Schedule LXIII - EGYPT PART I - MOST-FAVOURED-NATION ...

Schedule LXIII - EGYPT PART I - MOST-FAVOURED-NATION ...

Schedule LXIII - EGYPT PART I - MOST-FAVOURED-NATION ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

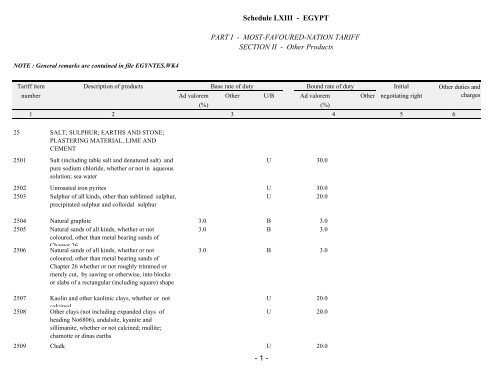

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

25 SALT; SULPHUR; EARTHS AND STONE;<br />

PLASTERING MATERIAL, LIME AND<br />

CEMENT<br />

2501 Salt (including table salt and denatured salt) and<br />

pure sodium chloride, whether or not in aqueous<br />

solution; sea water<br />

U 30.0<br />

2502 Unroasted iron pyrites U 30.0<br />

2503 Sulphur of all kinds, other than sublimed sulphur,<br />

precipitated sulphur and colloidal sulphur<br />

U 20.0<br />

2504 Natural graphite 3.0 B 3.0<br />

2505 Natural sands of all kinds, whether or not<br />

coloured, other than metal bearing sands of<br />

3.0 B 3.0<br />

2506<br />

Chapter 26<br />

Natural sands of all kinds, whether or not<br />

coloured, other than metal bearing sands of<br />

Chapter 26 whether or not roughly trimmed or<br />

merely cut, by sawing or otherwise, into blocks<br />

or slabs of a rectangular (including square) shape<br />

3.0 B 3.0<br />

2507 Kaolin and other kaolinic clays, whether or not<br />

calcined<br />

2508 Other clays (not including expanded clays of<br />

heading No6806), andalsite, kyanite and<br />

sillimanite, whether or not calcined; mullite;<br />

chamotte or dinas earths<br />

U 20.0<br />

U 20.0<br />

2509 Chalk U 20.0<br />

- 1 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2510 Natural calcium phosphates, natural aluminium<br />

calcium phosphates and phosphatic chalk<br />

2511 Natural barium sulphate (barytes); natural barium<br />

carbonate (witherite), whether or not calcined,<br />

other than barium oxide of heading No2816<br />

2512 Siliceous fossil meals (for example, kieselguhr,<br />

tripolite and diatomite) and similar siliceous<br />

earths, whether or not calcined, of an apparent<br />

specific gravity of 1 or less<br />

2513 Pumice stone; emery; natural corundum, natural<br />

garnet and other natural abrasives, whether or not<br />

heat-treated<br />

2514 Slate, whether or not roughly trimmed or merely<br />

cut, by sawing or otherwise, into blocks or slabs<br />

of a rectangular (including square) shape<br />

2515 Marble, travertine, ecaussine and other<br />

calcareous monumental or building stone of an<br />

apparent specific gravity of 2,5 or more, and<br />

alabaster, whether or not roughly trimmed or<br />

merely cut, by sawing or otherwise, into blocks<br />

or slabs of a rectangular<br />

2516 Granite, porphyry, basalt, sandstone and other<br />

monumental or building stone, whether or not<br />

roughly trimmed or merely cut, by sawing or<br />

otherwise, into blocks or slabs of a rectangular<br />

(including square) shape<br />

U 30.0<br />

U 20.0<br />

U 20.0<br />

U 20.0<br />

U 20.0<br />

15.0 B 15.0<br />

- 2 -<br />

U 60.0<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2517 Pebbles, gravel, broken or crushed stone, of a<br />

kind commonlysed for concrete aggregates, for<br />

road metalling or for railway or other ballast,<br />

shingle and flint, whether or not heat-treated;<br />

macadam of slag, dross or similar industrial<br />

waste, whether o<br />

2517.10 Pebbles, gravel, broken or crushed stone, of a<br />

kind commonlysed for concrete aggregates, for<br />

road metalling or for railway or other ballast,<br />

shingle and flint, whether or not heat-treated<br />

2517.20 Macadam of slag, dross or similar industrial<br />

waste, whether or not incorporating the materials<br />

cited in subheading 2517,10<br />

U 20.0<br />

U 20.0<br />

2517.30 Tarred macadam U 20.0<br />

2517.41 Of marble U 40.0<br />

2517.49 Other U 40.0<br />

2518 Dolomite, whether or not calcined; dolomite,<br />

roughly trimmed or merely cut, by sawing or<br />

otherwise, into blocks or slabs of a rectangular<br />

(including square) shape; agglomerated dolomite<br />

(including tarred dolomite)<br />

10.0 B 10.0<br />

- 3 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2519 Natural magnesium carbonate (magnesite); fused<br />

magnesia; dead-burned (sintered) magnesia,<br />

whether or not containing small quantities of<br />

other oxides added before sintering; other<br />

magnesium oxide, whether or not pure<br />

2519.10 Natural magnesium carbonate (magnesite) U 20.0<br />

2519.90 Other U 20.0<br />

2520 Gypsum; anhydrite; plasters (consisting of<br />

calcined gypsum or calcium sulphate) whether or<br />

not coloured, with or without small quantities of<br />

accelerators or retarders<br />

2520.10 Gypsum; anhydrite U 30.0<br />

2520.20 Plasters U 20.0<br />

2521 Limestone flux; limestone and other calcareous<br />

stone, of a kind used for the manufacture of lime<br />

15.0 B 15.0<br />

2522<br />

or cement<br />

Quicklime, slaked lime and hydraulic lime, other<br />

than calcium oxide and hydroxide of heading<br />

U 20.0<br />

2523<br />

No2825<br />

Portland cement, aluminous cement ("ciment<br />

fondu"), slag cement, supersulphate cement and<br />

similar hydraulic cements, whether or not<br />

coloured or in the form of clinkers<br />

U<br />

2523.10 Cement clinkers 50.0<br />

2523.21 White cement, whether or not artificially<br />

50.0<br />

2523.29<br />

2523.30<br />

coloured<br />

Other<br />

Aluminous cement ("ciment fondu") - 4 -<br />

30.0<br />

50.0<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2523.90 Other hydraulic cements 50.0<br />

2524 Asbestos<br />

2524.00 Asbestos 10.0 B 10.0 CAN.<br />

2525 Mica, including splittings; mica waste U 20.0<br />

2526 Natural steatite, whether or not roughly trimmed<br />

or merely cut, by sawing or otherwise, into blocks<br />

or slabs of a rectangular (including square)<br />

shape; talc<br />

U<br />

2526.10 Not crushed, not powdered 30.0<br />

2526.20 Crushed or powdered 20.0<br />

2527 Natural cryolite; natural chiolite U 20.0<br />

2528 Natural borates and concentrates thereof<br />

(whether or not calcined), but not including<br />

borates separated from natural brine; natural boric<br />

acid containing not more than 85 % of H3BO3<br />

calculated on the dry weight<br />

U 20.0<br />

2529 Felspar; leucite; nepheline and nepheline syenite;<br />

U 20.0<br />

2530<br />

fluorspar<br />

Mineral substances not elsewhere specified or<br />

U<br />

2530.10<br />

included<br />

Vermiculite, perlite and chlorites,nexpanded 20.0<br />

2530.20 Kieserite, epsomite (natural magnesium<br />

20.0<br />

2530.30<br />

sulphates)<br />

Earth colours 40.0<br />

2530.40 Natural micaceous iron oxides 20.0<br />

2530.90 Other 20.0<br />

26 ORES, SLAG AND ASH<br />

2601 Iron ores and concentrates, including roasted iron<br />

pyrites<br />

- 5 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2601.11 Non-agglomerated (ECSC) U 20.0<br />

