The Real Cost of Holding Inventory

The Real Cost of Holding Inventory

The Real Cost of Holding Inventory

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

etailer we studied, for example, used a rate <strong>of</strong> 6 percent while an electronics<br />

company used a 15-percent rate.<br />

<strong>The</strong>re are several challenges in estimating inventory noncapital carrying costs. For<br />

one, many companies' information systems do not capture these costs in a way<br />

that provides useful information for decision making. While this cost information<br />

may be captured at an enterprise-wide level and applied to total inventory, <strong>of</strong>ten<br />

it is not available for a product line, geography, customer group, or channel.<br />

Another challenge is understanding how these costs, which can be fixed or<br />

variable, vary with changes in inventory. For example, a reduction in inventory<br />

resulting from improved supply chain management tends to reduce obsolescence,<br />

insurance, and taxes. But unless there is a significant change in the network<br />

design, warehousing and other inventory-related costs tend to remain about the<br />

same.<br />

When evaluating supply chain initiatives, companies <strong>of</strong>ten discount or even omit<br />

the benefits <strong>of</strong> reducing inventory noncapital carrying costs because they do not<br />

possess credible estimates <strong>of</strong> these costs. Most agree that these benefits exist.<br />

But without credible estimates, the benefits typically are excluded from the<br />

analysis. This practice is understandable. Nevertheless, if the impact on these<br />

costs cannot be reasonably measured, the true value <strong>of</strong> many supply chain<br />

initiatives will be understated.<br />

For example, suppose an initiative is expected to permanently reduce inventory<br />

by $10 million. <strong>The</strong> variable noncapital carrying costs as a percentage <strong>of</strong><br />

inventory are 10 percent. <strong>The</strong> marginal tax rate is 40 percent and the after-tax<br />

cost <strong>of</strong> capital is 9 percent. <strong>The</strong> equation below shows that the value <strong>of</strong> this<br />

initiative is the change in the total value <strong>of</strong> inventory. That value is $10 million if<br />

noncapital carrying costs are excluded. However, the value is substantially<br />

higher—almost $7 million higher—when the impact on noncapital carrying costs is<br />

included.<br />

Illustrative Valuation <strong>of</strong> Change in <strong>Inventory</strong>*<br />

Noncapital Carrying<br />

<strong>Cost</strong>s<br />

Included Excluded<br />

<strong>Inventory</strong> Change $10.0m $10.0m<br />

% Noncapital Carrying 10.0% N/A<br />

Change in Noncapital Carrying <strong>Cost</strong>s $1.0m N/A<br />

Tax Rate 40.0% N/A<br />

Taxes $0.4m N/A<br />

Change in Annual After-Tax Pr<strong>of</strong>its $0.60 N/A<br />

Present Value (PV) <strong>of</strong> After-Tax Pr<strong>of</strong>its @ 9.0%<br />

<strong>Cost</strong> <strong>of</strong> Capital ($0.6m/9%)<br />

$6.7m N/A<br />

Total Value<br />

(<strong>Inventory</strong> Change + PV <strong>of</strong> After-Tax Pr<strong>of</strong>its)<br />

*Excludes cost <strong>of</strong> initiative.<br />

$16.7m $10.0m<br />

This example highlights the need for supply chain pr<strong>of</strong>essionals to build more<br />

credible estimates <strong>of</strong> inventory noncapital carrying costs. Failure to do so results<br />

in understating the real value <strong>of</strong> supply chain initiatives, which can lead to<br />

rejection <strong>of</strong> projects that should be accepted. As a starting point, we recommend<br />

focusing the estimates on the noncapital carrying costs components <strong>of</strong><br />

obsolescence, insurance, and taxes for these reasons: (1) these typically are most<br />

likely variable, (2) data for these components are <strong>of</strong>ten available or can be<br />

extracted without significant effort, and (3) they do not require allocation <strong>of</strong> fixed<br />

overhead costs.<br />

<strong>Inventory</strong> Capital Charge<br />

<strong>The</strong> inventory capital charge is calculated as: inventory × cost <strong>of</strong> capital. When<br />

calculated correctly, this charge <strong>of</strong>ten exceeds the noncapital carrying costs.<br />

Unfortunately, the capital charge <strong>of</strong>ten is underestimated because the wrong cost<br />

<strong>of</strong> capital is applied. Typically, this is the result <strong>of</strong> one <strong>of</strong> two factors: (1) a<br />

mismatch between the risk <strong>of</strong> inventory and the cost <strong>of</strong> capital, or (2) the mixing<br />

