2012 Mina - Chautauqua County

2012 Mina - Chautauqua County

2012 Mina - Chautauqua County

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

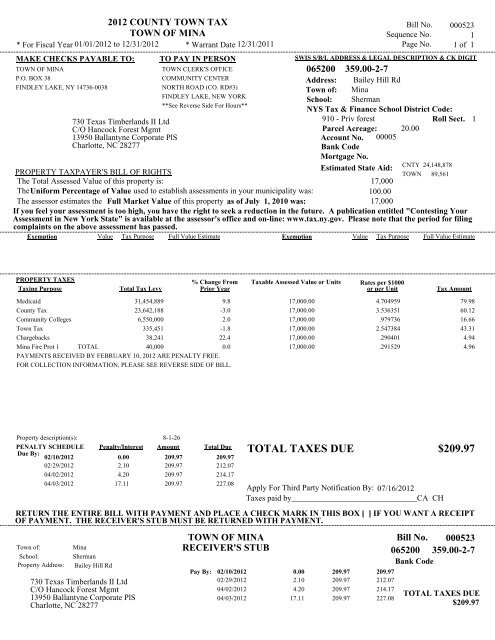

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

000523<br />

1<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 359.00-2-7<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: Bailey Hill Rd<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Sherman<br />

NYS Tax & Finance School District Code:<br />

730 Texas Timberlands II Ltd<br />

C/O Hancock Forest Mgmt<br />

13950 Ballantyne Corporate PlS<br />

Charlotte, NC 28277<br />

910 - Priv forest<br />

Parcel Acreage: 20.00<br />

Account No. 00005<br />

Bank Code<br />

Mortgage No.<br />

Roll Sect. 1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

17,000<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

17,000<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 17,000.00 4.704959 79.98<br />

<strong>County</strong> Tax 23,642,188 -3.0 17,000.00 3.536351 60.12<br />

Community Colleges 6,550,000 2.0 17,000.00 .979736 16.66<br />

Town Tax 335,451 -1.8 17,000.00 2.547384 43.31<br />

Chargebacks 38,241 22.4 17,000.00 .290401 4.94<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 17,000.00 .291529 4.96<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 8-1-26<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00<br />

209.97<br />

209.97<br />

02/29/<strong>2012</strong><br />

2.10<br />

209.97<br />

212.07<br />

04/02/<strong>2012</strong><br />

4.20<br />

209.97<br />

214.17<br />

04/03/<strong>2012</strong> 17.11 209.97 227.08<br />

730 Texas Timberlands II Ltd<br />

C/O Hancock Forest Mgmt<br />

13950 Ballantyne Corporate PlS<br />

Charlotte, NC 28277<br />

TOTAL TAXES DUE $209.97<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 000523<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Sherman<br />

RECEIVER'S STUB<br />

065200 359.00-2-7<br />

Bank Code<br />

Property Address: Bailey Hill Rd<br />

Full Value Estimate<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Pay By: 02/10/<strong>2012</strong><br />

02/29/<strong>2012</strong><br />

04/02/<strong>2012</strong><br />

Exemption Value Tax Purpose Full Value Estimate<br />

0.00<br />

2.10<br />

4.20<br />

209.97<br />

209.97<br />

209.97<br />

209.97<br />

212.07<br />

214.17<br />

04/03/<strong>2012</strong> 17.11 209.97 227.08<br />

TOTAL TAXES DUE<br />

$209.97

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

000524<br />

2<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 359.00-2-8<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: Bailey Hill Rd<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Sherman<br />

NYS Tax & Finance School District Code:<br />

730 Texas Timberlands II Ltd<br />

C/O Hancock Forest Mgmt<br />

13950 Ballantyne Corporate PlS<br />

Charlotte, NC 28277<br />

910 - Priv forest<br />

Parcel Acreage: 80.00<br />

Account No. 00005<br />

Bank Code<br />

Mortgage No.<br />

Roll Sect. 1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

68,000<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

68,000<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 68,000.00 4.704959 319.94<br />

<strong>County</strong> Tax 23,642,188 -3.0 68,000.00 3.536351 240.47<br />

Community Colleges 6,550,000 2.0 68,000.00 .979736 66.62<br />

Town Tax 335,451 -1.8 68,000.00 2.547384 173.22<br />

Chargebacks 38,241 22.4 68,000.00 .290401 19.75<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 68,000.00 .291529 19.82<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 8-1-29<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00<br />

839.82<br />

839.82<br />

02/29/<strong>2012</strong><br />

8.40<br />

839.82<br />

848.22<br />

04/02/<strong>2012</strong><br />

16.80<br />

839.82<br />

856.62<br />

04/03/<strong>2012</strong> 68.45 839.82 908.27<br />

730 Texas Timberlands II Ltd<br />

C/O Hancock Forest Mgmt<br />

13950 Ballantyne Corporate PlS<br />

Charlotte, NC 28277<br />

TOTAL TAXES DUE $839.82<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 000524<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Sherman<br />

