share) has increased its share by most, due to its policy of enlarging its stores<br />

and focus on fast fashion. It sells women’s footwear (http://www.newlook.co.uk).<br />

Peacocks (http://www.peacocks.co.uk) has become a significant clothing retailer selling footwear.<br />

The third position in UK footwear sales is held by the sports chain JD Sports (6.5% share).<br />

This chain serves a younger audience and has performed well in 2007 by focussing more on<br />

male sportswear fans, by exclusive footwear and by revamping their stores.<br />

Sports Direct (6.3% share), a heavy discounter expanded rapidly (http://www.sportsdirect.com).<br />

In addition, the supermarkets continue to increase their share. Sainsbury has now joined<br />

Asda (3.6% share), http://www.asda.co.uk, and Tesco (1.9% share) http://www.tesco.co.uk<br />

in selling footwear.<br />

The real impact of Internet retailing has only begun to be felt in 2006 with the wider uptake<br />

of fashion online by consumers and the arrival of broad product ranges on retailers’ sites.<br />

The Home Shopping share above has decreased, but this relates to traditional mail order<br />

companies. Internet retailing relates both to the home shopping sector, which is gradually moving<br />

online, and retailers’ own online websites. The most notable example was the launch of Amazon<br />

into footwear in October 2007. Nevertheless, the potential impact of the Internet on the footwear<br />

market should not be overstated. It is forecast to not amount to more than a few percent of sales.<br />

Finding a suitable trading partner<br />

There are a number of ways to look for a suitable trading partner in the UK. The first place to look<br />

would be to contact the main trade association(s), followed by trade fairs, which tend to feature a<br />

list of exhibitors, many of which may be potential partners – see Chapter 6. In addition to these<br />

sources, there are often a number of general or specific information portals that will be useful.<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 9 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

The following organisations may be worth looking at:<br />

• There are several associations for footwear and some of their members could be interested<br />

in contact with exporters from developing countries.<br />

Addresses and websites of these associations can be found in Chapter 6.<br />

• Leatherwise has good links to other leather-related sites, including footwear, some of which<br />

include contacts (http://www.leatherwise.co.uk).<br />

• UK contacts can also be found at trade magazines for the footwear and leather goods<br />

industry, which are mentioned in Chapter 6.<br />

• The International Trade Centre (http://www.intracen.org) and the British Chambers of<br />

Commerce (http://www.chamberonline.co.uk) are also useful organisations to find UK<br />

contacts.<br />

• UK Leather is a directory designed to identify companies in the leather sector, including<br />

footwear (http://www.ukleather.org).<br />

• UK Trade & Investment helps companies who wish to do business in the UK<br />

(http://www.uktradeinvest.gov.uk).<br />

More information can be found in chapter 4 of ‘From survey to success - exports guidelines’<br />

for footwear.<br />

3 Trade: imports and exports<br />

Imports<br />

Total imports<br />

In 2008, the UK imported footwear valued at almost € 3.3 billion, or 415 million pairs. This<br />

accounted for 12% of all EU imports by value, or 13% by volume. This represented an average<br />

annual decrease in value of 1.2% since 2004 from € 3.4 billion (an increase of 3.5% in volume<br />

from 361 million pairs). The UK was the fourth largest importer of footwear after Germany,<br />

Italy and France. Countries with similar levels of imports were Italy and France. It ranked<br />

second in volume terms, behind Germany.<br />

This compared with a 6% growth in exports (8.4% by volume). Import values were over 4<br />

times greater than export values but import volumes were over 10 times greater than export<br />

volumes. Production continued to fall in the UK and the consumer market has fallen since<br />

2006. The UK has become more reliant on footwear imports. It is clear that a significant<br />

proportion of its exports are in fact re-exports, mainly destined for the Irish market. The<br />

main point to note is the strong increase in volume imports that were not accompanied by<br />

an equivalent increase in the value of imports.<br />

The share of imports by developing countries was up from 46% in 2004 in value, and up from<br />