<strong>of</strong> after-tax capital charges with before-tax noncapital carrying charges. Let's first

explore how to properly match the risk <strong>of</strong> inventory with the appropriate cost <strong>of</strong><br />

capital.<br />

<strong>The</strong> cost <strong>of</strong> capital is one <strong>of</strong> the most important concepts in finance and a key<br />

building block in valuation and in estimating total costs. Unfortunately, it is <strong>of</strong>ten<br />

viewed as one <strong>of</strong> the more esoteric financial concepts. Plus, it's one <strong>of</strong> the most<br />

confusing for those who must use it for decision making. This confusion <strong>of</strong>ten<br />

stems from a lack <strong>of</strong> understanding <strong>of</strong> what comprises the cost <strong>of</strong> capital and the<br />

nature <strong>of</strong> risk-return relationships.<br />

Simply stated, the cost <strong>of</strong> capital is the opportunity cost <strong>of</strong> investing in an asset<br />

relative to the expected return on assets <strong>of</strong> similar risk. This is comparable to how<br />

we evaluate investments in our personal lives. For example, suppose that over<br />

the last year you earned 8 percent on a portfolio <strong>of</strong> stocks. How well did your<br />

portfolio perform? To answer this question, many <strong>of</strong> us compare the return on our<br />

portfolio to the performance <strong>of</strong> an index <strong>of</strong> stocks <strong>of</strong> similar risk. If our portfolio is<br />

comprised <strong>of</strong> a well-diversified group <strong>of</strong> stocks, we likely would use an index like<br />

the S&P 500. Suppose that over the last year, the S&P 500 returned 6 percent.<br />

<strong>The</strong>n our return <strong>of</strong> 8 percent compares favorably. If the S&P 500 returned 10<br />

percent, on the other hand, then that 8-percent return was less favorable.<br />

In this example, the return on the S&P 500 is the opportunity cost <strong>of</strong> money. If<br />

we expected the S&P 500 to earn 10 percent in the future, then we would use this<br />

benchmark in evaluating investments with similar risk in planning for retirement,<br />

children's education, and so forth.<br />

Now let's suppose that our risk tolerance was much lower than that required <strong>of</strong><br />

stock investments. Suppose that we are retired and focused more on income<br />

generation and maintaining the value <strong>of</strong> our investment principle. In this case,<br />

the benchmark—opportunity cost <strong>of</strong> capital—might be the return on corporate<br />

bonds, which currently yield approximately 6.5 percent. If we were even less risk<br />

tolerant, the opportunity cost <strong>of</strong> capital may be the return on U.S. Government<br />

Treasury bonds, currently around 5 percent. Suppose we were extremely risk<br />

averse and placed a high value on maintaining the worth <strong>of</strong> principle value and, at<br />

the same time, wanted a very high degree <strong>of</strong> liquidity because we are going to<br />

make a down payment on a house or other major purchase in a few months. In<br />

this example, the opportunity cost <strong>of</strong> capital likely would be the return on a<br />

short-term certificate <strong>of</strong> deposit, or about 1.25 percent.<br />

Ascertaining the risk <strong>of</strong> inventory is key to deciding what cost <strong>of</strong> capital should be<br />

used to calculate the inventory capital charge. <strong>The</strong> major risk <strong>of</strong> holding inventory<br />

is that its value becomes impaired because <strong>of</strong> price reductions, lower demand,<br />

and obsolescence. Recent events in the high-tech industry have underscored the<br />

risk <strong>of</strong> holding inventory.<br />

To illustrate, memory giant Micron Technology in its fourth quarter <strong>of</strong> 2002<br />

wrote-<strong>of</strong>f $174 million <strong>of</strong> inventory because the market had shifted to<br />

double-data-rate DRAM from SDRAM. In 2001, Cisco Systems declared $2.2<br />

billion in inventory to be worthless. Substantial write-downs also were reported by<br />

bellwethers like Nortel Networks, Lucent Technologies, Corning, and JDS<br />

Uniphase. While these write-downs may be extreme, they underscore the fact<br />

that investment in inventory is not without risk.<br />

<strong>The</strong> Weighted Average <strong>Cost</strong> <strong>of</strong> Capital<br />

Given the inherent risk <strong>of</strong> inventory, we recommend that companies use a<br />

weighted average cost <strong>of</strong> capital (WACC) to calculate the inventory capital charge.<br />

WACC is the opportunity cost for a company's average risk investment.<br />

<strong>The</strong>oretically, a different WACC should be applied to investments <strong>of</strong> different risk.<br />

But as a practical matter, the same weighted average cost typically is applied<br />

internally to all investments unless there is a substantial difference in risk.<br />

WACC is comprised <strong>of</strong> the cost <strong>of</strong> equity and the after-tax cost <strong>of</strong> debt. <strong>The</strong> cost<br />