2601.12 Agglomerated (ECSC) U 20.0<br />

2601.20 Roasted iron pyrites 5.0 B 5.0<br />

2602 Manganese ores and concentrates, including<br />

manganiferous iron ores and concentrates with a<br />

manganese content of 20 % or more, calculated<br />

on the dry weight (ECSC)<br />

U 20.0<br />

2603 Copper ores and concentrates U 20.0<br />

2604 Nickel ores and concentrates U 20.0<br />

2605 Cobalt ores and concentrates U 20.0<br />

2606 Aluminium ores and concentrates U 20.0<br />

2607 Lead ores and concentrates U 20.0<br />

2608 Zinc ores and concentrates U 20.0<br />

2609 Tin ores and concentrates U 20.0<br />

2610 Chromium ores and concentrates U 20.0<br />

2611 Tungsten ores and concentrates U 20.0<br />

2612 Uranium or thorium ores and concentrates U 20.0<br />

2613 Molybdenum ores and concentrates U 20.0<br />

2614 Titanium ores and concentrates U 20.0<br />

2615 Niobium, tantalum, vanadium or zirconium ores<br />

and concentrates<br />

U 20.0<br />

2616 Precious metal ores and concentrates U 20.0<br />

2617 Other ores and concentrates U 20.0<br />

2618 Granulated slag (slag sand) from the manufacture<br />

of iron or steel<br />

U 20.0<br />

- 6 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2619 Slag, dross (other than granulated slag), scalings<br />

and other waste from the manufacture of iron or<br />

steel<br />

2620 Ash and residues (other than from the<br />

manufacture of iron or steel), containing metals<br />

or metallic compounds<br />

U 20.0<br />

U 20.0<br />

2621 Other slag and ash, including seaweed ash (kelp) U 20.0<br />

27 MINERAL FUELS, MINERAL OILS AND<br />

PRODUCTS OF THEIR DISTILLATION;<br />

BITUMINOUS SUBSTANCES; MINERAL<br />

WAXES<br />

2701 Coal; briquettes, ovoids and similar solid fuels<br />

manufactured from coal<br />

2701.11 Anthracite (ECSC) U 5.0 AUS<br />

2701.12 Bituminous coal (ECSC) U 5.0 US.AUS<br />

2701.19 Other coal (ECSC) U 5.0 AUS<br />

2701.20 Briquettes, ovoids and similar solid fuels<br />

manufactured from coal (ECSC)<br />

U 20.0<br />

2702 Lignite, whether or not agglomerated, excluding<br />

jet<br />

U 20.0<br />

2703 Peat (including peat litter), whether or not<br />

agglomerated<br />

U 20.0<br />

2704 Coke and semi-coke of coal, of lignite or of peat,<br />

whether or not agglomerated; retort carbon<br />

U 20.0 AUS<br />

- 7 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2705 Coal gas, water gas, producer gas and similar<br />

gases, other than petroleum gases and other<br />

gaseous hydrocarbons<br />

2706 Tar distilled from coal, from lignite or from peat,<br />

and other mineral tars, whether or not dehydrated<br />

or partially distilled, including reconstituted tars<br />

2707 Oils and other products of the distillation of high<br />

temperature coal tar; similar products in which<br />

the weight of the aromatic constituents exceeds<br />

that of the non-aromatic constituents<br />

2708 Pitch and pitch coke, obtained from coal tar or<br />

from other mineral tars<br />

2709 Petroleum oils and oils obtained from bituminous<br />

minerals, crude<br />

2710 Petroleum oils and oils obtained from bituminous<br />

minerals, other than crude; preparations not<br />

elsewhere specified or included, containing by<br />

weight 70 % or more of petroleum oils or of oils<br />

obtained from bituminous minerals, these oils<br />

being the basi<br />

2711 Petroleum gases and other gaseous hydrocarbons<br />

U 20.0<br />

U 30.0<br />

U 30.0<br />

U 30.0<br />

U 20.0<br />

U 20.0<br />

2711.11 Natural gas U 20.0<br />

2711.12 Propane U 20.0<br />

2711.13 Butanes U 40.0<br />

- 8 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2711.14 Ethylene, propylene, butylene and butadiene U 20.0<br />

2711.19 Other U 20.0<br />

2711.21 Natural gas U 20.0<br />

2711.29 Other U 20.0<br />

2712 Petroleum jelly; paraffin wax, microcrystalline<br />

petroleum wax, slack wax, ozokerite, lignite wax,<br />

peat wax, other mineral waxes, and similar<br />

products obtained by synthesis or by other<br />

processes, whether or not coloured<br />

U 20.0<br />

2713 Petroleum coke, petroleum bitumen and other<br />

residues of petroleum oils or of oils obtained<br />

from bituminous minerals<br />

2714 Bitumen and asphalt, natural; bituminous or oil<br />

shale and tar sands; asphaltites and asphaltic<br />

rocks<br />

2715 Bituminous mixtures based on natural asphalt, on<br />

natural bitumen, on petroleum bitumen, on<br />

mineral tar or on mineral tar pitch (for example,<br />

bituminous mastics, cut-backs)<br />

U 20.0<br />

U 20.0<br />

U 20.0<br />

2716 Electrical energy U 20.0<br />

28 INORGANIC CHEMICALS ORGANIC OR<br />

INORGANIC COMPOUNDS OF PRECIOUS<br />

METALS, OF RARE-EARTH METALS, OF<br />

RADIOACTIVE ELEMENTS OR OF<br />

ISOTOPES<br />

2801<br />

2801.10<br />

Fluorine, chlorine, bromine and iodine<br />

Chlorine<br />

- 9 -<br />

U 40.0<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2801.20 Iodine U 20.0<br />

