Answers to bad debt provision exercises.pdf - NDLR Dspace

Answers to bad debt provision exercises.pdf - NDLR Dspace

Answers to bad debt provision exercises.pdf - NDLR Dspace

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1<br />

2<br />

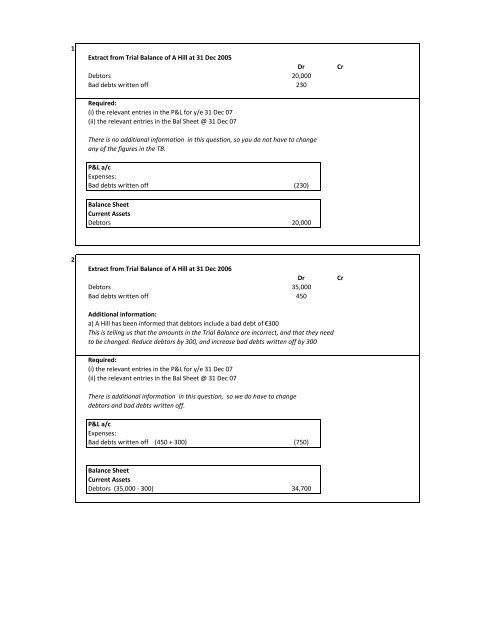

Extract from Trial Balance of A Hill at 31 Dec 2005<br />

Dr Cr<br />

Deb<strong>to</strong>rs 20,000<br />

Bad <strong>debt</strong>s written off 230<br />

Required:<br />

(i) the relevant entries in the P&L for y/e 31 Dec 07<br />

(ii) the relevant entries in the Bal Sheet @ 31 Dec 07<br />

There is no additional information in this question, so you do not have <strong>to</strong> change<br />

any of the figures in the TB.<br />

P&L a/c<br />

Expenses:<br />

Bad <strong>debt</strong>s written off (230)<br />

Balance Sheet<br />

Current Assets<br />

Deb<strong>to</strong>rs 20,000<br />

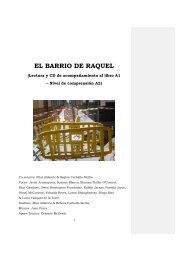

Extract from Trial Balance of A Hill at 31 Dec 2006<br />

Dr Cr<br />

Deb<strong>to</strong>rs 35,000<br />

Bad <strong>debt</strong>s written off 450<br />

Additional information:<br />

a) A Hill has been informed that deb<strong>to</strong>rs include a <strong>bad</strong> <strong>debt</strong> of €300<br />

This is telling us that the amounts in the Trial Balance are incorrect, and that they need<br />

<strong>to</strong> be changed. Reduce deb<strong>to</strong>rs by 300, and increase <strong>bad</strong> <strong>debt</strong>s written off by 300<br />

Required:<br />

(i) the relevant entries in the P&L for y/e 31 Dec 07<br />

(ii) the relevant entries in the Bal Sheet @ 31 Dec 07<br />

There is additional information in this question, so we do have <strong>to</strong> change<br />

deb<strong>to</strong>rs and <strong>bad</strong> <strong>debt</strong>s written off.<br />

P&L a/c<br />

Expenses:<br />

Bad <strong>debt</strong>s written off (450 + 300) (750)<br />

Balance Sheet<br />

Current Assets<br />

Deb<strong>to</strong>rs (35,000 ‐ 300) 34,700

3<br />

Extract from Trial Balance of A Hill at 31 Dec 2007<br />

Dr Cr<br />

Deb<strong>to</strong>rs 60,000<br />

Bad <strong>debt</strong>s (written off) 1,250<br />

Additional information:<br />

a) Deb<strong>to</strong>rs include a certain <strong>bad</strong> <strong>debt</strong> of €800<br />

b) Due <strong>to</strong> the recession A Hill fears that more of his remaining deb<strong>to</strong>rs will not pay their<br />

outstanding <strong>debt</strong>s. He wants <strong>to</strong> create a <strong>provision</strong> for <strong>bad</strong> <strong>debt</strong>s equal <strong>to</strong> 10% of deb<strong>to</strong>rs<br />

Required:<br />

(i) the relevant entries in the P&L for y/e 31 Dec 07<br />

(ii) the relevant entries in the Bal Sheet @ 31 Dec 07<br />

Step 1 ‐ change the amounts in the TB (reduce deb<strong>to</strong>rs by 800, increase <strong>bad</strong> <strong>debt</strong>s by 800)<br />

Deb<strong>to</strong>rs are now 59,200, <strong>bad</strong> <strong>debt</strong>s are now 2,050<br />

Step 2 ‐ create the new <strong>bad</strong> <strong>debt</strong> <strong>provision</strong> 10% of deb<strong>to</strong>rs<br />

10% * 59,200 = 5,920 is the new <strong>provision</strong> for <strong>bad</strong> <strong>debt</strong>s<br />

Rule for Bad Debt Provisions<br />

P&L ‐ an increase in a <strong>provision</strong> is an expense in the P&L<br />

a reduction in a <strong>provision</strong> is treated as income in the P&L<br />

B Sheet ‐ Reduce deb<strong>to</strong>rs by the new <strong>provision</strong> for <strong>bad</strong> <strong>debt</strong>s<br />

Because it is the first year he created a <strong>bad</strong> <strong>debt</strong> <strong>provision</strong>, it has increased from zero<br />