<strong>of</strong> equity is the cost <strong>of</strong> providing shareholders competitive returns on their<br />

invested dollars. <strong>The</strong> cost <strong>of</strong> debt is simply the overall interest rate on the debt<br />

taken on to finance the project, reduced by the tax benefit <strong>of</strong> interest expense.<br />

Expressed as a percentage, cost <strong>of</strong> capital is the average <strong>of</strong> the required return on<br />

equity and the interest rate on debt, weighted by the proportion <strong>of</strong> equity and<br />

debt, respectively, to total capitalization.<br />

<strong>The</strong> concept <strong>of</strong> the weighted average cost <strong>of</strong> capital can be explained within the<br />

context <strong>of</strong> one's personal investment portfolio.<br />

Suppose your portfolio has 30 percent invested in corporate bonds that

have an expected return <strong>of</strong> 6 percent.<br />

<strong>The</strong> remaining 70 percent is invested in stocks with a long-term expected<br />

return <strong>of</strong> 11 percent.<br />

<strong>The</strong> weighted average expected return on your portfolio is approximately<br />

9.5 percent (30% × 6% + 70% × 11%).<br />

In evaluating the future value <strong>of</strong> retirement savings and other decisions,<br />

you would use the blended rate <strong>of</strong> 9.5 percent.<br />

A company's weighted average cost <strong>of</strong> capital is calculated as:<br />

WACC = % Equity × <strong>Cost</strong> <strong>of</strong> Equity + % Debt × <strong>Cost</strong> <strong>of</strong> Debt × (100% - Marginal<br />

Tax Rate)<br />

where:<br />

% Equity is the targeted percentage <strong>of</strong> capital financed by equity<br />

% Debt is the targeted percentage <strong>of</strong> capital financed by debt<br />

% Equity + % Debt = 100%<br />

Estimating the cost <strong>of</strong> equity is the most challenging part <strong>of</strong> deriving the weighted<br />

average cost <strong>of</strong> capital. A review <strong>of</strong> the various methodologies used to estimate<br />

the cost <strong>of</strong> equity is beyond the scope <strong>of</strong> this article. But suffice it to say that<br />

most companies update the cost <strong>of</strong> equity estimate as well as the other WACC<br />

components once a year. While the WACC may range anywhere from 7 to 15<br />

percent depending on the company's operating risk and financial risk (percentage<br />

<strong>of</strong> debt financing), the average for U.S. companies is approximately 9 percent, as<br />

determined below:<br />

70% Equity × 11% <strong>Cost</strong> <strong>of</strong> Equity<br />

+ 30% Debt × 6.5 <strong>Cost</strong> <strong>of</strong> Debt × (100% - 40% Marginal Tax Rate)<br />

= 9.0% Weighted Average <strong>Cost</strong> <strong>of</strong> Capital<br />

It is important to note that the WACC is an after-tax rate. <strong>The</strong> 11-percent cost <strong>of</strong><br />

equity used here is an after-tax cost because it comprises dividends paid to<br />

shareholders and growth in stock price, neither <strong>of</strong> which are tax deductible. <strong>The</strong><br />

6.5-percent cost <strong>of</strong> debt is a before-tax cost that is adjusted to an after-tax rate<br />

by multiplying it by the term (100% - 40% marginal tax rate). This adjustment<br />

accounts for the tax-deductibility <strong>of</strong> interest.<br />

Why Use WACC?<br />

<strong>The</strong> overall weighted average cost <strong>of</strong> capital is driven by the risk <strong>of</strong> the company's<br />

assets like inventory, property, plant and equipment, and accounts receivable. For<br />

many industries, inventory is a significant portion <strong>of</strong> its net operating assets.<br />

Exhibit 2 shows inventory as a percentage <strong>of</strong> net operating assets for a sample <strong>of</strong><br />

companies from manufacturing, distribution, and retail. From an investor's<br />

perspective, inventory is a significant contributor to overall risk, given its<br />

underlying risks and its percentage <strong>of</strong> operating assets. Consequently, it is<br />

reasonable to apply the overall weighted average cost <strong>of</strong> capital in calculating the<br />

inventory capital charge.<br />

Use <strong>of</strong> the weighted average cost <strong>of</strong> capital is common practice in those<br />

companies using a financial management system like economic value added<br />

(EVA). However, many other companies apply a cost <strong>of</strong> capital that is<br />

substantially lower than the WACC. For example, they <strong>of</strong>ten use a short-term<br />

borrowing rate like the bank prime loan rate, which is currently at 4.25 percent.<br />

Or they use a short-term investment rate like commercial paper, currently around<br />