2801.30 Fluorine; bromine U 20.0<br />

2802 Sulphur, sublimed or precipitated; colloidal<br />

sulphur<br />

U 20.0<br />

2803 Carbon (carbon blacks and other forms of carbon<br />

not elsewhere specified or included)<br />

10.0 B 10.0<br />

2804 Hydrogen, rare gases and other non-metals<br />

2804.10 Hydrogen U 40.0<br />

2804.21 Argon U 20.0<br />

2804.29 Other U 20.0<br />

2804.30 Nitrogen U 40.0<br />

2804.40 Oxygen U 40.0<br />

2804.50 Boron; tellurium U 20.0<br />

2804.61 Containing by weight not less than 99,99 % of<br />

silicon<br />

U 20.0<br />

2804.69 Other U 20.0<br />

2804.70 Phosphorus U 20.0<br />

2804.80 Arsenic U 20.0<br />

2804.90 Selenium U 20.0<br />

2805 Alkali or alkaline-earth metals; rare-earth metals,<br />

scandium and yttrium, whether or not intermixed<br />

or interalloyed; mercury<br />

5.0 B 5.0<br />

2806 Hydrogen chloride (hydrochloric acid);<br />

chlorosulphuric acid<br />

U 30.0<br />

2807 Sulphuric acid; oleum U 30.0<br />

2808 Nitric acid; sulphonitric acids U<br />

- 10 -<br />

30.0<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2809 Diphosphorus pentaoxide; phosphoric acid and<br />

polyphosphoric acids<br />

5.0 B 5.0<br />

2810 Oxides of boron; boric acids 5.0 B 5.0<br />

2811 Other inorganic acids and other inorganic oxygen<br />

compounds of non-metals<br />

U 30.0<br />

2812 Halides and halide oxides of non-metals U 20.0<br />

2813 Sulphides of non-metals; commercial phosphorus<br />

trisulphide<br />

U 20.0<br />

2814 Ammonia, anhydrous or in aqueous solution 5.0 B 5.0<br />

2815 Sodium hydroxide (caustic soda); potassium<br />

hydroxide (caustic potash); peroxides of sodium<br />

or potassium<br />

2815.11 Solid 5.0 B 5.0<br />

2815.12 In aqueous solution (soda lye or liquid soda) 5.0 B 5.0<br />

2815.20 Potassium hydroxide (caustic potash) 5.0 B 5.0<br />

2815.30 Peroxides of sodium or potassium 5.0 B 5.0<br />

2816 Hydroxide and peroxide of magnesium; oxides,<br />

hydroxides and peroxides, of strontium or barium<br />

5.0 B 5.0<br />

2817 Zinc oxide; zinc peroxide U 20.0<br />

2818 Aluminium oxide (including artificial corundum); 5.0 B 5.0<br />

2819<br />

aluminium hydroxide<br />

Chromium oxides and hydroxides 5.0 B 5.0<br />

2820 Manganese oxides 5.0 B 5.0<br />

2821 Iron oxides and hydroxides; earth colours<br />

containing 70 % or more by weight of combined<br />

U 20.0<br />

iron evaluated as Fe2O3<br />

- 11 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2822 Cobalt oxides and hydroxides; commercial cobalt 5.0 B 5.0<br />

2823<br />

oxides<br />

Titanium oxides 10.0 B 10.0<br />

2824 Lead oxides; red lead and orange lead<br />

2824.10 Lead monoxide (litharge, massicot) U 40.0<br />

2824.20 Red lead and orange lead U 40.0<br />

2824.90 Other U 30.0<br />

2825 Hydrazine and hydroxylamine and their<br />

inorganic salts; other inorganic bases; other<br />

metal oxides, hydroxides and peroxides<br />

5.0 B 5.0<br />

2826 Fluorides; fluorosilicates, fluoroaluminates and<br />

other complex fluorine salts<br />

2827 Chlorides, chloride oxides and chloride<br />

hydroxides; bromides and bromide oxides;<br />

iodides and iodide oxides<br />

2828 Hypochlorites; commercial calcium hypochlorite;<br />

chlorites; hypobromites<br />

2829 Chlorates and perchlorates; bromates and<br />

perbromates; iodates and per iodates<br />

5.0 B 5.0<br />

5.0 B 5.0<br />

5.0 B 5.0<br />

5.0 B 5.0<br />

2830 Sulphides; polysulphides 5.0 B 5.0<br />

2831 Dithionites and sulphoxylates 5.0 B 5.0<br />

2832 Sulphites; thiosulphates 5.0 B 5.0<br />

2833 Sulphates; alums; peroxosulphates (persulphates) 5.0 B 5.0<br />

2834 Nitrites; nitrates 5.0 B 5.0<br />

2835 Phosphinates (hypophosphites), phosphonates<br />

(phosphites), phosphates and polyphosphates<br />

5.0 B 10.0<br />

- 12 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2836 Carbonates; peroxocarbonates (percarbonates);<br />

commercial ammonium carbonate containing<br />

ammonium carbamate<br />

5.0 B 5.0<br />

2836.10 Commercial ammonium carbonate and other<br />

5.0 B 10.0<br />

2836.20.10<br />

ammonium carbonates<br />

Disodium carbonate 5.0 B 5.0<br />

2836.20.90 Others 30.0 B 30.0<br />

2836.30 Sodium hydrogencarbonate (sodium bicarbonate) 5.0 B 10.0<br />

2836.40 Potassium carbonates 5.0 B 10.0<br />

2836.50 Calcium carbonate 5.0 B 10.0<br />

2836.60 Barium carbonate 5.0 B 10.0<br />

2836.70 Lead carbonate 5.0 B 10.0<br />

2836.91 Lithium carbonates 5.0 B 10.0<br />

2836.92 Strontium carbonate 5.0 B 10.0<br />

2836.93 Bismuth carbonate 5.0 B 10.0<br />

2836.99 Other 10.0 B 10.0<br />

2837 Cyanides, cyanide oxides and complex cyanides 10.0 B 10.0<br />

2838 Fulminates, cyanates and thiocyanates 5.0 B 5.0<br />

2839 Silicates; commercial alkali metal silicates 5.0 B 5.0<br />

2840 Borates; peroxoborates (perborates) 5.0 B 5.0<br />

2841 Salts of oxometallic or peroxometallic acids 5.0 B 5.0<br />

2842 Other salts of inorganic acids or peroxoacids,<br />

excluding azides<br />

2843 Colloidal precious metals; inorganic or organic<br />

compounds of precious metals, whether or not<br />

chemically defined ;amalgams of precious metals<br />

5.0 B 5.0<br />

5.0 B 5.0<br />

- 13 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2844 Radioactive chemical elements and radioactive<br />

isotopes (including the fissile or fertile chemical<br />

elements and isotopes) and their compounds;<br />

mixtures and residues containing these products<br />

2845 Isotopes other than those of heading No2844;<br />

compounds, inorganic or organic, of such<br />

isotopes, whether or not chemically defined<br />

2846 Compounds, inorganic or organic, of rare-earth<br />

metals, of yttrium or of scandium or of mixtures<br />

of these metals<br />

5.0 B 5.0<br />

5.0 B 5.0<br />

5.0 B 5.0<br />

2847 Hydrogen peroxide, whether or not solidified<br />

5.0 B 5.0<br />

2848<br />

withrea<br />

Phosphides, whether or not chemically defined, 5.0 B 5.0<br />

2849<br />

excluding ferrophosphorus<br />

Carbides, whether or not chemically definedB 5.0 B 5.0<br />

2850 Hydrides, nitrides, azides, silicides and borides,<br />

whether or not chemically defined<br />

2851 Other inorganic compounds (including distilled<br />

or conductivity water and water of similar purity);<br />

liquid air (whether or not rare gases have been<br />

removed); compressed air; amalgams, other than<br />

amalgams of precious metals<br />

5.0 B 5.0<br />

5.0 B 5.0<br />

29 ORGANIC CHEMICALS<br />

2901 Acyclic hydrocarbons<br />

2901.10 Saturated U 40.0<br />

- 14 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2901.90 Others U 20.0<br />

