A Christmas Poem - University of Idaho Extension (Ver página)

A Christmas Poem - University of Idaho Extension (Ver página)

A Christmas Poem - University of Idaho Extension (Ver página)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ITCT contact info:<br />

Editor: Luke Erickson—Rexburg<br />

erickson@uidaho.edu<br />

Lyle Hansen—Jerome<br />

lhansen@uidaho.edu<br />

Marnie Spencer—Bingham<br />

marniers@uidaho.edu<br />

Marilyn Bisch<strong>of</strong>f—Boise<br />

mbisch<strong>of</strong>@uidaho.edu<br />

Jim Schaffer—<strong>Idaho</strong> Falls<br />

schaffer@uidaho.edu<br />

-Track<br />

Spending<br />

-Save for<br />

Emergencies<br />

-Become<br />

Debt Free<br />

-Save For<br />

Retirement<br />

-Teach Kids About<br />

Money<br />

-Own Your Home<br />

-Leave a<br />

Legacy<br />

A <strong>Christmas</strong> <strong>Poem</strong><br />

Luke Erickson<br />

Let me share a tale about Harry and Ed McDougal.<br />

Harry liked spending, but Ed was more frugal.<br />

This <strong>Christmas</strong> Harry bought Ed a shiny new bugle,<br />

But Ed spent more time searching, starting with Google.<br />

Google gave Ed a few starting ideas,<br />

“Perhaps I could give Harry a gift card to Maria’s,<br />

Authentic cuisine, complete with tortillas,<br />

With waiters who always say ‘Muchas Graci-as.’”<br />

“Or maybe I’ll get Harry an i with a Pod,<br />

Or maybe I’ll get him a new shiny hot-rod,<br />

Or an Alaskan cruise where he can go fishing for cod.”<br />

But then Ed realized that his thoughts were quite odd.<br />

“I’m Ed McDougal, known for my thrift,<br />

I don’t need to give Harry an extravagant gift,<br />

He just needs to know I care,” he sniffed.<br />

“But <strong>Christmas</strong> is coming, I need to be swift.”<br />

<strong>Christmas</strong> morning arrived and Ed felt a little uneasy.<br />

Ed worried that Harry would find his gift cheesy.<br />

When Harry began to unwrap, Ed became queasy,<br />

He tried a distraction, “Let’s go play some Parcheesi!”<br />

But that morning Parcheesi was not to be played,<br />

Harry opened his gift, at first a little dismayed.<br />

“It’s nothing too fancy, it’s actually home-made,<br />

I put together home movies from the 80’s decade.”<br />

“I used a friend’s computer to make the DVD,<br />

It’s from when we were kids, here, pop it in and see.”<br />

Acid washed jeans, feathered hair, the old Atari,<br />

Transformers, He-man and even ET.<br />

Changing the<br />

financial lives <strong>of</strong><br />

<strong>Idaho</strong>ans, two<br />

cents at a time!<br />

December, 2008<br />

“Man the 80’s hit us hard! This is true hilarity.<br />

This is the best gift I’ve received,” Harry said with sincerity.<br />

Receive <strong>Idaho</strong>’s Two ¢ent Tips every month by sending an email to erickson@uidaho.edu<br />

with the word “subscribe” on the subject line.

Just for laughs!<br />

Email “subscribe” to erickson@uidaho.edu<br />

<strong>Extension</strong> pr<strong>of</strong>essionals work with the people <strong>of</strong> <strong>Idaho</strong> to address<br />

youth, community, family, environmental, natural resource<br />

and agricultural issues.<br />

<strong>Christmas</strong> morning the brothers spent in solidarity,<br />

But the brothers each had a much different prosperity.<br />

You see, Harry spent way too much on Ed’s horn.<br />

He spent the next year in debt and forlorn,<br />

“I haven’t felt so poor since the day I was born!<br />

I have way too much debt from <strong>Christmas</strong>,” he did mourn.<br />

“I need some kind <strong>of</strong> bailout just like Fannie Mae,<br />

I’ve got an idea! I’ll cash out my 401(k)!<br />

It was once worth 5 grand but worth only 9 dollars today,”<br />

Harry asked Ed’s advice but Ed said, “No way, Jose!”<br />

“I know that since <strong>Christmas</strong> you’ve been real low on money,<br />