1.25 percent. Both <strong>of</strong> these rates understate the capital charge that is

commensurate with the underlying risk <strong>of</strong> inventory. This can lead to nonoptimal<br />

decisions for activities such as transportation mode selection, network design, and<br />

sourcing that balance inventory investment against operating expenses. <strong>The</strong><br />

discussion below lays out the shortcomings <strong>of</strong> these common approaches to<br />

setting the costs <strong>of</strong> capital.<br />

<strong>The</strong> Short-Term Borrowing Rate<br />

One rationale for using the short-term borrowing rate is that inventory is a<br />

short-term asset that is financed by short-term loans. Technically, inventory is a<br />

short-term asset, or what is called a "current asset." For example, suppose a<br />

company has $100 million in inventory, which represents a 60-day supply <strong>of</strong><br />

goods. On average the $100 million in inventory is converted into either cash<br />

and/or accounts receivable every 60 days. However, the flaw in the short-term<br />

asset argument is that as long as the company continues to have 60 days in<br />

inventory, it will need to invest $100 million in inventory to maintain its current<br />

sales. In this case, inventory should be viewed as a "permanent current asset"<br />

even though it turns over every 60 days. <strong>The</strong>refore, a long-term cost <strong>of</strong> capital<br />

should be used in calculating the inventory carrying charge.<br />

Another common argument for the short-term borrowing rate is that inventory is<br />

used as collateral in asset-based lending arrangements. It is true that loans<br />

against inventory are common. However, there are several flaws in using the<br />

short-term borrowing rate as the overall cost <strong>of</strong> capital for inventory. One is that<br />

creditors seldom lend funds up to 100 percent <strong>of</strong> the inventory's value. A more<br />

typical lending arrangement is up to 50 percent <strong>of</strong> the value. <strong>The</strong> percentage may<br />

be lower (like for high tech) or higher (commodities), based on the inventory's<br />

underlying risk. Also, a lending arrangement <strong>of</strong>ten requires that a company<br />

commit cash flow from all other sources as a means to repay the loan, even if<br />

inventory is used as collateral.<br />

Suppose that a company with $100 million in inventory finances 50 percent ($50<br />

million) with a bank loan. This leaves 50 percent to be financed through other<br />

sources like trade credit, bonds, and equity—all <strong>of</strong> which have significantly higher<br />

costs than the short-term borrowing rate. Trade credit, in particular, is commonly<br />

viewed as providing funding for inventory. Trade credit increases the purchasing<br />

company's accounts payable (a liability) that funds the inventory asset. In recent<br />

years, however, many purchasing companies have demanded longer trade-credit<br />

terms from suppliers. Our research shows the following ratio <strong>of</strong> accounts payable<br />

to inventory for a sample group <strong>of</strong> companies: manufacturing (57 percent),<br />

distribution (62 percent), and retail (53 percent). <strong>The</strong> results suggest that trade<br />

credit is 50 percent or more <strong>of</strong> inventory, which argues against using a short-term<br />

rate.<br />

Another flaw in the use <strong>of</strong> the short-term borrowing cost for the inventory cost <strong>of</strong><br />

capital is that it does not consider the company's "targeted capital<br />

structure"—that is, what percentage the company desires in the long term to<br />

finance with debt (the sum <strong>of</strong> short-term and long-term debt) and what<br />

percentage to finance by equity. <strong>The</strong> targeted capital structure is a senior<br />

management decision that is driven by such factors as asset risk, product<br />

lifecycle, and useful economic life <strong>of</strong> fixed assets. <strong>The</strong> level and percentage <strong>of</strong><br />

debt financing that creditors are willing to provide are important factors as well.<br />

For example, many loans include restrictions on the total amount <strong>of</strong> overall debt<br />

financing.<br />

Earlier, we showed that for the average company, the capital structure is<br />

approximately 70-percent equity and 30-percent debt. However, this structure<br />

varies by industry. High-tech companies in computers, storage devices, and<br />

computer peripheral devices sell products with very short lifecycles and volatile<br />

demand. <strong>The</strong>ir average capital structure is approximately 95-percent equity and<br />

5-percent debt. At the other end are companies providing electric and gas<br />

services, which have an average capital structure <strong>of</strong> approximately 50-percent<br />

equity and 50-percent debt. <strong>The</strong> higher percentage <strong>of</strong> debt reflects the more<br />

stable demand for utility services and the long useful lives <strong>of</strong> its generation and<br />

transmission plant and equipment. Exhibit 3 shows the 5-year average capital<br />

structure for sample manufacturing, distribution and retail companies. <strong>The</strong> results<br />

suggest that the targeted capital structure for these companies, on average, is<br />

comprised, <strong>of</strong> 70 percent or more equity.