2901.21 Ethylene U 20.0<br />

2901.22 Propene (propylene) U 20.0<br />

2901.23 Butene (butylene) and isomers thereof U 20.0<br />

2901.24 Buta-1,3-diene and isoprene U 20.0<br />

2901.29.10 Other U 30.0<br />

2902 Cyclic hydrocarbons U 20.0<br />

2902.11 Cyclohexane U 20.0<br />

2902.19 Other U 20.0<br />

2902.20 Benzene U 30.0<br />

2902.30 Toluene U 20.0<br />

2902.41 o-Xylene U 20.0<br />

2902.42 m-Xylene U 20.0<br />

2902.43 p-Xylene U 20.0<br />

2902.44 Mixed xylene isomers U 20.0<br />

2902.50 Styrene U 20.0<br />

2902.60 Ethylbenzene U 20.0<br />

2902.70 Cumene<br />

2902.90 Other U 40.0<br />

2903 Halogenated derivatives of hydrocarbons 5.0 B 5.0<br />

2904 Sulphonated, nitrated or nitrosated derivatives of<br />

hydrocarbons, whether or not halogenated<br />

2905 Acyclic alcohols and their halogenated,<br />

sulphonated, nitrated or nitrosated derivatives<br />

U 20.0<br />

5.0 B 5.0<br />

2905.44 D-glucitol (sorbitol) U 20.0<br />

- 15 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2906 Cyclic alcohols and their halogenated,<br />

sulphonated, nitrated or nitrosated derivatives<br />

2906.11 Menthol 5.0 B 5.0<br />

2906.12 Cyclohexanol, methylcyclohexanols and<br />

U 20.0<br />

2906.13<br />

dimethylcyclohexanols<br />

Sterols and inositols U 20.0<br />

2906.14 Terpineols U 20.0<br />

2906.19 Other U 20.0<br />

2906.21 Benzyl alcohol U 20.0<br />

2906.29 Other U 20.0<br />

2907 Phenols; phenol-alcohols 5.0 B 5.0<br />

2908 Halogenated, sulphonated, nitrated or nitrosated<br />

derivatives of phenols or phenol-alcohols<br />

5.0 B 5.0<br />

2909 Ethers, ether-alcohols, ether-phenols, etheralcohol-phenols,<br />

alcohol peroxides, ether<br />

peroxides, ketone peroxides (whether or not<br />

chemically defined), and their halogenated,<br />

sulphonated, nitrated or nitrosated derivatives<br />

2910 Epoxides, epoxyalcohols, epoxyphenols and<br />

epoxyethers, with a three-membered ring, and<br />

their halogenated, sulphonated, nitrated or<br />

nitrosated derivatives<br />

2911 Acetals and hemiacetals, whether or not with<br />

other oxygen function, and their halogenated,<br />

sulphonated, nitrated or nitrosated derivatives<br />

U 20.0<br />

5.0 B 5.0<br />

5.0 B 5.0<br />

- 16 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2912 Aldehydes, whether or not with other oxygen<br />

function; cyclic polymers of aldehydes;<br />

paraformaldehyde<br />

2913 Halogenated, sulphonated, nitrated or nitrosated<br />

derivatives of products of heading No2912<br />

2914 Ketones and quinones, whether or not with other<br />

oxygen function, and their halogenated,<br />

sulphonated, nitrated or nitrosated derivatives<br />

U 20.0<br />

5.0 B 5.0<br />

2914.11 Acetone 5.0 B 5.0<br />

2914.12 Butanone (methyl ethyl ketone) U 20.0<br />

2914.13 4-Methylpentan-2-one (methyl isobutyl ketone) U 20.0<br />

2914.19 Other U 20.0<br />

2914.21 Camphor 5.0 B 5.0<br />

2914.22 Cyclohexanone and methylcyclohexanones U 20.0<br />

2914.23 Ionones and methylionones U 20.0<br />

2914.29 Other U 20.0<br />

2914.30 Aromatic ketones without other oxygen function U 20.0<br />

2914.41 4-Hydroxy-4-methylpentan-2-one (diacetone<br />

U 20.0<br />

2914.49<br />

alcohol)<br />

Other U 20.0<br />

2914.50 Ketone-phenols and ketones with other oxygen<br />

U 20.0<br />

2914.61<br />

function<br />

Anthraquinone U 20.0<br />

2914.69 Other U 20.0<br />

2914.70 Halogenated, sulphonated, nitrated or nitrosated<br />

U 20.0<br />

derivatives<br />

- 17 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2915 Saturated acyclic monocarboxylic acids and their<br />

anhydrides, halides,peroxides and peroxyacids;<br />

their halogenated, sulphonated, nitrated or<br />

nitrosated derivatives<br />

2915.11 Formic acid 5.0 B 5.0<br />

2915.12 Salts of formic acid 5.0 B 5.0<br />

2915.13 Esters of formic acid 5.0 B 5.0<br />

2915.21.90 Acetic acid 5.0 B 5.0<br />

2915.22 Sodium acetate 5.0 B 5.0<br />

2915.23 Cobalt acetates 5.0 B 5.0<br />

2915.24 Acetic anhydride 5.0 B 5.0<br />

2915.29 Other 5.0 B 5.0<br />

2915.31 Ethyl acetate U 10.0<br />

2915.32 Vinyl acetate U 10.0<br />

2915.33 n-Butyl acetate U 10.0<br />

2915.34 Isobutyl acetate U 20.0<br />

2915.35 2-Ethoxyethyl acetate U 20.0<br />

2915.39 Other U 20.0<br />

2915.40 Mono-, di- or trichloroacetic acids, their salts and<br />

U 20.0<br />

2915.50<br />

esters<br />

Propionic acid, its salts and esters U 20.0<br />

2915.60 Butyric acids, valeric acids, their salts and esters U 20.0<br />

2915.70 Palmitic acid, stearic acid, their salts and esters U 20.0<br />

2915.90 Other U 20.0<br />

- 18 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2916 Unsaturated acyclic monocarboxylic acids, cyclic<br />

monocarboxylic acids, their anhydrides, halides,<br />

peroxides and peroxyacids; their halogenated,<br />

sulphonated, nitrated or nitrosated derivatives<br />

2916.11 Acrylic acid and its salts U 20.0<br />

2916.12 Esters of acrylic acid U 20.0<br />

2916.13 Methacrylic acid and its salts 5.0 B 5.0<br />

2916.14 Esters of methacrylic acid 5.0 B 5.0<br />

2916.15 Oleic, linoleic or linolenic acids, their salts and<br />

U 20.0<br />

2916.19<br />

esters<br />

Other U 20.0<br />

2916.20 Cyclanic, cyclenic or cycloterpenic<br />

monocarboxylic acids, their anhydrides, halides,<br />

peroxides, peroxyacids and their derivatives<br />

U 20.0<br />

2916.31 Benzoic acid, its salts and esters U 20.0<br />

2916.32 Benzoyl peroxide and benzoyl chloride U 20.0<br />

2916.33 Phenylacetic acid, its salts and esters U 20.0<br />

2916.39 Other U 20.0<br />

2917 Polycarboxylic acids, their anhydrides, halides,<br />

peroxides and peroxy acids; their halogenated,<br />

sulphonated, nitrated or nitrosated derivatives<br />

10.0 B 10.0<br />

2918 Carboxylic acids with additional oxygen function<br />

and their anhydrides, halides, peroxides and<br />

peroxyacids; their halogenated, sulphonated,<br />

nitrated or nitrosated derivatives<br />

5.0 B 5.0<br />

- 19 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2919 Phosphoric esters and their salts, including<br />