But cashing out now is a big mistake, sonny!<br />

When you’re old you’ll be rich, it won’t even be funny!”<br />

“Thanks Ed,” Harry sniffed, ‘cause his nose became runny.<br />

“But I don’t know what to do to get rid <strong>of</strong> this debt,”<br />

He wished he had not borrowed for the shiny cornet.<br />

“<strong>Christmas</strong> debt is not good, Harry, don’t you forget,<br />

There’s no way out <strong>of</strong> loans, except through hard work and sweat.”<br />

Ed then showed Harry the interest on what he bought,<br />

How it added up to much much more than he thought,<br />

And Harry finally learned to do what he ought,<br />

“From now on I won’t ever spend more than I got!”<br />

Knock Debt Down for the Count!<br />

Lyle Hansen<br />

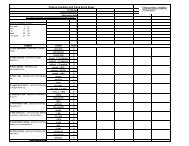

Creditor Name Balance Payment %Rate Pay<strong>of</strong>f Time<br />

Credit Card#1 $5,000 $150.00 19.99% 4 years 2 mos<br />

Feb 2012<br />

Credit Card #2 $3,500 $105.00 17.99% 5 years 6 mos<br />

Department<br />

Card<br />

June 2013<br />

$750 $22.50 24.99% 4 years 10 mos<br />

Oct 2012<br />

Car Loan $7,500 $300.00 7.99% 3 years 8 mos<br />

Aug 2011<br />

<strong>University</strong> <strong>of</strong> <strong>Idaho</strong> <strong>Extension</strong> is your source for unbiased financial Information.<br />

The <strong>University</strong> <strong>of</strong> <strong>Idaho</strong> <strong>Extension</strong> System does not sell, promote or endorse any financial product or institution. Our programs are strictly educational. Seek pr<strong>of</strong>essional advice<br />

from your accountant or financial advisor for specific product information. The <strong>University</strong> <strong>of</strong> <strong>Idaho</strong> provides equal opportunity in education and employment on the basis <strong>of</strong> race,<br />

color, national origin, religion, sex, sexual orientation, age, disability, or status as a disabled veteran or Vietnam-era veteran, as required by state and federal laws.

Electronic copies <strong>of</strong> this newsletter are available at http://extension.ag.uidaho.edu/madison<br />

Let’s face it, most <strong>of</strong> us have debt in some form or another<br />

and it <strong>of</strong>ten can be very overwhelming and hard<br />

to manage. Like losing weight you need to have a plan<br />

to effectively knock out your debt. To effectively<br />

knock out debt you need to first, make a commitment<br />

to stop spending or charging any debt. Second, create<br />

an effective plan to knock your debt out. If you are<br />

ready to follow step one there is a great free resource<br />

available to help you with the second step<br />

www.powerpay.org. Power Pay is a computer debt<br />

management program created by Utah State <strong>University</strong><br />

<strong>Extension</strong>. It is available in English and Espanol and<br />

is very easy to use. I recently went to<br />

www.powerpay.org and set up an account to try the<br />

program out. To run the program you have to enter<br />

information about each <strong>of</strong> your debts. For example I<br />

entered the following debts and listed minimum payments<br />

for all debts.<br />

As you can see from looking at the pay<strong>of</strong>f time, making<br />

only minimum payments can take a long time to<br />

get out <strong>of</strong> heavy debt.<br />

All you need to run the program is information about<br />

each debt. The program will compute how long it will<br />

take you to get completely out <strong>of</strong> debt. If you only<br />

make the minimum payments it can take almost a lifetime<br />

to get out <strong>of</strong> heavy debt. The idea behind Power<br />

Pay is that once you have paid <strong>of</strong>f one debt you roll<br />

that payment onto another debt thus increasing the<br />

payment made on the second debt. This pattern continues<br />

until all the money you are paying in a month is<br />

going to pay <strong>of</strong>f the last debt. Power Pay will calculate<br />

which debt will be in your best interest to pay <strong>of</strong>f first,<br />