RECEIVER'S STUB<br />

065200 359.00-2-8<br />

Bank Code<br />

Property Address: Bailey Hill Rd<br />

Full Value Estimate<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Pay By: 02/10/<strong>2012</strong><br />

02/29/<strong>2012</strong><br />

04/02/<strong>2012</strong><br />

Exemption Value Tax Purpose Full Value Estimate<br />

0.00<br />

8.40<br />

16.80<br />

839.82<br />

839.82<br />

839.82<br />

839.82<br />

848.22<br />

856.62<br />

04/03/<strong>2012</strong> 68.45 839.82 908.27<br />

TOTAL TAXES DUE<br />

$839.82

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

000386<br />

3<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 343.00-1-19<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: Marks Rd<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Sherman<br />

NYS Tax & Finance School District Code:<br />

Achenbach John<br />

Achenbach Anne<br />

3102 Marks Rd<br />

Sherman, NY 14781<br />

270 - Mfg housing<br />

Parcel Acreage: 6.30<br />

Account No. 00006<br />

Bank Code<br />

Mortgage No.<br />

Roll Sect. 1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

10,900<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

10,900<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 10,900.00 4.704959 51.28<br />

<strong>County</strong> Tax 23,642,188 -3.0 10,900.00 3.536351 38.55<br />

Community Colleges 6,550,000 2.0 10,900.00 .979736 10.68<br />

Town Tax 335,451 -1.8 10,900.00 2.547384 27.77<br />

Chargebacks 38,241 22.4 10,900.00 .290401 3.17<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 10,900.00 .291529 3.18<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 6-1-15.1<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00<br />

134.63<br />

134.63<br />

02/29/<strong>2012</strong><br />

1.35<br />

134.63<br />

135.98<br />

04/02/<strong>2012</strong><br />

2.69<br />

134.63<br />

137.32<br />

04/03/<strong>2012</strong> 10.97 134.63 145.60<br />

Achenbach John<br />

Achenbach Anne<br />

3102 Marks Rd<br />

Sherman, NY 14781<br />

TOTAL TAXES DUE $134.63<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 000386<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Sherman<br />

RECEIVER'S STUB<br />

065200 343.00-1-19<br />

Bank Code<br />

Property Address: Marks Rd<br />

Full Value Estimate<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Pay By: 02/10/<strong>2012</strong><br />

02/29/<strong>2012</strong><br />

04/02/<strong>2012</strong><br />

Exemption Value Tax Purpose Full Value Estimate<br />

0.00<br />

1.35<br />

2.69<br />

134.63<br />

134.63<br />

134.63<br />

134.63<br />

135.98<br />

137.32<br />

04/03/<strong>2012</strong> 10.97 134.63 145.60<br />

TOTAL TAXES DUE<br />

$134.63

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

000461<br />

4<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 344.00-1-20<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: 3102 Marks Rd<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Sherman<br />

NYS Tax & Finance School District Code:<br />

Achenbach John<br />

Achenbach Anne<br />

3102 Marks Rd<br />

Sherman, NY 14781<br />

210 - 1 Family Res<br />

Parcel Acreage: 10.30<br />

Account No. 00006<br />

Bank Code<br />

Mortgage No.<br />

Roll Sect. 1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

94,100<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

94,100<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 94,100.00 4.704959 442.74<br />

<strong>County</strong> Tax 23,642,188 -3.0 94,100.00 3.536351 332.77<br />

Community Colleges 6,550,000 2.0 94,100.00 .979736 92.19<br />

Town Tax 335,451 -1.8 94,100.00 2.547384 239.71<br />

Chargebacks 38,241 22.4 94,100.00 .290401 27.33<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 94,100.00 .291529 27.43<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 6-1-13.2<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00 1,162.17 1,162.17<br />

02/29/<strong>2012</strong><br />

11.62 1,162.17 1,173.79<br />

04/02/<strong>2012</strong><br />

23.24 1,162.17 1,185.41<br />

04/03/<strong>2012</strong> 94.72 1,162.17 1,256.89<br />

Achenbach John<br />

Achenbach Anne<br />

3102 Marks Rd<br />

Sherman, NY 14781<br />

TOTAL TAXES DUE $1,162.17<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 000461<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Sherman<br />

RECEIVER'S STUB<br />

065200 344.00-1-20<br />

Bank Code<br />

Property Address: 3102 Marks Rd<br />

Full Value Estimate<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Pay By: 02/10/<strong>2012</strong><br />