<strong>The</strong> calculation below for a sample distribution company illustrates the need to<br />

account for the impact <strong>of</strong> financing inventory with debt and, in turn, to apply the<br />

correct cost <strong>of</strong> capital in estimating the inventory carrying cost.<br />

Capital<br />

$ %<br />

<strong>Inventory</strong> $100m 60<br />

All other $67m 40<br />

Total $167m 100%<br />

Capital Structure<br />

$ %<br />

Debt $50m 30<br />

Equity $117m 70<br />

Total $167m 100%<br />

This calculation is based on the results in Exhibits 2 and 3 for a distribution<br />

company with $100 million in inventory. <strong>Inventory</strong> is 60 percent <strong>of</strong> total capital,<br />

and the capital structure is 70-percent equity and 30-percent debt. All other<br />

capital <strong>of</strong> $67 million is composed <strong>of</strong> net investment in accounts receivable,<br />

property, plant and equipment, and other assets. <strong>The</strong> $50 million in debt is a loan<br />

on the $100 million in inventory. <strong>The</strong> terms specify that 50 percent <strong>of</strong> inventory<br />

may be financed by the loan ($50 million loan = $100 million inventory × 50%<br />

loan financing).<br />

This example highlights the need to account for the impact <strong>of</strong> inventory debt<br />

financing on a company's debt capacity. <strong>The</strong> company's total debt capacity is $50<br />

million ($167m capital × 30% debt) with a 30% debt/70% equity capital<br />

structure. If the company finances 50 percent <strong>of</strong> inventory with a loan <strong>of</strong> $50<br />

million, then no additional debt is available to finance other assets like accounts<br />

receivables, property, plant, and equipment. <strong>The</strong>se assets must therefore be 100<br />

percent financed by equity in addition to the $50 million in inventory financed by<br />

equity. For decision-making purposes, it is unreasonable to apply 100 percent <strong>of</strong><br />

the cost <strong>of</strong> equity to these assets. This is why modern financial practice is to apply<br />

the weighted average cost <strong>of</strong> capital to most assets since this methodology<br />

allocates the costs <strong>of</strong> debt and equity, accounts for the targeted capital structure,<br />

and compensates for an asset's risk if it is not significantly different from the<br />

company's average risk.<br />

<strong>The</strong> Short-Term Investment Rate<br />

A short-term investment rate such as the yield on a money-market instrument<br />

like commercial paper or a certificate <strong>of</strong> deposit (currently around 1.25 percent) is<br />

also commonly used as the opportunity cost <strong>of</strong> holding inventory. But short-term<br />

investment rates, like short-term borrowing rates, ignore the basic risk/return<br />

principle underlying application <strong>of</strong> the cost <strong>of</strong> capital. <strong>The</strong>se rates significantly<br />

understate the cost <strong>of</strong> capital that is commensurate with the risk <strong>of</strong> inventory.<br />

Several factors cause commercial paper, certificates <strong>of</strong> deposits, and other

money-market instruments to exhibit lower risk and, therefore, a lower expected<br />

return. Specifically:<br />

<strong>The</strong>re is a legally binding contractual obligation that the issuer will pay to<br />

investors a fixed amount on interest and repay principle on specific dates.<br />

Because the maturity is short term (typically one, three, or six months),<br />

investors do not have long-term credit risk exposure.<br />

Money-market instruments are fairly liquid and can be sold in secondary<br />

markets if investors needed to sell the investment prior to the maturity<br />

date.<br />

<strong>The</strong>se factors are in sharp contrast to the realities <strong>of</strong> investment in inventory:<br />

Most investment in inventory is speculative, especially in<br />

wholesale/distribution and retail. <strong>The</strong>re is no legally binding contract that<br />

customers will buy the inventory. In cases where inventory is built to<br />

order, the purchaser <strong>of</strong>ten can change or cancel the order without fully<br />

compensating the selling company for the inventory's total value.<br />

<strong>Inventory</strong> may turn over every 60 days, for example, but a company must<br />

continue to reinvest in inventory in order to maintain sales. This is the<br />

"permanent current asset" nature <strong>of</strong> inventory discussed earlier.<br />

<strong>Inventory</strong> typically is not liquid. Disposal <strong>of</strong> inventory prior to its sale in<br />

the normal course <strong>of</strong> business <strong>of</strong>ten results in net proceeds that are<br />

substantially less than the original inventory investment. Exceptions to this<br />

are raw materials inventory invested in commodities like agricultural<br />

products and precious metals.<br />

It is reasonable to assume that for many companies, the risk associated with<br />

investment in inventory is substantially higher than the risk <strong>of</strong> investing in<br />

money-market instruments. Using the yield on a money-market instrument as a<br />

proxy for the inventory cost <strong>of</strong> capital, significantly understates the inventory<br />

carrying charge. This, in turn, can lead to incorrect inventory-related decisions.<br />