With Power Payments Without Power Payments<br />

Creditor # <strong>of</strong> payments Total Paid Int Paid # <strong>of</strong> payments Total Paid Int Paid<br />

Credit Card #1 35 $6,762.9 1,762.94 50 $7,357.03 $2,357.03<br />

Credit Card #2 38 $4,808.26 $1,308.26 47 $4,887.20 $1,387.23<br />

Department Store Card 12 $853.53 $103.53 58 $1,293.40 $543.40<br />

Car Loan 41 $861.52 $1,151.52 44 $8,664.50 $1,164.54<br />

Pay<strong>of</strong>f Time: Pay<strong>of</strong>f Time:<br />

3 yrs 5 mos Apr 2012<br />

Total Paid: Total Paid:<br />

$21,076.25 $22,202..20<br />

Total Interest: Total Interest:<br />

$4,326.25 $5,452.20<br />

Power Pay Benefits<br />

Time Reduction:<br />

1 year 5 months<br />

Amount Saved:<br />

$,125.95<br />

4 yrs 10 mos Sep 2013<br />

and provide you with an amortization chart. The amortization<br />

chart will give you month-by-month instruction on<br />

when and how much to pay which creditor. In the following<br />

example I used the above debts and entered them into<br />

the Power Pay system and calculated to pay <strong>of</strong>f debt by the<br />

highest interest first.<br />

A Better Perspective<br />

Luke Erickson<br />

Tell me if this sounds familiar.<br />

You’re trying to get home after<br />

work, and you’re cruising down<br />

main street. There’s a stack <strong>of</strong><br />

at least a dozen cars in the righthand<br />

lane and only one in the<br />

left. The car on the left might<br />

simply be planning to drive<br />

straight through on the next<br />

green light, but he just might be<br />

waiting to turn left onto Center<br />

Street, and has failed properly to indicate his intentions by<br />

using the left blinker like any normal non-idiotic person<br />

would do. I mean, blinkers were invented for a reason<br />

right? Are they really so hard to use? Is it too much to ask<br />

for a little flick <strong>of</strong> the wrist? Blinkers work wonders!<br />

Um, so where was I? Oh, so do you take the chance or<br />

wait behind the dozen car stack? You’re feeling courageous,<br />

and so you pull into the left lane, properly signaling<br />

first <strong>of</strong> course, and just as you ease in behind the car and<br />

the light turns green the driver pulls up a little and then<br />

slams on his brakes, and then to add insult to injury he sud-

denly flips on his left blinker, as though it is just a reminder<br />

<strong>of</strong> something you should have known already.<br />

You entirely miss the green light, because the leftturner<br />

has to wait for the dozen-car stack in the opposing<br />

lane, and by the time you get home your mood has<br />

completely soured, and you look at the clock and realize<br />

its only 5:11, and not 5:10 when you usually pull<br />

in.<br />

My point? In a big picture sense it makes no difference<br />

whether you get home at 5:10 or 5:11, unless <strong>of</strong><br />

course it’s the middle <strong>of</strong> the winter and that was the<br />

one remaining minute <strong>of</strong> daylight you had left. But in<br />

spite <strong>of</strong> this fact I actually do catch myself complaining<br />

about Rexburg traffic now and again, and this from<br />

a guy who’s lived in Cleveland, and worse yet, the<br />

dreaded Utah Valley. But putting things into perspective<br />

I realize that we don’t really have it that bad in<br />

rural Rexburg.<br />

Recent complaints about plummeting retirement accounts,<br />

and depreciating housing values, lost bonuses,<br />

or the like, and my tendency is to join along in the chorus<br />

<strong>of</strong> complainers about my perceived reduced quality<br />

<strong>of</strong> life. Never mind that most <strong>of</strong> my sour mood can be<br />