02/29/<strong>2012</strong><br />

04/02/<strong>2012</strong><br />

Exemption Value Tax Purpose Full Value Estimate<br />

0.00<br />

11.62<br />

23.24<br />

1,162.17<br />

1,162.17<br />

1,162.17<br />

1,162.17<br />

1,173.79<br />

1,185.41<br />

04/03/<strong>2012</strong> 94.72 1,162.17 1,256.89<br />

TOTAL TAXES DUE<br />

$1,162.17

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

001489<br />

5<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 376.07-2-3<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: Right Of Way<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Clymer<br />

NYS Tax & Finance School District Code:<br />

Ahlquist Bruce<br />

Ahlquist Tobi Z<br />

2188 Shadyside Rd<br />

PO Box 588<br />

Findley Lake, NY 14736-0588<br />

311 - Res vac land<br />

Parcel Dimensions:<br />

Account No.<br />

Bank Code<br />

Mortgage No.<br />

Roll Sect.<br />

10.00 X 195.00<br />

1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

10,900<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

10,900<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 10,900.00 4.704959 51.28<br />

<strong>County</strong> Tax 23,642,188 -3.0 10,900.00 3.536351 38.55<br />

Community Colleges 6,550,000 2.0 10,900.00 .979736 10.68<br />

Town Tax 335,451 -1.8 10,900.00 2.547384 27.77<br />

Chargebacks 38,241 22.4 10,900.00 .290401 3.17<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 10,900.00 .291529 3.18<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 20-3-22<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00<br />

134.63<br />

134.63<br />

02/29/<strong>2012</strong><br />

1.35<br />

134.63<br />

135.98<br />

04/02/<strong>2012</strong><br />

2.69<br />

134.63<br />

137.32<br />

04/03/<strong>2012</strong> 10.97 134.63 145.60<br />

Ahlquist Bruce<br />

Ahlquist Tobi Z<br />

2188 Shadyside Rd<br />

PO Box 588<br />

Findley Lake, NY 14736-0588<br />

TOTAL TAXES DUE $134.63<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 001489<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Clymer<br />

RECEIVER'S STUB<br />

065200 376.07-2-3<br />

Bank Code<br />

Property Address: Right Of Way<br />

Full Value Estimate<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Pay By: 02/10/<strong>2012</strong><br />

02/29/<strong>2012</strong><br />

04/02/<strong>2012</strong><br />

Exemption Value Tax Purpose Full Value Estimate<br />

0.00<br />

1.35<br />

2.69<br />

134.63<br />

134.63<br />

134.63<br />

134.63<br />

135.98<br />

137.32<br />

04/03/<strong>2012</strong> 10.97 134.63 145.60<br />

TOTAL TAXES DUE<br />

$134.63

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

001488<br />

6<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 376.07-2-2<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: Shadyside Rd<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Clymer<br />

NYS Tax & Finance School District Code:<br />

Ahlquist Bruce & Tobi<br />

2188 Shadyside<br />

PO Box 588<br />

Findley Lake, NY 14736<br />

312 - Vac w/imprv<br />

Roll Sect.<br />

Parcel Dimensions: 200.00 X 61.00<br />

Account No. 00001<br />

Bank Code<br />

Mortgage No.<br />

1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

108,800<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

108,800<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 108,800.00 4.704959 511.90<br />

<strong>County</strong> Tax 23,642,188 -3.0 108,800.00 3.536351 384.75<br />

Community Colleges 6,550,000 2.0 108,800.00 .979736 106.60<br />

Town Tax 335,451 -1.8 108,800.00 2.547384 277.16<br />

Chargebacks 38,241 22.4 108,800.00 .290401 31.60<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 108,800.00 .291529 31.72<br />

<strong>Mina</strong> Lt1 TOTAL 12,500 0.0 108,800.00 .145299 15.81<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 20-3-9<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00 1,359.54 1,359.54<br />

02/29/<strong>2012</strong><br />

13.60 1,359.54 1,373.14<br />

04/02/<strong>2012</strong><br />

27.19 1,359.54 1,386.73<br />

04/03/<strong>2012</strong> 110.80 1,359.54 1,470.34<br />

Ahlquist Bruce & Tobi<br />

2188 Shadyside<br />

PO Box 588<br />

Findley Lake, NY 14736<br />

TOTAL TAXES DUE $1,359.54<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 001488<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Clymer<br />

RECEIVER'S STUB<br />

065200 376.07-2-2<br />

Bank Code<br />

Property Address: Shadyside Rd<br />

Full Value Estimate<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Pay By: 02/10/<strong>2012</strong><br />