69% or 251 million pairs in volume. Increases were registered in the footwear supplies of China,<br />

India, Brazil, Indonesia, Thailand, Cambodia (!), Turkey (!) and Sri Lanka. There were falling<br />

supplies from Vietnam and Pakistan. See further in Annex 2 for more information.<br />

Imports by product group<br />

Leather footwear<br />

This was the largest footwear product group. Valued at € 2.1 billion in 2008, it represented<br />

64% of all footwear imports to the UK. This product group had decreased in both its value<br />

and its volume contribution since 2006 and since 2004. Intra-EU trade dominated the value<br />

supply accounting for 47% (27% by volume or 41 million pairs), but this decreased from 54%<br />

in 2004 (35% by volume or 56 million pairs). Italy’s share was down from 17% in 2004 to<br />

15% in 2008.<br />

Developing country suppliers represented 51% of all imports by value (71% by volume or 106<br />

million pairs), up from 39% in 2004 (57% by volume or 92 million pairs). See Table 2 in Annex<br />

for more information. Outdoor leather footwear with other outer soles was the largest subsector,<br />

accounting for 79% of all leather footwear in 2008 (83% by volume). This sub-sector<br />

has decreased in both value and volume since 2006 and since 2004.<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 10 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

Table 3.1 United Kingdom imports of footwear with leather uppers, 2004 - 2008,<br />

€ million / million pairs*<br />

2004 2006 2008 Average<br />

value volume value volume value volume annual %<br />

change in<br />

value<br />

Total UK, of which from 2,339 162 2,508 173 2,083 150 -2.9<br />

Intra-EU 1,253 56 1,196 52 974 41 -6.1<br />

Extra-EU 166 14 98 6 36 2 -31.8<br />

Developing countries 920 92 1,213 115 1,073 106 3.9<br />

Sports 128 10 139 9 124 9 -0.8<br />

Indoor 15 2 14 3 20 3 7.5<br />

Outdoor leather outer<br />

soles<br />

349 17 292 13 290 12 -4.5<br />

Outdoor other outer<br />

soles<br />

1,848 132 2,063 147 1,650 125 -2.8<br />

Source: Eurostat (2009) *See Annex for more detail<br />

Textile footwear<br />

This group was valued at € 538 million in 2008, accounting for 16% of all footwear imports to the<br />

UK. This group has increased in importance since 2004 but decreased in importance since 2006.<br />

Intra-EU trade accounted for 29% of imports by value (8.3% by volume or 11 million pairs). This<br />

position compared with 40% by value in 2004 (15% by volume or 16 million pairs).<br />

Table 3.2 United Kingdom imports of footwear with textile uppers, 2004 - 2008,<br />

€ million / million pairs*<br />

2004 2006 2008 Av. annual<br />

value volume value volume value volume % change<br />

in value<br />

Total UK, of which from 514 106 572 122 538 133 1.1<br />

Intra-EU 205 16 195 16 154 11 -6.9<br />

Extra-EU 12 2 15 2 11 2 -2.2<br />

Developing countries 296 87 362 104 374 120 6.0<br />

Sports 185 16 163 14 116 12 -11.0<br />

Indoor rubber/plastic<br />

outer soles<br />

25 8 26 11 33 14 7.2<br />

Indoor other outer soles 66 35 73 39 79 41 4.6<br />

Outdoor rubber/plastic<br />

outer soles<br />

185 38 248 48 265 57 9.4<br />

Outdoor other outer<br />

soles<br />

53 8 62 10 45 9 -4.0<br />

Source: Eurostat (2009) *See Annex for more detail<br />

Developing country suppliers represented 69% of all imports by value in 2008 (90% by volume<br />

or 120 million pairs), up from 58% in 2004 (82% by volume or 87 million pairs). See Table 3 in<br />

Annex for more information.<br />

Textile outdoor footwear with rubber or plastic soles was the largest sub-sector, accounting for<br />