lactophosphates; their halogenated, sulphonated,<br />

nitrated or nitrosated derivatives<br />

2920 Esters of other inorganic acids (excluding esters<br />

of hydrogen halides) and their salts; their<br />

halogenated, sulphonated, nitrated or nitrosated<br />

derivatives<br />

5.0 B 5.0<br />

5.0 B 5.0<br />

2921 Amine-function compounds U 10.0<br />

2922 Oxygen-function amino-compounds 5.0 B 5.0<br />

2923 Quaternary ammonium salts and hydroxides;<br />

lecithins and other phosphoaminolipids<br />

5.0 B 5.0<br />

2924 Carboxyamide-function compounds; amidefunction<br />

compounds of carbonic acid<br />

5.0 B 5.0<br />

2925 Carboxyimide-function compounds (including<br />

saccharin and its salts) and imine-function<br />

U 20.0<br />

2926<br />

compounds<br />

Nitrile-function compounds U 20.0<br />

2927 Diazo-, azo- or azoxy-compounds U 20.0<br />

2928 Organic derivatives of hydrazine or of<br />

U 20.0<br />

2929<br />

hydroxylamine<br />

Compounds with other nitrogen function U 20.0<br />

2930 Organo-sulphur compounds U 20.0<br />

2931 Other organo-inorganic compounds U 20.0<br />

2932 Heterocyclic compds with 02 hetero-atom(s) only U 20.0<br />

2933 Heterocyclic compds with 02 nitrogen only<br />

U 10.0<br />

2934<br />

nucleic acids and their salts<br />

Other heterocyclic compounds<br />

- 20 -<br />

U 20.0<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2935 Sulphonamides U 20.0<br />

2936 Provitamins and vitamins, natural or reproduced<br />

by synthesis (including natural concentrates),<br />

derivatives thereofsed primarily as vitamins, and<br />

intermixtures of the foregoing, whether or not in<br />

any solvent<br />

3.0 B 3.0<br />

2937 Hormones, natural or reproduced by synthesis;<br />

derivatives thereof, used primarily as hormones;<br />

other steroidssed primarily as hormones<br />

3.0 B 5.0<br />

2937.10 Pituitary (anterior) or similar hormones, and their 3.0 B 3.0<br />

2937.21<br />

derivatives<br />

Cortisone, hydrocortisone, prednisone<br />

(dehydrocortisone) and prednisolone<br />

3.0 B 3.0<br />

2937.22<br />

(dehydrohydrocortisone)<br />

Halogenated derivatives of adrenal cortical<br />

3.0 B 3.0<br />

2937.29<br />

hormones<br />

Other 3.0 B 3.0<br />

2937.91 Insulin and its salts 3.0 B 3.0<br />

2937.92 Oestrogens and progestogens 3.0 B 3.0<br />

2937.99 Other 3.0 B 3.0<br />

2938 Glycosides, natural or reproduced by synthesis,<br />

and their salts, ethers, esters and other<br />

U 20.0<br />

2939<br />

derivatives<br />

Vegetable alkaloids, natural or reproduced by<br />

synthesis, and their salts, esters and other<br />

U 20.0<br />

2939.90.10<br />

derivatives<br />

Other Morphine U 70.0 ARTICLE 20<br />

2939.90.20 Other Morphine U 70.0 ARTICLE 20<br />

- 21 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

2940 Sugars, chemically pure, other than sucrose,<br />

lactose, maltose, glucose and fructose; sugar<br />

ethers and sugar esters, and their salts, other than<br />

products of heading No2937,2938 or2939<br />

U 20.0<br />

2941 Antibiotics 5.0 B 5.0<br />

2942 Other organic compounds U 20.0<br />

30 PHARMACEUTICAL PRODUCTS<br />

3001 Glands and other organs for organo-therapeutic<br />

uses, dried, whether or not powdered; extracts of<br />

glands or other organs or of their secretions for<br />

organo therapeuticses; heparin and its salts; other<br />

human or animal substances prepared for<br />

therapeutic or<br />

U 20.0<br />

3002 Human blood; animal blood prepared for<br />

therapeutic, prophylactic or diagnosticses;<br />

antisera and other blood fractions; vaccines,<br />

toxins, cultures of micro- organisms (excluding<br />

yeasts) and similar products<br />

3003 Medicaments (excluding goods of heading<br />

No3002, 3005 or3006) consisting of two or more<br />

constituents which have been mixed together for<br />

therapeutic or prophylacticses, not putp in<br />

measured doses or in forms or packings for retail<br />

sale<br />

- 22 -<br />

U 10.0<br />

U 20.0<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3004 Medicaments (excluding goods of heading<br />

No3002, 3005 or3006) consisting of mixed<br />

ornmixed products for therapeutic or<br />

prophylacticses, putp in measured doses or in<br />

forms or packings for retail sale<br />

U 10.0<br />

3004.90.10 Medicaments (assortments) U 5.0<br />

3005 Wadding, gauze, bandages and similar articles<br />

(for example, dressings, adhesive plasters,<br />

poultices), impregnated or coated with<br />

pharmaceutical substances or putp in forms or<br />

packings for retail sale for medical, surgical,<br />

dental or veterinary purpose<br />

U 20.0<br />

3006 Pharmaceutical goods specified in Note 3 to this<br />

Chapter<br />

31 FERTILIZERS<br />

3101 Animal or vegetable fertilisers, whether or not<br />

mixed together or chemically treated; fertilisers<br />

produced by the mixing or chemical treatment of<br />

animal or vegetable products<br />

3102 Mineral or chemical fertilisers, nitrogenous<br />

U 20.0<br />

U 20.0<br />

3102.10 Urea, whether or not in aqueous solution U 40.0<br />

3102.21 Ammonium sulphate U 20.0<br />

3102.29 Other U 40.0<br />

3102.30 Ammonium nitrate, whether or not in aqueous<br />

U 40.0<br />

3102.40<br />

solution<br />

Mixtures of ammonium nitrate with calcium<br />

carbonate or other inorganic non-fertilising<br />

substances<br />

U<br />

- 23 -<br />

40.0<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3102.50 Sodium nitrate U 40.0<br />