02/29/<strong>2012</strong><br />

04/02/<strong>2012</strong><br />

Exemption Value Tax Purpose Full Value Estimate<br />

0.00<br />

13.60<br />

27.19<br />

1,359.54<br />

1,359.54<br />

1,359.54<br />

1,359.54<br />

1,373.14<br />

1,386.73<br />

04/03/<strong>2012</strong> 110.80 1,359.54 1,470.34<br />

TOTAL TAXES DUE<br />

$1,359.54

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

001487<br />

7<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 376.07-2-1<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: 2188 Shadyside Rd<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Clymer<br />

NYS Tax & Finance School District Code:<br />

Ahlquist Bruce & Tobi<br />

2188 Shadyside<br />

PO Box 588<br />

Findley Lake, NY 14736<br />

210 - 1 Family Res<br />

Roll Sect.<br />

Parcel Dimensions: 65.00 X 126.00<br />

Account No. 00001<br />

Bank Code<br />

Mortgage No.<br />

1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

113,300<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

113,300<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 113,300.00 4.704959 533.07<br />

<strong>County</strong> Tax 23,642,188 -3.0 113,300.00 3.536351 400.67<br />

Community Colleges 6,550,000 2.0 113,300.00 .979736 111.00<br />

Town Tax 335,451 -1.8 113,300.00 2.547384 288.62<br />

Chargebacks 38,241 22.4 113,300.00 .290401 32.90<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 113,300.00 .291529 33.03<br />

<strong>Mina</strong> Lt1 TOTAL 12,500 0.0 113,300.00 .145299 16.46<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 20-3-8<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00 1,415.75 1,415.75<br />

02/29/<strong>2012</strong><br />

14.16 1,415.75 1,429.91<br />

04/02/<strong>2012</strong><br />

28.32 1,415.75 1,444.07<br />

04/03/<strong>2012</strong> 115.38 1,415.75 1,531.13<br />

Ahlquist Bruce & Tobi<br />

2188 Shadyside<br />

PO Box 588<br />

Findley Lake, NY 14736<br />

TOTAL TAXES DUE $1,415.75<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 001487<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Clymer<br />

RECEIVER'S STUB<br />

065200 376.07-2-1<br />

Bank Code<br />

Property Address: 2188 Shadyside Rd<br />

Full Value Estimate<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Pay By: 02/10/<strong>2012</strong><br />

02/29/<strong>2012</strong><br />

04/02/<strong>2012</strong><br />

Exemption Value Tax Purpose Full Value Estimate<br />

0.00<br />

14.16<br />

28.32<br />

1,415.75<br />

1,415.75<br />

1,415.75<br />

1,415.75<br />

1,429.91<br />

1,444.07<br />

04/03/<strong>2012</strong> 115.38 1,415.75 1,531.13<br />

TOTAL TAXES DUE<br />

$1,415.75

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

000551<br />

8<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 359.06-1-10<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: 10412 Main St<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Clymer<br />

NYS Tax & Finance School District Code:<br />

Ahlquist Bruce W<br />

Ahlquist Tobi Z<br />

2188 Shadyside<br />

PO Box 588<br />

Findley Lake, NY 14736<br />

418 - Inn/lodge<br />

Parcel Acreage: 0.37<br />

Account No. 00004<br />

Bank Code<br />

Mortgage No.<br />

Roll Sect. 1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

162,700<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

162,700<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 162,700.00 4.704959 765.50<br />

<strong>County</strong> Tax 23,642,188 -3.0 162,700.00 3.536351 575.36<br />

Community Colleges 6,550,000 2.0 162,700.00 .979736 159.40<br />

Town Tax 335,451 -1.8 162,700.00 2.547384 414.46<br />

Chargebacks 38,241 22.4 162,700.00 .290401 47.25<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 162,700.00 .291529 47.43<br />

<strong>Mina</strong> Lt1 TOTAL 12,500 0.0 162,700.00 .145299 23.64<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 14-1-10<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00 2,033.04 2,033.04<br />

02/29/<strong>2012</strong><br />

20.33 2,033.04 2,053.37<br />

04/02/<strong>2012</strong><br />

40.66 2,033.04 2,073.70<br />

04/03/<strong>2012</strong> 165.69 2,033.04 2,198.73<br />

Ahlquist Bruce W<br />

Ahlquist Tobi Z<br />

2188 Shadyside<br />

PO Box 588<br />

Findley Lake, NY 14736<br />

TOTAL TAXES DUE $2,033.04<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 000551<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Clymer<br />

RECEIVER'S STUB<br />

065200 359.06-1-10<br />

Bank Code<br />

Property Address: 10412 Main St<br />

Full Value Estimate<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Pay By: 02/10/<strong>2012</strong><br />