49% of this group in 2008 (43% by volume). Its share has increased significantly.<br />

Rubber or plastic footwear<br />

This group was valued at € 493 million in 2008, accounting for 15% of all footwear imports to<br />

the UK. This group has increased its importance in terms of volume. Intra-EU trade accounted<br />

for 19% of imports by value (6.8% by volume or 8 million pairs). This compared with a position<br />

of 30% by value in 2004 (14% by volume or 12 million pairs).<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 11 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

Table 3.3 United Kingdom imports of footwear with plastic/rubber uppers,<br />

2004 - 2008, € million / million pairs<br />

2004 2006 2008 Average<br />

value volume value volume value volume annual %<br />

change in<br />

value<br />

Total UK, of which from 455 83 601 112 493 117 2.0<br />

Intra-EU 139 12 161 11 94 8 -9.3<br />

Extra-EU 26 5 21 4 11 3 -19.4<br />

Developing countries 290 66 418 97 389 106 7.6<br />

Sports 90 9 130 10 70 8 -6.1<br />

Indoor 3 2 5 2 4 2 7.5<br />

Outdoor 361 72 466 99 419 106 3.8<br />

Source: Eurostat (2009)<br />

Developing country suppliers represented 79% of all imports by value in 2008 (91% by volume<br />

or 106 million pairs), up from 64% in 2004 (79% by volume or 66 million pairs). Rubber or<br />

plastic outdoor footwear was the largest sub-sector, accounting for 85% of this group in 2008<br />

(91% by volume).<br />

Other footwear<br />

This was the smallest product group, valued at just € 142 million in 2008 (4.4% by value and<br />

3.4% by volume or 14 million pairs). Intra-EU supplies accounted for 26% of the value of this<br />

group (29% of volume), and that share has decreased from 31% in value and increased from 27%<br />

in volume over the period. China was the leading developing country value and volume supplier.<br />

Table 3.4 United Kingdom imports of other footwear, 2004 - 2008,<br />

€ million / million pairs<br />

2004 2006 2008 Average<br />

value volume value volume value volume annual %<br />

change in<br />

value<br />

Total UK, of which from 105 11 120 13 142 14 7.8<br />

Intra-EU 33 3 35 2 37 4 2.9<br />

Extra-EU 14 2 11 2 11 0 -5.9<br />

Developing countries 58 6 74 9 94 10 12.8<br />

Other uppers 20 5 25 7 43 6 21.1<br />

Waterproof 19 5 28 6 38 8 18.9<br />

Parts 66 1 66 0 61 0.1 -2.0<br />

Source: Eurostat (2009)<br />

Exports<br />

In 2008, the UK exported footwear valued at € 743 million, or 40 million pairs. This represented<br />

an average annual increase in value of 5.9% from € 590 million, and an average annual increase<br />

of 8.4% in volume since 2004 from 29 million pairs.<br />

In 2008, the UK was the eighth largest exporter by value after Italy, Germany, Belgium, Spain,<br />

Netherlands, France and Portugal. Its value was also close to Slovakia. It was ninth in volume,<br />

behind Slovakia. Re-exports from the UK exist, but they are not significant in the same way as<br />

Belgium or the Netherlands. Around 86% of UK exports were intra-EU (87% by volume),<br />

mainly to Ireland.<br />

In terms of product groups, leather footwear was valued at € 512 million or 20 million<br />

pairs, up an annual average of 5.4% from € 415 million and up 7.5% by volume from 15<br />

million pairs in 2004. Outdoor leather footwear with other outer soles dominated this group of<br />

exports. The main destinations were Ireland, Germany and France. The next largest group of<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 12 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

exports were textile footwear, which was valued at € 135 million or 11 million pairs, up 12%<br />

from € 85 million and down 12% by volume from 16 million pairs in 2004. Outdoor textile<br />

footwear with rubber or plastic outer soles was the leading sub-group. Ireland, Germany and<br />

the Netherlands were the main destinations.<br />

Rubber or plastic footwear was valued at € 75 million or 8 million pairs. This was up 8.1% from<br />