Summarizing our discussion, we believe that neither the short-term borrowing<br />

rate nor the short-term investment rate should be used to calculate the capital<br />

charge for inventory. Both ignore the fundamental risk/return principle underlying<br />

the use <strong>of</strong> cost <strong>of</strong> capital for decision-making purposes. Moreover, they both<br />

significantly understate the opportunity cost <strong>of</strong> holding inventory, which, in turn,<br />

impairs the decision-making process. <strong>The</strong> weighted average cost <strong>of</strong> capital is a<br />

much more appropriate rate to use in calculating the inventory capital charge.<br />

WACC is commensurate with the risk <strong>of</strong> holding inventory and the contribution<br />

inventory makes to a company's overall operating risk. This methodology also<br />

accounts for a company's targeted capital structure and debt capacity.<br />

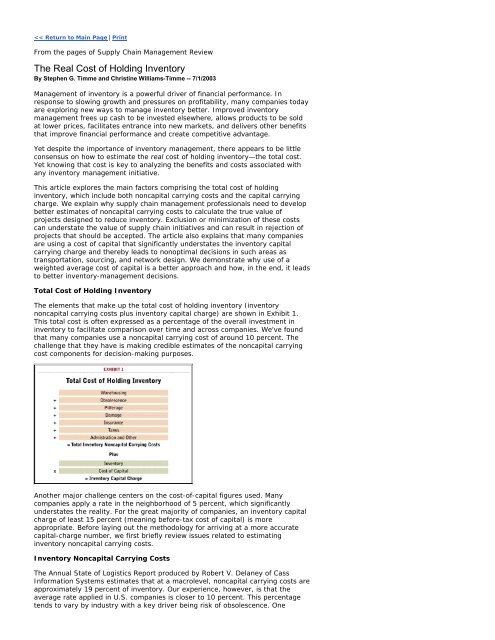

Before-Tax Total <strong>Inventory</strong> Carrying <strong>Cost</strong>s<br />

With the WACC in the equation, we can now combine the inventory noncapital<br />

carrying charge with the capital carrying costs to estimate the total cost <strong>of</strong> holding<br />

inventory. In our example, the noncapital carrying cost is 10 percent <strong>of</strong> the<br />

inventory balance. As shown in Exhibit 1, these costs are composed <strong>of</strong> operations<br />

expenses like obsolescence, warehousing, pilferage, insurance, and taxes—all <strong>of</strong><br />

which are stated on a before-tax basis. <strong>The</strong> cost <strong>of</strong> capital is 9 percent and is the<br />

after-tax weighted average cost <strong>of</strong> capital.<br />

Even when they use WACC to calculate the inventory capital carrying charge,<br />

companies <strong>of</strong>ten make the mistake <strong>of</strong> adding the before-tax percentage inventory<br />

noncapital carrying costs (like our example <strong>of</strong> 10 percent) to the after-tax cost <strong>of</strong><br />

capital (say 9 percent) to get the total carrying cost (19 percent). <strong>The</strong> problem is<br />

that combining these before- and after-tax costs understates the total cost <strong>of</strong><br />

holding inventory and can lead to nonoptimal inventory decisions.<br />

To arrive at that true inventory carrying picture, the two costs must be stated on<br />

the same basis—either before-tax or after-tax. <strong>The</strong>re are two options for doing<br />

this:<br />

Option 1: Adjust the before-tax percentage inventory noncapital carrying<br />

costs to an after-tax figure and add this to the after-tax cost <strong>of</strong> capital.<br />

Option 2: Convert the after-tax cost <strong>of</strong> capital to a before-tax number and<br />

add it to the before-tax percentage noncapital carrying cost.<br />

Total inventory carrying cost is <strong>of</strong>ten used for periodic internal reports and for<br />

decisions that are evaluated at the operating level on a before-tax basis. For<br />

these purposes, we recommend using Option 2 to estimate the total cost <strong>of</strong><br />

holding inventory. For traditional financial analysis involving the discounting <strong>of</strong>

after-tax cash flow, Option 1 is the required choice.<br />

<strong>The</strong> following equation shows the derivation <strong>of</strong> the before-tax cost <strong>of</strong> capital and<br />

total inventory carrying costs.<br />

Total <strong>Inventory</strong> Carrying <strong>Cost</strong>s as Percentage <strong>of</strong> <strong>Inventory</strong><br />

Percentage Noncapital Carrying 10%<br />

After-Tax Weighted Average <strong>Cost</strong> <strong>of</strong> Capital 9%<br />

Marginal Tax Rate 40%<br />

Before Tax <strong>Cost</strong> <strong>of</strong> Capital (9%/(100% - 40%)) 15%<br />