02/29/<strong>2012</strong><br />

04/02/<strong>2012</strong><br />

Exemption Value Tax Purpose Full Value Estimate<br />

0.00<br />

20.33<br />

40.66<br />

2,033.04<br />

2,033.04<br />

2,033.04<br />

2,033.04<br />

2,053.37<br />

2,073.70<br />

04/03/<strong>2012</strong> 165.69 2,033.04 2,198.73<br />

TOTAL TAXES DUE<br />

$2,033.04

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

000552<br />

9<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 359.06-1-11<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: Main St<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Clymer<br />

NYS Tax & Finance School District Code:<br />

Ahlquist Bruce W<br />

Ahlquist Tobi Z<br />

2188 Shadyside<br />

PO Box 588<br />

Findley Lake, NY 14736<br />

311 - Res vac land<br />

Parcel Acreage:<br />

Account No.<br />

Bank Code<br />

Mortgage No.<br />

0.99<br />

Roll Sect. 1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

3,700<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

3,700<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 3,700.00 4.704959 17.41<br />

<strong>County</strong> Tax 23,642,188 -3.0 3,700.00 3.536351 13.08<br />

Community Colleges 6,550,000 2.0 3,700.00 .979736 3.63<br />

Town Tax 335,451 -1.8 3,700.00 2.547384 9.43<br />

Chargebacks 38,241 22.4 3,700.00 .290401 1.07<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 3,700.00 .291529 1.08<br />

<strong>Mina</strong> Lt1 TOTAL 12,500 0.0 3,700.00 .145299 0.54<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 14-1-4.2<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00<br />

46.24<br />

46.24<br />

02/29/<strong>2012</strong><br />

0.46<br />

46.24<br />

46.70<br />

04/02/<strong>2012</strong><br />

0.92<br />

46.24<br />

47.16<br />

04/03/<strong>2012</strong> 3.77 46.24 50.01<br />

Ahlquist Bruce W<br />

Ahlquist Tobi Z<br />

2188 Shadyside<br />

PO Box 588<br />

Findley Lake, NY 14736<br />

TOTAL TAXES DUE $46.24<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 000552<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Clymer<br />

RECEIVER'S STUB<br />

065200 359.06-1-11<br />

Bank Code<br />

Property Address: Main St<br />

Full Value Estimate<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Pay By: 02/10/<strong>2012</strong><br />

02/29/<strong>2012</strong><br />

04/02/<strong>2012</strong><br />

Exemption Value Tax Purpose Full Value Estimate<br />

0.00<br />

0.46<br />

0.92<br />

46.24<br />

46.24<br />

46.24<br />

46.24<br />

46.70<br />

47.16<br />

04/03/<strong>2012</strong> 3.77 46.24 50.01<br />

TOTAL TAXES DUE<br />

$46.24

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

001490<br />

10<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 376.07-2-4<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: Right Of Way<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Clymer<br />

NYS Tax & Finance School District Code:<br />

Ahlquist Violet L<br />

Mickle Rebecca A<br />

5 Brenda Ln<br />

Russell, PA 16345<br />

311 - Res vac land<br />

Parcel Dimensions:<br />

Account No.<br />

Bank Code<br />

Mortgage No.<br />

Roll Sect.<br />

10.00 X 198.00<br />

1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

11,000<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

11,000<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 11,000.00 4.704959 51.75<br />

<strong>County</strong> Tax 23,642,188 -3.0 11,000.00 3.536351 38.90<br />

Community Colleges 6,550,000 2.0 11,000.00 .979736 10.78<br />

Town Tax 335,451 -1.8 11,000.00 2.547384 28.02<br />

Chargebacks 38,241 22.4 11,000.00 .290401 3.19<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 11,000.00 .291529 3.21<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 20-3-23<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00<br />

135.85<br />

135.85<br />

02/29/<strong>2012</strong><br />

1.36<br />

135.85<br />

137.21<br />

04/02/<strong>2012</strong><br />

2.72<br />

135.85<br />

138.57<br />

04/03/<strong>2012</strong> 11.07 135.85 146.92<br />

Ahlquist Violet L<br />

Mickle Rebecca A<br />

5 Brenda Ln<br />

Russell, PA 16345<br />

TOTAL TAXES DUE $135.85<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 001490<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Clymer<br />

RECEIVER'S STUB<br />

065200 376.07-2-4<br />

Bank Code<br />

Property Address: Right Of Way<br />

Full Value Estimate<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Pay By: 02/10/<strong>2012</strong><br />