attributed to the act <strong>of</strong> complaining and not the actual<br />

problems I’m complaining about!<br />

But if I wanted to truly put things in perspective I<br />

could easily flashback to a much different time in my<br />

life about eight years ago where I sat on a bamboo<br />

floor on a dark humid night. In a one-room hut lit only<br />

by a small oil lamp, I visited with a couple who, along<br />

with their seven small children were only able to eat<br />

one meal <strong>of</strong> rice that day with a few vegetables to<br />

share between them. You might say this family I met<br />

in the Philippines while on a religious mission had<br />

some things to complain about—but in that very setting<br />

I described, instead <strong>of</strong> uttering a word <strong>of</strong> complaint<br />

I actually found that family singing, laughing,<br />

telling stories and looking to the future with hope, in<br />

spite <strong>of</strong> their overwhelming poverty.<br />

These are tumultuous times we are facing as a country,<br />

that will likely affect us all in one way or another. Job<br />

stability, retirement savings, home values and all legitimate<br />

concerns, but before you start chanting “Woe<br />

is me!” and point fingers, as we might have a tendency<br />

to do, realize that the vast majority <strong>of</strong> the world’s<br />

population would love to have the luxury <strong>of</strong> worrying<br />

about these types <strong>of</strong> problems. This isn’t to belittle<br />

anyone’s current future financial troubles, but only to<br />

help us put things in proper perspective. You might<br />

realize that, in a manner <strong>of</strong> speaking, you’re complaining<br />

about getting home at 5:11 instead <strong>of</strong> 5:10 when<br />

there are those who won’t make it home at all.<br />

Email “subscribe” to erickson@uidaho.edu<br />

Managing Money in Tough<br />

Economic Times<br />

Marilyn Bisch<strong>of</strong>f<br />

More Americans feel stress and anxiety about their financial<br />

future as rising consumer debt, falling housing prices,<br />

rising costs <strong>of</strong> living, declining retail sales, and declining<br />

assets in retirement accounts bring up worries about the<br />

nation’s economic health.<br />

Money is <strong>of</strong>ten on the minds <strong>of</strong> most Americans. In fact,<br />

according to the American Psychological Association’s<br />

2007 Stress in America survey, money and work are two <strong>of</strong><br />

the top sources <strong>of</strong> stress for almost 75 percent <strong>of</strong> Americans.<br />

Add to the mix headlines declaring an economic recession,<br />

and many begin to fear how they can handle any<br />

further financial crunch.<br />

Learning positive money management techniques can help<br />

individuals and their families adapt to tough economic<br />

times. <strong>Extension</strong> specialists in several states developed a<br />

new eXtension website to help consumers with financial<br />

issues. More then 30 topics are addressed on the website<br />

titled, Managing Money in Tough Economic Times. Your<br />

clients can access the information at http://<br />

www.extension.org/pagesFinancial_Security:_Managing_<br />

Money_in_Tough_Times.<br />

Save Money on Food<br />

Shopping<br />

Marnie Spencer<br />

In a recent article, I discussed the costs <strong>of</strong> groceries and<br />