€ 55 million and up 12% by volume from 5 million pairs in 2004. Outdoor plastic footwear was<br />

the largest sub- group. Ireland, the Netherlands and France were the main destinations.<br />

Other footwear accounted for € 20 million or 0.9 million pairs. This was down 12.4% from € 34<br />

million but up 3% by volume from 0.8 million pairs in 2004. Other parts of footwear was the<br />

largest sub-group. Ireland, France and Italy were the principle destination countries.<br />

Opportunities and threats<br />

+ The UK is a potentially interesting market for exporters from developing countries. It has a<br />

mature domestic retail market, combined with the fact that local production has declined<br />

a lot in recent years. The mature market implies that consumers already have an enhanced<br />

demand for footwear, and local producers are no longer supplying that demand. Imports<br />

have not been increasing significantly in recent years, but they are forecasted to do so as<br />

local production declines further.<br />

+ The main Asian footwear suppliers have consolidated their hold over the UK market, but<br />

there will always be niche opportunities for other producers, particularly in a market as<br />

large as the UK. Although it is one of the smaller product groups, imports of rubber or<br />

plastic footwear appear to be offering the best opportunities currently, especially outdoor<br />

footwear. Nevertheless, the market for textile products is offering opportunities at the lower<br />

priced end of the market.<br />

+ The fact that the share of imports from most developing countries increased (in value and<br />

volume), implies a challenge for (new) DCs to compete on e.g. nearby location, originality or<br />

price in order to enter the UK market.<br />

- Exporters should take care not to trade at a loss or with unsustainably low margins over<br />

a prolonged period. This may be justifiable for a limited period to gain market entry, but<br />

it is neither advisable nor feasible to trade in this way in the long run.<br />

It is also important to note that an opportunity for one developing country can also be a threat<br />

to another. Many EU countries switch country sources purely for competitive advantage,<br />

rather than moving supplier because of changes in demand for other reasons. Exporters<br />

should read carefully the trends and developments outlined in other parts of this survey<br />

before establishing whether the UK offers a genuine export opportunity.<br />

See also chapter 7 of the <strong>CBI</strong> market survey covering the EU for a more general analysis.<br />

Useful sources<br />

• EU Expanding Exports Helpdesk<br />

http://exporthelp.europa.eu<br />

go to: trade statistics<br />

• Eurostat – official statistical office of the EU<br />

http://epp.eurostat.ec.europa.eu;<br />

go to ‘themes’ on the left side of the home page<br />

go to ‘external trade’<br />

go to ‘data – full view’<br />

go to ‘external trade - detailed data’<br />

• Understanding eurostat: Quick guide to easy comext<br />

http://www.eds-destatis.de/en/database/download/Handbook_Comext_Database.pdf<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 13 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

4 Price developments<br />

Consumer prices<br />

Consumer prices of footwear in the UK are just below the EU average. Prices have fallen<br />

recently as low-priced imports have entered the country in large volumes. This has changed<br />

the perception of how much consumers are prepared to pay. Prices vary considerably.<br />

Consumer prices for all items in the UK increased by 3.6% in 2008 and by 2% in 2009, which<br />

was above the EU average (3.7% and 1% respectively). However, UK consumer prices of<br />

footwear increased by 0.2% in 2008 and by 0.3% in 2009 across the EU as a whole. This was<br />

well below the EU average of price movements in the footwear sector.<br />

According to a footwear price study by the UK’s department of trade, the price of men’s<br />

Timberland premium waterproof boot was highest in the UK, as was the same product for<br />

women. The Dr Martens original 3-eyelet shoe was least expensive in the UK of the four<br />

countries studied (UK, France, Germany and Sweden).<br />

Table 4.1 highlights how footwear prices vary very significantly between retailers, depending<br />

on the style of shoe and the target audience that the respective shoes are intended for.<br />