3102.60 Double salts and mixtures of calcium nitrate and<br />

U 40.0<br />

3102.70<br />

ammonium nitrate<br />

Calcium cyanamide U 40.0<br />

3102.80 Mixtures ofrea and ammonium nitrate in aqueous<br />

U 40.0<br />

3102.90<br />

or ammoniacal solution<br />

Other, including mixtures no pecified in the<br />

U 40.0<br />

3103<br />

foregoing subheadings<br />

Mineral or chemical fertilisers, phosphatic U 40.0<br />

3104 Mineral or chemical fertilisers, potassic U 20.0<br />

3105 Mineral or chemical fertilisers containing two or<br />

three of the fertilising elements nitrogen,<br />

phosphorus and potassium; other fertilisers;<br />

goods of this Chapter in tablets or similar forms<br />

or in packages of a gross weight not exceeding 10<br />

kg<br />

32 TANNING OR DYEING EXTRACTS;<br />

TANNINS AND THEIR DERIVATIVES;<br />

DYES, PIGMENTS AND OTHERS<br />

COLOURING MATTER; PAINTS AND<br />

VARNISHES; PUTTY AND OTHER<br />

MASTICS; INKS<br />

3201 Tanning extracts of vegetable origin; tannins and<br />

their salts, ethers, esters and other derivatives<br />

U 20.0<br />

3.0 B 3.0<br />

- 24 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3202 Synthetic organic tanning substances; inorganic<br />

tanning substances; tanning preparations,<br />

whether or not containing natural tanning<br />

substances; enzymatic preparations for pretanning<br />

3203 Colouring matter of vegetable or animal origin<br />

(including dyeing extracts but excluding animal<br />

black), whether or not chemically defined;<br />

preparations as specified in Note 3 to this<br />

Chapter based on colouring matter of vegetable<br />

or animal origin<br />

3204 Synthetic organic colouring matter, whether or<br />

not chemically defined; preparations as specified<br />

in Note 3 to this Chapter based on synthetic<br />

organic colouring matter; synthetic organic<br />

products of a kind used as fluorescent<br />

brightening agents or as<br />

3205 Colour lakes; preparations as specified in Note 3<br />

to this Chapter based on colour lakes<br />

3206 Other colouring matter; preparations as specified<br />

in Note 3 to this Chapter, other than those of<br />

headingNo3203,3204 or3205; inorganic products<br />

of a kind used as luminophores, whether or not<br />

chemically defined<br />

3.0 B 3.0<br />

10.0 B 10.0<br />

10.0 B 10.0<br />

5.0 B 5.0<br />

15.0 B 15.0<br />

- 25 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3207 Prepared pigments, prepared opacifiers and<br />

prepared colours, vitrifiable enamels and glazes,<br />

engobes (slips), liquid lustres and similar<br />

preparations, of a kind used in the ceramic,<br />

enamelling or glass industry; glass frit and other<br />

glass, in the for<br />

3207.10 Prepared pigments, prepared opacifiers, prepared<br />

colours and similar preparations Vitrifiable<br />

enamels and glazes, engobes<br />

3207.20 Vitrifiable enamels and glazes, engobes (slips)<br />

and similar preparations<br />

20.0 B 20.0<br />

20.0 B 20.0<br />

3207.30 Liquid lustres and similar preparations 20.0 B 20.0<br />

3207.40 Glass frit and other glass, in the form of powder, 20.0 B 20.0<br />

3208<br />

granules or flakes<br />

Paints and varnishes (including enamels and<br />

lacquers) based on synthetic polymers or<br />

chemically modified natural polymers, dispersed<br />

or dissolved in a non-aqueous medium; solutions<br />

as defined in Note 4 to this Chapter<br />

3208.10.10 Based on polyesters 30.0 B 30.0<br />

3208.20 Based on acrylic or vinyl polymers 50.0 B 50.0<br />

3208.90 Other U 50.0<br />

3209 Paints and varnishes (including enamels and<br />

lacquers) based on synthetic polymers or<br />

chemically modified natural polymers, dispersed<br />

or dissolved in an aqueous medium<br />

- 26 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3209.10 Based on acrylic or vinyl polymers<br />

3209.90 Other<br />

3210 Other paints and varnishes (including enamels,<br />

lacquers and distempers ); prepared water<br />

pigments of kind used for finishing leather<br />

3211.00.10 & Prepared 3211.00.90 driers ; prepared water pigments of kind<br />

used for finishing leather<br />

50.0 B 50.0<br />

U 20.0<br />

3212 Pigments (including metallic powders and flakes)<br />

dispersed in non-aqueous media, in liquid or<br />

paste form, of a kind used in the manufacture of<br />

paints (including enamels); stamping foils; dyes<br />

and other colouring matter putp in forms or<br />

packings for r<br />

3212.10 Stamping foils U 20.0<br />

3212.90 Other U 50.0<br />

3213 Artists', student user signboard painterscolours,<br />

modifying tints, amusement colours and the like,<br />

in tablets, tubes, jars, bottles, pans or in similar<br />

forms or packings<br />

3213.10 Colours in sets U 40.0<br />

3213.90 Other U 40.0<br />

3214 Glaziersputty, grafting putty, resin cements,<br />

caulking compounds and other mastics; painters<br />

fillings; non-refractory surfacing preparations for<br />

facades, indoor walls, floors, ceilings or the like<br />

3214.10 Mastics; paintersfillings U 40.0<br />

- 27 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3214.90 Other U 50.0<br />

3215 Printing ink, writing or drawing ink and other<br />

inks, whether or not concentrated or solid<br />

3215.11 Black U 40.0<br />

3215.19 Other U 40.0<br />

3215.90 Other U 30.0<br />

33 ESSENTIAL OILS AND RESINOIDS;<br />

PERFUMERY, COSMETIC OR TOILET<br />

PREPARATIONS<br />

3301 Essential oils (terpeneless or not), including<br />

concretes and absolutes; resinoids; concentrates<br />

of essential oils in fats, in fixed oils, in waxes or<br />

the like, obtained by enfleurage or maceration;<br />

terpenic by-products of the deterpenation of<br />

essenti<br />

3301.11 Of bergamot U 40.0<br />

3301.12 Of orange U 40.0<br />

3301.13 Of lemon U 40.0<br />

3301.14 Of lime U 40.0<br />

3301.19 Other U 40.0<br />

3301.21 Of geranium U 40.0<br />

3301.22 Of jasmin U 50.0<br />

3301.23 Of lavender or of lavandin U 30.0<br />

3301.24 Of peppermint (Mentha piperita) U 30.0<br />

3301.25<br />

3301.26<br />

Of other mints<br />

Of vetiver<br />

U<br />

- 28 -<br />

U<br />

30.0<br />

30.0<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3301.29 Other U 50.0<br />

3301.30 Resinoids U 60.0<br />

3301.90 Other U 60.0<br />

3302 Mixtures of odoriferous substances and mixtures<br />

(including alcoholic solutions) with a basis of one<br />

or more of these substances, of a kind used as<br />

raw materials in industry<br />

3302.10.10 Of a kind used in the food or drink industries U 40.0<br />

3302.10.90 Others U 50.0<br />

3302.90.10 Other U 60.0<br />

3302.90.90 Others U 50.0<br />

3303 Perfumes and toilet waters U 60.0<br />

3304 Beauty or make-up preparations and preparations<br />

for the care of the skin (other than medicaments),<br />

including sunscreen or sun tan preparations;<br />

manicure or pedicure preparations<br />

U 60.0<br />

3305 Preparations forse on the hair U 60.0<br />

3306 Preparations for oral or dental hygiene, including<br />

denture fixative pastes and powders<br />

U 60.0<br />

3307 Pre-shave, shaving or after-shave preparations,<br />

personal deodorants, bath preparations,<br />

depilatories and other perfumery, cosmetic or<br />

toilet preparations, not elsewhere specified or<br />

included; prepared room deodorizers, whether or<br />

not perfumed or havin<br />

- 29 -<br />

U 60.0<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

34 SOAP, ORGANIC SURFACE-ACTIVE<br />

AGENTS, WASHING PREPARATIONS,<br />

LUBRICATING PREPARATIONS,<br />

ARTIFICIAL WAXES, PREPARED WASES,<br />

POLISHING OR SCOURING<br />

PREPARATIONS, CANDLES AND SIMILAR<br />

ARTICLES, MODELLING PASTES, 'DENTAL<br />

WAXESAND DENTAL PREPARATIONS<br />

WITH A BASIS OF<br />

3401 Soap; organic surface-active products and<br />

preparations forse as soap, in the form of bars,<br />

cakes, moulded pieces or shapes, whether or not<br />

containing soap; paper, wadding, felt and<br />

nonwovens, impregnated, coated or covered with<br />

soap or detergent<br />

3401.11.10 For toilet use (including medicated U 40.0<br />

3401.11.90 products) U 60.0<br />

3401.19 Other U 60.0<br />

3401.20.10 Soap in other forms U 40.0<br />

3401.20.20 Parafin oil for disinfectants U 20.0<br />

3401.20.90 Others U 60.0<br />

3402 Organic surface-active agents (other than soap);<br />

surface-active preparations, washing preparations<br />

(including auxiliary washing preparations) and<br />

cleaning preparations, whether or not containing<br />

soap, other than those of heading No3401<br />

- 30 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3402.11.10 Anionic U 40.0<br />