gave some brief suggestions on ways to save money. This<br />

article expands on ways to save<br />

money while shopping while still<br />

eating healthfully.<br />

Plan<br />

The most important step in saving<br />

money is to plan ahead. This means<br />

making a menu, writing a grocery list<br />

based on that menu, and sticking to<br />

the list while shopping. Basing your<br />

menu around the food that is on sale<br />

that week can be a money-saver.<br />

Alternately, if you have a standard<br />

menu that you cycle through, buy<br />

items for the meals when they are on sale and store them in<br />

the freezer or pantry. The grocery list should include food

for all meals and ingredients for one or two super<br />

quick meals for days when the original plan doesn’t<br />

work out. My research shows that a person can cook a<br />

quick meal and have it on the table in a shorter time<br />

than driving to a fast-food restaurant. Not only is it<br />

quicker, it is much less expensive and healthier.<br />

Choose Healthy Food<br />

A 2002 study published in the Journal <strong>of</strong> the American<br />

Dietetic Association found that eating healthier food<br />

can save money. The families in the study saved<br />

money by reducing portion sizes and cutting down on<br />

“extras”—foods that add calories but little nutritional<br />

value. So, when shopping, consider the nutritional<br />

value <strong>of</strong> food for the price.<br />

10 More Money-Saving Tips<br />

1. Buy produce in season. Each season has wonderful<br />

fruits and vegetables that are reasonably priced.<br />

2. Use sales and coupons. In addition to shopping<br />

sales which was mentioned above, using coupons<br />

wisely can be a money-saver.<br />

3. Brown bag it. Make your lunch rather than buying<br />

lunch. Use leftovers for meals at work, school, or<br />

wherever you a re going. If you don’t have access<br />

to a refrigerator, use freezer packs.<br />

4. Use frozen, canned, or dried products. They are<br />

<strong>of</strong>ten less expensive than fresh ingredients, yet<br />

equally nutritious.<br />

5. Save on protein foods. Non-meat protein sources<br />

such as beans, eggs, and legumes are an inexpensive<br />

source <strong>of</strong> protein. When you do buy meat,<br />

choose smaller portions <strong>of</strong> lean meat, poultry, and<br />

seafood.<br />

6. Waste not, want not. Before you buy perishable<br />

foods, decide whether you will be able to use them<br />

while they are still fresh. Leftovers can be used<br />

for soups, stews, salads and casseroles to create a<br />

new version <strong>of</strong> the food.<br />

7. Go generic. Store brands are usually less expensive<br />

than national brands. Sometimes they are the<br />

same product with a different label. And all food<br />

manufacturers follow standards for safe, quality<br />

food.<br />

8. Buy prepackaged only if you need to. They almost<br />

always are more expensive.<br />

9. Buy and cook in bulk. Buying<br />

in bulk can be a great way to save<br />

money, if the food gets used. Some<br />

stores have bulk bins that let you<br />

choose how much you buy. Cooking<br />

larger quantities <strong>of</strong> food and<br />

freezing them in family-size or in-<br />

dividual-size portions can also save money and yield<br />

tasty meals that only need to be heated.<br />

10. Plant a garden. Although gardening season is winding<br />

down, start planning a garden for next year. If space<br />

is an issue, consider container gardens for tomatoes,<br />

herbs, and other produce. The extension <strong>of</strong>fice has<br />

resources on freezing, drying and canning your harvest,<br />

so you can enjoy summer’s bounty all year long.<br />

Reference: Web MD<br />

When Should I Feel Comfortable<br />

Investing Again?<br />

Jim Schaffer<br />

We get a lot <strong>of</strong> questions about when we should feel comfortable<br />

buying into or back into the stock market. Some<br />

<strong>of</strong> us never got out <strong>of</strong> the market and have suffered serious<br />

asset declines in recent months. However, once the market<br />

goes “low enough”, it becomes a buying opportunity.<br />

Financial experts define a bear market as one in which the<br />

“market” has lost in excess <strong>of</strong> 20% <strong>of</strong> its value. Since<br />