Table 4.1 Average prices of various types of footwear, €, different retailers, 2009<br />

Clark’s Barratts Jones & Son<br />

Men’s leather shoe 64.33 58.69 101.83<br />

Men’s leather boot 105.82 66.08 118.62<br />

Ladies’ heeled fashion shoe 56.16 39.57 78.03<br />

Ladies’ plastic sandal na 13.28 16.34<br />

Ladies’ fashion boot 95.72 52.53 99.00<br />

Source: Retailer websites (2009/2010)<br />

Consumer price indices can also be found on the UK National Statistical website<br />

(http://www.statistics.gov.uk). The Bank of England also provides information on prices<br />

(http://www.bankofengland.co.uk). See chapter 2 for a list of main retailers, many of which<br />

feature prices on their websites. Clark’s, the well-known manufacturer and retailer feature<br />

prices on its website for a wide range of footwear products (http://www.clarks.co.uk).<br />

Barratts, part of the British Shoe Corporation, also publishes prices on its website<br />

(http://www.barratts.co.uk).<br />

Jones the Bootmaker also features a comprehensive range, including prices<br />

(http://www.jonesbootmaker.com). A good online footwear portal featuring retail prices is<br />

http://www.footwear.co.uk. Wholesale prices can be found via the Footwear and Shoe UK<br />

suppliers directory (http://thewholesaler.co.uk). Other sources include mail order company<br />

Argos - http://www.argos.co.uk - for lower priced items.<br />

Import prices<br />

Import prices to the UK have been falling during the period, as Table 4.2 indicates. Total<br />

import prices to the UK are below the EU average of € 8.49, and developing country prices are<br />

also below the EU average (€ 5.13). Prices from developing countries have been falling while<br />

intra-EU prices have been rising. Import prices from developing countries are more than<br />

one fourth of the level of intra-EU import prices.<br />

These price movements reinforce the trend of increasing purchases of lower-priced footwear<br />

from Asian manufacturers. Due to the anti-dumping duties, less was imported from Vietnam,<br />

while British importers sourced more low cost footwear from Cambodia, Indonesia and Turkey.<br />

Please note that these trends should be interpreted with care, as changes in imports do not<br />

reflect the demand in the UK.<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 14 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

Table 4.2 Development in the UK of average import values/prices, 2004 – 2008, €<br />

2004 2006 2008 ave. Annual<br />

ave price ave price ave price % change<br />

per pair per pair per pair<br />

Total imports 9.44 9.05 7.85 -4.5<br />

Intra-EU 18.74 19.81 19.73 1.3<br />

Developing countries 6.23 6.36 5.64 -2.4<br />

Source: Eurostat (2009)<br />

Price structure<br />

Footwear retailers’ margins have been severely impacted by anti-dumping tariffs. The retailer<br />

Stylo estimates it has increased its sourcing costs from China and Vietnam by between 5% and<br />

16%, although larger organisations such as clothing retailers have been less affected and more<br />

capable of withstanding such additional costs.<br />

Footwear margins have been falling in the UK in recent years, because of intense competition in<br />

the supply end and an intensification of competition between retailers. In general, there are some<br />

national differences, however, footwear is a global business and margins tend to become more<br />

similar in most EU markets. There are also differences in margin levels between different types<br />

of footwear, with generally higher retail margins for (branded) formal or evening footwear, and<br />

lower margins for more casual or sports footwear.<br />

In each trade channel different margins and prices apply, with a total mark-up (including VAT)<br />

of 2.3 up to 2.9 of the export (CIF) price. These margins will vary depending on which market<br />

segment is being approached. The higher the market segment, the higher the margins that<br />

can be commanded. Buying groups and multiples ask for large-volume discounts, which are<br />

then passed on to their affiliated stores. VAT of 17.5% is added to retail prices.<br />