Total <strong>Inventory</strong> Carrying <strong>Cost</strong> as Percentage <strong>of</strong> <strong>Inventory</strong> 25%<br />

<strong>The</strong> 9-percent after-tax weighted average cost <strong>of</strong> capital restated on a before-tax<br />

basis is 15 percent, which is the 9 percent grossed-up for taxes. <strong>The</strong> rationale is<br />

that if a company earns 15 percent before taxes and pays 40 percent <strong>of</strong> the 15<br />

percent in taxes (6% = 15% × 40%), it earns 9 percent after-tax (15% - 6%).<br />

Practical Applications<br />

To illustrate the total cost <strong>of</strong> inventory approach in action, we will again use the<br />

example <strong>of</strong> the company with $100 million in inventory and with average sales<br />

and operating income margin. <strong>The</strong> following chart compares the difference<br />

between using the 25 percent total cost <strong>of</strong> holding inventory and using the<br />

15-percent figure.<br />

<strong>The</strong> 15 percent is the sum <strong>of</strong> the 10 percent for noncapital carrying costs with a<br />

5-percent capital-carrying cost, which is approximately equal to the commonly<br />

used short-term borrow rate. <strong>The</strong> 5 percent is a before-tax figure and therefore<br />

does not need to be adjusted for taxes.<br />

Total <strong>Cost</strong> <strong>of</strong> <strong>Holding</strong> <strong>Inventory</strong> Applications<br />

<strong>Inventory</strong> $100m $100m<br />

Percentage Total <strong>Cost</strong> <strong>of</strong> <strong>Holding</strong> <strong>Inventory</strong> 25% 15%<br />

Total <strong>Cost</strong> <strong>of</strong> <strong>Holding</strong> <strong>Inventory</strong> $25m $15m<br />

Sales $750m $750m<br />

Operating Income Margin* 4% 4%<br />

Operating Income* $30m $30m<br />

Operating Income Absorbed by Total <strong>Cost</strong> <strong>of</strong> <strong>Holding</strong> <strong>Inventory</strong> 83% 50%<br />

*Excludes noncapital inventory carrying cost <strong>of</strong> $10 million ($100m inventory × 10% noncapital<br />

carrying costs).<br />

Using the more accurate 25 percent reveals that the total-dollar cost <strong>of</strong> holding<br />

inventory is $10 million higher than when the lower 15 percent is applied ($25<br />

million total cost <strong>of</strong> holding inventory vs. $15 million). To put the $10 million<br />

difference in a practical perspective, the calculation shows that the $25 million<br />

represents more than 80 percent <strong>of</strong> operating income being absorbed by total<br />

inventory carrying costs. By comparison, when the lower 15 percent is applied,<br />

inventory costs represent only 50 percent <strong>of</strong> operating income.<br />

Communicating an accurate estimate <strong>of</strong> the percentage <strong>of</strong> operating income<br />

absorbed by total inventory carrying costs is an effective way to:<br />

Develop a better understanding <strong>of</strong> the relative cost <strong>of</strong> holding inventory.<br />

Motivate an enterprise-wide view <strong>of</strong> inventory management.<br />

Stimulate initiatives to improve inventory management.<br />

Good communication also creates a greater sense <strong>of</strong> urgency throughout the<br />

organization for better inventory management.<br />

<strong>The</strong> more accurate 25-percent total-inventory-cost figure can also lead to better<br />

transportation management decisions. Consider the following illustration based on<br />

the sample company. Suppose that this company is exploring an initiative to<br />

lower inventory by 20 percent, or $20 million, by using expedited modes <strong>of</strong><br />

transportation. Using the 25-percent total-inventory-carrying-cost figure, the<br />

estimated annualized gross benefit <strong>of</strong> this transportation upgrade is $5 million

($20m × 25%). <strong>Holding</strong> all other factors like service levels the same, this means<br />

that the company could spend up to $5 million more in transportation costs and<br />

break even. By contrast, using the 15-percent inventory-cost figure, the<br />

estimated annual gross benefit and maximum transportation-cost increase is only<br />

