DEALMAKERS OF THE YEAR - Skadden

DEALMAKERS OF THE YEAR - Skadden

DEALMAKERS OF THE YEAR - Skadden

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

prop styling by jeff styles<br />

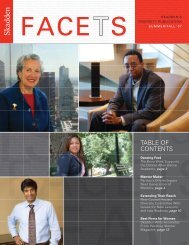

americanlawyer.com april 2011<br />

top transactions lawyers 2011<br />

dealmakers<br />

of the year<br />

skadden partner Jay Goffman channeled his inner Winston Churchill<br />

and led MGM in and out of bankruptcy in an unprecedented 29 days.<br />

Photographs By Paul Godwin<br />

As the nation finally shook off<br />

the recession, lawyers focused on<br />

fixing the damage.<br />

When <strong>Skadden</strong>, arpS, Slate, Meagher & FloM<br />

restructuring partner Jay Goffman stood before a<br />

Manhattan bankruptcy court judge last November to<br />

ask for Chapter 11 protection for Metro-Goldwyn-<br />

Mayer Inc., it wasn’t the start of a drawn-out<br />

restructuring but rather the coda: Goffman had a plan<br />

in place that had been approved by almost all of the<br />

studio’s 350 secured lenders, all but ensuring that there<br />

would be no unexpected court battles.<br />

Goffman likes his court appearances short and<br />

sweet. Ever since 1991, when he pushed through one of<br />

the earliest prepackaged bankruptcies, for now-defunct<br />

computer peripherals company Memorex Telex N.V.,<br />

Goffman has done more to promote the virtues of the<br />

lightning-quick filings than perhaps anyone. By his<br />

own count, he’s done at least 15 prepacks, including<br />

the first such plan approved over creditor objections,<br />

for In-Store Advertising, in 1992. He also handled the<br />

first prepack that was approved in under 30 days, a 13day<br />

bankruptcy for Harvest Foods Inc. in 1997, and<br />

the shortest, a one-day in-and-out affair for Blue Bird

By the time MGM got to bankruptcy court,<br />

its lawyers had already scripted a Hollywood ending<br />

for the once-legendary movie studio.<br />

Box office record<br />

Bus Corporation, in 2004. “I believe in them,” Goffman says. “My job<br />

isn’t to take a company and do a long, drawn-out restructuring. My job is<br />

to take it, fix the problem, and give it back.”<br />

Enter MGM. Its troubles were rooted in a 2005 leveraged buyout<br />

that heaped $4 billion in debt on the studio at a time when DVD sales<br />

were plummeting. In early 2009 MGM’s board brought in turnaround<br />

executive Stephen Cooper to deal with the crisis. He, in turn, tapped<br />

Goffman at the urging of <strong>Skadden</strong> private equity cohead Nick Saggese,<br />

who was close to an MGM board member. (Saggese recently became an<br />

adviser to the investment bank Moelis & Company.) Goffman “has a<br />

very open mind about how to deal with trouble,” says Saggese, whose last<br />

matter at <strong>Skadden</strong> was assisting Goffman on the MGM filing.<br />

Goffman and Cooper agreed that a prepack was the best strategy. For<br />

companies like MGM, with dozens of foreign affiliates exposed to foreign<br />

insolvency proceedings and core assets tied up in intellectual property, a<br />

long stay in bankruptcy court could be fatal. The disposition of IP assets<br />

“is a very gray area in bankruptcy,” says Cooper. “We had IP, and we had<br />

intellectual capital. If we had lost our IP, our intellectual capital would<br />

have been useless.”<br />

But MGM’s lenders initially did not want to be in the business of<br />

owning a studio. To accommodate their demands, Cooper put MGM on<br />

the block, but the auction drew only bottom-fishers.<br />

Goffman’s mission was to get the lenders to see the wisdom of taking<br />

over MGM—and perhaps selling the company at a better time, minus<br />

the debt. Ultimately, he<br />

prevailed. “Everyone<br />

deal in brieF<br />

had their own view of<br />

what should be done,”<br />

MgM bankruptcy<br />

says Simpson Thacher &<br />

Assets $2.67 billion<br />

Firm’s role Debtor’s Counsel<br />

By Julie Triedman<br />

Bartlett’s Peter Pantaleo, counsel to JPMorgan<br />

Chase & Co., the agent to the secured lenders.<br />

Goffman kept his ego out of it, he says, and helped<br />

lenders find common ground. Goffman “doesn’t<br />

elevate problems into disputes,” notes Pantaleo.<br />

By October, Goffman and Cooper felt<br />

they had the votes. But after the creditors had<br />

received their ballots on the proposed plan, the<br />

distressed investor Carl Icahn, who had been<br />

busy snapping up MGM debt, demanded that<br />

the vote be delayed. Icahn threatened to go to<br />

court if necessary, claiming that he represented<br />

a large but unidentified group of aggrieved<br />

debtholders.<br />

Cooper and Goffman called Icahn’s bluff.<br />

And when the votes were in, 80 percent were<br />

for the plan—more than the minimum required<br />

for a prepack. Still, rather than risk litigation,<br />

MGM extended an olive branch to Icahn,<br />

offering him a board seat. Icahn threw in his<br />

vote, pushing creditor support to 96 percent.<br />

Twenty-nine days later, MGM emerged, with<br />

$500 million in the bank and its $5 billion<br />

in debt reset to zero, making it the largest<br />

bankruptcy ever to be completed in under 30<br />

days—and ensuring the next round of James<br />

Bond and Hobbit films.<br />

E-mail: jtriedman@alm.com.

jay goffman | <strong>Skadden</strong>, Arps<br />

Reprinted with permission from the April 2011 edition of <strong>THE</strong> AMERICAN LAWYER © 2011 ALM Media Properties, LLC. All rights reserved. Further duplication without permission is<br />

prohibited. For information, contact 877-257-3382 or reprints@alm.com. # 001-03-11-09

www.skadden.com