Table 4.3 Overview of margins in footwear<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 15 of 18<br />

Low High<br />

Importers/wholesalers' margins 30% 40%<br />

Agents' margins 10% 15%<br />

Retailers' margins 45% 75%<br />

Mark-up CIF price - Consumer price 2.3 2.9<br />

More can be found in chapter 3.2 of the <strong>CBI</strong> market survey ‘The footwear market in the EU’.<br />

5 Market access requirements<br />

As a manufacturer in a developing country preparing to access the UK, you should be aware<br />

of the market access requirements of your trading partners and the UK government.<br />

For information on legislative and non-legislative requirements, go to ‘Search <strong>CBI</strong> database’<br />

at http://www.cbi.eu/marketinfo, select footwear and the UK in the category search, click on<br />

the search button and click on market access requirements.<br />

Also, the UK Customs and importers check carefully footwear coming from China, containing<br />

anti moisture sachets, on the appearance of DMF (Dimethyl Fumarate) in footwear. For more<br />

information see Chapter 6 Market requirements of the <strong>CBI</strong> market survey ‘The footwear market<br />

in the EU’ or the SATRA at http://www.satra.co.uk<br />

The new EU regulation on chemical substances, called REACH, has been in force since 2007.<br />

For more information on REACH, see the document on the <strong>CBI</strong> website at<br />

http://www.cbi.eu/marketinfo.<br />

Additional information on packaging can be found at the website of ITC on export packaging:<br />

http://www.intracen.org/ep/packit.htm<br />

Information on tariffs and quota can be found at http://exporthelp.europa.eu

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

6 Doing business<br />

The most important ways to develop a business relationship are to either exhibit at one of the<br />

main footwear trade fairs, or to make a direct approach to wholesalers or major retailers. In<br />

the UK, many business people still prefer a formal style of communication, both in the way a<br />

presentation is put together, and in the way contact is made. A very aggressive price driven<br />

approach will not be effective, although price is very important in the UK market.<br />

General information on doing business like approaching potential business partners, building<br />

up a relationship, drawing up an offer, handling the contract (methods of payment, and terms<br />

of delivery) can be found in <strong>CBI</strong>’s export manuals ‘Export Planner’ and ‘Your image builder’.<br />

Furthermore, cultural awareness is a critical skill in securing success as an exporter.<br />

Information on cultural differences in the EU can be found in chapter 3 of <strong>CBI</strong>’s export manual<br />

‘Exporting to the EU’. These manuals can be downloaded from http://www.cbi.eu/marketinfo -<br />

go to search publications.<br />

Trade magazines<br />

Advertising in trade magazines can sometimes be an effective means of reaching a small<br />

target group. The main publications in the UK are:<br />

• Leather International - http://www.leathermag.com - is a monthly publication, including a<br />

good search facility.<br />

• Fashion Extras - http://www.ras-publishing.com - is produced 8 times a year, targeting<br />

retailers, manufacturers, agents and suppliers of bags, shoes and other accessories. Attire<br />

Accessories - http://www.attireaccessories.co.uk - is produced 6 times a year and is<br />

targeted at specialist retailers in this sector. Drapers - http://www.drapersonline.com - is a<br />

well known fashion publication with good information online.<br />

• World Leather - http://www.worldleather.co.uk - is produced in the UK.<br />

• Footwear Today - http://www.footweartoday.co.uk - is produced 10 times a year and also<br />

features information on leather goods.<br />

• Insight - http://www.insight.ltd.uk - produces trend publications on accessories and leather<br />

goods, as well as footwear.<br />

Trade fairs<br />

The main footwear trade fair takes place each year in Birmingham in February and August and<br />

is called Moda Footwear (http://www.moda-uk.co.uk). Other trade fairs are:<br />

• Moda Accessories which takes place in February and August each year, also in Birmingham.<br />

• Pure London (http://www.purelondon.com), which takes place in February and August each year.<br />