02/29/<strong>2012</strong><br />

04/02/<strong>2012</strong><br />

Exemption Value Tax Purpose Full Value Estimate<br />

0.00<br />

1.36<br />

2.72<br />

135.85<br />

135.85<br />

135.85<br />

135.85<br />

137.21<br />

138.57<br />

04/03/<strong>2012</strong> 11.07 135.85 146.92<br />

TOTAL TAXES DUE<br />

$135.85

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

001491<br />

11<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 376.07-2-5<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: Shadyside Rd<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Clymer<br />

NYS Tax & Finance School District Code:<br />

Ahlquist Violet L<br />

Mickle Rebecca A<br />

5 Brenda Ln<br />

Russell, PA 16345<br />

311 - Res vac land<br />

Roll Sect.<br />

Parcel Dimensions: 55.00 X 141.00<br />

Account No. 00001<br />

Bank Code<br />

Mortgage No.<br />

1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

51,700<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

51,700<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 51,700.00 4.704959 243.25<br />

<strong>County</strong> Tax 23,642,188 -3.0 51,700.00 3.536351 182.83<br />

Community Colleges 6,550,000 2.0 51,700.00 .979736 50.65<br />

Town Tax 335,451 -1.8 51,700.00 2.547384 131.70<br />

Chargebacks 38,241 22.4 51,700.00 .290401 15.01<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 51,700.00 .291529 15.07<br />

<strong>Mina</strong> Lt1 TOTAL 12,500 0.0 51,700.00 .145299 7.51<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 20-3-7.1<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00<br />

646.02<br />

646.02<br />

02/29/<strong>2012</strong><br />

6.46<br />

646.02<br />

652.48<br />

04/02/<strong>2012</strong><br />

12.92<br />

646.02<br />

658.94<br />

04/03/<strong>2012</strong> 52.65 646.02 698.67<br />

Ahlquist Violet L<br />

Mickle Rebecca A<br />

5 Brenda Ln<br />

Russell, PA 16345<br />

TOTAL TAXES DUE $646.02<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 001491<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Clymer<br />

RECEIVER'S STUB<br />

065200 376.07-2-5<br />

Bank Code<br />

Property Address: Shadyside Rd<br />

Full Value Estimate<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Pay By: 02/10/<strong>2012</strong><br />

02/29/<strong>2012</strong><br />

04/02/<strong>2012</strong><br />

Exemption Value Tax Purpose Full Value Estimate<br />

0.00<br />

6.46<br />

12.92<br />

646.02<br />

646.02<br />

646.02<br />

646.02<br />

652.48<br />

658.94<br />

04/03/<strong>2012</strong> 52.65 646.02 698.67<br />

TOTAL TAXES DUE<br />

$646.02

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

001545<br />

12<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 376.07-2-62<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: 2186 Shadyside Rd<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Clymer<br />

NYS Tax & Finance School District Code:<br />

Ahlquist Violet L<br />

Mickle Rebecca A<br />

5 Brenda Ln<br />

Russell, PA 16345<br />

210 - 1 Family Res<br />

Roll Sect.<br />

Parcel Dimensions: 75.00 X 131.00<br />

Account No. 00002<br />

Bank Code<br />

Mortgage No.<br />

1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

134,700<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

134,700<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 134,700.00 4.704959 633.76<br />

<strong>County</strong> Tax 23,642,188 -3.0 134,700.00 3.536351 476.35<br />

Community Colleges 6,550,000 2.0 134,700.00 .979736 131.97<br />

Town Tax 335,451 -1.8 134,700.00 2.547384 343.13<br />

Chargebacks 38,241 22.4 134,700.00 .290401 39.12<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 134,700.00 .291529 39.27<br />

<strong>Mina</strong> Lt1 TOTAL 12,500 0.0 134,700.00 .145299 19.57<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 20-3-7.4.1<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00 1,683.17 1,683.17<br />

02/29/<strong>2012</strong><br />

16.83 1,683.17 1,700.00<br />

04/02/<strong>2012</strong><br />

33.66 1,683.17 1,716.83<br />

04/03/<strong>2012</strong> 137.18 1,683.17 1,820.35<br />

Ahlquist Violet L<br />

Mickle Rebecca A<br />

5 Brenda Ln<br />

Russell, PA 16345<br />

TOTAL TAXES DUE $1,683.17<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 001545<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Clymer<br />

RECEIVER'S STUB<br />

065200 376.07-2-62<br />

Bank Code<br />

Property Address: 2186 Shadyside Rd<br />

Full Value Estimate<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Pay By: 02/10/<strong>2012</strong><br />

02/29/<strong>2012</strong><br />

04/02/<strong>2012</strong><br />

Exemption Value Tax Purpose Full Value Estimate<br />

0.00<br />

16.83<br />

33.66<br />

1,683.17<br />

1,683.17<br />

1,683.17<br />

1,683.17<br />

1,700.00<br />

1,716.83<br />

04/03/<strong>2012</strong> 137.18 1,683.17 1,820.35<br />

TOTAL TAXES DUE<br />

$1,683.17

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

000698<br />

13<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 359.10-1-17<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: Shadyside Rd<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Clymer<br />