<strong>to</strong> 5,920. Therefore, we need <strong>to</strong> show an expense for this increase.<br />

P&L a/c<br />

Expenses: two expenses<br />

Bad <strong>debt</strong>s written off (1,250 + 800) (2,050) in the P&L for this<br />

Increase in <strong>provision</strong> for <strong>bad</strong> <strong>debt</strong>s (5,920 ‐ 0) (5,920) example<br />

Balance Sheet<br />

Current Assets<br />

Deb<strong>to</strong>rs (60,000 ‐ 800) 59,200 prov for <strong>bad</strong> <strong>debt</strong>s<br />

less <strong>provision</strong> for <strong>bad</strong> <strong>debt</strong>s (5,920) reduces deb<strong>to</strong>rs

4<br />

Extract from Trial Balance of A Hill at 31 Dec 2008<br />

Dr Cr<br />

Deb<strong>to</strong>rs 80,000<br />

Provision for <strong>bad</strong> <strong>debt</strong>s 5,920<br />

Bad <strong>debt</strong>s written off 4,000<br />

Additional information:<br />

old prov<br />

for <strong>bad</strong><br />

a) Update the <strong>bad</strong> <strong>debt</strong> <strong>provision</strong> so that is 10% of deb<strong>to</strong>rs. <strong>debt</strong>s<br />

Required: it is going<br />

(i) the relevant entries in the P&L for y/e 31 Dec 08 <strong>to</strong> increased by<br />

(ii) the relevant entries in the Bal Sheet @ 31 Dec 08 2,080 <strong>to</strong> 8,000<br />

Step 1 ‐ Update the <strong>bad</strong> <strong>debt</strong> <strong>provision</strong> <strong>to</strong> 10% of deb<strong>to</strong>rs<br />

80,000 * 10% = 8,000 is the new <strong>provision</strong>. Deb<strong>to</strong>rs will be reduced by 8,000 in the B Sheet<br />

has the <strong>provision</strong> increased or decreased? New Prov = 8,000. Old Prov = 5,920<br />

Prov has increased by 2,080 (8000‐5920) The increase is shown as an expense in P&L<br />

P&L a/c<br />

Expenses: two expenses<br />

Bad <strong>debt</strong>s written off (4,000) in the P&L for this<br />

Increase in <strong>provision</strong> for <strong>bad</strong> <strong>debt</strong>s (8,000 ‐ 5,920) (2,080) example<br />

Balance Sheet<br />

Current Assets<br />

Deb<strong>to</strong>rs 80,000 prov for <strong>bad</strong> <strong>debt</strong>s<br />

less <strong>provision</strong> for <strong>bad</strong> <strong>debt</strong>s (8,000) reduces deb<strong>to</strong>rs

5<br />

Extract from Trial Balance of A Hill at 31 Dec 2009<br />

Dr Cr<br />

Deb<strong>to</strong>rs 47,000<br />

Provision for <strong>bad</strong> <strong>debt</strong>s 8,000 this is the<br />

Bad <strong>debt</strong>s written off 1,200 old prov<br />

for <strong>bad</strong> <strong>debt</strong>s<br />

Additional information: We are going <strong>to</strong><br />

a) Deb<strong>to</strong>rs include a certain <strong>bad</strong> <strong>debt</strong> of €850 reduce it by<br />

b) Update the <strong>bad</strong> <strong>debt</strong> <strong>provision</strong> so that is 8% of deb<strong>to</strong>rs 4,308 <strong>to</strong> 3,692<br />

Required:<br />

(i) the relevant entries in the P&L for y/e 31 Dec 09<br />

(ii) the relevant entries in the Bal Sheet @ 31 Dec 09<br />

Step 1 ‐ Adjust deb<strong>to</strong>rs & <strong>bad</strong> <strong>debt</strong>s written off for the extra <strong>bad</strong> <strong>debt</strong> of 850<br />

Deb<strong>to</strong>rs = 46,150, Bad <strong>debt</strong>s = 2050<br />

Step 2 ‐ Update the <strong>bad</strong> <strong>debt</strong> <strong>provision</strong> <strong>to</strong> 8% of deb<strong>to</strong>rs<br />

46,150 * 8% = 3,692 New <strong>bad</strong> <strong>debt</strong> prov = 3,692.<br />

Deb<strong>to</strong>rs should be reduced by 3,692 in the Bal Sheet.<br />

Is it an increase or a decrease in the <strong>provision</strong>?<br />

New Prov 3,692<br />

Old Prov 8,000 (see Trial Balance)<br />

Decrease of 4,308<br />

Rule: a decrease in a <strong>bad</strong> <strong>debt</strong> <strong>provision</strong> is treated as income in the P&L a/c<br />

P&L a/c<br />

Add other income:<br />

decrease in <strong>provision</strong> for <strong>bad</strong> <strong>debt</strong>s (3,692 ‐ 8,000) +4308 income<br />

Expenses:<br />

Bad <strong>debt</strong>s written off (1,200 + 850) (2,050) expense<br />

Balance Sheet<br />

Current Assets<br />

Deb<strong>to</strong>rs 47,000 prov for <strong>bad</strong> <strong>debt</strong>s<br />

less <strong>provision</strong> for <strong>bad</strong> <strong>debt</strong>s (3,692) reduces deb<strong>to</strong>rs