• A further exhibition for fashion accessories buyers, called Boutique By Chic -<br />

http://www.boutique-by-chic.com - takes place each May and October.<br />

Trade associations<br />

There is information on the footwear industry in the UK at the website of the British Footwear<br />

Federation (http://www.britfoot.com). Some manufacturers featured may be looking to<br />

develop relationships with developing country exporters. Other useful contacts are:<br />

• The Independent Footwear Retailers Association (http://www.shoeshop.org.uk).<br />

• The world’s leading footwear research centre, Satra, is based in the UK,<br />

(http://www.satra.co.uk).<br />

• Insight provides trend information and analysis on the footwear market, and produces a<br />

news bulletin called Footnote (http://www.insight.ltd.uk).<br />

• Footwear Business News can be reached at http://www.pcdsreview.com.<br />

This survey was compiled for <strong>CBI</strong> by Searce<br />

Disclaimer <strong>CBI</strong> market information tools: http://www.cbi.eu/disclaimer<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 16 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

ANNEX ADDITIONAL STATISTICAL TABLES<br />

Table 1 United Kingdom imports and leading suppliers of footwear, 2004-2008,<br />

€ million/million pairs, average annual changes<br />

2004 2006 2008 % % % %<br />

value volume value volume value volume value change volume change<br />

share value share volume<br />

Total UK<br />

of which from<br />

3,412 361 3,801 420 3,257 415 100.0 -1.2 100.0 3.5<br />

Intra-EU<br />

of which<br />

1,630 87 1,587 81 1,259 64 38.6 -6.3 15.4 -7.4<br />

Italy 462 24 372 18 355 16 10.9 -6.4 3.8 -9.6<br />

Belgium 162 7 340 17 183 9 5.6 3.1 2.2 6.5<br />

Netherlands 267 14 258 12 163 9 5.0 -11.6 2.2 -10.5<br />

Extra-EU<br />

(ex. DC)<br />

219 23 146 14 68 9 2.1 -25.4 2.2 -20.9<br />

Developing<br />

countries<br />

of which<br />

1,564 251 2,067 325 1,930 342 59.3 5.4 82.4 8.0<br />

China 486 116 942 201 869 221 26.7 15.6 53.2 17.5<br />

Vietnam 601 79 554 71 476 64 14.6 -5.7 15.4 -5.1<br />

India 163 16 174 16 190 19 5.8 3.9 4.6 4.4<br />

Brazil 117 9 175 11 169 10 5.2 9.6 2.4 2.7<br />

Indonesia 95 12 119 12 125 16 3.8 7.1 3.8 7.5<br />

Thailand 34 4 53 5 38 4 1.2 2.8 1.0 0.0<br />

Cambodia 5 0.7 12 1 34 4 1.0 61.5 1.0 54.6<br />

Turkey 3 1 8 1 8 0.9 0.2 27.8 0.2 -2.6<br />

Pakistan 12 3 9 2 4 1 0.1 -24.0 0.2 -24.0<br />

Sri Lanka 3 0.4 5 0.4 4 0.3 0.1 7.5 0.07 -6.9<br />

Source: Eurostat (2009)<br />

Table 2 United Kingdom imports and leading suppliers of footwear with leather<br />