NYS Tax & Finance School District Code:<br />

Allen Robert K<br />

Allen Glenda M<br />

2650 Shadyside Rd<br />

Findley Lake, NY 14736<br />

311 - Res vac land<br />

Roll Sect.<br />

Parcel Dimensions: 35.00 X 73.00<br />

Account No. 00001<br />

Bank Code<br />

Mortgage No.<br />

1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

23,000<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

23,000<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 23,000.00 4.704959 108.21<br />

<strong>County</strong> Tax 23,642,188 -3.0 23,000.00 3.536351 81.34<br />

Community Colleges 6,550,000 2.0 23,000.00 .979736 22.53<br />

Town Tax 335,451 -1.8 23,000.00 2.547384 58.59<br />

Chargebacks 38,241 22.4 23,000.00 .290401 6.68<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 23,000.00 .291529 6.71<br />

<strong>Mina</strong> Lt1 TOTAL 12,500 0.0 23,000.00 .145299 3.34<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 15-2-1<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00<br />

287.40<br />

287.40<br />

02/29/<strong>2012</strong><br />

2.87<br />

287.40<br />

290.27<br />

04/02/<strong>2012</strong><br />

5.75<br />

287.40<br />

293.15<br />

04/03/<strong>2012</strong> 23.42 287.40 310.82<br />

Allen Robert K<br />

Allen Glenda M<br />

2650 Shadyside Rd<br />

Findley Lake, NY 14736<br />

TOTAL TAXES DUE $287.40<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 000698<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Clymer<br />

RECEIVER'S STUB<br />

065200 359.10-1-17<br />

Bank Code<br />

Property Address: Shadyside Rd<br />

Full Value Estimate<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Pay By: 02/10/<strong>2012</strong><br />

02/29/<strong>2012</strong><br />

04/02/<strong>2012</strong><br />

Exemption Value Tax Purpose Full Value Estimate<br />

0.00<br />

2.87<br />

5.75<br />

287.40<br />

287.40<br />

287.40<br />

287.40<br />

290.27<br />

293.15<br />

04/03/<strong>2012</strong> 23.42 287.40 310.82<br />

TOTAL TAXES DUE<br />

$287.40

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

000699<br />

14<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 359.10-1-18<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: Shadyside Rd<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Clymer<br />

NYS Tax & Finance School District Code:<br />

Allen Robert K<br />

Allen Glenda M<br />

2650 Shadyside Rd<br />

Findley Lake, NY 14736<br />

311 - Res vac land<br />

Roll Sect.<br />

Parcel Dimensions: 33.00 X 53.00<br />

Account No. 00002<br />

Bank Code<br />

Mortgage No.<br />

1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

1,600<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

1,600<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 1,600.00 4.704959 7.53<br />

<strong>County</strong> Tax 23,642,188 -3.0 1,600.00 3.536351 5.66<br />

Community Colleges 6,550,000 2.0 1,600.00 .979736 1.57<br />

Town Tax 335,451 -1.8 1,600.00 2.547384 4.08<br />

Chargebacks 38,241 22.4 1,600.00 .290401 0.46<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 1,600.00 .291529 0.47<br />

<strong>Mina</strong> Lt1 TOTAL 12,500 0.0 1,600.00 .145299 0.23<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 15-2-6<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00<br />

20.00<br />

20.00<br />

02/29/<strong>2012</strong><br />

0.20<br />

20.00<br />

20.20<br />

04/02/<strong>2012</strong><br />

0.40<br />

20.00<br />

20.40<br />

04/03/<strong>2012</strong> 1.63 20.00 21.63<br />

Allen Robert K<br />

Allen Glenda M<br />

2650 Shadyside Rd<br />

Findley Lake, NY 14736<br />

TOTAL TAXES DUE $20.00<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 000699<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Clymer<br />

RECEIVER'S STUB<br />

065200 359.10-1-18<br />

Bank Code<br />

Property Address: Shadyside Rd<br />

Full Value Estimate<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Pay By: 02/10/<strong>2012</strong><br />

02/29/<strong>2012</strong><br />

04/02/<strong>2012</strong><br />

Exemption Value Tax Purpose Full Value Estimate<br />

0.00<br />

0.20<br />

0.40<br />

20.00<br />

20.00<br />

20.00<br />

20.00<br />

20.20<br />

20.40<br />

04/03/<strong>2012</strong> 1.63 20.00 21.63<br />

TOTAL TAXES DUE<br />

$20.00

<strong>2012</strong> COUNTY TOWN TAX<br />

TOWN OF MINA<br />

Bill No.<br />

Sequence No.<br />

000700<br />

15<br />

* For Fiscal Year 01/01/<strong>2012</strong> to 12/31/<strong>2012</strong> * Warrant Date 12/31/2011<br />