3402.11.90 Other U 20.0<br />

3402.12.10 Cationic U 40.0<br />

3402.12.90 Other U 20.0<br />

3402.13.10 Non-ionic U 40.0<br />

3402.13.90 Other U 20.0<br />

3402.19.10 Other U 40.0<br />

3402.19.90 Other U 20.0<br />

3402.20 Preparations putp for retail sale U 60.0<br />

3402.90.10 Other U 30.0<br />

3402.90.90 Other U 40.0<br />

3403 Lubricating preparations (including cutting-oil<br />

preparations, bolt or nut release preparations,<br />

anti-rust or anti-corrosion preparations and mould<br />

release preparations, based on lubricants) and<br />

preparations of a kind used for the oil or grease<br />

treatme<br />

3403.11 Preparations for the treatment of textile materials,<br />

leather, furskins or other materials<br />

3403.11.10 Ready for retail sale U 40.0<br />

3403.11.90 Other U 20.0<br />

3403.19.10<br />

3403.19.90<br />

Ready for retail sale<br />

Other<br />

U<br />

- 31 -<br />

U<br />

40.0<br />

20.0<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3403.91.10 Ready for retail sale U 40.0<br />

3403.91.90 Other U 20.0<br />

3403.99.10 Ready for retail sale U 40.0<br />

3403.99.90 Others U 20.0<br />

3404 Artificial waxes and prepared waxes U 20.0<br />

3405 Polishes and creams, for footwear, furniture,<br />

floors, coachwork, glass or metal, scouring<br />

pastes and powders and similar preparations<br />

(whether or not in the form of paper, wadding,<br />

felt, nonwovens, cellular plastics or cellular<br />

rubber, impregnated, co<br />

U 50.0<br />

3406 Candles, tapers and the like U 60.0<br />

3407 Modelling pastes, including those putp for<br />

children's amusement; preparations known as<br />

dental wax" or as "dental impression<br />

compounds", putp in sets, in packings for retail<br />

sale or in plates, horseshoe shapes, sticks or<br />

similar forms; other preparatio<br />

5.0 B 5.0<br />

35 ALBUMINOIDAL SUBSTANCES; MODIFIED<br />

STARCHES; GLUES; ENZYMES<br />

3501 Casein, caseinates and other casein derivatives;<br />

3502<br />

casein glues<br />

Albumins, albuminates and other albumin<br />

derivatives<br />

U 20.0<br />

U 20.0<br />

- 32 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3503 Gelatin (including gelatin in rectangular<br />

(including square) sheets, whether or not surfaceworked<br />

or coloured) and gelatin derivatives;<br />

isinglass; other glues of animal origin, excluding<br />

casein glues of heading No3501<br />

3503.00.11 U 20.0<br />

3503.00.19 U 30.0<br />

3503.00.20 U 30.0<br />

3503.00.90 U 30.0<br />

3504 Peptones and their derivatives; other protein<br />

substances and their derivatives, not elsewhere<br />

specified or included; hide powder, whether or<br />

not chromed<br />

3505 Dextrins and other modified starches (for<br />

example, pregelatinised or esterified starches);<br />

glues based on starches, or on dextrins or other<br />

modified starches<br />

U 20.0<br />

U 30.0<br />

3506 Prepared glues and other prepared adhesives, not<br />

elsewhere specified or included; products<br />

suitable forse as glues or adhesives, putp for<br />

retail sale as glues or adhesives, not exceeding a<br />

net weight of 1kg<br />

U 30.0<br />

3507 Enzymes; prepared enzymes not elsewhere<br />

U 20.0<br />

36<br />

specified or included<br />

EXPLOSIVES; PYROTECHNIC PRODUCTS;<br />

MATCHES; PYROPHORIC ALLOY CERTAIN<br />

COMBUSTIBLE PREPARATIONS<br />

3601 Propellent powders<br />

- 33 -<br />

U 40.0<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3602 Prepared explosives, other than propellent<br />

3603<br />

powders<br />

Safety fuses; detonating fuses; percussion or<br />

detonating caps; igniters; electric detonators<br />

3604 Fireworks, signalling flares, rain rockets, fog<br />

signals and other pyrotechnic articles<br />

U 40.0<br />

40.0 B 40.0<br />

3604.10 Fireworks U 60.0<br />

3604.90.10 Other U 30.0<br />

3604.90.90 Others U 40.0<br />

3605 Matches, other than pyrotechnic articles of<br />

U 60.0<br />

3606<br />

heading No3604<br />

Ferro-cerium and other pyrophoric alloys in all<br />

forms; articles of combustible materials as<br />

specified in Note 2 to this Chapter<br />

U 40.0<br />

37 PHOTOGRAPHIC OR CINEMATOGRAPHIC<br />

3701<br />

GOODS<br />

Photographic plates and film in the flat,<br />

sensitised, unexposed, of any material other than<br />

paper, paperboard or textiles; instant print film in<br />

the flat, sensitised, unexposed, whether or not in<br />

packs<br />

3701.10 For X-ray U 20.0<br />

3701.20 Instant print film U 40.0<br />

3701.30.10 Other plates and film, with any side U 40.0<br />

3701.30.20 exceeding 255 mm U 20.0<br />

3701.30.90 Others U 40.0<br />

3701.91<br />

3701.99.10<br />

For colour photography (polychrome)<br />

Other<br />

U<br />

- 34 U- 40.0<br />

40.0<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3701.99.20 For X-Rays U 20.0<br />