uppers, 2004-2008, € million/million pairs, average annual changes<br />

2004 2006 2008 % % % %<br />

value volume value volume value volume value change volume change<br />

share value share volume<br />

Total UK<br />

of which from<br />

2,339 162 2,508 173 2,083 150 100.0 -2.9 100.0 -1.9<br />

Intra-EU<br />

of which<br />

1,253 56 1,196 52 974 41 46.8 -6.1 27.3 -7.5<br />

Italy 394 18 319 13 306 11 14.7 -6.1 7.3 -11.6<br />

Netherlands 197 9 214 9 124 6 5.9 -10.9 4.0 -9.6<br />

Belgium 60 2 174 8 108 5 5.2 15.8 3.3 25.7<br />

Extra-EU<br />

(ex. DC)<br />

166 14 98 6 36 2 1.7 -31.8 1.3 -38.5<br />

Developing<br />

countries<br />

of which<br />

920 92 1,213 115 1,073 106 51.5 3.9 70.7 3.6<br />

Vietnam 417 44 363 37 300 32 14.4 -7.9 23.3 -7.7<br />

China 132 13 368 37 257 27 12.3 18.1 18.0 20.0<br />

India 137 13 147 14 167 17 8.0 5.1 11.3 6.9<br />

Brazil 113 8 171 10 162 9 7.8 9.4 6.0 3.0<br />

Indonesia 63 7 91 9 108 13 5.2 14.4 8.7 16.7<br />

Thailand 24 2 42 3 31 3 1.5 6.6 2.0 10.7<br />

Cambodia 3 0.2 9 0.9 22 3 1.1 64.6 2.0 96.8<br />

Turkey 0.6 0.06 2 0.2 4 0.3 0.2 60.7 0.2 49.5<br />

Sri Lanka 2 0.2 5 0.3 3 0.2 0.1 10.7 0.1 0.0<br />

Bangladesh 3 0.6 2 0.4 3 0.4 0.1 0.0 0.3 -9.6<br />

Source: Eurostat (2009)<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 17 of 18

<strong>CBI</strong> <strong>MARKET</strong> SURVEY: <strong>THE</strong> <strong>FOOTWEAR</strong> <strong>MARKET</strong> <strong>IN</strong> <strong>THE</strong> <strong>UNITED</strong> K<strong>IN</strong>GDOM<br />

Table 3 United Kingdom imports and leading suppliers of footwear with textile<br />

uppers, 2004-2008, € million/million pairs, average annual changes<br />

2004 2006 2008 % % % %<br />

value volume value volume value volume value change volume change<br />

share value share volume<br />

Total UK<br />

of which from<br />

514 106 572 122 538 133 100.0 1.1 100.0 5.8<br />

Intra-EU<br />

of which<br />

205 16 195 16 154 11 28.6 -6.9 8.3 -9.0<br />

Belgium 52 2 62 4 37 2 6.9 -8.2 1.5 0.0<br />

Italy 32 3 26 2 26 2 4.8 -5.1 1.5 -9.6<br />

Germany 11 1 16 1 19 1 3.5 14.6 0.7 0.0<br />

Extra-EU<br />

(ex. DC)<br />

12 2 15 2 11 2 2.0 -2.2 1.5 0.0<br />

Developing<br />

countries<br />

of which<br />

296 87 362 104 374 120 69.5 6.0 90.2 8.4<br />

China 184 62 250 81 275 100 51.1 10.6 75.2 12.7<br />

Vietnam 74 15 84 16 78 15 14.5 1.3 11.3 0.0<br />

Indonesia 15 2 6 0.9 5 0.9 0.9 -24.0 0.7 -18.1<br />

Thailand 6 1 7 1 5 0.9 0.9 -4.5 0.7 -2.6<br />

Brazil 1 0.3 1 0.2 3 0.2 0.6 31.6 0.1 -9.6<br />

India 4 2 5 2 3 1 0.6 -6.9 0.7 -15.9<br />

Cambodia 0.6 0.1 1 0.2 3 0.3 0.6 49.5 0.2 31.6<br />

Turkey 1 0.9 2 0.3 0.7 0.2 0.1 -8.5 0.1 -31.3<br />

Pakistan 4 2 2 1 0.5 0.3 0.09 -40.5 0.2 -37.8<br />

Bangladesh 0.1 0.04 0.4 0.1 0.2 0.09 0.04 18.9 0.07 22.5<br />

Source: Eurostat (2009)<br />

Source: <strong>CBI</strong> Market Information Database • URL: www.cbi.eu • Contact: marketinfo@cbi.eu • www.cbi.eu/disclaimer<br />

Page 18 of 18