Volume 2, Issue 48 March 27 - The South Asian Times

Volume 2, Issue 48 March 27 - The South Asian Times

Volume 2, Issue 48 March 27 - The South Asian Times

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

14 Finance<br />

<strong>March</strong> <strong>27</strong>- April 2, 2010 <strong>The</strong><strong>South</strong><strong>Asian</strong><strong>Times</strong>.info<br />

By Harry Aurora<br />

Foreclosure Statistics,<br />

Procedures and Relief II<br />

Harry Aurora is a mortgage banker and leading realtor,<br />

serving the community for over a decade, operating<br />

under Wall St Commercial Capital. His Sherman<br />

Oaks Realty is helping homeowners and investors in<br />

Manhattan and Nassau County. Recently, Aurora's<br />

new venture Wall Street Modification Services has<br />

helped hundreds of homeowners save their houses<br />

from foreclosure. He can be contacted at 516-681-<br />

8000, email: harry@shermanoaksrealty.com, website:<br />

wallstreetmodification.com. This is his second monthly<br />

column on the subject.<br />

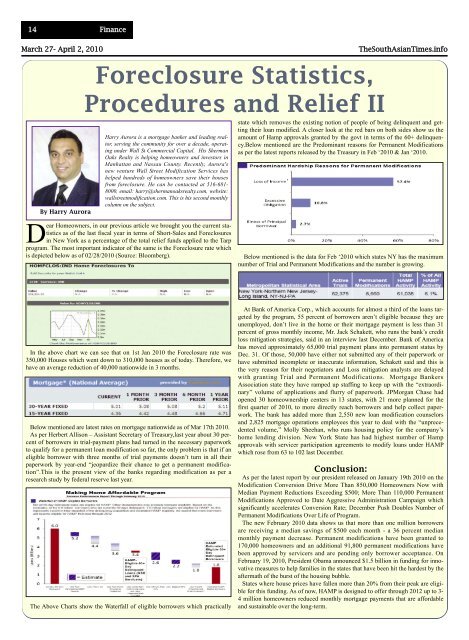

Dear Homeowners, in our previous article we brought you the current statistics<br />

as of the last fiscal year in terms of Short-Sales and Foreclosures<br />

in New York as a percentage of the total relief funds applied to the Tarp<br />

program. <strong>The</strong> most important indicator of the same is the Foreclosure rate which<br />

is depicted below as of 02/28/2010 (Source: Bloomberg).<br />

In the above chart we can see that on 1st Jan 2010 the Foreclosure rate was<br />

350,000 Houses which went down to 310,000 houses as of today. <strong>The</strong>refore, we<br />

have an average reduction of 40,000 nationwide in 3 months.<br />

Below mentioned are latest rates on mortgage nationwide as of Mar 17th 2010.<br />

As per Herbert Allison – Assistant Secretary of Treasury,last year about 30 percent<br />

of borrowers in trial-payment plans had turned in the necessary paperwork<br />

to qualify for a permanent loan modification so far, the only problem is that if an<br />

eligible borrower with three months of trial payments doesn’t turn in all their<br />

paperwork by year-end “jeopardize their chance to get a permanent modification”.This<br />

is the present view of the banks regarding modification as per a<br />

research study by federal reserve last year.<br />

<strong>The</strong> Above Charts show the Waterfall of eligible borrowers which practically<br />

state which removes the existing notion of people of being delinquent and getting<br />

their loan modified. A closer look at the red bars on both sides show us the<br />

amount of Hamp approvals granted by the govt in terms of the 60+ delinquency.Below<br />

mentioned are the Predominant reasons for Permanent Modifications<br />

as per the latest reports released by the Treasury in Feb ‘2010 & Jan ‘2010.<br />

Below mentioned is the data for Feb ‘2010 which states NY has the maximum<br />

number of Trial and Permanent Modifications and the number is growing.<br />

At Bank of America Corp., which accounts for almost a third of the loans targeted<br />

by the program, 55 percent of borrowers aren’t eligible because they are<br />

unemployed, don’t live in the home or their mortgage payment is less than 31<br />

percent of gross monthly income, Mr. Jack Schakett, who runs the bank’s credit<br />

loss mitigation strategies, said in an interview last December. Bank of America<br />

has moved approximately 65,000 trial payment plans into permanent status by<br />

Dec. 31. Of those, 50,000 have either not submitted any of their paperwork or<br />

have submitted incomplete or inaccurate information, Schakett said and this is<br />

the very reason for their negotiators and Loss mitigation analysts are delayed<br />

with granting Trial and Permanent Modifications. Mortgage Bankers<br />

Association state they have ramped up staffing to keep up with the “extraordinary”<br />

volume of applications and flurry of paperwork. JPMorgan Chase had<br />

opened 30 homeownership centers in 13 states, with 21 more planned for the<br />

first quarter of 2010, to more directly reach borrowers and help collect paperwork.<br />

<strong>The</strong> bank has added more than 2,550 new loan modification counselors<br />

and 2,825 mortgage operations employees this year to deal with the “unprecedented<br />

volume,” Molly Sheehan, who runs housing policy for the company’s<br />

home lending division. New York State has had highest number of Hamp<br />

approvals with servicer participation agreements to modify loans under HAMP<br />

which rose from 63 to 102 last December.<br />

Conclusion:<br />

As per the latest report by our president released on January 19th 2010 on the<br />

Modification Conversion Drive More Than 850,000 Homeowners Now with<br />

Median Payment Reductions Exceeding $500; More Than 110,000 Permanent<br />

Modifications Approved to Date Aggressive Administration Campaign which<br />

significantly accelerates Conversion Rate; December Push Doubles Number of<br />

Permanent Modifications Over Life of Program.<br />

<strong>The</strong> new February 2010 data shows us that more than one million borrowers<br />

are receiving a median savings of $500 each month - a 36 percent median<br />

monthly payment decrease. Permanent modifications have been granted to<br />

170,000 homeowners and an additional 91,800 permanent modifications have<br />

been approved by servicers and are pending only borrower acceptance. On<br />

February 19, 2010, President Obama announced $1.5 billion in funding for innovative<br />

measures to help families in the states that have been hit the hardest by the<br />

aftermath of the burst of the housing bubble.<br />

States where house prices have fallen more than 20% from their peak are eligible<br />

for this funding. As of now, HAMP is designed to offer through 2012 up to 3-<br />

4 million homeowners reduced monthly mortgage payments that are affordable<br />

and sustainable over the long-term.