1950 the S&P 500 has experienced nine bear markets and<br />

one near bear in 1990 (-19.9%) as shown in the first chart.<br />

The question most investors have is, “How do we know<br />

when it’s hit bottom?”<br />

A resource that I like to study is the website dshort.com,<br />

called Financial Life Cycle Planning. Doug Short <strong>of</strong>ten<br />

has very interesting charts and graphs with excellent analyses<br />

<strong>of</strong> their implications. The following two charts came<br />

from his website and show the bear markets since 1950<br />

and the four worst bear markets in the well recorded history<br />

<strong>of</strong> the U.S. stock market, respectively. If you go to<br />

dshort.com and look at these charts on that website, you<br />

will discover a great deal more detail and Mr. Short’s<br />

analyses. I’d recommend you “bookmark” his website for<br />

future reference.<br />

Data provided by Prudential reveal that <strong>of</strong> the nine bear<br />

markets since 1950 (excluding the current one and including<br />

the 1990 “near bear”), the average loss from the prebear<br />

peak was 32%. The average recovery in the year following<br />

the bear market low was 36%. But that recovery<br />

potential depended on targeting the exact “bottom” <strong>of</strong> the<br />

bear market. Most <strong>of</strong> us don’t know how to hit the bear<br />

market “bottom” and are simply left to guess that the market<br />

has hit bottom.<br />

Short’s detailed charts reveal that the length <strong>of</strong> the<br />

“bottom” ranged from six weeks to almost 8 months for<br />

the bear markets since 1950. His analysis on the current

ear market claim that we have been searching for the<br />

“bottom” for almost eight weeks already.<br />

The second chart shows relative lengths and severity <strong>of</strong><br />

the four worst U.S. bear markets. The graph shows<br />

that those “bad” bear markets span differing periods <strong>of</strong><br />

time. With the exception <strong>of</strong> the worst bear market in<br />

our history (1929 to 1932 total loss <strong>of</strong> 89.2%), the<br />

other three worst losses approximated 50%. The current<br />

bear market began October 9, 2007 and has appeared<br />

to “bottom” on November 20, 2008 with a<br />

51.9% loss. If the market goes no lower than on that<br />

date, the current “bad” bear will have lasted slightly<br />

over one year. The recent bear market associated with<br />

the crash in technology stocks lasted over two years<br />

before rebounding.<br />

Note that the worst bear begun in 1929 approached a<br />

50% loss within two months <strong>of</strong> its beginning. There<br />

was an apparent recovery that spanned many months.<br />

Then a gradual decline set in that spanned almost two<br />

more years. Analyses by economics historians in recent<br />

years have placed the blame for the length <strong>of</strong> the Great<br />

Depression on government policies that exacerbated the<br />

problem <strong>of</strong> the recession, extended a recession into a depression,<br />

and extended the losses in the stock market.<br />

While we may never know that for sure, many legal and<br />

regulatory changes occurred after the Great Depression to<br />

protect savers and investors from the dramatic and extended<br />

losses that occurred at that time. Whether they will<br />

work to protect us this time will only be known for sure<br />

after the fact.<br />

Another important point needs to be acknowledged. Those<br />

<strong>of</strong> us who have invested in, or only in, recent years have<br />

now experienced two <strong>of</strong> the worst bear markets in U.S.<br />

stock market history. That makes most people a little nervous<br />

about investing at all at a time like this let along taking<br />

money from cash or bonds to buy more stocks right now.<br />

So what lesson should you take away from this? Savvy<br />

long term investors are calling this a “buying opportunity.”

As an investor who has been investing during four<br />

bears and the one “near” bear, I know that I should be<br />

rebalancing my portfolio and taking assets from a relatively<br />

secure bond fund to move them to a potentially<br />

risky stock fund. However, I have not done that yet<br />

because I am not certain that we have finally hit the<br />

stock market “bottom” for this serious bear market.<br />

One technique that I have used is to “dollar cost average”<br />

into the stock market with my monthly contribution<br />

to my retirement account. Prior to the recent market<br />

losses, my monthly contribution was allocated 60%<br />

to the purchase <strong>of</strong> stock funds and 40% to bond funds.<br />

Just recently, I switched my allocation so that 100% <strong>of</strong><br />

my upcoming monthly retirement contribution goes to<br />

purchase stock funds. That will move my asset allocation<br />

more slowly into stocks and should allow me to<br />

purchase some <strong>of</strong> my stock funds at the market<br />

“bottom.” It also protects me from making a major<br />

purchasing mistake by making it all at one time. How-<br />

ever, if we have already passed the bear market “bottom,” I<br />

will be precluded from making big gains by rebalancing at<br />

the “right” time.<br />

Prudential makes the point about recessions and bear markets<br />

that the stock market’s low point and recovery have<br />

occurred while the recession was still taking place. According<br />

to them, “… historically the most pessimistic period<br />

has made for good long term buying opportunities.”<br />

Take this as food for thought as you contemplate important<br />

purchasing or rebalancing decisions in a risky market like<br />

this.