3701.99.90 Others U 40.0<br />

3702 Photographic film in rolls, sensitised, unexposed,<br />

of any material other than paper, paperboard or<br />

textiles; instant print film in rolls, sensitised,<br />

U 40.0<br />

3703<br />

unexposed<br />

Photographic paper, paperboard and textiles,<br />

U 40.0<br />

3704<br />

sensitised, unexposed<br />

Photographic plates, film, paper, paperboard and<br />

textiles, exposed but not developed<br />

U 40.0<br />

3705 Photographic plates and film, exposed and<br />

developed, other than cinematographic film<br />

3706 Cinematographic film, exposed and developed,<br />

whether or not incorporating sound track or<br />

consisting only of sound track<br />

U 40.0<br />

3706.10.10 Of a width of 35 mm or more U 30.0<br />

3706.10.90 Positive U 60.0<br />

3706.90.10 Other U 30.0<br />

3706.90.20 Positive U 60.0<br />

3707 Chemical preparations for photographicses (other<br />

than varnishes, glues, adhesives and similar<br />

preparations); unmixed products for photographic<br />

uses, putp in measured portions or putp for retail<br />

sale in a form ready forse<br />

U 30.0<br />

38 MISCELLANEOUS CHEMICAL PRODUCTS<br />

- 35 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3801 Artificial graphite; colloidal or semi-colloidal<br />

graphite; preparations based on graphite or other<br />

carbon in the form of pastes, blocks, plates or<br />

other semi-manufactures<br />

20.0 B 20.0<br />

3802 Activated carbon; activated natural mineral<br />

products; animal black, including spent animal<br />

U 20.0<br />

3803<br />

black<br />

Tall oil, whether or not refined 5.0 B 5.0<br />

3804 Residual lyes from the manufacture of wood pulp,<br />

whether or not concentrated, desugared or<br />

chemically treated, including lignin sulphonates,<br />

but excluding tall oil of heading No3803B<br />

10.0 10.0<br />

3805 Gum, wood or sulphate turpentine and other<br />

terpenic oils produced by the distillation or other<br />

treatment of coniferous woods; crude dipentene;<br />

sulphite turpentine and other crude para-cymene;<br />

pine oil containing alpha-terpineol as the main<br />

constituent<br />

3806 Rosin and resin acids, and derivatives thereof;<br />

rosin spirit and rosin oils; run gums<br />

3807 Wood tar; wood tar oils; wood creosote; wood<br />

naphtha; vegetable pitch; brewerspitch and<br />

similar preparations based on rosin, resin acids<br />

or on vegetable pitch<br />

10.0 B 10.0<br />

- 36 -<br />

U 20.0<br />

U 20.0<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3807.00 Wood tar; wood tar oils; wood creosote; wood<br />

naphtha; vegetable pitch; brewerspitch and<br />

similar preparations based on rosin, resin acids<br />

or on vegetable pitch<br />

3808 Insecticides, rodenticides, fungicides, herbicides,<br />

anti-sprouting products and plant-growth<br />

regulators, disinfectants and similar products,<br />

putp in forms or packings for retail sale or as<br />

preparations or articles (for example, sulphurtreated<br />

bands,<br />

3808.10 Insecticides 30.0 30.0<br />

3808.20.10 Fungicides U 20.0<br />

3808.20.90 Others U 30.0 US,EC.<br />

3808.30.10 Herbicides, anti-sprouting products and plant-<br />

U 20.0<br />

3808.30.90<br />

growth regulators<br />

Others U 30.0 US,EC.<br />

3808.40 Disinfectants 30.0 B 30.0 US,EC.<br />

3808.90.10 Other U 20.0<br />

3808.90.90 Other U 30.0 US,EC.<br />

3809 Finishing agents, dye carriers to accelerate the<br />

dyeing or fixing of dyestuffs and other products<br />

and preparations (for example, dressings and<br />

mordants), of a kind used in the textile, paper,<br />

leather or like industries, not elsewhere specified<br />

or incl<br />

10.0 B 10.0<br />

- 37 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3810 Pickling preparations for metal surfaces; fluxes<br />

and other auxiliary preparations for soldering,<br />

brazing or welding; soldering, brazing or welding<br />

powders and pastes consisting of metal and other<br />

materials; preparations of a kind used as cores or<br />

coat<br />

U 20.0<br />

3811 Anti-knock preparations, oxidation inhibitors,<br />

gum inhibitors, viscosity improvers, anticorrosive<br />

preparations and other prepared<br />

additives, for mineral oils (including gasoline) or<br />

for other liquids used for the same purposes as<br />

mineral oils<br />

10.0 B 10.0<br />

3812 Prepared rubber accelerators; compound<br />

plasticisers for rubber or plastics, not elsewhere<br />

specified or included; anti-oxidising preparations<br />

and other compound stabilisers for rubber or<br />

plastics<br />

3812.10 Preapared rubber accelerators U 20.0<br />

3812.20 Compound plasticisers for rubber or plasticsB 10.0 B 10.0<br />

3812.30 Anti-oxidising preparations and other Compound<br />

stabilisers for rubber or plasticsB<br />

3813 Preparations and charges for fire-extinguishers;<br />

charged fire-extinguishing grenades<br />

3814 Organic composite solvents and thinners, not<br />

elsewhere specified or included; prepared paint or<br />

varnish removers<br />

10.0 B 10.0<br />

U 20.0<br />

10.0 B 10.0<br />

- 38 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3815 Reaction initiators, reaction accelerators and<br />

catalytic preparations, not elsewhere specified or<br />

included<br />

10.0 B 10.0<br />

3815.12 With precious metal or precious metal<br />

10.0 B 10.0<br />

3815.19<br />

compounds as the active substance<br />

Other 10.0 B 10.0<br />

3815.90 Other 10.0 B 10.0<br />

3816 Refractory cements, mortars, concretes and<br />

similar compositions, other than products of<br />

heading No3801 similar compositions, other than<br />

products of<br />

10.0 B 10.0<br />

3816.00 Refractory cements, mortars, concretes and<br />

similar compositions, other than products of<br />

heading No3801<br />

3817 Mixed alkylbenzenes and mixed<br />

alkylnaphthalenes, other than those of heading<br />

No2707 or2902<br />

3818 Chemical elements doped forse in electronics, in<br />

the form of discs, wafers or similar forms;<br />

chemical compounds doped forse in electronics<br />

3819 Hydraulic brake fluids and other prepared liquids<br />

for hydraulic transmission, not containing or<br />

containing less than 70 % by weight of petroleum<br />

oils or oils obtained from bituminous minerals<br />

3820 Anti-freezing preparations and prepared de-icing<br />

3821<br />

fluids<br />

Prepared culture media for development of microorganisms<br />

10.0 B 10.0<br />

10.0 B 10.0<br />

10.0 B 10.0<br />

10.0 B 10.0<br />

10.0 B 10.0<br />

- 39 -<br />

Other duties and<br />

charges

NOTE : General remarks are contained in file EGYNTES.WK4<br />

<strong>Schedule</strong> <strong>LXIII</strong> - <strong>EGYPT</strong><br />

<strong>PART</strong> I - <strong>MOST</strong>-<strong>FAVOURED</strong>-<strong>NATION</strong> TARIFF<br />

SECTION II - Other Products<br />

Tariff item Description of products Base rate of duty Bound rate of duty Initial<br />

number Ad valorem Other U/B Ad valorem Other negotiating right<br />

(%) (%)<br />

1 2 3 4 5 6<br />

3821.00 Prepared culture media for development of microorganisms<br />

3822 Composite diagnostic or laboratory reagents,<br />

other than those of heading No3002 or3006<br />

3823 Prepared binders for foundry moulds or cores;<br />

chemical products and preparations of the<br />

chemical or allied industries (including those<br />

consisting of mixtures of natural products), not<br />

elsewhere specified or included; residual<br />

products of the chemical<br />

39 PLASTICS AND ARTICLES THEREOF<br />

10.0 B 10.0<br />

10.0 B 10.0<br />

3901 Polymers of ethylene, in primary forms 30.0 B 30.0<br />