Page No. 1 of 1<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

MAKE CHECKS PAYABLE TO: TO PAY IN PERSON SWIS S/B/L ADDRESS & LEGAL DESCRIPTION & CK DIGIT<br />

TOWN OF MINA<br />

TOWN CLERK'S OFFICE<br />

065200 359.10-1-19<br />

P.O. BOX 38<br />

COMMUNITY CENTER<br />

Address: Shadyside Rd<br />

FINDLEY LAKE, NY 14736-0038<br />

NORTH ROAD (CO. RD#3)<br />

FINDLEY LAKE, NEW YORK<br />

**See Reverse Side For Hours**<br />

Town of: <strong>Mina</strong><br />

School: Clymer<br />

NYS Tax & Finance School District Code:<br />

Allen Robert K<br />

Allen Glenda M<br />

2650 Shadyside Rd<br />

Findley Lake, NY 14736<br />

311 - Res vac land<br />

Roll Sect.<br />

Parcel Dimensions: 33.00 X 53.00<br />

Account No. 00002<br />

Bank Code<br />

Mortgage No.<br />

1<br />

PROPERTY TAXPAYER'S BILL OF RIGHTS<br />

The Total Assessed Value of this property is:<br />

Estimated State Aid:<br />

1,600<br />

CNTY 24,148,878<br />

TOWN 89,561<br />

The Uniform Percentage of Value used to establish assessments in your municipality was: 100.00<br />

The assessor estimates the Full Market Value of this property as of July 1, 2010 was:<br />

1,600<br />

If you feel your assessment is too high, you have the right to seek a reduction in the future. A publication entitled "Contesting Your<br />

Assessment in New York State" is available at the assessor's office and on-line: www.tax.ny.gov. Please note that the period for filing<br />

complaints on the above assessment has passed.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

Exemption Value Tax Purpose<br />

PROPERTY TAXES<br />

% Change From Taxable Assessed Value or Units<br />

Taxing Purpose Total Tax Levy Prior Year<br />

Rates per $1000<br />

or per Unit<br />

Tax Amount<br />

Medicaid 31,454,889 9.8 1,600.00 4.704959 7.53<br />

<strong>County</strong> Tax 23,642,188 -3.0 1,600.00 3.536351 5.66<br />

Community Colleges 6,550,000 2.0 1,600.00 .979736 1.57<br />

Town Tax 335,451 -1.8 1,600.00 2.547384 4.08<br />

Chargebacks 38,241 22.4 1,600.00 .290401 0.46<br />

<strong>Mina</strong> Fire Prot 1 TOTAL 40,000 0.0 1,600.00 .291529 0.47<br />

<strong>Mina</strong> Lt1 TOTAL 12,500 0.0 1,600.00 .145299 0.23<br />

PAYMENTS RECEIVED BY FEBRUARY 10, <strong>2012</strong> ARE PENALTY FREE.<br />

FOR COLLECTION INFORMATION, PLEASE SEE REVERSE SIDE OF BILL.<br />

Property description(s): 15-2-5<br />

PENALTY SCHEDULE Penalty/Interest Amount Total Due<br />

Due By:<br />

02/10/<strong>2012</strong><br />

0.00<br />

20.00<br />

20.00<br />

02/29/<strong>2012</strong><br />

0.20<br />

20.00<br />

20.20<br />

04/02/<strong>2012</strong><br />

0.40<br />

20.00<br />

20.40<br />

04/03/<strong>2012</strong> 1.63 20.00 21.63<br />

Allen Robert K<br />

Allen Glenda M<br />

2650 Shadyside Rd<br />

Findley Lake, NY 14736<br />

TOTAL TAXES DUE $20.00<br />

Apply For Third Party Notification By: 07/16/<strong>2012</strong><br />

Taxes paid by_______________________________CA CH<br />

RETURN THE ENTIRE BILL WITH PAYMENT AND PLACE A CHECK MARK IN THIS BOX [ ] IF YOU WANT A RECEIPT<br />

OF PAYMENT. THE RECEIVER'S STUB MUST BE RETURNED WITH PAYMENT.<br />

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------<br />

TOWN OF MINA<br />

Bill No. 000700<br />

Town of:<br />

School:<br />

<strong>Mina</strong><br />

Clymer<br />

RECEIVER'S STUB<br />

065200 359.10-1-19<br />

Bank Code<br />

Property Address: Shadyside Rd<br />

Full Value Estimate<br />