$3 million ($20m × 15%). To put the $2 million difference in perspective,<br />

transportation costs <strong>of</strong>ten average approximately 4 percent <strong>of</strong> sales. Using this<br />

average, transportation costs for the sample company are $30 million ($750m<br />

sales × 4%). Thus, the $2 million difference represents almost 7 percent <strong>of</strong><br />

current transportation costs.<br />

Our experience is that use <strong>of</strong> the more accurate percentage for total cost <strong>of</strong><br />

holding inventory that incorporates the before-tax weighted average cost <strong>of</strong><br />

capital has a great impact on transportation decisions and generally supports the<br />

use <strong>of</strong> faster modes. Similarly, this more accurate figure <strong>of</strong>ten affects decisions on<br />

sourcing and network optimization, which involve balancing operating expense<br />

with inventory levels.<br />

<strong>The</strong> Goal: Better Decision Making<br />

Summing up our discussion, supply chain management pr<strong>of</strong>essionals must<br />

develop better estimates <strong>of</strong> the components <strong>of</strong> the total cost <strong>of</strong> holding<br />

inventory—the noncapital carrying costs and the capital carrying charge. Better<br />

estimates <strong>of</strong> these components (which are almost always higher than the current<br />

estimates used) provide more accurate insights into the total cost <strong>of</strong> holding<br />

inventory. And knowing this more accurate total cost can be a powerful catalyst<br />

for exploring new solutions to manage inventory more effectively.<br />

In particular, supply chain pr<strong>of</strong>essionals must develop more credible estimates <strong>of</strong><br />

noncapital carrying costs—obsolescence, warehousing, pilferage, damage,<br />

insurance, taxes, and so forth. Current estimates <strong>of</strong> these costs <strong>of</strong>ten cannot be<br />

traced to specific line-item costs and incorporated into budgets. <strong>The</strong>refore, they<br />

are <strong>of</strong>ten excluded when calculating the value <strong>of</strong> inventory-reduction initiatives<br />

such as investments in technology to improve forecasting and inventory visibility.<br />

Exclusion <strong>of</strong> these costs understates the return on investment <strong>of</strong> these initiatives<br />

and can result in rejection <strong>of</strong> projects that should be accepted. Again, we<br />

recommend that as a starting point companies focus on estimating the<br />

noncapital-carrying-cost components <strong>of</strong> obsolescence, insurance, and taxes.<br />

Information on these costs tends to be more readily available at a product-line,<br />

geographical, or line-<strong>of</strong>-business level than other noncapital carrying costs.<br />

Obsolescence, insurance, and taxes also are typically variable costs—varying with<br />

the level <strong>of</strong> inventory investment.<br />

Companies also should be mindful <strong>of</strong> using a cost <strong>of</strong> capital that significantly<br />

understates the inventory capital charge. Specifically, they <strong>of</strong>ten use a short-term<br />

borrowing or lend rate instead <strong>of</strong> the more accurate weighted average cost <strong>of</strong><br />

capital. Use <strong>of</strong> the WACC can lead to better inventory-management decisions.<br />

Transportation management is just one example. <strong>Inventory</strong> can be lowered by<br />

utilizing faster modes <strong>of</strong> transportation; for example, by moving to less than<br />

truckload (LTL) from full truckload, or to air from LTL. Although using faster<br />

modes increases transportation costs, it lowers the total cost <strong>of</strong> holding inventory.<br />

Applying the WACC in calculating the inventory capital charge would justify the<br />

initiative. <strong>The</strong> reason: Although total transportation costs increase, the total cost<br />

<strong>of</strong> holding inventory and total supply chain costs are lowered—driving<br />

improvement in overall financial performance.<br />

Network design is another area where use <strong>of</strong> the weighted average cost <strong>of</strong> capital<br />

in the capital carrying charge calculation leads to better decisions. A part <strong>of</strong><br />

network design is balancing total transportation expenses against total inventory<br />

carrying costs. When the more accurate WACC is used, total inventory carrying<br />

costs are higher. This warrants incurring higher transportation costs in order to<br />

lower total inventory carrying costs and, in turn, total network costs. Thus, in<br />

many cases, a more consolidated network is optimal even though total<br />

transportation costs are higher.<br />

Finally, consider the impact <strong>of</strong> knowing the total cost <strong>of</strong> inventory on procurement<br />

decisions. To illustrate, many companies are switching to Asia-based sourcing<br />

because <strong>of</strong> lower purchase-price costs. However, this practice <strong>of</strong>ten leads to<br />

increased investment in inventory because <strong>of</strong> higher in-transit and safety-stock<br />

inventories. Use <strong>of</strong> the weighted average cost <strong>of</strong> capital provides a more accurate<br />

view <strong>of</strong> the inventory's impact on total landed cost. It turns out that the source<br />

with the lowest purchase-price cost doesn't always have the lowest total landed<br />

cost when the weighted average cost <strong>of</strong> capital is utilized. Once again, knowing<br />

the real costs <strong>of</strong> holding inventory leads to a better decision.

Author Information<br />

Stephen G. Timme is president <strong>of</strong> FinListics Solutions and an adjunct pr<strong>of</strong>essor at Georgia<br />

Institute <strong>of</strong> Technology, where he teaches in the Executive Masters in International Logistics<br />

Program. Christine Williams-Timme is CEO <strong>of</strong> FinListics Solutions.<br />